0001376339 false 0001376339 2024-07-31 2024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 31, 2024

MIMEDX GROUP, INC.

(Exact name of registrant as specified in charter)

|

|

|

|

|

| Florida |

|

001-35887 |

|

26-2792552 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

| 1775 West Oak Commons Ct., NE, Marietta GA 30062 |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (770) 651-9100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

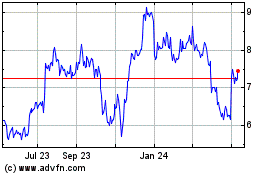

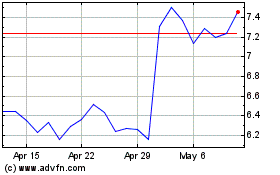

MDXG |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Important Cautionary Statement

This report includes forward-looking statements. Statements regarding: (i) future sales or sales growth; (ii) our 2024 financial goals and expectations for future financial results, including levels of net sales, Adjusted EBITDA, Adjusted EBITDA margin, corporate expenses and cash; (iii) our cash flows; (iv) our expectations regarding our new products, including EPIEFFECT and AMNIOEFFECT; (v) our expectations regarding the launch of our collagen particulate xenograft product; and (vi) continued growth in different care settings. Additional forward-looking statements may be identified by words such as “believe,” “expect,” “may,” “plan,” “goal,” “outlook,” “potential,” “will,” “preliminary,” and similar expressions, and are based on management’s current beliefs and expectations.

Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ from expectations include: (i) future sales are uncertain and are affected by competition, access to customers, patient access to healthcare providers, the reimbursement environment and many other factors; (ii) the Company may change its plans due to unforeseen circumstances; (iii) the results of scientific research are uncertain and may have little or no value; (iv) our ability to sell our products in other countries depends on a number of factors including adequate levels of reimbursement, market acceptance of novel therapies, and our ability to build and manage a direct sales force or third party distribution relationship; (v) the effectiveness of amniotic tissue as a therapy for particular indications or conditions is the subject of further scientific and clinical studies; and (vi) we may alter the timing and amount of planned expenditures for research and development based on regulatory developments. The Company describes additional risks and uncertainties in the Risk Factors section of its most recent annual report and quarterly reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this press release and the Company assumes no obligation to update any forward-looking statement.

| Item 2.02 |

Results of Operations and Financial Condition. |

On July 31, 2024, MiMedx Group, Inc. (the “Company”), issued a press release (the “Earnings Press Release”) announcing its results for the second quarter ended June 30, 2024. A copy of the Earnings Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The foregoing information is furnished pursuant to Item 2.02, “Results of Operations and Financial Condition”, including Exhibit 99.1 attached hereto, and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. It may only be incorporated by reference into another filing under the Exchange Act or Securities Act of 1933, as amended (the “Securities Act”), if such subsequent filing specifically references this Form 8-K. All information in the Earnings Press Release speaks as of the date thereof and the Company does not assume any obligation to update said information in the future. In addition, the Company disclaims any inference regarding the materiality of such information which otherwise may arise as a result of its furnishing such information under Item 2.02 of this report on Form 8-K.

| Item 7.01 |

Regulation FD Disclosure. |

On July 31, 2024, at 4:30 p.m. Eastern Daylight Time, the Company intends to host a conference call and webcast (the “Earnings Call”) to discuss its financial and operating results for the second quarter ended June 30, 2024. A copy of the slide presentation to be used by the Company in connection with the Earnings Call is attached hereto as Exhibit 99.2 and is incorporated herein by reference. A copy of the investor presentation materials made available to the investors by the Company on the Company’s website in connection with Earnings Release is furnished as Exhibit 99.3 to this Current Report and is incorporated herein by reference.

The foregoing information is furnished pursuant to Item 7.01, including Exhibits 99.2 and 99.3 attached hereto, and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. It may only be incorporated by reference into another filing under the Exchange Act or Securities Act if such subsequent filing specifically references this Form 8-K.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

MIMEDX GROUP, INC. |

|

|

|

|

| Date: July 31, 2024 |

|

|

|

By: |

|

/s/ Doug Rice |

|

|

|

|

|

|

Doug Rice Chief Financial Officer |

Exhibit 99.1

MIMEDX Announces Second Quarter 2024 Operating and Financial Results

Net Sales of $87 Million Grew 7% Year-Over-Year for the Second Quarter

Second Quarter GAAP Net Income and Earnings Per Share were $18 Million and $0.12, Respectively

Second Quarter Adjusted EBITDA was $20 Million, or 23% of Net Sales

Management to Host Conference Call Today, July 31, 2024, at 4:30 PM ET

MARIETTA, Ga., July 31, 2024 — MiMedx Group, Inc. (Nasdaq: MDXG) (“MIMEDX” or the “Company”), today

announced operating and financial results for the second quarter 2024.

Recent Operating and Financial Highlights:

| |

• |

|

Second quarter 2024 net sales of $87 million, reflecting 7% growth over the prior year period.

|

| |

• |

|

GAAP net income from continuing operations and net income margin for the second quarter 2024 of $18 million

and 20%, respectively. |

| |

• |

|

Adjusted EBITDA and Adjusted EBITDA margin for the second quarter 2024 of $20 million and 23%, respectively.

|

| |

• |

|

Announced publication focused on surgical applications using MIMEDX placental-based allografts in Nature

– Scientific Reports. |

| |

• |

|

Launched HELIOGEN™, a Fibrillar Collagen Matrix and the

Company’s first xenograft product. |

| |

• |

|

Commenced Randomized Controlled Trial for EPIEFFECT®.

|

Joseph H. Capper, MIMEDX Chief Executive Officer, commented, “Our second quarter 2024 results were marked by exceptional resolve,

focus and execution, resulting in total net sales growth of 7% year-over-year and an Adjusted EBITDA margin of 23%, both compared to a strong second quarter in 2023. During the quarter, we faced commercial challenges as a result of certain

competitive behavior. Specifically, several companies continue to engage in schemes to sell artificially high-priced, yet clinically unproven, skin substitutes primarily in the private office, by sharing a substantial portion of the revenue with

treating physicians. Since remedial action has yet to be implemented, these selling practices have escalated dramatically, reaching a fevered pitch as of late. As a result, we unfortunately experienced higher than normal employee and customer

attrition during the quarter as people were swept up by the promise of riches.”

Mr. Capper continued, “We are in active dialogue with

several regulatory and legislative bodies in an effort to promote positive change in this area. Despite these near-term challenges, we are enthusiastic about our progress in pursuit of the company’s long-term priorities. We are excited for the

full market release of our first xenograft product, HELIOGEN, to help drive the continued expansion of our footprint in various surgical settings. Our commitment to high-quality clinical and scientific research is unmatched in our market, as

evidenced by our recent peer-reviewed publication in Nature - Scientific Reports.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net Income |

|

$ |

17,625 |

|

|

$ |

1,200 |

|

|

$ |

26,886 |

|

|

$ |

(3,783 |

) |

| Non-GAAP Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation expense |

|

|

577 |

|

|

|

687 |

|

|

|

1,135 |

|

|

|

1,401 |

|

| Amortization of intangible assets |

|

|

572 |

|

|

|

191 |

|

|

|

761 |

|

|

|

380 |

|

| Interest (income) expense, net |

|

|

(3 |

) |

|

|

1,630 |

|

|

|

1,687 |

|

|

|

3,184 |

|

| Income tax provision expense (benefit), net |

|

|

5,595 |

|

|

|

(74 |

) |

|

|

7,944 |

|

|

|

(23 |

) |

| Share-based compensation |

|

|

4,091 |

|

|

|

4,060 |

|

|

|

8,431 |

|

|

|

8,405 |

|

| Investigation, restatement and related expenses |

|

|

(9,701 |

) |

|

|

1,017 |

|

|

|

(9,390 |

) |

|

|

4,690 |

|

| Impairment of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

54 |

|

|

|

— |

|

| Transaction related expenses |

|

|

484 |

|

|

|

— |

|

|

|

556 |

|

|

|

— |

|

| Extraordinary legal and regulatory expenses |

|

|

581 |

|

|

|

— |

|

|

|

631 |

|

|

|

— |

|

| Expenses related to disbanding of Regenerative Medicine Business Unit |

|

|

(4 |

) |

|

|

5,391 |

|

|

|

(204 |

) |

|

|

5,391 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

19,817 |

|

|

$ |

14,102 |

|

|

$ |

38,491 |

|

|

$ |

19,645 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA margin |

|

|

22.7 |

% |

|

|

17.4 |

% |

|

|

22.4 |

% |

|

|

12.8 |

% |

Second Quarter 2024 Results Discussion1

Net Sales

MIMEDX reported net sales for the three months

ended June 30, 2024, of $87 million, compared to $81 million for the three months ended June 30, 2023, an increase of 7%. The increase was primarily driven by growing contributions from its AMNIOEFFECT® and EPIEFFECT® products, partially offset by commercial challenges associated with competitive behavior in the marketplace, namely the

sale of artificially high-priced skin substitute products and the ongoing uncertainty related to Medicare’s reimbursement of these products, based upon recently proposed Local Coverage Determinations, and headwinds relating to turnover of

certain of our sales team and customers.

| 1 |

The following discussion of the Company’s second quarter 2024 results are made on a “continuing

operations basis” and exclude the historical costs of the Regenerative Medicine business unit, which was disbanded beginning in June 2023. For a full discussion of the impact of these discontinued operations, please refer to our Annual Report

on Form 10-K filed with the Securities and Exchange Commission for the year ended December 31, 2023 and our Quarterly Report on Form 10-Q for the three months ended

June 30, 2024. |

Gross Profit and Margin

Gross profit for the three months ended June 30, 2024, was $72 million, an increase of $5 million as compared to the prior year period. Gross

margin for the three months ended June 30, 2024 was 83.0%, compared to 83.3% in the prior year period. The year-over-year reduction in gross margin was driven by the amortization of distribution rights stemming from the TELA Bio, Inc. and

Regenity Biosciences agreements entered into during the first quarter of 2024. Excluding this amortization expense, gross margin for the second quarter was roughly flat compared to the prior year period.

Operating Expenses

Selling, general and administrative

(“SG&A”) expenses for the three months ended June 30, 2024, were $55 million compared to $52 million for the three months ended June 30, 2023. The increase in SG&A was driven by year-over-year increases in

compensation related to higher salary and benefit costs from merit raises, promotions, as well as commissions driven by increases in sales volumes and proportionally higher sales through sales agents. Incremental spend from legal and regulatory

disputes in the current period also contributed to the increase.

Research and development expenses for the three months ended June 30, 2024, were

$3 million compared to $4 million for the three months ended June 30, 2023. The decrease was the result of lower headcount and the timing of R&D activities compared to the prior year.

Investigation, restatement and related expense for the three months ended June 30, 2024, was a benefit of $10 million compared to expense of

$1 million for the three months ended June 30, 2023. The benefit in the second quarter 2024 resulted from various settlements, including those with former officers and other matters.

Net income from continuing operations for the three months ended June 30, 2024 was $18 million compared to $9 million for the three months

ended June 30, 2023.

Cash and Cash Equivalents

As of June 30, 2024, the Company had $69 million of cash and cash equivalents compared to $82 million as of December 31, 2023. The decrease

during the period ended June 30, 2024 was primarily a result of our repaying the $30 million outstanding balance on our revolving credit facility in the first quarter of 2024, as well as the $5 million cash payment also in the first

quarter 2024 associated with our agreement with TELA Bio, Inc., paving the way for our exclusive manufacturing and supply agreement with Regenity Biosciences. The decrease was partially offset by year-over-year increases in net sales, which drove

increases in collections from customers.

Financial Outlook

For 2024, MIMEDX expects net sales growth to be in the mid-to-high

single-digits as a percentage compared to 2023, due principally to the ongoing uncertainty surrounding Medicare reimbursement policy for skin substitutes in the private office and adjacent care settings.

Longer-term, the Company continues to expect to achieve annual net sales growth in the low double-digits as

a percentage with an adjusted EBITDA margin above 20%.

Conference Call and Webcast

MIMEDX will host a conference call and webcast to review its second quarter 2024 results on Wednesday, July 31, 2024, beginning at 4:30 p.m., Eastern

Time. The call can be accessed using the following information:

Webcast: Click here

U.S. Investors: 877-407-6184

International Investors: 201-389-0877

Conference ID: 13747365

A replay of the webcast will be

available for approximately 30 days on the Company’s website at www.mimedx.com following the conclusion of the event.

Important Cautionary

Statement

This press release includes forward-looking statements. Statements regarding: (i) future sales or sales growth; (ii) our 2024

financial goals and expectations for future financial results, including levels of net sales, Adjusted EBITDA, and Adjusted EBITDA margin; (iii) our cash flows; (iv) our expectations regarding the use of our products, including EPIEFFECT

and AMNIOEFFECT; (v) our expectations regarding the launch of HELIOGEN; and (v) continued growth in different care settings. Additional forward-looking statements may be identified by words such as “believe,” “expect,”

“may,” “plan,” “goal,” “outlook,” “potential,” “will,” “preliminary,” and similar expressions, and are based on management’s current beliefs and expectations.

Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements.

Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ from expectations include: (i) future sales are uncertain and are affected by competition, access to

customers, patient access to healthcare providers, the reimbursement environment and many other factors; (ii) the Company may change its plans due to unforeseen circumstances; (iii) the results of scientific research are uncertain and may

have little or no value; (iv) our ability to sell our products in other countries depends on a number of factors including adequate levels of reimbursement, market acceptance of novel therapies, and our ability to build and manage a direct

sales force or third party distribution relationship; (v) the effectiveness of amniotic tissue as a therapy for particular indications or conditions is the subject of further scientific and clinical studies; and (vi) we may alter the

timing and amount of planned expenditures for research and development based on regulatory developments. The Company describes additional risks and uncertainties in the Risk Factors section of its most recent annual report and quarterly reports

filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this press release and the Company assumes no obligation to update any forward-looking statement.

About MIMEDX

MIMEDX is a pioneer and leader focused on helping humans heal. With more than a decade of helping clinicians manage chronic and other hard-to-heal wounds, MIMEDX is dedicated to providing a leading portfolio of products for applications in the wound care, burn, and surgical sectors of healthcare. The

Company’s vision is to be the leading global provider of healing solutions through relentless innovation to restore quality of life. For additional information, please visit www.mimedx.com.

Contact:

Matt Notarianni

Investor Relations

470.304.7291

mnotarianni@mimedx.com

Selected Unaudited Financial

Information

MiMedx Group, Inc.

Condensed Consolidated Balance Sheets

(in thousands) Unaudited

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2024 |

|

|

December 31,

2023 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

69,037 |

|

|

$ |

82,000 |

|

| Accounts receivable, net |

|

|

52,798 |

|

|

|

53,871 |

|

| Inventory |

|

|

25,056 |

|

|

|

21,021 |

|

| Prepaid expenses |

|

|

4,030 |

|

|

|

5,624 |

|

| Other current assets |

|

|

3,097 |

|

|

|

1,745 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

154,018 |

|

|

|

164,261 |

|

| Property and equipment, net |

|

|

6,822 |

|

|

|

6,974 |

|

| Right of use asset |

|

|

3,175 |

|

|

|

2,132 |

|

| Deferred tax asset, net |

|

|

33,441 |

|

|

|

40,777 |

|

| Goodwill |

|

|

19,441 |

|

|

|

19,441 |

|

| Intangible assets, net |

|

|

12,047 |

|

|

|

5,257 |

|

| Other assets |

|

|

1,239 |

|

|

|

205 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

230,183 |

|

|

$ |

239,047 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Current portion of long term debt |

|

$ |

1,000 |

|

|

$ |

1,000 |

|

| Accounts payable |

|

|

7,603 |

|

|

|

9,048 |

|

| Accrued compensation |

|

|

17,645 |

|

|

|

22,353 |

|

| Accrued expenses |

|

|

9,281 |

|

|

|

9,361 |

|

| Current portion of Profit Share Payments |

|

|

2,196 |

|

|

|

— |

|

| Current liabilities of discontinued operations |

|

|

217 |

|

|

|

1,352 |

|

| Other current liabilities |

|

|

2,070 |

|

|

|

2,894 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

40,012 |

|

|

|

46,008 |

|

| Long term debt, net |

|

|

18,249 |

|

|

|

48,099 |

|

| Other liabilities |

|

|

3,882 |

|

|

|

2,223 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

62,143 |

|

|

|

96,330 |

|

| Total stockholders’ equity |

|

|

168,040 |

|

|

|

142,717 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

230,183 |

|

|

$ |

239,047 |

|

|

|

|

|

|

|

|

|

|

MiMedx Group, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share amounts) Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net sales |

|

$ |

87,207 |

|

|

$ |

81,257 |

|

|

$ |

171,915 |

|

|

$ |

152,933 |

|

| Cost of sales |

|

|

14,855 |

|

|

|

13,583 |

|

|

|

27,841 |

|

|

|

26,002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

72,352 |

|

|

|

67,674 |

|

|

|

144,074 |

|

|

|

126,931 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative |

|

|

55,401 |

|

|

|

51,955 |

|

|

|

110,530 |

|

|

|

104,203 |

|

| Research and development |

|

|

3,012 |

|

|

|

3,672 |

|

|

|

5,852 |

|

|

|

7,156 |

|

| Investigation, restatement and related |

|

|

(9,701 |

) |

|

|

1,017 |

|

|

|

(9,390 |

) |

|

|

4,690 |

|

| Amortization of intangible assets |

|

|

190 |

|

|

|

191 |

|

|

|

379 |

|

|

|

380 |

|

| Impairment of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

54 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

23,450 |

|

|

|

10,839 |

|

|

|

36,649 |

|

|

|

10,502 |

|

| Other expense, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income (expense), net |

|

|

3 |

|

|

|

(1,630 |

) |

|

|

(1,687 |

) |

|

|

(3,184 |

) |

| Other expense, net |

|

|

(237 |

) |

|

|

(32 |

) |

|

|

(336 |

) |

|

|

(32 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations before income tax provision |

|

|

23,216 |

|

|

|

9,177 |

|

|

|

34,626 |

|

|

|

7,286 |

|

| Income tax provision (expense) benefit from continuing operations |

|

|

(5,595 |

) |

|

|

74 |

|

|

|

(7,944 |

) |

|

|

23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income from continuing operations |

|

|

17,621 |

|

|

|

9,251 |

|

|

|

26,682 |

|

|

|

7,309 |

|

| Income (loss) from discontinued operations, net of tax |

|

|

4 |

|

|

|

(8,051 |

) |

|

|

204 |

|

|

|

(11,092 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

17,625 |

|

|

$ |

1,200 |

|

|

$ |

26,886 |

|

|

$ |

(3,783 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income available to common stockholders from continuing operations |

|

$ |

17,621 |

|

|

$ |

7,523 |

|

|

$ |

26,682 |

|

|

$ |

3,898 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

|

0.12 |

|

|

|

0.07 |

|

|

|

0.18 |

|

|

|

0.04 |

|

| Discontinued operations |

|

|

— |

|

|

|

(0.07 |

) |

|

|

— |

|

|

|

(0.10 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income (loss) per common share |

|

$ |

0.12 |

|

|

$ |

(0.00 |

) |

|

$ |

0.18 |

|

|

$ |

(0.06 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

0.12 |

|

|

$ |

0.06 |

|

|

|

0.18 |

|

|

|

0.04 |

|

| Discontinued operations |

|

|

0.00 |

|

|

|

(0.05 |

) |

|

|

— |

|

|

|

(0.10 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income (loss) per common share |

|

$ |

0.12 |

|

|

$ |

0.01 |

|

|

$ |

0.18 |

|

|

$ |

(0.06 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding - basic |

|

|

147,326,273 |

|

|

|

115,866,371 |

|

|

|

147,033,879 |

|

|

|

115,136,646 |

|

| Weighted average common shares outstanding - diluted |

|

|

148,897,920 |

|

|

|

146,862,924 |

|

|

|

149,211,012 |

|

|

|

115,849,854 |

|

MiMedx Group, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands) Unaudited

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| Net cash flows provided by operating activities from continuing operations |

|

|

28,722 |

|

|

|

12,567 |

|

| Net cash flows used in operating activities of discontinued operations |

|

|

(930 |

) |

|

|

(8,840 |

) |

| Net cash flows provided by operating activities |

|

$ |

27,792 |

|

|

$ |

3,727 |

|

| Net cash flows used in investing activities |

|

|

(6,929 |

) |

|

|

(1,025 |

) |

| Net cash flows used in financing activities |

|

|

(33,826 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net change in cash |

|

$ |

(12,963 |

) |

|

$ |

2,702 |

|

Reconciliation of Non-GAAP Measures

In addition to our GAAP results, we provide certain non-GAAP measures including Adjusted EBITDA, related margins, Free

Cash Flow, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Net Income, and Adjusted Earnings Per Share (“Adjusted EPS”). We believe that the presentation of these measures provides important supplemental information to management

and investors regarding our performance. These measures are not a substitute for GAAP measures. Company management uses these non-GAAP measures as aids in monitoring our ongoing financial performance from quarter-to-quarter and year-to-year on a regular basis and for benchmarking against comparable

companies.

These non-GAAP financial measures reflect the exclusion of the following items:

| |

• |

|

Share-based compensation expense - expense recognized related to awards to various

employees and our board of directors pursuant to our share-based compensation plans. This expense is reflected amongst cost of sales, research and development expense, and selling, general, and administrative expense in the unaudited condensed

consolidated statements of operations. |

| |

• |

|

Investigation, restatement, and related (benefit) expense - expenses incurred toward the legal defense of the

Company and advanced on behalf of certain former officers and directors, net of negotiated reductions and settlements of amounts previously advanced, related to certain legal matters. This expense is reflected in the line of the same name in our

unaudited condensed consolidated statements of operations. |

| |

• |

|

Impairment of intangible assets - reflects the impairment of intangibles. This expense is reflected in the line

of the same name in our unaudited condensed consolidated statements of operations. |

| |

• |

|

Transaction-related expenses - reflects expenses incrementally incurred resulting from the consummation of

material strategic transactions or the integration of acquired assets or operations into our core business. With respect to the three and six months ended June 30, 2024, this relates to our acquisition and integration of exclusive distribution

rights to HELIOGEN. |

| |

• |

|

Strategic legal and regulatory expenses - With respect to the three and six months ended June 30, 2024, this

relates to litigation and regulatory expenses. Litigation expenses incurred relate to suits filed against former employees and their employers for violation of non-compete and

non-solicitation agreements and related matters. Regulatory expenses relate to legal fees incurred stemming from action taken against the United States Food & Drug Administration (“FDA”)

surrounding the designation of one of our products. |

| |

• |

|

Loss on extinguishment of debt - reflects the excess of cash paid to extinguish debt over the carrying value of

the debt on our balance sheet upon the repayment and termination of a loan agreement. With respect to the six months ended June 30, 2024, this relates to the repayment and termination of the Company’s loan agreement with Hayfin. Amounts in

this line reflect (i) prepayment premium paid and (ii) write-offs of unamortized original issue discount and deferred financing costs. |

| |

• |

|

Expenses related to the Disbanding of Regenerative Medicine - incremental expenses recognized or incurred

directly as a result of our announcement to disband our Regenerative Medicine segment. |

| |

• |

|

Amortization of acquired intangible assets - reflects amortization expense recognized solely related to assets

which were acquired as part of a transaction. With respect to the three and six months ended June 30, 2024, this relates solely to the amortization of distribution rights stemming from the TELA Bio, Inc. and Regenity Biosciences agreements

entered into during the first quarter of 2024. These expenses are reflected in cost of sales in our consolidated statements of operations. |

| |

• |

|

Income Tax Adjustment - for purposes of calculating Adjusted Net Income (Loss) and

Adjusted Earnings Per Share, reflects our expectation of a long-term effective tax rate, which is normalized and balance sheet-agnostic. Actual reporting tax expense will be based on GAAP earnings, and may differ from the expected long-term

effective tax rate due to a variety of factors, including the tax treatment of various transactions included in GAAP net income and other reconciling items that are excluded in determining Adjusted Net Income (Loss) and Adjusted EPS. The long-term

normalized effective tax rate was 25% for each of the quarters ended June 30, 2024 and 2023. |

Adjusted EBITDA and Adjusted EBITDA margin

Adjusted EBITDA consists of GAAP net income (loss) excluding: (i) depreciation, (ii) amortization of intangibles, (iii) interest (income) expense,

net, (iv) income tax provision, (v) share-based compensation, (vi) investigation, restatement and related expenses, (vii) expenses related to disbanding of the Regenerative Medicine business unit, (viii) extraordinary legal

and regulatory expenses, (x) transaction-related expenses, and (ix) impairment of intangible assets.

Please refer to the tables at the

beginning of this press release for reconciliation to GAAP net income (loss).

Adjusted Net Income (Loss)

Adjusted Net Income (Loss) provides a view of our operating performance, exclusive of certain items which are

non-recurring or not reflective of our core operations.

Adjusted Net Income is defined as GAAP net income (loss)

plus (i) loss on extinguishment of debt, (ii) investigation restatement and related expenses, (iii) impairment of intangible assets, (iv) amortization of acquired intangible assets, (v) transaction related expenses,

(vi) strategic legal and regulatory expenses, and (vii) expenses related to disbanding of our Regenerative Medicine business unit, and (viii) the long-term effective income tax rate adjustment.

A reconciliation of GAAP Net Income (Loss) to Adjusted Net Income appears in the table below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net income (loss) |

|

$ |

17,625 |

|

|

$ |

1,200 |

|

|

$ |

26,886 |

|

|

$ |

(3,783 |

) |

| Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

1,401 |

|

|

|

— |

|

| Investigation, restatement and related expenses |

|

|

(9,701 |

) |

|

|

1,017 |

|

|

|

(9,390 |

) |

|

|

4,690 |

|

| Impairment of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

54 |

|

|

|

— |

|

| Amortization of acquired intangible assets |

|

|

382 |

|

|

|

— |

|

|

|

382 |

|

|

|

— |

|

| Transaction related expenses |

|

|

484 |

|

|

|

— |

|

|

|

556 |

|

|

|

— |

|

| Strategic legal and regulatory expenses |

|

|

581 |

|

|

|

— |

|

|

|

631 |

|

|

|

— |

|

| Expenses related to disbanding of Regenerative Medicine Business Unit |

|

|

(4 |

) |

|

|

5,391 |

|

|

|

(204 |

) |

|

|

5,391 |

|

| Long-term effective income tax rate adjustment |

|

|

1,855 |

|

|

|

(1,958 |

) |

|

|

879 |

|

|

|

(1,592 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income |

|

$ |

11,222 |

|

|

$ |

5,650 |

|

|

$ |

21,195 |

|

|

$ |

4,706 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A reconciliation of various line items included in our GAAP unaudited condensed consolidated statements of operations to

Adjusted Net Income for the three and six months ended June 30, 2024 and 2023 are presented in the tables below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, 2024 |

|

| |

|

Gross Profit |

|

|

Selling, General

& Administrative

Expense |

|

|

Research and

Development

Expense |

|

|

Net Income |

|

| Reported GAAP Measure |

|

$ |

72,352 |

|

|

$ |

55,401 |

|

|

$ |

3,012 |

|

|

$ |

17,625 |

|

| Investigation, restatement and related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(9,701 |

) |

| Amortization of acquired intangible assets |

|

|

382 |

|

|

|

— |

|

|

|

— |

|

|

|

382 |

|

| Transaction related expenses |

|

|

— |

|

|

|

(414 |

) |

|

|

— |

|

|

|

484 |

|

| Strategic legal and regulatory expenses |

|

|

— |

|

|

|

(581 |

) |

|

|

— |

|

|

|

581 |

|

| Expenses related to disbanding of Regenerative Medicine Business Unit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4 |

) |

| Long-term effective income tax rate adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,855 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Measure |

|

$ |

72,734 |

|

|

$ |

54,406 |

|

|

$ |

3,012 |

|

|

$ |

11,222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit Margin |

|

|

83.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit Margin, as adjusted |

|

|

83.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended June 30, 2023 |

|

| |

|

Gross Profit |

|

|

Selling, General

& Administrative

Expense |

|

|

Research and

Development

Expense |

|

|

Net Income |

|

| Reported GAAP Measure |

|

$ |

67,674 |

|

|

$ |

51,955 |

|

|

$ |

3,672 |

|

|

$ |

1,200 |

|

| Investigation, restatement and related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,017 |

|

| Expenses related to disbanding of Regenerative Medicine Business Unit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,391 |

|

| Long-term effective income tax rate adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,958 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Measure |

|

$ |

67,674 |

|

|

$ |

51,955 |

|

|

$ |

3,672 |

|

|

$ |

5,650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit Margin |

|

|

83.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit Margin, as adjusted |

|

|

83.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, 2024 |

|

| |

|

Gross Profit |

|

|

Selling, General

& Administrative

Expense |

|

|

Research and

Development

Expense |

|

|

Net Income |

|

| Reported GAAP Measure |

|

$ |

144,074 |

|

|

$ |

110,530 |

|

|

$ |

5,852 |

|

|

$ |

26,886 |

|

| Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,401 |

|

| Investigation, restatement and related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(9,390 |

) |

| Impairment of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

54 |

|

| Amortization of acquired intangible assets |

|

|

382 |

|

|

|

— |

|

|

|

— |

|

|

|

382 |

|

| Transaction related expenses |

|

|

— |

|

|

|

(486 |

) |

|

|

— |

|

|

|

556 |

|

| Strategic legal and regulatory expenses |

|

|

— |

|

|

|

(631 |

) |

|

|

— |

|

|

|

631 |

|

| Expenses related to disbanding of Regenerative Medicine Business Unit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(204 |

) |

| Long-term effective income tax rate adjustment |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

879 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Measure |

|

$ |

144,456 |

|

|

$ |

109,413 |

|

|

$ |

5,852 |

|

|

$ |

21,195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit Margin |

|

|

83.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit Margin, as adjusted |

|

|

84.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, 2023 |

|

| |

|

Gross Profit |

|

|

Selling, General

& Administrative

Expense |

|

|

Research and

Development

Expense |

|

|

Net (Loss)

Income |

|

| Reported GAAP Measure |

|

$ |

126,931 |

|

|

$ |

104,203 |

|

|

$ |

7,156 |

|

|

$ |

(3,783 |

) |

| Investigation, restatement and related expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,690 |

|

| Expenses related to disbanding of Regenerative Medicine Business Unit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,391 |

|

| Long-term effective income tax rate adjustment |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

(1,592 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Measure |

|

$ |

126,931 |

|

|

$ |

104,203 |

|

|

$ |

7,156 |

|

|

$ |

4,706 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit Margin |

|

|

83.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit Margin, as adjusted |

|

|

83.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Earnings Per Share

Adjusted Earnings Per Share is intended to provide a normalized view of earnings per share by removing items that may be irregular, one-time, or non-recurring from net income. This enables us to identify underlying trends in our business that could otherwise be masked by such items. Adjusted Earnings Per

Share consists of GAAP diluted net income (loss) per common share including adjustments for: (i) loss on extinguishment of debt, (ii) investigation restatement and related expenses, (iii) impairment of intangible assets,

(iv) amortization of acquired intangible assets, (v) transaction related expenses, (vi) strategic legal and regulatory expenses, and (vii) expenses related to disbanding of our Regenerative Medicine business unit, (viii) the

long-term effective income tax rate adjustment, and (ix) effects of antidilution, reflecting changes resulting from the removal of securities which are considered dilutive for purposes of calculating GAAP diluted net income (loss) per common

share, but antidilutive for non-GAAP purposes.

A reconciliation of GAAP diluted earnings per share to Adjusted

Earnings Per Share appears in the table below (per diluted share):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| GAAP net income (loss) per common share - diluted |

|

$ |

0.12 |

|

|

$ |

0.01 |

|

|

$ |

0.18 |

|

|

$ |

(0.06 |

) |

| Loss on extinguishment of debt |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.01 |

|

|

|

0.00 |

|

| Investigation, restatement and related (benefit) expense |

|

|

(0.07 |

) |

|

|

0.01 |

|

|

|

(0.06 |

) |

|

|

0.04 |

|

| Impairment of intangible assets |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

| Amortization of acquired intangible assets |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

| Transaction related expenses |

|

|

0.01 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

| Strategic legal and regulatory expenses |

|

|

0.01 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

| Expenses related to disbanding of Regenerative Medicine business unit |

|

|

0.00 |

|

|

|

0.05 |

|

|

|

0.00 |

|

|

|

0.05 |

|

| Long-term effective income tax rate adjustment |

|

|

0.01 |

|

|

|

(0.02 |

) |

|

|

0.01 |

|

|

|

(0.01 |

) |

| Effects of antidilution |

|

|

0.00 |

|

|

|

(0.02 |

) |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Earnings Per Share |

|

$ |

0.08 |

|

|

$ |

0.03 |

|

|

$ |

0.14 |

|

|

$ |

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP weighted average common shares outstanding - diluted |

|

|

148,897,920 |

|

|

|

146,862,924 |

|

|

|

149,211,012 |

|

|

|

115,849,854 |

|

| Effects of antidilution |

|

|

— |

|

|

|

(29,997,271 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding - adjusted |

|

|

148,897,919 |

|

|

|

116,865,653 |

|

|

|

149,211,012 |

|

|

|

115,849,854 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow

Free Cash

Flow is intended to provide a measure of our ability to generate cash in excess of capital investments. It provides management with a view of cash flows which can be used to finance operational and strategic investments.

Free Cash Flow is defined as net cash provided by (used in) operating activities less capital expenditures, including purchases of equipment.

A reconciliation of GAAP net cash flows provided by (used in) operating activities to Free Cash Flow appears

in the table below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net cash flows provided by operating activities |

|

$ |

21,814 |

|

|

$ |

7,775 |

|

|

$ |

27,792 |

|

|

$ |

3,727 |

|

| Capital expenditures, including purchases of equipment |

|

|

(105 |

) |

|

|

(299 |

) |

|

|

(1,249 |

) |

|

|

(932 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free Cash Flow |

|

$ |

21,709 |

|

|

$ |

7,476 |

|

|

$ |

26,543 |

|

|

$ |

2,795 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales by Product Category by Quarter

Below is a summary of net sales by product category (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2023 |

|

|

2024 |

|

| |

|

Q1 |

|

|

Q2 |

|

|

Q3 |

|

|

Q4 |

|

|

Q1 |

|

|

Q2 |

|

| Wound |

|

$ |

45,206 |

|

|

$ |

53,319 |

|

|

$ |

51,156 |

|

|

$ |

55,980 |

|

|

$ |

57,049 |

|

|

$ |

57,546 |

|

| Surgical |

|

|

26,468 |

|

|

|

27,939 |

|

|

|

30,557 |

|

|

|

30,852 |

|

|

|

27,660 |

|

|

|

29,660 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

71,674 |

|

|

$ |

81,258 |

|

|

$ |

81,713 |

|

|

$ |

86,832 |

|

|

$ |

84,709 |

|

|

$ |

87,206 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit 99.2 Q2 2024 Results Conference Call July 31, 2024

Disclaimer & Cautionary Statements This presentation includes

forward-looking statements. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the

forward-looking statements. Such forward-looking statements include statements regarding: • Future sales or sales growth; • Estimates of potential market size and demand for the Company’s current and future products; • Plans

for expansion outside of the U.S.; • The effectiveness of amniotic tissue as a therapy for any particular indication or condition; • Expected spending on research and development and litigation; • Expectations regarding the

reimbursement environment for the Company’s products; • The Company’s long-term strategy and goals for value creation, the status of its pipeline products, expectations for future products, and expectations for future growth and

profitability 2

Disclaimer & Cautionary Statements Additional forward-looking

statements may be identified by words such as believe, expect, may, plan, potential, will, preliminary, and similar expressions, and are based on management's current beliefs and expectations. Forward-looking statements are subject to risks and

uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ from

expectations include: • Future sales are uncertain and are affected by competition, access to customers, patient access to hospitals and healthcare providers, the reimbursement environment and many other factors; • The future market for

the Company’s products can depend on regulatory approval of such products, which might not occur at all or when expected, and is based in part on assumptions regarding the number of patients who elect less acute and more acute treatment than

the Company’s products, market acceptance of the Company’s products, and adequate reimbursement for such therapies; • The process of obtaining regulatory clearances or approvals to market a biological product or medical device from

the FDA or similar regulatory authorities outside of the U.S. is costly and time consuming, and such clearances or approvals may not be granted on a timely basis, or at all, and the ability to obtain the rights to market additional, suitable

products depends on negotiations with third parties which may not be forthcoming; and • The Company describes additional risks and uncertainties in the Risk Factors section of its most recent annual report and quarterly reports filed with the

Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this presentation and the Company assumes no obligation to update any forward- looking statement. 3

Joe Capper Chief Executive Officer helping humans heal.

Q2:24 Highlights 1 Net Income Net Sales Gross Margin Adjusted EBITDA

$18MM $87MM 83% $20MM +7% year-over-year 23% of net sales Portfolio Expansion First Publication 1 Cash Balance Free Cash Flow into Xenografts in $69MM $22MM 5 1 – EBITDA, Adjusted EBITDA, related margins and Free Cash Flow are non-GAAP

financial measures. See our Earnings Release for the quarter ended June 30, 2024 for a reconciliation to the nearest GAAP measure.

Executing on Strategic Priorities Despite Wound Market Turbulence

Strategic Priorities Progress Update ➢ Strong Q2 growth from AMNIOEFFECT® & EPIEFFECT® Innovate & diversify product portfolio to maximize growth ➢ Ongoing uptake in Japan ➢ First ever publication in Nature for

MIMEDX Develop & deploy programs to expand footprint in Surgical market ➢ HELIOGEN , our first xenograft offering, now available ➢ Long-term plan to lower customer churn Introduce initiatives to enhance customer intimacy ➢

Robust adoption of MIMEDX Connect Committed to Evolving & Achieving Strategic Priorities to Strengthen and Grow Business Over Long-Term 6

Doug Rice Chief Financial Officer helping humans heal.

Q2:24 Net Sales Recap Total Net Sales By Product Category By Site of

Service $87 $81 Other $13MM $30 +18% $28 Hospital Private $47MM Office +2% $27MM +13% $58 $53 Q2:23 Q2:24 Q2:23 Q2:24 Wound Surgical 8 $ millions $ millions

Q2:24 Gross Profit & Gross Margin Roughly Flat Year/Year 80 $72 $68

Q2:24 GAAP gross profit and gross margin impacted by HELIOGEN transaction-related accounting, 83% excluding this $0.4 million impact, 83% gross margins were flat 0 Q2:23 Q2:24 9 $ millions Gross Margin

Q2:24 Operating Expenses Q2:23 $55 $52 Q2:24 Higher SG&A due to

increased commercial expenses $4 $3 % of net sales 64% 64% 5% 3% R&D SG&A Continue to deliver strong Net $20 $18 $14 Income and an $11 $6 Adjusted EBITDA $1 margin above 20% 20% 7% 13% 17% 23% % of net sales 1% GAAP Net Income Adj. Net

Income Adj. EBITDA 10 $ millions $ millions

Q2:24 Balance Sheet & Cash Flows …Enabling Net Cash to Nearly

Quadruple Strong Free Cash Flow Generated by the Since Beginning of 2023 Business… $50 $22 $34 $32 $29 $12 $10 $20 $7 $13 $5 Q1:23 Q2:23 Q3:23 Q4:23 Q1:24 Q2:24 -$5 Q1:23 Q2:23 Q3:23 Q4:23 Q1:24 Q2:24 Continue to Organically Strengthen Balance

Sheet with Robust Free Cash Flow Generation 11 $ millions $ millions

Joe Capper Chief Executive Officer helping humans heal.

Q2:24 Summary Net Sales of $87 million were up 7% year-over-year Gross

profit margin 83% Adjusted EBITDA of $20 million reflected 23% of net sales Q2:24 cash balance of $69 million HELIOGEN launch underway and already being used in surgical cases Recent Nature publication builds on our industry-leading scientific

evidence base and expands use cases for amniotic tissue 13

Physician Office Medicare Reimbursement Overhaul Needed 1 Medicare

Allowed Charges for skin Loopholes creating commercial frenzy that has caused tremendous disruption in the market substitutes have exploded since 2020 $4.0B $4 6 Disruption surged in Q2:24 for MIMEDX 5 $3 Above average employee & customer churn

4 $2 3 Recent DOJ cases underscore issue $1.5B 2 $1.0B $1 LCDs – proposed in April – would mark important first step to prevent abuses 1 $0.5B $0 0 Meanwhile, CMS has not yet acted, leaving the LCDs as the most likely solution 2020 2021

2022 2023 Medicare Allowed Charges Recent Proposed LCDs Reflect Unified National Approach to Curb Abuses in Private Office 1) The Moran Company. (2024). Volume and Total Payment by Skin Substitute Product, CY 2019-2023. 2) ASP List refers to the

Medicare Part B ASP Drug Pricing Files and CMS refers to the Centers for Medicare and Medicaid Services, Data Source: ASP Pricing Files. Centers for Medicare & Medicaid Services. Accessed March 18, 2024.

https://www.cms.gov/medicare/payment/all-fee-service-providers/medicare-part-b-drug-average-sales-price/asp-pricing-files 14 3) LCDs refer to “Local Coverage Determination” $ billions Volume (millions)

2024 & Long-Term Outlook Long-Term Long-Term Net 2024 Net Sales %

Growth Sales % Growth Profitability Adjusted Mid-to-high EBITDA Low double- single digits margin above digits vs. 2023 20% Despite near-term disruption, long-term outlook for the business remains unchanged 15

Closing Remarks, Q&A

Exhibit 99.3 Investor Presentation August 2024 helping humans

heal.

Disclaimer & Cautionary Statements This presentation includes

forward-looking statements. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the

forward-looking statements. Such forward-looking statements include statements regarding: • Future sales or sales growth; • Estimates of potential market size and demand for the Company’s current and future products; • Plans

for expansion outside of the U.S.; • The effectiveness of amniotic tissue as a therapy for any particular indication or condition; • Expected spending on research and development and litigation; • Expectations regarding the

reimbursement environment for the Company’s products; • The Company’s long-term strategy and goals for value creation, the status of its pipeline products, expectations for future products, and expectations for future growth and

profitability 2

Disclaimer & Cautionary Statements Additional forward-looking

statements may be identified by words such as believe, expect, may, plan, potential, will, preliminary, and similar expressions, and are based on management's current beliefs and expectations. Forward-looking statements are subject to risks and

uncertainties, and the Company cautions investors against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ from

expectations include: • Future sales are uncertain and are affected by competition, access to customers, patient access to hospitals and healthcare providers, the reimbursement environment and many other factors; • The future market for

the Company’s products can depend on regulatory approval of such products, which might not occur at all or when expected, and is based in part on assumptions regarding the number of patients who elect less acute and more acute treatment than

the Company’s products, market acceptance of the Company’s products, and adequate reimbursement for such therapies; • The process of obtaining regulatory clearances or approvals to market a biological product or medical device from

the FDA or similar regulatory authorities outside of the U.S. is costly and time consuming, and such clearances or approvals may not be granted on a timely basis, or at all, and the ability to obtain the rights to market additional, suitable

products depends on negotiations with third parties which may not be forthcoming; and • The Company describes additional risks and uncertainties in the Risk Factors section of its most recent annual report and quarterly reports filed with the

Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this presentation and the Company assumes no obligation to update any forward-looking statement. 3

A Pioneer and Leader in Healing Solutions for Wound & Surgical To be

the leading global Helping Our Our provider of healing solutions Humans through relentless innovation Why Vision Heal to restore quality of life. Large, national placental New product innovations The most studied portfolio A key partner to

healthcare donation network and leading to untapped of placental-based products professionals with industry opportunities for growth, with 50+ clinical & scientific proprietary tissue leading support services publications and over 300

processing. including an increasing and customer-focused footprint in the Surgical million payer covered lives. approach. market. 4

The Unmet Need for Wound Healing Solutions Is Large and Growing 1

million people suffer from chronic, non-healing wounds in the U.S. >10 • Aging population Favorable • Obesity Demographic • Smoking history• Heart & vascular disease Trends • Diabetes Chronic Wounds ~16% of the

Medicare beneficiary population is impacted by Burden Medicare 1 chronic wounds—and this proportion is increasing. Beneficiaries Ineffective Wound It is estimated that up to 85% of amputations are avoidable with a Management holistic

multispecialty team approach that incorporates innovative Leads to Poor 2 treatments and adherence to treatment parameters. Outcomes Advances Driving When applied following parameters for use, patients treated with EPIFIX® 2 Improved Outcomes

experienced reductions in major amputations and hospital utilization. for Patients 1) Sen CK. Human Wound and Its Burden: Updated 2022 Compendium of Estimates. Adv Wound Care (New Rochelle). 2023;12(12):657-670. 5 2) Tettelbach WH, et al.

Cost-effectiveness of dehydrated human amnion/chorion membrane allografts in lower extremity diabetic ulcer treatment. J Wound Care. 2022 Feb 1;31(Sup2):S10-S31.

The Patient Journey in Wound Care MIMEDX products are available in all

settings …and are used on a range of chronic and other where patients receive care… hard-to-heal wounds. Private Acute Wounds Office Wound Hospital Care Clinic Inpatient Mohs surgery Burn/Trauma Hospital Home Chronic Wounds Outpatient

Health Diabetic Foot Ulcer Venous Leg Ulcer Assisted Mobile Living Health Complex/ Facility Dehisced Wounds …and other Nursing care Facility settings 6 Limb Salvage Dehiscence

Significant Opportunity to Drive Further Utilization in Surgical Neuro

Mohs Orthopedic Spine Colorectal Anastomoses Procedures Cranioplasty Procedures with AMNIOFIX® with AMNIOFIX Gastrointestinal 3 1 Anastomotic Leak Rate with & without AMNIOFIX Clinical Outcomes with Conventional Methods 4% OB/GYN Average

Frequent Fibrosis has dissection time fibrosis increased ~30 minutes reported complications Vascular p=0.0022 2 Clinical Outcomes with AMNIOFIX 1.03% Average Minimal dural No dissection time fibrosis in 86% intraoperative Foot & Ankle < 3

minutes of patients complications Conventional Closure Procedures with AMNIOFIX 1) Lee B. MIMEDX interview with Bryan Lee, MD. October 4, 2023. Leak / N 80 / 2,000 4 / 390 2) Endicott L, Ehresman J, Tettelbach W, Forsyth A, Lee B. Dehydrated human

amnion/chorion membrane (DHACM) use in emergent craniectomies shows minimal dural adhesions. J Wound 7 Care. 2023;32(10):634-640. 3) F. Raymond Ortega, MD, FACS; Dennis Choat, MD, FACS, FASCRS; Emery Minnard, MD; Jeffrey Cohen, MD. The American

College of Surgeons Clinical Congress, Oct 22-26, 2017, San Diego, CA.

Our Strategic Priorities • Continue momentum with new organic