Millicom (Tigo) declares $0.75 per share interim dividend to be paid on April 15, 2025

February 26 2025 - 1:55PM

Millicom (Tigo) declares $0.75 per share

interim dividend to be paid on April 15, 2025

Luxembourg, February 26, 2025 – In line with the

press release published on January 14, 2025, the Board of Directors

of Millicom International Cellular S.A. (“Millicom”) approved the

interim dividend of $0.75 per share to be paid on April 15, 2025

(the “Payment Date”). Other important dates and information

relating to the Interim Dividend are as follows:

- Interim Dividend Record Date: the Interim Dividend will

be paid to shareholders who are registered in the U.S. with

Broadridge on April 8, 2025, at 23.59 CET;

- Ex-dividend Date: the last trading day on which shares

acquired will be eligible to receive the Interim Dividend payment,

would be April 8, 2025;

- Currency: the Interim Dividends will be paid in U.S.

dollars;

- Payment Date: holders of Millcom shares will be paid in

accordance with the applicable procedures of Broadridge and the

Depository Trust Company (“DTC”) on April 15, 2025.

The Company intends to file a delisting

application with Nasdaq Stockholm on March 3, 2025, which will

result in the SDR program being terminated. The last day of

trading for SDRs is estimated to be on or around March 17, 2025.

Therefore, it is expected that only holders of common shares on the

Interim Dividend Record Date will receive the Interim Dividend paid

on April 15, 2025.

As regards certain tax aspects, Millicom can

currently inform investors as follows. In accordance with

Luxembourg income tax law, the payment of the Interim Dividend will

be subject to a 15% withholding tax. Millicom will withhold the 15%

withholding tax and pay this amount to the Luxembourg tax

administration. The Interim Dividend will be paid net of

withholding tax. However, a reduced withholding tax rate may be

foreseen in a double tax treaty concluded between Luxembourg and

the country of residence of the shareholder or an exemption may be

available in cases where the Luxembourg withholding tax exemption

regime conditions are fulfilled. These shareholders should contact

their advisors regarding the procedure and the deadline for a

potential refund of the withholding tax from the Luxembourg tax

authority. Millicom shareholders should consult their tax advisor

regarding potential tax implications. Additional information

available on the “Nasdaq Stockholm Delisting & Interim

Dividend” section of the Millicom website:

https://www.millicom.com/investors/Nasdaq_Stockholm_Delisting_and_Interim_Dividend

-END-

For further information, please

contact

|

Press: Sofía Corral, Director Corporate

Communicationspress@millicom.com |

Investors: Michel Morin, VP Investor Relations

investors@millicom.com |

About Millicom

Millicom (NASDAQ U.S.: TIGO, Nasdaq Stockholm:

TIGO_SDB) is a leading provider of fixed and mobile

telecommunications services in Latin America. Through our TIGO® and

Tigo Business® brands, we provide a wide range of digital services

and products, including TIGO Money for mobile financial services,

TIGO Sports for local entertainment, TIGO ONEtv for pay TV,

high-speed data, voice, and business-to-business solutions such as

cloud and security. As of September 30, 2024, Millicom, including

its Honduras Joint Venture, employed approximately 15,000 people,

and provided mobile and fiber-cable services through its digital

highways to more than 46 million customers, with a fiber-cable

footprint of about 14 million homes passed. Founded in 1990,

Millicom International Cellular S.A. is headquartered in

Luxembourg.

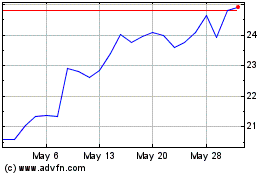

Millicom International C... (NASDAQ:TIGO)

Historical Stock Chart

From Feb 2025 to Mar 2025

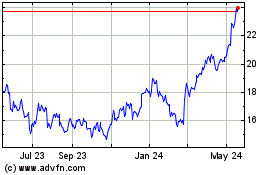

Millicom International C... (NASDAQ:TIGO)

Historical Stock Chart

From Mar 2024 to Mar 2025