SmallCapsDaily: Mill City Ventures Outperforms in the Specialty Finance Space

August 02 2022 - 11:27AM

InvestorsHub NewsWire

New York, NY -- August 2, 2022 -- InvestorsHub NewsWire --

Mill City Ventures III, Ltd. (OTCQB:

MCVT), a non-bank lender and specialty finance company, was the

subject of recent coverage by leading financial news website and

publisher, SmallCapsDaily. The coverage details how Mill City

Ventures plays a key role for small, high-growth businesses and

real estate operators in a credit market environment that is

relatively unstable, with higher thresholds for bank lending and

increasing interest rates. SmallCapsDaily's deep dive outlines the

fundamentals and returns on capital employed by Mill City Ventures

III, Ltd. (OTCQB:

MCVT), noting that Mill City specializes in lending money or

other specialty finance options for public and private companies to

fund their operations, including start-up, acquisition, and

growth.

The article also describes how Mill City focuses primarily on

lending to privately held and publicly traded businesses and

reveals that their objective is to provide above-market returns to

their investors while making every effort to lower investor risk.

Headquartered in Wayzata, Minnesota, the coverage notes Mill City

also provides litigation finance, asset-backed loans, title loans,

tax anticipation loans, real estate bridge loans, mortgages, and

more. The company is headquartered in Wayzata, Minnesota.

Given its unique approach to lending, in that Mill City Ventures

evaluates each loan request by considering hard data like the

borrower's intention and ability to pay, as well as the asset value

of any pledged collateral, coupled with the company's

fast-processing speed which justifies the higher cost of borrowing

for any borrower, prospective borrowers are increasingly seeking

out Mill City.

For more detailed information, visit

https://smallcapsdaily.com/mill-city-ventures-a-true-outperformer-in-the-specialty-finance-domain

Key Takeaways

-

With fewer reporting requirements, Mill City Ventures has

significantly higher flexibility with respect to its investments

and lending policy and it has an excellent blend of aggressive

lending and robust risk management.

-

Mill City Ventures has a solid return on equity of 11% and an

overall return on capital employed of 9.4%.

-

Mill City Ventures is managing almost $19 million, when taking

the total debt and equity holdings of the company in

consideration.

-

Mill City has had ROI's on recent lending as high as 58.29%.

About Mill City Ventures III, Ltd.

Founded in 2007, Mill City Ventures III, Ltd., is a short-term

non-bank lending and specialty finance company. Additional

information can be found at www.sec.gov.

Forward-Looking Statements

SmallCapsDaily profiles are not a solicitation or recommendation

to buy, sell or hold securities. SmallCapsDaily is a paid

advertiser and is not offering securities for sale. Neither

SmallCapsDaily nor its owners, operators, affiliates or anyone

disseminating information on its behalf is registered as an

Investment Advisor under any federal or state law and none of the

information provided by SmallCapsDaily its owners, operators,

affiliates or anyone disseminating information on its behalf should

be construed as investment advice or investment recommendations.

Small Caps Daily does not recommend that the securities profiled

should be purchased, sold or held and is not liable for any

investment decisions by its readers or subscribers. Information

presented by Small Caps Daily may contain "forward-looking

statements" within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. Any

statements that express or involve discussions with respect to

predictions, expectations, beliefs, plans, projections, objectives,

goals, assumptions, or future events or performance, are not

statements of historical fact and may be "forward-looking

statements." Forward-looking statements are based on expectations,

estimates and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward-looking statements may be identified through

the use of words such as "expects," "will," "anticipates,"

"estimates," "believes," "may," or by statements indicating that

certain actions "may," "could," or "might" occur.

Contact:

SmallCapsDaily

info@smallcapsdaily.com

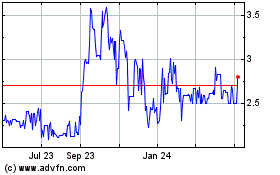

Mill City Ventures III (NASDAQ:MCVT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Mill City Ventures III (NASDAQ:MCVT)

Historical Stock Chart

From Feb 2024 to Feb 2025