Notice of Exempt Solicitation

Pursuant to Rule 14a-103

Name of the Registrant: Meta Platforms, Inc.

Name of persons relying on exemption:

| · | Illinois State Treasurer Michael Frerichs |

| · | Wespath Benefits and Investments |

| · | Schroders International Selection Fund |

Address of persons relying on exemption:

| · | Illinois State Treasurer Michael Frerichs– 555 W. Monroe St., 14th Floor, Chicago, IL 60661 |

| · | Wespath Benefits and Investments—1901 Chestnut Ave, Glenview IL, 60025 |

| · | Schroders – 5 Rue Hohenhof, Senningberg, 1736, Luxembourg |

This Notice and the attached written materials are filed pursuant to

Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934.

May 17, 2024

Dear Meta Platforms, Inc. Shareholders,

We, the Proponents1, are writing to urge shareholders

of Meta Platforms, Inc. (Meta or “the Company”) to vote FOR Proposal #7 on the Company’s 2024 proxy statement, a proposal

which recommends that the Company disaggregate voting results by share class, during Meta’s Annual General Meeting on May 29, 2024.

The resolved clause of our proposal states,

“Shareholders request that Meta Platforms, Inc. (the “Company”)

disclose the voting results on matters subject to a shareholder vote according to the class of shares, namely differentiating between

those shares carrying one voting right and those carrying multiple voting rights, effective beginning at the Company’s 2025 annual

meeting of shareholders.”

The Proposal, which has been submitted by the Illinois State Treasurer,

Wespath Benefits and Investments, and Schroder International Select Fund, is a call for enhanced transparency that is based on principles

of sound corporate governance. One key method of corporate governance enhancement would be to end the dual-class stock structure the Company

has maintained since going public in 2012, which is a structure of unequal voting rights that practically grants CEO and Chair, Mark Zuckerberg,

the deciding vote on all shareholder concerns. Since the Company is not willing to eliminate or phase-out its dual-class stock structure,

it should at least provide more transparency over how proposals are voted on by independent and non-independent shareholders. This is

what Proposal #7 calls for.

| 1. | Dual-Class stock structures run contrary to corporate governance best practices. |

The Council of Institutional Investors (CII), a nonprofit, nonpartisan

association whose members’ collective assets under management total approximately $5 trillion, describes the “one share, one

vote” concept as a bedrock principle of sound corporate governance.2 CII maintains that companies should establish arrangements

that allow shareholders to vote in proportion to the size of their holdings, and that having different shares of stock with unequal voting

powers can deprive non-insiders of a voice in company matters, a structure that can ultimately lead to board entrenchment.

A prominent study on US firms with dual-class stock structures showed

that although these companies typically enjoy higher valuations around the time of their Initial Public Offerings (IPOs), this premium

tends to erode over the span of around six years, at which point their valuations drop below those of single-class firms.3

Other research has generally substantiated this finding: dual-class companies enjoy a premium in the short term, but eventually that premium

transforms into a discount.4

Proponents of dual-class systems argue that dual-class structures are

necessary to allow founders and management to pursue long-term goals and thwart unwanted takeover attempts. This insulates young companies

from short-termism at a time when leadership is still trying to demonstrate the company’s viability5. In response to

such concerns, and for companies that insist on establishing a multi-class structure at their IPOs, advocates urge them to at least set

in place sunset provisions that revert all stock to a single class within seven years.6

_____________________________

1 Illinois

State Treasurer, Wespath Benefits and Investments, and Schroder International Selection Fund

2 https://www.cii.org/dualclass_stock,

see also https://www.cii.org/corp_gov_policies

3 https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3062895

4 https://www.cii.org/files/CII%20Summary%20of%20DC%20Studies.pdf

5 https://iveybusinessjournal.com/dual-class-shares-risks-and-advantages/

6 https://www.railpen.com/knowledge-hub/our-thinking/2023/icev-one-share-one-vote/

This is what makes Meta Platforms particularly troubling. For one,

the Company is no longer in its infancy. With an IPO dating back to 2012, Meta has been publicly traded for over a decade. Its sizeable

market capitalization of $1.23 trillion—among the largest in the US—demonstrates the Company’s long-term viability,

which would make takeover attempts challenging and expensive. Despite this, Meta has yet to make any commitments to remove its dual-class

stock structure, put in place a sunset provision, or otherwise modify its unequal voting rights policies.

| 2. | Mark Zuckerberg owns virtually all available Class B stock, disproportionately influencing shareholder voting |

One of the most troubling aspects of Meta’s governance is that

its preferred stock ownership is concentrated in a single shareholder: Mark Zuckerberg. Opponents of dual-class stock structures argue

that such mechanisms can lead to board entrenchment or allow a relatively small number of shareholders to have an outsized voice in corporate

decisions. Meta’s arrangement is such that a supermajority power belongs to a single individual.

While Meta maintains a Class A stock that grants one vote per share,

its Class B stock grants ten votes per share. The Company’s 2023 proxy statement reveals that Mark Zuckerberg owns 99.8% of the

outstanding Class B shares.7 While this represents only 13% of the economic ownership, it grants him 61% of the voting power.8

Most importantly, it also makes him the sole deciding vote on each proposal presented to shareholders.

| 3. | Ongoing controversies signal a need for enhanced transparency. |

Controversies continue to mar Meta, with legal, reputational, and regulatory

risks continuing to grow. Over the past few years, we have witnessed:

| · | Legal Challenges. In October 2023, more than 40 states sued Meta and alleged that Facebook and Instagram “exploit and

manipulate children”.9 In June 2022, the U.S. Justice Department sued the Company for alleged widespread discrimination

that violated Title VII of the Civil Rights Act; Meta settled with the Department on the same date the lawsuit was filed.10 |

| · | Federal Scrutiny. Mark Zuckerberg, along with other social media CEOs, testified in front of the Senate Judiciary Committee

this January over bipartisan concerns that these platforms negatively impact the mental health of young users. In documents published

in advance of the hearing, it was revealed that Zuckerberg ignored recommendations to bolster the Company’s child safety team11.

Ranking member Senator Lindsey Graham (R-SC) even called for the repeal of Section 230 of the U.S. code that prevents social media companies

from being sued for the third-party content they publish on their sites.12 |

_____________________________

7 https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001326801/000132680123000050/meta-20230414.htm

8 https://www.railpen.com/media/pmcil2eb/icev-report-2023-undermining-the-shareholder-voice.pdf

9 https://www.npr.org/2023/10/24/1208219216/states-sue-meta-claiming-instagram-facebook-fueled-youth-mental-health-crisis

10 https://www.justice.gov/usao-sdny/pr/united-states-attorney-resolves-groundbreaking-suit-against-meta-platforms-inc-formerly

11 https://www.msn.com/en-us/news/technology/tiktok-snap-x-and-meta-ceos-grilled-at-tense-senate-hearing-on-social-media-and-kids/ar-BB1hxlbh

12 https://www.pbs.org/newshour/politics/watch-live-ceos-of-meta-tiktok-x-and-other-social-media-companies-testify-in-senate-hearing

| · | Mounting Penalties. In November of 2022, the Company was fined €265 million ($277 million) by the European Union’s

Irish Data Protection Commission for failing to prevent the leak of over half a billion users’ personal data.13 The fines

for data privacy violations only continued to climb from there. The company was fined an additional €390 million ($414 million) in

January 2023,14 and was fined once again in May of the same year, this time for a record €1.2 billion ($1.3 billion).15 |

Over the years, shareholders have presented proposals that

have covered aspects of the above topics16. It would be beneficial if disaggregated vote totals were readily presented to shareholders

so they could determine, with certainty, which proposals (if any) may have received majority support among independent shareholders.

To be clear, we are not asserting that the Company would

have avoided the consequences detailed above if they had enacted any proposals that may have received majority independent support. That

is impossible to know. Instead, we believe that shareholders are expressing concerns over matters that have already resulted in legal,

reputational, and financial harm to the Company. Therefore, we believe greater transparency is warranted to help determine when these

concerns are shared by a majority of independent investors.

| 4. | Disaggregating votes by share class would not be onerous for management. |

We are unaware of any technical or practical challenges that would

prevent the Company from disaggregating vote totals by share class as outlined in the proposal. Over the course of numerous engagement

conversations and dialogue we have participated in, Company representatives have never made the claim to these Proponents that installing

such a practice would present an onerous burden for management. In fact, representatives have highlighted that such data is already presented

to the Board for their review internally after each proxy season. Furthermore, we have identified other U.S. companies that have already

implemented this practice, such as the Duluth Trading Company17 and the Salem Media Group18.

_____________________________

13 https://www.bloomberg.com/news/articles/2022-11-28/meta-fined-277-million-for-data-leak-of-half-a-billion-users

14 https://time.com/6244496/meta-ads-fine/

15 https://www.nytimes.com/2023/05/22/business/meta-facebook-eu-privacy-fine.html#:~:text=Meta%20on%20Monday%20was%20fined%20a%20record%201.2,company%20for%20violating%20European%20Union%20data%20protection%20rules.

16 For example: , page 74;

https://www.sec.gov/Archives/edgar/data/1326801/000132680122000043/meta2022definitiveproxysta.htm#i046933ef7c26477e9c8a108d937e294d_2748779070185,

page 74;

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001326801/000132680123000050/meta-20230414.htm,

page 88;

https://www.sec.gov/Archives/edgar/data/1326801/000132680122000043/meta2022definitiveproxysta.htm#i046933ef7c26477e9c8a108d937e294d_2748”7907’185,

page 78

17 https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001649744/000119312523157684/d444328d8k.htm

18 https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001050606/000119312523149534/d650502d8k.htm

Finally, if implemented as requested, our proposal would not require

the Company to report disaggregated vote totals until after their 2025 Annual General Meeting, which we believe would provide them with

ample time to work through any technical or practical challenges.

Conclusion

Dual-class stock structures violate core principles of sound corporate

governance. The voting arrangement at Meta is, in our view, one of the most egregious among publicly traded companies as it grants Mark

Zuckerberg the sole deciding vote on all corporate matters brought by shareholders. The request of our proposal is modest, would not be

difficult to implement, and is based on another bedrock principle of sound corporate governance: transparency. If the Company is unwilling

to phase out or reform its dual-class voting structure, it should at least disclose how non-Class B shareholders vote on matters that

are important to them.

IMPORTANT NOTICE: The cost of this communication is being

borne entirely by Illinois State Treasurer. The foregoing information may be disseminated to shareholders via telephone, U.S. mail, e-mail,

certain websites and certain social media venues, and should not be construed as investment advice or as a solicitation of authority to

vote your proxy. Proxy cards will not be accepted by Illinois State Treasurer, Wespath Benefits and Investments, or Schroder International

Select Fund. To vote your proxy, please follow the instructions on your proxy card. These written materials may be submitted pursuant

to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934. The views expressed are those of the authors as of the

date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be a forecast

of future events or a guarantee of future results. These views may not be relied upon as investment advice. The information contained

herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete

summary or statement of all available data. This piece is for informational purposes and should not be construed as a research report.

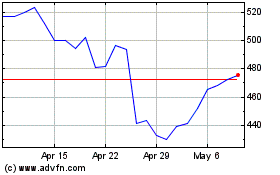

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From May 2024 to Jun 2024

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Jun 2023 to Jun 2024