Mercer International Inc. (Nasdaq: MERC) today reported third

quarter 2022 Operating EBITDA of $140.9 million similar to $148.1

million in the third quarter of 2021 and $145.1 million in the

second quarter of 2022.

In the third quarter

of 2022, net income was $66.7 million (or $1.01 per basic share and

$1.00 per diluted share) compared to $69.1 million (or $1.05 per

basic share and $1.04 per diluted share) in the third quarter of

2021 and net income of $71.4 million (or $1.08 per basic share and

$1.07 per diluted share) in the second quarter of 2022.

In the first nine

months of 2022, Operating EBITDA increased by 40% to $440.4 million

from $313.9 million in the same period of 2021. In the first nine

months of 2022, net income increased to $227.0 million (or $3.43

per basic share and $3.41 per diluted share) from $96.5 million (or

$1.46 per share) in the same period of 2021.

Mr. Juan Carlos Bueno,

the Chief Executive Officer, stated: “I am pleased with our third

quarter operating results. Strong energy and pulp prices combined

with favorable foreign exchange movements and lower planned major

maintenance were the main factors behind our operating results

relative to the second quarter.

We are excited about

the addition of the HIT Torgau mill to the Mercer group. This

acquisition will increase our lumber capacity to almost one billion

board feet and diversifies our product offering with the addition

of both pallets and wood pellets. The Torgau mill acquisition also

brings additional green energy production capacity to our business.

Since the acquisition closed on September 30th, we have focused on

integrating this business and also ensuring we begin capitalizing

on the estimated $16 million of annual synergies that we have

identified.

Total pulp production

in the current quarter decreased by approximately 11% compared to

the same quarter of 2021, primarily due to lower production at our

Stendal mill, which had a fire in its woodyard. The fire resulted

in the mill being down for most of July, and after its restart, it

has operated at approximately 90% of its capacity. We currently

expect to install replacement equipment at our Stendal mill in the

fourth quarter of 2022 and first quarter of 2023. We maintain

property and business interruption insurance for the Stendal mill

and we expect the property damage and business interruption to be

covered.

Our Friesau sawmill

ran well in the third quarter, but significantly weaker lumber

prices in the United States negatively impacted both sales prices

and volumes compared to the prior quarter of 2022.

The negative impact of

increased key production costs such as fiber, energy and chemicals

in the third quarter is expected to continue in the fourth quarter

of 2022. In particular, fiber costs in Germany increased because of

materially higher demand for wood for energy purposes. Our

production costs are primarily incurred in euros and Canadian

dollars. However, our pulp and a material portion of our lumber

sales are priced in dollars. During the third quarter of 2022, the

dollar continued to strengthen against the euro and the Canadian

dollar which had a positive impact on our euro and Canadian dollar

denominated costs and expenses and partially offset the negative

impact of such inflationary pressures. The strengthening of the

dollar increased our operating income by approximately $13.8

million compared to the prior quarter of 2022 and by approximately

$37.0 million compared to the third quarter of 2021.

Looking forward to the

fourth quarter, we currently expect pulp prices and demand to

remain generally strong with some modest price declines as a result

of inflationary pressures negatively impacting paper demand. Lumber

demand and prices are expected to be generally similar to the third

quarter due to continued economic uncertainty caused by inflation

and higher interest rates.

Strong energy demand

and prices in Germany are expected to continue in the fourth

quarter of 2022. In October, 2022, in response to restricted energy

supply and price increases, the EU implemented a temporary

mandatory cap on market revenues at €180 per MWh for intra-marginal

generators such as renewables, nuclear and lignite producers. The

cap applies to both electricity traded in the market as well as

bilateral trading and will be in effect from December 1, 2022, to

June 30, 2023."

Mr. Bueno concluded:

"With our expanded solid wood operations and product lines combined

with our world-class assets, we believe we are well positioned to

enhance value for our stakeholders going forward."

____________________

*Operating EBITDA is

not a measure of financial performance under accounting principles

generally accepted in the United States ("GAAP") and should not be

considered in isolation or as a substitute for analysis of our

results as reported under GAAP. See page 6 of the financial tables

included in this press release for a reconciliation of net income

to Operating EBITDA.

Consolidated Financial

Results

|

|

Q3 |

|

|

Q2 |

|

|

Q3 |

|

|

YTD |

|

|

YTD |

|

|

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

(in thousands, except per share amounts) |

|

|

|

Revenues |

$ |

532,814 |

|

|

$ |

572,326 |

|

|

$ |

469,746 |

|

|

$ |

1,697,881 |

|

|

$ |

1,284,298 |

|

|

|

Operating income |

$ |

108,723 |

|

|

$ |

114,031 |

|

|

$ |

113,755 |

|

|

$ |

345,105 |

|

|

$ |

216,620 |

|

|

|

Operating EBITDA |

$ |

140,867 |

|

|

$ |

145,059 |

|

|

$ |

148,070 |

|

|

$ |

440,393 |

|

|

$ |

313,857 |

|

|

| Loss

on early extinguishment of debt |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(30,368 |

) |

(1) |

| Net

income |

$ |

66,746 |

|

|

$ |

71,372 |

|

|

$ |

69,118 |

|

|

$ |

227,015 |

|

|

$ |

96,466 |

|

|

| Net

income per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

1.01 |

|

|

$ |

1.08 |

|

|

$ |

1.05 |

|

|

$ |

3.43 |

|

|

$ |

1.46 |

|

|

|

Diluted |

$ |

1.00 |

|

|

$ |

1.07 |

|

|

$ |

1.04 |

|

|

$ |

3.41 |

|

|

$ |

1.46 |

|

|

____________________

(1) Redemption of

6.50% senior notes due 2024 and 7.375% senior notes due

2025.Consolidated – Three Months Ended September 30, 2022

Compared to Three Months Ended September 30, 2021Total

revenues in the third quarter of 2022 increased by approximately

13% to $532.8 million from $469.7 million in the same quarter of

2021 primarily due to higher energy and pulp sales realizations

partially offset by lower sales volumes and lower lumber sales

realizations.

In the third quarter of 2022, energy and

chemical revenues increased by approximately 169% to $71.2 million

from $26.5 million in the same quarter of 2021 primarily as a

result of higher energy prices in Germany, which were more than

triple those in the same quarter of 2021. In the third quarter of

2022, our average energy sales realizations in Germany were

approximately €388 per MWh compared to about €104 per MWh in the

comparative quarter of 2021.

Costs and expenses in the third quarter of 2022

increased by approximately 19% to $424.1 million from $356.0

million in the third quarter of 2021 driven by higher key

production costs, such as fiber, chemicals and energy, and higher

freight costs. Such cost increases were partially offset by the

positive impact of a stronger dollar on our euro and Canadian

dollar denominated costs and expenses.

In the third quarter of 2022, Operating EBITDA

decreased by approximately 5% to $140.9 million from $148.1 million

in the same quarter of 2021 primarily due to higher per unit fiber

costs, higher other production and freight costs and lower sales

volumes partially offset by higher energy and pulp sales

realizations and the positive impact of a stronger dollar.

Segment

ResultsPulp

| |

Three Months Ended September 30, |

|

|

| |

2022 |

|

|

2021 |

|

|

| |

(in thousands) |

|

|

|

Pulp revenues |

$ |

395,459 |

|

|

$ |

374,287 |

|

|

|

Energy and chemical revenues |

$ |

61,198 |

|

|

$ |

22,456 |

|

|

|

Operating income |

$ |

109,985 |

|

|

$ |

99,918 |

|

|

In the third quarter of 2022, pulp segment

operating income increased by approximately 10% to $110.0 million

from $99.9 million in the same quarter of 2021 primarily due to

higher sales realizations and the positive impact of a stronger

dollar, partially offset by higher per unit fiber costs, higher

other production and freight costs and lower sales volumes.

Pulp revenues in the third quarter of 2022

increased by approximately 6% to $395.5 million from $374.3 million

in the same quarter of 2021 due to higher sales realizations

partially offset by lower sales volumes.

In the third quarter of 2022, third-party

industry quoted average list prices for NBSK pulp increased from

the same quarter of 2021 primarily as a result of low customer

inventory levels. Our average NBSK pulp sales realizations

increased by approximately 8% to $911 per ADMT in the third quarter

of 2022 from approximately $847 per ADMT in the same quarter of

2021.

Energy and chemical revenues increased to a

record $61.2 million in the third quarter of 2022 from $22.5

million in the same quarter of 2021 due to higher sales

realizations. During the third quarter of 2022, we benefitted from

strong energy demand and higher energy prices in Germany.

In the third quarter of 2022 compared to the

same quarter of 2021, we had a positive impact of approximately

$32.6 million in operating income due to foreign exchange,

primarily as a result of the effect of the stronger dollar on costs

and expenses.

Costs and expenses in the third quarter of 2022

increased by approximately 17% to $346.7 million from $296.9

million in the third quarter of 2021 primarily due to higher per

unit fiber, chemical, energy and freight costs. The higher costs

were partially offset by the positive impact of a stronger dollar

and lower pulp sales volumes.

In the third quarter of 2022 per unit fiber

costs increased by approximately 32% from the same quarter of 2021

due to higher per unit fiber costs for all of our mills. Our German

mills had higher per unit fiber costs as a result of strong demand

from other wood consumers such as heating pellet manufacturers. For

our Canadian mills, per unit fiber costs increased due to strong

demand in the mills' fiber baskets and for our Celgar mill a

decrease in the availability of wood chips due to regional sawmill

curtailments. We currently expect per unit fiber costs to increase

in the fourth quarter of 2022 with an increase in Germany due to

continued strong demand and generally flat per unit fiber costs in

Canada.

Solid Wood

| |

Three Months Ended September 30, |

|

|

| |

2022 |

|

|

2021 |

|

|

| |

(in thousands) |

|

|

|

Lumber revenues |

$ |

61,444 |

|

|

$ |

67,605 |

|

|

|

Energy revenues |

$ |

8,111 |

|

|

$ |

1,801 |

|

|

| Wood

residual revenues |

$ |

4,711 |

|

|

$ |

1,317 |

|

|

|

Operating income |

$ |

2,896 |

|

|

$ |

17,949 |

|

|

In the third quarter of 2022,

operating income decreased by approximately 84% to $2.9 million

from $17.9 million in the same quarter of 2021 primarily due to

higher per unit fiber costs and other production costs, lower

lumber sales realizations and sales volumes partially offset by

higher energy and wood residuals sales realizations.

Average lumber sales realizations decreased by

approximately 13% to $605 per Mfbm in the third quarter of 2022

from approximately $692 per Mfbm in the same quarter of 2021 due to

lower demand in the European market. Demand in both the European

and U.S. markets is being negatively impacted by concerns over

rising interest rates, inflationary pressures and a weaker economic

outlook.

Fiber costs were approximately 70% of our lumber

cash production costs in the third quarter of 2022. In the third

quarter of 2022, per unit fiber costs modestly increased compared

to the same quarter of 2021. Higher per unit fiber costs in euros

due to strong fiber demand in Germany were partially offset by the

positive impact of a stronger dollar on our euro denominated fiber

costs. We currently expect per unit fiber costs to modestly

increase in the fourth quarter of 2022.

Consolidated – Nine Months Ended

September 30, 2022 Compared to Nine Months Ended September 30,

2021Total revenues for the nine months ended September 30,

2022 increased by approximately 32% to $1,697.9 million from

$1,284.3 million in the nine months ended September 30, 2021

primarily due to higher sales realizations and higher pulp sales

volumes.

In the nine months ended September 30, 2022,

energy and chemical revenues increased by approximately 137% to

$165.2 million from $69.7 million in the same period of 2021

primarily as a result of higher energy prices in Germany, which

were more than double those in the same period of 2021. In the nine

months ended September 30, 2022, our average energy sales

realizations in Germany were approximately €241 per MWh compared to

about €89 per MWh in the comparative period of 2021.

Costs and expenses in the nine months ended

September 30, 2022 increased by approximately 27% to $1,352.8

million from $1,067.7 million in the nine months ended September

30, 2021 primarily due to higher per unit fiber, freight, energy

and chemical costs and a higher pulp sales volume partially offset

by the positive impact of a stronger dollar on our euro and

Canadian dollar denominated costs and expenses.

In the nine months ended September 30, 2022,

Operating EBITDA increased by approximately 40% to $440.4 million

from $313.9 million in the same period of 2021 primarily due to

higher sales realizations, the positive impact of a stronger dollar

and higher pulp sales volumes partially offset by higher per unit

fiber costs and higher other production and freight costs.

LiquidityAs of September 30,

2022, we had cash, cash equivalents and a term deposit aggregating

$362.3 million and approximately $258.9 million available under our

revolving credit facilities providing us with aggregate liquidity

of about $621.2 million.

Quarterly DividendA quarterly

dividend of $0.075 per share will be paid on December 29, 2022 to

all shareholders of record on December 21, 2022. Future dividends

will be subject to Board approval and may be adjusted as business

and industry conditions warrant.

Earnings Release CallIn

conjunction with this release, Mercer International Inc. will host

a conference call, which will be simultaneously broadcast live over

the Internet. Management will host the call, which is scheduled for

October 28, 2022 at 10:00 AM ET. Listeners can access the

conference call live and archived for 30 days over the Internet at

https://edge.media-server.com/mmc/p/tr7ugjbz or through a link on

the company's home page at https://www.mercerint.com. Please allow

15 minutes prior to the call to visit the site and download and

install any necessary audio software.

Mercer International Inc. is a global forest

products company with operations in Germany, the USA and Canada

with a consolidated annual production capacity of 2.3 million

tonnes of pulp, 960 million board feet of lumber, 140 thousand

cubic meters of CLT, 17 million pallets and 150,000 metric tonnes

of wood pellets. To obtain further information on the company,

please visit its website at www.mercerint.com.

The preceding includes forward looking

statements which involve known and unknown risks and uncertainties

which may cause our actual results in future periods to differ

materially from forecasted results. Words such as "expects",

"anticipates", "are optimistic that", "projects", "intends",

"designed", "will", "believes", "estimates", "may", "could" and

variations of such words and similar expressions are intended to

identify such forward-looking statements. Among those factors which

could cause actual results to differ materially are the following:

the highly cyclical nature of our business, raw material costs, our

level of indebtedness, competition, foreign exchange and interest

rate fluctuations, our use of derivatives, expenditures for capital

projects, environmental regulation and compliance, disruptions to

our production, market conditions and other risk factors listed

from time to time in our SEC reports.

APPROVED BY:Jimmy S.H. LeeExecutive Chairman(604) 684-1099

Juan Carlos BuenoChief Executive Officer (604) 684-1099

-FINANCIAL TABLES FOLLOW-

Summary Financial Highlights

| |

Q3 |

|

|

Q2 |

|

|

Q3 |

|

|

YTD |

|

|

YTD |

|

|

| |

2022 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

| |

(in thousands, except per share amounts) |

|

|

|

Pulp segment revenues |

$ |

456,657 |

|

|

$ |

460,304 |

|

|

$ |

396,743 |

|

|

$ |

1,402,892 |

|

|

$ |

1,046,748 |

|

|

|

Solid wood segment revenues |

|

74,266 |

|

|

|

110,985 |

|

|

|

70,723 |

|

|

|

290,048 |

|

|

|

232,149 |

|

|

|

Corporate and other revenues |

|

1,891 |

|

|

|

1,037 |

|

|

|

2,280 |

|

|

|

4,941 |

|

|

|

5,401 |

|

|

| Total revenues |

$ |

532,814 |

|

|

$ |

572,326 |

|

|

$ |

469,746 |

|

|

$ |

1,697,881 |

|

|

$ |

1,284,298 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pulp segment operating income |

$ |

109,985 |

|

|

$ |

75,471 |

|

|

$ |

99,918 |

|

|

$ |

271,692 |

|

|

$ |

138,552 |

|

|

|

Solid wood segment operating income |

|

2,896 |

|

|

|

43,726 |

|

|

|

17,949 |

|

|

|

84,923 |

|

|

|

88,240 |

|

|

|

Corporate and other operating loss |

|

(4,158 |

) |

|

|

(5,166 |

) |

|

|

(4,112 |

) |

|

|

(11,510 |

) |

|

|

(10,172 |

) |

|

| Total operating income |

$ |

108,723 |

|

|

$ |

114,031 |

|

|

$ |

113,755 |

|

|

$ |

345,105 |

|

|

$ |

216,620 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pulp segment depreciation and amortization |

$ |

28,174 |

|

|

$ |

27,001 |

|

|

$ |

29,982 |

|

|

$ |

82,859 |

|

|

$ |

84,995 |

|

|

|

Solid wood segment depreciation and amortization |

|

3,733 |

|

|

|

3,792 |

|

|

|

4,025 |

|

|

|

11,719 |

|

|

|

11,496 |

|

|

|

Corporate and other depreciation and amortization |

|

237 |

|

|

|

235 |

|

|

|

308 |

|

|

|

710 |

|

|

|

746 |

|

|

| Total depreciation and

amortization |

$ |

32,144 |

|

|

$ |

31,028 |

|

|

$ |

34,315 |

|

|

$ |

95,288 |

|

|

$ |

97,237 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating EBITDA |

$ |

140,867 |

|

|

$ |

145,059 |

|

|

$ |

148,070 |

|

|

$ |

440,393 |

|

|

$ |

313,857 |

|

|

| Loss on early extinguishment

of debt |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(30,368 |

) |

(1) |

| Income tax provision |

$ |

(31,294 |

) |

|

$ |

(34,126 |

) |

|

$ |

(32,490 |

) |

|

$ |

(89,656 |

) |

|

$ |

(45,873 |

) |

|

| Net income |

$ |

66,746 |

|

|

$ |

71,372 |

|

|

$ |

69,118 |

|

|

$ |

227,015 |

|

|

$ |

96,466 |

|

|

| Net income per common

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

1.01 |

|

|

$ |

1.08 |

|

|

$ |

1.05 |

|

|

$ |

3.43 |

|

|

$ |

1.46 |

|

|

|

Diluted |

$ |

1.00 |

|

|

$ |

1.07 |

|

|

$ |

1.04 |

|

|

$ |

3.41 |

|

|

$ |

1.46 |

|

|

| Common shares outstanding at

period end |

|

66,167 |

|

|

|

66,167 |

|

|

|

66,037 |

|

|

|

66,167 |

|

|

|

66,037 |

|

|

____________________

(1) Redemption of 6.50%

senior notes due 2024 and 7.375% senior notes due 2025.

Summary Operating Highlights

| |

Q3 |

|

|

Q2 |

|

|

Q3 |

|

|

YTD |

|

|

YTD |

|

|

| |

2022 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

Pulp Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pulp production ('000 ADMTs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NBSK |

|

362.9 |

|

|

|

418.3 |

|

|

|

443.0 |

|

|

|

1,216.7 |

|

|

|

1,195.0 |

|

|

|

NBHK |

|

82.1 |

|

|

|

51.6 |

|

|

|

57.8 |

|

|

|

190.4 |

|

|

|

143.9 |

|

|

|

Annual maintenance downtime ('000 ADMTs) |

|

17.3 |

|

|

|

54.2 |

|

|

|

42.8 |

|

|

|

71.5 |

|

|

|

253.7 |

|

|

|

Annual maintenance downtime (days) |

|

17 |

|

|

|

43 |

|

|

|

44 |

|

|

|

60 |

|

|

|

188 |

|

|

|

Pulp sales ('000 ADMTs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NBSK |

|

356.6 |

|

|

|

405.7 |

|

|

|

402.2 |

|

|

|

1,267.4 |

|

|

|

1,151.3 |

|

|

|

NBHK |

|

69.3 |

|

|

|

65.8 |

|

|

|

45.7 |

|

|

|

185.0 |

|

|

|

145.1 |

|

|

|

Average NBSK pulp prices ($/ADMT)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

|

1,500 |

|

|

|

1,437 |

|

|

|

1,345 |

|

|

|

1,422 |

|

|

|

1,223 |

|

|

|

China |

|

969 |

|

|

|

1,008 |

|

|

|

832 |

|

|

|

959 |

|

|

|

892 |

|

|

|

North America |

|

1,800 |

|

|

|

1,743 |

|

|

|

1,542 |

|

|

|

1,690 |

|

|

|

1,481 |

|

|

|

Average NBHK pulp prices ($/ADMT)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

China |

|

855 |

|

|

|

815 |

|

|

|

623 |

|

|

|

779 |

|

|

|

694 |

|

|

|

North America |

|

1,620 |

|

|

|

1,517 |

|

|

|

1,320 |

|

|

|

1,483 |

|

|

|

1,212 |

|

|

|

Average pulp sales realizations ($/ADMT)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NBSK |

|

911 |

|

|

|

890 |

|

|

|

847 |

|

|

|

865 |

|

|

|

777 |

|

|

|

NBHK |

|

990 |

|

|

|

843 |

|

|

|

684 |

|

|

|

858 |

|

|

|

604 |

|

|

|

Energy production ('000 MWh)(3) |

|

484.2 |

|

|

|

496.6 |

|

|

|

464.5 |

|

|

|

1,512.4 |

|

|

|

1,345.6 |

|

|

|

Energy sales ('000 MWh)(3) |

|

174.3 |

|

|

|

199.3 |

|

|

|

185.8 |

|

|

|

568.3 |

|

|

|

517.8 |

|

|

|

Average energy sales realizations ($/MWh)(3) |

|

339 |

|

|

|

186 |

|

|

|

114 |

|

|

|

233 |

|

|

|

101 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Solid Wood Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lumber production (MMfbm) |

|

97.1 |

|

|

|

112.2 |

|

|

|

102.1 |

|

|

|

324.8 |

|

|

|

336.6 |

|

|

|

Lumber sales (MMfbm) |

|

89.8 |

|

|

|

111.0 |

|

|

|

97.7 |

|

|

|

310.7 |

|

|

|

315.3 |

|

|

|

Average lumber sales realizations ($/Mfbm) |

|

605 |

|

|

867 |

|

|

692 |

|

|

|

782 |

|

|

702 |

|

|

|

Energy production and sales ('000 MWh) |

|

20.6 |

|

|

|

25.5 |

|

|

|

14.1 |

|

|

|

70.6 |

|

|

|

51.4 |

|

|

|

Average energy sales realizations ($/MWh) |

|

394 |

|

|

198 |

|

|

128 |

|

|

260 |

|

|

128 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Spot Currency Exchange Rates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ / €(4) |

|

1.0066 |

|

|

|

1.0646 |

|

|

|

1.1784 |

|

|

|

1.0636 |

|

|

|

1.1958 |

|

|

|

$ / C$(4) |

|

0.7659 |

|

|

0.7836 |

|

|

0.7937 |

|

|

0.7796 |

|

|

0.7996 |

|

|

____________________

(1) Source: RISI

pricing report. Europe and North America are list prices. China are

net prices which include discounts, allowances and rebates.

(2) Sales realizations after customer discounts, rebates and

other selling concessions. Incorporates the effect of pulp price

variations occurring between the order and shipment

dates.(3) Does not include our 50% joint venture interest in

the Cariboo mill, which is accounted for using the equity

method.(4) Average Federal Reserve Bank of New York Noon

Buying Rates over the reporting period.

MERCER

INTERNATIONAL INC.INTERIM CONSOLIDATED STATEMENTS

OF OPERATIONS(Unaudited)(In

thousands, except per share data)

| |

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

Revenues |

|

$ |

532,814 |

|

|

$ |

469,746 |

|

|

$ |

1,697,881 |

|

|

$ |

1,284,298 |

|

|

| Costs

and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales, excluding depreciation and amortization |

|

|

367,710 |

|

|

|

302,221 |

|

|

|

1,187,476 |

|

|

|

910,244 |

|

|

|

Cost of sales depreciation and amortization |

|

|

32,122 |

|

|

|

34,294 |

|

|

|

95,223 |

|

|

|

97,175 |

|

|

|

Selling, general and administrative expenses |

|

|

24,259 |

|

|

|

19,476 |

|

|

|

70,077 |

|

|

|

60,259 |

|

|

|

Operating income |

|

|

108,723 |

|

|

|

113,755 |

|

|

|

345,105 |

|

|

|

216,620 |

|

|

| Other

income (expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(17,935 |

) |

|

|

(16,882 |

) |

|

|

(52,731 |

) |

|

|

(53,031 |

) |

|

|

Loss on early extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(30,368 |

) |

|

|

Other income |

|

|

7,252 |

|

|

|

4,735 |

|

|

|

24,297 |

|

|

|

9,118 |

|

|

| Total

other expenses, net |

|

|

(10,683 |

) |

|

|

(12,147 |

) |

|

|

(28,434 |

) |

|

|

(74,281 |

) |

|

| Income

before income taxes |

|

|

98,040 |

|

|

|

101,608 |

|

|

|

316,671 |

|

|

|

142,339 |

|

|

| Income

tax provision |

|

|

(31,294 |

) |

|

|

(32,490 |

) |

|

|

(89,656 |

) |

|

|

(45,873 |

) |

|

| Net

income |

|

$ |

66,746 |

|

|

$ |

69,118 |

|

|

$ |

227,015 |

|

|

$ |

96,466 |

|

|

| Net

income per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.01 |

|

|

$ |

1.05 |

|

|

$ |

3.43 |

|

|

$ |

1.46 |

|

|

|

Diluted |

|

$ |

1.00 |

|

|

$ |

1.04 |

|

|

$ |

3.41 |

|

|

$ |

1.46 |

|

|

|

Dividends declared per common share |

|

$ |

0.075 |

|

|

$ |

0.065 |

|

|

$ |

0.225 |

|

|

$ |

0.195 |

|

|

MERCER INTERNATIONAL

INC.INTERIM CONSOLIDATED BALANCE

SHEETS(Unaudited)(In thousands,

except share and per share data)

| |

|

September 30, |

|

|

December 31, |

|

|

| |

|

2022 |

|

|

2021 |

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

287,254 |

|

|

$ |

345,610 |

|

|

|

Term deposit |

|

|

75,000 |

|

|

|

— |

|

|

|

Accounts receivable, net |

|

|

324,343 |

|

|

|

345,345 |

|

|

|

Inventories |

|

|

385,961 |

|

|

|

356,731 |

|

|

|

Prepaid expenses and other |

|

|

24,130 |

|

|

|

16,619 |

|

|

| Total current assets |

|

|

1,096,688 |

|

|

|

1,064,305 |

|

|

|

Property, plant and equipment, net |

|

|

1,249,056 |

|

|

|

1,135,631 |

|

|

|

Investment in joint ventures |

|

|

45,262 |

|

|

|

49,651 |

|

|

|

Amortizable intangible assets, net |

|

|

57,406 |

|

|

|

47,902 |

|

|

|

Goodwill |

|

|

33,037 |

|

|

|

— |

|

|

|

Operating lease right-of-use assets |

|

|

12,620 |

|

|

|

9,712 |

|

|

|

Pension asset |

|

|

3,543 |

|

|

|

4,136 |

|

|

|

Other long-term assets |

|

|

46,371 |

|

|

|

38,718 |

|

|

|

Deferred income tax |

|

|

— |

|

|

|

1,177 |

|

|

| Total assets |

|

$ |

2,543,983 |

|

|

$ |

2,351,232 |

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

Accounts payable and other |

|

$ |

322,368 |

|

|

$ |

282,307 |

|

|

|

Pension and other post-retirement benefit obligations |

|

|

725 |

|

|

|

817 |

|

|

| Total current liabilities |

|

|

323,093 |

|

|

|

283,124 |

|

|

|

Long-term debt |

|

|

1,339,086 |

|

|

|

1,237,545 |

|

|

|

Pension and other post-retirement benefit obligations |

|

|

18,126 |

|

|

|

21,252 |

|

|

|

Operating lease liabilities |

|

|

8,306 |

|

|

|

6,574 |

|

|

|

Other long-term liabilities |

|

|

12,163 |

|

|

|

13,590 |

|

|

|

Deferred income tax |

|

|

122,860 |

|

|

|

95,123 |

|

|

| Total liabilities |

|

|

1,823,634 |

|

|

|

1,657,208 |

|

|

| Shareholders’ equity |

|

|

|

|

|

|

|

|

|

|

Common shares $1 par value; 200,000,000 authorized; 66,167,000

issued and outstanding (2021 – 66,037,000) |

|

|

66,132 |

|

|

|

65,988 |

|

|

|

Additional paid-in capital |

|

|

351,438 |

|

|

|

347,902 |

|

|

|

Retained earnings |

|

|

583,057 |

|

|

|

370,927 |

|

|

|

Accumulated other comprehensive loss |

|

|

(280,278 |

) |

|

|

(90,793 |

) |

|

| Total shareholders’

equity |

|

|

720,349 |

|

|

|

694,024 |

|

|

| Total liabilities and

shareholders’ equity |

|

$ |

2,543,983 |

|

|

$ |

2,351,232 |

|

|

MERCER INTERNATIONAL

INC.INTERIM CONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited)(In

thousands)

| |

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

|

| |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

Cash flows from (used in) operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

66,746 |

|

|

$ |

69,118 |

|

|

$ |

227,015 |

|

|

$ |

96,466 |

|

|

|

Adjustments to reconcile net income to cash flows from operating

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

32,144 |

|

|

|

34,315 |

|

|

|

95,288 |

|

|

|

97,237 |

|

|

|

Deferred income tax provision |

|

|

620 |

|

|

|

5,005 |

|

|

|

15,627 |

|

|

|

7,485 |

|

|

|

Loss on early extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

30,368 |

|

|

|

Defined benefit pension plans and other post-retirement benefit

plan expense |

|

|

424 |

|

|

|

879 |

|

|

|

1,301 |

|

|

|

2,654 |

|

|

|

Stock compensation expense |

|

|

1,214 |

|

|

|

1,005 |

|

|

|

3,680 |

|

|

|

2,590 |

|

|

|

Foreign exchange transaction gains |

|

|

(11,283 |

) |

|

|

(5,721 |

) |

|

|

(24,702 |

) |

|

|

(12,361 |

) |

|

|

Other |

|

|

(3,726 |

) |

|

|

(844 |

) |

|

|

(4,497 |

) |

|

|

(1,104 |

) |

|

|

Defined benefit pension plans and other post-retirement benefit

plan contributions |

|

|

(511 |

) |

|

|

(1,065 |

) |

|

|

(2,905 |

) |

|

|

(3,190 |

) |

|

|

Changes in working capital |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(17,679 |

) |

|

|

(31,441 |

) |

|

|

(4,297 |

) |

|

|

(27,500 |

) |

|

|

Inventories |

|

|

(8,803 |

) |

|

|

(39,512 |

) |

|

|

(23,870 |

) |

|

|

(82,275 |

) |

|

|

Accounts payable and accrued expenses |

|

|

34,323 |

|

|

|

12,180 |

|

|

|

37,569 |

|

|

|

46,783 |

|

|

|

Other |

|

|

(6,809 |

) |

|

|

(3,775 |

) |

|

|

(10,198 |

) |

|

|

(5,569 |

) |

|

|

Net cash from (used in) operating activities |

|

|

86,660 |

|

|

|

40,144 |

|

|

|

310,011 |

|

|

|

151,584 |

|

|

| Cash

flows from (used in) investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(48,554 |

) |

|

|

(38,306 |

) |

|

|

(128,875 |

) |

|

|

(125,692 |

) |

|

|

Acquisitions, net of cash acquired |

|

|

(257,367 |

) |

|

|

(51,258 |

) |

|

|

(257,367 |

) |

|

|

(51,258 |

) |

|

|

Insurance proceeds |

|

|

1,164 |

|

|

|

1,530 |

|

|

|

7,574 |

|

|

|

21,578 |

|

|

|

Purchase of term deposit |

|

|

— |

|

|

|

— |

|

|

|

(75,000 |

) |

|

|

— |

|

|

|

Purchase of amortizable intangible assets |

|

|

(69 |

) |

|

|

(460 |

) |

|

|

(154 |

) |

|

|

(1,669 |

) |

|

|

Other |

|

|

474 |

|

|

|

2,873 |

|

|

|

1,126 |

|

|

|

2,764 |

|

|

|

Net cash from (used in) investing activities |

|

|

(304,352 |

) |

|

|

(85,621 |

) |

|

|

(452,696 |

) |

|

|

(154,277 |

) |

|

| Cash

flows from (used in) financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redemption of senior notes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(824,557 |

) |

|

|

Proceeds from issuance of senior notes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

875,000 |

|

|

|

Proceeds from (repayment of) revolving credit facilities, net |

|

|

99,065 |

|

|

|

3,967 |

|

|

|

116,503 |

|

|

|

(53,145 |

) |

|

|

Dividend payments |

|

|

(4,962 |

) |

|

|

(4,293 |

) |

|

|

(9,922 |

) |

|

|

(8,582 |

) |

|

|

Payment of debt issuance costs |

|

|

(1,849 |

) |

|

|

(69 |

) |

|

|

(3,033 |

) |

|

|

(14,483 |

) |

|

|

Proceeds from government grants |

|

|

— |

|

|

|

361 |

|

|

|

1,067 |

|

|

|

8,893 |

|

|

|

Payment of finance lease obligations |

|

|

(1,640 |

) |

|

|

(2,227 |

) |

|

|

(8,246 |

) |

|

|

(5,763 |

) |

|

|

Other |

|

|

(27 |

) |

|

|

(27 |

) |

|

|

(593 |

) |

|

|

3,598 |

|

|

|

Net cash from (used in) financing activities |

|

|

90,587 |

|

|

|

(2,288 |

) |

|

|

95,776 |

|

|

|

(19,039 |

) |

|

| Effect

of exchange rate changes on cash and cash equivalents |

|

|

(5,502 |

) |

|

|

1,961 |

|

|

|

(11,447 |

) |

|

|

(636 |

) |

|

| Net

decrease in cash and cash equivalents |

|

|

(132,607 |

) |

|

|

(45,804 |

) |

|

|

(58,356 |

) |

|

|

(22,368 |

) |

|

| Cash and

cash equivalents, beginning of period |

|

|

419,861 |

|

|

|

384,534 |

|

|

|

345,610 |

|

|

|

361,098 |

|

|

| Cash and

cash equivalents, end of period |

|

$ |

287,254 |

|

|

$ |

338,730 |

|

|

$ |

287,254 |

|

|

$ |

338,730 |

|

|

MERCER INTERNATIONAL

INC.COMPUTATION OF OPERATING

EBITDA(Unaudited)(In

thousands)

Operating EBITDA is defined as operating income

plus depreciation and amortization and non-recurring capital asset

impairment charges. Management uses Operating EBITDA as a benchmark

measurement of its own operating results, and as a benchmark

relative to its competitors. Management considers it to be a

meaningful supplement to operating income as a performance measure

primarily because depreciation expense and non-recurring capital

asset impairment charges are not an actual cash cost, and

depreciation expense varies widely from company to company in a

manner that management considers largely independent of the

underlying cost efficiency of our operating facilities. In

addition, we believe Operating EBITDA is commonly used by

securities analysts, investors and other interested parties to

evaluate our financial performance.

Operating EBITDA does

not reflect the impact of a number of items that affect our net

income, including financing costs and the effect of derivative

instruments. Operating EBITDA is not a measure of financial

performance under GAAP, and should not be considered as an

alternative to net income or operating income as a measure of

performance, nor as an alternative to net cash from (used in)

operating activities as a measure of liquidity. The following

tables set forth the net income to Operating EBITDA:

|

|

Q3 |

|

|

Q2 |

|

|

Q3 |

|

|

YTD |

|

|

YTD |

|

|

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

Net income |

$ |

66,746 |

|

|

$ |

71,372 |

|

|

$ |

69,118 |

|

|

$ |

227,015 |

|

|

$ |

96,466 |

|

|

|

Income tax provision |

|

31,294 |

|

|

|

34,126 |

|

|

|

32,490 |

|

|

|

89,656 |

|

|

|

45,873 |

|

|

|

Interest expense |

|

17,935 |

|

|

|

17,332 |

|

|

|

16,882 |

|

|

|

52,731 |

|

|

|

53,031 |

|

|

| Loss

on early extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

30,368 |

|

|

| Other

income |

|

(7,252 |

) |

|

|

(8,799 |

) |

|

|

(4,735 |

) |

|

|

(24,297 |

) |

|

|

(9,118 |

) |

|

|

Operating income |

|

108,723 |

|

|

|

114,031 |

|

|

|

113,755 |

|

|

|

345,105 |

|

|

|

216,620 |

|

|

| Add:

Depreciation and amortization |

|

32,144 |

|

|

|

31,028 |

|

|

|

34,315 |

|

|

|

95,288 |

|

|

|

97,237 |

|

|

|

Operating EBITDA |

$ |

140,867 |

|

|

$ |

145,059 |

|

|

$ |

148,070 |

|

|

$ |

440,393 |

|

|

$ |

313,857 |

|

|

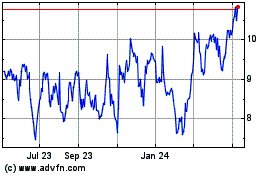

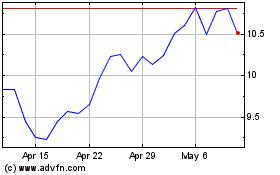

Mercer (NASDAQ:MERC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mercer (NASDAQ:MERC)

Historical Stock Chart

From Jul 2023 to Jul 2024