Maris-Tech Releases Fourth Quarter and Full Year 2021 Financial Results

April 29 2022 - 8:00AM

Maris-Tech Ltd. (Nasdaq: MTEK) (“Maris-Tech” or

the “Company”), a B2B provider of intelligent video transmission

technology, has released its financial results for the fourth

quarter and year ended December 31, 2021.

Revenues for the year ended December 31, 2021 were $2,075,755,

an increase of over 110% compared to $987,833 in revenues for the

year ended December 31, 2020.

Israel Bar, CEO of Maris-Tech, said, "We are proud of our

results for 2021, representing a year over year of growth and many

great research and development achievements. In 2022, we completed

our initial public offering on and listing Nasdaq, with $17.8

million raised. During 2021 and recent months we established wide

infrastructure, which includes highly advanced products, channel

network of global partnerships, intellectual property protection,

strong management and sales team and funding. I believe that

Maris-Tech is well positioned to continue our growth in 2022 and

provide the market with innovative solutions."

Recent Highlights

- As of April 28, 2022, the Company's

backlog was approximately $1,202,000

- On April 19, 2022, the Company

announced first major U.S. customer; received purchase order from

top surveillance manufacturer for $300,000

- At the end of March 2022, the

Company received a purchase order to supply advanced video

recording and interrogation system technology to a leading defense

organization

- On March 23, 2022, the Company

appointed Mr. Avi Gilor, a 20-year industry veteran, to lead the

Company’s sales and marketing initiatives in the United States

- During February 2022, the Company

announced $227,000 purchase order for its Advanced Surveillance

Systems from a U.K. reseller

- On February 17, 2022, the Company

announced it has signed a letter of intent with a fabless

semiconductor supplier to develop video-based edge computing

products

- On the February 4, 2022, the Company

announced the closing of $17.8 million initial public offering with

simultaneous exercise of the over-allotment option

"Moving forwards, we intend to expand our sales and marketing

efforts world-wide and engage with new leading partners to continue

present rapid growth. We are excited about our robust product

pipeline and are looking forward to capitalizing on the clear and

pressing need we see in the market for our solutions," Mr. Bar

added.

About Maris-Tech Ltd.

Maris-Tech is a B2B provider of intelligent video transmission

technology, founded by veterans of the Israel technology sector

with extensive electrical engineering and imaging experience. Our

products are designed to meet the growing demands of commercial and

tactical applications, delivering high-performance, compact, low

power and low latency solutions to companies worldwide, including

leading electro-optical payload, RF datalink and unmanned platform

manufacturers as well as defense, HLS, and communication companies.

For more information, visit https://www.maris-tech.com/.

Forward-Looking Statement Disclaimer

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, that are intended to be covered by the “safe harbor”

created by those sections. Forward-looking statements, which are

based on certain assumptions and describe our future plans,

strategies and expectations, can generally be identified by the use

of forward-looking terms such as “believe,” “expect,” “may,”

“should,” “could,” “seek,” “intend,” “plan,” “goal,” “estimate,”

“anticipate” or other comparable terms. For example, we are using

forward-looking statements when we are discussing our expectations

regarding our future growth and expansion of our sales and

marketing efforts and our plans to continue providing the market

with innovative solutions and engage new partners. Forward-looking

statements are neither historical facts nor assurances of future

performance. Instead, they are based only on our current beliefs,

expectations and assumptions regarding the future of our business,

future plans and strategies, projections, anticipated events and

trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that

are difficult to predict and many of which are outside of our

control. Our actual results and financial condition may differ

materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause our actual results

and financial condition to differ materially from those indicated

in the forward-looking statements include, among others, the

following: our ability to continue to generate revenues at levels

above prior levels; our ability to successfully market our products

and services, including in the United States; the acceptance of our

products and services by customers; our continued ability to pay

operating costs and ability to meet demand for our products and

services; the amount and nature of competition from other security

and telecom products and services; the effects of changes in the

cybersecurity and telecom markets; our ability to successfully

develop new products and services; our success establishing and

maintaining collaborative, strategic alliance agreements, licensing

and supplier arrangements; our ability to comply with applicable

regulations; and the other risks and uncertainties described in the

Registration Statement on Form F-1, as amended, filed with the SEC

related to our initial public offering and our other filings with

the SEC. We undertake no obligation to publicly update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

Investor Relations:

Dave Gentry, CEORedChip

CompaniesMTEK@redchip.com1-800-733-2447

Michal Efraty,

Adi and Michal PR- IR

Investor Relations, Israel

+972-(0)52-3044404michal@efraty.com

Balance SheetsU.S. dollars

| |

|

December 31, |

|

|

|

|

2021 |

|

|

2020 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

785 |

|

|

$ |

20,524 |

|

|

Restricted deposits |

|

|

- |

|

|

|

14,004 |

|

|

Trade receivables |

|

|

571,482 |

|

|

|

127,538 |

|

|

Other receivables |

|

|

2,873 |

|

|

|

2,778 |

|

|

Inventories, net |

|

|

391,484 |

|

|

|

251,067 |

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

966,624 |

|

|

|

415,911 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

|

Restricted deposits |

|

|

48,341 |

|

|

|

19,843 |

|

|

Deferred issuance costs |

|

|

871,171 |

|

|

|

- |

|

|

Property, plant and equipment, net |

|

|

16,511 |

|

|

|

13,600 |

|

|

Severance pay deposits |

|

|

136,620 |

|

|

|

115,163 |

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets |

|

|

1,072,643 |

|

|

|

148,606 |

|

| |

|

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

2,039,267 |

|

|

$ |

564,517 |

|

| |

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Short-term bank credit and current maturities of long-term bank

loans |

|

$ |

410,324 |

|

|

$ |

592,115 |

|

|

Trade payables |

|

|

463,653 |

|

|

|

249,794 |

|

|

Other current liabilities |

|

|

791,038 |

|

|

|

295,022 |

|

|

Short-term liabilities due to shareholders |

|

|

296,459 |

|

|

|

120,881 |

|

|

Total current liabilities |

|

|

1,961,474 |

|

|

|

1,257,812 |

|

|

|

|

|

|

|

|

|

|

|

|

Long-Term Liabilities |

|

|

|

|

|

|

|

|

|

Long-term loans, net of current maturities |

|

|

744,769 |

|

|

|

601,694 |

|

|

Long-term loans from shareholders |

|

|

1,088,250 |

|

|

|

1,088,703 |

|

|

Warrants to purchase ordinary shares |

|

|

351,845 |

|

|

|

|

|

|

Accrued severance pay |

|

|

272,509 |

|

|

|

217,457 |

|

|

Total long-term liabilities |

|

|

2,457,373 |

|

|

|

1,907,854 |

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

|

4,418,847 |

|

|

|

3,165,666 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

|

Shareholders’ capital deficiency |

|

|

|

|

|

|

|

|

|

Ordinary shares, no par value: Authorized- |

|

|

- |

|

|

|

- |

|

|

12,500,000 as of December 31, 2021 and 2020, issued and |

|

|

|

|

|

|

|

|

|

outstanding: 3,085,000 as of December 31, 2021 and 2020, |

|

|

|

|

|

|

|

|

|

Preferred shares, no par value: Authorized 1,250,000

shares |

|

|

|

|

|

|

|

|

|

as of December 31, 2021; issued and outstanding: 489,812 shares and

no shares as of December 31, 2021 and 2020. |

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

2,124,601 |

|

|

|

1,078,808 |

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated deficit |

|

|

(4,504,181 |

) |

|

|

(3,679,957 |

) |

|

|

|

|

|

|

|

|

|

|

|

Total Shareholders’ capital deficiency |

|

|

(2,379,580 |

) |

|

|

(2,601,149 |

) |

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities net of capital deficiency |

|

$ |

2,039,267 |

|

|

$ |

564,517 |

|

|

|

|

|

|

|

|

|

|

|

Statements of Operations

U.S. dollars

|

|

|

Year ended December 31 |

|

|

|

|

2021 |

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

2,075,755 |

|

|

$ |

987,883 |

|

|

$ |

893,034 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

1,106,447 |

|

|

|

500,696 |

|

|

|

502,514 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

969,308 |

|

|

|

487,187 |

|

|

|

390,520 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

706,021 |

|

|

|

781,417 |

|

|

|

750,768 |

|

|

Sales and marketing |

|

|

241,114 |

|

|

|

22,551 |

|

|

|

24,927 |

|

|

General and administrative |

|

|

595,074 |

|

|

|

74,169 |

|

|

|

75,771 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

1,542,209 |

|

|

|

878,138 |

|

|

|

851,463 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

572,901 |

|

|

|

390,951 |

|

|

|

460,943 |

|

|

Financial expenses |

|

|

251,323 |

|

|

|

249,392 |

|

|

|

87,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

824,224 |

|

|

$ |

640,343 |

|

|

$ |

548,244 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

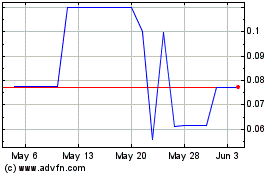

Maris Tech (NASDAQ:MTEKW)

Historical Stock Chart

From Jun 2024 to Jul 2024

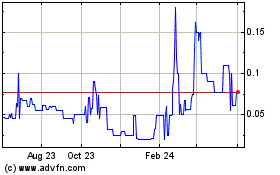

Maris Tech (NASDAQ:MTEKW)

Historical Stock Chart

From Jul 2023 to Jul 2024