Uber Slows Down in Traffic on Its Way to IPO -- WSJ

April 13 2019 - 3:02AM

Dow Jones News

By Eliot Brown

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 13, 2019).

Uber Technologies Inc. has talked up its expansion into new

businesses beyond ride-hailing, from food delivery to long-haul

trucking. But it can't escape the fierce competition.

The ride-hailing giant's IPO documents made public Thursday show

a company besieged by competitors on all fronts, leading to sharp

declines in revenue growth just as it readies to market itself to

growth-hungry public-market investors.

Faced with a now-formidable U.S. competitor in Lyft Inc. and

many well-funded meal-delivery startups, Uber has had to pour on

subsidies and discounts for riders and drivers in both its main

ride-hailing and meal-delivery businesses.

Uber explained throughout its filing that it faces intensifying

competition around the world, taking a particular toll on the

business in the second half of 2018. The onslaught is so pronounced

that a key measure of revenue growth between quarters has halted

after surging in prior years.

Revenue from ride-hailing -- minus some incentive payments to

drivers and other costs -- was $2.31 billion in the fourth quarter,

down about $1 million from three months earlier. By contrast, in

the final quarter of 2017, ride-hailing revenue on an adjusted

basis grew 12%.

Adjusted revenue for the newer Uber Eats meal delivery service

-- touted last year by executives and investors as the shining star

of rapid growth -- fell 14% the final three months of last year to

$165 million, compared with 37% quarter-to-quarter growth a year

earlier.

Uber said in the filing that its business has been hit by "heavy

subsidies and discounts by our competitors" which the company has

been matching "in order to remain competitive."

"This is what a price war looks like," said Rett Wallace,

co-founder of Triton Research, which analyzes late-stage private

companies. "They're in a competitive pushing match -- and they had

to spend more."

The high level of competition across its divisions -- which also

include electric scooters and a freight-matching business -- topped

Uber's lists of risks disclosed to investors.

As it gears up to woo public investors, Uber appears ready to

play up its long-term growth potential. Casting itself as the

global transportation provider of the future, the company explained

to investors in its filing Thursday that it has massive potential

for expansion given that transportation globally accounts for

trillions of dollars of spending a year, of which Uber today has a

minuscule slice.

"Because we are not even 1% done with our work, we will operate

with an eye toward the future," Uber CEO Dara Khosrowshahi said in

a letter in the filing.

But the recent slowdown and competitive pressures could be

troubling for a company that had been trying to streamline costs

and show clear potential for future profits.

The problem for Uber is that its competitors keep raising lots

of money and gaining scale.

In the U.S. ride-hailing market, Lyft had long been a small

cash-starved competitor, often with longer wait times for riders.

But it has raised over $4 billion since the start of 2018 --

including more than $2 billion in its recent IPO -- and lured

numerous riders as Uber struggled with scandals that hurt its

brand. Lyft has also aggressively offered discounted fares in

recent months.

In the meal-delivery world, a litany of competitors -- Uber

lists 10 -- have gained steam as the business has grown, attracting

heavy investment from venture capital investors. San

Francisco-based DoorDash, for instance, has raised a total of $1.4

billion, most recently at a $7 billion valuation in February,

according to research firm PitchBook.

Many of Uber's competitors are funded in part by its largest

shareholder, SoftBank Group Corp., which has bet billions of

dollars in recent years on ride-hailing and delivery companies.

The competition highlights the low barriers to entry, with

numerous players offering virtually the same services. They are in

a spending arms race to draw new drivers and consumers, bidding up

ads on Facebook and Google and forking out hefty bonuses to new

drivers. Uber warned that is experiencing "driver supply

constraints" in most of its markets, and said the top five

money-grossing metro areas -- from which it gets about a quarter of

its bookings -- are also among its most competitive.

The pricing wars mean Uber is taking in far less money from each

sale. For instance, Uber's overall ride-share "bookings"--a measure

for the total fares paid by riders -- rose 9% in the final three

months of last year. Its adjusted revenue -- the share taken by

Uber -- was flat.

Uber Eats is suffering even more. While bookings -- the total

bill including what goes to drivers and restaurants -- during the

fourth quarter rose 20% from the prior quarter to $2.6 billion --

the share taken by Uber fell 14%.

Uber expects that its share of transactions -- known as its

"take rate" -- will "decrease in the near term," after having

improved over the past few years.

Another challenge for the Eats delivery service is the low fees

Uber gets from some of its biggest customers. Uber -- which charges

both customers and restaurants a fee on delivery -- said in the

filings it charges a "lower fee" to "certain of our largest chain

restaurant partners" so much so that Uber sometimes pays more to a

driver than it gets in fees from an order. Its largest partners

include restaurant chains McDonald's Corp. and Subway, although

their fees weren't specified.

Write to Eliot Brown at eliot.brown@wsj.com

(END) Dow Jones Newswires

April 13, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

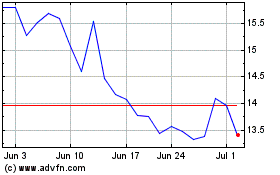

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Jul 2023 to Jul 2024