Live Ventures Incorporated (Nasdaq: LIVE), (“Live Ventures” or the

“Company”), a diversified holding company, today announced

financial results for its fiscal third quarter ended June 30,

2022.

Third Quarter FY 2022 Key Highlights:

- Revenue of $68.3 million

- Gross Profit of $22.3 million

- Adjusted EBITDA¹ of $8.8 million

- Net income was $3.5 million and diluted earnings per share

(“EPS”) were $1.11 per share

- Acquired The Kinetic Co., Inc. (“Kinetic”), a highly regarded

brand name in the production of industrial knives and hardened wear

products

- Repurchased 14,160 shares of common stock at an average price

of $23.31

- Total assets of $262.8 million

- Approximately $35.6 million of cash and availability under our

credit facilities

“We are pleased that we delivered solid operating and financial

results in our fiscal third quarter despite increased inflationary

pressures during the quarter,” commented David Verret, Chief

Financial Officer of Live Ventures. “While the business environment

remains challenging, we remain optimistic that we can navigate the

obstacles in the current business environment in order to drive

long-term returns for stockholders.”

“During our fiscal third quarter we continued to execute our

multi-lever strategic plan to maximize stockholder value by both

adding Kinetic to our growing steel manufacturing segment and

repurchasing 14,160 of our common shares during the quarter,”

stated Jon Isaac, President and CEO of Live Ventures.

1Adjusted EBITDA is a non-GAAP measure. A reconciliation of the

non-GAAP measures is included below.

Third Quarter FY 2022 Financial Summary (in thousands

except per share amounts)

| |

During the three months ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

% Change |

|

Revenue |

$ |

68,269 |

|

|

$ |

69,095 |

|

|

|

-1.2 |

% |

| Operating Income |

$ |

5,864 |

|

|

$ |

8,232 |

|

|

|

-28.8 |

% |

| Net income |

$ |

3,472 |

|

|

$ |

9,938 |

|

|

|

-65.1 |

% |

| Diluted earnings per

share |

$ |

1.11 |

|

|

$ |

3.01 |

|

|

|

-63.2 |

% |

Third quarter 2022 revenue of $68.3 million decreased 1.2% due

to decreased revenue in the Retail and Flooring Manufacturing

segments. The decrease was partially offset by increased revenue in

the Steel Manufacturing Segment due to inflationary price increases

and the Corporate and Other Segment due to the addition of Salomon

Whitney LLC (“SW Financial”) as a consolidated variable interest

entity (“VIE”) during fiscal 2021.

Operating income of $5.9 million for the third quarter of 2022

decreased 28.8%, as compared with the prior year period, primarily

due to decreased revenues coupled with inflationary cost increases

in costs of goods sold and general and administrative expenses.

Net income of $3.5 million for the three months ended June 30,

2022 decreased $6.5 million, or 65.1%, as compared with the prior

year period. The decrease is primarily attributable to the fiscal

year 2021 gains on settlement of debts of approximately $5.4

million, including a gain on payroll protection program loan

forgiveness. Diluted EPS for the current quarter was $1.11 per

share, a decrease of 63.2% as compared with the prior year

period.

Adjusted EBITDA of $8.8 million decreased approximately $0.9

million, or 9.5%, for the third quarter of 2022 as compared to the

prior year period. The decrease in EBITDA is primarily due to the

decrease in revenue and an increase in the cost of revenue due to

inflationary pressures.

As of June 30, 2022, the Company had total cash availability of

$35.6 million, consisting of cash on hand of $3.6 million and cash

availability under its various lines of credit of $32.0 million,

and total assets of $262.8 million. Stockholders’ equity was $98.0

million as of June 30, 2022.

Third Quarter FY 2022 Segment Results (in

thousands)

| |

During the three months ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

% Change |

| Revenue |

|

|

|

|

|

|

Retail |

$ |

19,227 |

|

|

$ |

21,719 |

|

|

|

-11.5 |

% |

| Flooring Manufacturing |

|

32,188 |

|

|

|

34,234 |

|

|

|

-6.0 |

% |

| Steel Manufacturing |

|

14,974 |

|

|

|

13,018 |

|

|

|

15.0 |

% |

| Corporate & other |

|

1,880 |

|

|

|

124 |

|

|

|

1416.1 |

% |

|

|

$ |

68,269 |

|

|

$ |

69,095 |

|

|

|

-1.2 |

% |

|

|

|

|

|

|

|

| |

During the three months ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

% Change |

| Operating Income

(loss) |

|

|

|

|

|

| Retail |

$ |

2,202 |

|

|

$ |

3,860 |

|

|

|

-43.0 |

% |

| Flooring Manufacturing |

|

3,289 |

|

|

|

3,997 |

|

|

|

-17.7 |

% |

| Steel Manufacturing |

|

1,268 |

|

|

|

1,928 |

|

|

|

-34.2 |

% |

| Corporate & other |

|

(895 |

) |

|

|

(1,553 |

) |

|

|

42.4 |

% |

|

|

$ |

5,864 |

|

|

$ |

8,232 |

|

|

|

-28.8 |

% |

| |

During the three months ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

% Change |

| Adjusted

EBITDA |

|

|

|

|

|

|

Retail |

$ |

2,456 |

|

|

$ |

4,239 |

|

|

|

-42.1 |

% |

| Flooring Manufacturing |

|

3,927 |

|

|

|

4,762 |

|

|

|

-17.5 |

% |

| Steel Manufacturing |

|

2,441 |

|

|

|

2,069 |

|

|

|

18.0 |

% |

| Corporate & other |

|

16 |

|

|

|

(1,300 |

) |

|

|

NA |

|

|

Total Adjusted EBITDA |

$ |

8,840 |

|

|

$ |

9,770 |

|

|

|

-9.5 |

% |

|

|

|

|

|

|

|

| Adjusted

EBITDA as a percentage of revenue |

|

|

|

|

| Retail |

|

12.8 |

% |

|

|

19.5 |

% |

|

|

| Flooring Manufacturing |

|

12.2 |

% |

|

|

13.9 |

% |

|

|

| Steel Manufacturing |

|

16.3 |

% |

|

|

15.9 |

% |

|

|

| Corporate & other |

|

0.9 |

% |

|

|

-1048.4 |

% |

|

|

| Consolidated adjusted

EBITDA |

|

12.9 |

% |

|

|

14.1 |

% |

|

|

|

as a percentage of revenue |

|

|

|

|

|

Retail

Third quarter 2022 Retail Segment revenue of $19.2 million

decreased approximately $2.5 million or 11.5%, as compared with the

prior year period, the decrease is primarily due to reduced demand

as a result of inflationary factors. Cost of revenue as a

percentage of sales increased slightly in the current quarter.

General and administrative expenses as a percentage of revenues

increased primarily due to increases in employee compensation and

related costs. Current quarter operating income was approximately

$2.2 million as compared to operating income of approximately $3.9

million for the prior year period.

Flooring Manufacturing

Third quarter 2022 Flooring Manufacturing Segment revenue of

$32.2 million decreased approximately $2.0 million, or 6.0%, as

compared with the prior year period, primarily due to reduced

customer demand. Cost of revenue increased primarily due to

increases in raw material costs as a result of inflationary

pressures. The increase in the cost of revenue was partially offset

by a decrease in general and administrative expenses primarily due

to decreases in taxes and license costs, as well as employee

compensation costs as a result of decreased bonuses. Current

quarter operating income was approximately $3.3 million as compared

to operating income of approximately $4.0 million for the prior

year period.

Steel Manufacturing

Third quarter 2022 Steel Manufacturing Segment revenue of $15.0

million increased approximately $2.0 million, or 15.0%, as compared

with the prior year period, primarily due to increasing sales

prices resulting from rising costs. Cost of revenue for the

second quarter of 2022 increased in line with the increase in

revenue. Current period operating income was approximately $1.3

million as compared to operating income of approximately $1.9

million in the prior year period. Current period operating income

includes approximately $1.0 million of non-recurring acquisition

costs related to the acquisition of Kinetic.

Corporate and Other

Third quarter 2022 Corporate and other revenue increased

approximately $1.8 million, primarily due to the addition of SW

Financial as a consolidated VIE during fiscal 2021. Current quarter

operating loss was approximately $0.9 million, as compared to a

loss of approximately $1.6 million in the prior period.

Nine Months FY 2022 Financial Summary (in thousands

except per share amounts)

| |

During the nine months ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

% Change |

|

Revenue |

$ |

213,133 |

|

|

$ |

202,439 |

|

|

|

5.3 |

% |

| Operating Income |

$ |

24,720 |

|

|

$ |

26,648 |

|

|

|

-7.2 |

% |

| Net income |

$ |

25,376 |

|

|

$ |

24,085 |

|

|

|

5.4 |

% |

| Diluted earnings per

share |

$ |

8.01 |

|

|

$ |

7.31 |

|

|

|

9.5 |

% |

Revenue increased approximately $10.7 million, or 5.3%, to

$213.1 million for the nine months ended June 30, 2022, as compared

to the prior year period. Revenue primarily increased due to

inflationary price increases and due to the addition of SW

Financial as a consolidated VIE during fiscal 2021. For the nine

months ended operating income of $24.7 million decreased 7.2%, as

compared with the prior year period.

For the nine months ended June 30, 2022, net income of $25.4

million increased $1.3 million, or 5.4%, as compared with the prior

year period. The increase is primarily attributable to fiscal year

2022 gains on settlement of debts of approximately $11.4 million.

Diluted EPS for the current period was $8.01 per share, an increase

of 9.5% as compared with the prior year period.

For the nine months ended June 30, 2022, adjusted EBITDA of

$31.2 million decreased approximately $1.8 million, or 5.5%, as

compared with the prior year period.

Nine Months FY 2022 Segment Results (in

thousands)

| |

During the nine months ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

% Change |

| Revenue |

|

|

|

|

|

|

Retail |

$ |

66,179 |

|

|

$ |

68,092 |

|

|

|

-2.8 |

% |

| Flooring Manufacturing |

|

97,832 |

|

|

|

97,428 |

|

|

|

0.4 |

% |

| Steel Manufacturing |

|

41,367 |

|

|

|

36,546 |

|

|

|

13.2 |

% |

| Corporate & other |

|

7,755 |

|

|

|

373 |

|

|

|

1979.1 |

% |

|

|

$ |

213,133 |

|

|

$ |

202,439 |

|

|

|

5.3 |

% |

|

|

|

|

|

|

|

| |

During the nine months ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

% Change |

| Operating Income

(loss) |

|

|

|

|

|

| Retail |

$ |

10,144 |

|

|

$ |

13,424 |

|

|

|

-24.4 |

% |

| Flooring Manufacturing |

|

11,772 |

|

|

|

14,158 |

|

|

|

-16.9 |

% |

| Steel Manufacturing |

|

5,641 |

|

|

|

3,814 |

|

|

|

47.9 |

% |

| Corporate & other |

|

(2,837 |

) |

|

|

(4,748 |

) |

|

|

40.2 |

% |

|

|

$ |

24,720 |

|

|

$ |

26,648 |

|

|

|

-7.2 |

% |

| |

During the nine months ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

% Change |

| Adjusted

EBITDA |

|

|

|

|

|

|

Retail |

$ |

11,270 |

|

|

$ |

14,833 |

|

|

|

-24.0 |

% |

| Flooring Manufacturing |

|

13,761 |

|

|

|

16,586 |

|

|

|

-17.0 |

% |

| Steel Manufacturing |

|

7,113 |

|

|

|

4,600 |

|

|

|

54.6 |

% |

| Corporate & other |

|

(951 |

) |

|

|

(2,999 |

) |

|

|

68.3 |

% |

|

Total Adjusted EBITDA |

$ |

31,193 |

|

|

$ |

33,020 |

|

|

|

-5.5 |

% |

|

|

|

|

|

|

|

| Adjusted

EBITDA as a percentage of revenue |

|

|

|

|

| Retail |

|

17.0 |

% |

|

|

21.8 |

% |

|

|

| Flooring Manufacturing |

|

14.1 |

% |

|

|

17.0 |

% |

|

|

| Steel Manufacturing |

|

17.2 |

% |

|

|

12.6 |

% |

|

|

| Corporate & other |

|

-12.3 |

% |

|

|

-804.0 |

% |

|

|

| Consolidated adjusted

EBITDA |

|

14.6 |

% |

|

|

16.3 |

% |

|

|

|

as a percentage of revenue |

|

|

|

|

|

Retail

Revenue for the nine months ended June 30, 2022, decreased

approximately $1.9 million, or 2.8%, as compared to the prior year,

primarily due to the impact of additional U.S. Government stimulus

payments during the prior year’s period that allowed for more

discretionary consumer spending in that period at Vintage Stock

locations. Cost of revenue increased due to changes in product mix,

as well as other inflationary pressures. General and administrative

expenses increased primarily due to increases in employee

compensation and related costs. Operating income was approximately

$10.1 million as compared to operating income of approximately

$13.4 million for the prior year period.

Flooring Manufacturing

Revenue for the nine months ended June 30, 2022, increased

approximately $0.4 million, or 0.4%, as compared to the prior year

period. Cost of revenue increased primarily due to increases in raw

material costs as compared with the prior year period. The increase

in the cost of revenue was partially offset by a decrease in

general and administrative expenses primarily due to decreases in

taxes and license costs, as well as employee compensation costs as

a result of decreased bonuses. Operating income for the nine months

ended June 30, 2022 was approximately $11.8 million as compared to

operating income of approximately $14.2 million for the prior year

period.

Steel Manufacturing

Revenue for the nine months ended June 30, 2022, increased $4.8

million, or 13.2%, as compared to the prior year period, primarily

due to increased sales prices resulting from rising costs. Cost of

revenue decreased as a percentage of sales due to improved

manufacturing efficiencies. Operating income for the nine months

ended June 30, 2022 was approximately $5.6 million as compared to

operating income of approximately $3.8 million in the prior period.

Current period operating income includes approximately $1.0 million

of non-recurring acquisition costs related to the acquisition of

Kinetic. The increase in operating income is primarily due to an

increase in gross profit.

Corporate and Other

Revenues for the nine months ended June 30, 2022, increased by

$7.4 million, primarily due to the addition of SW Financial as a

consolidated VIE during fiscal 2021. General and administrative

expenses increased at the corporate level primarily due to the

addition of SW Financial. Operating loss for the nine months ended

June 30, 2022 was approximately $2.8 million, as compared to a loss

of approximately $4.7 million in the prior period.

Non-GAAP Financial Information

Adjusted EBITDA

We evaluate the performance of our operations based on financial

measures such as revenue and “Adjusted EBITDA.” Adjusted EBITDA is

defined as net income (loss) before interest expense, interest

income, income taxes, depreciation, amortization, stock-based

compensation, and other non-cash or nonrecurring charges. We

believe that Adjusted EBITDA is an important indicator of the

operational strength and performance of the business, including the

business’s ability to fund acquisitions and other capital

expenditures, and to service its debt. Additionally, this measure

is used by management to evaluate operating results and perform

analytical comparisons and identify strategies to improve

performance. Adjusted EBITDA is also a measure that is customarily

used by financial analysts to evaluate a company’s financial

performance, subject to certain adjustments. Adjusted EBITDA does

not represent cash flows from operations, as defined by generally

accepted accounting principles (“GAAP”), should not be construed as

an alternative to net income or loss, and is indicative neither of

our results of operations, nor of cash flows available to fund all

of our cash needs. It is, however, a measurement that the Company

believes is useful to investors in analyzing its operating

performance. Accordingly, Adjusted EBITDA should be considered in

addition to, but not as a substitute for, net income, cash flow

provided by operating activities, and other measures of financial

performance prepared in accordance with GAAP. Adjusted EBITDA is a

non-GAAP financial measure. As companies often define non-GAAP

financial measures differently, Adjusted EBITDA, as calculated by

Live Ventures Incorporated should not be compared to any similarly

titled measures reported by other companies.

About Live VenturesLive Ventures is a growing,

diversified holding company with a strategic focus on

value-oriented acquisitions of domestic middle-market companies.

Live Ventures’ acquisition strategy is sector agnostic and focuses

on well-run, closely-held businesses with a demonstrated track

record of earnings growth and cash flow generation. The Company

looks for opportunities to partner with management teams of its

acquired businesses to build increased stockholder value through a

disciplined buy-build-hold long-term focused strategy. Live

Ventures was founded in 1968. In late 2011 Jon Isaac, CEO and

strategic investor took over the company and in 2015, refocused it

into a diversified holding company. The Company’s current portfolio

of diversified operating subsidiaries includes companies in the

textile, flooring, tools, steel, entertainment, and financial

services industries.

About Our Main Operating Subsidiaries

Marquis Industries

Based in Chatsworth, GA, and acquired by Live Ventures in 2015,

Marquis Industries, Inc. (“Marquis”) is a leading manufacturer of

residential and commercial carpets sold primarily in North America

and focused on residential, niche commercial, and hospitality

end-markets. In addition to a diverse offering of carpeting

products, Marquis Industries also designs, sources, and sells

hard-surface flooring products.

Vintage Stock

Based in Joplin, MO, and acquired by Live Ventures in 2016,

Vintage Stock Inc. (“Vintage Stock”) is an award-winning specialty

entertainment retailer that sells new and pre-owned movies, classic

and current generation video games and systems, music on CD &

LP, collectible comics, books, toys, and more through a unique

buy-sell-trade model. Vintage Stock sells through its 65 retail

stores and its website, allowing the company to ship products

worldwide directly to the customer’s doorstep.

Precision Marshall

Based in Washington, PA, and acquired by Live Ventures in 2020,

Precision Industries, Inc. (“Precision Marshall”) is a leading

manufacturer of premium steel tools and specialty alloys. Precision

Marshall manufactures pre-finished decarb-free tool and die steel.

For over 70 years, Precision Marshall has been known by steel

distributors for its quick and accurate service and has led the

industry with exemplary availability and value-added processing. In

June 2022, Precision Marshall acquired The Kinetic Co., Inc. a

highly regarded brand name in the production of industrial knives

and hardened wear products.

Salomon Whitney

Based in Melville, NY, Salomon Whitney LLC (“Salomon Whitney”),

and acquired in June 2021, is a licensed broker-dealer and

investment bank offering clients a broad range of products and

services, including broker retailing of corporate equity and debt

securities, private placement of securities, corporate finance

consulting regarding mergers and acquisitions, broker selling of

variable life insurance or annuities, and broker retailing of U.S.

government and municipal securities. Salomon Whitney has over 70

registered representatives and is licensed to operate in all 50

states. As of December 31, 2021, Live Ventures owns a 24.9%

interest in Salomon Whitney. However, Salomon Whitney is

consolidated into Live Ventures’ financial statements as a variable

interest entity.

Contact:Live Ventures IncorporatedGreg Powell,

Director of Investor

Relations725.500.5597gpowell@liveventures.comwww.liveventures.com

Source: Live Ventures Incorporated

LIVE VENTURES

INCORPORATEDCONSOLIDATED BALANCE

SHEETS(dollars in thousands, except per share amounts)

|

|

June 30, 2022 |

|

|

September 30, 2021 |

|

|

|

(Unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

Cash |

$ |

3,625 |

|

|

$ |

4,664 |

|

| Trade receivables, net of

allowance for doubtful accounts of approximately $56,000 at June

30, 2022 and $61,000 at September 30, 2021 |

|

24,974 |

|

|

|

21,559 |

|

| Inventories, net of reserves of

approximately $2.3 million at June 30, 2022, and approximately $1.8

million at September 30, 2021 |

|

95,961 |

|

|

|

70,747 |

|

| Prepaid expenses and other

current assets |

|

4,596 |

|

|

|

1,640 |

|

| Debtor in possession assets |

|

— |

|

|

|

180 |

|

|

Total current assets |

|

129,156 |

|

|

|

98,790 |

|

| Property and equipment, net of

accumulated depreciation of approximately $24.4 million at June 30,

2022, and approximately $20.6 million at September 30, 2021 |

|

52,437 |

|

|

|

35,632 |

|

| Right of use asset - operating

leases |

|

31,487 |

|

|

|

30,466 |

|

| Deposits and other assets |

|

1,043 |

|

|

|

682 |

|

| Intangible assets, net of

accumulated amortization of approximately $2.9 million at June 30,

2022, and approximately $2.2 million at September 30, 2021 |

|

4,991 |

|

|

|

4,697 |

|

| Goodwill |

|

43,653 |

|

|

|

41,471 |

|

|

Total assets |

$ |

262,767 |

|

|

$ |

211,738 |

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

17,016 |

|

|

$ |

10,644 |

|

|

Accrued liabilities |

|

13,689 |

|

|

|

17,048 |

|

|

Income taxes payable |

|

395 |

|

|

|

876 |

|

|

Current portion of lease obligations - operating leases |

|

7,293 |

|

|

|

7,202 |

|

|

Current portion of lease obligations - finance leases |

|

376 |

|

|

|

— |

|

|

Current portion of long-term debt |

|

18,418 |

|

|

|

16,055 |

|

|

Current portion of notes payable related parties |

|

— |

|

|

|

2,000 |

|

|

Debtor-in-possession liabilities |

|

— |

|

|

|

11,135 |

|

|

Total current liabilities |

|

57,187 |

|

|

|

64,960 |

|

| Long-term debt, net of current

portion |

|

58,475 |

|

|

|

37,559 |

|

| Lease obligation long term -

operating leases |

|

31,014 |

|

|

|

29,343 |

|

| Lease obligation long term -

finance leases |

|

7,803 |

|

|

|

— |

|

| Notes payable related parties,

net of current portion |

|

4,000 |

|

|

|

2,000 |

|

| Deferred taxes |

|

5,326 |

|

|

|

2,796 |

|

| Other non-current

liabilities |

|

997 |

|

|

|

— |

|

|

Total liabilities |

|

164,802 |

|

|

|

136,658 |

|

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

Series B convertible preferred stock, $0.001 par value, 1,000,000

shares authorized, 0 and 315,790 shares issued and outstanding at

June 30, 2022 and September 30, 2021, respectively |

|

— |

|

|

|

— |

|

|

Series E convertible preferred stock, $0.001 par value, 200,000

shares authorized, 47,840 shares issued and outstanding at June 30,

2022 and September 30, 2021, respectively, with a liquidation

preference of $0.30 per share outstanding |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value, 10,000,000 shares authorized,

3,081,456 and 1,582,334 shares issued and outstanding at June 30,

2022 and September 30, 2021, respectively |

|

2 |

|

|

|

2 |

|

|

Paid in capital |

|

65,321 |

|

|

|

65,284 |

|

|

Treasury stock common 614,348 shares as of June 30, 2022 and

534,520 shares as of September 30, 2021, respectively |

|

(7,047 |

) |

|

|

(4,519 |

) |

|

Treasury stock Series E preferred 50,000 shares as of June 30, 2022

and of September 30, 2021, respectively |

|

(7 |

) |

|

|

(7 |

) |

|

Retained earnings |

|

40,144 |

|

|

|

14,768 |

|

|

Equity attributable to Live stockholders |

|

98,413 |

|

|

|

75,528 |

|

|

Non-controlling interest |

|

(448 |

) |

|

|

(448 |

) |

|

Total stockholders' equity |

|

97,965 |

|

|

|

75,080 |

|

|

Total liabilities and stockholders' equity |

$ |

262,767 |

|

|

$ |

211,738 |

|

LIVE VENTURES,

INCORPORATEDCONSOLIDATED STATEMENTS OF

INCOME(UNAUDITED)(dollars in thousands,

except per share)

|

|

For the Three Months Ended June 30, |

|

|

For the Nine Months Ended June 30, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Revenue |

$ |

68,269 |

|

|

$ |

69,095 |

|

|

$ |

213,133 |

|

|

$ |

202,439 |

|

| Cost of revenue |

|

45,920 |

|

|

|

44,029 |

|

|

|

138,215 |

|

|

|

128,614 |

|

| Gross profit |

|

22,349 |

|

|

|

25,066 |

|

|

|

74,918 |

|

|

|

73,825 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

13,407 |

|

|

|

13,794 |

|

|

|

40,718 |

|

|

|

38,638 |

|

|

Sales and marketing expenses |

|

3,078 |

|

|

|

3,040 |

|

|

|

9,480 |

|

|

|

8,539 |

|

|

Total operating expenses |

|

16,485 |

|

|

|

16,834 |

|

|

|

50,198 |

|

|

|

47,177 |

|

| Operating income |

|

5,864 |

|

|

|

8,232 |

|

|

|

24,720 |

|

|

|

26,648 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(674 |

) |

|

|

(938 |

) |

|

|

(2,549 |

) |

|

|

(4,057 |

) |

|

Gain on Payroll Protection Program loan forgiveness |

|

— |

|

|

|

4,768 |

|

|

|

— |

|

|

|

6,150 |

|

|

Gain (loss) on debt extinguishment |

|

279 |

|

|

|

— |

|

|

|

(84 |

) |

|

|

— |

|

|

Loss on disposal of fixed assets |

|

(443 |

) |

|

|

— |

|

|

|

(444 |

) |

|

|

— |

|

|

Loss on write-off of ROU asset |

|

(522 |

) |

|

|

— |

|

|

|

(522 |

) |

|

|

— |

|

|

Gain on bankruptcy settlement |

|

— |

|

|

|

650 |

|

|

|

11,352 |

|

|

|

1,765 |

|

|

Other income (expense) |

|

333 |

|

|

|

(76 |

) |

|

|

751 |

|

|

|

782 |

|

|

Total other income (expense), net |

|

(1,027 |

) |

|

|

4,404 |

|

|

|

8,504 |

|

|

|

4,640 |

|

| Income before provision for

income taxes |

|

4,837 |

|

|

|

12,636 |

|

|

|

33,224 |

|

|

|

31,288 |

|

| Provision for income taxes |

|

1,365 |

|

|

|

2,703 |

|

|

|

7,848 |

|

|

|

7,381 |

|

| Net income |

|

3,472 |

|

|

|

9,933 |

|

|

|

25,376 |

|

|

|

23,907 |

|

| Net income attributable to

non-controlling interest |

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

178 |

|

| Net income attributable to Live

stockholders |

$ |

3,472 |

|

|

$ |

9,938 |

|

|

$ |

25,376 |

|

|

$ |

24,085 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

1.12 |

|

|

$ |

6.35 |

|

|

$ |

8.11 |

|

|

$ |

15.41 |

|

|

Diluted |

$ |

1.11 |

|

|

$ |

3.01 |

|

|

$ |

8.01 |

|

|

$ |

7.31 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

3,090,321 |

|

|

|

1,566,064 |

|

|

|

3,128,813 |

|

|

|

1,563,025 |

|

|

Diluted |

|

3,130,925 |

|

|

|

3,297,854 |

|

|

|

3,169,258 |

|

|

|

3,294,815 |

|

LIVE VENTURES

INCORPORATEDNON-GAAP MEASURES

RECONCILIATION

Adjusted EBITDA

The following table provides a reconciliation of Net income to

total Adjusted EBITDA for the periods indicated (dollars in

thousands):

| |

For the Three Months Ended |

|

|

For the Nine Months Ended |

|

| |

June 30, 2022 |

|

|

June 30, 2021 |

|

|

June 30, 2022 |

|

|

June 30, 2021 |

|

|

Net income |

$ |

3,472 |

|

|

$ |

9,933 |

|

|

$ |

25,376 |

|

|

$ |

23,907 |

|

| Depreciation and

amortization |

|

1,571 |

|

|

|

1,670 |

|

|

|

4,616 |

|

|

|

5,089 |

|

| Stock-based compensation |

|

— |

|

|

|

(56 |

) |

|

|

37 |

|

|

|

230 |

|

| Interest expense, net |

|

674 |

|

|

|

938 |

|

|

|

2,549 |

|

|

|

4,057 |

|

| Income tax expense |

|

1,365 |

|

|

|

2,703 |

|

|

|

7,848 |

|

|

|

7,381 |

|

| Gain on bankruptcy

settlement |

|

— |

|

|

|

(650 |

) |

|

|

(11,352 |

) |

|

|

(1,765 |

) |

| Gain/loss on extinguishment of

debt |

|

(279 |

) |

|

|

(4,768 |

) |

|

|

84 |

|

|

|

(6,150 |

) |

| Acquisition costs |

|

974 |

|

|

|

— |

|

|

|

974 |

|

|

|

— |

|

| Write-off of fixed assets |

|

438 |

|

|

|

|

|

|

438 |

|

|

|

— |

|

| Write-off of ROU assets |

|

522 |

|

|

|

|

|

|

522 |

|

|

|

— |

|

| Other company initiatives |

|

103 |

|

|

|

— |

|

|

|

101 |

|

|

|

— |

|

| Non-recurring loan costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

271 |

|

| Adjusted EBITDA |

$ |

8,840 |

|

|

$ |

9,770 |

|

|

$ |

31,193 |

|

|

$ |

33,020 |

|

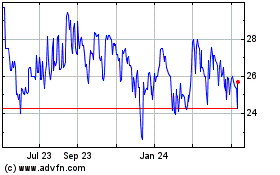

Live Ventures (NASDAQ:LIVE)

Historical Stock Chart

From Oct 2024 to Nov 2024

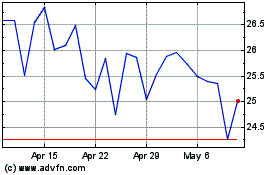

Live Ventures (NASDAQ:LIVE)

Historical Stock Chart

From Nov 2023 to Nov 2024