UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE

13D

Under the Securities Exchange

Act of 1934

(Amendment No. 20)*

(Name of Issuer)

Common Stock

(Title of Class of Securities)

531914109

(CUSIP Number)

Edward Smolyansky

1219 N Wells St

Chicago, IL 60610

(847) 967-1010

(Name, Address and

Telephone Number of Person Authorized to Receive Notices and Communications)

August 13, 2024

(Date of Event Which

Requires Filing of this Statement)

If the

filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and

is filing this schedule because of 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See 240.13d-7(b) for other parties to whom copies

are to be sent.

*The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

|

SCHEDULE 13D

CUSIP No. 531914109 |

| |

| |

1. |

Names of reporting persons

Ludmila Smolyansky |

| |

| |

2. |

Check the appropriate box if a member of a group (see instructions) |

| |

|

(a) |

☒ |

| |

|

(b) |

☐ |

| |

| |

3. |

SEC use only |

| |

| |

4. |

Source of funds (see instructions)

OO |

| |

5. |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| |

6. |

Citizenship of place of organization

United States |

| |

Number of

shares

beneficially

owned by

each

reporting

person with |

7. |

Sole voting power 1,152,476 |

| |

| 8. |

Shared voting power 75,000 |

| |

| 9. |

Sole dispositive power 1,152,476 |

| |

| 10. |

Shared dispositive power 75,000 |

| |

| |

11. |

Aggregate amount beneficially owned by each reporting

person

1,227,476 |

| |

| |

12. |

Check if the aggregate amount in Row (11) excludes certain shares (See Instructions) ☐ |

| |

| |

13. |

Percent of class represented by amount in Row (11)

8.3% |

| |

| |

14. |

Type of reporting person (see instructions)

IN |

| |

|

|

|

|

|

|

SCHEDULE 13D

CUSIP No. 531914109 |

| |

| |

1. |

Names of reporting persons

Edward Smolyansky |

| |

| |

2. |

Check the appropriate box if a member of a group (see instructions) |

| |

|

(a) |

☒ |

| |

|

(b) |

☐ |

| |

| |

3. |

SEC use only |

| |

| |

4. |

Source of funds (see instructions)

OO |

| |

5. |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐

|

| |

6. |

Citizenship of place of organization

United States |

| |

Number of

shares

beneficially

owned by

each

reporting

person with |

7. |

Sole voting power 2,604,975 |

| |

| 8. |

Shared voting power 575,000 |

| |

| 9. |

Sole dispositive power 2,604,975 |

| |

| 10. |

Shared dispositive power 575,000 |

| |

| |

11. |

Aggregate amount beneficially owned by each reporting

person

3,179,975 |

| |

| |

12. |

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) ☐ |

| |

| |

13. |

Percent of class represented by amount in Row (11)

21.5% |

| |

| |

14. |

Type of reporting person (see instructions)

IN |

| |

|

|

|

|

|

|

SCHEDULE 13D

CUSIP No. 531914109 |

| |

| |

1. |

Names of reporting persons

The Edward Smolyansky Trust 2/2/16 |

| |

| |

2. |

Check the appropriate box if a member of a group (see instructions) |

| |

|

(a) |

☒ |

| |

|

(b) |

☐ |

| |

| |

3. |

SEC use only |

| |

| |

4. |

Source of funds (see instructions)

OO |

| |

5. |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) [_]

|

| |

6. |

Citizenship of place of organization

United States |

| |

Number of

shares

beneficially

owned by

each

reporting

person with |

7. |

Sole voting power 1,233,333 |

| |

| 8. |

Shared voting power 0 |

| |

| 9. |

Sole dispositive power 1,233,333 |

| |

| 10. |

Shared dispositive power 0 |

| |

| |

11. |

Aggregate amount beneficially owned by each reporting

person

1,233,333 |

| |

| |

12. |

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) ☐ |

| |

| |

13. |

Percent of class represented by amount in Row (11)

8.3% |

| |

| |

14. |

Type of reporting person (see instructions)

OO |

| |

|

|

|

|

|

AMENDMENT

NO. 20 to SCHEDULE 13D

This Amendment No. 20 (this “Amendment”)

further amends and supplements the Schedule 13D filed by Ludmila Smolyansky, Edward Smolyansky and The Edward Smolyansky Trust 2/2/16

(the “Edward Smolyansky Trust” and, together with Ludmila Smolyansky and Edward Smolyansky, the “Filing Persons”).

This Amendment is being filed by the Filing Persons for the purpose of providing the additional information set forth below.

ITEM 4. Purpose of Transaction

Item 4 is hereby amended and supplemented by the

addition of the following:

On August 13, 2024, the Filing Persons filed

a preliminary consent statement with the Securities and Exchange Commission, regarding their plans to seek approval from the shareholders

of Lifeway Foods, Inc. (the “Company”) for the following proposals (each, as described therein, a “Proposal”):

| 1. | The Bylaw Restoration Proposal: To repeal any amendment to the Company’s by-laws (the “Bylaws”)

that is made by the Company’s board of directors (the “Board”) and becomes effective on or after March 24, 2023 and

prior to this Proposal becoming effective; |

| | | |

| 2. | The Board Removal Proposal: To remove each director of the Company, including Julie Smolyansky, Juan Carlos

Dalto, Jody Levy, Dorri McWhorter, Perfecto Sanchez, Jason Scher, Pol Sikar and any other director appointed by the Board on or after

June 15, 2024 and prior to this Proposal becoming effective, subject to the approval of the Director Election Proposal below; |

| | | |

| 3. | The Director Election Proposal: To elect each of Edward Smolyansky, Ludmila Smolyansky, Richard Beleutz,

Cindy Curry, Michael Leydervuder, George Sent and Robert Whalen (each a “Nominee”), to serve as directors of the Company until

the Company’s next annual meeting of shareholders and until their respective successors are duly elected and qualified (or, if any

such Nominee is unable or unwilling to serve as a director of the Company, or if the Board changes the number of directorships to be a

number other than seven, the persons designated as Nominees by the then-remaining Nominee(s)), subject to the approval of the Board Removal

Proposal; and |

| | | |

| 4. | The Anti-Nepotism Proposal: To amend the Bylaws to prohibit the Company from employing or engaging any

immediate family member of the Company’s president or chief executive officer. |

The preliminary consent statement is filed herewith

as Exhibit 99.1 and is incorporated by reference herein.

In addition, on August 13, 2024, the Filing

Persons issued a press release announcing the filing of the preliminary consent statement. A copy of the press release is attached hereto

as Exhibit 99.2, and is incorporated herein by reference.

ITEM 5. Interest in Securities of the Issuer

Item 5 is hereby amended and supplemented by the

addition of the following:

| (a) | As of August 13, 2024, for purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), (i) Ludmila Smolyansky may be deemed to be the beneficial owner of 1,227,476 shares of Common Stock,

representing approximately 8.3% of the outstanding shares of Common Stock, (ii) Edward Smolyansky may be deemed to be the beneficial

owner of 3,179,975 shares of Common Stock, representing approximately 21.5% of the outstanding shares of Common Stock, (iii) the

Edward Smolyansky Trust may be deemed to be the beneficial owner of 1,233,333 shares of Common Stock, representing approximately 8.3%

of the outstanding shares of Common Stock, and (iv) the Filing Persons together may be deemed to be the beneficial owners of an aggregate

of 4,332,451 shares of Common Stock, representing approximately 29.3% of the outstanding shares of Common Stock. The foregoing percentage

calculations were based on 14,790,747 shares outstanding as of August 6, 2024, as reported by the Company on its Quarterly Report

on Form 10-Q for the quarterly period ended June 30, 2024, as filed with the SEC. |

| (b) | Ludmila Smolyansky has sole power to vote or direct the vote of, and sole power to dispose or direct the

disposition of, 1,152,476 shares of Common Stock, and shared power to vote or direct the vote of, and shared power to dispose or direct

the disposition of, 75,000 shares of Common Stock held by the Ludmila and Edward Smolyansky Family Foundation, of which Ludmila Smolyansky

is a director. Edward Smolyansky has sole power to vote or direct the vote of, and sole power to dispose or direct the disposition of,

3,104,975 shares of Common Stock, which includes the 1,233,333 shares beneficially owned by the Edward Smolyansky Trust and 100,000 shares

held by his son, and shared power to vote or direct the vote of, and shared power to dispose or direct the disposition of, 500,000 shares

of Common Stock held by Smolyansky Family Holdings LLC, over which Edward Smolyansky and Julie Smolyansky share voting power and dispositive

power, and 75,000 shares of Common Stock held by the Ludmila and Edward Smolyansky Family Foundation, of which Edward Smolyansky is a

director. Julie Smolyansky is a United States citizen and the Chief Executive Officer of the Company, with a business address at 6431

Oakton Street, Morton Grove, IL 60053. Each of Ludmila Smolyansky and Edward Smolyansky disclaims beneficial ownership of the 75,000 shares

held by the Ludmila and Edward Smolyansky Family Foundation. Edward Smolyansky disclaims beneficial ownership of shares held by Smolyansky

Family Holdings LLC, except to the extent of any pecuniary interest therein, and disclaims beneficial ownership of the shares held by

his son. The Edward Smolyansky Trust has sole power to vote or direct the vote of, and sole power to dispose or direct the disposition

of, 1,233,333 shares of Common Stock. |

| | | |

| (c) | There have been no transactions in the shares of Common Stock by any of the Filing Persons during the

past sixty days, other than the sale by Ludmila Smolaynsky of 14,620 shares of Common Stock on July 24, 2024. |

ITEM 7. Material to be Filed as Exhibits

SIGNATURES

After reasonable inquiry and

to the best knowledge and belief of the undersigned, the undersigned certify that the information set forth in this statement is true,

complete and correct.

| Date: August 14, 2024 |

/s/ Ludmila Smolyansky |

|

| |

Ludmila Smolyansky |

|

| |

|

|

|

|

| Date: August 14, 2024 |

/s/ Edward Smolyansky |

|

| |

Edward Smolyansky |

|

| |

|

|

|

|

| Date: August 14, 2024 |

By: |

/s/ Edward Smolyansky |

|

| |

Name: |

Edward Smolyansky |

|

| |

Title: |

Trustee |

|

Exhibit 99.2

FOR IMMEDIATE RELEASE:

August 13, 2024

MEDIA CONTACT:

Chloe Swicegood

(850) 702-9800

chloe@sachsmedia.com

Edward and Ludmila

Smolyansky File Consent Statement to Change Leadership at Lifeway Foods (NASDAQ: LWAY)

CHICAGO, IL — Son and mother Edward and Ludmila Smolyansky,

significant shareholders of Lifeway Foods, Inc. (NASDAQ: LWAY), today announced the filing of a consent statement with the U.S. Securities

and Exchange Commission, marking the launch of their “Life Back to Lifeway” campaign.

The campaign seeks to replace the health food company’s current

Board of Directors, including CEO Julie Smolyansky, with leadership committed to revitalizing the company with a strategic vision aligned

with the best interests of its shareholders. The Lifeway board has overseen significant and repeated failures of corporate governance

that have harmed the business and its employees and driven poor financial results for shareholders.

"Under my sister Julie’s authority, Lifeway has been on

autopilot for far too long, missing critical market opportunities due to a lack of strategic vision," said Edward Smolyansky, former

COO of Lifeway Foods. "It’s time for a fresh approach to leadership that prioritizes growth and innovation over personal agendas."

Ludmila Smolyansky, co-founder and former Chairperson of Lifeway Foods,

added, "This decision hasn’t been easy, but my focus is on what’s best for Lifeway. The company, started by my husband

and me in 1986, needs a fresh direction that honors its legacy while securing its future. A new path forward will benefit everyone —

our employees, our shareholders, and even my daughter Julie."

Lifeway Foods Inc. was founded by Michael Smolyansky in 1986 and run

with support from his wife Ludmila. When Michael passed away in 2002, his children Julie and Edward took over leadership, with Julie as

CEO and Edward Smolyansky as COO.

The Life Back to Lifeway campaign underscores the Smolyanskys’

commitment to revitalizing the company with a clear vision and strategic plan that prioritizes greater marketing investments, improved

ethical governance, and more efficient operations and processing techniques.

For more information and updates, visit lifebacktolifeway.com.

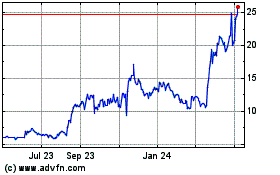

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Nov 2024 to Dec 2024

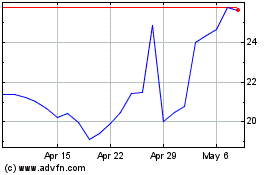

Lifeway Foods (NASDAQ:LWAY)

Historical Stock Chart

From Dec 2023 to Dec 2024