Filed by Liberty Media Corporation pursuant to

Rule 425 of the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12

of the

Securities Exchange Act of 1934

Subject Company: Liberty Media Corporation

Commission File No.: 001-35707

Subject Company: Liberty

Sirius XM Holdings Inc.

Commission File No.: 333-276758

Subject Company: Sirius XM Holdings Inc.

Commission File No.: 001-34295

August 23, 2024

Split-Off of Liberty Sirius XM Holdings Approved

at Liberty Media’s Special Meeting of Stockholders

ENGLEWOOD, Colo.—(BUSINESS WIRE)—Liberty Media

Corporation (“Liberty Media”) (Nasdaq: LSXMA, LSXMB, LSXMK, FWONA, FWONK, LLYVA, LLYVK) announced today that, at Liberty

Media’s virtual special meeting of its holders of Series A Liberty SiriusXM common stock (“LSXMA”) and

Series B Liberty SiriusXM common stock (“LSXMB”) held on August 23, 2024 at 10:15 a.m. M.T., based on

preliminary results of such special meeting, the holders of LSXMA and LSXMB approved the previously announced redemptive split-off

(the “Split-Off”) of Liberty Sirius XM Holdings Inc. (“New Sirius”), which will be the owner of all of the

businesses, assets and liabilities previously attributed to the Liberty SiriusXM Group. Following the Split-Off, New Sirius will

combine with Sirius XM Holdings Inc. (“Sirius XM”) to create a new public company which will continue to operate under

the Sirius XM name and brand.

Assuming the requisite conditions to the Split-Off are satisfied or

waived, as applicable, at 4:05 p.m., New York City time, on September 9, 2024, Liberty Media will redeem each outstanding share of

Liberty SiriusXM common stock in exchange for a fraction of a share of common stock of New Sirius equal to the exchange ratio (as further

described in New Sirius’ final prospectus, which was filed with the SEC on July 23, 2024), with cash paid in lieu of any fractional

shares. Liberty Media intends to publicly announce the final exchange ratio on or about September 5, 2024 prior to the completion

of the Split-Off once the exchange ratio and the underlying calculations are determined by the parties.

In connection with the Split-Off, Liberty Media expects that the last

day of trading of Liberty SiriusXM common stock will be September 9, 2024. Liberty Media has notified Nasdaq of its intention to

voluntarily delist from the Nasdaq Global Select Market and its intention to

request that Nasdaq file appropriate forms with the Securities and Exchange Commission on or about September 9, 2024. As a result,

Liberty Media expects Liberty SiriusXM common stock will cease to trade following market close on September 9, 2024.

Additionally, following the Split-Off, a wholly owned subsidiary of

New Sirius will merge with Sirius XM, and Sirius XM stockholders (other than New Sirius and its subsidiaries) will receive one-tenth (0.1)

of a share of New Sirius common stock (the “Merger”), at 6:00 p.m., New York City time, on September 9, 2024, with cash

paid in lieu of any fractional shares.

Following the Merger, Liberty Media expects that the shares of New

Sirius common stock will be listed on the Nasdaq Stock Market under the ticker symbol “SIRI”. Liberty Media expects that New

Sirius common stock will begin trading on the Nasdaq Stock Market on September 10, 2024.

Forward-Looking Statements

This communication includes certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995, including certain statements relating to the Split-Off and Merger

(collectively, the “Transactions”) and their proposed timing and other matters related to the Transactions. All statements

other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws.

These forward-looking statements generally can be identified by phrases such as “possible,” “potential,” “intends”

or “expects” or other words or phrases of similar import or future or conditional verbs such as “will,” “may,”

“might,” “should,” “would,” “could,” or similar variations. These forward-looking statements

involve many risks and uncertainties that could cause actual results and the timing of events to differ materially from those expressed

or implied by such statements, including, without limitation, the satisfaction of conditions to the Transactions. These forward-looking

statements speak only as of the date of this communication, and Liberty Media expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained herein to reflect any change in Liberty Media’s expectations

with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly

filed documents of Liberty Media, including its definitive proxy statement materials for the special meeting and its most recent Forms

10-K and 10-Q, as such risk factors may be amended, supplemented or superseded from time to time by other reports Liberty Media subsequently

files with the SEC, for additional information about Liberty Media and about the risks and uncertainties related to Liberty Media’s

business which may affect the statements made in this communication.

Additional Information

Nothing in this press release shall constitute a solicitation to buy

or an offer to sell shares of common stock of Liberty Media, Sirius XM or New Sirius. The proposed offer and issuance of shares of New

Sirius common stock in the Transactions will be made only pursuant to New Sirius’ effective registration statement on Form S-4,

which includes a prospectus of New Sirius. Liberty Media and Sirius XM stockholders and other investors are urged to read the registration

statement, Liberty Media’s definitive proxy statement materials for the special meeting and Sirius XM’s information statement,

together with all relevant SEC filings regarding the Transactions, and any other relevant documents filed as exhibits therewith, as well

as any amendments or supplements to those documents, because they contain important information about the Transactions. The prospectus/proxy

statement/information statement and other relevant materials for the proposed transaction have previously been provided to all LSXMA,

LSXMB and Sirius XM stockholders. Copies of these SEC filings are available, free of charge, at the SEC’s website (http://www.sec.gov).

Copies of the filings together with the materials incorporated by reference therein are available, without charge, by directing a request

to Liberty Media Corporation, 12300 Liberty Boulevard, Englewood, Colorado 80112, Attention: Investor Relations, Telephone: (877) 772-1518

or Sirius XM Holdings Inc., 1221 Avenue of the Americas, 35th Floor, New York, New York 10021, Attention: Investor Relations, (212) 584-5100.

About Liberty Media Corporation

Liberty Media Corporation operates and owns interests in a broad range

of media, communications, sports and entertainment businesses. Those businesses are attributed to three tracking stock groups: the Liberty

SiriusXM Group, the Formula One Group and the Liberty Live Group. The businesses and assets attributed to the Liberty SiriusXM Group (NASDAQ:

LSXMA, LSXMB, LSXMK) include Liberty Media’s interest in Sirius XM. The businesses and assets attributed to the Formula One Group

(NASDAQ: FWONA, FWONK) include Liberty Media’s subsidiaries Formula 1 and Quint, and other minority investments. The businesses

and assets attributed to the Liberty Live Group (NASDAQ: LLYVA, LLYVK) include Liberty Media’s interest in Live Nation and other

minority investments.

Shane Kleinstein, 720-875-5432

Source: Liberty Media Corporation

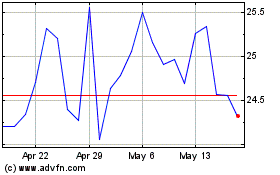

Liberty Media (NASDAQ:LSXMK)

Historical Stock Chart

From Oct 2024 to Nov 2024

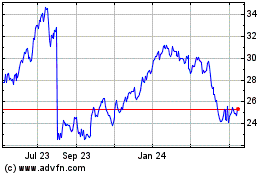

Liberty Media (NASDAQ:LSXMK)

Historical Stock Chart

From Nov 2023 to Nov 2024