Current Report Filing (8-k)

February 26 2019 - 4:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 20, 2019

LIBERTY LATIN AMERICA LTD.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

Bermuda

|

|

001-38335

|

|

98-1386359

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification #)

|

Clarendon House,

2 Church Street,

Hamilton HM 11, Bermuda

(Address of Principal Executive Office)

(303) 925-6000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02.

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) Compensatory Arrangements of Certain Officers

2019 Performance Awards

. Pursuant to the Liberty Latin America 2019 Annual Incentive Plan (the “

Incentive Plan

”), on February 20, 2019, the Compensation Committee (the “

Committee

”) of the Board of Directors of Liberty Latin America Ltd. (the “

Company

”) approved performance goals for the year ending December 31, 2019, for annual performance awards to its executive officers (the “

2019 Performance Awards

”). In the following text, the terms “we”, “our”, and “our company” refer to the Company.

The Incentive Plan seeks to align the Company behind one vision, one culture, and one team by rewarding employees for the combined success of the Company. The target 2019 Performance Awards will be split among the following consolidated Company performance metrics for the year ending December 31, 2019:

|

|

|

|

•

|

the achievement of budgeted revenue growth;

|

|

|

|

|

•

|

the achievement of budgeted operating free cash flow

1

; and

|

|

|

|

|

•

|

the achievement of a target average customer relationship net promotor score.

|

Based on the achievement of these performance metrics, a payout of up to 150% of the target bonus amount is available for over-performance against budget/target. The Company has also created a recognition program for high performers who are eligible to receive, based on personal performance, a payout over 150%, subject to Committee approval of any recognition award for the 2019 NEOs.

Balan Nair, our Chief Executive Officer, Chris Noyes, our Chief Financial Officer, Betzalel Kenigsztein, our Chief Operating Officer, Vivek Khemka, our Chief Technology and Product Officer, and John Winter, our Chief Legal Officer, each of whom we anticipate will be among our five most highly compensated executive officers for 2019 (the “

2019 NEOs

”), will participate in the 2019 Performance Awards. The cash target 2019 Performance Awards are $3,500,000 for our CEO and $1,000,000

for each of the other 2019 NEOs.

Shareholder Incentive Program

. In connection with our annual performance award program, including the 2019 Performance Awards, we encourage increased share ownership among senior management in our various countries, aligning incentives among employees and shareholders. As a result, the Committee implemented a shareholder incentive program that allows senior management to receive up to 100% of their annual performance awards (including the 2019 Performance Awards) in Company common shares in lieu of cash. Persons electing common shares in respect of their 2019 Performance Awards will also receive restricted share units equal to 12.5% of the common shares they earn pursuant to the 2019 Performance Awards. The restricted share units vest one year after the grant date provided that the employee holds all of the common shares issued in respect of the 2019 Performance Awards through that period.

|

|

|

|

1.

|

Represents operating income (loss) before depreciation and amortization, share-based compensation, provisions and provision releases related to significant litigation, and impairment, restructuring and other operating items less property and equipment additions.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

LIBERTY LATIN AMERICA LTD.

|

|

|

|

|

|

By:

|

/s/ BRIAN ZOOK

|

|

|

|

Brian Zook

|

|

|

|

Chief Accounting Officer

|

Date: February 26, 2019

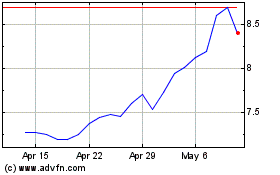

Liberty Latin America (NASDAQ:LILAK)

Historical Stock Chart

From Sep 2024 to Oct 2024

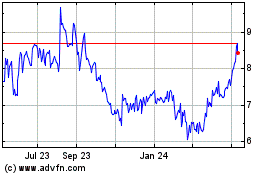

Liberty Latin America (NASDAQ:LILAK)

Historical Stock Chart

From Oct 2023 to Oct 2024