Virgin Media Receivables Financing Notes II Designated Activity Company Negotiates Private Placement Add-On of £50 Million o...

July 19 2018 - 4:10PM

Business Wire

Virgin Media Receivables Financing Notes II Designated Activity

Company (the “Issuer”) announced today that it successfully

negotiated a private placement of £50 million in

aggregate principal amount of its 5¾% Receivables Financing Notes

due 2023 (the “New Additional Notes”). The New

Additional Notes will be issued and sold as an additional issue of

the Issuer’s outstanding 5¾% Receivables Financing Notes due 2023,

originally issued on 4 April 2018 (the “Original Notes”) in

an aggregate principal amount of £300 million. On 13 June

2018, the Issuer issued £50 million in aggregate principal

amount of its 5¾% Receivables Financing Notes due 2023 in a private

placement (the “June Additional Notes” and, together with

the Original Notes, the “Existing Notes”).

The New Additional Notes are expected to be issued on 26 July

2018. Upon issuance, the New Additional Notes will have a different

international securities identification number (“ISIN”) and

common code (“Common Code”) from, and will not trade

fungibly with, the Original Notes (or the June Additional Notes)

during the 40-day period prescribed by Regulation S (“Regulation

S”) under the U.S. Securities Act of 1933, as amended,

commencing on the issue date of the New Additional Notes (the

“Distribution Compliance Period”). Following the

Distribution Compliance Period, the New Additional Notes will

become fully fungible with, and have the same ISIN and Common Code

as, the Original Notes sold pursuant to Regulation S.

The Issuer has outstanding the following debt securities listed

on the Irish Stock Exchange:

- Original Notes: £300,000,000 original

aggregate principal amount of 5¾% Receivables Financing Notes due

2023 (ISIN: XS1797821037, Common Code: 179782103)

- June Additional Notes: £50,000,000

aggregate principal amount of additional 5¾% Receivables Financing

Notes due 2023 (Temporary ISIN: XS1838122387, Temporary Common

Code: 183812238). Following the distribution compliance period for

the June Additional Notes, the June Additional Notes will have the

same ISIN (XS1797821037) and Common Code (179782103) and be fully

fungible with the Original Notes

The Issuer will use the proceeds of the New Additional Notes,

together with the proceeds from the Existing Notes to (i) purchase

eligible accounts receivable of Virgin Media Investment Holdings

Limited (“VMIH”), a subsidiary of Virgin Media Inc.

(“Virgin Media”) and certain of its subsidiaries and (ii)

make revolving loans to VMIH.

The Issuer is a special purpose financing company. The legal

interest in the entire issued share capital of the Issuer is held

by a share trustee (with the beneficial interest being held on

charitable trust under the laws of the Republic of Ireland). None

of Virgin Media, VMIH or their respective subsidiaries have any

equity or voting interest in the Issuer, and accordingly, the

Issuer will not be consolidated into Virgin Media’s consolidated

financial statements.

About the Virgin Media Group

Virgin Media is the leading cable operator in the U.K. and

Ireland, delivering 14.4 million broadband, video and fixed-line

telephony services to 5.9 million cable customers and voice and

data services to 3.1 million mobile subscribers at March 31,

2018.

This announcement is not directed at, or intended for

distribution to or use by any person or entity that is a citizen or

resident or located in any locality, state, country or other

jurisdiction where such distribution or use would be contrary to

law or regulation or which would require any registration or

licensing.

The Existing Notes and the New Additional Notes have not been

and will not be registered under the U.S. Securities Act of 1933,

as amended (the “Securities Act”), or with any securities

regulatory authority of any state or jurisdiction of the United

States, and may not be offered, sold, resold or otherwise

transferred, directly or indirectly, in or into the United States

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act and

in compliance with any applicable securities law of any state or

other jurisdiction of the United States.

This announcement contains or, incorporates by reference,

“forward-looking statements.” These forward-looking statements may

be identified by the use of forward-looking terminology, including

the terms “believes,” “estimates,” “anticipates,” “projects,”

“expects,” “intends,” “aims,” “plans,” “predicts,” “may,” “will,”

“seeks,” “could,” “would,” “shall” or “should” or, in each case,

their negative or other variations or comparable terminology, or by

discussions of strategy, plans, objectives, goals, future events or

intentions. These forward-looking statements include all matters

that are not historical facts and include statements regarding the

intentions, beliefs or current expectations of Virgin Media

concerning, among other things, Virgin Media’s results of

operations, financial condition, prospects, growth, strategies and

the industries in which Virgin Media operates.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future or are beyond

Virgin Media’s control. Forward-looking statements are not

guarantees of future performance and are based on one or more

assumptions relating to Virgin Media’s actual results of operations

and financial condition and the development of the industries in

which Virgin Media operates which may differ materially from those

suggested by the forward-looking statements contained in, or

incorporated by reference into, in this announcement. In addition,

even if Virgin Media’s actual results of operations, financial

condition and the development of the industries in which Virgin

Media operates are consistent with the forward-looking statements

contained in this announcement, those results or developments may

not be indicative of results or developments in subsequent

periods.

The forward-looking statements contained in, or incorporated by

reference into, this announcement speak only as of the date of this

announcement. Virgin Media expressly disclaims any obligations or

undertaking to update or revise publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise, unless required to do so by applicable law.

MiFID II professionals / ECPs-only / No PRIIPs KID –

Manufacturer target market (MIFID II product governance) is

eligible counterparties and professional clients only (all

distribution channels). No PRIIPs key information document (KID)

has been prepared as not available to retail in EEA.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180719005726/en/

Liberty Global plcInvestor Relations:John Rea, +1 303 220

4238

Liberty Global (NASDAQ:LBTYK)

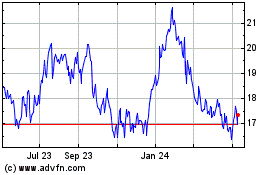

Historical Stock Chart

From Feb 2025 to Mar 2025

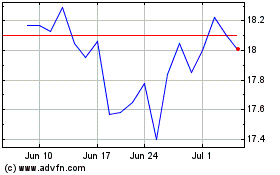

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Mar 2024 to Mar 2025