false

0001509745

0001509745

2024-11-13

2024-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(D)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 13, 2024

Leap Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-37990 |

|

27-4412575 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

47 Thorndike Street, Suite B1-1

Cambridge, MA |

02141 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone

number, including area code: (617) 714-0360

N/A

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name

of each exchange on which

registered |

| Common Stock, par value $0.001 |

LPTX |

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results

of Operations and Financial Condition

On November 13, 2024, Leap Therapeutics, Inc.

(the “Company”) announced its financial results for the quarter ended September 30, 2024. The full text of the

press release issued by the Company in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained herein and in the accompanying

exhibit shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless

of any general incorporation language in such filing, unless expressly incorporated by specific reference to such filing. The information

in this Current Report on Form 8-K, including the information set forth under this Item 2.02 and the exhibit hereto, shall not be

deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject

to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

LEAP THERAPEUTICS, INC. |

| |

|

| Dated: November 13, 2024 |

By: |

/s/ Douglas E. Onsi |

| |

Name: |

Douglas E. Onsi |

| |

Title: |

Chief Executive Officer and President |

Exhibit 99.1

Leap Therapeutics Reports Third Quarter 2024

Financial Results

Cambridge, MA – November 13, 2024

– Leap Therapeutics, Inc. (Nasdaq:LPTX), a biotechnology company focused on developing targeted and immuno-oncology therapeutics,

today reported financial results for the third quarter ended September 30, 2024.

Leap Highlights:

| · | Completed enrollment in the expanded randomized controlled Part B of the Phase 2 DeFianCe study evaluating

DKN-01, Leap’s anti-DKK1 monoclonal antibody, in combination with standard of care bevacizumab and chemotherapy in second-line patients

with advanced colorectal cancer (CRC); data expected in mid-2025 |

| · | Patient follow-up continuing in the randomized controlled Part C of the Phase 2 DisTinGuish study

evaluating DKN-01 in combination with tislelizumab and chemotherapy in first-line patients with advanced gastroesophageal junction (GEJ)

and gastric cancer; data expected in late 2024 or early 2025 |

| · | Initiated development of FL-501, Leap’s anti-GDF-15 monoclonal antibody |

“We have made significant progress advancing

our pipeline this quarter, including the completion of enrollment in the expanded Part B of the Phase 2 DeFianCe study of DKN-01

in patients with advanced colorectal cancer,” said Douglas E. Onsi, President and Chief Executive Officer of Leap. “We look

forward to sharing initial randomized controlled data from the DisTinGuish study and the DeFianCe study in the coming months. In addition,

based on positive preclinical data, we are enthusiastically moving FL-501 into development. With a strong cash position that is expected

to fund operations into Q2 2026, Leap is well positioned for continued success and long-term growth to deliver personalized medicines

to patients fighting against cancer.”

DKN-01 Development Update

| · | Enrollment

completed in the expanded randomized controlled Part B of the DeFianCe study evaluating

DKN-01 in combination with standard of care bevacizumab and chemotherapy as a second-line

treatment for patients with advanced CRC. Part B of the DeFianCe study (NCT05480306)

is a Phase 2, randomized, controlled, open-label study of DKN-01 in combination with standard

of care bevacizumab and chemotherapy in patients with advanced CRC who have received one

prior systemic therapy. Part B of the study enrolled 188 patients. The Company expects

to report initial data in mid-2025. |

| · | Patient

follow-up continuing in the randomized controlled Part C of the DisTinGuish study evaluating

DKN-01 in combination with tislelizumab and chemotherapy in patients with GEJ and gastric

cancer, with initial data expected in late 2024 or early 2025. Part C of the

DisTinGuish study (NCT0436380) is a Phase 2, randomized, controlled, open-label study

of DKN-01 in combination with tislelizumab and chemotherapy in first-line, HER-2 negative

patients with GEJ and gastric cancer. Part C of the study enrolled 170 patients. The

Company expects to report initial data in late 2024 or early 2025. |

Pipeline Update:

| · | Advancing FL-501 into development as a potential best-in-class anti-GDF-15 antibody with promising

preclinical data. FL-501 is a potential best-in-class monoclonal antibody designed to neutralize GDF-15 to treat patients with

cachexia and other GDF-15-driven diseases. FL-501 may also enhance the activity of the immune system in the tumor micro-environment. FL-501

was engineered for higher target affinity and a longer plasma half-life compared to competing therapies. In preclinical cachexia models,

FL-501 increased body weight and restored muscle mass. |

Selected Third Quarter 2024 Financial Results

Net Loss was $18.2 million for the third

quarter 2024, compared to $13.7 million for the same period in 2023. The increase was primarily due to an increase in research

and development expenses.

Research and development expenses were $14.9

million for the third quarter 2024, compared to $11.5 million for the same period in 2023. The increase of $3.4 million

was primarily due to an increase of $1.7 million in manufacturing costs related to clinical trial material and manufacturing campaigns,

and an increase of $0.8 million in clinical trial costs due to patient enrollment, the duration of patients on study, the enhancement

of correlative studies, increase in site activity associated with Part C of the DisTinGuish study, and the expansion of the size

of Part B of the DeFianCe study. There was also an increase of $0.5 million in consulting fees associated with research and development

activities and an increase of $0.4 million in payroll and other related expenses due to an increase in headcount of our research and development

full-time employees.

General and administrative expenses were $2.9

million for the third quarter 2024, compared to $3.3 million for the same period in 2023. The decrease of $0.4 million

in general and administrative expenses during the three months ended September 30, 2024 as compared to the same period in 2023, was

due to a $0.4 million decrease in professional fees.

Cash and cash equivalents totaled $62.8 million at September 30,

2024.

About Leap Therapeutics

Leap Therapeutics (Nasdaq: LPTX) is focused

on developing targeted and immuno-oncology therapeutics. Leap's most advanced clinical candidate, DKN-01, is a humanized monoclonal antibody

targeting the Dickkopf-1 (DKK1) protein. DKN-01 is being developed in patients with esophagogastric, colorectal, and gynecological cancers.

Leap’s pipeline also includes FL-501, a humanized monoclonal antibody targeting the growth and differentiation factor 15 (GDF-15)

protein, in preclinical development. For more information about Leap Therapeutics, visit http://www.leaptx.com or

view our public filings with the SEC that are available via EDGAR at http://www.sec.gov or via https://investors.leaptx.com/.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements

within the meaning of the federal securities laws. Such statements are based upon current plans, estimates and expectations of the management

of Leap that are subject to various risks and uncertainties that could cause actual results to differ materially from such statements.

The inclusion of forward-looking statements should not be regarded as a representation that such plans, estimates and expectations will

be achieved. Words such as "anticipate," "expect," "project," "intend," "believe," "may,"

"will," "should," "plan," "could," "continue," "target," "contemplate,"

"estimate," "forecast," "guidance," "predict," "possible," "potential," "pursue,"

"likely," and words and terms of similar substance used in connection with any discussion of future plans, actions or events

identify forward-looking statements.

All statements, other than historical facts, including

statements regarding the potential safety, efficacy, and regulatory and clinical progress of Leap's product candidates; the anticipated

timing for initiation or completion of clinical trials and release of clinical trial data and the expectations surrounding the outcomes

thereof; Leap's future clinical or preclinical product development plans for any of Leap's product candidates; Leap's estimations of projected

cash runway; and any assumptions underlying any of the foregoing, are forward-looking statements. Important factors that could cause actual

results to differ materially from Leap's plans, estimates or expectations could include, but are not limited to: (i) Leap's ability

to successfully execute its clinical trials and the timing of enrollment in and cost of such clinical trials; (ii) the results of

Leap's clinical trials and pre-clinical studies; (iii) Leap's ability to successfully enter into new strategic partnerships for DKN-01

or any of its other programs and to maintain its ongoing collaborations with BeiGene and Adimab; (iv) whether any Leap clinical trials

and products will receive approval from the U.S. Food and Drug Administration or equivalent foreign regulatory agencies; and (v) exposure

to inflation, currency rate and interest rate fluctuations, as well as fluctuations in the market price of Leap's traded securities. New

risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations

or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. Leap may not actually achieve

the forecasts disclosed in such forward-looking statements, and you should not place undue reliance on such forward-looking statements.

Such forward-looking statements are subject to a number of material risks and uncertainties including but not limited to those set forth

under the caption "Risk Factors" in Leap's most recent Annual Report on Form 10-K filed with the SEC, as well as discussions

of potential risks, uncertainties, and other important factors in its subsequent filings with the SEC. Any forward-looking statement speaks

only as of the date on which it was made. Neither Leap, nor any of its affiliates, advisors or representatives, undertake any obligation

to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except

as required by law. These forward-looking statements should not be relied upon as representing Leap's views as of any date subsequent

to the date hereof.

CONTACT:

Douglas E. Onsi

President & Chief Executive Officer

Leap Therapeutics, Inc.

617-714-0360

donsi@leaptx.com

Matthew DeYoung

Investor Relations

Argot Partners

212-600-1902

leap@argotpartners.com

Leap Therapeutics, Inc

Consolidated Statement of Operations

Leap Therapeutics, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share amounts)

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

$ | 14,915 | | |

$ | 11,503 | | |

$ | 44,099 | | |

$ | 61,549 | |

| General and administrative | |

| 2,940 | | |

| 3,330 | | |

| 9,833 | | |

| 10,672 | |

| Total operating expenses | |

| 17,855 | | |

| 14,833 | | |

| 53,932 | | |

| 72,221 | |

| Loss from operations | |

| (17,855 | ) | |

| (14,833 | ) | |

| (53,932 | ) | |

| (72,221 | ) |

| Interest income | |

| 894 | | |

| 1,084 | | |

| 2,534 | | |

| 3,089 | |

| Australian research and development incentives | |

| (499 | ) | |

| 554 | | |

| - | | |

| 1,124 | |

| Foreign currency loss | |

| (8 | ) | |

| (501 | ) | |

| (18 | ) | |

| (953 | ) |

| Change in fair value of Series X preferred stock warrant liability | |

| - | | |

| - | | |

| - | | |

| 12 | |

| Loss before income taxes | |

| (17,468 | ) | |

| (13,696 | ) | |

| (51,416 | ) | |

| (68,949 | ) |

| Provision for income taxes | |

| (708 | ) | |

| - | | |

| (708 | ) | |

| - | |

| Net loss | |

| (18,176 | ) | |

| (13,696 | ) | |

| (52,124 | ) | |

| (68,949 | ) |

| Dividend attributable to down round feature of warrants | |

| - | | |

| - | | |

| (234 | ) | |

| - | |

| Net loss attributable to common stockholders | |

$ | (18,176 | ) | |

$ | (13,696 | ) | |

$ | (52,358 | ) | |

$ | (68,949 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share | |

| | | |

| | | |

| | | |

| | |

| Basic & diluted | |

$ | (0.44 | ) | |

$ | (0.51 | ) | |

$ | (1.44 | ) | |

$ | (3.78 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic & diluted | |

| 41,209,639 | | |

| 26,987,182 | | |

| 36,307,890 | | |

| 18,240,455 | |

Leap Therapeutics, Inc

Consolidated Balance Sheet

Leap Therapeutics, Inc.

Consolidated Balance Sheets

(in thousands, except share and per share amounts)

| | |

September 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 62,823 | | |

$ | 70,643 | |

| Research and development incentive receivable | |

| 780 | | |

| 771 | |

| Prepaid expenses and other current assets | |

| 209 | | |

| 183 | |

| Total current assets | |

| 63,812 | | |

| 71,597 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| - | | |

| 5 | |

| Right of use assets, net | |

| 370 | | |

| 257 | |

| Deposits | |

| 865 | | |

| 966 | |

| Total assets | |

$ | 65,047 | | |

$ | 72,825 | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 5,946 | | |

$ | 6,465 | |

| Accrued expenses | |

| 9,049 | | |

| 5,957 | |

| Income tax payable | |

| 722 | | |

| - | |

| Lease liability - current portion | |

| 376 | | |

| 262 | |

| Total current liabilities | |

| 16,093 | | |

| 12,684 | |

| | |

| | | |

| | |

| Total liabilities | |

| 16,093 | | |

| 12,684 | |

| | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Preferred stock, $0.001 par value;

10,000,000 shares authorized; 0 shares issued and outstanding | |

| - | | |

| - | |

| Common stock, $0.001 par value; 240,000,000 shares authorized; 38,264,464 and 25,565,414 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | |

| 38 | | |

| 26 | |

| Additional paid-in capital | |

| 500,850 | | |

| 459,591 | |

| Accumulated other comprehensive income | |

| 6 | | |

| 106 | |

| Accumulated deficit | |

| (451,940 | ) | |

| (399,582 | ) |

| Total stockholders’ equity | |

| 48,954 | | |

| 60,141 | |

| Total liabilities and stockholders' equity | |

$ | 65,047 | | |

$ | 72,825 | |

Leap Therapeutics, Inc

Consolidated Statement of Cash Flows

Leap Therapeutics, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

Three Months Ended September 30 | | |

Nine Months Ended September 30 | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Cash used in operating activities | |

$ | (15,600 | ) | |

$ | (10,488 | ) | |

$ | (44,787 | ) | |

$ | (33,373 | ) |

| Cash provided by investing activities | |

| - | | |

| - | | |

| - | | |

| 48,969 | |

| Cash provided by (used in) financing activities | |

| (66 | ) | |

| (1 | ) | |

| 37,080 | | |

| (30 | ) |

| Effect of exchange rate changes on cash and cash equivalents | |

| 10 | | |

| (183 | ) | |

| (113 | ) | |

| (323 | ) |

| Net increase (decrease) in cash and cash equivalents | |

| (15,656 | ) | |

| (10,672 | ) | |

| (7,820 | ) | |

| 15,243 | |

| Cash and cash equivalents at beginning of period | |

| 78,479 | | |

| 91,415 | | |

| 70,643 | | |

| 65,500 | |

| Cash and cash equivalents at end of period | |

$ | 62,823 | | |

$ | 80,743 | | |

$ | 62,823 | | |

$ | 80,743 | |

| | |

| | | |

| | | |

| | | |

| | |

v3.24.3

Cover

|

Nov. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 13, 2024

|

| Entity File Number |

001-37990

|

| Entity Registrant Name |

Leap Therapeutics, Inc.

|

| Entity Central Index Key |

0001509745

|

| Entity Tax Identification Number |

27-4412575

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

47 Thorndike Street

|

| Entity Address, Address Line Two |

Suite B1-1

|

| Entity Address, City or Town |

Cambridge

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02141

|

| City Area Code |

617

|

| Local Phone Number |

714-0360

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

LPTX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

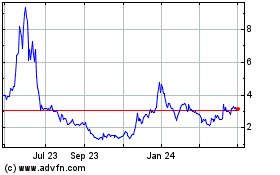

Leap Therapeutics (NASDAQ:LPTX)

Historical Stock Chart

From Jan 2025 to Feb 2025

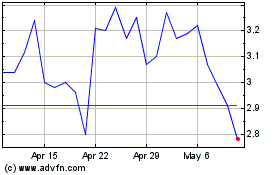

Leap Therapeutics (NASDAQ:LPTX)

Historical Stock Chart

From Feb 2024 to Feb 2025