Delivered Q3 2023 revenue of $10.6 million

Reported Q3 2023 net loss of $2.2 million and

adjusted EBITDA1 loss of $0.2 million

Leafly Holdings, Inc. (“Leafly” or “the Company”) (NASDAQ:

LFLY), a leading online cannabis discovery marketplace and resource

for cannabis consumers, today announced financial results for its

third quarter ended September 30, 2023.

“Our third quarter results reflect our progress toward building

a sustainable business in a challenging market," said Yoko

Miyashita, CEO of Leafly. “Cannabis markets continue to experience

pain points of various types, but the industry continues to evolve.

The Leafly platform plays an important role, providing the

technology retailers need to drive consumer sales and e-commerce

shopping experiences. With a strategic focus on profitability, we

are carefully managing expenses which we believe will set us up for

growth as the cannabis market matures and recovers."

Third Quarter Financial Results

- Revenue was $10.6 million, compared to $11.8 million in Q3

2022.

- Gross margin was 89%, an improvement over Q3 2022 gross margin

of 87%.

- Total operating expense was $10.9 million, a 33% reduction from

$16.3 million in Q3 2022, reflecting operational rigor and

continued focus on cost discipline.

- Net loss for Q3 2023 was $2.2 million, compared to net income

of $15.5 million for Q3 2022, which included a $22.3 million

non-cash benefit from change in fair value derivative

liabilities.

- Adjusted EBITDA1, a non-GAAP measure, was a loss of $0.2

million compared to adjusted EBITDA loss of $5.2 million in Q3

2022.

- Ended the quarter with $14.5 million, excluding restricted

cash, essentially flat compared to Q2 2023.

1 The non-GAAP financial measures EBITDA and adjusted EBITDA are

presented in this release. See the reconciliations of such non-GAAP

financial measures to their most comparable GAAP measures in the

table included in this release below.

“We continue to focus on operating with efficiency and managing

costs," said Suresh Krishnaswamy, CFO of Leafly. "Our third quarter

results are a reflection of the difficult environment our retail

and brand customers are facing, driven by lack of access to banking

and capital, license delays, and margin compression. We are

supporting our customers to provide value aligned with their needs,

while also right-sizing their services for maximum impact given

their budget constraints."

Key Performance Metrics

Three Months Ended September

30,

2023

2022

Change

Change (%)

Ending retail accounts

4,466

5,637

(1,171

)

-21

%

Retailer ARPA

$

644

$

556

$

88

16

%

Third Quarter Business Highlights

- On September 29, 2023, the Company received formal notice from

The Nasdaq Stock Market LLC that it regained compliance with the

minimum bid price rule.

- Retailer average revenue per account (“ARPA”) was $644, an

increase of $88 from Q3 2022, and also increased over Q2 2023. The

increase was largely driven by the roll-out of new rate cards and

churn of lower ARPA accounts.

- The Company completed rolling out new rate cards and price

increases in select markets to select clients to better align

pricing with the value the Company delivers to its various

partners.

- Leafly introduced a new API for order integration, which

provides seamless integration between cannabis point of sale

systems and Leafly, leading to less friction for retailers.

- The Company introduced scheduled delivery to enhance the

ordering experience and drive customer retention and loyalty.

- The Company introduced new, consumer life-cycle management to

improve the consumer shopping experience and help generate sales

for retailers.

Financial Outlook

Today, Leafly is issuing fourth quarter 2023 guidance. Based on

current business trends and conditions, the financial outlook is

expected to be around $9.5 million in revenue and adjusted EBITDA

loss is expected to be around $1.3 million.

Leafly has not provided a quantitative reconciliation of

forecasted GAAP net income (loss) to forecasted total adjusted

EBITDA within this communication because the Company is unable,

without making unreasonable efforts, to calculate certain

reconciling items with confidence. These items include, but are not

limited to: depreciation and amortization expense from new assets;

impairments of assets; changes in the valuation of any derivatives;

the valuation of, and changes in, grants of equity-based

compensation; and gains or losses on modification or extinguishment

of debt. These items, which could materially affect the computation

of forward-looking GAAP net income (loss), are inherently uncertain

and depend on various factors, many of which are outside of

Leafly’s control. For more information regarding the non-GAAP

financial measures discussed in this communication, please see

“Non-GAAP Financial Measures” below.

Webcast and Conference Call Information

Leafly will host a conference call and webcast to discuss the

results today, Thursday, November 9, 2023 at 1:30 p.m. Pacific Time

(4:30 p.m. Eastern Time). A live webcast of the call can be

accessed from Leafly’s Investor Relations website at

https://investor.leafly.com.

The live call may also be accessed via telephone at (833)

470-1428 toll-free domestically. Please reference conference ID:

#065993. An archived version of the webcast will be available from

the same website after the call.

About Leafly

Leafly helps millions of people discover cannabis each year.

Leafly's powerful tools help shoppers make informed purchasing

decisions and empower cannabis businesses to attract and retain

loyal customers through advertising and technology services. Learn

more at Leafly.com or download the Leafly mobile app through

Apple’s App Store or Google Play.

Definitions of Key Performance Metrics

Ending retail accounts Ending

retail accounts is the number of paying retailer accounts with

Leafly as of the last month of the respective period. Retail

accounts can include more than one retailer.

Retailer average revenue per

account Retailer ARPA is calculated as monthly retail

revenue, on an account basis, divided by the number of retail

accounts that were active during that same month. An active account

is one that had an active paying subscription with Leafly in the

month. Leafly does not provide retailers with an ongoing free

subscription offering but may offer a free introductory period with

certain subscriptions.

Given that each of ending retail accounts and retailer ARPA are

operational measures and that the Company’s methodology for

calculating these measures does not meet the definition of a

non-GAAP measure, as that term is defined by the U.S. Securities

and Exchange Commission (the "SEC"), a quantitative reconciliation

for each is not required or provided.

Cautionary Statement Regarding Forward Looking

Statements

This document contains certain forward-looking statements within

the meaning of the federal securities laws, including statements

regarding the services offered by Leafly and the markets in which

Leafly operates, business strategies, performance metrics, industry

environment, potential growth opportunities, Leafly’s projected

future results and financial outlook, and expected savings from

cost-cutting measures. These forward-looking statements generally

are identified by the words “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,”

“forecast,” “opportunity,” “outlook,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions (including the negative versions of such

words or expressions).

Forward-looking statements are predictions, projections and

other statements about future events that are based on current

expectations and assumptions as of the date of this release and, as

a result, are subject to risks and uncertainties that could cause

actual results to differ materially from those expressed in such

forward-looking statements.

Many factors could cause actual future events to differ

materially from the forward-looking statements in this press

release, including but not limited to, Leafly’s inability to raise

sufficient capital to execute its business plan; inability to

continue to meet the continued listing requirements applicable to

companies listed on the Nasdaq Capital Market; the size, demands

and growth potential of the markets for Leafly’s products and

services and Leafly’s ability to serve those markets; the impact of

worldwide economic conditions, including the resulting effect on

consumer spending at local cannabis retailers and the level of

advertising spending by such retailers; the degree of market

acceptance and adoption of Leafly’s products and services; and the

other risks and uncertainties described in the “Risk Factors”

section of the Annual Report on Form 10-K filed by Leafly with the

SEC on March 29, 2023, and in Leafly’s Quarterly Reports on Form

10-Q for the quarters ended March 31, 2023 and June 30, 2023, and

in the other documents filed by Leafly from time to time with the

SEC.

These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements, and Leafly assumes no obligation and, except as

required by law, does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise. Leafly does not give any assurance

that it will achieve its expectations.

LEAFLY HOLDINGS, INC

CONDENSED CONSOLIDATED BALANCE

SHEETS - UNAUDITED

(in thousands, except per

share amounts)

September 30, 2023

December 31, 2022

ASSETS

Current assets

Cash and cash equivalents

$

14,469

$

24,594

Accounts receivable, net of allowance for

doubtful accounts of $1,400 and $908, respectively

3,409

3,298

Prepaid expenses and other current

assets

2,339

1,792

Restricted cash

—

360

Total current assets

20,217

30,044

Property, equipment, and software, net

2,541

2,285

Restricted cash - long-term portion

249

248

Other assets

55

135

Total assets

$

23,062

$

32,712

LIABILITIES AND STOCKHOLDERS'

DEFICIT

Current liabilities

Accounts payable

$

1,609

$

1,625

Accrued expenses and other current

liabilities

2,990

6,235

Deferred revenue

2,095

1,958

Total current liabilities

6,694

9,818

Non-current liabilities

Non-current portion of convertible

promissory notes, net

29,272

28,863

Private warrants derivative liability

113

182

Escrow shares derivative liability

5

52

Stockholder earn-out rights derivative

liability

25

204

Total non-current liabilities

29,415

29,301

Total liabilities

36,109

39,119

Commitments and contingencies

Stockholders' deficit

Preferred stock

—

—

Common stock

—

—

Treasury stock

(31,663

)

(31,663

)

Additional paid-in capital

92,359

89,956

Accumulated deficit

(73,743

)

(64,700

)

Total stockholders' deficit

(13,047

)

(6,407

)

Total liabilities and stockholders'

deficit

$

23,062

$

32,712

LEAFLY HOLDINGS, INC

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS - UNAUDITED

(in thousands, except per

share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2022

2023

2022

Revenue

$

10,583

$

11,781

$

32,507

$

35,251

Cost of revenue

1,163

1,515

3,747

4,411

Gross profit

9,420

10,266

28,760

30,840

Operating expenses

Sales and marketing

2,563

6,403

10,326

21,529

Product development

2,533

3,406

8,133

10,927

General and administrative

5,799

6,489

17,475

20,730

Total operating expenses

10,895

16,298

35,934

53,186

Loss from operations

(1,475

)

(6,032

)

(7,174

)

(22,346

)

Interest expense, net

(720

)

(705

)

(2,157

)

(2,119

)

Change in fair value of derivatives

14

22,264

295

36,264

Other income (expense), net

(29

)

(73

)

(7

)

(962

)

Net (loss) income

$

(2,210

)

$

15,454

$

(9,043

)

$

10,837

Net (loss) income per share:

Basic

$

(1.10

)

$

8.69

$

(4.58

)

$

6.15

Diluted

$

(1.10

)

$

5.64

$

(4.58

)

$

5.45

Weighted average shares outstanding:

Basic

2,011

1,779

1,974

1,763

Diluted

2,011

2,149

1,974

1,924

LEAFLY HOLDINGS, INC

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS - UNAUDITED

(in thousands)

Nine Months Ended September

30,

2023

2022

Cash flows from operating

activities

Net (loss) income

$

(9,043

)

$

10,837

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

697

276

Stock-based compensation expense

2,235

3,159

Bad debt expense

2,350

1,023

Loss on disposition of assets

63

—

Noncash amortization of debt discount

409

369

Noncash interest expense associated with

convertible debt

—

243

Noncash change in fair value of

derivatives

(295

)

(36,264

)

Other

(1

)

15

Changes in operating assets and

liabilities:

Accounts receivable

(2,461

)

(675

)

Prepaid expenses and other current

assets

(467

)

(2,222

)

Accounts payable

(16

)

173

Accrued expenses and other current

liabilities

(3,246

)

(2,141

)

Deferred revenue

137

77

Net cash used in operating activities

(9,638

)

(25,130

)

Cash flows from investing activities

Additions of property, equipment, and

software

(1,042

)

(2,194

)

Proceeds from sale of property and

equipment

27

—

Net cash used in investing activities

(1,015

)

(2,194

)

Cash flows from financing activities

Proceeds from exercise of stock

options

—

158

Proceeds from convertible promissory

notes

—

29,374

Proceeds from business combination placed

in escrow and restricted

—

39,032

Trust proceeds received from

recapitalization at closing

—

582

Issuance of common stock under ESPP

168

—

Repurchase of common stock and settlement

of forward purchase agreements

—

(31,303

)

Transaction costs associated with

recapitalization

—

(10,761

)

Advances (repayments) of related party

payables

1

(17

)

Net cash provided by financing

activities

169

27,065

Net decrease in cash, cash equivalents,

and restricted cash

(10,484

)

(259

)

Cash, cash equivalents, and restricted

cash, beginning of period

25,202

28,695

Cash, cash equivalents, and restricted

cash, end of period

$

14,718

$

28,436

LEAFLY HOLDINGS, INC NON-GAAP

FINANCIAL MEASURES - UNAUDITED (in thousands)

Earnings Before Interest, Taxes and

Depreciation and Amortization (EBITDA) and Adjusted EBITDA

To provide investors with additional information regarding our

financial results, we have disclosed EBITDA and Adjusted EBITDA,

both of which are non-GAAP financial measures that we calculate as

net loss before interest, taxes and depreciation and amortization

expense in the case of EBITDA and further adjusted to exclude

non-cash, unusual and/or infrequent costs in the case of Adjusted

EBITDA. Below we have provided a reconciliation of net (loss)

income (the most directly comparable GAAP financial measure) to

EBITDA and from EBITDA to Adjusted EBITDA.

We present EBITDA and Adjusted EBITDA because these metrics are

a key measure used by our management to evaluate our operating

performance, generate future operating plans, and make strategic

decisions regarding the allocation of investment capacity.

Accordingly, we believe that EBITDA and Adjusted EBITDA provide

useful information to investors and others in understanding and

evaluating our operating results in the same manner as our

management.

EBITDA and Adjusted EBITDA have limitations as analytical tools,

and you should not consider either in isolation or as a substitute

for analysis of our results as reported under GAAP. Some of these

limitations are as follows:

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and both EBITDA and Adjusted EBITDA do not reflect

cash capital expenditure requirements for such replacements or for

new capital expenditure requirements;

- EBITDA and Adjusted EBITDA do not reflect changes in, or cash

requirements for, our working capital needs; and

- EBITDA and Adjusted EBITDA do not reflect interest or tax

payments that may represent a reduction in cash available to

us.

Because of these limitations, you should consider EBITDA and

Adjusted EBITDA alongside other financial performance measures,

including net (loss) income and our other GAAP results.

A reconciliation of net (loss) income to non-GAAP EBITDA and

Adjusted EBITDA is as follows:

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2022

2023

2022

Net (loss) income

$

(2,210

)

$

15,454

$

(9,043

)

$

10,837

Interest expense, net

720

705

2,157

2,119

Depreciation and amortization expense

276

127

697

276

EBITDA

(1,214

)

16,286

(6,189

)

13,232

Stock-based compensation

997

771

2,235

3,159

Transaction expenses allocated to

derivatives

55

—

55

874

Severance

—

—

754

—

Change in fair value of derivatives

(14

)

(22,264

)

(295

)

(36,264

)

Adjusted EBITDA

$

(176

)

$

(5,207

)

$

(3,440

)

$

(18,999

)

Source: Leafly Holdings, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231109375813/en/

Media Josh deBerge josh.deberge@leafly.com

206-445-9387

Investors Stacie Clements IR@leafly.com

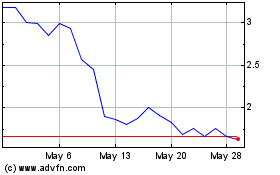

Leafly (NASDAQ:LFLY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Leafly (NASDAQ:LFLY)

Historical Stock Chart

From Dec 2023 to Dec 2024