Collective Audience, Inc. (Nasdaq: CAUD), a leading provider of

digital consumer acquisition solutions, has appointed Elisabeth

DeMarse as independent member of its board of directors. She was

also appointed chair of the compensation committee.

"We welcome Elisabeth’s extensive executive and board experience

at both private and public companies,” stated Suen. “Her more than

a decade of experience as chief marketing officer at Bloomberg as

well as having served as president and CEO of TheStreet makes

Elisabeth a tremendous asset to our management team. She has helped

transform and grow several companies, including AppNexus which was

acquired by AT&T for $1.7 billion. She joins us at an opportune

time as we pursue a number of prospective acquisitions, and we look

forward to her guidance and insights as we take Collective Audience

to the next level.”

DeMarse commented: “The digital advertising industry is primed

for great change, and I see Collective Audience as well-positioned

to disrupt the market with its digital advertising platform that

uniquely eliminates inefficiencies from the digital ad buyer and

seller process. Now as a Nasdaq company, it can leverage this

stronger position to pursue strategic accretive acquisitions that

complement its leading-edge technology and accelerate its

growth.”

Elisabeth DeMarse Bio

For more than 35 years, DeMarse has served on the board and in

executive positions on several digital media and technology

companies. She previously served as president, CEO and chairman of

the board of TheStreet, where she notably diversified the company

from a B2C ad supported, retail stock picking business into a

global B2B M&A, data and news organization. Founded by Martin

Peretz and Jim Cramer in 1996, TheStreet distinguished itself from

other financial media companies with its journalistic excellence,

unbiased approach and interactive multimedia coverage of the

financial markets, economy, industry trends, investment and

financial planning.

Earlier, DeMarse was CEO and president of CreditCards.com, which

she created by consolidating numerous assets around the world, and

eventually selling the company to Bankrate in 2010 for $145

million.

DeMarse also transformed iLife.com into Bankrate, engineering

the turnaround of the company, driving exponential growth, and

creating $450 million in shareholder value.

She spent a decade as chief marketing officer for Bloomberg,

working directly for the founder, Michael Bloomberg, and was

instrumental in the formation of several media properties.

DeMarse serves as a limited partner of Tritium Partners, a

private equity firm focused on buyouts of growth companies in the

lower middle market, with a focus on internet and information

services, asset-light supply chain and logistics, and

differentiated financial and business services.

She is also a limited partner at Kimbark, a family limited

partnership that owns and operates commercial real estate. Earlier,

she served as CEO and on the board of Newser, an American news

aggregation website.

Her previous board directorships include:

-

Kubient (Nasdaq: KBNT), a cloud advertising

platform.

-

AppNexus, a global technology company with a

cloud-based software platform powers and optimizes the programmatic

sale and purchase of programmatic advertising. She also served on

its compensation committee until it was acquired by AT&T for

$1.7 billion.

-

ZipRealty, a Nasdaq-traded company and provider of

solutions that empower real estate experts to thrive. She also

served on the company’s compensation and audit committees until it

was acquired by Realogy.

- All Star

Directories, an independent, employee-owned marketing and

technology company focused on helping individuals advance their

careers and improve their lives through education.

- Internet

Patents Corporation, a former Nasdaq-traded company and an

operator of a patent licensing business focused on its e-commerce

technologies. She also served on the company’s audit and governance

committees.

-

InsWeb (acquired by Bankrate), an online insurance

marketplace designed to allow consumers to compare insurance

products and rate quotes from a variety of providers. She also

served on the company’s audit and governance committees.

-

EDGAR-Online, a division of OTC Markets Group and

a premium supplier of real-time SEC regulatory data and financial

analytics. She also served on the company’s compensation and audit

committees.

-

Heska (acquired by Mars), a former Nasdaq-traded

company and a purpose-driven business, supporting veterinary

professionals globally. She also served on the company’s audit

committee.

DeMarse previously served as Entrepreneur-in-Residence at Austin

Ventures, where she worked together via DeMarseCo. The company’s

thesis is to provide growth equity for buyouts, spinouts, recaps

rollups and acquisitions in the consumer internet sector. Its

acquisitions have included AllStarDirectories, ClickSuccess and

Freedom Marketing.

DeMarse has received numerous awards, including Working Mother

of the Year, Folio’s Top Women in Media, Dealmaker of the Year,

Most Intriguing Person in Media, Girls Scouts Woman of the Year,

NOW Woman of Power and Influence, Fast Company 50, Inc. 500 and ACG

Award for Outstanding Corporate Growth.

DeMarse received her AB in History from Wellesley College and

MBA from Harvard Business School.

About Collective AudienceCollective Audience is

a U.S.-based provider of e-commerce and digital customer

acquisition solutions that simplifies digital advertising. It

provides data-driven, end-to-end marketing through its results

solutions or access to data for activating campaigns across

multiple channels.

The company’s digital marketing business includes a holistic,

self-serve AdTech platform, a proprietary data-driven, AI-powered

system that enables brands and agencies to advertise across

thousands of the world’s leading digital media and connected TV

platforms.

To learn more, visit collectiveaudience.co.

Important Cautions Regarding Forward-Looking

Statements

This press release includes certain statements that are not

historical facts but are forward-looking statements for purposes of

the safe harbor provisions under the United States Private

Securities Litigation Reform Act of 1995. Forward-looking

statements generally are accompanied by words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “should,” “would,” “plan,” “predict,” “potential,”

“seem,” “seek,” “future,” “outlook” and similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. All statements, other than

statements of present or historical fact included in this press

release, regarding the company’s future financial performance, as

well as the company’s strategy, future operations, estimated

financial position, estimated revenues and losses, projected costs,

prospects, plans and objectives of management are forward-looking

statements. These statements are based on various assumptions,

whether or not identified in this press release, and on the current

expectations of the management of Collective Audience and are not

predictions of actual performance. These forward-looking statements

are provided for illustrative purposes only and are not intended to

serve as, and must not be relied on as, a guarantee, an assurance,

a prediction or a definitive statement of fact or probability.

Actual events and circumstances are difficult or impossible to

predict and will differ from assumptions. Many actual events and

circumstances are beyond the control of Collective. Potential risks

and uncertainties that could cause the actual results to differ

materially from those expressed or implied by forward-looking

statements include, but are not limited to, changes in domestic and

foreign business, market, financial, political and legal

conditions; unanticipated conditions that could adversely affect

the company; the overall level of consumer demand for Collective

Audience’s products/services; general economic conditions and other

factors affecting consumer confidence, preferences, and behavior;

disruption and volatility in the global currency, capital, and

credit markets; the financial strength of Collective Audience’s

customers; Collective Audience’s ability to implement its business

strategy; changes in governmental regulation, Collective Audience’s

exposure to litigation claims and other loss contingencies;

disruptions and other impacts to Collective Audience’s business, as

a result of the COVID-19 pandemic and government actions and

restrictive measures implemented in response; stability of

Collective Audience’s suppliers, as well as consumer demand for its

products, in light of disease epidemics and health-related concerns

such as the COVID-19 pandemic; the impact that global climate

change trends may have on Collective Audience and its suppliers and

customers; Collective Audience’s ability to protect patents,

trademarks and other intellectual property rights; any breaches of,

or interruptions in, Collective Audience’s information systems;

fluctuations in the price, availability and quality of electricity

and other raw materials and contracted products as well as foreign

currency fluctuations; changes in tax laws and liabilities,

tariffs, legal, regulatory, political and economic risks. More

information on potential factors that could affect Collective

Audience’s financial results is included from time to time in

Collective Audience’s public reports filed with the SEC. If any of

these risks materialize or Collective Audience’s assumptions prove

incorrect, actual results could differ materially from the results

implied by these forward-looking statements. There may be

additional risks that Collective Audience presently knows, or that

Collective Audience currently believes are immaterial, that could

also cause actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements

reflect Collective Audience’s expectations, plans or forecasts of

future events and views as of the date of this press release.

Nothing in this press release should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved.

Collective Audience anticipates that subsequent events and

developments will cause their assessments to change. However, while

Collective Audience may elect to update these forward-looking

statements at some point in the future, Collective Audience

specifically disclaims any obligation to do so, except as required

by law. These forward-looking statements should not be relied upon

as representing Collective Audience‘s assessments as of any date

subsequent to the date of this press release. Accordingly, undue

reliance should not be placed upon the forward-looking

statements.

Company Contact:

Brent Suen, CEO Collective Audience, Inc.Email contact

Investor Contact:Ron Both CMA Investor

RelationsTel (949) 432-7566Email contact

Media Contact:Tim RandallCMA Media Relations

Tel (949) 432-7572Email contact

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e257140f-12d9-4aab-a5d5-c14fc4766d52

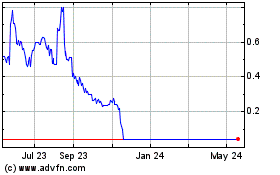

Kubient (NASDAQ:KBNT)

Historical Stock Chart

From Nov 2024 to Dec 2024

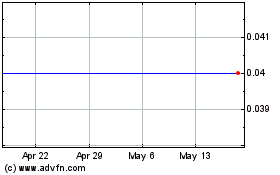

Kubient (NASDAQ:KBNT)

Historical Stock Chart

From Dec 2023 to Dec 2024