Kubient, Inc. (NasdaqCM: KBNT, KBNTW) (“Kubient” or

the “Company”), a cloud-based software platform for

digital advertising, today reported financial results for the third

quarter ended September 30, 2022.

Third Quarter 2022 and Recent Operational

Highlights

- Renewed media buying partnership with one of the Company’s

largest direct advertising clients, due to the strong results

Kubient was able to help provide.

- Launched the KAI Dashboard, a reporting and optimization

platform that helps media publishers and platforms better

understand and manage inventory health.

- Announced that the United States Patent and Trademark Office

(USPTO) issued a Notice of Allowance for the Company’s proprietary

ad fraud identification and prevention technology, Kubient

Artificial Intelligence (KAI).

Management Commentary"The implementation of the

previous quarter's cost cutting measures have helped us conserve

capital and direct our attention towards further unveiling the true

potential of our KAI offering," said Kubient Founder, Chairman,

CEO, CSO, and President, Paul Roberts. "With the launch of the KAI

Dashboard, we're progressively offering new ways for existing and

future customers to utilize the power of our artificial

intelligence tools to not only avoid the pitfalls of ad-fraud, but

to also increase the efficiency of their digital advertising

ecosystem. As a result, the quality and quantity of our

partnerships and customers have grown to more comprehensive

arrangements that better take advantage of our Audience Cloud

platform.

“Along with KAI, another positive growth area has been the

success of our Kubient Managed Services team. There is a massive

opportunity to attract middle market advertisers that cannot get

the attention of the largest AdTech platforms and offer them tools

and team members to ensure campaign success has proven its value.

This strategy combined with our Audience Marketplace has allowed

clients to not only extend budgets, but net new campaign launches

in the process. We will continue our investments into KAI's growing

portfolio of capabilities as we look and field interest for

inorganic growth opportunities. With a robust core technology,

strong balance sheet, and a seasoned executive team, we seek to

provide lasting value to our customers and shareholders alike."

Third Quarter 2022 Financial ResultsNet

revenues for the quarter ended September 30th, 2022 decreased to

approximately $482,000 compared to approximately $677,000 in the

same period last year. The decrease was primarily due to a decrease

of net revenues associated with a major customer as compared to the

2021 period, partially offset by revenues generated in the 2022

period related to customer contracts acquired in connection with

the Company’s acquisition of MediaCrossing in November 2021.

Technology expenses decreased to approximately $525,000 from

approximately $777,000 in the same period last year. The

year-over-year decrease is primarily due to a decrease in headcount

costs, hosting fees, software-technology subscription expense,

amortization and consulting expenses.

General and administrative expenses decreased to approximately

$1.1 million compared to approximately $1.5 million in the same

period last year. The decrease was primarily due to decreases in

non-cash stock-based compensation, professional services and

consulting expense.

GAAP net loss was approximately $1.7 million, or $(0.12) loss

per share, compared to a net loss of approximately $2.3 million, or

$(0.16) loss per share, in the same period last year.

Adjusted EBITDA loss decreased to approximately $1.5 million, or

$(0.11) per basic and diluted share, compared to an adjusted EBITDA

loss of approximately $1.9 million, or $(0.13) per basic and

diluted share, in the same period last year.

As of September 30, 2022, the Company had a cash balance of

approximately $16.9 million.

Conference CallKubient will hold a conference

call today at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to

discuss these results.

Kubient management will host the conference call, followed by a

question and answer period.

Date: Monday, November 14, 2022Time: 4:30 p.m. Eastern time

(1:30 p.m. Pacific time)U.S. dial-in: 1-877-545-0320International

dial-in: 1-973-528-0002Operator Prompted Access Code: 229023

Please call the conference telephone number 10 minutes prior to

the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Investor Relations at

949-574-3860.

The conference call will be broadcast live and available for

replay here and via the Investor Relations section of Kubient’s

website.

A telephonic replay of the conference call will be available

after 7:30 p.m. Eastern time on the same day through November 24,

2022.

Toll-free replay number: 1-877-481-4010International replay

number: 1-919-882-2331Replay ID: 46914

About Kubient Kubient is a technology company

with a mission to transform the digital advertising industry to

audience-based marketing. Kubient’s next generation cloud-based

infrastructure enables efficient marketplace liquidity for buyers

and sellers of digital advertising. The Kubient Audience

Marketplace is a flexible open marketplace for advertisers and

publishers to reach, monetize and connect their audiences. The

Company’s platform provides a transparent programmatic environment

with proprietary artificial intelligence-powered pre-bid ad fraud

prevention, and proprietary real-time bidding (RTB) marketplace

automation for the digital out of home industry. The Audience

Marketplace is the solution for brands and publishers that demand

transparency and the ability to reach audiences across all channels

and ad formats. For additional information, please visit

https://kubient.com.

Forward-Looking StatementsThe information

contained herein includes forward-looking statements. These

statements relate to future events or to our future financial

performance, and involve known and unknown risks, uncertainties and

other factors that may cause our actual results, levels of

activity, performance, or achievements to be materially different

from any future results, levels of activity, performance or

achievements expressed or implied by these forward-looking

statements. You should not place undue reliance on forward-looking

statements since they involve known and unknown risks,

uncertainties and other factors which are, in some cases, beyond

our control and which could, and likely will, materially affect

actual results, levels of activity, performance or achievements.

Any forward-looking statement reflects our current views with

respect to future events and is subject to these and other risks,

uncertainties and assumptions relating to our operations, results

of operations, growth strategy and liquidity. We assume no

obligation to publicly update or revise these forward-looking

statements for any reason, or to update the reasons actual results

could differ materially from those anticipated in these

forward-looking statements, even if new information becomes

available in the future. The safe harbor for forward-looking

statements contained in the Securities Litigation Reform Act of

1995 protects companies from liability for their forward-looking

statements if they comply with the requirements of the Act.

Non-GAAP MeasuresThe Company defines EBITDA as

net income (loss) before interest (including non-cash interest),

taxes and depreciation and amortization. The Company defines

Adjusted EBITDA as EBITDA, further adjusted to eliminate the impact

of certain non-recurring items and other items that we do not

consider in our evaluation of our ongoing operating performance

from period to period. These items will include stock-based

compensation that the Company does not believe reflects the

underlying business performance.

EBITDA and Adjusted EBITDA are financial measures that are not

calculated in accordance with accounting principles generally

accepted in the United States of America (“U.S. GAAP”). Management

believes that because Adjusted EBITDA excludes (a) certain non-cash

expenses (such as depreciation, amortization and stock-based

compensation) and (b) expenses that are not reflective of the

Company’s core operating results over time (such as stock based

compensation expense), this measure provides investors with

additional useful information to measure the Company’s financial

performance, particularly with respect to changes in performance

from period to period. The Company’s management uses EBITDA and

Adjusted EBITDA (a) as a measure of operating performance, (b) for

planning and forecasting in future periods, and (c) in

communications with the Company’s board of directors concerning the

Company’s financial performance. The Company’s presentation of

EBITDA and Adjusted EBITDA are not necessarily comparable to other

similarly titled captions of other companies due to different

methods of calculation and should not be used by investors as a

substitute or alternative to net income or any measure of financial

performance calculated and presented in accordance with U.S. GAAP.

Instead, management believes EBITDA and Adjusted EBITDA should be

used to supplement the Company’s financial measures derived in

accordance with U.S. GAAP to provide a more complete understanding

of the trends affecting the business.

Although Adjusted EBITDA is frequently used by investors and

securities analysts in their evaluations of companies, Adjusted

EBITDA has limitations as an analytical tool, and investors should

not consider it in isolation or as a substitute for, or more

meaningful than, amounts determined in accordance with U.S. GAAP.

Some of the limitations to using non-GAAP measures as an analytical

tool are (a) they do not reflect the Company’s interest income and

expense, or the requirements necessary to service interest or

principal payments on the Company’s debt, (b) they do not reflect

future requirements for capital expenditures or contractual

commitments, and (c) although depreciation and amortization charges

are non-cash charges, the assets being depreciated and amortized

will often have to be replaced in the future, and non-GAAP measures

do not reflect any cash requirements for such replacements.

Kubient Investor RelationsGateway Investor

RelationsMatt Glover and John YiT:

1-949-574-3860Kubient@gatewayir.com

Kubient,

Inc.Consolidated Statements of

Operations(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended |

|

For the Nine

Months Ended |

|

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Net Revenues |

$ |

481,812 |

|

|

$ |

676,986 |

|

|

$ |

2,127,467 |

|

|

$ |

1,882,311 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses: |

|

|

|

|

|

|

|

|

|

| |

Sales and

marketing |

|

735,296 |

|

|

|

715,820 |

|

|

|

3,118,729 |

|

|

|

1,977,150 |

|

|

|

| |

Technology |

|

525,383 |

|

|

|

776,573 |

|

|

|

2,640,239 |

|

|

|

1,916,020 |

|

|

|

| |

General and

administrative |

|

1,132,649 |

|

|

|

1,514,913 |

|

|

|

4,824,406 |

|

|

|

3,878,765 |

|

|

|

| |

Impairment

loss on intangible assets |

|

- |

|

|

|

- |

|

|

|

2,626,974 |

|

|

|

- |

|

|

|

| |

Impairment

loss on property and equipment |

|

- |

|

|

|

- |

|

|

|

49,948 |

|

|

|

- |

|

|

|

| |

Impairment

loss on goodwill |

|

- |

|

|

|

- |

|

|

|

463,000 |

|

|

|

- |

|

|

|

| |

Loss accrual

on customer contract |

|

(232,964 |

) |

|

|

- |

|

|

|

142,723 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Costs and Expenses |

|

2,160,364 |

|

|

|

3,007,306 |

|

|

|

13,866,019 |

|

|

|

7,771,935 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loss From Operations |

|

(1,678,552 |

) |

|

|

(2,330,320 |

) |

|

|

(11,738,552 |

) |

|

|

(5,889,624 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (Expense) Income: |

|

|

|

|

|

|

|

|

|

| |

Interest

expense |

|

(2,508 |

) |

|

|

(2,098 |

) |

|

|

(8,916 |

) |

|

|

(5,308 |

) |

|

|

| |

Interest

income |

|

6,896 |

|

|

|

21,805 |

|

|

|

11,921 |

|

|

|

84,469 |

|

|

|

| |

Change in

fair value of contingent consideration |

|

- |

|

|

|

- |

|

|

|

613,000 |

|

|

|

- |

|

|

|

| |

Other

income |

|

- |

|

|

|

- |

|

|

|

11,000 |

|

|

|

233 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Other Income |

|

4,388 |

|

|

|

19,707 |

|

|

|

627,005 |

|

|

|

79,394 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Loss |

$ |

(1,674,164 |

) |

|

$ |

(2,310,613 |

) |

|

$ |

(11,111,547 |

) |

|

$ |

(5,810,230 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Net Loss Per Share - Basic and Diluted |

$ |

(0.12 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.78 |

) |

|

$ |

(0.43 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted Average Common Shares Outstanding - |

|

|

|

|

|

|

|

|

|

| |

Basic and Diluted |

|

14,337,412 |

|

|

|

14,252,886 |

|

|

|

14,300,022 |

|

|

|

13,627,435 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Kubient, Inc.

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

September

30, |

|

December

31, |

|

|

| |

|

2022 |

|

|

|

2021 |

|

|

|

| |

(unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Current

Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

16,897,563 |

|

|

$ |

24,907,963 |

|

|

|

|

Accounts receivable, net |

|

448,815 |

|

|

|

2,291,533 |

|

|

|

|

Other receivables |

|

- |

|

|

|

526,070 |

|

|

|

|

Prepaid expenses and other current assets |

|

502,912 |

|

|

|

495,178 |

|

|

|

|

|

|

|

|

|

|

|

Total Current Assets |

|

17,849,290 |

|

|

|

28,220,744 |

|

|

|

| Intangible

assets, net |

|

- |

|

|

|

2,946,610 |

|

|

|

|

Goodwill |

|

- |

|

|

|

463,000 |

|

|

|

| Property and

equipment, net |

|

- |

|

|

|

44,756 |

|

|

|

| Deferred

offering costs |

|

10,000 |

|

|

|

10,000 |

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

$ |

17,859,290 |

|

|

$ |

31,685,110 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

|

Accounts payable - suppliers |

$ |

727,432 |

|

|

$ |

1,844,544 |

|

|

|

|

Accounts payable - trade |

|

369,040 |

|

|

|

659,362 |

|

|

|

|

Accrued expenses and other current liabilities |

|

716,484 |

|

|

|

2,493,287 |

|

|

|

|

Deferred revenue |

|

767,833 |

|

|

|

395,914 |

|

|

|

|

Notes payable |

|

1,539 |

|

|

|

151,336 |

|

|

|

|

|

|

|

|

|

|

|

Total Current Liabilities |

|

2,582,328 |

|

|

|

5,544,443 |

|

|

|

| Contingent

consideration |

|

- |

|

|

|

613,000 |

|

|

|

| Notes

payable, non-current portion |

|

77,361 |

|

|

|

77,407 |

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

2,659,689 |

|

|

|

6,234,850 |

|

|

|

|

|

|

|

|

|

|

| Commitments

and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity: |

|

|

|

|

|

|

Preferred stock, $0.00001 par value; 5,000,000 shares

authorized; |

|

|

|

|

|

|

No shares issued and outstanding |

|

|

|

|

|

|

as of September 30, 2022 and December 31, 2021 |

|

- |

|

|

|

- |

|

|

|

|

Common stock, $0.00001 par value; 95,000,000 shares

authorized; |

|

|

|

|

|

|

14,402,500 and 14,253,948 shares issued and outstanding |

|

|

|

|

|

|

as of September 30, 2022 and December 31, 2021, respectively |

|

144 |

|

|

|

143 |

|

|

|

|

Additional paid-in capital |

|

52,891,794 |

|

|

|

52,030,907 |

|

|

|

|

Accumulated deficit |

|

(37,692,337 |

) |

|

|

(26,580,790 |

) |

|

|

|

|

|

|

|

|

|

|

Total Stockholders' Equity |

|

15,199,601 |

|

|

|

25,450,260 |

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity |

$ |

17,859,290 |

|

|

$ |

31,685,110 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Kubient, Inc.

Consolidated Statements of Cash

Flows(Unaudited)

|

|

|

|

|

|

|

|

For the Nine

Months Ended |

|

|

|

September 30, |

|

| |

|

2022 |

|

|

|

2021 |

|

|

| |

|

|

|

|

| Cash

Flows From Operating Activities: |

|

|

|

|

|

Net loss |

$ |

(11,111,547 |

) |

|

$ |

(5,810,230 |

) |

|

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

Bad debt expense |

|

7,000 |

|

|

|

- |

|

|

|

Impairment loss on intangible assets |

|

2,626,974 |

|

|

|

- |

|

|

|

Impairment loss on property and equipment |

|

49,948 |

|

|

|

- |

|

|

|

Impairment loss on goodwill |

|

463,000 |

|

|

|

- |

|

|

|

Depreciation and amortization |

|

330,993 |

|

|

|

304,068 |

|

|

|

Change in fair value of contingent consideration |

|

(613,000 |

) |

|

|

- |

|

|

|

Stock-based compensation: |

|

|

|

|

|

Common stock |

|

872,123 |

|

|

|

516,381 |

|

|

|

Options |

|

6,598 |

|

|

|

7,618 |

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Accounts receivable |

|

1,835,718 |

|

|

|

1,000,783 |

|

|

|

Other receivable |

|

507,387 |

|

|

|

- |

|

|

|

Prepaid expenses and other current assets |

|

350,132 |

|

|

|

(155,367 |

) |

|

|

Accounts payable - suppliers |

|

(1,117,112 |

) |

|

|

115,681 |

|

|

|

Accounts payable - trade |

|

(290,321 |

) |

|

|

(289,215 |

) |

|

|

Accrued expenses and other current liabilities |

|

(1,817,278 |

) |

|

|

(274,667 |

) |

|

|

Accrued interest |

|

- |

|

|

|

7,025 |

|

|

|

Deferred revenue |

|

371,919 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

Net Cash Used In Operating Activities |

|

(7,527,466 |

) |

|

|

(4,577,923 |

) |

|

|

|

|

|

|

|

| Cash

Flows From Investing Activities: |

|

|

|

|

|

Purchase of intangible assets |

|

- |

|

|

|

(1,133,072 |

) |

|

|

Purchase of property and equipment |

|

(16,549 |

) |

|

|

(24,331 |

) |

|

|

|

|

|

|

|

|

Net Cash Used In Investing Activities |

|

(16,549 |

) |

|

|

(1,157,403 |

) |

|

|

|

|

|

|

|

| Cash

Flows From Financing Activities: |

|

|

|

|

|

Proceeds from exercise of warrants [1] |

|

- |

|

|

|

9,787,149 |

|

|

|

Proceeds from exercise of options |

|

- |

|

|

|

8,361 |

|

|

|

Repayment of PPP loan |

|

(149,843 |

) |

|

|

(68,346 |

) |

|

|

Repayment of financed director and officer insurance premiums |

|

(316,542 |

) |

|

|

- |

|

|

|

Payment of deferred offering costs |

|

- |

|

|

|

(27,510 |

) |

|

|

|

|

|

|

|

|

Net Cash (Used In) Provided By Financing

Activities |

|

(466,385 |

) |

|

|

9,699,654 |

|

|

|

|

|

|

|

|

|

Net (Decrease) Increase In Cash and Cash

Equivalents |

|

(8,010,400 |

) |

|

|

3,964,328 |

|

|

|

|

|

|

|

|

| Cash

and Cash Equivalents - Beginning of the Period |

|

24,907,963 |

|

|

|

24,782,128 |

|

|

|

|

|

|

|

|

| Cash

and Cash Equivalents - End of the Period |

$ |

16,897,563 |

|

|

$ |

28,746,456 |

|

|

| |

|

|

|

|

[1] Includes gross proceeds of $10,169,027, less

issuance costs of $381,878.

Kubient, Inc.

Reconciliation of GAAP EBITDA to Non- GAAP Adjusted

EBITDA(Unaudited)

| |

For the

Three Months Ended |

|

For the Nine

Months Ended |

|

|

|

| |

September 30, |

|

September 30, |

|

|

|

| |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

| Net

Loss |

$ |

(1,674,164 |

) |

|

$ |

(2,310,613 |

) |

|

$ |

(11,111,547 |

) |

|

$ |

(5,810,230 |

) |

|

|

|

|

Interest expense |

|

2,508 |

|

|

|

2,098 |

|

|

|

8,916 |

|

|

|

5,308 |

|

|

|

|

|

Interest income |

|

(6,896 |

) |

|

|

(21,805 |

) |

|

|

(11,921 |

) |

|

|

(84,469 |

) |

|

|

|

|

Depreciation and amortization |

|

- |

|

|

|

144,775 |

|

|

|

330,993 |

|

|

|

304,068 |

|

|

|

|

|

EBITDA |

|

(1,678,552 |

) |

|

|

(2,185,545 |

) |

|

|

(10,783,559 |

) |

|

|

(5,585,323 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

$ |

157,094 |

|

|

$ |

263,247 |

|

|

|

878,721 |

|

|

|

523,999 |

|

|

|

|

|

Impairment loss on intangible assets |

|

- |

|

|

|

- |

|

|

|

2,626,974 |

|

|

|

- |

|

|

|

|

|

Impairment loss on property and equipment |

|

- |

|

|

|

- |

|

|

|

49,948 |

|

|

|

- |

|

|

|

|

|

Impairment loss on goodwill |

|

- |

|

|

|

- |

|

|

|

463,000 |

|

|

|

- |

|

|

|

|

|

Change in fair value of contingent consideration |

|

- |

|

|

|

- |

|

|

|

(613,000 |

) |

|

|

- |

|

|

|

|

|

Adjusted EBITDA |

$ |

(1,521,458 |

) |

|

$ |

(1,922,298 |

) |

|

$ |

(7,377,916 |

) |

|

$ |

(5,061,324 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Adjusted Loss Per Share |

$ |

(0.11 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.37 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding - |

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

14,337,412 |

|

|

|

14,252,886 |

|

|

|

14,300,022 |

|

|

|

13,627,435 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

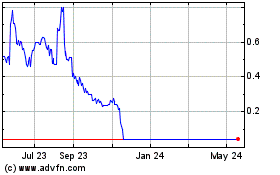

Kubient (NASDAQ:KBNT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kubient (NASDAQ:KBNT)

Historical Stock Chart

From Dec 2023 to Dec 2024