UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

Kiromic BioPharma, Inc.

(Name of Issuer)

Common stock, par value $0.001 per share

(Title of Class of Securities)

497634204

(CUSIP Number)

Brian Hungerford

c/o Kiromic BioPharma Inc.

7707 Fannin, Suite 200

Houston, Texas 77054

(832) 968-4888

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

With a copy to:

Jeffrey Fessler

Sheppard Mullin Richter & Hampton

LLP

30 Rockefeller Plaza

New York, NY 10112

(212) 653-8700

May 14, 2024

(Date of Event Which Requires Filing of This

Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for

other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act (however, see the Notes).

| CUSIP NO. 497634204 |

SCHEDULE 13D |

| 1 |

NAMES OF REPORTING PERSONS

Shannon Ralston |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

SEC

USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

2,783,140 shares of Common Stock issuable upon conversion

of Series C Convertible Voting Preferred Stock (See Item 5)*

3,438,904 shares of Common Stock issuable upon conversion

of Series D Convertible Voting Preferred Stock (See Item 5)*

5,021,616 shares of Common Stock issuable upon conversion

of Senior Secured Convertible Notes (See Item 5)*

|

| 8 |

SHARED VOTING POWER

|

| 9 |

SOLE DISPOSITIVE POWER

2,783,140 shares of Common Stock issuable upon conversion

of Series C Convertible Voting Preferred Stock (See Item 5)*

3,438,904 shares of Common Stock issuable upon conversion

of Series D Convertible Voting Preferred Stock (See Item 5)*

5,021,616 shares of Common Stock issuable upon conversion

of Senior Secured Convertible Notes (See Item 5)*

|

| 10 |

SHARED DISPOSITIVE POWER

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

2,783,140 shares of Common Stock issuable upon conversion

of Series C Convertible Voting Preferred Stock (See Item 5)*

3,438,904 shares of Common Stock issuable upon conversion

of Series D Convertible Voting Preferred Stock (See Item 5)*

5,021,616 shares of Common Stock issuable upon conversion

of Senior Secured Convertible Notes (See Item 5)*

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.99% (See Item 5)* |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

*As

more fully described in Item 5, the Series C Convertible Voting Preferred Stock, the Series D Convertible Voting Preferred Stock

and the Senior Secured Convertible Notes are subject to a 19.99% blocker, and the percentage set forth in row (13) gives effect to such

blocker. However, as more fully described in Item 5, the securities reported in rows (7), (9) and (11) show the number of shares

of Common Stock that would be issuable upon full exercise of such reported securities and do not give effect to such blocker. Therefore,

the actual number of shares of Common Stock beneficially owned by such Reporting Person, after giving effect to such blocker, is less

than the number of securities reported in rows (7), (9) and (11).

| CUSIP NO. 497634204 |

SCHEDULE 13D |

| 1 |

NAMES OF REPORTING PERSONS

S.hield Cap1tal Funding LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

SEC

USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

2,783,140 shares of Common Stock issuable upon conversion

of Series C Convertible Voting Preferred Stock (See Item 5)*

3,438,904 shares of Common Stock issuable upon conversion

of Series D Convertible Voting Preferred Stock (See Item 5)*

5,021,616 shares of Common Stock issuable upon conversion

of Senior Secured Convertible Notes (See Item 5)*

|

| 8 |

SHARED VOTING POWER

|

| 9 |

SOLE DISPOSITIVE POWER

2,783,140 shares of Common Stock issuable upon conversion

of Series C Convertible Voting Preferred Stock (See Item 5)*

3,438,904 shares of Common Stock issuable upon conversion

of Series D Convertible Voting Preferred Stock (See Item 5)*

5,021,616 shares of Common Stock issuable upon conversion

of Senior Secured Convertible Notes (See Item 5)*

|

| 10 |

SHARED DISPOSITIVE POWER

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

2,783,140 shares of Common Stock issuable upon conversion

of Series C Convertible Voting Preferred Stock (See Item 5)*

3,438,904 shares of Common Stock issuable upon conversion

of Series D Convertible Voting Preferred Stock (See Item 5)*

5,021,616 shares of Common Stock issuable upon conversion

of Senior Secured Convertible Notes (See Item 5)*

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.99% (See Item 5)* |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

*As

more fully described in Item 5, the Series C Convertible Voting Preferred Stock, the Series D Convertible Voting Preferred Stock

and the Senior Secured Convertible Notes are subject to a 19.99% blocker, and the percentage set forth in row (13) gives effect to such

blocker. However, as more fully described in Item 5, the securities reported in rows (7), (9) and (11) show the number of shares

of Common Stock that would be issuable upon full exercise of such reported securities and do not give effect to such blocker. Therefore,

the actual number of shares of Common Stock beneficially owned by such Reporting Person, after giving effect to such blocker, is less

than the number of securities reported in rows (7), (9) and (11).

| Item 1. |

Security and Issuer. |

This Schedule 13D (this “Statement”)

relates to the common stock, par value $0.001 per share, of the Issuer. The principal executive office of the Issuer is located at 7707

Fannin, Suite 200, Houston, Texas 77054.

| Item 2. |

Identity and Background. |

(a) This Statement is

being filed jointly on behalf of Shannon Ralston and S.hield Cap1tal Funding LLC (collectively, the “Reporting Persons”).

The Reporting Persons have entered into a joint filing agreement, dated as of May 20, 2024, a copy of which is attached hereto as

Exhibit 1.

Each of the Reporting Persons

disclaims beneficial ownership of all securities reported in this Statement except to the extent of such Reporting Person’s pecuniary

interest therein, other than those securities reported herein as being held directly by such Reporting Person.

(b) The business address

of the Reporting Persons is c/o Kiromic BioPharma, Inc., 7707 Fannin, Suite 200, Houston, Texas 77054.

(c) Shannon Ralston

is the sole member of S.hield Cap1tal Funding LLC.

(d)–(e) During

the last five years, none of the Reporting Persons has been (i) convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and

as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or

mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) Shannon Ralston

is a citizen of the United States of America and S.hield Cap1tal Funding LLC is incorporated in Texas.

| Item 3. |

Source and Amount of Funds or Other Consideration. |

The Reporting Persons beneficially own an aggregate

of 11,243,660 shares of common stock (the “Subject Shares”) without taking into account the Blocker (as defined herein).

The Subject Shares are issuable upon conversion

of Series C Convertible Voting Preferred Stock, Series D Convertible Voting Preferred Stock (collectively, the “Preferred

Stock”) and 25% Senior Secured Convertible Promissory Notes (collectively, the “Notes” and together with the Preferred

Stock, the “Securities”). The Securities were acquired by or on behalf of the Reporting Persons by S.hield Cap1tal Funding

LLC.

| Item 4. |

Purpose of Transaction. |

The Reporting

Persons do not have any present plans or proposals of the types set forth in paragraphs (a) through (j) of Item 4 of Schedule

13D. The Reporting Persons may, from time to time, acquire additional securities or dispose of all or a portion of the common stock that

she or it beneficially owns, either in the open market or in privately negotiated transactions.

| Item 5. |

Interest in Securities of the Issuer. |

(a) The percentage set forth in Row

13 of the cover page for each Reporting Person is based on 1,542,420 shares of Common Stock issued

and outstanding as of May 15, 2024, as represented in the Issuer’s Definitive Proxy Statement filed with the Securities and

Exchange Commission on May 17, 2024 and assumes the conversion of the Company’s Securities (as defined below) subject to the

Blocker (as defined below).

Pursuant to the terms of the Securities, the Reporting

Persons cannot convert the Securities to the extent the Reporting Persons would beneficially own, after

any such conversion, more than 19.99% of the outstanding shares of common stock (the "Blocker"),

and the percentage set forth in Row 13 of the cover page for each Reporting Person gives effect

to the Blocker. Consequently, as of the date of the event which requires the filing of this statement,

the Reporting Persons were not able to convert all of the Securities due to the Blocker.

| (b) |

No other person is known to the Reporting

Persons to have the right to receive or the power to direct the receipt of dividends from, or

the proceeds from the sale of, the Subject Shares, except that the Reporting Persons have the right to receive dividends from, and

proceeds from the sale of, the shares of common stock held of record. |

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

None.

SIGNATURE

After reasonable inquiry

and to the best of the undersigned’s knowledge and belief, the undersigned hereby certifies that the information set forth in this

statement is true, complete and correct.

| Dated: May 20, 2024 |

/s/ Shannon Ralston |

| |

Shannon Ralston |

| |

|

| |

|

| |

S.hield Cap1tal Funding LLC |

| |

|

| |

By: |

/s/ Shannon Ralston |

| |

|

Name: Shannon Ralston |

| |

|

Title: |

EXHIBIT 1

The undersigned acknowledge and agree that the

foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent amendments to such statement

on Schedule 13D shall be filed on behalf of each of the undersigned without the necessity of filing additional joint filing statements.

The undersigned acknowledge that each shall be responsible for the timely filing of such amendments and for the completeness and accuracy

of the information concerning him or it contained therein, but shall not be responsible for the completeness and accuracy of the information

concerning the other entity or person, except to the extent that he or it knows or has reason to believe that such information is inaccurate.

Dated: May 20, 2024

| |

Shannon Ralston |

| |

|

| |

/s/

Shannon Ralston |

| |

|

| |

|

| |

S.hield Cap1tal Funding LLC |

| |

|

| |

By: |

/s/

Shannon Ralston |

| |

|

Name: Shannon Ralston |

| |

|

Title: |

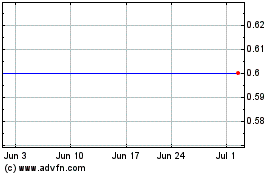

Kiromic BioPharma (NASDAQ:KRBP)

Historical Stock Chart

From May 2024 to Jun 2024

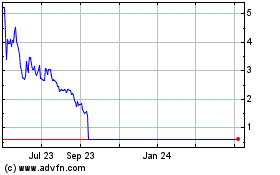

Kiromic BioPharma (NASDAQ:KRBP)

Historical Stock Chart

From Jun 2023 to Jun 2024