Kidpik Corp. (NASDAQ: PIK) (“Kidpik”), a kids’ online clothing

subscription-based e-commerce company, and Nina Footwear Corp., a

private company operating a brand specializing in women’s and kids’

dress shoes and accessories for special occasions (“Nina Footwear”), today announced that they have

entered into a definitive merger agreement.

The Board of Directors of both companies have approved the

all-stock transaction. The combined company will operate as Nina

Holdings Corp. In connection with the merger, Nina Footwear

stockholders will be issued shares of common stock of Kidpik such

that upon closing thereof, Nina Footwear’s stockholders will own

80% of Kidpik’s outstanding common stock.

Kidpik is controlled by Mr. Ezra Dabah, the Chief Executive

Officer, Chairman, and majority stockholder (67% beneficial owner)

of Kidpik, who is also the Chief Executive Officer of Nina

Footwear. Mr. Dabah and his children own approximately 79.3% of

Nina Footwear, and Mr. Dabah and his extended family own 100% of

Nina Footwear. Mr. Dabah, his children and wife are expected to

continue to control approximately 76.8% of the combined company’s

voting shares following the closing of the merger.

Kidpik’s entry into the merger agreement was approved by the

Kidpik Board of Directors (with Mr. Dabah abstaining from the

vote), acting on the unanimous recommendation of a special

committee consisting of independent and disinterested directors of

Kidpik that was formed to negotiate and evaluate a potential

strategic transaction involving Kidpik.

“Our transaction is expected to increase Kidpik’s revenue,

cashflow and prospects, while also strengthening Kidpik’s balance

sheet and significantly increasing stockholder value. I am

extremely happy to fulfill the wish of my late father in-law, Mr.

Stanley Silverstein, to make Nina a public company on the heels of

the 70th anniversary of our family business,” said Mr. Dabah. He

continued, “As a team we will refocus our attention on growing Nina

through brand and category extensions, international expansion, the

resurrection of the Delman shoe brand, and mining our extensive

Nina Footwear archive for additional growth, which we believe

presents great value. I believe the retention of the net operating

loss carryforwards is of tremendous value to our shareholders in

entering into the merger,” concluded Mr. Dabah.

An important factor in the special committee of the Board of

Directors recommending the approval of the merger was that due to

Mr. Dabah’s control of both companies, it is expected that Kidpik

will retain its ability to use its significant net operating loss

(NOL) carryforwards following the merger (currently estimated at

approximately $38 million), and that the transaction is not

anticipated to be deemed a change of control under Nasdaq

rules.

About the Proposed Transaction

According to the terms of the merger agreement, Kidpik will

acquire Nina Footwear through a reverse subsidiary merger that is

intended to be a tax-free reorganization. Upon closing of the

merger, the combined company will be renamed “Nina Holding Corp.”

and its symbol will change to “NINA”. There is not expected to be

any change in Kidpik’s officers or directors as a result of the

transaction.

There are also a number of related party transactions between

Nina Footwear and Kidpik as disclosed in Kidpik’s filings with the

Securities and Exchange Commission (SEC), which are expected to be

extinguished as a result of the merger.

The closing of the transaction is subject to customary closing

conditions, including the preparation and mailing of a proxy

statement by Kidpik, and the receipt of required stockholder

approvals from Kidpik and Nina Footwear stockholders, and is

expected to close in the third quarter of 2024.

Additional information regarding the proposed merger and the

merger agreement can be found in the Current Report on Form 8-K

filed with the SEC today by Kidpik.

About Kidpik

Founded in 2016, KIDPIK (NASDAQ:PIK) is an online clothing

subscription box for kids, offering mix & match, expertly

styled outfits that are curated based on each member’s style

preferences. Kidpik delivers a surprise box monthly or seasonally,

providing an effortless shopping experience for parents and a fun

discovery for kids. Each seasonal collection is designed in-house

by a team with decades of experience designing childrenswear.

Kidpik combines the expertise of fashion stylists with proprietary

data and technology to translate kids’ unique style preferences

into surprise boxes of curated outfits. We also sell our branded

clothing and footwear through our e-commerce website,

shop.kidpik.com. For more information, visit www.kidpik.com.

About Nina Footwear

Nina Footwear has been a leader in the women’s fashion footwear

industry for over 70 years. The company was founded by Stanley and

Mike Silverstein in a factory on Prince Street in SoHo, making

women’s premium clogs. Stanley named the brand after his daughter,

Nina Miner, who is now Nina’s Chief Creative Officer. Under the

leadership of CEO Ezra Dabah, the Nina brand includes women’s and

children’s premium footwear and accessories. The Nina collection is

designed for the modern woman who enjoys glamorous footwear,

fashionable design and exceptional quality at an accessible price.

The highly sought-after brand has been worn by many style icons and

celebrities. To discover the collection visit

www.ninashoes.com.

About Ezra Dabah

Ezra Dabah has served as the Chief Executive Officer and

director of the Company since April 2015 and as Chairman since

October 2021. Mr. Dabah has also served since 2012 as the Chief

Executive Officer and member of the Board of Directors of, and is

the majority owner of, Nina Footwear Corp., a wholesaler of women’s

and kids’ shoes and accessories. From 2013 to June 2015, Mr. Dabah

served as the Chief Executive Officer of Ezrani 2 Corp. d/b/a RUUM

American Kid’s Wear (“RUUM”), a

company which owned and operated childrenswear specialty retail

stores. Mr. Dabah purchased this business from American Eagle

Outfitters Inc (NYSE: AEO) and rebranded the stores and business

from 77 kids by American Eagle to RUUM American kids wear. Ezrani 2

Corp., voluntarily filed for Chapter 7 bankruptcy on June 18, 2015,

while Mr. Dabah was its Chief Executive Officer, which bankruptcy

was closed in August 2018. Mr. Dabah has over 45 years of

experience in apparel wholesale and retail operations. From 1972 to

1993, he was a director and an executive officer of The Gitano

Group, Inc. (NYSE:GIT)(“Gitano”),

where he managed product design, merchandising, and procurement. In

1984, he founded and became president of E.J. Gitano, a children’s

apparel division of Gitano. In 1991, Mr. Dabah joined The

Children’s Place Retail Stores, Inc. (NASDAQ:PLCE) as its Chairman

and CEO, leading the company’s turnaround and repositioning it from

a store that sold discounted brands to a single vertically

integrated brand that has stores, taking it public in 1997. In

November 2004, The Children’s Place purchased The Disney Stores

(300+ stores) from the Walt Disney Co (NYSE: DIS). Under Mr.

Dabah’s leadership the store count grew from approximately 150 in

1990 to almost 1,200 and sales reached $2 billion by the end of

2006. Mr. Dabah resigned from The Children’s Place as its Chief

Executive in September 2007. Between 2007 and 2012, Mr. Dabah

developed Ahhmigo, a natural and organic energy drink with patented

ingredients dispensing cap technology.

Changes and Additional Information About the Proposed Merger

and Where to Find It

This communication is not intended to be, and is not, a

substitute for the proxy statement or any other document that

Kidpik has filed or may file with the Securities and Exchange

Commission (“SEC”) in connection with

the proposed merger.

In connection with the proposed merger, Kidpik intends to file a

proxy statement with the SEC (the “Proxy

Statement”), that will be distributed to holders of Kidpik’s

common stock in connection with its solicitation of proxies for the

vote by Kidpik’s stockholders with respect to the proposed merger

and other matters as may be described in the Proxy Statement. The

Proxy Statement, when it is filed and mailed to stockholders, will

contain important information about the proposed merger and the

other matters to be voted upon at a meeting of Kidpik’s

stockholders to be held to approve the proposed merger and other

matters (the “Meeting”). Kidpik may

also file other documents with the SEC regarding the proposed

merger. Kidpik stockholders and other interested persons are

advised to read, when available, the Proxy Statement, as well as

any amendments or supplements thereto, because they will contain

important information about the proposed merger. When available,

the definitive Proxy Statement will be mailed to Kidpik

stockholders as of a record date to be established for voting on

the proposed merger and the other matters to be voted upon at the

Meeting.

Kidpik’s stockholders may obtain copies of the aforementioned

documents and other documents filed by Kidpik with the SEC, without

charge, once available, at the SEC’s web site at www.sec.gov, on

Kidpik’s website at https://investor.kidpik.com/sec-filings or,

alternatively, by directing a request by mail, email or telephone

to Kidpik at 200 Park Avenue South, 3rd Floor, New York, New York

10003; ir@kidpik.com; or (212) 399-2323, respectively.

Cautionary Statement Regarding Forward-Looking

Statements

Certain statements contained in this press release regarding

matters that are not historical facts, are forward-looking

statements within the meaning of Section 21E of the Securities and

Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995 (the “PSLRA”). These include, but are not limited to,

statements regarding the anticipated completion and effects of the

proposed merger, projections and estimates of Kidpik’s corporate

strategies, future operations and plans, including the costs

thereof; and other statements regarding management’s intentions,

plans, beliefs, expectations or forecasts for the future. No

forward-looking statement can be guaranteed, and actual results may

differ materially from those projected. Kidpik and Nina Footwear

undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future events or

otherwise, except to the extent required by law. We use words such

as “anticipates,” “believes,” “plans,”

“expects,” “projects,” “future,”

“intends,” “may,” “will,”

“should,” “could,” “estimates,”

“predicts,” “potential,” “continue,” “guidance,” and similar expressions to identify

these forward-looking statements that are intended to be covered by

the safe-harbor provisions of the PSLRA. Such forward-looking

statements are based on our expectations and involve risks and

uncertainties; consequently, actual results may differ materially

from those expressed or implied in the statements due to a number

of factors, including, but not limited to, the outcome of any legal

proceedings that may be instituted against Nina Footwear or Kidpik

following the announcement of the merger; the inability to complete

the merger, including due to the failure to obtain approval of the

stockholders of Kidpik or Nina Footwear; delays in obtaining,

adverse conditions contained in, or the inability to obtain

necessary regulatory approvals or complete regular reviews required

to complete the merger, if any; the inability to recognize the

anticipated benefits of the merger, which may be affected by, among

other things, competition, the ability of the combined company to

grow and successfully execute on its business plan; costs related

to the merger; changes in the applicable laws or regulations; the

possibility that the combined company may be adversely affected by

other economic, business, and/or competitive factors; the combined

company’s ability to manage future growth; the combined company’s

ability to raise funding; the complexity of numerous regulatory and

legal requirements that the combined company needs to comply with

to operate its business; the reliance on the combined company’s

management; the prior experience and successes of the combined

company’s management team are not indicative of any future success;

Kidpik’s and the combined company’s ability to meet Nasdaq’s

continued listing requirements; Kidpik and the combined company’s

ability to maintain the listing of their common stock on Nasdaq;

the ability to obtain additional funding, the terms of such funding

and potential dilution caused thereby; the continuing effect of

rising interest rates and inflation on Kidpik’s and the combined

company’s operations, sales, and market for their products;

deterioration of the global economic environment; rising interest

rates and inflation and Kidpik’s and the combined company’s ability

to control costs, including employee wages and benefits and other

operating expenses; Kidpik’s decision to cease manufacturing new

products; Kidpik’s history of losses; Kidpik’s and the combined

company’s ability to maintain current members and customers and

grow members and customers; risks associated with the effect of

global pandemics, and governmental responses thereto on Kidpik’s

and the combined company’s operations, those of Kidpik’s and the

combined company’s vendors, Kidpik’s and the combined company’s

customers and members and the economy in general; risks associated

with Kidpik’s and the combined company’s supply chain and

third-party service providers, interruptions in the supply of raw

materials and merchandise; increased costs of raw materials,

products and shipping costs due to inflation; disruptions at

Kidpik’s and the combined company’s warehouse facility and/or of

their data or information services, Kidpik’s and the combined

company’s ability to locate warehouse and distribution facilities

and the lease terms of any such facilities; issues affecting our

shipping providers; disruptions to the internet; risks that effect

our ability to successfully market Kidpik’s and the combined

company’s products to key demographics; the effect of data security

breaches, malicious code and/or hackers; increased competition and

our ability to maintain and strengthen Kidpik’s and the combined

company’s brand name; changes in consumer tastes and preferences

and changing fashion trends; material changes and/or terminations

of Kidpik’s and the combined company’s relationships with key

vendors; significant product returns from customers, excess

inventory and Kidpik’s and the combined company’s ability to manage

our inventory; the effect of trade restrictions and tariffs,

increased costs associated therewith and/or decreased availability

of products; Kidpik’s and the combined company’s ability to

innovate, expand their offerings and compete against competitors

which may have greater resources; the fact that Kidpik’s Chief

Executive Officer has majority voting control over Kidpik and will

have majority control over the combined company; if the use of

“cookie” tracking technologies is further restricted, regulated, or

blocked, or if changes in technology cause cookies to become less

reliable or acceptable as a means of tracking consumer behavior;

Kidpik’s and the combined company’s ability to comply with the

covenants of future loan and lending agreements and covenants;

Kidpik’s and the combined company’s ability to prevent credit card

and payment fraud; the risk of unauthorized access to confidential

information; Kidpik’s and the combined company’s ability to protect

intellectual property and trade secrets, claims from third-parties

that Kidpik and/or the combined company have violated their

intellectual property or trade secrets and potential lawsuits in

connection therewith; Kidpik’s and the combined company’s ability

to comply with changing regulations and laws, penalties associated

with any non-compliance (inadvertent or otherwise), the effect of

new laws or regulations, and Kidpik’s and the combined company’s

ability to comply with such new laws or regulations; changes in tax

rates; Kidpik’s and the combined company’s reliance and retention

of management; the outcome of future lawsuits, litigation,

regulatory matters or claims; the fact that Kidpik and the combined

company have a limited operating history; the effect of future

acquisitions on Kidpik’s and the combined company’s operations and

expenses; and others that are included from time to time in filings

made by Kidpik with the Securities and Exchange Commission, many of

which are beyond the control of Kidpik and the combined company,

including, but not limited to, in the “Cautionary Note Regarding

Forward-Looking Statements” and “Risk Factors” sections in Kidpik’s

Form 10-Ks and Form 10-Qs and in its Form 8-Ks, which it has filed,

and files from time to time, with the Securities and Exchange

Commission, including, but not limited to its Annual Report on Form

10-K for the year ended December 31, 2022 and its Quarterly Report

on Form 10-Q for the quarter ended September 30, 2023, and its

Annual Report on Form 10-K for the year ended December 30, 2023,

when filed. These reports are available at www.sec.gov and on

Kidpik’s website at https://investor.kidpik.com/sec-filings. Kidpik

cautions that the foregoing list of important factors is not

complete. All subsequent written and oral forward-looking

statements attributable to Kidpik or any person acting on behalf of

Kidpik are expressly qualified in their entirety by the cautionary

statements referenced above. Other unknown or unpredictable factors

also could have material adverse effects on Kidpik’s and the

combined company’s future results and/or could cause their actual

results and financial condition to differ materially from those

indicated in the forward-looking statements. The forward-looking

statements included in this press release are made only as of the

date hereof. Kidpik cannot guarantee future results, levels of

activity, performance or achievements. Accordingly, you should not

place undue reliance on these forward-looking statements. Except as

required by law, neither Nina Footwear nor Kidpik undertakes any

obligation to update publicly any forward-looking statements for

any reason after the date of this press release to conform these

statements to actual results or to changes in their expectations.

If they update one or more forward-looking statements, no inference

should be drawn that they will make additional updates with respect

to those or other forward-looking statements.

No Offer or Solicitation

This communication is for informational purposes only and is not

intended to and shall not constitute a proxy statement or the

solicitation of a proxy, consent or authorization with respect to

any securities or in respect of the merger agreement and is not

intended to and shall not constitute an offer to sell or the

solicitation of an offer to sell or the solicitation of an offer to

buy or subscribe for any securities or a solicitation of any vote

of approval, nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction.

Participants in the Solicitation

Kidpik, Nina Footwear, and their respective directors, executive

officers and other members of management and employees may be

deemed to be participants in the solicitation of proxies from

Kidpik’s stockholders with respect to the proposed merger.

Information regarding the persons who may be deemed participants in

the solicitation of proxies from Kidpik’s stockholders in

connection with the proposed merger will be contained in the Proxy

Statement relating to the proposed merger, when available, which

will be filed with the SEC. Additionally, information about

Kidpik’s directors and executive officers and their ownership of

Kidpik is available in Kidpik’s Definitive Information Statement on

Schedule 14A, as filed with the Securities and Exchange Commission

on May 1, 2023 (the “Annual Meeting Proxy Statement”) and the

Current Report on Form 8-K filed with the SEC on December 8, 2023.

To the extent holdings of securities by potential participants (or

the identity of such participants) have changed since the

information printed in the Annual Meeting Proxy Statement, such

information has been or will be reflected on Kidpik’s Statements of

Change in Ownership on Forms 3 and 4 filed with the SEC. You may

obtain free copies of these documents using the sources indicated

above.

Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in

the Proxy Statement and other relevant materials to be filed with

the SEC regarding the merger agreement when they become available.

Investors should read the Proxy Statement carefully when it becomes

available before making any voting or investment decisions. You may

obtain free copies of these documents from Kidpik using the sources

indicated above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240401494590/en/

Investor Relations: ir@kidpik.com

Media: press@kidpik.com

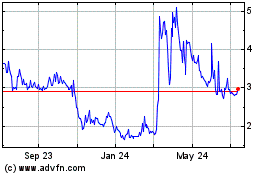

Kidpik (NASDAQ:PIK)

Historical Stock Chart

From Dec 2024 to Jan 2025

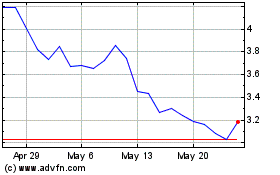

Kidpik (NASDAQ:PIK)

Historical Stock Chart

From Jan 2024 to Jan 2025