0001297341

false

0001297341

2023-09-06

2023-09-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 6, 2023

KENTUCKY

FIRST FEDERAL BANCORP

(Exact

Name of Registrant as Specified in Its Charter)

| United

States |

|

0-51176 |

|

61-1484858 |

| (State or other jurisdiction

of |

|

(Commission File Number) |

|

(IRS Employer |

| incorporation or organization) |

|

|

|

Identification No.) |

| 655

Main Street, Hazard, Kentucky |

|

41702 |

| (Address of principal executive

offices) |

|

(Zip Code) |

(502)

223-1638

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.01 par value per share |

|

KFFB |

|

The

NASDAQ Stock Market LLC |

Item

2.02 Results of Operations and Financial Condition

On

September 6, 2023, Kentucky First Federal Bancorp (the “Company”) announced its unaudited financial results for the twelve

and three months ended June 30, 2023. For more information, see the Company’s press release dated September 6, 2023, which is filed

as Exhibit 99.1 hereto and is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits

The

following exhibit is filed herewith:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

KENTUCKY FIRST FEDERAL BANCORP |

| |

|

|

| Date: September 7, 2023 |

By: |

/s/

R. Clay Hulette |

| |

|

R. Clay Hulette |

| |

|

Vice President and Chief

Finance Officer |

2

Exhibit 99.1

Kentucky First Federal Bancorp

Hazard, Kentucky, Frankfort, Kentucky, Danville, Kentucky and Lancaster,

Kentucky

For Immediate Release September 6, 2023

Contact: Don Jennings, President, or Clay Hulette, Vice President

(502) 223-1638

216 West Main Street

P.O. Box 535

Frankfort, KY 40602

Kentucky First Federal Bancorp Releases Earnings

Kentucky First Federal Bancorp (Nasdaq: KFFB),

(the “Company”) the holding company for First Federal Savings and Loan Association of Hazard and First Federal Savings Bank

of Kentucky (the two banks being collectively referred to as the “Banks”), announced net income of $933,000 or $0.11 basic

and diluted earnings per share for the year ended June 30, 2023, compared to net income of $1.6 million or $0.19 per common share for

the twelve months ended June 30, 2022. Net earnings for the quarter ended June 30, 2023 totaled $42,000 or $0.00 basic and diluted earnings

per share compared to net earnings of $206,000 or $0.02 per common share for the quarter ended June 30, 2022.

Net income decreased $657,000 or 41.3% compared

to the fiscal year ended June 30, 2022 primarily due to decreased net interest income, decreased non-interest income, increased provision

for loan losses, and increased non-interest expenses, which were somewhat offset by decreased income taxes. Net interest income decreased

$304,000 or 3.3% and totaled $8.9 million for the year just ended, as interest income increased $1.8 million or 16.9% to $12.8 million

and interest expense increased $2.1 million or 122.5% to $3.9 million. In the general economy the fiscal year was marked by historical

interest rate increases as the Federal Open Market Committee continued its fight against inflation. As with most financial institutions,

our funding sources repriced more quickly during the unprecedented interest rate increases than our assets. Consequently, the increase

in our interest expense was attributed primarily to higher average rates paid on both deposits and FHLB advances, while the increase in

our interest income was a combination of both higher average balances and higher rates earned on those assets. Non-interest income decreased

$213,000 or 41.4% and totaled $302,000, primarily due to decreased gains on loan sales. The Company sells its long-term fixed rate loans

to the Federal Home Loan Bank of Cincinnati as part of its asset/liability management strategy and the sale of such loans decreased along

with the rise in general interest rates during the fiscal year. The Company recorded a provision for loan loss of $113,000 for the year

just ended compared to a credit of $60,000 for the prior fiscal year. For the year ended June 30, 2023, non-interest expense increased

$150,000 or 2.0% and totaled $7.8 million. Income tax expense decreased $183,000 or 38.4% year over year due to lower income before taxes.

For the three months ended June 30, 2023, net income

decreased $164,000 or 79.6%, primarily as net interest income decreased $253,000 or 11.6% and totaled $1.9 million for the quarterly period

compared to $2.2 million for the prior year quarter. Interest income increased $934,000 or 36.0% to $3.5 million, while interest expense

increased $1.2 million or 286.7% and totaled $1.6 million. Non-interest income decreased $27,000 or 29.0% to $66,000 for the quarter just

ended compared to the same quarter in 2022. There was no provision for loan losses on loans during the recently-ended quarter compared

to a $46,000 provision for loan losses on loans in the prior year period.

At June 30, 2023, assets totaled $349.0 million,

an increase of $20.9 million or 6.4% compared to June 30, 2022. This increase was attributed primarily to an increase of $39.2 million

or 14.3% in loans, net, which totaled $313.8 million at June 30, 2023. Somewhat offsetting the increase in loans was a decrease of $17.7

million or 68.4% in cash and cash equivalents. Total liabilities increased $22.3 million or 8.1% to $298.3 million at June 30, 2023, primarily

as a result of increased FHLB advances, which increased $36.0 million or 105.7% and totaled $70.1 million at June 30, 2023, and were somewhat

offset by decreased deposits, which decreased $13.5 million or 5.6% and totaled $226.3 million at year end.

At June 30, 2023, the Community Bank Leverage Ratio

(“CBLR”) of the Company was 15.0%, while the ratio for First Federal Savings and Loan Association of Hazard and First Federal

Savings Bank of Kentucky were 20.4% and 11.7%, respectively. With respect to the Banks, an interim final rule under the Coronavirus Aid,

Relief, and Economic Security (“CARES”) Act established the current minimum ratio of 9%.

At June 30, 2023, the Company reported its book

value per share as $6.27. The change in shareholders’ equity was primarily associated with net income for the period, less dividends

paid on common stock and cost of shares repurchased for treasury purposes.

This press release may contain statements that

are forward-looking, as that term is defined by the Private Securities Litigation Act of 1995 or the Securities and Exchange Commission

in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe harbors created

thereby. All forward-looking statements are based on current expectations regarding important risk factors including, but not limited

to, real estate values, the impact of interest rates on financing, changes in general economic conditions, legislative and regulatory

changes that adversely affect the business of the Company, changes in the securities markets and the Risk Factors described in Item 1A

of the Company’s Annual Report on Form 10-K for the year ended June 30, 2022. Accordingly, actual results may differ from those

expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by the Company

or any other person that results expressed therein will be achieved.

Kentucky First Federal Bancorp is the parent company

of First Federal Savings and Loan Association of Hazard, which operates one banking office in Hazard, Kentucky and First Federal Savings

Bank of Kentucky, which operates three banking offices in Frankfort, Kentucky, two banking offices in Danville, Kentucky and one banking

office in Lancaster, Kentucky. Kentucky First Federal Bancorp shares are traded on the Nasdaq National Market under the symbol KFFB. At

June 30, 2023, the Company had approximately 8,086,715 shares outstanding of which approximately 58.5% was held by First Federal MHC.

SUMMARY OF FINANCIAL HIGHLIGHTS

Condensed Consolidated Balance Sheets

(In thousands,

except share data)

| | |

June 30,

2023 | | |

June 30,

2022 | |

| ASSETS | |

| |

| Cash and cash equivalents | |

$ | 8,167 | | |

$ | 25,823 | |

| Investment Securities | |

| 12,354 | | |

| 10,816 | |

| Loans available-for sale | |

| - | | |

| 152 | |

| Loans, net | |

| 313,807 | | |

| 274,583 | |

| Real estate acquired through foreclosure | |

| 70 | | |

| 10 | |

| Goodwill | |

| 947 | | |

| 947 | |

| Other Assets | |

| 13,677 | | |

| 15,749 | |

| Total Assets | |

$ | 349,022 | | |

$ | 328,080 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Deposits | |

$ | 226,309 | | |

$ | 239,857 | |

| FHLB Advances | |

| 70,087 | | |

| 34,066 | |

| Other Liabilities | |

| 1,915 | | |

| 2,132 | |

| Total liabilities | |

| 298,311 | | |

| 276,027 | |

| Shareholders’ Equity | |

| 50,711 | | |

| 52,025 | |

| Total liabilities and shareholders’ equity | |

$ | 349,022 | | |

$ | 328,080 | |

| Book value per share | |

$ | 6.27 | | |

$ | 6.38 | |

| Tangible book value per share | |

$ | 6.15 | | |

$ | 6.26 | |

| Outstanding shares | |

| 8,086,715 | | |

| 8,154,695 | |

Condensed Consolidated Statements of Income

(In thousands, except share data)

| | |

Twelve months ended

June 30, | | |

Three months ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Interest Income | |

$ | 12,758 | | |

$ | 10,914 | | |

$ | 3,532 | | |

$ | 2,598 | |

| Interest Expense | |

| 3,902 | | |

| 1,754 | | |

| 1,601 | | |

| 414 | |

| Net Interest Income | |

| 8,856 | | |

| 9,160 | | |

| 1,931 | | |

| 2,184 | |

| Provision (credit) for Losses on Loans | |

| 113 | | |

| (60 | ) | |

| - | | |

| 46 | |

| Non-interest Income | |

| 302 | | |

| 515 | | |

| 66 | | |

| 93 | |

| Other Non-interest Expense | |

| 7,818 | | |

| 7,668 | | |

| 1,944 | | |

| 1,922 | |

| Income Before Income Taxes | |

| 1,227 | | |

| 2,067 | | |

| 53 | | |

| 309 | |

| Income Taxes | |

| 294 | | |

| 477 | | |

| 11 | | |

| 103 | |

| Net Income | |

$ | 933 | | |

$ | 1,590 | | |

$ | 42 | | |

$ | 206 | |

| Earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

$ | 0.11 | | |

$ | 0.19 | | |

$ | 0.00 | | |

$ | 0.02 | |

| Weighted average outstanding shares: | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

| 8,133,927 | | |

| 8,213,407 | | |

| 8,101,287 | | |

| 8,202,780 | |

3

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

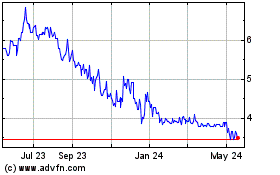

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Dec 2024 to Jan 2025

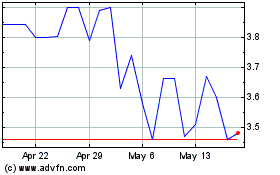

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Jan 2024 to Jan 2025