Current Report Filing (8-k)

May 22 2023 - 4:10PM

Edgar (US Regulatory)

0001867066

false

0001867066

2023-05-16

2023-05-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

c

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

May 16, 2023

Journey Medical Corporation

(Exact Name of Registrant as Specified in Charter)

| Delaware | |

001-41063 | |

47-1879539 |

(State or Other Jurisdiction

of Incorporation) | |

(Commission File Number) | |

(IRS

Employer Identification No.) |

9237 E Via de Ventura Blvd., Suite 105

Scottsdale, AZ 85258

(Address of Principal Executive Offices)

(480) 434-6670

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act.

¨ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act.

¨ Pre-commencement communications

pursuant to Rule 14d-2b under the Exchange Act.

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act.

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

DERM |

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter). x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01. | Entry into a Material Definitive Agreement. |

Journey Medical Corporation (the “Company”)

and its subsidiary, JG Pharma, Inc. (“JGP”), are party to that certain Loan and Security Agreement, dated March 31, 2021 (as

amended, the “EWB Facility”), with East West Bank (“EWB”) under which EWB originally made a $7.5 million line

of credit available to the Company. On January 12, 2022, the EWB Facility was amended to increase the borrowing capacity of the revolving

line of credit to $10.0 million and add a term loan not to exceed $20.0 million. The Company subsequently borrowed the full $20 million

under the term loan. On May 16, 2023, the Company entered into the Fifth Amendment to Loan and Security Agreement with EWB and JGP (the

“2023 Amendment”). Under the 2023 Amendment, the Company agreed to pay off $10 million of the term loan upon the closing of

the 2023 Amendment. The term loan previously had an interest-only payment period through January 12, 2024, after which the outstanding

balance of the term loan was to have been payable in equal monthly installments of principal, plus all accrued interest, through the term

loan maturity date. The 2023 Amendment revises the maturity date of the term loan from January 12, 2026 to July 1, 2024 and provides that

the Company is no longer required to make monthly installments of principal of the term loan, and instead, is required to make interest-only

payments until the maturity date, at which time all principal and all accrued but unpaid interest will be due. The Company may elect to

prepay all or any part of the term loan without penalty or premium, but the Company may not re-borrow any amount, once repaid. The 2023

Amendment removed the revolving line of credit as of the effective date of the 2023 Amendment. There were no amounts outstanding under

the revolving line of credit as of such date. The EWB Facility included customary financial covenants such as collateral ratios and minimum

liquidity provisions. Upon the effectiveness of the 2023 Amendment, all of these financial covenants were removed, except for the minimum

liquidity ratio, and certain other nonfinancial covenants were added. To ensure compliance with the minimum liquidity ratio, the Company

is now required to maintain $8.75 million in deposit accounts at EWB that are subject to assignment to EWB until August 31 2023, when this amount increases to $10 million.

| Item 2.02. | Results of Operations and Financial Condition. |

On May 22, 2023, the

Company issued a press release to provide a corporate update and to announce its financial results for the three months ended March 31,

2023. A copy of such press release is being furnished as Exhibit 99.1 to this report.

The information in this

Item 2.02 and Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Item

2.02 and Exhibit 99.1 attached hereto shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended,

except as shall otherwise be expressly set forth by specific reference in such filing.

| Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The disclosures set forth in Item 1.01 of this Current Report on Form

8-K are incorporated by reference herein.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibits are furnished herewith:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| Journey Medical Corporation |

| | |

| | (Registrant) |

| | | |

| | | |

Date: May 22, 2023 | By: | /s/ Claude Maraoui |

| | | Claude Maraoui |

| | | Chief Executive Officer, President and Director |

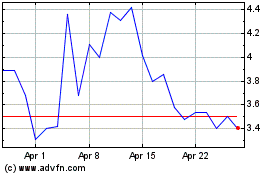

Journey Medical (NASDAQ:DERM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Journey Medical (NASDAQ:DERM)

Historical Stock Chart

From Nov 2023 to Nov 2024