Jamf (NASDAQ: JAMF), the standard in Apple Enterprise Management,

today announced financial results for its fourth quarter and fiscal

year ended December 31, 2021.

Fourth Quarter 2021 Financial Highlights

-

ARR: ARR increase of 45% year-over-year to

$412.5 million as of December 31, 2021.

- Revenue: Total

revenue of $103.8 million, an increase of 36% year-over-year.

- Gross Profit: GAAP

gross profit of $76.5 million, or 74% of total revenue, compared to

$59.1 million in the fourth quarter of 2020. Non-GAAP Gross Profit

of $83.4 million, or 80% of total revenue, compared to $62.2

million in the fourth quarter of 2020.

- Operating

Loss/Income: GAAP operating loss of $26.1 million,

compared to GAAP operating loss of $13.1 million in the fourth

quarter of 2020. Non-GAAP Operating Income of $2.9 million, or 3%

of total revenue, compared to $1.8 million in the fourth quarter of

2020.

Fiscal Year 2021 Financial

Highlights

- Revenue: Total

revenue of $366.4 million, an increase of 36% year-over-year.

- Gross Profit: GAAP

gross profit of $276.0 million, or 75% of total revenue, compared

to $208.1 million in fiscal year 2020. Non-GAAP Gross Profit of

$296.6 million, or 81% of total revenue, compared to $219.7 million

in fiscal year 2020.

- Operating

Loss/Income: GAAP operating loss of $76.2 million,

compared to GAAP operating loss of $17.5 million in fiscal year

2020. Non-GAAP Operating Income of $20.5 million, or 6% of total

revenue, compared to $27.5 million for fiscal year 2020.

- Cash Flow: Cash

flow provided by operations of $65.2 million for the fiscal year

ended December 31, 2021, compared to $52.8 million for the

fiscal year ended December 31, 2020. Unlevered free cash flow

of $66.4 million for the fiscal year ended December 31, 2021,

or 18% of total revenue, compared to $66.3 million for the fiscal

year ended December 31, 2020.

A reconciliation between historical GAAP and

non-GAAP information is contained in the tables below and the

section titled “Non-GAAP Financial Measures” below contains

descriptions of these reconciliations.

“2021 represented a pivotal year for Jamf as we

expanded and strengthened our platform, completed our largest

acquisition to date, closed the three largest customer contracts in

our history, and added a record number of devices to our platform,

all while completing our first full fiscal year as a public company

and consistently delivering strong financial results,” said Dean

Hager, CEO of Jamf. “As we enter 2022, we’re well-positioned to

continue delivering for our customers, employees and investors as

we help drive expansion of Apple in the enterprise.”

Recent Business Highlights

- Added a record number of devices in

fiscal year 2021, over six million, to end the fiscal year with

more than 26.6 million devices on our platform.

- Ended fiscal year 2021 serving more

than 60,000 customers, representing an increase of over 13,000

customers for the fiscal year.

- Announced success with our new line

of security-focused products for commercial organizations, with

approximately 8,000 commercial customers running Jamf Connect, Jamf

Private Access, Jamf Protect, Jamf Threat Defense, or Jamf Data

Policy on millions of devices.

- Helped customers deploy

approximately one million Macs powered by the M1 family of chips in

the first year of availability.

- Announced we now empower more than

36 million students via one-to-one and shared Apple devices across

more than 32,000 schools around the globe with key functionality to

facilitate technology-enabled active learning.

- Appointed John Strosahl to

president and chief operating officer and Beth Tschida to chief

technology officer, as Jamf continues to build a world-class team

to further its mission of helping organizations succeed with

Apple.

- Ranked #75 in the 2021 Best

Workplaces for Parents™ by Great Place to Work®.

Financial Outlook

For the first quarter of 2022, Jamf currently

expects:

- Total revenue of $104.5 to $106.5

million

- Non-GAAP Operating Income of $1.0 to $2.0 million

For the full year 2022, Jamf currently

expects:

- Total revenue of $466.0 to $472.0

million

- Non-GAAP Operating Income of $18.0 to $22.0 million

To assist with modeling, for the first quarter

of 2022 and full year 2022, amortization is expected to be

approximately $12.2 million and $47.6 million, respectively. In

addition, for the first quarter of 2022 and full year 2022,

stock-based compensation and related payroll taxes is expected to

be approximately $16.9 million and $114.2 million,

respectively.

Jamf is unable to provide a quantitative

reconciliation of forward-looking guidance of Non-GAAP Operating

Income to GAAP operating income (loss) because certain items are

out of Jamf’s control or cannot be reasonably predicted.

Historically, these items have included, but are not limited to,

acquisition-related expenses and acquisition-related earn-out,

offering costs, amortization and stock-based compensation and

related payroll taxes. Accordingly, a reconciliation for

forward-looking Non-GAAP Operating Income is not available without

unreasonable effort. These items are uncertain, depend on various

factors, and could result in projected GAAP operating income (loss)

being materially less than is indicated by currently estimated

Non-GAAP Operating Income.

These statements are forward-looking and actual

results may differ materially. Refer to the Forward-Looking

Statements safe harbor below for information on the factors that

could cause our actual results to differ materially from these

forward-looking statements.

Webcast and Conference Call

Information

Jamf will host a conference call and live

webcast for analysts and investors at 3:30 p.m. Central Time (4:30

p.m. Eastern Time) on March 1, 2022. Parties in the United

States and Canada can access the call by dialing +1

(833) 519-1319, and international parties can access the call by

dialing +1 (914) 800-3885.

The live webcast of Jamf’s earnings conference call can be

accessed at ir.jamf.com, along with the earnings press release,

financial tables, earnings presentation and investor presentation.

A telephonic replay of the conference call will be available

through March 8, 2022. To access the replay, parties should dial

(855) 859-2056, or (404) 537-3406 and enter the passcode

8134528#.

Please note that Jamf uses its

https://ir.jamf.com website as a means of disclosing material

non-public information, announcing upcoming investor conferences

and for complying with its disclosure obligations under Regulation

FD. Accordingly, you should monitor our investor relations website

in addition to following our press releases, SEC filings and public

conference calls and webcasts.

Non-GAAP Financial Measures

In addition to our results determined in

accordance with generally accepted accounting principles in the

United States (“GAAP”), we believe the non-GAAP measures of

Non-GAAP Operating Expenses, Non-GAAP Gross Profit, Non-GAAP Gross

Profit Margin, Non-GAAP Operating Income (Loss), Non-GAAP Operating

Income (Loss) Margin, Non-GAAP Net Income (Loss), Unlevered Free

Cash Flow and Unlevered Free Cash Flow Margin are useful in

evaluating our operating performance. Certain of these non-GAAP

measures exclude stock-based compensation, amortization expense,

acquisition-related expenses, acquisition-related earnout, offering

costs, foreign currency transaction loss, payroll taxes related to

stock-based compensation, legal settlement, loss on extinguishment

of debt, amortization of debt issuance costs and discrete tax

items. We believe that non-GAAP financial information, when

taken collectively, may be helpful to investors because it provides

consistency and comparability with past financial performance and

assists in comparisons with other companies, some of which use

similar non-GAAP information to supplement their GAAP results. The

non-GAAP financial information is presented for supplemental

informational purposes only, and should not be considered a

substitute for financial information presented in accordance with

GAAP, and may be different from similarly-titled non-GAAP measures

used by other companies. The principal limitation of these non-GAAP

financial measures is that they exclude significant expenses that

are required by GAAP to be recorded in our financial statements. In

addition, they are subject to inherent limitations as they reflect

the exercise of judgment by our management about which expenses are

excluded or included in determining these non-GAAP financial

measures. Reconciliation tables of the most comparable GAAP

financial measures to the non-GAAP financial measures used in this

press release are included with the financial tables at the end of

this release. Jamf strongly encourages investors to review our

consolidated financial statements included in publicly filed

reports in their entirety and not rely solely on any single

financial measurement or communication.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995, including but

not limited to, statements regarding our financial outlook and

market positioning. Forward-looking statements give our current

expectations and projections relating to our financial condition,

results of operations, plans, objectives, future performance and

business. You can identify forward-looking statements by the fact

that they do not relate strictly to historical or current facts.

These statements may include words such as “anticipate,”

“estimate,” “expect,” “project,” “plan,” “intend,” “believe,”

“may,” “will,” “should,” “can have,” “likely” and other words and

terms of similar meaning in connection with any discussion of the

timing or nature of future operating or financial performance or

other events. All forward-looking statements are subject to risks

and uncertainties that may cause actual results to differ

materially from those that we expected, including, among others:

statements regarding our future financial and operating performance

(including our financial outlook for future reporting periods); the

impact on our operations and financial condition from the effects

of the current COVID-19 pandemic; the potential impact of customer

dissatisfaction with Apple or other negative events affecting Apple

services and devices, and failure of enterprises to adopt Apple

products; the potentially adverse impact of changes in features and

functionality by Apple on our engineering focus or product

development efforts; changes in our continued relationship with

Apple; the fact that we are not party to any exclusive agreements

or arrangements with Apple; our reliance, in part, on channel

partners for the sale and distribution of our products; our ability

to successfully develop new products or materially enhance current

products through our research and development efforts; our ability

to continue to attract new customers; our ability to retain our

current customers; our ability to sell additional functionality to

our current customers; our ability to correctly estimate market

opportunity and forecast market growth; risks associated with

failing to continue our recent growth rates; our dependence on one

of our products for a substantial portion of our revenue; our

ability to scale our business and manage our expenses; our ability

to change our pricing models, if necessary to compete successfully;

the impact of delays or outages of our cloud services from any

disruptions, capacity limitations or interferences of third-party

data centers that host our cloud services, including Amazon Web

Services; our ability to meet service-level commitments under our

subscription agreements; our ability to maintain, enhance and

protect our brand; our ability to maintain our corporate culture;

the ability of Jamf Nation to thrive and grow as we expand our

business; the potential impact of inaccurate, incomplete or

misleading content that is posted on Jamf Nation; our ability to

offer high-quality support; risks and uncertainties associated with

acquisitions and divestitures (such as our recent acquisition of

Wandera); our ability to predict and respond to rapidly evolving

technological trends and our customers' changing needs; our ability

to compete with existing and new companies; the impact of adverse

general and industry-specific economic and market conditions; the

impact of reductions in IT spending; our ability to attract and

retain highly qualified personnel; risks associated with

competitive challenges faced by our customers; the impact of our

often long and unpredictable sales cycle; the risks associated with

sales to new and existing enterprise customers; our ability to

develop and expand our marketing and sales capabilities; the risks

associated with free trials and other inbound, lead-generation

sales strategies; the risks associated with indemnity provisions in

our contracts; our management team’s limited experience managing a

public company; risks associated with cyber-security events; the

impact of real or perceived errors, failures or bugs in our

products; the impact of general disruptions to data transmission;

risks associated with stringent and changing privacy laws,

regulations and standards, and information security policies and

contractual obligations related to data privacy and security; the

risks associated with intellectual property infringement claims;

our reliance on third-party software and intellectual property

licenses; our ability to protect our intellectual property and

proprietary rights; the risks associated with our use of open

source software in our products; and risks associated with our

indebtedness.

Additional information concerning these and

other factors can be found in our filings with the Securities and

Exchange Commission. Given these factors, as well as other

variables that may affect our operating results, you should not

rely on forward-looking statements, assume that past financial

performance will be a reliable indicator of future performance, or

use historical trends to anticipate results or trends in future

periods. The forward-looking statements included in this press

release relate only to events as of the date hereof. We undertake

no obligation to update or revise any forward-looking statement as

a result of new information, future events or otherwise, except as

otherwise required by law.

About Jamf

Jamf, the standard in Apple Enterprise

Management, extends the legendary Apple experience people love to

businesses, schools and government organizations through its

software and the world’s largest online community of IT admins

focused exclusively on Apple, Jamf Nation. To learn more, visit:

www.jamf.com.

Investor ContactJennifer

Gaumondir@jamf.com

Media ContactRachel

Nauenmedia@jamf.com

Jamf Holding

Corp.Consolidated Balance Sheets(in

thousands)(unaudited)

| |

December 31,2021 |

|

December 31,2020 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

177,150 |

|

|

$ |

194,868 |

|

|

Trade accounts receivable, net of allowances of $391 and $530 |

|

79,143 |

|

|

|

69,056 |

|

|

Income taxes receivable |

|

608 |

|

|

|

632 |

|

|

Deferred contract costs |

|

12,904 |

|

|

|

8,284 |

|

|

Prepaid expenses |

|

17,581 |

|

|

|

13,283 |

|

|

Other current assets |

|

4,212 |

|

|

|

1,113 |

|

|

Total current assets |

|

291,598 |

|

|

|

287,236 |

|

| Equipment and leasehold

improvements, net |

|

18,045 |

|

|

|

15,130 |

|

| Goodwill |

|

845,734 |

|

|

|

541,480 |

|

| Other intangible assets,

net |

|

264,593 |

|

|

|

202,878 |

|

| Deferred contract costs,

non-current |

|

29,842 |

|

|

|

22,202 |

|

| Other assets |

|

30,608 |

|

|

|

5,359 |

|

|

Total assets |

$ |

1,480,420 |

|

|

$ |

1,074,285 |

|

| |

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

9,306 |

|

|

$ |

6,967 |

|

|

Accrued liabilities |

|

54,022 |

|

|

|

31,916 |

|

|

Income taxes payable |

|

167 |

|

|

|

713 |

|

|

Deferred revenues |

|

223,031 |

|

|

|

160,002 |

|

|

Total current liabilities |

|

286,526 |

|

|

|

199,598 |

|

| Deferred revenues,

non-current |

|

59,097 |

|

|

|

45,507 |

|

| Deferred tax liability,

net |

|

8,700 |

|

|

|

5,087 |

|

| Convertible senior notes,

net |

|

362,031 |

|

|

|

— |

|

| Other liabilities |

|

25,640 |

|

|

|

13,079 |

|

|

Total liabilities |

|

741,994 |

|

|

|

263,271 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Preferred stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

119 |

|

|

|

117 |

|

|

Additional paid-in capital |

|

913,581 |

|

|

|

903,116 |

|

|

Accumulated other comprehensive loss |

|

(7,866 |

) |

|

|

— |

|

|

Accumulated deficit |

|

(167,408 |

) |

|

|

(92,219 |

) |

|

Total stockholders’ equity |

|

738,426 |

|

|

|

811,014 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,480,420 |

|

|

$ |

1,074,285 |

|

|

|

|

|

|

|

|

|

|

Jamf Holding

Corp.Consolidated Statements of

Operations(in thousands, except share and per share

amounts)(unaudited)

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Revenue: |

|

|

|

|

|

|

|

|

Subscription |

$ |

98,343 |

|

|

$ |

70,441 |

|

|

$ |

344,243 |

|

|

$ |

248,879 |

|

|

Services |

|

4,107 |

|

|

|

3,903 |

|

|

|

16,122 |

|

|

|

14,519 |

|

|

License |

|

1,352 |

|

|

|

1,923 |

|

|

|

6,023 |

|

|

|

5,734 |

|

|

Total revenue |

|

103,802 |

|

|

|

76,267 |

|

|

|

366,388 |

|

|

|

269,132 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

Cost of subscription(1)(2)(3)(4) (exclusive of amortization expense

shown below) |

|

19,235 |

|

|

|

11,509 |

|

|

|

63,441 |

|

|

|

39,529 |

|

|

Cost of services(1)(2)(3) (exclusive of amortization expense shown

below) |

|

2,871 |

|

|

|

2,979 |

|

|

|

10,898 |

|

|

|

10,726 |

|

|

Amortization expense |

|

5,183 |

|

|

|

2,719 |

|

|

|

16,018 |

|

|

|

10,753 |

|

|

Total cost of revenue |

|

27,289 |

|

|

|

17,207 |

|

|

|

90,357 |

|

|

|

61,008 |

|

|

Gross profit |

|

76,513 |

|

|

|

59,060 |

|

|

|

276,031 |

|

|

|

208,124 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing(1)(2)(3)(4) |

|

44,552 |

|

|

|

31,327 |

|

|

|

148,192 |

|

|

|

98,885 |

|

|

Research and development(1)(2)(3)(4) |

|

24,104 |

|

|

|

15,169 |

|

|

|

82,541 |

|

|

|

52,513 |

|

|

General and administrative(1)(2)(3)(4) |

|

26,918 |

|

|

|

20,015 |

|

|

|

96,206 |

|

|

|

51,603 |

|

|

Amortization expense |

|

7,019 |

|

|

|

5,634 |

|

|

|

25,294 |

|

|

|

22,575 |

|

|

Total operating expenses |

|

102,593 |

|

|

|

72,145 |

|

|

|

352,233 |

|

|

|

225,576 |

|

|

Loss from operations |

|

(26,080 |

) |

|

|

(13,085 |

) |

|

|

(76,202 |

) |

|

|

(17,452 |

) |

| Interest expense, net |

|

(870 |

) |

|

|

(66 |

) |

|

|

(2,478 |

) |

|

|

(10,741 |

) |

| Loss on extinguishment of

debt |

|

— |

|

|

|

— |

|

|

|

(449 |

) |

|

|

(5,213 |

) |

| Foreign currency transaction

loss |

|

(54 |

) |

|

|

(251 |

) |

|

|

(849 |

) |

|

|

(722 |

) |

| Other income, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

91 |

|

|

Loss before income tax benefit |

|

(27,004 |

) |

|

|

(13,402 |

) |

|

|

(79,978 |

) |

|

|

(34,037 |

) |

| Income tax benefit |

|

3,254 |

|

|

|

5,038 |

|

|

|

4,789 |

|

|

|

9,955 |

|

|

Net loss |

$ |

(23,750 |

) |

|

$ |

(8,364 |

) |

|

$ |

(75,189 |

) |

|

$ |

(24,082 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.20 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.64 |

) |

|

$ |

(0.22 |

) |

| Weighted‑average shares used

to compute net loss per share, basic and diluted |

|

119,145,856 |

|

|

|

116,647,340 |

|

|

|

118,276,462 |

|

|

|

108,908,597 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes stock-based compensation as follows:

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

|

|

|

|

Subscription |

$ |

1,371 |

|

|

$ |

342 |

|

|

$ |

3,755 |

|

|

$ |

732 |

|

|

Services |

|

213 |

|

|

|

77 |

|

|

|

594 |

|

|

|

139 |

|

| Sales and marketing |

|

4,175 |

|

|

|

851 |

|

|

|

10,938 |

|

|

|

1,748 |

|

| Research and development |

|

3,436 |

|

|

|

712 |

|

|

|

10,512 |

|

|

|

1,533 |

|

| General and

administrative |

|

3,836 |

|

|

|

858 |

|

|

|

10,006 |

|

|

|

2,591 |

|

| |

$ |

13,031 |

|

|

$ |

2,840 |

|

|

$ |

35,805 |

|

|

$ |

6,743 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Includes payroll taxes related to stock-based compensation

as follows:

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

|

|

|

|

Subscription |

$ |

10 |

|

|

$ |

— |

|

|

$ |

122 |

|

|

$ |

— |

|

|

Services |

|

2 |

|

|

|

— |

|

|

|

24 |

|

|

|

— |

|

| Sales and marketing |

|

15 |

|

|

|

— |

|

|

|

431 |

|

|

|

— |

|

| Research and development |

|

44 |

|

|

|

— |

|

|

|

335 |

|

|

|

— |

|

| General and

administrative |

|

114 |

|

|

|

— |

|

|

|

615 |

|

|

|

— |

|

| |

$ |

185 |

|

|

$ |

— |

|

|

$ |

1,527 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) Includes depreciation expense as follows:

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

|

|

|

|

Subscription |

$ |

320 |

|

|

$ |

249 |

|

|

$ |

1,134 |

|

|

$ |

985 |

|

|

Services |

|

45 |

|

|

|

51 |

|

|

|

169 |

|

|

|

207 |

|

| Sales and marketing |

|

636 |

|

|

|

514 |

|

|

|

2,342 |

|

|

|

1,966 |

|

| Research and development |

|

354 |

|

|

|

284 |

|

|

|

1,277 |

|

|

|

1,149 |

|

| General and

administrative |

|

263 |

|

|

|

428 |

|

|

|

835 |

|

|

|

876 |

|

| |

$ |

1,618 |

|

|

$ |

1,526 |

|

|

$ |

5,757 |

|

|

$ |

5,183 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) Includes acquisition-related expense as follows:

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| |

(in thousands) |

| Cost of revenue: |

|

|

|

|

|

|

|

|

Subscription |

$ |

71 |

|

|

$ |

— |

|

|

$ |

88 |

|

|

$ |

— |

|

| Sales and marketing |

|

146 |

|

|

|

— |

|

|

|

180 |

|

|

|

— |

|

| Research and development |

|

498 |

|

|

|

— |

|

|

|

1,088 |

|

|

|

— |

|

| General and

administrative |

|

889 |

|

|

|

872 |

|

|

|

5,032 |

|

|

|

5,200 |

|

| |

$ |

1,604 |

|

|

$ |

872 |

|

|

$ |

6,388 |

|

|

$ |

5,200 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative also includes acquisition-related

earnout of $1.2 million and $2.1 million for the three months ended

December 31, 2021 and 2020, respectively, and $6.0 million and

$(1.0) million for the years ended December 31, 2021 and 2020,

respectively. The acquisition-related earnout was an expense for

the year ended December 31, 2021 compared to a benefit for the

year ended December 31, 2020 reflecting the change in fair value of

the Digita acquisition contingent liability due to growth in sales

of our Jamf Protect product. General and administrative also

includes the full settlement of a $5.0 million legal-related matter

for the year ended December 31, 2021.

Jamf Holding

Corp.Consolidated Statements of Cash

Flows(in thousands)(unaudited)

| |

Years Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

| Cash flows from

operating activities |

|

|

|

|

Net loss |

$ |

(75,189 |

) |

|

$ |

(24,082 |

) |

|

Adjustments to reconcile net loss to cash provided by operating

activities: |

|

|

|

|

Depreciation and amortization expense |

|

47,069 |

|

|

|

38,511 |

|

|

Amortization of deferred contract costs |

|

12,534 |

|

|

|

7,953 |

|

|

Amortization of debt issuance costs |

|

1,251 |

|

|

|

773 |

|

|

Non-cash lease expense |

|

4,994 |

|

|

|

— |

|

|

Provision for credit losses and returns |

|

37 |

|

|

|

1,024 |

|

|

Loss on extinguishment of debt |

|

449 |

|

|

|

5,213 |

|

|

Share‑based compensation |

|

35,805 |

|

|

|

6,743 |

|

|

Deferred tax benefit |

|

(5,644 |

) |

|

|

(10,318 |

) |

|

Adjustment to contingent consideration |

|

6,037 |

|

|

|

(1,000 |

) |

|

Other |

|

1,419 |

|

|

|

(490 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

Trade accounts receivable |

|

(6,521 |

) |

|

|

(23,112 |

) |

|

Income tax receivable/payable |

|

(611 |

) |

|

|

(766 |

) |

|

Prepaid expenses and other assets |

|

(9,265 |

) |

|

|

(3,620 |

) |

|

Deferred contract costs |

|

(24,795 |

) |

|

|

(20,398 |

) |

|

Accounts payable |

|

2,069 |

|

|

|

4,026 |

|

|

Accrued liabilities |

|

4,345 |

|

|

|

5,501 |

|

|

Deferred revenue |

|

71,216 |

|

|

|

64,945 |

|

|

Other liabilities |

|

(35 |

) |

|

|

1,898 |

|

|

Net cash provided by operating activities |

|

65,165 |

|

|

|

52,801 |

|

| Cash flows from

investing activities |

|

|

|

|

Acquisitions, net of cash acquired |

|

(352,711 |

) |

|

|

(2,512 |

) |

|

Payment of deferred consideration |

|

(25,000 |

) |

|

|

— |

|

|

Purchases of equipment and leasehold improvements |

|

(9,755 |

) |

|

|

(4,368 |

) |

|

Proceeds from sale of equipment and leasehold improvements |

|

48 |

|

|

|

4 |

|

|

Net cash used in investing activities |

|

(387,418 |

) |

|

|

(6,876 |

) |

| Cash flows from

financing activities |

|

|

|

|

Proceeds from convertible senior notes |

|

373,750 |

|

|

|

— |

|

|

Proceeds from bank borrowings |

|

250,000 |

|

|

|

— |

|

|

Payment of bank borrowings |

|

(250,000 |

) |

|

|

(205,000 |

) |

|

Payment for purchase of capped calls |

|

(36,030 |

) |

|

|

— |

|

|

Debt issuance costs |

|

(13,134 |

) |

|

|

(1,264 |

) |

|

Payment of debt extinguishment costs |

|

— |

|

|

|

(2,050 |

) |

|

Proceeds from initial public offering, net of underwriting

discounts and commissions |

|

— |

|

|

|

326,316 |

|

|

Cash paid for offering costs |

|

(543 |

) |

|

|

(7,256 |

) |

|

Proceeds from private placement |

|

— |

|

|

|

2,233 |

|

|

Cash paid for contingent consideration |

|

(4,206 |

) |

|

|

— |

|

|

Payment of deferred consideration |

|

(25,000 |

) |

|

|

— |

|

|

Proceeds from the exercise of stock options |

|

10,691 |

|

|

|

2,985 |

|

|

Net cash provided by financing activities |

|

305,528 |

|

|

|

115,964 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

(993 |

) |

|

|

604 |

|

|

Net (decrease) increase in cash and cash equivalents |

|

(17,718 |

) |

|

|

162,493 |

|

| Cash and cash equivalents,

beginning of period |

|

194,868 |

|

|

|

32,375 |

|

| Cash and cash equivalents, end

of period |

$ |

177,150 |

|

|

$ |

194,868 |

|

| |

|

|

|

|

|

|

|

Jamf Holding

Corp.Supplemental Financial

InformationDisaggregated Revenues(in

thousands)(unaudited)

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| SaaS subscription and support

and maintenance |

$ |

91,278 |

|

|

$ |

63,376 |

|

|

$ |

313,950 |

|

|

$ |

223,655 |

|

| On‑premise subscription |

|

7,065 |

|

|

|

7,065 |

|

|

|

30,293 |

|

|

|

25,224 |

|

|

Subscription revenue |

|

98,343 |

|

|

|

70,441 |

|

|

|

344,243 |

|

|

|

248,879 |

|

| Professional services |

|

4,107 |

|

|

|

3,903 |

|

|

|

16,122 |

|

|

|

14,519 |

|

| Perpetual licenses |

|

1,352 |

|

|

|

1,923 |

|

|

|

6,023 |

|

|

|

5,734 |

|

|

Non‑subscription revenue |

|

5,459 |

|

|

|

5,826 |

|

|

|

22,145 |

|

|

|

20,253 |

|

|

Total revenue |

$ |

103,802 |

|

|

$ |

76,267 |

|

|

$ |

366,388 |

|

|

$ |

269,132 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jamf Holding

Corp.Supplemental Financial

InformationReconciliation of GAAP to non-GAAP

Financial Data(in thousands, except share and per share

amounts)(unaudited)

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Operating expenses |

$ |

102,593 |

|

|

$ |

72,145 |

|

|

$ |

352,233 |

|

|

$ |

225,576 |

|

| Amortization expense |

|

(7,019 |

) |

|

|

(5,634 |

) |

|

|

(25,294 |

) |

|

|

(22,575 |

) |

| Stock-based compensation |

|

(11,447 |

) |

|

|

(2,421 |

) |

|

|

(31,456 |

) |

|

|

(5,872 |

) |

| Acquisition-related

expense |

|

(1,533 |

) |

|

|

(872 |

) |

|

|

(6,300 |

) |

|

|

(5,200 |

) |

| Acquisition-related

earnout |

|

(1,200 |

) |

|

|

(2,100 |

) |

|

|

(6,037 |

) |

|

|

1,000 |

|

| Offering costs |

|

— |

|

|

|

(670 |

) |

|

|

(594 |

) |

|

|

(670 |

) |

| Payroll taxes related to

stock-based compensation |

|

(173 |

) |

|

|

— |

|

|

|

(1,381 |

) |

|

|

— |

|

| Legal settlement |

|

(800 |

) |

|

|

— |

|

|

|

(5,000 |

) |

|

|

— |

|

| Non-GAAP Operating

Expenses |

$ |

80,421 |

|

|

$ |

60,448 |

|

|

$ |

276,171 |

|

|

$ |

192,259 |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

| |

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Gross profit |

$ |

76,513 |

|

|

$ |

59,060 |

|

|

$ |

276,031 |

|

|

$ |

208,124 |

|

| Amortization expense |

|

5,183 |

|

|

|

2,719 |

|

|

|

16,018 |

|

|

|

10,753 |

|

| Stock-based compensation |

|

1,584 |

|

|

|

419 |

|

|

|

4,349 |

|

|

|

871 |

|

| Acquisition-related

expense |

|

71 |

|

|

|

— |

|

|

|

88 |

|

|

|

— |

|

| Payroll taxes related to

stock-based compensation |

|

12 |

|

|

|

— |

|

|

|

146 |

|

|

|

— |

|

| Non-GAAP Gross Profit |

$ |

83,363 |

|

|

$ |

62,198 |

|

|

$ |

296,632 |

|

|

$ |

219,748 |

|

| Non-GAAP Gross Profit

Margin |

|

80% |

|

|

|

82% |

|

|

|

81% |

|

|

|

82% |

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

| |

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Operating loss |

$ |

(26,080 |

) |

|

$ |

(13,085 |

) |

|

$ |

(76,202 |

) |

|

$ |

(17,452 |

) |

| Amortization expense |

|

12,202 |

|

|

|

8,353 |

|

|

|

41,312 |

|

|

|

33,328 |

|

| Stock-based compensation |

|

13,031 |

|

|

|

2,840 |

|

|

|

35,805 |

|

|

|

6,743 |

|

| Acquisition-related

expense |

|

1,604 |

|

|

|

872 |

|

|

|

6,388 |

|

|

|

5,200 |

|

| Acquisition-related

earnout |

|

1,200 |

|

|

|

2,100 |

|

|

|

6,037 |

|

|

|

(1,000 |

) |

| Offering costs |

|

— |

|

|

|

670 |

|

|

|

594 |

|

|

|

670 |

|

| Payroll taxes related to

stock-based compensation |

|

185 |

|

|

|

— |

|

|

|

1,527 |

|

|

|

— |

|

| Legal settlement |

|

800 |

|

|

|

— |

|

|

|

5,000 |

|

|

|

— |

|

| Non-GAAP Operating Income |

$ |

2,942 |

|

|

$ |

1,750 |

|

|

$ |

20,461 |

|

|

$ |

27,489 |

|

| Non-GAAP Operating Income

Margin |

|

3% |

|

|

|

2% |

|

|

|

6% |

|

|

|

10% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Net loss |

$ |

(23,750 |

) |

|

$ |

(8,364 |

) |

|

$ |

(75,189 |

) |

|

$ |

(24,082 |

) |

| Amortization expense |

|

12,202 |

|

|

|

8,353 |

|

|

|

41,312 |

|

|

|

33,328 |

|

| Stock-based compensation |

|

13,031 |

|

|

|

2,840 |

|

|

|

35,805 |

|

|

|

6,743 |

|

| Foreign currency transaction

loss |

|

54 |

|

|

|

251 |

|

|

|

849 |

|

|

|

722 |

|

| Loss on extinguishment of

debt |

|

— |

|

|

|

— |

|

|

|

449 |

|

|

|

5,213 |

|

| Amortization of debt issuance

costs |

|

678 |

|

|

|

— |

|

|

|

1,002 |

|

|

|

— |

|

| Acquisition-related

expense |

|

1,604 |

|

|

|

872 |

|

|

|

6,388 |

|

|

|

5,200 |

|

| Acquisition-related

earnout |

|

1,200 |

|

|

|

2,100 |

|

|

|

6,037 |

|

|

|

(1,000 |

) |

| Offering costs |

|

— |

|

|

|

670 |

|

|

|

594 |

|

|

|

670 |

|

| Payroll taxes related to

stock-based compensation |

|

185 |

|

|

|

— |

|

|

|

1,527 |

|

|

|

— |

|

| Legal settlement |

|

800 |

|

|

|

— |

|

|

|

5,000 |

|

|

|

— |

|

| Discrete tax items |

|

(1,591 |

) |

|

|

(2,213 |

) |

|

|

(1,655 |

) |

|

|

(3,879 |

) |

| Benefit for income

taxes(1) |

|

(1,836 |

) |

|

|

(3,192 |

) |

|

|

(3,361 |

) |

|

|

(9,662 |

) |

| Non-GAAP Net Income |

$ |

2,577 |

|

|

$ |

1,317 |

|

|

$ |

18,758 |

|

|

$ |

13,253 |

|

| Net loss

per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.20 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.64 |

) |

|

$ |

(0.22 |

) |

|

Diluted |

$ |

(0.20 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.64 |

) |

|

$ |

(0.22 |

) |

|

Weighted‑average shares used in computing net loss per share: |

|

|

|

|

|

|

|

|

Basic |

|

119,145,856 |

|

|

|

116,647,340 |

|

|

|

118,276,462 |

|

|

|

108,908,597 |

|

|

Diluted |

|

119,145,856 |

|

|

|

116,647,340 |

|

|

|

118,276,462 |

|

|

|

108,908,597 |

|

| Non-GAAP

Net Income per Share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.16 |

|

|

$ |

0.12 |

|

|

Diluted |

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.15 |

|

|

$ |

0.12 |

|

| Weighted-average shares used

in computing Non-GAAP Net Income per Share: |

|

|

|

|

|

|

|

|

Basic |

|

119,145,856 |

|

|

|

116,647,340 |

|

|

|

118,276,462 |

|

|

|

108,908,597 |

|

|

Diluted |

|

129,512,412 |

|

|

|

120,069,893 |

|

|

|

123,105,959 |

|

|

|

111,868,920 |

|

(1) For the year ended December 31, 2021, our annual

effective tax rate was materially different from our statutory rate

due to changes in the domestic valuation allowance. Therefore, we

used a tax rate of 6.2% for the fourth quarter of fiscal 2021,

which reflects the annual effective tax rate catch-up for the first

through third quarters due to the impact of the Wandera

acquisition, resulting in a tax rate of 6.0% for the year ended

December 31, 2021. For the years ended December 31, 2020 and 2019,

we used our annual effective tax rates, which were not materially

different from the statutory rates.

| |

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Net cash

provided by operating activities |

$ |

338 |

|

|

$ |

19,702 |

|

|

$ |

65,165 |

|

|

$ |

52,801 |

|

|

Add: |

|

|

|

|

|

|

|

|

Cash paid for interest |

|

23 |

|

|

|

2 |

|

|

|

967 |

|

|

|

12,649 |

|

|

Cash paid for acquisition-related expense |

|

1,154 |

|

|

|

1,900 |

|

|

|

5,039 |

|

|

|

5,200 |

|

|

Cash paid for legal settlement |

|

5,000 |

|

|

|

— |

|

|

|

5,000 |

|

|

|

— |

|

|

Less: |

|

|

|

|

|

|

|

|

Purchases of equipment and leasehold improvements |

|

(2,494 |

) |

|

|

(2,532 |

) |

|

|

(9,755 |

) |

|

|

(4,368 |

) |

|

Unlevered free cash flow |

$ |

4,021 |

|

|

$ |

19,072 |

|

|

$ |

66,416 |

|

|

$ |

66,282 |

|

|

Unlevered free cash flow margin |

|

4% |

|

|

|

25% |

|

|

|

18% |

|

|

|

25% |

|

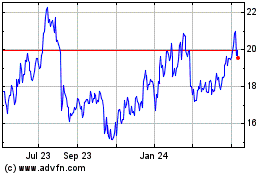

Jamf (NASDAQ:JAMF)

Historical Stock Chart

From Jun 2024 to Jul 2024

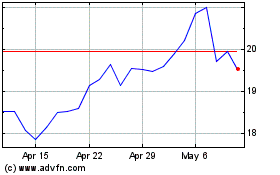

Jamf (NASDAQ:JAMF)

Historical Stock Chart

From Jul 2023 to Jul 2024