UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment

No. 4)

ISUN,

INC.

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

465246106

(CUSIP

Number)

Jeffrey

Peck, 400 Avenue D, Suite 10, Williston, VT 05495 (802) 658-3378

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May

31, 2024

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

NOTE:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| 1. |

Names

of reporting persons

Jeffrey

Peck |

|

| 2. |

Check

the appropriate box if a member of group (See Instructions)

|

(a)

☒

(b)

☐ |

| 3. |

SEC

use only

|

|

| 4. |

Source

of funds (See Instructions)

SC |

|

| 5. |

Check

if disclosure of legal proceedings is required pursuant to item 2(d) or 2(e)

|

☐ |

| 6. |

Citizenship

or place of organization

United

States |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH

REPORTING

PERSON

WITH |

7.

|

Sole

voting power

2,188,965 |

|

8.

|

Shared

voting power

0 |

|

9.

|

Sole

dispositive power

1,577,056 |

|

| 10. |

Shared

dispositive power

0 |

|

| 11. |

Aggregate

amount beneficially owned by each reporting person

2,188,965 |

|

| 12. |

Check

if the aggregate amount in row (11) excludes certain shares (See Instructions)

|

☐ |

| 13. |

Percent

of class represented by amount in row (11)

4.6% |

|

| 14. |

Type

of reporting person (See Instructions)

IN |

|

| 1. |

Names

of reporting persons

Corundum

AB |

|

| 2. |

Check

the appropriate box if a member of group (See Instructions)

|

(a)

☒

(b)

☐ |

| 3. |

SEC

use only

|

|

| 4. |

Source

of funds (See Instructions)

SC |

|

| 5. |

Check

if disclosure of legal proceedings is required pursuant to item 2(d) or 2(e)

|

☐ |

| 6. |

Citizenship

or place of organization

Sweden |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH

REPORTING

PERSON

WITH |

7.

|

Sole

voting power

0 |

|

8.

|

Shared

voting power

0 |

|

9.

|

Sole

dispositive power

0 |

|

| 10. |

Shared

dispositive power

90,660 |

|

| 11. |

Aggregate

amount beneficially owned by each reporting person

90,660 |

|

| 12. |

Check

if the aggregate amount in row (11) excludes certain shares (See Instructions)

|

☐ |

| 13. |

Percent

of class represented by amount in row (11)

0.19% |

|

| 14. |

Type

of reporting person (See Instructions)

OO |

|

| 1. |

Names

of reporting persons

Mats

Wennberg |

|

| 2. |

Check

the appropriate box if a member of group (See Instructions)

|

(a)

☒

(b)

☐ |

| 3. |

SEC

use only

|

|

| 4. |

Source

of funds (See Instructions)

SC |

|

| 5. |

Check

if disclosure of legal proceedings is required pursuant to item 2(d) or 2(e)

|

☐ |

| 6. |

Citizenship

or place of organization

Sweden |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH

REPORTING

PERSON

WITH |

7.

|

Sole

voting power

0 |

|

8.

|

Shared

voting power

0 |

|

9.

|

Sole

dispositive power

0 |

|

| 10. |

Shared

dispositive power

90,660 |

|

| 11. |

Aggregate

amount beneficially owned by each reporting person

90,660 |

|

| 12. |

Check

if the aggregate amount in row (11) excludes certain shares (See Instructions)

|

☐ |

| 13. |

Percent

of class represented by amount in row (11)

0.19% |

|

| 14. |

Type

of reporting person (See Instructions)

OO |

|

| 1. |

Names

of reporting persons

John

P. Comeau |

|

| 2. |

Check

the appropriate box if a member of group (See Instructions)

|

(a)

☒

(b)

☐ |

| 3. |

SEC

use only

|

|

| 4. |

Source

of funds (See Instructions)

SC |

|

| 5. |

Check

if disclosure of legal proceedings is required pursuant to item 2(d) or 2(e)

|

☐ |

| 6. |

Citizenship

or place of organization

United

States Citizen |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH

REPORTING

PERSON

WITH |

7.

|

Sole

voting power

0 |

|

8.

|

Shared

voting power

0 |

|

9.

|

Sole

dispositive power

29,749 |

|

| 10. |

Shared

dispositive power

0 |

|

| 11. |

Aggregate

amount beneficially owned by each reporting person

29,749 |

|

| 12. |

Check

if the aggregate amount in row (11) excludes certain shares (See Instructions)

|

☐ |

| 13. |

Percent

of class represented by amount in row (11)

0.06% |

|

| 14. |

Type

of reporting person (See Instructions)

IN |

|

| 1. |

Names

of reporting persons

Sassoon

M. Peress |

|

| 2. |

Check

the appropriate box if a member of group (See Instructions)

|

(a)

☒

(b)

☐ |

| 3. |

SEC

use only

|

|

| 4. |

Source

of funds (See Instructions)

SC |

|

| 5. |

Check

if disclosure of legal proceedings is required pursuant to item 2(d) or 2(e)

|

☐ |

| 6. |

Citizenship

or place of organization

Canada |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH

REPORTING

PERSON

WITH |

7.

|

Sole

voting power

0 |

|

8.

|

Shared

voting power

0 |

|

9.

|

Sole

dispositive power

491,500 |

|

| 10. |

Shared

dispositive power

0 |

|

| 11. |

Aggregate

amount beneficially owned by each reporting person

491,500 |

|

| 12. |

Check

if the aggregate amount in row (11) excludes certain shares (See Instructions)

|

☐ |

| 13. |

Percent

of class represented by amount in row (11)

1.04% |

|

| 14. |

Type

of reporting person (See Instructions)

IN |

|

| Item

1. |

Security

and Issuer |

The

securities covered by this Schedule 13D are shares of Common Stock, par value $0.0001 per share (the “Common Stock”) of iSun,

Inc. formerly known as The Peck Company Holdings, Inc., a Delaware corporation (the “Issuer”). The Issuer’s principal

executive offices are located at 400 Avenue D, Suite 10, Williston, Vermont 05495.

| Item

2. |

Identity

and Background |

| (a),

(f) |

This

statement is being filed on behalf of: |

| |

(i) |

Jeffrey

Peck, a citizen of the United States of America; |

| |

|

|

| |

(ii) |

Corundum

AB, a Swedish limited company (“Corundum”); |

| |

|

|

| |

(iii) |

Mats

Wennberg, a citizen of Sweden; |

| |

|

|

| |

(iv) |

Sassoon

M. Peress, a citizen of Canada; and |

| |

|

|

| |

(vi) |

John

P. Comeau, a citizen of the United States of America (together with Jeffrey Peck, Corundum AB, Sassoon Peress, and John P. Comeau,

the “Reporting Persons”) |

Jeffrey

Peck, and Corundum AB have entered into a Joint Filing Agreement, dated as of July 1, 2019, a copy of which is incorporated herein by

reference as Exhibit 5. Sassoon M. Peress entered into a Joint Filing Agreement, dated as of February 16, 2021, a copy of which is incorporated

herein as Exhibit 6. John P. Comeau has entered into a Joint Filing Agreement, dated as of February 28, 2022, a copy of which is incorporated

herein as Exhibit 9.

| (b) |

The

business address of Jeffrey Peck is 400 Avenue D, Suite 10, Williston, VT 05495. |

The

business address of Corundum and Mats Wennberg is Box 57, 182 05 Djursholm, Stockholms län.

The

business address of Sassoon M. Peress is 7501 Mountain Sights Apt 505, Montreal, QC H4P 0A8, Canada.

The

business address of John P. Comeau is 2 ½ Joseph Street, Derry, NH 03038.

| (c) |

Jeffrey

Peck is the Chief Executive Officer of the Issuer and a member of the Issuer’s Board of Directors. The business address of

the Issuer is 400 Avenue D, Suite 10, Williston, VT 05495. |

Mats

Wennberg is the Chief Executive Officer of Corundum. Corundum’s principal business is investment management. Mr. Wennberg, as Chief

Executive Officer of Corundum, may be deemed to have the shared power to dispose or direct the disposition of the shares of Common Stock

of the Issuer that are directly held by Corundum.

John

P. Comeau is the General Manager of Liberty Electric, Inc., a New Hampshire corporation and a wholly-owned subsidiary of iSun Industrial,

LLC, a Delaware limited liability company and a wholly-owned subsidiary of the Issuer. Mr. Comeau’s business address is 2 ½

Joseph Street, Derry, NH 03038.

(d)

None of the Reporting Person have, during the last five years, been convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors).

(e)

None of the Reporting Person have, during the last five years, been party to a civil proceeding of a judicial or administrative body

of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect

to such laws.

| Item

3. |

Source

and Amount of Funds or Other Consideration |

As

reported on Schedule 13D filed on June 20, 2019 (the “Closing Date”), the Issuer consummated the previously announced business

combination (the “Business Combination”) pursuant to a Share Exchange Agreement, dated as of February 26, 2019 (the “Exchange

Agreement”), by and among the Issuer, Peck Electric and Peck Electric’s stockholders (the “Stockholders”). In

connection with the closing of the Business Combination (the “Closing”), the Issuer changed its name from “Jensyn Acquisition

Corp.” to “The Peck Company Holdings, Inc.” “Jensyn” refers to the Registrant prior to the Closing. In

connection with the Closing, Jensyn issued 3,234,501 shares of Jensyn’s Common Stock to the Stockholders in exchange for all of

the equity securities of Peck Electric, and Peck Electric became a wholly-owned subsidiary of the Issuer. In this regard, the following

Reporting Persons received the following number of shares of Common Stock in consideration for their equity securities of Peck Electric:

(a) Jeffrey Peck received 1,406,974 shares of Common Stock; and (b) Corundum received 90,660 shares of Common Stock.

The

foregoing summary of the Exchange Agreement is qualified in its entirety by reference to the Exchange Agreement, a copy of which is filed

as Exhibit 2.2 to the Issuer’s Current Report on Form 8-K filed with the Securities and Exchange Commission on March 1, 2019, which

was attached to the Schedule 13D as Exhibit 1 and incorporated herein by reference.

On

January 19, 2021 the Issuer changed its name of iSun, Inc.

On

January 19, 2021, the Issuer entered into an Agreement and Plan of Merger and Reorganization (the “iSun Merger Agreement’)

with Peck Mercury, Inc., iSun Energy, LLC, and Sassoon M. Peress. Pursuant to the iSun Merger Agreement, as amended, Mr. Peress was issued

shares of Common Stock, Warrants and other consideration. Mr. Peress was issued 200,000 shares of Common Stock at Closing. Mr. Peress

subsequently transferred an aggregate of 8,500 shares of Common Stock of the Issuer to Dan Cohen, Manish Hirapara, Emma Peress, and Shoshanna

Zimmerman. Mr. Peress was subsequently issued an additional 200,000 shares pursuant to a Confidential Settlement and Release by and between

the Issuer and Mr. Peress dated November 28, 2022. Mr. Peress has executed an Irrevocable Proxy in favor of Mr. Peck with respect to

such shares of Common Stock.

Pursuant

to the iSun Merger Agreement, Mr. Peress was issued a Warrant to acquire 100,000 shares of Common Stock. Mr. Peress exercised such Warrant

on February 8, 2021 and was issued 100,000 shares of Common. Mr. Peress has executed an Irrevocable Proxy in favor of Mr. Peck with respect

to such shares of Common Stock.

The

foregoing summary of the iSun Merger Agreement is qualified in its entirety by reference to the iSun Merger Agreement, a copy of which

is filed as Exhibit 2.1 to the Issuer’s Current Report on Form 8-K filed with the Securities and Exchange Commission on January

25, 2021, incorporated herein by reference.

On

January 4, 2021 the Board of Directors of the Issuer approved a grant of shares of Common Stock and Non-Qualified Stock Options to Mr.

Peck. The shares of Common Stock are subject to vesting. As of the date of this Amendment No. 5 the shares of Common Stock have vested

in the following amounts: Mr. Peck – 82,000.

On

November 18, 2021, John Stark Electric, Inc., a New Hampshire corporation (“JSI”) and wholly-owned subsidiary of the Issuer,

Liberty Electric, Inc., a New Hampshire Corporation (“Liberty”) and John P. Comeau (“Comeau”) after obtaining

required consents, released signature pages and closed an Asset Purchase Agreement (the “Liberty Asset Purchase Agreement”),

pursuant to which JSI acquired all of the assets of Liberty. Pursuant to the Liberty Asset Purchase Agreement, Mr. Comeau was issued

29,749 shares of Common Stock. Mr. Comeau executed an Irrevocable Proxy in favor of Mr. Peck with respect to such shares of Common Stock.

The

foregoing summary of the Liberty Asset Purchase Agreement is qualified in its entirety by reference to the Liberty Asset Purchase Agreement,

a copy of which is filed as Exhibit 2.1 to the Issuer’s Current Report on Form 8-K filed with the Securities and Exchange Commission

on November 19, 2021, incorporated herein by reference.

On

January 24, 2022 the Board of Directors of the Issuer approved a grant of shares of Common Stock and Non-Qualified Stock Options to Mr.

Peck. The shares of Common Stock are subject to vesting. As of the date of this Amendment No. 5 the shares of Common Stock have vested

in the following amounts: Mr. Peck – 50,000.

On

August 11, 2022, the Irrevocable Proxies granted by Messrs. Peterson, Moore, and Irish to Mr. Peck were terminated.

On

September 22, 2022 Mr. Peck exercised Non-Qualified Stock Options to purchase shares of Common Stock in the following amount: Mr. Peck

– 36,666.

On

January 3, 2023 the Board of Directors of the Issuer approved a grant of shares of Common Stock to Mr. Peck pursuant to Restricted Stock

Agreements. The shares of Common Stock are subject to vesting. As of the date of this Amendment No. 5, 26,667shares of Common Stock have

vested.

On

May 23, 2023 Mr. Peck purchased 50,000 shares of Common Stock on the open market.

On

July 5, 2023 the Issuer’s shares outstanding increased due to the issuance of shares of Common Stock in partial payment of amounts

outstanding under certain Senior Secured Convertible Notes (the “Notes”), resulting in the change in the percent beneficially

owned by the Reporting Persons. As of the date of Amendment No. 4, a total of 5,138,487 shares of Common Stock of the Issuer have been

issued in partial payment of the Notes.

On

November 1, 2023, Mr. d’Amato and Veroma, LLC granted an Irrevocable Proxy to Mr. Peck.

On

December 12, 2023 the Issuer’s shares outstanding increased due to the issuance of an aggregate of 3,500,000 shares of Common Stock

in redemption of all amounts outstanding under the Notes, resulting in the change in the percent beneficially owned by the Reporting

Persons.

On

or about January 7, 2024, former reporting persons Richard L. Mooers and Mooers Partners, LLC sold all of their remaining shares.

On

or about February 7, 2024, former reporting persons Roger G. Branton and Branton Partners, LLC sold all of their remaining shares.

On

or about May 13, 2024, former reporting persons Michael D’Amato and Veroma, LLC sold all of their remaining shares.

| Item

4. |

Purpose

of Transaction |

Jeffrey

Peck and Corundum previously held shares of capital stock in Peck Electric and received the shares of Common Stock as consideration from

the Issuer pursuant to the terms of the above described Exchange Agreement in connection with the Business Combination.

Mr.

Peress received the shares of Common Stock as consideration from the Issuer pursuant to the above described iSun Merger Agreement.

Mr.

Comeau received the shares of Common Stock as consideration from the Issuer pursuant to the above described Liberty Asset Purchase Agreement.

Mr.

Peck received the shares of Common Stock and Non-Qualified Stock Options from the Issuer pursuant to the Issuer’s 2020 Equity Incentive

Plan.

Jeffrey

Peck intends to participate in and influence the affairs of the Issuer through his positions as Chief Executive Officer of the Issuer

and a member of its Board of Directors through his voting rights with respect to ownership of the Common Stock of the Issuer.

Subject

to applicable legal requirements, the Reporting Persons may purchase additional securities of the Issuer from time to time in open market

or private transactions, depending on their evaluation of the Issuer’s business, prospects and financial condition, the market

for the Issuer’s securities, other developments concerning the Issuer, the reaction of the Issuer to the Reporting Persons’

ownership of the Issuer’s securities, other opportunities available to the Reporting Persons, and general economic, money market

and stock market conditions. In addition, depending upon the factors referred to above, the Reporting Persons may dispose of all or a

portion of their securities of the Issuer at any time. The Reporting Persons reserve the right to increase or decrease their holdings

on such terms and at such times as they may decide.

Other

than as described above, the Reporting Persons do not have any plan or proposal relating to or that would result in:

| (a) |

the

acquisition by any person of additional securities of the Issuer or the disposition of securities of the Issuer; |

| |

|

| (b) |

an

extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; |

| |

|

| (c) |

a

sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries; |

| |

|

| (d) |

any

change in the present Board of Directors or management of the Issuer, including any plans or proposals to change the number or terms

of directors or to fill any existing vacancies on the Board of Directors of the Issuer; |

| |

|

| (e) |

any

material change in the present capitalization or dividend policy of the Issuer; |

| |

|

| (f) |

any

other material change in the Issuer’s business or corporate structure; |

| |

|

| (g) |

any

changes in the Issuer’s charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition

of control of the Issuer by any person; |

| |

|

| (h) |

a

class of securities of the Issuer being delisted from a national securities exchange or ceasing to be authorized to be quoted in

an inter-dealer quotation system of a registered national securities association; |

| |

|

| (i) |

a

class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Exchange

Act; or |

| |

|

| (j) |

any

action similar to those enumerated above. |

| Item

5. |

Interest

in Securities of the Issuer |

(a)

— (b)

| | |

| | |

| | |

(b)

Number of Shares as to which the person has: | |

| Name | |

(a)

Amount

Beneficially

Owned | | |

(a)

Percent

of Class* | | |

Sole Power to

Vote or to

Direct the

Vote | | |

Shared

Power to

Vote or to

Direct the

Vote | | |

Sole Power to

Dispose or to

Direct the

Disposition of | | |

Shared Power to

Dispose or to

Direct the

Disposition of | |

| Jeffrey Peck | |

| 2,188,965 | | |

| 4.6 | % | |

| 2,188,965 | | |

| 0 | | |

| 1,577,056 | | |

| 0 | |

| | |

| | |

| | |

(b)

Number of Shares as to which the person has: | |

| Name | |

(a)

Amount

Beneficially

Owned | | |

(a)

Percent

of Class* | | |

Sole Power to

Vote or to

Direct the

Vote | | |

Shared

Power to

Vote or to

Direct the

Vote | | |

Sole Power to

Dispose or to

Direct the

Disposition of | | |

Shared Power to

Dispose or to

Direct the

Disposition of | |

| Corundum AB | |

| 90,660 | | |

| 0.19 | % | |

| 0 | | |

| 0 | | |

| 0 | | |

| 90,660 | |

| | |

| | |

| | |

(b)

Number of Shares as to which the person has: | |

| Name | |

(a)

Amount

Beneficially

Owned | | |

(a)

Percent

of Class* | | |

Sole Power to

Vote or to

Direct the

Vote | | |

Shared

Power to

Vote or to

Direct the

Vote | | |

Sole Power to

Dispose or to

Direct the

Disposition of | | |

Shared Power to

Dispose or to

Direct the

Disposition of | |

| Mats Wennberg | |

| 90,660 | | |

| 0.19 | % | |

| 0 | | |

| 0 | | |

| 0 | | |

| 90,660 | |

| | |

| | |

| | |

(b)

Number of Shares as to which the person has: | |

| Name | |

(a)

Amount

Beneficially

Owned | | |

(a)

Percent

of Class* | | |

Sole Power to

Vote or to

Direct the

Vote | | |

Shared

Power to

Vote or to

Direct the

Vote | | |

Sole Power to

Dispose or to

Direct the

Disposition of | | |

Shared Power to

Dispose or to

Direct the

Disposition of | |

| Sassoon M. Peress | |

| 491,500 | | |

| 1.04 | % | |

| 0 | | |

| 0 | | |

| 491,500 | | |

| 0 | |

| | |

| | |

| | |

(b)

Number of Shares as to which the person has: | |

| Name | |

(a)

Amount

Beneficially

Owned | | |

(a)

Percent

of Class* | | |

Sole Power to

Vote or to

Direct the

Vote | | |

Shared

Power to

Vote or to

Direct the

Vote | | |

Sole Power to

Dispose or to

Direct the

Disposition of | | |

Shared Power to

Dispose or to

Direct the

Disposition of | |

| John P. Comeau | |

| 29,749 | | |

| 0.06 | % | |

| 0 | | |

| 0 | | |

| 0 | | |

| 29,749 | |

*

Based on 47,384,672 shares of Common Stock outstanding as of May 31, 2024 – as reported by the Issuer’s transfer agent.

| (c) |

Except

for the transactions described in Items 3, 4, 5 or 6 of this Schedule 13D, which are incorporated by reference into this Item5(c),

during the last sixty days there were no transactions with respect to the Common Stock effected by the Reporting Person. |

| |

|

| (d) |

No

person other than the Reporting Person is known to have the right to receive or the power to direct the receipt of dividends from,

or the proceeds from the sale of, the securities discussed herein. |

| |

|

| (e) |

Not

applicable. |

| Item

6. |

Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Pursuant

to the Exchange Agreement described further under Item 4, the following Reporting Persons received the following number of shares of

Common Stock in consideration for their equity securities of Peck Electric: (a) Jeffrey Peck received 1,406,974 shares of Common Stock;

and (b) Corundum received 90,660 shares of Common Stock. The foregoing summary of the Exchange Agreement is qualified in its entirety

by reference to the Exchange Agreement, a copy of which is filed as Exhibit 2.2 to the Issuer’s Current Report on Form 8-K filed

with the Securities and Exchange Commission on March 1, 2019, attached hereto as Exhibit 1 and incorporated herein by reference.

On

June 20, 2019, Corundum (a “Key Holder”) entered into a voting agreement with Jeffrey Peck and the Issuer (the “Voting

Agreement”). Pursuant to the terms of the Voting Agreement, the Key Holder transferred to Jeffrey Peck all of the voting power

they otherwise would have as a result of their ownership of shares of Common Stock of the Issuer. The foregoing summary of the Voting

Agreement is qualified in its entirety by reference to the Voting Agreement, a copy of which is incorporated by reference as Exhibit

2.

On

January 19, 2021, the Issuer entered into an Agreement and Plan of Merger and Reorganization, as amended (the “iSun Merger Agreement’),

incorporated by reference as Exhibit 3, with Peck Mercury, Inc., iSun Energy, LLC, and Sassoon M. Peress. Pursuant to the Merger Agreement,

Mr. Peress was issued shares of Common Stock, Warrants and other consideration. Mr. Peress was issued 200,000 shares of Common Stock

at Closing and 200,000 shares subsequently on February 7, 2023. Mr. Peress has executed an Irrevocable Proxy in favor of Mr. Peck with

respect to such shares of Common Stock, attached hereto as Exhibit 4.

Pursuant

to the iSun Merger Agreement, Mr. Peress was issued a Warrant to acquire 100,000 shares of Common Stock. Mr. Peress exercised such Warrant

on February 8, 2021 and was issued 100,000 shares of Common. Mr. Peress has executed an Irrevocable Proxy in favor of Mr. Peck with respect

to such shares of Common Stock.

On

November 18, 2021, John Stark Electric, Inc., a New Hampshire corporation (“JSI”) and wholly-owned subsidiary of the Issuer,

Liberty Electric, Inc., a New Hampshire Corporation (“Liberty”) and John P. Comeau (“Comeau”) after obtaining

required consents released signature pages and closed an Asset Purchase Agreement (the “Liberty Asset Purchase Agreement”),

pursuant to which JSI acquired all of the assets of Liberty. Pursuant to the Liberty Asset Purchase Agreement, Mr. Comeau was issued

29,749 shares of Common Stock. Mr. Comeau executed an Irrevocable Proxy in favor of Mr. Peck with respect to such shares of Common Stock.

The

foregoing summary of the Liberty Asset Purchase Agreement is qualified in its entirety by reference to the Liberty Asset Purchase Agreement,

a copy of which is filed as Exhibit 2.1 to the Issuer’s Current Report on Form 8-K filed with the Securities and Exchange Commission

on November 19, 2021, incorporated herein by reference.

Other

than as described in this Amendment No. 5 to Schedule 13D, to the best of the Reporting Person’s knowledge, there are no other

contracts, arrangements, understandings or relationships (legal or otherwise) between the Reporting Person and any person with respect

to any securities of the Issuer.

| Item

7. |

|

Material

to be Filed as Exhibits |

| |

|

|

| Exhibit

1 |

|

Form of Exchange Agreement (incorporated by reference to Exhibit 2.2 to the Issuer’s Current Report on Form 8-K filed with the Securities and Exchange Commission on March 1, 2019). |

| |

|

|

| Exhibit

2 |

|

Voting Agreement dated June 20, 2019 by and among the Reporting Persons. (incorporated by reference to Exhibit 10.21 to the Issuer’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on April 14, 2020) |

| |

|

|

| Exhibit

3 |

|

Agreement and Plan of Merger (incorporated by reference to Exhibit 2.1 to the Issuer’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on January 25, 2021) |

| |

|

|

| Exhibit

4 |

|

Irrevocable Proxy (incorporated by reference to Exhibit 10.4 to the Issuer’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on January 25, 2021) |

| |

|

|

| Exhibit

5 |

|

Agreement as to Joint Filing of Schedule 13D, dated as of July 1, 2019 among certain of the Reporting Persons (incorporated by reference to Exhibit 3 to the Schedule 13D filed with the Securities and Exchange Commission on July 2, 2019) |

| |

|

|

| Exhibit

6 |

|

Agreement as to Joint Filing of Schedule 13D, dated as of February 16, 2021 between Jeffrey Peck and Sassoon M. Peress (incorporated by reference to Exhibit 7 to the Schedule 13D filed with the Securities and Exchange Commission on February 19, 2021) |

| |

|

|

| Exhibit

7 |

|

Asset Purchase Agreement (incorporated by reference to Exhibit 2.1 to the Issuer’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on November 19, 2021) |

| |

|

|

| Exhibit

8 |

|

Irrevocable Proxy (incorporated by reference to Exhibit 10.2 to the Issuer’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on November 19, 2021) |

| |

|

|

| Exhibit

9 |

|

Agreement as to Joint Filing of Schedule 13D, dated as of February 28, 2022 between Jeffrey Peck and John P. Comeau (incorporated by reference to Exhibit 14 to the Schedule 13D filed with the Securities and Exchange Commission on March 10, 2022) |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Date:

May 31, 2024

| |

/s/

Jeffrey Peck |

| |

Jeffrey

Peck, individually |

| |

|

|

| |

|

|

| |

CORUNDUM

AB |

| |

|

|

| |

By: |

/s/

Mats Wennberg |

| |

Name:

|

Mats

Wennberg |

| |

Title: |

Authorized

Person |

| |

|

|

| |

/s/

Mats Wennberg |

| |

Mats

Wennberg, individually |

| |

|

|

| |

/s/

Sassoon M. Peress |

| |

Sassoon

M. Peress, individually |

| |

|

|

| |

/s/

John P. Comeau |

| |

John

P. Comeau, individually |

EXHIBIT

INDEX

| Exhibit |

|

Description |

| |

|

|

| Exhibit

1 |

|

Form of Exchange Agreement (incorporated by reference to Exhibit 2.2 to the Issuer’s Current Report on Form 8-K filed with the Securities and Exchange Commission on March 1, 2019). |

| |

|

|

| Exhibit

2 |

|

Voting Agreement dated June 20, 2019 by and among the Reporting Persons. (incorporated by reference to Exhibit 10.21 to the Issuer’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on April 14, 2020) |

| |

|

|

| Exhibit

3 |

|

Agreement and Plan of Merger (incorporated by reference to Exhibit 2.1 to the Issuer’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on January 25, 2021) |

| |

|

|

| Exhibit

4 |

|

Irrevocable Proxy (incorporated by reference to Exhibit 10.4 to the Issuer’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on January 25, 2021) |

| |

|

|

| Exhibit

5 |

|

Agreement as to Joint Filing of Schedule 13D, dated as of July 1, 2019 among certain of the Reporting Persons (incorporated by reference to Exhibit 3 to the Schedule 13D filed with the Securities and Exchange Commission on July 2, 2019) |

| |

|

|

| Exhibit

6 |

|

Agreement as to Joint Filing of Schedule 13D, dated as of February 16, 2021 between Jeffrey Peck and Sassoon M. Peress (incorporated by reference to Exhibit 7 to the Schedule 13D filed with the Securities and Exchange Commission on February 19, 2021) |

| |

|

|

| Exhibit

7 |

|

Asset Purchase Agreement (incorporated by reference to Exhibit 2.1 to the Issuer’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on November 19, 2021) |

| |

|

|

| Exhibit

8 |

|

Irrevocable Proxy (incorporated by reference to Exhibit 10.2 to the Issuer’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on November 19, 2021) |

| |

|

|

| Exhibit

9 |

|

Agreement as to Joint Filing of Schedule 13D, dated as of February 28, 2022 between Jeffrey Peck and John P. Comeau (incorporated by reference to Exhibit 14 to the Schedule 13D filed with the Securities and Exchange Commission on March 10, 2022). |

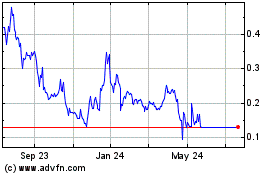

iSun (NASDAQ:ISUN)

Historical Stock Chart

From Nov 2024 to Dec 2024

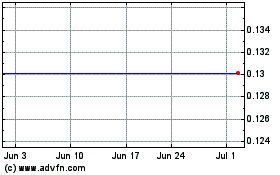

iSun (NASDAQ:ISUN)

Historical Stock Chart

From Dec 2023 to Dec 2024