0001006045false00010060452024-05-142024-05-14

|

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

|

FORM 8-K CURRENT REPORT |

|

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

|

May 14, 2024 |

|

(Date of Report (date of earliest event reported) |

|

IRIDEX CORPORATION |

(Exact name of registrant as specified in its charter) |

|

Delaware |

000-27598 |

77-0210467 |

(State or other jurisdiction of

incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer

Identification Number) |

1212 Terra Bella Avenue

Mountain View, California 94043 |

(Address of principal executive offices, including zip code) |

|

(650) 940-4700 |

(Registrant’s telephone number, including area code) |

(Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Class |

|

Trading Symbol |

|

Name of Exchange on Which Registered |

Common Stock, par value $0.01 per share |

|

IRIX |

|

Nasdaq Global Market |

Item 2.02. Results of Operations and Financial Condition.

On May 14, 2024, IRIDEX Corporation issued a press release discussing its financial results for its first fiscal quarter ended March 30, 2024. The press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

IRIDEX CORPORATION |

|

|

|

|

|

By: |

|

/s/David I. Bruce |

|

|

|

David I. Bruce |

|

|

|

President and Chief Executive Officer |

|

|

|

|

Date: May 14, 2024 |

|

|

|

Exhibit 99.1

Iridex Reports First Quarter 2024 Financial Results

MOUNTAIN VIEW, Calif., May 14, 2024 -- Iridex Corporation (Nasdaq: IRIX), a worldwide leader providing innovative and versatile laser-based medical systems, delivery devices, and procedure probes for the treatment of glaucoma and retinal diseases, today reported financial results for the first quarter ended March 30, 2024, and provided a business update.

First Quarter 2024 Financial Highlights

•Generated total revenue of $11.8 million, compared to $13.7 million in the prior year period

•Cyclo G6® product family revenue in the first quarter of $3.0 million, compared to $3.7 million in the prior year period

oSold 13,300 Cyclo G6 probes, compared to 12,700 in the prior quarter and 13,800 in the prior year quarter

oSold 22 Cyclo G6 Glaucoma Laser Systems, compared to 61 in the prior year quarter

•Retina product revenue was $6.8 million, representing a decrease of 6% year-over-year

•Cash and cash equivalents as of March 30, 2024 was approximately $5.4 million, a reduction of $1.6 million in the quarter

“We saw some of the firming we expected during the first quarter, but longer sales cycles continued into the first quarter and we also experienced another round of end-of-quarter capital equipment purchase deferrals. Fortunately, we are seeing additional firming in the second quarter as well as indications that a good portion of the orders that have been queueing up are expected to ship during the second quarter,” said David Bruce, President and CEO of Iridex.

“In the first quarter, solid growth from the sale of Pascal® scanning laser systems and G6 probes internationally was offset by the deferrals and resulting revenue declines of other products. While the period of capital equipment softness has extended longer than we anticipated, Iridex’s position in our markets remains strong based on the differentiated features and clinical evidence supporting Iridex technology,” continued Mr. Bruce. “Our refreshed retina portfolio, including new Iridex 532® and 577® single spot laser platforms, is generating customer interest that we expect to convert into revenue in upcoming quarters, plus further recovery driven by stabilized reimbursement for glaucoma procedures should improve G6 probe sales.”

Mr. Bruce continued, “Iridex is continuing an active strategic review process and we remain committed to pursuing a transaction or series of transactions that will benefit our stockholders. While the first transaction that we had expected to announce relating to the sale of certain assets will not be going forward, discussions with multiple other parties relating to specific product lines and the entire company are ongoing and will now come to the fore.”

First Quarter 2024 Financial Results

Revenue for the three months ended March 30, 2024 was $11.8 million compared to $13.7 million during the same period of the prior year. Retina product revenue decreased 6% compared to the prior year period to $6.8 million primarily driven primarily by lower medical and surgical system sales, partially offset by higher Pascal system sales. Total product revenue from the Cyclo G6 glaucoma product group was $3.0 million, a decrease of $0.7 million versus the first quarter of 2023, primarily driven by lower system sales, while lower U.S. probe sales were partially offset by a rebound in international probe sales. Other revenue decreased to $2.0 million in the first quarter of 2024 compared to $2.8 million the prior year period, primarily driven by decreased royalties due to the expiration of licensed patents and lower service revenue.

Gross profit for the first quarter of 2024 was $4.5 million or a 37.9% gross margin, a decrease compared to $5.9 million, or a 43.3% gross margin, in the same period of the prior year driven by lower overhead absorption across a reduced revenue base.

Operating expenses of $7.8 million in the first quarter of 2024 decreased compared to $8.3 million due to cost reduction initiatives and partially offset by a $0.4 million increase in legal expenses related to the strategic review process.

Net loss for the first quarter of 2024 was $3.5 million, or $0.21 per share, compared to a net loss of $2.1 million, or $0.13 per share, in the same period of the prior year.

Cash and cash equivalents totaled $5.4 million as of March 30, 2024. Cash use was $1.6 million in the first quarter of 2024.

Webcast and Conference Call Information

Iridex’s management team will host a conference call today beginning at 2:00 p.m. PT / 5:00 p.m. ET. Investors interested in listening to the conference call may do so by accessing the live and recorded webcast on the “Event Calendar” page of the “Investors” section of the Company’s website at www.iridex.com.

About Iridex Corporation

Iridex Corporation is a worldwide leader in developing, manufacturing, and marketing innovative and versatile laser-based medical systems, delivery devices and consumable instrumentation for the ophthalmology market. The Company’s proprietary MicroPulse® technology delivers a differentiated treatment that provides safe, effective, and proven treatment for targeted sight-threatening eye conditions. Iridex’s current product line is used for the treatment of glaucoma and diabetic macular edema (DME) and other retinal diseases. Iridex products are sold in the United States through a direct sales force and internationally primarily through a network of independent distributors into more than 100 countries. For further information, visit the Iridex website at www.iridex.com.

MicroPulse® is a registered trademark of Iridex Corporation, Inc. in the United States, Europe and other jurisdictions. © 2024 Iridex Corporation. All rights reserved.

Safe Harbor Statement

This announcement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934, as amended, including those statements concerning clinical expectations and commercial trends, market adoption and

expansion, value-maximizing transactions, demand for and utilization of the Company's products and results and expected sales volumes. The Company can provide no assurance that it will complete any value-maximizing transactions on behalf of its stockholders. These statements are not guarantees of future performance and actual results may differ materially from those described in these forward-looking statements as a result of a number of factors. Please see a detailed description of these and other risks contained in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 29, 2024. Forward-looking statements contained in this announcement are made as of this date and will not be updated.

Investor Relations Contact

Philip Taylor

Gilmartin Group

investors@iridex.com

IRIDEX Corporation

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 30, 2024 |

|

|

April 1, 2023 |

|

Total revenues |

|

$ |

11,761 |

|

|

$ |

13,706 |

|

Cost of revenues |

|

|

7,303 |

|

|

|

7,768 |

|

Gross profit |

|

|

4,458 |

|

|

|

5,938 |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

|

1,536 |

|

|

|

1,749 |

|

Sales and marketing |

|

|

3,747 |

|

|

|

4,283 |

|

General and administrative |

|

|

2,468 |

|

|

|

2,250 |

|

Total operating expenses |

|

|

7,751 |

|

|

|

8,282 |

|

Loss from operations |

|

|

(3,293 |

) |

|

|

(2,344 |

) |

Other income (expense), net |

|

|

(133 |

) |

|

|

266 |

|

Loss from operations before provision for income taxes |

|

|

(3,426 |

) |

|

|

(2,078 |

) |

Provision for income taxes |

|

|

38 |

|

|

|

12 |

|

Net loss |

|

$ |

(3,464 |

) |

|

$ |

(2,090 |

) |

Net loss per share: |

|

|

|

|

|

|

Basic |

|

$ |

(0.21 |

) |

|

$ |

(0.13 |

) |

Diluted |

|

$ |

(0.21 |

) |

|

$ |

(0.13 |

) |

Weighted average shares used in computing net loss per common share: |

|

|

|

|

|

|

Basic |

|

|

16,253 |

|

|

|

16,001 |

|

Diluted |

|

|

16,253 |

|

|

|

16,001 |

|

IRIDEX Corporation

Condensed Consolidated Balance Sheets

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

March 30, 2024 |

|

|

December 30, 2023 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,419 |

|

|

$ |

7,034 |

|

Accounts receivable, net |

|

|

9,146 |

|

|

|

9,654 |

|

Inventories |

|

|

11,003 |

|

|

|

9,906 |

|

Prepaid expenses and other current assets |

|

|

2,010 |

|

|

|

856 |

|

Total current assets |

|

|

27,578 |

|

|

|

27,450 |

|

Property and equipment, net |

|

|

265 |

|

|

|

351 |

|

Intangible assets, net |

|

|

1,558 |

|

|

|

1,642 |

|

Goodwill |

|

|

965 |

|

|

|

965 |

|

Operating lease right-of-use assets, net |

|

|

2,402 |

|

|

|

2,632 |

|

Other long-term assets |

|

|

1,324 |

|

|

|

1,396 |

|

Total assets |

|

$ |

34,092 |

|

|

$ |

34,436 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

7,991 |

|

|

$ |

4,727 |

|

Accrued compensation |

|

|

2,256 |

|

|

|

1,619 |

|

Accrued expenses |

|

|

1,112 |

|

|

|

1,996 |

|

Other current liabilities |

|

|

1,265 |

|

|

|

1,233 |

|

Deferred revenue, current |

|

|

2,447 |

|

|

|

2,404 |

|

Operating lease liabilities, current |

|

|

995 |

|

|

|

995 |

|

Total current liabilities |

|

|

16,066 |

|

|

|

12,974 |

|

Long-term liabilities: |

|

|

|

|

|

|

Deferred revenue |

|

|

9,708 |

|

|

|

10,025 |

|

Operating lease liabilities |

|

|

1,526 |

|

|

|

1,751 |

|

Other long-term liabilities |

|

|

304 |

|

|

|

164 |

|

Total liabilities |

|

|

27,604 |

|

|

|

24,914 |

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock |

|

|

172 |

|

|

|

172 |

|

Additional paid-in capital |

|

|

88,838 |

|

|

|

88,444 |

|

Accumulated other comprehensive loss |

|

|

(16 |

) |

|

|

(52 |

) |

Accumulated deficit |

|

|

(82,506 |

) |

|

|

(79,042 |

) |

Total stockholders’ equity |

|

|

6,488 |

|

|

|

9,522 |

|

Total liabilities and stockholders’ equity |

|

$ |

34,092 |

|

|

$ |

34,436 |

|

|

|

|

|

|

|

|

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

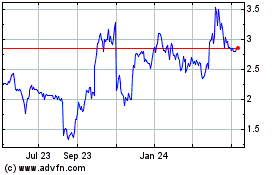

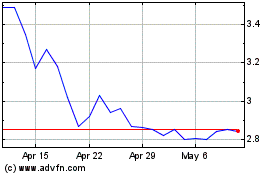

IRIDEX (NASDAQ:IRIX)

Historical Stock Chart

From Apr 2024 to May 2024

IRIDEX (NASDAQ:IRIX)

Historical Stock Chart

From May 2023 to May 2024