Iridex Corporation (Nasdaq: IRIX), a worldwide leader providing

innovative and versatile laser-based medical systems, delivery

devices, and procedure probes for the treatment of glaucoma and

retinal diseases, today reported financial results for the third

quarter ended September 30, 2023 and provided a business update.

Recent Business Updates

- Generated total revenue of $12.9 million, representing flat

sequential quarter revenue and a decrease of 12%

year-over-year

- Cyclo G6® product family revenue in the third quarter of $3.0

million, representing a decrease 12% year-over-year due to reduced

systems sales

- Sold 13,200 Cyclo G6 probes, representing a 3% revenue increase

and 3% unit decrease year-over-year

- Sold 27 Cyclo G6 Glaucoma Laser Systems, compared to 41 in the

second quarter of 2023 and 54 in the prior year period

- Retina product revenue was $7.9 million, representing

sequential growth of 15% and a decrease of 10% year-over-year

- Cash and cash equivalents totaled approximately $8.0 million as

of September 30, 2023

- Announced in late August that the Company is undertaking a

review and evaluation of strategic alternatives to unlock

shareholder value

- Subsequent to the quarter end, five of seven U.S. Medicare

Administrative Contractors (MACs) issued Local Coverage

Determinations that impose additional clinical requirements for

reimbursement of minimally invasive glaucoma surgery (MIGS) device

procedures and for cyclophotocoagulation procedures performed by

the Company’s G6 laser system and probes

“Our third quarter results reflected a seasonally strong rebound

in retina revenue from softness in the first half, but came in

below last year’s third quarter results, reflecting continued

softer environment for capital equipment and the conclusion of a

long-running royalty contract earlier this year,” said David Bruce,

Iridex President and CEO. “While we remain confident in our market

position and continuing opportunities based on our differentiated

retina laser platforms and unique glaucoma products supported by

strong clinical evidence and global user base of thousands of

ophthalmologists, subsequent to the quarter end new restrictions to

parts of US glaucoma Medicare reimbursement were announced,

injecting new challenges in our U.S. glaucoma business. We strongly

disagree with the method used by these MACs in determining these

changes and in the specific coverage criteria that resulted. We are

challenging these restrictions on multiple fronts.”

Third Quarter 2023 Financial ResultsRevenue for

the three months ended September 30, 2023 was $12.9 million

compared to $14.6 million during the same period of the prior year

and flat versus the second quarter. Retina product revenue

decreased 10% compared to the prior year period to $7.9 million,

primarily driven by continued softness in capital equipment demand,

and represents an increase of 15% sequentially compared to the

second quarter of 2023. Total product revenue from the Cyclo G6

glaucoma product group was $3.0 million, a decrease of 12% compared

to the third quarter of 2022 driven entirely by reduced laser

systems, while Cyclo G6 probe revenue grew 3%. Other revenue

decreased to $1.9 million in the third quarter of 2023 compared to

the prior year period of $2.4 million, primarily driven by

decreased royalties due to expiration of licensed patents and lower

service revenue.

Gross profit for the third quarter of 2023 was $5.6 million or a

43.7% gross margin, a decrease compared to $6.5 million, or a 44.1%

gross margin, in the same period of the prior year, and represents

sequential growth of 200 basis points compared to the second

quarter of 2023.

Operating expenses for the third quarter of 2023 decreased to

$7.3 million for the third quarter of 2023 compared to $8.2 million

in the same period of the prior year and $8.3 million in the second

quarter of 2023. The decrease is the result of cost optimization

efforts that began in the second quarter of 2023.

Net loss for the third quarter of 2023 was $1.8 million, or

$0.11 per share, compared to a net loss of $1.8 million, or $0.11

per share, in the same period of the prior year and $2.8 million,

or $0.17 per share in the second quarter of 2023.

Cash and cash equivalents totaled $8.0 million as of September

30, 2023. Cash use of $1.8 million in the third quarter increased

compared to $1.2 million in the second quarter of 2023. Balance

sheet shifts affected cash usage in the quarter as previously

announced operating cost reductions and inventory reductions to

reduce cash usage were offset by a $1.7 million reduction in

accounts payable. We expect to continue making progress with

inventory reductions and expect fourth quarter cash usage to be

significantly less than the third quarter.

Glaucoma Reimbursement Developments Between

October 24th and November 9th, five of the seven Medicare

Administrative Contractors (“MACs”) that manage part of US Medicare

coverage in the U.S. published “Local Coverage Determination” (the

“LCDs”), that become effective December 24, 2023. The new LCDs

primarily targeted Minimally Invasive Glaucoma Surgery (MIGS)

procedures and devices, however also significantly restricted the

criteria for coverage of cyclophotocoagulation reimbursement, the

procedures which utilize Iridex’s G6 laser system and probes, for

glaucoma patients.

After consultation with expert external advisors, Iridex

believes that the LCDs will likely be interpreted to materially

limit the patient types for which the respective MACs will

reimburse cyclophotocoagulation procedures.

Iridex has been in contact with a number of societies and

individual physicians who communicated concern over the potential

limitation in the range of their patients covered for transscleral

cyclophotocoagulation laser treatment. Iridex intends to appeal the

restrictive criteria of the LCDs and to engage with the MACs to

distinguish the clinical justification between non-incisional

transscleral cyclophotocoagulation procedures and the alternative

incisional surgical MIGS procedures.

At this time, Iridex cannot accurately predict the impact these

LCDs coverage changes will have on its glaucoma business.

Approximately two-thirds of our total U.S. glaucoma procedure

volume is performed in regions covered by the five MACs that issued

LCDs. The American Glaucoma Society estimates 60% of U.S. glaucoma

patients are covered by Medicare, and among Medicare patients,

approximately half are covered by MACs, with the other half

enrolled in Medicare Advantage plans who have not restricted the

coverage criteria for cyclophotocoagulation. This implies about 20%

of U.S. procedures fall directly under the coverage restrictions,

with our glaucoma procedures for the most severe patients least

affected and those for more moderate stage most affected. At this

time, it is uncertain how physicians will react to coverage

reductions and their decisions to offer our treatments to patients.

Iridex is working to educate physicians about specific patient

coverage ratios in their practice area and to support continued use

and further expand adoption of our procedures where coverage for

the devices and related procedures is maintained. Outside the U.S.,

which accounts for approximately 50% of Iridex glaucoma revenue, no

material impact to the business is expected.

“Our top priority is maintaining fair market access to the

procedures performed by the G6 laser platform following the

recently issued LCDs. We disagree with the restrictive criteria

defined to deem the procedures medically necessary and are

collaborating with industry stakeholders to have the coverage

policies appealed to reflect the extensive clinical evidence in

support of cyclophotocoagulation procedures. We have submitted an

appeal for correction based on inconsistency between the

conclusions of the referenced studies and the final coverage

restrictions. Among other unintended consequences, we believe that

by limiting coverage of our MicroPulse and continuous-wave

procedures, the LCDs have the potential to direct more patients

into higher risk surgical procedures that both increase the

potential for complications in patients, increase the total cost of

care and decrease overall patient welfare,” said David Bruce,

Iridex President and CEO. “As we work to retain full coverage of

CPC in the affected MAC regions, we remain focused on our

initiatives to accelerate G6 probe adoption in the covered

population, including advancing our large multicenter prospective

trial to further validate the safety and effectiveness of MPTLT

procedures. We have high confidence that the efficacy and safety of

or procedures will prevail, and the increased clinician awareness

generated through this process can provide increased exposure to

position MPTLT solidly as a key non-incisional procedure in the

glaucoma continuum of care.”

Guidance Withdrawn for Full Year 2023Iridex

cannot accurately predict the impact to our glaucoma probes and

system sales that will result from the reimbursement changes of the

five LCDs as our customers and prospects evaluate their usage of

probes and system purchases. Given this uncertainty, guidance has

been withdrawn as the impact to Cyclo G6 system and probe sales is

evaluated further.

Strategic Review to Unlock Shareholder ValueIn

August 2023, the Iridex board of directors announced it is

conducting, in consultation with its financial and legal advisors,

a review and evaluation of strategic alternatives that may be

available to the Company to unlock shareholder value. Iridex has

engaged Piper Sandler to act as financial advisor in connection

with the strategic review process.

Scott Shuda, Chairman of the board of directors, commented on

the strategic review process, “As a public company, Iridex must

always seek to maximize shareholder value. Iridex’s product

offerings today are stronger than they have ever been, and the

board believes this is an appropriate time to explore strategic

options for the future of each of our product lines.”

Webcast and Conference Call InformationIridex’s

management team will host a conference call today beginning at 2:00

p.m. PT / 5:00 p.m. ET. Investors interested in listening to the

conference call may do so by accessing the live and recorded

webcast on the “Event Calendar” page of the “Investors” section of

the Company’s website at www.iridex.com.

About IridexIridex Corporation is a

worldwide leader in developing, manufacturing, and marketing

innovative and versatile laser-based medical systems, delivery

devices and consumable instrumentation for the ophthalmology

market. The Company’s proprietary MicroPulse® technology delivers a

differentiated treatment that provides safe, effective, and proven

treatment for targeted sight-threatening eye conditions. Iridex’s

current product line is used for the treatment of glaucoma and

diabetic macular edema (DME) and other retinal diseases. Iridex

products are sold in the United States through a direct sales force

and internationally primarily through a network of independent

distributors into more than 100 countries. For further information,

visit the Iridex website at www.iridex.com.

Safe Harbor StatementThis announcement contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Act of 1934, as amended, including those statements

concerning clinical expectations and commercial trends, market

adoption and expansion, demand for and utilization of the Company's

products and results and expected sales volumes. These statements

are not guarantees of future performance and actual results may

differ materially from those described in these forward-looking

statements as a result of a number of factors. Please see a

detailed description of these and other risks contained in our

Quarterly Report on Form 10-Q filed with the Securities and

Exchange Commission on August 10, 2023. Forward-looking statements

contained in this announcement are made as of this date and will

not be updated.

Investor Relations ContactPhilip

TaylorGilmartin Groupinvestors@iridex.com

IRIDEX

CorporationCondensed Consolidated Statements of

Operations(In thousands, except per share

data)(unaudited)

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, 2023 |

|

October 1, 2022 |

|

September 30, 2023 |

|

October 1, 2022 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

$ |

12,850 |

|

|

$ |

14,635 |

|

|

$ |

39,411 |

|

|

$ |

41,777 |

|

| Cost of revenues |

|

7,229 |

|

|

|

8,175 |

|

|

|

22,489 |

|

|

|

23,073 |

|

|

Gross profit |

|

5,621 |

|

|

|

6,460 |

|

|

|

16,922 |

|

|

|

18,704 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

1,541 |

|

|

|

1,687 |

|

|

|

5,135 |

|

|

|

5,725 |

|

| Sales and marketing |

|

3,823 |

|

|

|

4,445 |

|

|

|

12,370 |

|

|

|

13,352 |

|

| General and

administrative |

|

1,945 |

|

|

|

2,023 |

|

|

|

6,343 |

|

|

|

5,759 |

|

|

Total operating expenses |

|

7,309 |

|

|

|

8,155 |

|

|

|

23,848 |

|

|

|

24,836 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

(1,688 |

) |

|

|

(1,695 |

) |

|

|

(6,926 |

) |

|

|

(6,132 |

) |

| Other income (expense),

net |

|

(58 |

) |

|

|

(58 |

) |

|

|

346 |

|

|

|

(216 |

) |

| Loss from operations before

provision for income taxes |

|

(1,746 |

) |

|

|

(1,753 |

) |

|

|

(6,580 |

) |

|

|

(6,348 |

) |

| Provision for income

taxes |

|

8 |

|

|

|

14 |

|

|

|

30 |

|

|

|

51 |

|

| Net loss |

$ |

(1,754 |

) |

|

$ |

(1,767 |

) |

|

$ |

(6,610 |

) |

|

$ |

(6,399 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.11 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.40 |

) |

|

Diluted |

$ |

(0.11 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.40 |

) |

| Weighted average shares used

in computing net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

16,231 |

|

|

|

15,986 |

|

|

|

16,089 |

|

|

|

15,921 |

|

|

Diluted |

|

16,231 |

|

|

|

15,986 |

|

|

|

16,089 |

|

|

|

15,921 |

|

|

IRIDEX CorporationCondensed Consolidated

Balance Sheets(In thousands and unaudited) |

| |

| |

September 30, |

|

|

December 31, |

|

| |

2023 |

|

|

2022 |

|

|

Assets |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

7,981 |

|

|

$ |

13,922 |

|

|

Accounts receivable, net |

|

8,114 |

|

|

|

9,768 |

|

|

Inventories |

|

10,118 |

|

|

|

10,608 |

|

|

Prepaid expenses and other current assets |

|

1,129 |

|

|

|

1,468 |

|

| Total current assets |

|

27,342 |

|

|

|

35,766 |

|

| Property and equipment,

net |

|

524 |

|

|

|

462 |

|

| Intangible assets, net |

|

1,726 |

|

|

|

1,977 |

|

| Goodwill |

|

965 |

|

|

|

965 |

|

| Operating lease right-of-use

assets, net |

|

2,789 |

|

|

|

1,665 |

|

| Other long-term assets |

|

1,603 |

|

|

|

1,455 |

|

| Total assets |

$ |

34,949 |

|

|

$ |

42,290 |

|

| |

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

2,613 |

|

|

$ |

3,873 |

|

|

Accrued compensation |

|

2,197 |

|

|

|

2,448 |

|

|

Accrued expenses |

|

1,171 |

|

|

|

1,548 |

|

|

Other current liabilities |

|

886 |

|

|

|

968 |

|

|

Accrued warranty |

|

247 |

|

|

|

168 |

|

|

Deferred revenue |

|

2,239 |

|

|

|

2,411 |

|

|

Operating lease liabilities |

|

995 |

|

|

|

1,037 |

|

| Total current liabilities |

|

10,348 |

|

|

|

12,453 |

|

| |

|

|

|

|

|

|

|

| Long-term liabilities: |

|

|

|

|

|

|

|

|

Deferred revenue |

|

10,472 |

|

|

|

11,742 |

|

|

Other long-term liabilities |

|

2,065 |

|

|

|

864 |

|

| Total liabilities |

|

22,885 |

|

|

|

25,059 |

|

| |

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

Common stock |

|

172 |

|

|

|

169 |

|

|

Additional paid-in capital |

|

87,993 |

|

|

|

86,802 |

|

|

Accumulated other comprehensive loss |

|

(19 |

) |

|

|

(24 |

) |

|

Accumulated deficit |

|

(76,082 |

) |

|

|

(69,716 |

) |

|

Total stockholders' equity |

|

12,064 |

|

|

|

17,231 |

|

| Total liabilities and

stockholders' equity |

$ |

34,949 |

|

|

$ |

42,290 |

|

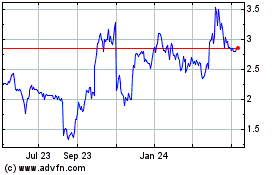

IRIDEX (NASDAQ:IRIX)

Historical Stock Chart

From Nov 2024 to Dec 2024

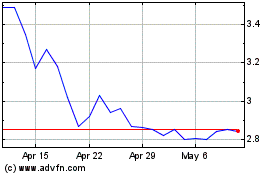

IRIDEX (NASDAQ:IRIX)

Historical Stock Chart

From Dec 2023 to Dec 2024