IREN closes $440 million convertible notes offering

December 06 2024 - 4:21PM

IREN Limited (NASDAQ: IREN) (ACN 629 842 799) (“IREN”) today

announced the closing of its offering of $440 million aggregate

principal amount of 3.25% convertible senior notes due 2030 (the

“notes”) in a private offering to persons reasonably believed to be

qualified institutional buyers pursuant to Rule 144A under the

Securities Act of 1933, as amended (the “Securities Act”).

Key details of the transaction

- Oversubscribed and upsized from $300 million to $400 million,

plus $40 million greenshoe

- Net proceeds of approximately $425.4 million

- 3.25% coupon, 30% conversion premium

- Capped call transactions entered into in connection with the

notes are generally expected to provide a hedge upon conversions up

to an initial cap price of $25.86 per share, which represents a

100% premium (as compared to the 30% conversion premium under the

notes)

- Citigroup Global Markets Inc and J.P. Morgan Securities LLC

acted as joint bookrunners

Oversubscribed and upsized

In response to strong investor demand, IREN upsized the initial

offering size of $300.0 million aggregate principal amount of notes

to $400.0 million, and the initial purchasers fully exercised their

option to purchase an additional $40.0 million aggregate principal

amount of the notes. The notes were issued pursuant to, and are

governed by, an indenture, dated as of December 6, 2024, between

IREN and U.S. Bank Trust Company, National Association, as

trustee.

Use of proceeds

The net proceeds from the offering are approximately $425.4

million, after deducting the initial purchasers’ discounts and

commissions and IREN’s estimated offering expenses.

IREN intends to use the net proceeds as follows:

- $44.4 million to fund the cost of the capped call transactions

(described below)

- $73.7 million to fund the cost of the prepaid forward

transaction (described below)

- General corporate purposes and working capital

Capped call transactions

In connection with the pricing of the notes and the exercise by

the initial purchasers of their option to purchase additional

notes, IREN entered into privately negotiated capped call

transactions with certain of the initial purchasers or their

affiliates and certain other financial institutions (the “option

counterparties”). The capped call transactions cover, subject to

anti-dilution adjustments, the number of ordinary shares of IREN

that initially underlie the notes. The cap price of the capped call

transactions is initially $25.86 per share, which represents a

premium of 100% over the last reported sale price of IREN’s

ordinary shares of $12.93 per share on December 3, 2024, and is

subject to certain adjustments under the terms of the capped call

transactions.

The capped call transactions are expected to generally reduce

the potential dilution to IREN’s ordinary shares upon any

conversion of the notes and/or offset any potential cash payments

IREN is required to make in excess of the principal amount of

converted notes, as the case may be, with such offset and/or

reduction subject to a cap price. If, however, the market price per

ordinary share of IREN, as measured under the terms of the capped

call transactions, exceeds the cap price of the capped call

transactions, there would nevertheless be dilution and/or there

would not be an offset of such potential cash payments, in each

case, to the extent that such market price exceeds the cap price of

the capped call transactions. The capped call transactions will be

solely cash settled unless certain conditions are satisfied.

Prepaid forward transactions

In connection with the pricing of the notes, IREN also entered

into a prepaid forward share purchase transaction (the “prepaid

forward transaction”) with one of the initial purchasers of the

notes or its affiliate (the “forward counterparty”), pursuant to

which IREN purchased approximately $73.7 million of its ordinary

shares (based on the last reported sale price of IREN’s ordinary

shares on the pricing date), for settlement shortly after the

maturity date of the notes, subject to any early settlement, in

whole or in part, of the prepaid forward transaction. The prepaid

forward transaction will be solely cash settled unless certain

conditions are satisfied.

The prepaid forward transaction is generally intended to

facilitate privately negotiated derivative transactions, including

swaps, between the forward counterparty or its affiliates and

investors in the notes relating to IREN’s ordinary shares by which

investors in the notes will establish short positions relating to

IREN’s ordinary shares and otherwise hedge their investments in the

notes. As a result, the prepaid forward transaction is expected to

allow the investors to establish short positions that generally

correspond to (but may be greater than) commercially reasonable

initial hedges of their investment in the notes. In the event of

such greater initial hedges, investors may offset such greater

portion by purchasing IREN’s ordinary shares on or shortly after

the day IREN prices the notes.

No registration

The notes were only offered and sold to persons reasonably

believed to be qualified institutional buyers pursuant to Rule 144A

under the Securities Act. The offer and sale of the notes and any

of IREN’s ordinary shares issuable upon conversion of the notes

have not been, and will not be, registered under the Securities Act

or any other securities laws, and the notes and any such shares

cannot be offered or sold except pursuant to an exemption from, or

in a transaction not subject to, the registration requirements of

the Securities Act and any other applicable securities laws. This

press release does not constitute an offer to sell, or the

solicitation of an offer to buy, the notes or any of IREN’s

ordinary shares issuable upon conversion of the notes, nor will

there be any sale of the notes or any such shares, in any state or

other jurisdiction (including the United States and Australia) in

which such offer, sale or solicitation would be unlawful.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements regarding the completion of the offering

and the expected amount and intended use of the net proceeds.

Forward-looking statements represent IREN’s current expectations,

beliefs, and projections regarding future events and are subject to

known and unknown uncertainties, risks, assumptions and

contingencies, many of which are outside IREN’s control and that

could cause actual results to differ materially from those

described in or implied by the forward-looking statements. Among

those risks and uncertainties are market conditions and risks

relating to IREN’s business, including those described in periodic

reports that IREN files from time to time with the SEC. IREN cannot

provide any assurances regarding its ability to effectively apply

the net proceeds after funding the cost of entering into the capped

call transactions and financing the prepaid forward as described

above. The forward-looking statements included in this press

release speak only as of the date of this press release, and IREN

does not undertake any obligation to update the forward-looking

statements included in this press release for subsequent

developments, except as may be required by law. For a further

discussion of factors that could cause IREN’s future results to

differ materially from any forward-looking statements, see the

section entitled “Risk Factors” in IREN’s Annual Report on Form

20-F for the year ended June 30, 2024 and other risks described in

documents filed by IREN from time to time with the Securities and

Exchange Commission.

About IREN

IREN is a leading data center business powering the future of

Bitcoin, AI and beyond utilizing 100% renewable energy.

- Bitcoin Mining: providing security to the Bitcoin network,

expanding to 50 EH/s in H1 2025. Operations since 2019.

- AI Cloud Services: providing cloud compute to AI customers,

1,896 NVIDIA H100 & H200 GPUs. Operations since 2024.

- Next-Generation Data Centers: 460MW of operating data centers,

expanding to 810MW in H1 2025. Specifically designed and

purpose-built infrastructure for high-performance and power-dense

computing applications.

- Technology: technology stack for performance optimization of AI

Cloud Services and Bitcoin Mining operations.

- Development Portfolio: 2,310MW of grid-connected power secured

across North America, >2,000 acre property portfolio and

additional development pipeline.

- 100% Renewable Energy (from clean or renewable energy sources

or through the purchase of RECs): targets sites with low-cost &

underutilized renewable energy, and supports electrical grids and

local communities.

Contacts

|

MediaJon Snowball Sodali & Co+61 477 946

068Megan BolesAircover Communications+1 562 537 7131 |

InvestorsLincoln Tan IREN+61 407 423

395lincoln.tan@iren.com |

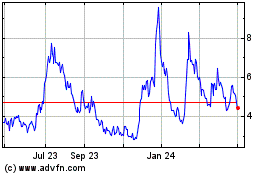

IREN (NASDAQ:IREN)

Historical Stock Chart

From Nov 2024 to Dec 2024

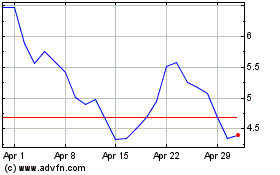

IREN (NASDAQ:IREN)

Historical Stock Chart

From Dec 2023 to Dec 2024