IREN Limited (NASDAQ: IREN) (ACN 629 842 799) (“IREN”) today

announced the pricing of its offering of $400 million aggregate

principal amount of 3.25% convertible senior notes due 2030 (the

“notes”) in a private offering to persons reasonably believed to be

qualified institutional buyers pursuant to Rule 144A under the

Securities Act of 1933, as amended (the “Securities Act”).

Key details of the transaction

- $400 million

convertible senior notes offering (3.25% coupon, 30% conversion

premium)

- Offering size was

increased from the previously announced offering size of $300

million aggregate principal amount of notes

- Capped call

transactions entered into in connection with the notes, which are

expected generally to provide a hedge upon conversions up to an

initial cap price of $25.86 per share, which represents a 100%

premium (as compared to the 30% conversion premium under the

notes)

The issuance and sale of the notes are scheduled to settle on

December 6, 2024, subject to customary closing conditions. IREN

also granted the initial purchasers of the notes an option to

purchase, for settlement within a period of 13 days from, and

including, the date the notes are first issued, up to an additional

$40 million principal amount of notes.

Use of proceeds

IREN estimates that the net proceeds from the offering will be

approximately $386.5 million (or approximately $425.4 million if

the initial purchasers fully exercise their option to purchase

additional notes), after deducting the initial purchasers’

discounts and commissions and IREN’s estimated offering

expenses.

IREN intends to use approximately $40.3 million of the net

proceeds to fund the cost of entering into the capped call

transactions described below, approximately $75.9 million to fund

the cost of entering into the prepaid forward transaction described

below and the remainder of the net proceeds from the offering for

general corporate purposes and working capital.

Additional transaction details

The notes will be senior, unsecured obligations of IREN and will

accrue interest at a rate of 3.25% per annum, payable semi-annually

in arrears on June 15 and December 15 of each year, beginning on

June 15, 2025. The notes will mature on June 15, 2030, unless

earlier repurchased, redeemed or converted. Before March 15, 2030,

noteholders will have the right to convert their notes only upon

the occurrence of certain events. From and after March 15, 2030,

noteholders may convert their notes at any time at their election

until the close of business on the second scheduled trading day

immediately before the maturity date. IREN will settle conversions

by paying or delivering, as the case may be, cash, its ordinary

shares or a combination of cash and its ordinary shares, at its

election. The initial conversion rate is 59.4919 ordinary shares

per $1,000 principal amount of notes, which represents an initial

conversion price of approximately $16.81 per ordinary share. The

initial conversion price represents a premium of approximately 30%

over the last reported sale price of $12.93 per share of IREN’s

ordinary shares on December 3, 2024. The conversion rate and

conversion price will be subject to adjustment upon the occurrence

of certain events.

The notes will be redeemable, in whole or in part (subject to

certain limitations), for cash at IREN’s option, on or after

December 20, 2027 and on or before the 30th scheduled trading day

immediately before the maturity date, but only if the last reported

sale price per share of IREN’s ordinary shares exceeds 130% of the

conversion price for a specified period of time and certain other

conditions are satisfied. The redemption price will be equal to the

principal amount of the notes to be redeemed, plus accrued and

unpaid interest, if any, to, but excluding, the redemption

date.

If a “fundamental change” (as defined in the indenture for the

notes) occurs, then, subject to a limited exception, noteholders

may require IREN to repurchase their notes for cash. The repurchase

price will be equal to the principal amount of the notes to be

repurchased, plus accrued and unpaid interest, if any, to, but

excluding, the applicable repurchase date.

Capped call transactions

In connection with the pricing of the notes, IREN entered into

privately negotiated capped call transactions with one or more of

the initial purchasers or their affiliates and/or one or more other

financial institutions (the “option counterparties”). The capped

call transactions cover, subject to anti-dilution adjustments, the

number of ordinary shares of IREN that initially underlie the

notes. If the initial purchasers exercise their option to purchase

additional notes, then IREN expects to enter into additional capped

call transactions with the option

counterparties.

The cap price of the capped call transactions is initially

$25.86 per share, which represents a premium of 100% over the last

reported sale price of IREN’s ordinary shares of $12.93 per share

on December 3, 2024, and is subject to certain adjustments under

the terms of the capped call transactions.

The capped call transactions are expected generally to reduce

the potential dilution to IREN’s ordinary shares upon any

conversion of the notes and/or offset any potential cash payments

IREN is required to make in excess of the principal amount of

converted notes, as the case may be, with such offset and/or

reduction subject to a cap price. If, however, the market price per

ordinary share of IREN, as measured under the terms of the capped

call transactions, exceeds the cap price of the capped call

transactions, there would nevertheless be dilution and/or there

would not be an offset of such potential cash payments, in each

case, to the extent that such market price exceeds the cap price of

the capped call transactions. In addition, the capped call

transactions will be solely cash settled until IREN receives

shareholder approval to repurchase its ordinary shares pursuant to

the terms of the capped call transactions or is otherwise permitted

to repurchase its ordinary shares pursuant to the terms of the

capped call transactions under the laws of its jurisdiction of

incorporation. The Company retains flexibility to seek and/or renew

such approval from time to time during the terms of the capped call

transactions at a general meeting or future annual general

meeting.

IREN has been advised that, in connection with establishing

their initial hedges of the capped call transactions, the option

counterparties or their respective affiliates expect to enter into

various derivative transactions with respect to IREN’s ordinary

shares and/or purchase the ordinary shares of IREN concurrently

with or shortly after the pricing of the notes. This activity could

increase (or reduce the size of any decrease in) the market price

of IREN’s ordinary shares or the notes at that time. Any such

trades by the option counterparties or their respective affiliates

would be on a principal basis and without any agreement,

arrangement or understanding between, or with, IREN on how those

parties would hedge their own positions.

In addition, the option counterparties and/or their respective

affiliates may modify their hedge positions by entering into or

unwinding various derivatives with respect to IREN’s ordinary

shares and/or purchasing or selling IREN’s ordinary shares or other

securities of IREN in secondary market transactions following the

pricing of the notes and prior to the maturity of the notes (and

are likely to do so (x) on each exercise date for the capped call

transactions, which are expected to occur on each trading day

during the 30 trading day period beginning on the 31st scheduled

trading day prior to the maturity date of the notes and (y)

following any early conversion of the notes or any repurchase of

the notes by IREN on any fundamental change repurchase date, any

redemption date or any other date on which the notes are

repurchased by IREN, in each case if IREN exercises the relevant

election to terminate the corresponding portion of the capped call

transactions). This activity could also cause or avoid an increase

or a decrease in the market price of IREN’s ordinary shares or the

notes, which could affect the ability of noteholders to convert the

notes, and, to the extent the activity occurs following a

conversion or during any observation period related to a conversion

of the notes, it could affect the number of IREN’s ordinary shares

and value of the consideration that noteholders will receive upon

conversion of the notes.

Prepaid forward transaction

In connection with the pricing of the notes, IREN also entered

into a prepaid forward share purchase transaction (the “prepaid

forward transaction”) with one of the initial purchasers of the

notes or its affiliate (the “forward counterparty”), pursuant to

which IREN will purchase approximately $75.9 million of its

ordinary shares (based on the last reported sale price of IREN’s

ordinary shares on the pricing date), for settlement on the date

that is shortly after the maturity date of the notes, subject to

any early settlement, in whole or in part, of the prepaid forward

transaction. The prepaid forward transaction will be solely cash

settled until IREN receives shareholder approval to repurchase its

ordinary shares pursuant to the terms of the prepaid forward

transaction or is otherwise permitted to repurchase its ordinary

shares pursuant to the terms of the prepaid forward transaction

under the laws of its jurisdiction of incorporation.

The prepaid forward transaction is generally intended to

facilitate privately negotiated derivative transactions, including

swaps, between the forward counterparty or its affiliates and

investors in the notes relating to IREN’s ordinary shares by which

investors in the notes will establish short positions relating to

IREN’s ordinary shares and otherwise hedge their investments in the

notes. As a result, the prepaid forward transaction is expected to

allow the investors to establish short positions that generally

correspond to (but may be greater than) commercially reasonable

initial hedges of their investment in the notes. In the event of

such greater initial hedges, investors may offset such greater

portion by purchasing IREN’s ordinary shares on or shortly after

the day IREN prices the notes. Facilitating investors’ hedge

positions by entering into the prepaid forward transaction,

particularly if investors purchase IREN’s ordinary shares on or

shortly after the pricing date, could increase (or reduce the size

of any decrease in) the market price of IREN’s ordinary shares and

effectively raise the initial conversion price of the notes. In

connection with establishing their initial hedges of the prepaid

forward transaction, the forward counterparty or its affiliates may

enter into one or more derivative transactions with respect to

IREN’s ordinary shares with the investors of the notes concurrently

with or after the pricing of the notes. Any such trades by the

forward counterparty or its affiliates would be on a principal

basis and without any agreement, arrangement or understanding

between, or with, IREN on how those parties would hedge their own

positions. IREN’s entry into the prepaid forward transaction with

the forward counterparty and the entry by the forward counterparty

into derivative transactions in respect of IREN’s ordinary shares

with the investors of the notes could have the effect of increasing

(or reducing the size of any decrease in) the market price of

IREN’s ordinary shares concurrently with, or shortly after, the

pricing of the notes and effectively raising the initial conversion

price of the notes.

Neither IREN nor the forward counterparty will control how

investors of the notes may use such derivative transactions. In

addition, such investors may enter into other transactions relating

to IREN’s ordinary shares or the notes in connection with or in

addition to such derivative transactions, including the purchase or

sale of IREN’s ordinary shares. As a result, the existence of the

prepaid forward transaction, such derivative transactions and any

related market activity could cause more purchases or sales of

IREN’s ordinary shares over the term of the prepaid forward

transaction than there otherwise would have been had IREN not

entered into the prepaid forward transaction. Such purchases or

sales could potentially increase (or reduce the size of any

decrease in) or decrease (or reduce the size of any increase in)

the market price of IREN’s ordinary shares and/or the price of the

notes.

In addition, the forward counterparty or its affiliates may

modify their hedge positions by entering into or unwinding one or

more derivative transactions with respect to IREN’s ordinary shares

and/or purchasing or selling IREN’s ordinary shares or other

securities of IREN in secondary market transactions at any time

following the pricing of the notes and prior to the maturity of the

notes. These activities could also cause or avoid an increase or a

decrease in the market price of IREN’s ordinary shares or the

notes, which could affect the ability of noteholders to convert the

notes and, to the extent the activity occurs following conversion

or during any observation period related to a conversion of notes,

it could affect the amount and value of the consideration that

noteholders will receive upon conversion of the notes.

The offer and sale of the notes and any of IREN’s ordinary

shares issuable upon conversion of the notes have not been, and

will not be, registered under the Securities Act or any other

securities laws, and the notes and any such shares cannot be

offered or sold except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and any other applicable securities laws.

This press release does not constitute an offer to sell, or the

solicitation of an offer to buy, the notes or any of IREN’s

ordinary shares issuable upon conversion of the notes, nor will

there be any sale of the notes or any such shares, in any state or

other jurisdiction (including the United States and Australia) in

which such offer, sale or solicitation would be unlawful.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements regarding the completion of the offering

and the expected amount and intended use of the net proceeds.

Forward-looking statements represent IREN’s current expectations,

beliefs, and projections regarding future events and are subject to

known and unknown uncertainties, risks, assumptions and

contingencies, many of which are outside IREN’s control and that

could cause actual results to differ materially from those

described in or implied by the forward-looking statements. Among

those risks and uncertainties are market conditions, the

satisfaction of the closing conditions related to the offering and

risks relating to IREN’s business, including those described in

periodic reports that IREN files from time to time with the SEC.

IREN may not consummate the offering described in this press

release and, if the offering is consummated, cannot provide any

assurances regarding its ability to effectively apply the net

proceeds after funding the cost of entering into the capped call

transactions and financing the prepaid forward as described above.

The forward-looking statements included in this press release speak

only as of the date of this press release, and IREN does not

undertake any obligation to update the forward-looking statements

included in this press release for subsequent developments, except

as may be required by law. For a further discussion of factors that

could cause IREN’s future results to differ materially from any

forward-looking statements, see the section entitled “Risk Factors”

in IREN’s Annual Report on Form 20-F for the year ended June 30,

2024 and other risks described in documents filed by IREN from time

to time with the Securities and Exchange Commission.

About IREN

IREN is a leading data center business powering the future of

Bitcoin, AI and beyond utilizing 100% renewable energy.

- Bitcoin Mining:

providing security to the Bitcoin network, expanding to 50 EH/s in

H1 2025. Operations since 2019.

- AI Cloud Services:

providing cloud compute to AI customers, 1,896 NVIDIA H100 &

H200 GPUs. Operations since 2024.

- Next-Generation Data

Centers: 460MW of operating data centers, expanding to 810MW in H1

2025. Specifically designed and purpose-built infrastructure for

high-performance and power-dense computing applications.

- Technology:

technology stack for performance optimization of AI Cloud Services

and Bitcoin Mining operations.

- Development

Portfolio: 2,310MW of grid-connected power secured across North

America, >2,000 acre property portfolio and additional

development pipeline.

- 100% Renewable

Energy (from clean or renewable energy sources or through the

purchase of RECs): targets sites with low-cost & underutilized

renewable energy, and supports electrical grids and local

communities.

Contacts

|

MediaJon SnowballSodali & Co+61 477 946

068Megan BolesAircover Communications+1 562 537 7131 |

InvestorsLincoln Tan IREN+61 407 423

395lincoln.tan@iren.com |

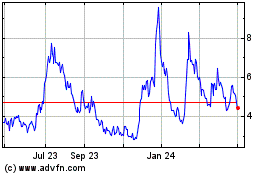

IREN (NASDAQ:IREN)

Historical Stock Chart

From Nov 2024 to Dec 2024

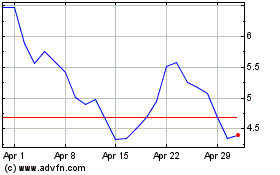

IREN (NASDAQ:IREN)

Historical Stock Chart

From Dec 2023 to Dec 2024