0000736012

true

Client had edits

0000736012

2023-09-18

2023-09-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

Table of Contents

As filed with the U.S. Securities and Exchange

Commission on September 18, 2023

Registration No. 333-273930

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective

Amendment No. 2

to

Form S-1/A

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

INTRUSION INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

3576 |

|

75-1911917 |

|

(State or other jurisdiction

of incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

101 East Park Blvd, Suite 1200

Plano, Texas 75074

Telephone: (972) 234-6400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Anthony Scott

Chief Executive Officer

Intrusion Inc.

101 East Park Blvd, Suite 1200

Plano, Texas 75074

Telephone: (972) 234-6400

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

|

Laura Anthony, Esq.

Craig D. Linder, Esq.

Anthony L.G., PLLC

625 N. Flagler Drive, Suite 600

West Palm Beach, Florida 33401

Telephone: (561) 514-0936 |

|

Robert F. Charron, Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas

New York, New York 10105

Telephone: (212) 370-1300

|

Approximate date of commencement of proposed sale

to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.

☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check

market if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a)

may determine.

The information in this preliminary

prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities

and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer

to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

DATED SEPTEMBER 18, 2023

Preliminary Prospectus

Intrusion Inc.

Up to 23,750,000 Units, each consisting

of

One Share of Common Stock or One Pre-Funded

Warrant to Purchase One Share of Common Stock

and

One Warrant to Purchase One Share of Common

Stock

Placement Agent Warrants to Purchase up to

2,375,000 Shares of Common Stock

Up to 49,875,000 Shares of Common Stock

Underlying the Warrants,

Pre-Funded Warrants, and Placement Agent Warrants

We are offering up to 23,750,000

units (“Units”), each Unit consisting of (i) one share of common stock, par value $0.01 per share, and (ii) one warrant

with a five-year term to purchase one share of common stock at an exercise price of $0.44 per share (110% of the offering price

per Unit) (“Warrant”) on a best-efforts basis. We are offering each Unit at an assumed public offering price of $0.40 per

Unit, equal to the closing price of our common stock on the Nasdaq Capital Market on September 15, 2023. Each Warrant will be

immediately exercisable for one share of common stock at an assumed exercise price of $0.44 per share (not less than 110% of the

public offering price of each Unit sold in this offering). The actual public offering price per Unit will be determined between us, Joseph

Gunnar & Co., LLC (“Joseph Gunnar” or the “Placement Agent”) and the investors in the offering, and may be

at a discount to the current market price of our common stock. Therefore, the assumed public offering price used throughout this prospectus

may not be indicative of the final offering price.

We are also offering to each

purchaser of Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common

stock immediately following the consummation of this offering, the opportunity to purchase Units consisting of one pre-funded warrant

to purchase one share of common stock (“Pre-Funded Warrant”) (in lieu of one share of common stock) and one Warrant. Subject

to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the

holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be

increased to up to 9.99%) of the number of common stock outstanding immediately after giving effect to such exercise. Each Pre-Funded

Warrant will be exercisable for one share of common stock. The purchase price of each Unit including a Pre-Funded Warrant will be equal

to the price per Unit including one share of common stock, minus $0.001, and the remaining exercise price of each Pre-Funded Warrant will

equal $0.001 per share. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised

at any time until all of the Pre-Funded Warrants are exercised in full. For each Unit including a Pre-Funded Warrant we sell (without

regard to any limitation on exercise set forth therein), the number of Units including a share of common stock we are offering will be

decreased on a one-for-one basis. The common stock and Pre-Funded Warrants, if any, can each be purchased in this offering only with the

accompanying Warrant as part of a Unit, but the components of the Units will immediately separate upon issuance. We are also registering

the common stock issuable from time to time upon exercise of the Pre-Funded Warrants and the Warrants included in the Units offered hereby.

See “Description of Securities — Description of Securities We Are Offering” in this prospectus for more

information.

This offering will terminate

on ____________, 2023, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date.

We will have one closing for all the securities purchased in this offering. The public offering price per Unit will be fixed for the duration

of this offering.

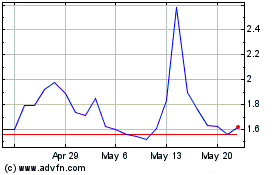

Our common stock is listed

on the Nasdaq Capital Market (“Nasdaq”) under the symbol “INTZ”. On September 15, 2023, the closing sale

price of our common stock was $0.40 per share, as reported by Nasdaq.

There is no established

trading market for the Units, Pre-Funded Warrants, or the Warrants. We have applied to list the Warrants (forming part of the

Units offered hereby) on the Nasdaq under the symbol “INTZW.” We do not intend to list the Units or Pre-Funded Warrants on

any securities exchange or other trading market. We do not expect an active trading market to develop for the Units or Pre-Funded Warrants.

Without an active trading market, the liquidity of these securities will be limited.

We are also seeking to register

the issuance of Warrants to purchase 2,375,000 shares of common stock (the “Placement Agent Warrants”) to the Placement

Agent (including the common stock forming part of the Units and the common stock underlying the Warrants and Pre-Funded Warrants forming

part of the Units) (assuming the Units are only sold to investors introduced by the Placement Agent), as well as 2,375,000 shares

of common stock issuable upon exercise by the Placement Agent of the Placement Agent Warrants at an exercise price of $0.50 per

share (125% of public offering price).

There is no minimum number

of Units or minimum aggregate amount of proceeds for this offering to close. We expect this offering to be completed not later than two

business days following the commencement of this offering and we will deliver all securities to be issued in connection with this offering

delivery versus payment (“DVP”)/receipt versus payment (“RVP”)/DWAC upon receipt of investor funds received by

the Company. Accordingly, neither we nor the Placement Agent have made any arrangements to place investor funds in an escrow account or

trust account since the placement agent will not receive investor funds in connection with the sale of the securities offered hereunder.

We are a “smaller

reporting company,” as defined under the U.S. federal securities laws and, as such, we have elected to comply with certain reduced

public company reporting requirements for this prospectus and future filings.

Investing in our securities

is speculative and involves a high degree of risk. You should carefully consider the risk factors beginning on page 12 of this prospectus

before investing in our securities.

| |

|

Per

Unit

consisting

of common

stock and

Warrant |

|

|

Per

Unit

consisting

of pre-funded

warrant and

Warrant |

|

|

Total |

|

| Assumed Public Offering Price

(1) (2) |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Placement Agent fees (3) (4) |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Proceeds, before expenses, to us |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| |

(1) |

Calculated

based on an assumed offering price of $0.40, which represents the closing sales price on the Nasdaq Capital Market of the registrant’s

common stock on September 15, 2023 and assuming no Units with Pre-Funded Warrants are sold in this offering. This amount will decrease

by $0.001 for each Unit including a Pre-Funded Warrant sold in this offering. |

| |

(2) |

The

public offering price corresponds to (x)(i) a public offering price per share of $ and

(ii) a public offering price per Warrant of $0.01, and (y)(i) a public offering price per Pre-Funded Warrant of $ and

(ii) a public offering price per Warrant of $0.01. |

| |

(3) |

The

placement agent fees shall equal (i) eight percent (8%) of the gross proceeds of the securities sold by us in this offering to investors

introduced by the Placement Agent or (ii) a fee equal to four percent (4%) of the gross proceeds of the securities sold by us in

this offering to investors (friends and family) introduced by us. The calculation above is based on the assumption that all shares

sold in this offering were to investors introduced by the Placement Agent. Proceeds to the Company will be higher if any shares sold

in this offering were to investors introduced by us. |

| |

(4) |

The Placement Agent will receive compensation in addition to the placement agent fees described above. See “Plan of Distribution” for a description of compensation payable to the Placement Agent. |

We have engaged the Placement

Agent as our exclusive placement agent to use its reasonable best efforts to solicit offers to purchase our securities in this offering.

The Placement Agent has no obligation to purchase any of the securities from us or to arrange for the purchase or sale of any specific

number or dollar amount of the securities. Because there is no minimum offering amount required as a condition to closing in this offering

the actual public amount, placement agent’s fee, and proceeds to us, if any, are not presently determinable and may be substantially

less than the total maximum offering amounts set forth above and throughout this prospectus. We have agreed to pay the Placement Agent

the placement agent fees set forth in the table above and to provide certain other compensation to the Placement Agent. See “Plan of Distribution” beginning on page 43 of this prospectus for more information regarding these arrangements.

We expect to deliver the

shares of common stock and Warrants, or Pre-Funded Warrants and Warrants, constituting the Units against payment in New York, New York

on or about , 2023.

Neither the Securities

and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Sole Placement

Agent

JOSEPH

GUNNAR & CO., LLC

The date of this prospectus is _______________,

2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

The registration statement of which this prospectus

forms a part that we have filed with the Securities and Exchange Commission, or SEC, includes exhibits that provide more detail of the

matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC before making your investment

decision.

You should rely only on the

information provided in this prospectus or in a prospectus supplement or any free writing prospectuses or amendments thereto. Neither

we nor the placement agent have authorized anyone else to provide you with different information. We do not, and the placement agent and

its affiliates do not, take any responsibility for, and can provide no assurance as to the reliability of, any information that others

may provide to you. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that

the information in this prospectus is accurate only as of the date hereof, regardless of the time of delivery of this prospectus or any

sale of securities. Our business, financial condition, results of operations and prospects may have changed since that date.

We are not, and the placement

agent is not, offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted.

We and the placement agent have not done anything that would permit this offering or possession or distribution of this prospectus in

any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come

into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities

as to distribution of the prospectus outside of the United States.

Unless the context otherwise

requires, references in this prospectus to “Intrusion,” “the Company,” “we,” “us” and

“our” refer to Intrusion, Inc. and our subsidiaries. Solely for convenience, trademarks and tradenames referred to in this

prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not

assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks

and tradenames.

PROSPECTUS SUMMARY

This prospectus summary

highlights certain information about our company and other information contained elsewhere in this prospectus or in documents incorporated

by reference. This summary does not contain all of the information that you should consider before investing in our securities. You should

carefully read this entire prospectus, and our other filings with the SEC, including the following sections, which are either included

herein and/or incorporated by reference herein, “Risk Factors,” “Special Note Regarding Forward-Looking Statements,”

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial

statements incorporated by reference herein, before making a decision about whether to invest in our securities.

Company Overview

Our Business

Intrusion,

Inc. is a cybersecurity company based in Plano, Texas. We offer our customers access to our exclusive threat intelligence database containing

the historical data, known associations, and reputational behavior of over 8.5 billion Internet Protocol (“IP”) addresses.

After years of gathering global internet intelligence and working exclusively with government entities, we released INTRUSION Shield,

our first commercial product, in 2021.

For the fiscal years ended

December 31, 2022 and 2021, we generated revenues of approximately $7,529,000 and $7,277,000, respectively, and reported net loss of

approximately $16,229,000 and $18,802,000, respectively, and cash flow used in operating activities of approximately $13,190,000 and

$16,557,000, respectively. For the six months ended June 30, 2023 and 2022, we generated revenues of approximately $2,777,000 and $3,893,000,

respectively, and reported net loss of approximately $7,863,000 and $8,119,000, respectively, and cash flow used in operating activities

of approximately $3,275,000 and $7,125,000, respectively. As noted in our unaudited financial statements, as of June 30, 2023, we had

an accumulated deficit of $104,189,000 and working capital deficit of $13,889,000. There

is substantial doubt regarding our ability to continue as a going concern as a result of our historical recurring

losses from operations, negative cash flows from operations, net working capital deficiency as well as our dependence on equity

and debt financings. See “Risk Factors—We have a history of operating losses, our management has concluded

that there is substantial doubt about our ability to continue as a going concern and our auditor has included an explanatory paragraph

relating to our ability to continue as a going concern in its audit report for the fiscal years ended December 31, 2022 and 2021.”

Our Solutions

INTRUSION Shield™

INTRUSION Shield, our

newest cybersecurity solution is a Zero Trust reputation-based Security-as-a-Service (“SaaS”) solution that inspects and kills

dangerous network (in and outbound) connections. What makes our approach unique is that INTRUSION Shield evaluates

every packet and analyzes the IP addresses (source and destination), as well as domain information and the ports utilized and, when combined

with other threat intelligence data reports, blocks malicious connections. Many breaches today are caused by Zero-Day and malware free

compromises that may not trigger alarms in a traditional firewall or endpoint solution. INTRUSION Shield’s capabilities

are designed to continuously evolve as the threats and landscape change over time. Unlike traditional industry approaches that rely heavily

on signatures, complex rules, and human factors mitigation, which malicious actors and nation states have learned to bypass, INTRUSION Shield’s proprietary

architecture isolates and neutralizes malicious traffic and network flows that existing solutions are ill equipped to handle.

In

September 2022, we expanded the INTRUSION Shield product line to include the Shield Cloud and Shield End-Point

solutions. The initial INTRUSION Shield offering released in early 2021, the Shield On-Premise solution,

utilizes hardware and is placed behind a firewall in a data center. Shield Cloud extends the effectiveness of the Shield On-Premise solution

to Infrastructure as a Service (IaaS), Platform as a Service (PaaS), SaaS and serverless resources in the public cloud. This product serves

as a protective gateway to the cloud, providing both Zero Trust access to, and protecting outbound connections from, virtual hosts and

serverless functions within the cloud. Shield Endpoint helps protect the network outside of the corporate enclave and data center to include

protection for remote workers, mobile, and cloud devices. This product brings the network protection of the Shield On-Premise to these

remote user devices establishing a Zero Trust network, both for intra-organization connectivity and external internet connectivity.

INTRUSION TraceCop®

INTRUSION TraceCop is

a big data tool with extensive IP intelligence canvassing the entire internet. It contains what we believe to be the largest existing

repository of reputation information on known good and known bad active IP addresses (both IPv4 and IPv6). TraceCop contains

an inventory of network selectors and enrichments useful to support forensic investigations. The data contains a history

of IPv4 and IPv6 block allocations and transfers, historical mappings of IP addresses to Autonomous Systems (ASNs) as observed through

BGP, and approximately one billion historically registered domain names and registration context. TraceCop contains

tens of billions of historic DNS resolutions of Fully Qualified Domain Names (FQDNs or hostnames) on each of these domains. Together,

the resulting data shows relationships, hosting, and attribution for internet resources. TraceCop also

contains web server surveys of content, such as natural language and topic of the content on hundreds of millions of websites and servers

and OS fingerprints of services showing applications running on a given IP address. TraceCop also contains a history

of threat and reputation for each hostname and IP address over time. All these features combine to create a very effective network forensics

and cybersecurity analysis tool.

INTRUSION Savant®

INTRUSION Savant is

a network monitoring solution that leverages the rich data available in TraceCop to identify suspicious traffic

in real-time. Savant uses several original patents to uniquely characterize and record all network flows. Savant is

a network reconnaissance and attack analysis tool used by forensic analysts in the DoD, Federal Government, and corporations with in-house

threat research teams. For example, Savant users can create various automated rules to inspect packets matching

(or not) certain criteria such as creating a rule to ensure the Source MAC address field in the Ethernet header and Source IP address

from the IP header are always the same, failing which could indicate MAC or IP Spoofing in progress. Similarly, threat investigators can

create rules using regular expressions to analyze multiple fields in the packet headers.

Our Intellectual Property

and Licenses

Our

success and our ability to compete are primarily dependent upon our proprietary technology. We principally rely on a combination of contractual

rights, trade secrets and copyright laws to establish and protect our proprietary rights in our solutions. In addition, we have received

two patents. We have also entered into non-disclosure agreements with our suppliers, resellers, and certain customers to limit access

to and disclosure of our proprietary information. There can be no assurance that the steps taken by us to protect our intellectual property

will be adequate to prevent misappropriation of our technology or that our competitors will not independently develop technologies that

are substantially equivalent or superior to our technology, although it would be extremely difficult to replicate the proprietary and

comprehensive internet databases we have developed over the past 26 years.

We

have entered into software and solution license agreements with various suppliers. These license agreements provide us with additional

software and hardware components that add value to our cybersecurity solutions. These license agreements do not provide proprietary rights

that are unique or exclusive to us and are generally available to other parties on the same or similar terms and conditions, subject to

payment of applicable license fees and royalties. We do not consider any of the solution license, software, or supplier agreements to

be material to our business, instead, they are complementary to our business and offerings.

Our Competition

The

market for network and data protection security solutions is intensely competitive and subject to frequent introductions of new technologies,

and potentially improved price and performance characteristics. Industry suppliers compete in areas such as conformity to existing and

emerging industry standards, interoperability with networking and other cybersecurity solutions, management and security capabilities,

performance, price, ease of use, scalability, reliability, flexibility, features and technical support. Our principal competitors in the

data mining and advanced persistent threat market include Niksun, NetScout, and Darktrace.

There

are numerous companies competing in various segments of the data security market. At this time, we have little or no competitors for TraceCop;

however, we believe competitors could emerge in the future. These competitors currently perform only a portion of the functions that we

can perform with TraceCop. We have been continuously collecting the TraceCop data for more

than twenty years, and we believe that none of our current or future competitors will have the ability to provide and reference this historical

data. In our newest market segment, data mining and advanced persistent threat detection, we compete directly and indirectly with companies

and open-source technologies in the firewall, intrusion detection and prevention, anti-virus, network analysis, endpoint protection, and

insider threat prevention areas of cybersecurity technology.

We

believe the INTRUSION Shield product line is novel and unique in our industry because of our proprietary

threat-enriched big data. We believe that our INTRUSION Shield family of solutions complement our customer’s

existing cybersecurity processes and third-party solutions. If the INTRUSION Shield receives widespread acceptance

in the market, we anticipate that other businesses will seek to compete with INTRUSION Shield; however, we believe

our existing, mature, and proprietary database which is integral to the operation of INTRUSION Shield will

be difficult, if not impossible, for other companies in our industry to replicate and will be a significant barrier to entry of competitors

in the near- and long-term future of cyber security solutions.

Our Customers: Government

Sales

Sales

to U.S. government customers accounted for 65.8% of our revenues for the year ended December 31, 2022, compared to 71.4% of our revenue

in 2021. We expect to continue to derive a substantial portion of our revenues from sales to governmental entities in the future as we

continue to market our products and data mining products to the government, and we intend to market INTRUSION Shield not

only to our long-standing governmental customer base but to expand our efforts to include more traditionally administrative and civilian

governmental entities. Sales to government clients present risks in addition to those involved in sales to commercial customers that could

adversely affect our revenues, including potential disruption due to irregularities in or interruptions to appropriation and spending

patterns, delays in approving a federal budget and the government’s reservation of the right to cancel contracts and purchase orders

for its convenience.

We

make our sales under purchase orders and contracts. Our customers, including government customers, may cancel their orders or contracts

with little or no prior notice and without penalty. Although we transact business with various government entities, we believe that the

cancellation of any order in itself could have a material adverse effect on our financial results. Because we derive and expect to continue

to derive a substantial portion of our revenue from sales to government entities, a large number of cancelled or renegotiated government

orders or contracts could have a material adverse effect on our financial results.

Third-Party Products

We

currently utilize commercially available computers and servers from various vendors which we integrate with our software products for

implementation into our customer networks. We do not consider any of these third party relationships to be material to the Company’s

business or results of operations.

Customer Services

Our

solution sales may include installation, operation of our technology and threat data interpretation and reporting.

Sales, Marketing and

Customers

Field

Sales Force. Our sales organization focuses on major account sales, channel partners including distributors, value added

resellers (VARs) and integrators; promotes our solutions to current and potential customers; and monitors evolving customer requirements.

The field sales and technical support force provides training and technical support to our resellers and end users and assists our customers

in designing cyber secure data networking solutions. We currently conduct sales and marketing efforts from our principal office in Plano,

Texas.

Resellers. Resellers

such as domestic and international system integrators and VARs sell our solutions as stand-alone solutions to end users and integrate

our solutions with products sold by other vendors into network security systems that are sold to end users. Our field sales force and

technical support organization provide support to these resellers. Our agreements with resellers are non-exclusive, and our resellers

generally sell other products and solutions that may compete with our solutions. Resellers may place higher priority on products or solutions

of other suppliers who are larger and have more name recognition, and there can be no assurance that resellers will continue to sell and

support our solutions.

Foreign

Sales. Export sales did not account for any revenue in 2022 and 2021.

Marketing. We

have implemented several methods to market our solutions, including participation in trade shows and seminars, distribution of sales literature

and solution specifications and ongoing communication with our resellers and installed base of end-user customers.

Customers. Our

end-user customers include United States (“U.S”) federal government, state and local government entities, large and diversified

conglomerates, and manufacturing entities. Sales to certain customers and groups of customers can be impacted by seasonal capital expenditure

approval cycles, and sales to customers within certain geographic regions can be subject to seasonal fluctuations in demand.

In

2022, 65.8% of our revenue was derived from a variety of U.S. government entities through direct sales and indirectly through system integrators

and resellers. These sales are attributable to seven U.S. Government customers through direct and indirect channels; three U.S government

customers individually exceeded 10% of total revenue in 2022. A reduction in our sales to U.S. government entities could have a material

adverse effect on our business and operating results if not replaced.

Backlog. We

believe that only a small portion of our order backlog is non-cancelable, and that the dollar amount associated with the non-cancelable

portion is immaterial. Commercial orders are generally fulfilled within two days to two weeks following receipt of an order. Certain orders

may be scheduled over several months, generally not exceeding one year.

Customer

Support, Service and Warranty. We service, repair, and provide technical support for our solutions. Our field sales and technical

support force works closely with resellers and end-user customers on-site and by telephone to assist with pre- and post- sales support

services such as network security design, system installation and technical consulting. By working closely with our customers, our employees

increase their understanding of end-user requirements and are then able to provide specific input in our solution development process.

We

warrant all our solutions against defects in materials and workmanship for periods ranging from 90 days to 36 months. Before and after

expiration of the solution warranty period, we offer both on-site and factory-based support, parts replacement, and repair services. Extended

warranty services are separately invoiced on a time and materials basis or under an annual maintenance contract.

Recent Developments

Amendment

to Promissory Notes Issued to Streeterville Capital, LLC

On

January 11, 2023, the Company entered into an amendment (the “Amendment”) of certain promissory notes pursuant to the Securities

Purchase Agreement dated March 10, 2022 (the Purchase Agreement”), between the Company and Streeterville Capital, LLC, a Utah limited

liability company (the “Streeterville”). The Company had previously sold and issued to Streeterville certain promissory notes,

dated March 10, 2022 (“Note #1”), and June 29, 2022 (“Note #2”) (collectively, the “Notes”) pursuant

to the Purchase Agreement (the Notes and Purchase Agreement collectively referred to as the “Transaction Documents”). The

principal purpose of the Amendment was to temporarily defer Streeterville from making redemptions under the Transaction Documents for

the period beginning on January 11, 2023, and ending on March 31, 2023, in exchange for a fee equal to 3.75% of the outstanding balance

of each of the Notes, and the Amendment made certain other amendments to the Transaction Documents. The fee was added to the outstanding

principal balance of each Note as of January 11, 2023.

Issuance

of Secured Promissory Note to Streeterville Capital, LLC

On

February 23, 2023, the Company entered into a note purchase agreement with Streeterville Capital, LLC (“Streeterville”), pursuant

to which, among other things, Streeterville purchased from the Company a secured promissory note (the “Secured Promissory Note”)

in the aggregate principal amount of $1.4 million plus certain reimbursed expenses in exchange for $1.3 million to the Company. Under

the Secured Promissory Note, the Company shall make principal payments to Streeterville in

the amount $50,000 per week each week prior to its maturity on March 31, 2023. No interest accrues on the balance of the Secured

Promissory Note prior to maturity. In connection with the issuance of the Secured Promissory

Note, the Company and Streeterville also entered into a security agreement, which provides, according

to its terms, a security interest in all employee retention credits or other funds, earned, owed or otherwise payable to the Company under

the Cares Act

Repayment

of Secured Promissory Note of Streeterville Capital, LLC

On

March 14, 2023, the Company repaid in full and in advance of the maturity date the Secured Promissory Note with

Streeterville Capital, LLC, dated February 23, 2023. The aggregate principal amount of the note was $1.4 million. The Secured Promissory

Note was subject to a security agreement which provided a security interest in all employee retention

credits (“ERC”) or other funds, earned, owed or otherwise payable to Intrusion under the Cares Act. The Company received payment

for the ERC owed to the Company on March 13, 2023.

Amendment

to Executive Employment Agreement of Anthony Scott

On

March 27, 2023, the Company and Anthony Scott, the President and Chief Executive Officer of the Company, entered into an Amendment to

the Executive Employment Agreement, dated December 1, 2021, between the Company and Mr. Scott providing for a temporary reduction of Mr.

Scott’s annualized base salary in the amount of $106,250 during the period beginning March 24, 2023, to September 22, 2023, and

granted an award of options to purchase 131,715 shares of Common Stock. The options vest one-year from the date of the award and state

an exercise price of $1.21 per share.

Deficiency Notice

from Nasdaq

On

April 28, 2023, the Company received written notice (the “Notice”) from the Listing Qualifications Department (the “Staff”)

of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that, for the last 30 consecutive business days, the Company’s

Market Value of Listed Securities (“MVLS”) was below the minimum of $35 million required for continued listing on the Nasdaq

Capital Market pursuant to Nasdaq Listing Rule 5550(b)(2) (the “Market Value Standard”). The Staff also noted that the Company

does not meet the requirements under Nasdaq Listing Rules 5550(b)(1) (Equity Standard) and 5550(b)(3) (Net Income Standard).

The

Notice provided that, in accordance with Nasdaq Listing Rule 5810(c)(3)(C) (the “Compliance Period Rule”), the Company has

a period of 180 calendar days from the date of the Notice, or until October 25, 2023 (the “Compliance Date”), to regain compliance

with the Market Value Standard. During this period, the Company’s common stock will continue to trade on the Nasdaq Capital Market.

If at any time before the Compliance Date the Company’s MVLS closes at or above $35 million for a minimum of 10 consecutive business

days as required under the Compliance Period Rule, the Staff will provide written confirmation of compliance and will close the matter.

In

the event the Company does not regain compliance with the Market Value Standard by the Compliance Date, the Staff will provide a written

notification to the Company that its common stock will be subject to delisting. At that time, the Company may appeal the Staff’s

delisting determination to a Hearings Panel (the “Panel”). However, there can be no assurance that, if the Company receives

a delisting notice and appeals the delisting determination by the Staff to the Panel, such appeal would be successful.

The

Company intends to monitor its MLVS between now and the Compliance Date, and may, if appropriate, evaluate available options to resolve

the deficiency under the Market Value Standard and regain compliance with the Market Value Standard. The Company may also try to comply

with another Nasdaq listing criteria, such as the one under Nasdaq Listing Rule 5550(b)(1) (Equity Standard). However, there can be no

assurance that the Company will be able to regain or maintain compliance with the Nasdaq listing criteria.

Approval of 2023

Employee Stock Purchase Plan

On

April 12, 2023, the board of directors of the Company approved the 2023 Employee Stock Purchase Plan (2023 ESPP) to enable its employees

to purchase shares of its common stock through voluntary payroll deductions. As of May 16, 2023, a majority of the stockholders of the

Company approved the 2023 ESPP.

Approval of Amendment

to 2021 Omnibus Stock Incentive Plan

On

March 27, 2023, the board of directors of the Company approved an amendment (the “Amendment”) to the 2021 Omnibus Incentive

Plan (the “Plan”), which made the following material changes to the Plan (as amended by the Amendment, the “Amended

Plan”): (1) permits the Compensation Committee to recognize the existence of special circumstances with the approval of the Board

of Directors; and, (2) under such special circumstances, issue awards not otherwise subject to the attainment of a performance criteria

to vest during a period less than one (1) year. As of May 16, 2023, a majority of the stockholders of the Company approved the Amended

Plan.

Employment Separations

– Chief Operating Officer and Chief Strategy Officer

On

May 19, 2023, the Company and its Chief Operating Officer, Christopher Duzich, mutually agreed to a separation of employment. Mr. Duzich’s

separation of employment was not due to a dispute or disagreement with the Company or its management. Mr. Duzich’s employment as

Chief Operating Officer ceased as of the close of business on May 19, 2023. The Company does not intend to fill the Chief Operating Officer

role at this time, and Mr. Duzich’s responsibilities will be overseen by other members of the Company’s management team.

On

May 19, 2023, the Company and its Chief Strategy Officer, Ross Mandel, mutually agreed to a separation of employment. Mr. Mandel’s

separation of employment was not due to a dispute or disagreement with the Company or its management. Mr. Mandel’s employment as

Chief Strategy Officer ceased as of the close of business on May 19, 2023. The Company does not intend to fill the Chief Strategy Officer

role at this time, and Mr. Mandel’s responsibilities will be overseen by other members of the Company’s management team.

Forbearance and Standstill

– Streeterville Notes

On August

2, 2023, the Company and Streeterville entered into a Forbearance and Standstill Agreement (the “Forbearance Agreement”) under

which both parties agreed to extend the maturity date of each Note by 12 months. The maturity date of Note #1 is now September 10, 2024,

and the maturity date of Note #2 is now December 29, 2024.

On August

7, 2023, the Company and Streeterville entered into an amendment to the Forbearance Agreement (“Forbearance Amendment”) under

which Streeterville will not seek to redeem any portion of either Note for 180 days from the date on which the Company closes on the sale

of common stock in a best-efforts public offering (“Qualified Public Offering”) registered under the Securities Act of 1933

for aggregate proceeds of not less than $5,000,000, so long as the Qualified Public Offering occurs on or before October 1, 2023 (the

“Standstill”). If a Qualified Public Offering does not occur by October 1, 2023, the Standstill shall not take effect. Upon

the expiration of the Standstill, redemption obligations under the Notes would resume, in addition to weekly cash payments to Streeterville

in the amount of $50,000.00 due in the aggregate under the Notes via ACH withdrawal.

In consideration

of the extension of the maturity dates and the Standstill, the Company entered into a Security Agreement (Exhibit A to the Forbearance

Agreement which is an Exhibit to the registration statement of which this prospectus forms a part) with Streeterville, dated August 2,

2023 (the “Security Agreement”), under which Streeterville was granted a first-position security interest in the property

described in Schedule A to the Security Agreement (the “Collateral”), subject to dispositions in the ordinary course of such

Collateral. The Collateral would include, among other properties and interests, all customer accounts, goods and equipment, inventory,

accounts receivable, trademarks, inventions, contract rights, royalties, license rights, cash, deposit accounts, and all other assets,

goods and personal property of the Company.

Copies of the Forbearance

Agreement and Forbearance Amendment are attached hereto as Exhibits 10.24 and 10.25, respectively, and incorporated herein by reference.

The foregoing description of the terms of the Forbearance Agreement and Forbearance Amendment are qualified in their entirety by reference

to the full text of the Forbearance Agreement, the Forbearance Amendment, and the Exhibits thereto.

Corporate Information

Intrusion, Inc. was organized

in Texas in September 1983 and reincorporated in Delaware in October 1995. On October 9, 2020, our shares of common stock began trading

on the Nasdaq Capital Market under the symbol “INTZ.” Our principal executive offices are located at 101 East Park Blvd, Suite

1200, Plano, Texas 75074, and our telephone number is (972) 234-6400. Our corporate website address is www.intrusion.com. The information

contained on, or accessible through, our website is not incorporated in, and shall not be part of, this prospectus. TraceCop

(“TraceCop™”) and Intrusion Savant (“Intrusion Savant™”) are registered

trademarks of Intrusion.

THE OFFERING

| Issuer |

Intrusion, Inc. |

| |

|

| Securities offered by us |

Up to 23,750,000 Units on a best-efforts

basis. Each Unit consists of (i) one share of common stock and (ii) one Warrant to purchase one share of common stock (together with

the common stock underlying the Warrants).

We are also offering to each purchaser, with respect

to the purchase of Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding

common stock immediately following the consummation of this offering, the opportunity to purchase one Pre-Funded Warrant in lieu of one

share of common stock. Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion

of its Pre-Funded Warrant if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election

of the holder, such limit may be increased to up to 9.99%) of the number of common stock outstanding immediately after giving effect to

such exercise. Each Pre-Funded Warrant will be exercisable for one share of common stock. The purchase price per Pre-Funded Warrant will

be equal to the price per share of common stock, minus $0.001, and the exercise price of each Pre-Funded Warrant will equal $0.001 per

share. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time

in perpetuity until all of the Pre-Funded Warrants are exercised in full.

The Units will not be certificated or issued in

stand-alone form. The common stock and/or Pre-Funded Warrants and the Warrants comprising the Units are immediately separable upon issuance

and will be issued separately in this offering. |

| |

|

| Description of the Warrants and Pre-Funded Warrants |

Each Warrant will have an assumed exercise price of $0.44 per

share (not less than 110% of the public offering price of each unit sold in this offering), will be exercisable upon issuance and

will expire five years from issuance. Each Pre-Funded Warrant will have an exercise price of $0.001 per share, will be immediately

exercisable (subject to the beneficial ownership cap) and may be exercised at any time in perpetuity. Each Warrant and

Pre-Funded Warrant is exercisable for one share of common stock, subject to adjustment in the event of stock dividends, stock splits,

stock combinations, reclassifications, reorganizations or similar events affecting our common stock as described herein. The terms

of the Warrants will be governed by a Warrant Agency Agreement, dated as of the closing date of this offering, that we expect to

be entered into between us and Computershare Trust Company N.A., or its affiliate (the “Warrant Agent”). This prospectus

also relates to the offering of the common stock issuable upon exercise of the Warrants and Pre-Funded Warrants. For more information

regarding the Warrants and Pre-Funded Warrants, you should carefully read the section titled “Description of Securities –

Description of Securities We are Offering” in this prospectus. |

| |

|

| Placement Agent Warrant |

The registration statement of which this prospectus is a part also

registers for sale warrants to purchase up to 2,375,000 shares of our common stock (5% of the shares of common stock forming

part of the Units sold to investors introduced by the Placement Agent in this offering and 5% of the shares of common stock underlying

the Pre-Funded Warrants and Warrants forming part of the Units sold in this offering) to be issued to the Placement Agent or its

designee, as a portion of the placement agent compensation payable in connection with this offering. Notwithstanding the foregoing,

to the extent the Units sold in the offering were sold to investors (friends and family) introduced by us (as listed in Exhibit A

to the engagement letter, dated June 19, 2023, between the Placement Agent and us), as amended, we shall only issue to Placement

Agent 2.5% of the shares of common stock forming part of the Units sold to investors introduced by the Placement Agent in this offering

and 2.5% of the shares of common stock underlying the Pre-Funded Warrants and Warrants forming part of the Units sold in this offering.

The warrants will be exercisable at any time, and from time to time, in whole or in part, commencing from the closing of the offering

and expiring five (5) years from the commencement of sales of the offering, at an exercise price of $0.50 (125% of the assumed

public offering price of the Units). Please see “Plan of Distribution—Placement Agent Warrants”

for a description of these warrants. |

| Size of Offering |

$9,500,000 |

| |

|

| Assumed Price Per Unit |

$0.40 per Unit including

one share of common stock (or $0.399 per Unit including one Pre-Funded Warrant in lieu of one share of common stock) |

| |

|

| Common stock outstanding prior to this offering (1) |

24,060,199 shares |

| |

|

| Common stock to be outstanding after this offering (1) |

Up to approximately 47,810,199 shares (assuming no issuance

of Pre-Funded Warrants and no exercise of Common Warrants offered in this offering). |

| |

|

| Use of proceeds |

Assuming the maximum number of Units are sold in this offering at an

assumed public offering price of $0.40 per Unit, which represents the closing price of our common stock on Nasdaq on September 15, 2023,

and assuming no issuance of Units including Pre-Funded Warrants in connection with this offering or exercise of the Warrants offered in

this offering, we estimate the net proceeds of the offering will be approximately $8,418,999, after deducting cash expenses relating to

this offering payable by us estimated at approximately $1,081,001, including Placement Agent fees (assuming all investors were introduced

by the Placement Agent) of approximately $950,000 and offering expenses of $131,001. However, this is a best-efforts offering with no

minimum number of securities or amount of proceeds as a condition to closing, and we may not sell all or any of these securities offered

pursuant to this prospectus; as a result, we may receive significantly less in net proceeds. We expect to use the net proceeds from this

offering for working capital and general corporate purposes; provided, however, to the extent we receive gross proceeds greater than or

equal to $8,000,000, we may use net proceeds to repay up to $3,000,000 of outstanding indebtedness to Streeterville Capital, LLC. It is

possible that, pending their use, we may invest the net proceeds in a way that does not yield a favorable, or any, return for us. See “Use of Proceeds.”

Our management will have broad discretion in the application of the net proceeds, and investors will be relying on our judgment regarding

the application of the net proceeds from this offering. See “Risk Factors” for a discussion of certain risks that may

affect our intended use of the net proceeds from this offering. |

| |

|

| Listing |

Our common stock currently trades on the Nasdaq Capital Market under

the symbol “INTZ”. We have applied to list our Warrants on the Nasdaq Capital Market under the symbol “INTZW”.

We do not intend to list the Units or Pre-Funded Warrants offered hereunder on any stock exchange. |

| |

|

| Risk factors |

An investment in our securities is highly speculative and involves a significant degree of risk. See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. |

| |

|

| Best Efforts Offering |

We have agreed to offer and sell the securities offered hereby to the purchasers through the Placement Agent. The Placement Agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page 43 of this prospectus. |

| |

(1) |

The number of shares of common stock to be

outstanding after this offering is based on 24,060,199 shares of common stock outstanding as of September 15, 2023,

but excludes the following as of such date: |

| |

· |

1,212,593 shares of common stock issuable

upon the exercise of outstanding warrants at weighted average exercise price of $5.22 per share; |

| |

· | 1,013,094 shares of common stock issuable upon the exercise of outstanding stock options at weighted average exercise price of $3.12

per share; |

| |

| |

| |

· | 1,638,496 shares of common stock in aggregate reserved for issuance under our 2015 Stock Incentive Plan and 2021 Omnibus Incentive

Plan; |

| |

| |

| |

· | 239,757 shares of common stock underlying restricted stock awards outstanding; and |

| |

| |

| |

· | 2,375,000 shares of common stock underlying

the warrants to be issued to the Placement Agent in connection with this offering. |

Unless otherwise indicated, this prospectus reflects

and assumes the following:

| · | no sale of Pre-Funded Warrants in this offering, which, if sold, would reduce the number of common stock

that we are offering on a one-for-one basis; and |

| · | no exercise of the Warrants issued in this offering. |

RISK FACTORS

Investing in our securities involves a

high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the specific risk

factors discussed in the sections entitled “Risk Factors” contained in our annual report on Form 10-K for the

fiscal year ended December 31, 2022 under the heading “Item 1A. Risk Factors,” and as described or may be

described in any subsequent quarterly report on Form 10-Q under the heading “Item 1A. Risk Factors,” as well as in

any applicable prospectus supplement and contained or to be contained in our filings with the SEC and incorporated by reference in

this prospectus, together with all of the other information contained in this prospectus, or any applicable prospectus supplement.

For a description of these reports and documents, and information about where you can find them, see “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.” If any of the risks or uncertainties described

in our SEC filings or any prospectus supplement or any additional risks and uncertainties actually occur, our business, financial

condition and results of operations could be materially and adversely affected. In that case, the trading price of our securities

could decline and you might lose all or part of the value of your investment.

Risk Related to our Business

We have a history of operating losses, our

management has concluded that there is substantial doubt about our ability to continue as a going

concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its

audit report for the fiscal years ended December 31, 2022 and 2021.

To date, we have not been profitable and have

incurred significant losses and cash flow deficits. For the fiscal years ended December 31, 2022 and 2021, we have reported net loss

of approximately $16,229,000 and $18,802,000, respectively, and cash flow used in operating activities of approximately $13,190,000 and

$16,557,000, respectively. For the six months ended June 30, 2023 and 2022, we have reported net loss of approximately $7,863,000 and

$8,119,000, respectively, and cash flow used in operating activities of approximately $3,275,000 and $7,125,000, respectively. As noted

in our unaudited financial statements, as of June 30, 2023, we had an accumulated deficit of $104,189,000 and

working capital deficit of $13,889,000. Our management has concluded that our

historical recurring losses from operations, negative cash flows from operations, working capital deficiency as well as our dependence

on equity and debt financings raise substantial doubt about our ability to continue as a going

concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its

audit report for the fiscal years ended December 31, 2022 and 2021.

Our financial statements do not include any adjustments

that might result from the outcome of this uncertainty. These adjustments would likely include substantial impairment of the carrying

amount of our assets and potential contingent liabilities that may arise if we are unable to fulfill various operational commitments.

In addition, the value of our securities, including common stock issued in this offering, would be greatly impaired. Our ability to continue

as a going concern is dependent upon generating sufficient cash flow from operations and obtaining additional capital and financing, including

funds to be raised in this offering. If our ability to generate cash flow from operations is delayed or reduced and we are unable to raise

additional funding from other sources, we may be unable to continue in business even if this offering is successful.

We may require additional funding for our

growth plans, and such funding may result in a dilution of your investment.

We attempted to estimate our funding requirements

in order to implement our growth plans. If the costs of implementing such plans should exceed these estimates significantly or if we come

across opportunities to grow through expansion plans which cannot be predicted at this time, and our funds generated from our operations

prove insufficient for such purposes, we may need to raise additional funds to meet these funding requirements.

These additional funds may be raised by issuing

equity or debt securities or by borrowing from banks or other resources. We cannot assure you that we will be able to obtain any additional

financing on terms that are acceptable to us, or at all. If we fail to obtain additional financing on terms that are acceptable to us,

we will not be able to implement such plans fully if at all. Such financing even if obtained, may be accompanied by conditions that limit

our ability to pay dividends or require us to seek lenders’ consent for payment of dividends, or restrict our freedom to operate

our business by requiring lender’s consent for certain corporate actions.

Further, if we raise additional funds by way of

a rights offering or through the issuance of new shares, any shareholders who are unable or unwilling to participate in such an additional

round of fund raising may suffer dilution in their investment.

Risks Related to This Offering and Ownership of Our Securities

Our common stock

may be delisted from The Nasdaq Capital Market if we cannot maintain compliance with Nasdaq’s continued listing requirements.

Our common stock is listed

on the Nasdaq Capital Market. There are a number of continued listing requirements that we must satisfy in order to maintain our

listing on the Nasdaq Capital Market.

On April 28, 2023, the

Company received written notice (the “Notice”) from the Listing Qualifications Department (the “Staff”) of The

Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that, for the last 30 consecutive business days, the Company’s

Market Value of Listed Securities (“MVLS”) was below the minimum of $35 million required for continued listing on the Nasdaq

Capital Market pursuant to Nasdaq Listing Rule 5550(b)(2) (the “Market Value Standard”). The Staff also noted that the Company

does not meet the requirements under Nasdaq Listing Rules 5550(b)(1) (Equity Standard) and 5550(b)(3) (Net Income Standard).

The Notice provided that,

in accordance with Nasdaq Listing Rule 5810(c)(3)(C) (the “Compliance Period Rule”), the Company has a period of 180 calendar

days from the date of the Notice, or until October 25, 2023 (the “Compliance Date”), to regain compliance with the Market

Value Standard. During this period, the Company’s common stock will continue to trade on the Nasdaq Capital Market. If at any time

before the Compliance Date the Company’s MVLS closes at or above $35 million for a minimum of 10 consecutive business days as required

under the Compliance Period Rule, the Staff will provide written confirmation of compliance and will close the matter.

In the event the Company

does not regain compliance with the Market Value Standard by the Compliance Date, the Staff will provide a written notification to the

Company that its common stock will be subject to delisting. At that time, the Company may appeal the Staff’s delisting determination

to a Hearings Panel (the “Panel”). However, there can be no assurance that, if the Company receives a delisting notice and

appeals the delisting determination by the Staff to the Panel, such appeal would be successful.

The Company intends to

monitor its MLVS between now and the Compliance Date, and may, if appropriate, evaluate available options to resolve the deficiency under

the Market Value Standard and regain compliance with the Market Value Standard. The Company may also try to comply with another Nasdaq

listing criteria, such as the one under Nasdaq Listing Rule 5550(b)(1) (Equity Standard). However, there can be no assurance that the

Company will be able to regain or maintain compliance with the Nasdaq listing criteria.

In addition, we cannot

assure you our securities will meet the continued listing requirements to be listed on Nasdaq in the future. If Nasdaq delists our common

stock from trading on its exchange, we could face significant material adverse consequences including:

| · | a limited availability of market quotations for our securities; |

| · | a determination that our common stock is a “penny stock” which will require brokers trading

in our common stock to adhere to more stringent rules and possibly resulting in a reduced level of trading activity in the secondary trading

market for our common stock; |

| · | a limited amount of news and analyst coverage for our company; and |

| · | a decreased ability to issue additional securities or obtain additional financing in the future. |

If we fail to maintain

compliance with all applicable continued listing requirements for the Nasdaq Capital Market and Nasdaq determines to delist our common

stock, the delisting could adversely affect the market liquidity of our common stock, our ability to obtain financing to repay debt and

fund our operations.

We could fail to maintain compliance with

any Nasdaq listing requirements, which could negatively affect the market price of our common stock, our liquidity and our ability to

raise capital.

Currently, our common stock trades on the Nasdaq

Capital Market. We have applied to list our Warrants on the Nasdaq under the symbol “INTZW”. If we fail to maintain

compliance with any Nasdaq listing requirements, our common stock and/or Warrants could be delisted from the Nasdaq Capital Market. This

could severely limit the liquidity of our common stock and/or Warrants and your ability to sell the common stock and/or Warrants on the

secondary market.

The best-efforts structure of this offering

may have an adverse effect on our business plan.

The Placement Agent is offering the securities

in this offering on a “best-efforts” basis. The Placement Agent is not required to purchase any securities, but will use its

best efforts to sell the securities offered. As a “best-efforts” offering, there can be no assurance that the offering contemplated

hereby will ultimately be consummated or will result in any proceeds being made available to us. The success of this offering will impact

our ability to use the proceeds to execute our business plan. We may have insufficient capital to implement our business plan, potentially

resulting in greater operating losses unless we are able to raise the required capital from alternative sources. There is no assurance

that alternative capital, if needed, would be available on terms acceptable to us, or at all.

Purchasers who purchase our securities in this offering pursuant

to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit of a securities purchase

agreement.

In addition to rights and remedies available

to all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement

in this offering will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach of contract

provides those investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement including:

(i) timely delivery of shares; (ii) agreement to not enter into variable rate financings for one year from closing, subject certain exceptions;

(iii) agreement to not enter into any financings for 90 days from closing, subject to certain exceptions; and (iv) indemnification for

breach of contract.

Future sales of our common stock may depress

our share price.

As of September 15, 2023, we had 24,060,199

shares of our common stock outstanding. Sales of a number of shares of common stock in the public market or issuances of additional

shares pursuant to the exercise of our outstanding warrants, or the expectation of such sales or exercises, could cause the market price

of our common stock to decline. We may also sell additional shares of common stock or securities convertible into or exercisable or exchangeable

for common stock in subsequent public or private offerings or other transactions, which may adversely affect the market price of our

common stock.

Our stockholders may experience substantial

dilution in the value of their investment if we issue additional shares of our capital stock.

Our charter allows us to issue up to 80,000,000

shares of our common stock and up to 5,000,000 shares of preferred stock. To raise additional capital, we may in the future sell additional

shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that are lower than the

prices paid by existing stockholders, and investors purchasing shares or other securities in the future could have rights superior to

existing stockholders, which could result in substantial dilution to the interests of existing stockholders.

Our management will have broad discretion

over the use of the net proceeds from this offering, you may not agree with how we use the proceeds and the proceeds may not be invested

successfully.

Other than amounts required to be paid to certain

lenders, our management will have broad discretion as to the use of the net proceeds from this offering and could use them for purposes

other than those contemplated at the time of commencement of this offering. Accordingly, you will be relying on the judgment of our management

with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether

the proceeds are being used appropriately. It is possible that, pending their use, we may invest the net proceeds in a way that does not

yield a favorable, or any, return for us.

The failure of our management to use such funds

effectively could have a material adverse effect on our business, financial condition, operating results and cash flows.

If you purchase our Units (of which common

stock forms a part) in this Offering, you will experience immediate and substantial dilution in the net tangible book

value of your shares of common stock (if you exercise the Warrants or the Pre-Funded Warrants). In

addition, we may issue additional equity or convertible debt securities in the future, which may result in additional dilution to investors.

Because the price per share of our common stock

in the Unit being offered hereunder is higher than the pro forma as-adjusted net tangible book value per share of our common stock, you

will suffer substantial dilution in the net tangible book value of the common stock you purchase in this Offering.

Based on an assumed offering price of $0.40

per Unit, and the net tangible book value per share of our common stock of ($0.47) as of June 30, 2023, if you purchase Units in

this offering you will suffer dilution of $0.44 per share with respect to the net tangible book value per share of the common

stock, which will be ($0.04) per share following the offering on a pro forma as adjusted basis (attributing no value to the Warrants).

See the section of this prospectus entitled “Dilution” below for a more detailed discussion of

the dilution you will incur if you purchase our Units in this offering.

This offering may cause the trading price

of our common stock to decrease.

The number of shares of common stock underlying

the securities we propose to issue and ultimately will issue if this offering is completed, may result in an immediate decrease in the

market price of our common stock. This decrease may continue after the completion of this offering. We cannot predict the effect, if any,

that the availability of shares for future sale represented by the Warrants and Pre-Funded Warrants issued in connection with the offering

will have on the market price of our common stock from time to time.

Holders of Pre-Funded Warrants and Warrants

will have no rights as a common stockholder until such holders exercise their Warrants and Pre-Funded Warrants, respectively, and acquire

our common stock, except as set forth in the Pre-Funded Warrants and Warrants.

Until holders of Warrants and Pre-Funded Warrants

acquire shares of our common stock upon exercise of the Warrants and Pre-Funded Warrants, as the case may be, holders of Warrants and

Pre-Funded Warrants will have no rights with respect to the shares of our common stock underlying such Warrants and Pre-Funded Warrants,

except as set forth in the Pre-Funded Warrants and Warrants. Upon exercise of the Warrants and Pre-Funded Warrants, the holders thereof

will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise

date.

Absence of a public trading market for

the Warrants and Pre-Funded Warrants may limit your ability to resell the Warrants and Pre-Funded Warrants.

There is no established trading market for

the Warrants and Pre-Funded Warrants to be issued pursuant to this offering. Although we have applied to list the Warrants on

The Nasdaq Capital Market, we cannot guarantee that our application will be approved. If the Warrants are not approved for listing on

The Nasdaq Capital Market, an active market may never develop and the liquidity of the warrants will be limited. The Pre-Funded Warrants

will not be listed for trading on Nasdaq or any other securities exchange or market, and the Pre-Funded Warrants may not be widely distributed.

Purchasers of the Pre-Funded Warrants may be unable to resell the Pre-Funded Warrants or sell them only at an unfavorable price for an

extended period of time, if at all.

The market price of our common stock may

never exceed the exercise price of the Warrants issued in connection with this offering.

The Warrants being issued in connection with this

offering become exercisable upon issuance and will expire in five years, from the date of issuance. The market price of our common stock

may never exceed the exercise price of the Warrants prior to their date of expiration. Any Warrants not exercised by their date of expiration

will expire worthless and we will be under no further obligation to the Warrant holder.

The Warrants and Pre-Funded Warrants contain

features that may reduce your economic benefit from owning them.

For so long as you continue to hold Warrants and

Pre-Funded Warrants, you will not be permitted to enter into any short sale or similar transaction with respect to our common stock. This

could prevent you from pursuing investment strategies that could provide you greater financial benefits from owning the Warrants and Pre-Funded

Warrants.

Since the Warrants and Pre-Funded Warrants

are executory contracts, they may have no value in a bankruptcy or reorganization proceeding.

In the event a bankruptcy or reorganization proceeding

is commenced by or against us, a bankruptcy court may hold that any unexercised Pre-Funded Warrants are executory contracts that are subject

to rejection by us with the approval of the bankruptcy court. As a result, holders of the Pre-Funded Warrants may, even if we have sufficient

funds, not be entitled to receive any consideration for their Warrants or may receive an amount less than they would be entitled to if

they had exercised their Pre-Funded Warrants prior to the commencement of any such bankruptcy or reorganization proceeding.

Proposed legislation in the U.S. Congress,

including changes in U.S. tax law, and the Inflation Reduction Act of 2022 may adversely impact us and the value of the Common Stock,

the Warrants, and the Pre-Funded Warrants forming a part of the Units being offered, and the Common Stock underlying such Warrants and

Pre-Funded Warrants.

Changes to U.S. tax laws (which changes may have

retroactive application) could adversely affect us or holders of the Common Stock, the Warrants, and the Pre-Funded Warrants forming a

part of the Units being offered, or the Common Stock underlying such Warrants and Pre-Funded Warrants. In recent years, many changes to

U.S. federal income tax laws have been proposed and made, and additional changes to U.S. federal income tax laws are likely to continue

to occur in the future.

The U.S. Congress is currently considering numerous

items of legislation which may be enacted prospectively or with retroactive effect, which legislation could adversely impact our financial

performance and the value of the Common Stock, the Warrants, and the Pre-Funded Warrants forming a part of the Units being offered, or

the Common Stock underlying such Warrants and Pre-Funded Warrants. Additionally, states in which we operate or own assets may impose new

or increased taxes. If enacted, most of the proposals would be effective for the current or later years. The proposed legislation remains

subject to change, and its impact on us and holders of the Common Stock, the Warrants, and the Pre-Funded Warrants forming a part of the

Units being offered, or the Common Stock underlying such Warrants and Pre-Funded Warrants is uncertain.