Intrusion Inc. Announces First Quarter Results First Quarter Orders

Total $1.9 Million RICHARDSON, Texas, April 29

/PRNewswire-FirstCall/ -- Intrusion Inc. , ("Intrusion") today

announced financial results for the three months ended March 31,

2004. Orders for the first quarter 2004 were $1.9 million compared

to $1.8 million for the fourth quarter 2003 and $1.3 million for

the first quarter of 2003, a 40% increase year-to-year and a 5%

sequential quarterly increase. In addition, two orders totaling

$0.7 million that were expected in the first quarter were delayed.

Revenue for the first quarter 2004 was $1.3 million compared to

$2.0 million for the fourth quarter 2003 and $1.5 million for the

first quarter 2003. Intrusion's net loss was $1.3 million in the

first quarter 2004 compared to $1.5 million in the fourth quarter

2003 and $2.8 million in the first quarter 2003. Gross profit

margin was 50% of revenue in the first quarter of 2004 compared to

49% of revenue in the fourth quarter of 2003 and 32% of revenue in

the first quarter of 2003. As a result of cost reduction efforts,

Intrusion's operating expenses were $1.9 million in the first

quarter of 2004, compared to $2.5 million in the fourth quarter of

2003 and $3.3 million in the first quarter of 2003. As of March 31,

2004, Intrusion reported cash, cash equivalents and short- term

investments of $6.3 million, working capital of $5.9 million and no

debt. The increase in cash and cash equivalents was a result of

Intrusion's $5.0 million private placement completed on March 25,

2004, which yielded net proceeds to Intrusion of approximately $4.7

million. Excluding the impact of the private placement, cash burn

rate in the first quarter was $1.1 million compared to $1.9 million

in the fourth quarter 2003. "We believe our reduction in operating

expenses, improved gross margin and reduction in operating loss are

evidence that we are heading in the right direction. We continue to

expand our product offerings and prepare for future growth," stated

G. Ward Paxton, Chairman, President and CEO of Intrusion.

"Historically, the first quarter has been extremely challenging and

this year was no different as reflected by our first quarter

revenue; however, we expect our increased bookings of new orders to

represent an extremely important signal for the future," Paxton

concluded. During the first quarter, Intrusion announced the second

product of its Regulated Information Compliance Systems (RICS)

family. This product, the Intrusion SecureNet HCM HIPAA compliance

monitor, provides real-time, full- time, full-coverage monitoring

for health care providers, pharmaceuticals and pharmacies,

insurance companies and medical device manufacturers. The SecureNet

HCM is a self-contained system that can be purchased as a Hardware-

Appliance or Software-Appliance CD that turns leading servers into

network security monitors. The monitors provide low total cost of

ownership with a simple and highly productive web browser interface

that manages, monitors and maintains the system. Unlike other

solutions that are susceptible to both false positives, or

incorrectly flagging network traffic and false negatives, or

missing violations, the SecureNet HCM delivers a very high level of

accuracy. It is the first RICS solution to use Intrusion's

innovative D3 technology, that exactly matches network traffic to

existing electronic Protected Health Information. Intrusion's D3

technology is the foundation for SecureNet HCM and other planned

RICS solutions to be introduced throughout 2004. D3 allows the

monitor to stay in synch with the enterprise's regulated

information, including information that is covered by the

Gramm-Leach-Bliley Act and California Senate Bill 1386. Intrusion's

management will host its regularly scheduled quarterly conference

call to discuss the Company's financial and operational progress at

4:00 P.M., CDT today. Interested investors can access the call at

1-800-399-2043 (if outside the United States, 1-706-634-5518). For

those unable to participate in the live conference call, a replay

will be accessible beginning today at 7:00 P.M., CDT until May 5,

2004 by calling 1-800-642-1687 (if outside the United States,

1-706-645-9291). At the replay prompt, enter conference

identification number 6994227. Additionally, a live and archived

audio webcast of the conference call will be available at

http://www.intrusion.com/ . About Intrusion Inc. Intrusion Inc. is

a leading global provider of the Intrusion SecureNet(TM) line of

leading network intrusion prevention, intrusion detection and

regulated information compliance products, as well as deployment

technologies and security services for the information-driven

economy. The Intrusion SecureNet(TM) family of network security

products for governments and enterprises help protect critical

information assets by quickly detecting, analyzing and responding

to attacks and the misuse of classified and regulated information.

Associated Intrusion SecureNet(TM) Intrusion Detection(R) services

provide unique value to governments and enterprises in protecting

information assets. For more information, please visit

http://www.intrusion.com/ . This release, other than historical

information, may include forward- looking statements regarding

future events or the future financial performance of the Company.

These statements are made under the "safe harbor" provisions of the

Private Securities Litigation Reform Act of 1995 and involve risks

and uncertainties which could cause actual results to differ

materially from those in the forward-looking statements, including

but not limited to the following: the difficulties in forecasting

future sales caused by current economic and market conditions, the

effect of military actions on government and corporate spending on

information security products, spending patterns of, and

appropriations to, U.S. government departments, the impact of our

cost reduction programs and our refocused product line, the

difficulties and uncertainties in successfully developing and

introducing new products, our ability to continue to meet operating

expenses through current cash flow or additional financings, our

ability to obtain additional financing on acceptable terms, the

highly competitive market for our products, difficulties in

accurately estimating market growth, the consolidation of the

information security industry, the impact of changing economic

conditions, business conditions in the information security

industry, our ability to manage acquisitions effectively, our

ability to manage discontinued operations effectively, the impact

of market peers and their products as well as risks concerning

future technology and others identified in our Annual Report on

Form 10-K and other Securities and Exchange Commission filings.

These filings can be obtained by contacting Intrusion Investor

Relations. This release may include various non-GAAP financial

measures (as defined by SEC Regulation G). The Company's management

believes these measures provide useful information to investors

about the Company's financial condition and results of operations

for the period presented by eliminating the effects of one-time and

other transactions that can distort underlying operational results

in order to provide greater comparability of the Company's

quarterly financial performance on a year-to-year basis. The most

directly comparable GAAP financial measures and reconciliation of

the differences between the GAAP financial measures can be found in

the text of this release and the Company's Condensed Consolidated

Statement of Operations attached to this release. INTRUSION INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands except par

value amounts) March 31, December 31, 2004 2003 ASSETS (Unaudited)

(Audited) Current Assets: Cash and cash equivalents $5,787 $974

Short-term investments 505 1,705 Accounts receivable, net of

allowance for doubtful accounts of $574 in 2004 and $574 in 2003

498 972 Inventories, net 1,481 1,286 Other current assets 402 449

Total current assets 8,673 5,386 Property and equipment, net 234

297 Other assets 77 77 TOTAL ASSETS $8,984 $5,760 LIABILITIES AND

STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable and

accrued expenses $1,875 $2,188 Deferred revenue 867 788 Total

current liabilities 2,742 2,976 Stockholders' Equity: Preferred

stock, $.01 par value: Authorized shares 5,000 - 1,000 shares

issued and outstanding, net of discount 3,534 --- Common stock,

$.01 par value: Authorized shares 80,000 Issued shares - 5,176 in

2004 and 5,173 in 2003 Outstanding shares - 5,166 in 2004 and 5,163

in 2003 52 52 Common stock held in Treasury, at cost: 10 shares

(362) (362) Additional paid-in capital 48,723 47,526 Accumulated

deficit (45,477) (44,204) Accumulated other comprehensive loss

(228) (228) Total stockholders' equity 6,242 2,784 TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY $8,984 $5,760 INTRUSION INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands

except per share amounts) (Unaudited) Three Months Ended March 31,

December 31, March 31, 2004 2003 2003 Revenue $1,267 $1,963 $1,476

Cost of revenue 637 997 1,004 Gross profit 630 966 472 Operating

expenses: Sales and marketing 960 1,130 1,863 Research and

development 601 814 923 General and administrative 264 410 402

Severance costs 96 108 126 Operating loss (1,291) (1,496) (2,842)

Interest income, net 18 25 61 Loss before income taxes (1,273)

(1,471) (2,781) Income tax provision --- --- --- Net loss (1,273)

(1,471) (2,781) Beneficial conversion feature on preferred stock

(938) --- --- Net loss attributable to common stockholders $(2,211)

$(1,471) $(2,781) Net loss per share attributable to common

stockholders (basic and diluted) $(0.43) $(0.28) $(0.54) Weighted

average shares outstanding - Basic and Diluted 5,163 5,163 5,162

INTRUSION INC. Non-GAAP Operating Expenses, Excluding Severance

Charges (In thousands except per share amounts) (Unaudited) Three

Months Ended March 31, December 31, March 31, 2004 2003 2003

Operating expenses (excluding severance charges): Sales and

marketing $960 $1,130 $1,863 Research and development 601 814 923

General and administrative 264 410 402 Operating expenses,

excluding severance charges $1,825 $2,354 $3,188 Financial Contact

Michael L. Paxton, VP, CFO 972.301.3658, Media Contact Ryon Packer,

VP 972.664.8072,

http://www.newscom.com/cgi-bin/prnh/20030703/INTRUSIONLOGO

http://photoarchive.ap.org/ DATASOURCE: Intrusion Inc. CONTACT:

financial, Michael L. Paxton, VP, CFO, +1-972-301-3658, or , or

media, Ryon Packer, VP, +1-972-664-8072, or , both of Intrusion

Inc. Web site: http://www.intrusion.com/

Copyright

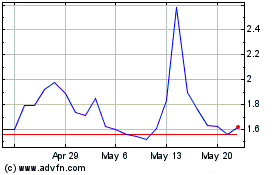

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024