Intrusion Inc. Announces First Quarter Results $1.0 Million Phase

II Fort Hood Order Slips Into Second Quarter RICHARDSON, Texas, May

3 /PRNewswire-FirstCall/ -- Intrusion Inc. (NASDAQ:INTZ),

("Intrusion") today announced financial results for the three

months ended March 31, 2005. Revenue for the first quarter 2005 was

$1.2 million compared to $2.0 million for the fourth quarter 2004

and $1.3 million for the first quarter 2004. A $1.0 million order

for Phase II of the U.S. Army Fort Hood project expected in the

first quarter of 2005 was delayed until April. If the Fort Hood

order had been received in the first quarter as expected, first

quarter 2005 revenue would have been approximately $2.1 million, an

increase of 5% sequentially. Intrusion's operating loss was $1.0

million in the first quarter 2005 compared to $0.7 million in the

fourth quarter 2004 and $1.3 million in the first quarter 2004. If

the Fort Hood order had been shipped in the first quarter, as

expected, the net loss would have been approximately $0.5 million,

a decrease of 38% sequentially. Gross profit margin was 56 percent

of revenue in the first quarter of 2005 compared to 55 percent of

revenue in the fourth quarter of 2004 and 50 percent of revenue in

the first quarter of 2004. Intrusion's first quarter 2005 operating

expenses were $1.7 million, compared to $1.8 million for the fourth

quarter 2004 and $1.9 million for the first quarter 2004. As of

March 31, 2005, Intrusion reported cash, cash equivalents and

short- term investments of $4.2 million, working capital of $3.9

million and no debt. The increase in cash and cash equivalents was

a result of Intrusion's $2.7 million private placement completed on

March 28, 2005, which yielded net proceeds to Intrusion of

approximately $2.5 million. Excluding the impact of the private

placement, the cash burn rate in the first quarter was $0.7

million, a 42 percent sequential decline compared to the $1.2

million in the fourth quarter 2004. "The delayed order for Phase II

of the Fort Hood project negatively impacted the quarter's results,

however, we believe that we are moving in the right direction and

the Phase II Fort Hood order exemplifies that fact," stated G. Ward

Paxton, Chairman, President and CEO of Intrusion. "Historically,

the first quarter has been extremely challenging and this year was

no different. However, if the Fort Hood order had not been delayed,

our revenues for the first quarter would have exceeded $2.1 million

and we would have achieved our goal of sequential quarterly

growth," Paxton concluded. Since the beginning of 2005, the

momentum for Intrusion's Compliance Commander Regulated Information

Compliance products has been building. The first sale of the HIPAA

Compliance Monitor (HCM) to Orthofix International, N.V. was

announced in February and the first sale of the Regulated

Information Monitor (RIM) to Pasadena Federal Credit Union was

announced in April. Intrusion announced its new service for

tracking down and identifying intruders in February. This new

entity identification service is branded TraceCop(TM). Another

highlight of the first quarter was the completion of a $2.7 million

private placement of convertible preferred stock in March.

Intrusion's management will host its regularly scheduled quarterly

conference call to discuss the Company's financial and operational

progress at 4:00 P.M., CDT today. Interested investors can access

the call at 1-800-399-2043 (if outside the United States,

1-706-634-5518). For those unable to participate in the live

conference call, a replay will be accessible beginning today at

7:00 P.M., CDT until May 10, 2005 by calling 1-800-642-1687 (if

outside the United States, 1-706-645-9291). At the replay prompt,

enter conference identification number 5883351. Additionally, a

live and archived audio webcast of the conference call will be

available at http://www.intrusion.com/ . About Intrusion Inc.

Intrusion Inc. is a leading global provider of regulated

information compliance, entity identification systems, data privacy

protection products, and network intrusion prevention and detection

solutions. In addition, Intrusion Inc. offers deployment

technologies along with security services for the

information-driven economy. Intrusion's product families include

the Compliance Commander(TM) for regulated information and data

privacy protection, TraceCop(TM) identification and location

service, Intrusion SpySnare(TM) for real-time inline blocking of

spyware and unwanted P2P applications, and Intrusion SecureNet(TM)

for network intrusion prevention and detection. Intrusion's

products help protect critical information assets by quickly

detecting, protecting, analyzing and reporting attacks or misuse of

classified, private and regulated information for government and

enterprise networks. For more information, please visit

http://www.intrusion.com/ . This release, other than historical

information, may include forward- looking statements regarding

future events or the future financial performance of the Company.

These statements are made under the "safe harbor" provisions of the

Private Securities Litigation Reform Act of 1995 and involve risks

and uncertainties which could cause actual results to differ

materially from those in the forward-looking statements, including

but not limited to the following: the difficulties in forecasting

future sales caused by current economic and market conditions, the

effect of military actions on government and corporate spending on

information security products, spending patterns of, and

appropriations to, U.S. government departments, the impact of our

cost reduction programs and our refocused product line, the

difficulties and uncertainties in successfully developing and

introducing new products in emerging markets, market acceptance of

our products, the impact of our sustained losses on our ability to

successfully operate and grow our business, our stock price and our

ongoing Nasdaq eligibility, our ability to generate sufficient cash

flow or obtain additional financing on acceptable terms in order to

fund ongoing liquidity needs, the highly competitive market for our

products, the effects of sales and implementation cycles for our

products on our quarterly results, difficulties in accurately

estimating market growth, the consolidation of the information

security industry, the impact of changing economic conditions,

business conditions in the information security industry, our

ability to manage acquisitions effectively, our ability to manage

discontinued operations effectively, the impact of market peers and

their products as well as risks concerning future technology and

others identified in our Annual Report on Form 10-KSB, as amended,

and other Securities and Exchange Commission filings. These filings

can be obtained by contacting Intrusion Investor Relations. This

release may include various non-GAAP financial measures (as defined

by SEC Regulation G). The Company's management believes these

measures provide useful information to investors about the

Company's financial condition and results of operations for the

period presented by eliminating the effects of one-time and other

transactions that can distort underlying operational results in

order to provide greater comparability of the Company's quarterly

financial performance on a year-to-year basis. The most directly

comparable GAAP financial measures and reconciliation of the

differences between the GAAP financial measures can be found in the

text of this release and the Company's Condensed Consolidated

Statements of Operations attached to this release. INTRUSION INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands except par

value amounts) March 31, December 31, 2005 2004 ASSETS (Unaudited)

(Audited) Current Assets: Cash and cash equivalents $3,791 $2,315

Short-term investments 425 75 Accounts receivable, net of allowance

for doubtful accounts of $369 in 2005 and $508 in 2004 605 1,220

Inventories, net 868 950 Prepaid expenses 370 393 Total current

assets 6,059 4,953 Property and equipment, net 316 299 Other assets

54 64 TOTAL ASSETS $6,429 $5,316 LIABILITIES AND STOCKHOLDERS'

EQUITY Current Liabilities: Accounts payable and accrued expenses

$1,375 $1,667 Deferred revenue 775 799 Total current liabilities

2,150 2,466 Stockholders' Equity: Preferred stock, $.01 par value:

Authorized shares - 5,000 Series 1 shares issued and outstanding -

439 in 2005 and 840 in 2004 Liquidation preference of $2,252,000

1,553 2,968 Series 2 shares issued and outstanding - 1,065

Liquidation preference of $2,664,000 1,675 --- Common stock, $.01

par value: Authorized shares - 80,000 Issued shares - 6,068 in 2005

and 5,431 in 2004 Outstanding shares - 6,058 in 2005 and 5,421 in

2004 61 54 Common stock held in treasury, at cost - 10 shares (362)

(362) Additional paid-in capital 51,290 49,095 Accumulated deficit

(49,759) (48,732) Accumulated other comprehensive loss (179) (173)

Total stockholders' equity 4,279 2,850 TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $6,429 $5,316 INTRUSION INC. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands except per

share amounts) (Unaudited) Three Months Ended March 31, December

31, March 31, 2005 2004 2004 Revenue $1,185 $1,972 $1,267 Cost of

revenue 527 894 637 Gross profit 658 1,078 630 Operating expenses:

Sales and marketing 759 823 960 Research and development 702 602

601 General and administrative 228 262 264 Severance costs --- 139

96 Operating loss (1,031) (748) (1,291) Interest income, net 4 8 18

Other expense, net --- (48) --- Loss before income taxes (1,027)

(788) (1,273) Income tax provision --- --- --- Net loss (1,027)

(788) (1,273) Preferred stock dividends accrued (29) (62) ---

Beneficial conversion feature on preferred stock (919) --- (938)

Net loss attributable to common stockholders $(1,975) $(850)

$(2,211) Net loss per share attributable to common stockholders

(basic and diluted) $(0.33) $(0.16) $(0.43) Weighted average shares

outstanding - Basic and Diluted 6,030 5,208 5,163 Financial Contact

Michael L. Paxton, VP, CFO 972.301.3658, Media Contact Ben Bittle,

Director of Product Management 972.664.8107,

http://www.newscom.com/cgi-bin/prnh/20030703/INTRUSIONLOGO

http://photoarchive.ap.org/ DATASOURCE: Intrusion Inc. CONTACT:

financial, Michael L. Paxton, VP, CFO, +1-972-301-3658, or , or

media, Ben Bittle, Director of Product Management, +1-972-664-8107,

or , both of Intrusion Inc. Web site: http://www.intrusion.com/

Copyright

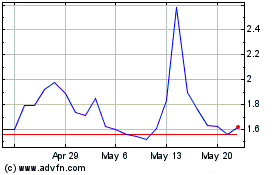

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Intrusion (NASDAQ:INTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024