Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

September 27 2022 - 4:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

Dated September 27, 2022

Commission

File Number 001-38018

Integrated

Media Technology Limited

(Exact

Name as Specified in its Charter)

N/A

(Translation

of Registrant’s Name)

Level

7, 420 King William Street

Adelaide

SA 5000

Australia

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b) (7): ☐

OTHER

EVENTS

INTRODUCTION TO THE UNAUDITED PRO FORMA CONSOLIDATED

FINANCIAL INFORMATION

The unaudited pro forma financial information

in Exhibit 99.1 was prepared in conformity with Article 11 of Regulation S-X. The unaudited pro forma consolidated financial

information of Integrated Media Technology Limited’s (“IMTE” or “Company”) give effect to the deemed disposal

of Greifenberg Digital Limited and its subsidiaries, the disposal of eGlass Technologies Ltd and its subsidiaries and the disposal of

Grand Dynasty Limited and its subsidiary. (collectively “Dispositions”).

The

description of the Dispositions is as follows:

| 1. | Deemed

Disposal of Greifenberg Digital Limited and its subsidiaries (“Greifenberg”) |

On February 15, 2022, IMTE shareholding

in the equity of Greifenberg was reduced from 40.75% to 23.96% as a result of investors subscripting for shares in Greifenberg (“Greifenberg

Deemed Disposal”). Greifenberg is engaged in analytic financial research services.

IMTE’s unaudited pro forma consolidated

financial information giving effect to the Greifenberg Deemed Disposal and related transactions is attached as Exhibit 99.1.

| 2. | Disposal

of eGlass Technologies Ltd and its subsidiary (“eGlass”) |

As reported under cover of Form 6-K

on July 12, 2022, IMTE entered into the Sales and Purchase Agreement (“SP Agreement”) with Capital Stone Holdings Limited

(“Purchaser”), pursuant to which the Company agreed to sell to the Purchaser 100% of its equity interest in eGlass Technologies

Ltd (“eGlass”), a wholly-owned subsidiary of the Company that held all the assets of our switchable glass business in China

(the “eGlass Disposal”) for US$6.8 million (“Consideration”).

The Purchaser agreed to pay the Consideration

by issuing to IMTE a debt instrument (“Loan”), which bears interests of 5% per annum, is repayable in 2 years and is secured

against the shares of eGlass.

The Purchaser has indicated an intention

to list eGlass on the Australia Securities Exchange (“ASX”) by July 2024. Pursuant to the SP Agreement, the Purchaser has

the right to pay the Loan by giving IMTE the number of shares in eGlass calculated by dividing the amount of outstanding loan by 10% discount

to the then 5 day volume weighted average closing price (“VWAP”); provided that such price may not be greater than the 120%

of the IPO Price. Alternatively, the Company has the right to have the Purchaser repay the Loan by transferring to IMTE the number of

shares in eGlass calculated by dividing the amount of outstanding loan by the IPO Price. Any outstanding loan amount that could not be

fully repaid by the eGlass shares would be settled by cash.

This eGlass Disposal was completed

in September 2022 and as a result IMTE no longer has any operation in China and very little operation in Hong Kong where it will focus

on transferring/disposing all of its operation out Hong Kong before the end of the year.

The IMTE’s unaudited pro forma

consolidated financial information giving effect to the Disposal and related transactions is attached as Exhibit 99.1.

| 3. | Disposal

of Grand Dynasty Limited and its subsidiary (“Grand Dynasty”) |

On July 25, 2022, IMTE entered into

a sales and purchase agreement with an independent third party to sell 100% of its interest in Grand Dynasty (the “GD Disposal”)

for consideration of HK$1.00 or US$0.13.

Grand Dynasty and its subsidiary have

no assets and have not commenced any operation since their inception in 2021.

IMTE’s unaudited pro forma consolidated

financial information giving effect to the GD Disposal and related transactions is attached as Exhibit 99.1.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

Dated: September 27, 2022

|

Integrated

Media Technology Limited |

| |

|

|

| |

By: |

/s/ Xiaodong

Zhang |

| |

Name: |

Xiaodong Zhang |

| |

Title: |

Chief Executive Officer |

EXHIBIT

INDEX

3

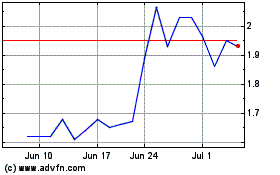

Intergrated Media Techno... (NASDAQ:IMTE)

Historical Stock Chart

From Oct 2024 to Nov 2024

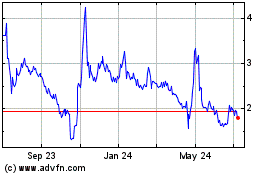

Intergrated Media Techno... (NASDAQ:IMTE)

Historical Stock Chart

From Nov 2023 to Nov 2024