As filed with the Securities and Exchange

Commission on March 19, 2024

Registration No. 333-276859

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT

NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Zoomcar

Holdings, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware |

|

7510 |

|

99-0431609 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

Anjaneya Techno Park, No.147, 1st

Floor

Kodihalli, Bangalore, India

560008

+91 99454-8382

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

The

Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, Delaware 19801

(Name, Address, Including Zip Code, and Telephone

Number, Including Area Code, of Agent For Service)

With copies to:

Douglas

Ellenoff, Esq.

Matthew Bernstein, Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas, 11th Floor

New York, New York 10105

Telephone: (212) 370-1300

Fax: (212) 370-7889

Approximate date of commencement

of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being

registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. ☒

If this form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging

growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

| |

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

| |

|

|

|

Emerging growth company |

☒ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Securities and Exchange

Commission, acting pursuant to said Section 8(a), may determine.

The information in

this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an

offer to buy these securities in any state where such offer or sale is not permitted.

Subject to completion,

dated March 19, 2024

Preliminary Prospectus

ZOOMCAR HOLDINGS,

INC.

18,603,584

Shares of Common Stock

This prospectus relates

to the offer and sale, from time to time, by the selling security holders identified in this prospectus (such selling security holders

and their permitted transferees, the “Selling Holders”) of up to an aggregate of 18,603,584 shares of common stock,

par value $0.0001 per share (the “Common Stock”) of Zoomcar Holdings, Inc., a Delaware corporation (the “Company”

“we,” “us” and “our”), consisting of: (i) up to 1,200,000 shares of Common

Stock that were issued in lieu of payment of deferred underwriting commissions in an aggregate amount of $12,100,000, or an effective

price of $10.08 per share, pursuant to that certain fee modification agreement (the “Fee Modification Agreement”),

dated as of December 28, 2023, by and among the Company, Cantor Fitzgerald& Co. (“Cantor”) and J.V.B. Financial

Group, LLC (“J.V.B.”), in connection with the Closing of the Business Combination (as defined herein), (ii) up to

1,666,666 shares of Common Stock that were issued at a price of $3.00 per share pursuant to that certain fee agreement (the “MWE

Fee Agreement”), dated as of December 28, 2023, by and between McDermott Will & Emery LLP (“MWE”) and

the Company, in connection with payment of Business Combination transaction expenses, (iii) up to 466,666 shares of Common Stock that

the Company is contractually bound to issue at a price of $3.00 per share pursuant to that certain fee modification agreement (the “EGS

Fee Agreement”), dated as of December 27, 2023, by and among Zoomcar, Inc., the Company and Ellenoff Grossman & Schole

LLP (“EGS”), in connection with payment of Business Combination transaction expenses, (iv) up to 20,000 shares of

Common Stock that were issued at a price of $3.00 per share pursuant to that certain marketing services agreement (the “OTB

Agreement”), dated as of September 28, 2023, between a subsidiary of the Company and Outside the Box Capital Inc. (“OTBC”),

in connection with the Closing of the Business Combination, (v) up to 1,071,506 shares of Common Stock that were issued to Ananda Small

Business Trust (“Ananda Trust”), an affiliate of the Sponsor (as defined herein), for an aggregate purchase price

of $10,000,000, or approximately $9.33 per share, pursuant to a subscription agreement dated October 13, 2022 which closed upon the Closing

of the Business Combination, (vi) up to 1,666,666 shares of Common Stock that were issued to Ananda Trust at a price of $3.00 per

share in connection with the Closing of the Business Combination, and (vii) up to 12,512,080 shares of Common Stock issuable to ACM Zoomcar

Convert LLC (“ACM”) or its registered assigns upon the conversion of a promissory note (“Note”)

held by ACM, which such Note is convertible at (x) a conversion price of $10.00 per share, subject to adjustment as described therein

and subject to a floor price of $0.25 per share (the “Conversion Price”), in any amount, in ACM’s discretion,

and (y) the Amortization Conversion Price, up to an amount equal to 25% of the highest trading day value of shares of Common Stock on

a daily basis during the 20 trading days preceding the applicable conversion date, or a greater amount upon obtaining the Company’s

prior written consent. “Amortization Conversion Price” for purposes of the Note means the lower of (i) the Conversion

Price, and (ii) a 7.5% discount to the lowest VWAP over the 20 trading days immediately preceding the applicable payment date or other

date of determination, subject to the terms of the Note.

This prospectus provides you

with a general description of such securities and the general manner in which the Selling Holders may offer or sell the securities. More

specific terms of any securities that the Selling Holders may offer or sell may be provided in a prospectus supplement that describes,

among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement

may also add, update or change information contained in this prospectus.

We will not receive any

proceeds from the conversion of the Notes or the resale of any of the shares of common stock being registered hereby sold by the Selling

Holders. For more information regarding our financial condition, including our limited cash position, please see “Management’s

Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.”

The securities registered

for resale by the Selling Holders in the registration statement of which this prospectus forms a part represent approximately 29.59%

of our total shares outstanding (assuming conversion in full of the Note at the floor price of $0.25 per share and the issuance of the

shares pursuant to the EGS Fee Agreement) and will therefore constitute a considerable percentage of our public float which may be available

for immediate resale upon effectiveness of the registration statement, and for so long as such registration statement remains available,

subject to the expiration of the Lock-Up Periods (as defined below), as applicable. Given the substantial number of shares being registered

for potential resale by Selling Holders pursuant to this prospectus, whether as a result of substantial sales of our Common Stock by

the Selling Holders or the perception in the market that holders of a large number of shares intend to sell their shares, the market

price of shares of our Common Stock could decline significantly and the volatility of the market price of our Common Stock could increase

significantly.. Sales of a substantial number of shares of our Common Stock by the Selling Holders in the public market could occur at

any time, subject to certain lock-up restrictions. Sales of our Common Stock by the Selling Holders, or the perception that such sales

may occur, may also cause the market price of our Common Stock to drop significantly even if our business is doing well. See “Risk

Factors.”

Our registration of the securities

covered by this prospectus does not mean that the Selling Holders will offer or sell any of the securities. The Selling Holders may offer

and sell the securities covered by this prospectus in a number of different ways and at varying prices. We provide more information about

how the Selling Holders may sell the shares in the section entitled “Plan of Distribution.” In addition, certain of

the securities being registered hereby are subject transfer restrictions that may prevent the Selling Holders from offering or selling

such securities upon the effectiveness of the registration statement of which this prospectus is a part. See “Description of

Securities” for more information.

You should read this

prospectus and any prospectus supplement or amendment carefully before investing in our securities. Our Common Stock trades on the Nasdaq

Global Market under the symbol “ZCAR,” and certain of our warrants (the “Public Warrants”) trade on the

Nasdaq Capital Market under the symbol “ZCARW.” On March 8, 2024, the closing price of our Common Stock as reported by The

Nasdaq Stock Market LLC was $1.31 per share and the closing price of our Public Warrants as reported by Nasdaq was $0.0356. Each of our

Public Warrants is exercisable for one share of Common Stock at an exercise price of $5.71 per share (see “Description of Securities” regarding the recent adjustment to the exercise price of

the Public Warrants).

We are an emerging growth company

and a smaller reporting company under the federal securities laws and, as such, are subject to certain reduced public company reporting

requirements. See “Prospectus Summary - Implications of Being an Emerging Growth Company and a Smaller Reporting Company”

on page 2 of this prospectus.

Investing in our

Common Stock and warrants involves a high degree of risk. See the section titled “Risk Factors” beginning on page

7.

Neither the Securities and

Exchange Commission (the “SEC”) nor any other state securities commission has approved or disapproved of these securities

or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement on Form S-1 pursuant to which the Selling Holders may, from time to time, sell up to an aggregate of 18,603,584 shares

of Common Stock from time to time through any means described in the section entitled “Plan of Distribution.” More

specific terms of any securities that the Selling Holders offer and sell may be provided in a prospectus supplement that describes, among

other things, the specific amounts and prices of the Common Stock being offered and the terms of the offering. We will not receive any

proceeds from the sale by such Selling Holders of the securities offered by them described in this prospectus.

A prospectus supplement may

also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified

or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes

such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement

so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus,

any applicable prospectus supplement or any related free writing prospectus. See “Where You Can Find More Information.”

We have not authorized anyone

to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement

or any free writing prospectus we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of,

any other information that others may give you. This prospectus is an offer to sell only the shares of Common Stock offered hereby and

only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give

any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing

prospectus. This prospectus is not an offer to sell our securities, and it is not soliciting an offer to buy our securities, in any jurisdiction

where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement

is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable

prospectus supplement. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries

of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete

information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to

herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus

is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

On December 28, 2023 (the “Closing

Date”), we consummated the transactions contemplated by that certain Agreement and Plan of Merger and Reorganization, dated

as of October 13, 2022 (as amended, the “Merger Agreement”), by and among Innovative International Acquisition Corp.,

a Cayman Islands exempted company (“IOAC”), Innovative International Merger Sub Inc., a Delaware corporation and a

wholly-owned subsidiary of IOAC (“Merger Sub”), Zoomcar, Inc., a Delaware corporation (“Zoomcar, Inc.”),

and Greg Moran, solely in the capacity as the representative of the Zoomcar stockholders (in such capacity, the “Seller Representative”)

(collectively, the “Business Combination”). The consummation of the Business Combination (the “Closing”)

involved (i) prior to the Closing, the continuation of IOAC into the State of Delaware so as to become a Delaware corporation (the “Domestication”)

and (ii) the merger of Merger Sub with and into Zoomcar, Inc., with Zoomcar, Inc. continuing as the surviving corporation (the “Merger”),

as well as the other transactions contemplated in the Merger Agreement. As a result of the Merger, the Company owns 100% of the outstanding

common stock of Zoomcar, Inc. In connection with the closing of the Business Combination, the Company changed its name from “Innovative

International Acquisition Corp.” to “Zoomcar Holdings, Inc.”

Unless the context indicates

otherwise, references to the “Company,” “we,” “us” and “our”

refer to Zoomcar Holdings, Inc., a Delaware corporation, and its consolidated subsidiaries following the Closing of the Business Combination,

and references to “Zoomcar” refer to Zoomcar, Inc. and its consolidated subsidiaries before the Closing the Business

Combination and Zoomcar Holdings, Inc., a Delaware corporation, and its consolidated subsidiaries following the Closing of the Business

Combination.

FREQUENTLY USED TERMS

Unless otherwise stated in

this prospectus or the context otherwise requires, references to:

In this document:

“ACM” means

ACM Zoomcar Convert LLC.

“Board”

means the board of directors of the Company. References herein to the Company will include its subsidiaries to the extent reasonably applicable.

“Business Combination”

means the business combination of the IOAC and Zoomcar pursuant to the terms of the Merger Agreement and the other transactions contemplated

by the Merger Agreement.

“Bylaws”

means the Amended and Restated Bylaws of the Company as in effect on the date of this prospectus.

“Charter”

means the Amended and Restated Certificate of Incorporation of the Company as in effect on the date of this prospectus.

“Class A Ordinary

Shares” means the Class A ordinary shares, par value $0.0001 per share, of IOAC, prior to the Closing of the Business Combination.

“Class B Ordinary

Shares” means the Class B ordinary shares, par value $0.0001 per share, of IOAC, prior to the Closing of the Business Combination.

“Closing”

means the closing of the Business Combination.

“Closing Date”

means December 28, 2023.

“Common Stock”

means the shares of Common Stock, par value $0.0001 per share, of the Company.

“Company”

means Zoomcar Holdings, Inc., a Delaware corporation, following the Closing.

“Code” means

the Internal Revenue Code of 1986, as amended.

“Founder Shares”

means Class B Ordinary Shares initially purchased by the Sponsor in the private placement prior to the IPO, and the shares of Common Stock

issued upon the conversion thereof at the Closing.

“DGCL” means

the General Corporation Law of the State of Delaware, as amended.

“Effective Time”

means the effective time of the Merger in accordance with the Merger Agreement.

“Incentive Plan”

means the Zoomcar Holdings, Inc. 2023 Equity Incentive Plan.

“Exchange Act”

means the Securities Exchange Act of 1934, as amended.

“GAAP” means

generally accepted accounting principles in the United States.

“Insider Letter”

means the letter agreement, dated October 26, 2021, by and among IOAC, its officers and directors as of the date thereof, and the Sponsor.

“IOAC” means

the Company prior to the Closing.

“IPO” means

the initial public offering of IOAC’s Units at a public offering price of $10.00 per Unit that it consummated on October 29, 2021.

“Merger”

means the merger of Merger Sub with and into Zoomcar, with Zoomcar continuing as the surviving corporation and as a wholly-owned subsidiary

of the Company, in accordance with the terms of the Merger Agreement.

“Merger Agreement”

means the Agreement and Plan of Merger and Reorganization, dated as of October 13, 2022, as amended by the Post-Closing Amendment, by

and among IOAC, Zoomcar, Merger Sub and the Seller Representative.

“Nasdaq”

means The Nasdaq Stock Market LLC.

“Note”

means the unsecured convertible promissory note, dated December 28, 2023, issued by the Company and Zoomcar, Inc. to ACM in the principal

amount of $8,434,605, in connection with certain transaction expenses associated with the Business Combination.

“Ordinary Shares”

means the Class A Ordinary Shares and Class B Ordinary Shares.

“Post-Closing Amendment”

means the amendment to the Merger Agreement, dated as of December 29, 2023.

“Private Placement

Shares” means the Class A ordinary shares issued by IOAC to the Sponsor, Cantor and CCM in a private placement simultaneously

with the closing of the IPO.

“Public Warrants”

or “Warrants” means one (1) whole redeemable warrant that was included in as part of each Unit, entitling the holder

thereof to purchase one (1) share of Common Stock after the Business Combination at a purchase price of $5.71 per share.

“Amended and Restated

Registration Rights Agreement” means the Amended and Restated Registration Rights Agreement, dated as of December 28, 2023,

by and among the Company, the Sponsor, certain shareholders of IOAC and certain stockholders of Zoomcar.

“SEC” means

the U.S. Securities and Exchange Commission.

“Securities Act”

means the Securities Act of 1933, as amended.

“Securities Purchase

Agreement” means the securities purchase agreement, dated as of December 28, 2023, by and among the Company, Zoomcar, Inc. and

ACM.

“Selling Holders”

means the selling security holders identified in this prospectus and their permitted transferees.

“Sponsor”

means Innovative International Sponsor I LLC, a Delaware limited liability company.

“Trust Account”

means the trust account of IOAC, established at the time of our IPO, containing the net proceeds of the sale of the Units in the IPO,

including from overallotment securities sold by IOAC’s underwriters, and the sale of the Private Placement Shares, following the

closing of the IPO.

“Units”

means the units issued in the IPO consisting of one (1) Class A Ordinary Share and one-half (1/2) of one Public Warrant.

“Warrant Agent”

means Equiniti Trust Company, LLC (f/k/a American Stock Transfer & Trust Company, LLC).

“Warrant Agreement”

means that certain Warrant Agreement, dated October 26, 2021, between IOAC and the Warrant Agent.

“Zoomcar Common Stock”

means, collectively, the shares of common stock, par value $0.0001 per share, of Zoomcar, Inc. prior to the Business Combination.

“Zoomcar, Inc.”

means Zoomcar, Inc., a Delaware corporation. References herein to Zoomcar will include its subsidiaries to the extent reasonably applicable.

“Zoomcar India”

means Zoomcar India Private Limited, an Indian limited liability company and subsidiary of Zoomcar.

“Zoomcar Stockholders”

means security holders of Zoomcar prior to the Closing, including holders of outstanding shares of Zoomcar India.

MARKET AND INDUSTRY DATA

This prospectus includes industry

position and industry data and forecasts that were obtained or derived from internal company reports, independent third-party publications

and other industry data. Some data are also based on good faith estimates, which are derived from internal company analyses or review

of internal company reports as well as the independent sources referred to above. Although we believe that the information on which we

have based these estimates of industry position and industry data are generally reliable, the accuracy and completeness of this information

is not guaranteed, and we have not independently verified any of the data from third-party sources nor have we ascertained the underlying

economic assumptions relied upon therein. Our internal reports have not been verified by any independent source. Statements as to industry

position are based on market data currently available. While we are not aware of any misstatements regarding the industry data presented

herein, these estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed

under the heading “Risk Factors” in this prospectus.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained

in this prospectus may constitute “forward-looking statements” within the meaning of the “safe harbor” provisions

of the United States Private Securities Litigation Reform Act of 1995. This includes, without limitation, statements regarding expectations,

hopes, beliefs, intentions, plans, prospects, financial results or strategies regarding us and the future held by our management team

and the products and markets, future financial condition, expected future performance and market opportunities of our business. These

statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can

be identified by the fact that they do not relate strictly to historical or current facts. When used in this prospectus, forward-looking

statements may be identified by the use of words such as “estimate,” “continue,” “could,” “may,”

“might,” “possible,” “predict,” “should,” “would,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,”

“seek,” “target,” “designed to” or other similar expressions that predict or indicate future events

or trends or that are not statements of historical facts. In addition, any statements that refer to projections, forecasts or other characterizations

of future events or circumstances, including any underlying assumptions, are forward-looking statements.

We caution readers of this

prospectus that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many

of which are beyond our control, which could cause the actual results to differ materially from the expected results. The following factors,

among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations

expressed in the forward-looking statements contained in this prospectus:

| ● | our ability

to execute our anticipated business plans and strategy, particularly in light of our current

liquidity and capital resources; |

| ● | the risk that the Business Combination disrupts our plans

and operations as a result of the consummation of the Business Combination; |

| ● | the ability to recognize the anticipated benefits of the Business

Combination, which may be affected by, among other things, competition, the ability of the Company to grow and manage growth profitably,

maintain its reputation, increase the numbers of Hosts, Guests and registered vehicles on our platform, maintain relationships with Hosts

and Guests and retain our management and key employees; |

| ● | the impact of the COVID-19 pandemic on our business; |

| ● | our limited operating history under our current business model

and history of net losses; |

| ● | our ability

to obtain additional capital which will be necessary to continue our business and operations; |

| ● | our reliance on key technology providers and payment processors

facilitating payments to and by our customers; |

| ● | unfavorable interpretations of laws or regulations or changes

in applicable laws or regulations; |

| ● | the possibility that we may be adversely affected by other

economic, business, regulatory, and/or competitive factors; |

| ● | our estimates of future bookings, revenues and capital requirements; |

| ● | the evolution of the markets in which we compete; |

| ● | political instability associated with operating in current

and future emerging markets we have entered or may later enter; |

| ● | risks associated

with our ability to obtain and maintain adequate insurance to cover risks associated with

business operations now or in the future; |

| ● | our ability to implement its strategic initiatives and continue

to innovate our platform technology and features; |

| ● | our ability to adhere to legal requirements with respect to

the protection of personal data and privacy laws; |

| ● | cybersecurity risks, data loss and other breaches of our network

security and the disclosure of personal information or the infringement upon our intellectual property by unauthorized third parties; |

| ● | risks associated with the performance or reliability of infrastructure

upon which we rely, including, but not limited to, internet and cellular phone services; |

| ● | the risk of regulatory or other lawsuits or proceedings relating

to our platform or the peer-to-peer car sharing we facilitate; |

| ● | increased compliance risks associated with operating in multiple

foreign jurisdictions at once, including regulatory and accounting compliance issues; and |

| ● | other risks and uncertainties described in this prospectus,

including those under the section entitled “Risk Factors.” |

If any of these risks materialize

or any of our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements.

There may be additional risks that we presently do not know or that we currently believe are immaterial that could also cause actual results

to differ materially from those contained in the forward-looking statements. In addition, forward-looking statements reflect our expectations,

plans or forecasts of future events and views as of the date of this prospectus. We anticipate that subsequent events and developments

may cause our assessments to change. However, while we may elect to update these forward-looking statements at some point in the future,

we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our assessments

as of any date subsequent to the date of this prospectus. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Actual results, performance or achievements may, and are likely to, differ materially, and potentially adversely, from any projections

and forward-looking statements and the assumptions on which those forward-looking statements were based. There can be no assurance that

the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking

statements as a predictor of future performance as projected financial information and other information are based on estimates and assumptions

that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control. Forward-looking

statements are not guarantees of performance. All forward-looking statements attributable to us or a person acting on our behalf are expressly

qualified in their entirety by the foregoing cautionary statements.

PROSPECTUS SUMMARY

This summary highlights

information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before

investing in our Common Stock or Warrants. You should read this entire prospectus carefully, including the matters discussed under the

sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

“Business” and the consolidated financial statements and related notes included elsewhere in this prospectus before making

an investment decision.

Company Overview

Zoomcar, headquartered in Bangalore,

India, is a leading emerging market-focused online car sharing marketplace, based on the number of current vehicles and active users on

our platform. Our platform enables Hosts and Guests to connect and share the use of a Host’s car, made available to Guests at mutually

convenient locations.

Founded in 2012, our growing

online platform facilitates mobility in emerging markets, where convenient, cost-efficient transportation options are limited. Guests

on our platform browse and choose from a range of available car models, makes, sizes and price points to book vehicles listed on our platform

by Hosts. Hosts, in turn, can turn underutilized vehicles into revenue-generating opportunities by sharing their cars with individuals

who require a car to satisfy leisure, work or other short to medium-term transportation needs.

We believe our business model

is particularly well-suited to emerging markets because of the transportation challenges faced by urban residents in these areas. In the

markets that Zoomcar serves, the costs of car ownership can be prohibitively high relative to average personal income levels, with less

than ten percent of persons in these markets owning a car. At the same time, these individuals typically lack access to alternative transportation

modalities that are sufficiently convenient or affordable. These same markets also have growing middle classes, rapidly urbanizing metropolitan

areas, and vast numbers of young, tech-fluent citizens. In total, these overarching demographic trends all contribute to management’s

estimated total addressable market (“TAM”) of $90 billion by 2025, as further described in the section entitled “Business

- Market Opportunity.”

Already present in over 50

cities across three countries, we plan to continue evolving our platform offerings to meet Guests’ mobility needs in ways that are

convenient, modern and cost-efficient, providing both transportation solutions and entrepreneurship opportunities within the communities

where we operate. Our business model has evolved since our inception, as our platform originally offered short-term rental of vehicles

owned or leased directly by Zoomcar. Between 2018 and 2020, we began shifting the focus of our technology and product development efforts

towards capabilities relevant to our current “asset-light” business model focused on our digital platform for peer-to-peer

car sharing. We completed our business model shift during the second half of 2021. Until October 2021, we operated exclusively in India,

but have since expanded into Egypt (October 2021), and Indonesia (March 2022). Over time, we have expanded our platform’s functionality,

and we continue to evolve our offerings as consumer preferences change.

Our Platform

Zoomcar’s marketplace

is 100% asset-light; all vehicles available through the platform are provided by third-party “Hosts” who are able to earn

money by sharing their vehicles for use by “Guests” who book rentals on the platform. Since Zoomcar’s inception, approximately

7 million bookings have been completed on its platform. This platform-based, peer-to-peer business model, through which revenues are allocated

between Zoomcar and vehicle hosts, is broadly similar to disruptive business models being employed in the hospitality, real estate and

other industries to facilitate cost-effective, efficient and user-friendly ways to connect people and resources to solve problems.

Industry and Consumer Preferences

Our platform is designed around

consumer preferences and aims to provide smart transportation solutions within urban communities across emerging market countries. Mobility

options are currently limited in the markets we serve and the transportation options that are currently available are often outdated,

expensive and, in many cases, inflexible and inconvenient for short-term needs. Our business model and platform offerings continue to

evolve with changing consumer expectations and the observable shift in emerging market populations toward personalized, digitized goods

and services offered on-demand. We believe that our positioning in most major cities in the three countries in which we currently operate,

together with our scalable technology and platform features, make Zoomcar well-positioned to continue attracting customers from addressable

markets with few parallels in terms of scale and size. As further in the “Business” section, based on publicly available

population and economic data published by the United Nations, Fitch and other sources, coupled with Zoomcar management estimates informed

by professional experience, we estimate that by 2025, our platform will have a serviceable addressable market (“SAM”)

of approximately $20 billion, assuming a penetration rate of less than 25% among potential customers expected to fall within certain demographic

parameters, and a TAM of $90 billion, assuming broader adoption across a potential customer base that includes Hosts and Guests across

the 25 countries we identify as our core target markets.

Corporate Information

Zoomcar Holdings, Inc. is a

Delaware corporation. Our principal executive offices are located at Zoomcar’s principal executive office is located at Anjaneya

Techno Park, No.147, 1st Floor, Kodihalli, Bangalore, India 560008, and our telephone number is +91 99454-8382. Our principal website

address is www.zoomcar.com. Information contained in, or accessible through, our website is not a part of, and is not incorporated

into, this prospectus.

Implications of Being an Emerging Growth Company

and a Smaller Reporting Company

We qualify as an “emerging

growth company” (“EGC”), as defined in the Jumpstart Our Business Startups Act of 2012. We may remain an EGC

until the last day of the fiscal year following the fifth anniversary of the consummation of our IPO, although if the market value of

our common stock that is held by non-affiliates exceeds $700 million as of any June 30 before that time or if we have annual gross revenues

of $1.235 billion or more in any fiscal year, we would cease to be an EGC as of December 31 of the applicable year. We also would cease

to be an EGC if we issue more than $1 billion of non-convertible debt over a three-year period. For so long as we remain an EGC, we are

permitted and intend to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are

not EGCs. Accordingly, the information contained herein may be different than the information you receive from other public companies

in which you hold stock.

We are also a “smaller

reporting company,” as defined in Rule 12b-2 promulgated under the Exchange Act. We may continue to be a smaller reporting company

if either (1) the market value of our stock held by non-affiliates is less than $250 million or (2) our annual revenue was less than $100

million during the most recently completed fiscal year and the market value of our stock held by non-affiliates is less than $700 million.

If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from

certain disclosure requirements that are available to smaller reporting companies. For so long as we remain a smaller reporting company,

we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies

that are not smaller reporting companies.

Risk Factor Summary

Our business is subject to

numerous risks and uncertainties, including those highlighted in the section entitled “Risk Factors” immediately following

this prospectus summary, that represent challenges that we face in connection with the successful implementation of our strategy and the

growth of our business. In particular, the following considerations, among others, may offset our competitive strengths or have a negative

effect on our business strategy, which could cause a decline in the price of shares of our Common Stock or Warrants and result in a loss

of all or a portion of your investment:

| ● | We have recently transitioned to our current peer-to-peer

car sharing business model, as a consequence of which it is difficult to predict our future operating results or compare our performance

to historical results; |

| ● | We have a history

of operating losses and negative cash flow and we will need to raise additional funds to

finance operations; |

| ● | Our operating and financial forecasts are subject to various

known and unknown contingencies and factors outside of our control and may not prove accurate, and we may not achieve results consistent

with management’s expectations; |

| ● | Various factors, some of which are outside of our control, which

may adversely affect our business operations, our competitive standing, and the market price of our Common Stock; |

| ● | The market for online platforms for peer-to-peer car sharing

is relatively new, competitive, and rapidly evolving; |

| ● | We will require

additional capital to support our current operations and the growth of our business, which

may not be available on terms acceptable to us, or at all; |

| ● | While we have taken significant steps to build and improve our

brand and reputation, failure to maintain or enhance our brand and reputation will cause our business to suffer; |

| ● | Cybersecurity breaches or infringement of our intellectual property

could negatively impact our business; |

| ● | Our business depends on attracting and retaining capable management,

technology development and operating personnel; |

| ● | We may be exposed to risk if we cannot enhance, maintain, and

adhere to our internal controls and procedures; |

| ● | We are in the process of remediating identified material weaknesses

in our internal controls and if we fail to remediate these weaknesses or otherwise fail to maintain effective internal controls in accordance

with Section 404 of the Sarbanes-Oxley Act, we may not be able to accurately or timely report our financial condition or results of operations,

or comply with the accounting and reporting requirements applicable to public companies; |

| ● | Geographic areas in which Zoomcar operates and plans to operate

in the future have been and may continue to be subject to political and economic instability, and certain laws and regulations in the

jurisdictions where Zoomcar operates are currently evolving; |

| ● | We may incur liability for the activities of Hosts or Guests; |

| ● | Our management team has limited experience managing a public

company; |

| ● | We will incur significant increased expenses and administrative

burdens as a public company; |

| ● | If

we fail to comply with the listing requirements of Nasdaq (including the requirement to maintain

a majority independent board of directors for which we have received a deficiency notice),

we would face possible delisting, which would result in a limited public market for our securities; |

| ● | We are an “emerging growth company” within the meaning

of the Securities Act, and, if we take advantage of certain exemptions from disclosure requirements available to emerging growth companies,

this could make our securities less attractive to investors; |

| ● | A portion of our total outstanding shares are restricted from

immediate resale but may be sold into the market in the near future; |

| ● | Uncertain global macro-economic and political conditions could

materially adversely affect our results of operations and financial condition; and |

| ● | Natural disasters, including and not limited to unusual weather

conditions, epidemic outbreaks, terrorist acts and political events could disrupt our business schedule. |

THE OFFERING

We are registering the

offer and sale, from time to time, by the Selling Holders of (i) up to 1,200,000 shares of Common Stock that were issued in lieu

of payment of deferred underwriting commissions in an aggregate amount of $12,100,000, or an effective price of $10.08 per share, pursuant

to the Fee Modification Agreement, in connection with the Closing of the Business Combination, (ii) up to 1,666,666 shares of Common

Stock that were issued at a price of $3.00 per share pursuant to the MWE Fee Agreement in connection with payment of Business Combination

transaction expenses, (iii) up to 466,666 shares of Common Stock that the Company is contractually bound to issue at a price of $3.00

per share pursuant to the EGS Fee Agreement in connection with payment of Business Combination transaction expenses, (iv) up to 20,000

shares of Common Stock that were issued at a price of $3.00 per share pursuant to the OTB Agreement in connection with the Closing of

the Business Combination, (v) up to 1,071,506 shares of Common Stock that were issued to Ananda Trust for an aggregate purchase price

of $10,000,000, or approximately $9.33 per share, pursuant to a subscription agreement dated October 13, 2022 which closed upon the Closing

of the Business Combination, (vi) up to 1,666,666 shares of Common Stock that were issued to Ananda Trust at a price of $3.00 per

share in connection with the Closing of the Business Combination, and (vii) up to 12,512,080 shares of Common Stock issuable to ACM or

its registered assigns upon the conversion of the Note, at a conversion price of (x) the Conversion Price, in any amount, in ACM’s

discretion, and (y) the Amortization Conversion Price, up to an amount equal to 25% of the highest trading day value of shares of Common

Stock on a daily basis during the 20 trading days preceding the applicable conversion date, or a greater amount upon obtaining the Company’s

prior written consent.

If

each of the Selling Holders were to sell their shares of Common Stock registered for resale herein, based on the closing price of our

Common Stock of $1.39 as of March 6, 2024, the Selling Holders would receive the following returns: Cantor and J.V.B would be expected

to earn an effective loss of $8.69 per share, MWE, EGS and OTBC would be expected to earn an effective loss of $1.61 per share, Ananda

Trust would be expected to earn a loss of $7.94 per share issued in connection with the October 2022 subscription agreement and to earn

a loss of $1.61 per share issued in connection with the Closing of the Business Combination and ACM would be expected to earn an effective

loss of $8.61 per share at the initial Conversion Price (but could earn an effective gain of up to $1.14 per share if the Conversion

Price is adjusted to the floor price). Even if the trading price of our Common Stock is significantly below the effective price at which

the Selling Holders purchased or otherwise received their shares, the Selling Holders may still have an incentive to sell their shares,

particularly in such instances where the shares were issued in lieu of cash fees due to the Selling Holder at the closing of the Business

Combination. Furthermore, because ACM may convert its Note at a discount to the then current market price down to the floor price, there

may be significant pressure on the stock price of our Common Stock upon the effectiveness of the registration statement that this prospectus

forms a part. Public investors should be aware that they may not experience a similar rate of return on the securities they purchase

due to differences in the purchase prices and the current trading price. See “Risk Factors” for more information.

The following information

is as of March 1, 2024 and does not give effect to issuances of our Common Stock, warrants or options to purchase shares of our Common

Stock after such date, or any exercise of warrants or options after such date.

|

Issuer

|

|

Zoomcar Holdings, Inc. |

| |

|

|

Shares of our Common Stock outstanding

as of the date hereof |

|

65,088,271 |

| |

|

|

|

Shares of Common Stock offered by the

Selling Holders |

|

18,603,584 |

| |

|

|

|

Use of Proceeds |

|

We will not receive any proceeds from the sale of the Common Stock

to be offered by the Selling Holders. We will also not receive any proceeds from the conversion of Notes. |

| Lock-Up |

|

Subject to certain customary exceptions, the 1,200,000 shares of Common Stock issued to Cantor and J.V.B. pursuant to the Fee Modification Agreement (the “Modified Fee Shares”) are subject to certain restrictions on transfer as follows: (i) as to the first one-third of each holder’s Modified Fee Shares, six (6) months after the Closing, (ii) as to the second one-third of such holder’s Modified Fee Shares, nine (9) months after the Closing, and (iii) as to all remaining Modified Fee Shares, twelve (12) months after the Closing. Notwithstanding the foregoing, the applicable lock-up period shall terminate as to all Modified Fee Shares upon the completion by the Company of a liquidation, restructuring (whether in or out of court), merger, reverse-merger, capital stock exchange offer, tender offer or rights offer, reorganization, recapitalization or other similar transactions that results in all of the Company’s stockholders having the right to exchange their shares for cash, securities or other property. Subject to certain customary exceptions, the 1,666,666 shares of Common Stock issued to MWE under the MWE Fee Agreement (the “MWE Shares”) are subject to certain restrictions on transfer as follows: (i) as to the first one-third of the MWE Shares, six (6) months after the Closing, (ii) as to the second one-third of the MWE Shares, nine (9) months after the Closing, and (iii) as to all remaining MWE Shares, twelve (12) months after the Closing. Notwithstanding the foregoing, the applicable lock-up period shall terminate as to all MWE Shares upon the completion by the Company of a liquidation, restructuring (whether in or out of court), merger, reverse-merger, capital stock exchange offer, tender offer or rights offer, reorganization, recapitalization or other similar transactions that results in all of the Company’s stockholders having the right to exchange their shares for cash, securities or other property. The 20,000 shares of Common Stock issued to OTBC under the OTB Agreement (the “OTBC Shares”) are subject to a lock-up period ending six months from the Closing Date. The 2,738,172 shares of Common Stock issued to Ananda Trust (the “Ananda Trust Shares” and, together with the Modified Fee Shares, MWE Shares and OTBC Shares, the “Lock-Up Shares,” and such lock-up periods, the “Lock-Up Periods”) in connection with the Closing of the Business Combination are subject to a lock-up period terminating upon the earlier of (i) twelve months after the Closing Date or (ii) subsequent to the Business Combination, the date on which the Company completes a liquidation, merger, capital stock exchange, reorganization or other similar transactions that results in all of the Company’s stockholders having the right to exchange their shares of cash, securities or other property. See “Securities Act Restrictions on Resale of Securities - Lock-Up Agreements” for further discussion. |

| |

|

|

| Nasdaq Ticker Symbols |

|

Common Stock: “ZCAR” Warrants: “ZCARW” |

| |

|

|

| Outstanding Warrants |

|

In addition to the Company’s Common Stock and the Notes, the Company also has warrants to

purchase 49,456,226 shares of Common Stock outstanding. These warrants include 11,500,000 Public Warrants which have an exercise

price of $5.71 per share and warrants to purchase 37,956,226 shares of Common Stock at an exercise price of $3.00 per share.

All of the Company’s warrants are currently out of the money and there is no guarantee that the warrants will be in the money.

Any cash proceeds associated with the exercises of the warrants are dependent on the Company’s stock price. See “Risk

Factors” herein. |

MARKET PRICE, TICKER SYMBOLS AND DIVIDEND INFORMATION

Market Price and Ticker Symbols

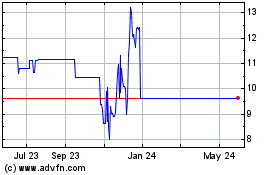

Our Common Stock trades on

the Nasdaq Global Market under the symbol “ZCAR,” and our Warrants commenced trade on the Nasdaq Capital Market under the

symbol “ZCARW.”

The closing price of

our Common Stock and Warrants as reported by Nasdaq on March 8, 2024, was $1.31 and $0.0356, respectively.

Holders

As of March 1, 2024,

there were 583 holders of record of our Common Stock and one holder of record of our Warrants. A substantially greater number of

holders are “street name” or beneficial holders, whose shares of record are held by banks, brokers, and other financial institutions.

Dividend Policy

We have not paid any cash dividends

on our Common Stock to date. It is the present intention of our Board to retain all earnings, if any, for use in our business operations

and, accordingly, our Board does not anticipate declaring any dividends in the foreseeable future. The payment of cash dividends

in the future will be dependent upon our revenues and earnings, if any, capital requirements and general financial condition. The payment

of any cash dividends is within the discretion of our Board. Further, our ability to declare dividends may be limited by the terms of

financing or other agreements entered into by us or our subsidiaries from time to time.

RISK FACTORS

An investment in our Common

Stock and Warrants involves a high degree of risk. You should carefully consider the risks described below before making an investment

decision. Our business, prospects, financial condition or operating results could be harmed by any of these risks, as well as other risks

not currently known to us or that we currently consider immaterial. The trading price of our Common Stock and Warrants could decline due

to any of these risks, and, as a result, you may lose all or part of your investment.

In the course of conducting

our business operations, we are exposed to a variety of risks. Any of the risk factors we describe below have affected or could materially

adversely affect our business, financial condition and results of operations. The market price of our securities could decline, possibly

significantly or permanently, if one or more of these risks and uncertainties occurs. Certain statements in “Risk Factors”

are forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

Risks related to our Business and Operations

Our current business model’s limited

operating history and financial results make our future results, prospects and the risks we may encounter difficult to predict.

Although Zoomcar commenced

operating in 2013, we have recently transitioned from a prior business model to our current business model, consisting of our asset-light

online platform for peer-to-peer car sharing. As a result of this transition, certain components of our financial statements have experienced

variation, and our operating history may not be indicative of our future growth or financial results. The limited history of our current

business model makes predicting our future operating and other results difficult, if not impossible, and there is no assurance that we

will be able to grow our revenues in future periods. Our results of operations are impacted by a number of factors, some of which are

beyond our control, and we may suffer adverse impacts to our further development as a result of circumstances which include decreasing

customer demand, increasing competition, declining growth of the car sharing industry in general, insufficient supply of vehicles on our

platform, or changes in government policies or general economic conditions. We will continue to develop and improve the features, functions,

technologies and other offerings on our platform to increase our Guest and Host bases and volume of bookings on our platform. However,

the execution of our business plan is subject to uncertainty and bookings may not grow at the rate we expect. If our growth rates decline,

investors’ perceptions of our business and prospects may be adversely affected and the market price of our common stock could decline.

Potential investors should

also consider the risks and uncertainties that a company with a limited history, such as ours, will face in the evolving personal mobility

solutions market. In particular, there can be no assurance that we will:

| ● | successfully

execute on our business plan, particularly in light of our current liquidity and capital

resources; |

| ● | facilitate sufficient bookings to become profitable in the

near-term if at all; |

| ● | attract increasing numbers of Hosts and Guests within our

current markets and future potential additional markets; |

| ● | increase penetration within our current markets through continued

improvements in vehicle density, platform features and strategic marketing efforts; |

| ● | enable us to successfully execute our business plans; |

| ● | enhance our brand recognition and awareness; |

| ● | acquire new Hosts and Guests by increasing our market penetration

with deeper market coverage and a broader geographical reach; |

| ● | develop new platform functionality and features that enhance

our ability to retain Guests and Hosts; |

| ● | develop, improve or innovate our proprietary technology that

allows for a sustainable competitive advantage; |

| ● | attract, retain, and manage a sufficient staff of management

and technology personnel; or |

| ● | respond effectively to competitive pressures. |

We have a history of operating losses

and negative cash flow, and we will need to raise additional funds imminently to finance operations.

We have a history of

operating losses and expect to continue incurring operating losses in the foreseeable future as we continue to develop our current business

model and enhance our platform offerings. Additionally, as of March 1, 2024, we have cash and cash equivalents that is sufficient to

support our business and operations for only the next 30 days and we have indebtedness that is in default in excess of our current capital

resources (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity

and Capital Resources”). Accordingly, we will require additional funds imminently to support current operations and, in the

long term, the growth of our business. Our operations have consumed substantial amounts of cash, and we have incurred operating losses

since we began operating in 2013. While our cash consumption has been reduced following our business transition from short-term rental

of vehicles owned by or leased to Zoomcar to an online platform for peer-to-peer car sharing, we have consumed significant amounts of

cash in effecting such transition in terms of technology and platform innovation, and our cash consumption has varied over time. Our

cash needs will depend on numerous factors, including our revenues, upgrade and innovation of our peer-to-peer car sharing platform,

customer and market acceptance and use of our platform, and our ability to reduce and control costs. We expect to devote substantial

capital resources to, among other things, fund operations, continue improvement, upgrading or innovation of our platform, and expand

our international outreach. If we are unable to secure such additional financing, it will have a material adverse effect on our business,

and we may have to limit operations in a manner inconsistent with our development.

Our operating and financial forecasts are

subject to various known and unknown contingencies and factors outside of our control and may not prove accurate, and we may not achieve

results consistent with management’s expectations.

Our quarterly and annual operating

results have fluctuated in the past and are likely to fluctuate in the future. During any given period, our operating and financial results

may be influenced by numerous factors, many of which are unpredictable or are outside of our control. Additionally, our limited operating

history with our current peer-to-peer car sharing business model makes it difficult for us to forecast our future results and subjects

us to a number of uncertainties, including our ability to plan for and anticipate future growth. As a result, you should not rely upon

our past quarterly and annual operating results as indicators of future performance. We have encountered, and will continue to encounter,

risks and uncertainties frequently experienced by growing companies in rapidly evolving markets, such as the risks and uncertainties described

herein.

The market for online platforms for peer-to-peer

car sharing is relatively new and rapidly evolving. If we fail to successfully adapt to developments in our market, or if peer-to-peer

car sharing online platforms do not achieve general acceptance, it could adversely affect our business, financial condition and operating

results.

The market for online peer-to-peer

car sharing platforms is relatively new and unproven and the data and research available regarding the market or the industry may be limited

and unreliable. It is uncertain whether the peer-to-peer car sharing market will continue to develop or if our platform will achieve and

sustain a level of demand and market acceptance sufficient for us to generate meaningful revenue, net income, and cash flow. Our success

will depend to a substantial extent on the willingness of Hosts and Guests to use our platform to identify car sharing opportunities.

Some Hosts may be reluctant or unwilling to make their vehicles available for use on our platform because of concerns which may include,

but are not limited to, potential decline in the value of their vehicle if listed on our platform, uncertainty of economic benefits from

platform usage, ability to recover losses associated with lost or damaged property, compliance with our platform’s terms of use,

data privacy and security concerns, or other reasons.

In addition, our success also

requires utilization of our platform by Guests to book vehicles. Guests’ willingness to utilize our platform may depend, among other

factors, on Guests’ belief in the ease-of use, integrity, quality, availability, safety, cost-effectiveness, convenience and reliability

of our platform and the vehicles listed by Hosts for bookings thereon. Any shift in Guest preferences in the markets in which we operate

could have a material adverse effect on our business. Additionally, Guests may be reluctant or unwilling to use a platform requiring Guests

to provide personally identifiable information, payment information and driver’s license details, or have their driving behaviors

monitored during bookings. Further, Guests may be reluctant to book vehicles containing GPS-enabled tracking or monitoring devices accessible

by Zoomcar, or to use our platform at all due to the perception of the use of such devices.

If we do not retain existing Hosts, or attract

and maintain new Hosts, or if Hosts fail to provide an adequate supply of high-quality vehicles, our business, financial condition, and

results of operations may be negatively impacted.

Our success in a given geographic

market depends on our ability to establish and grow the scale of our platform in that market by attracting Hosts and Guests to our platform.

We depend upon having Hosts register high quality vehicles on our platform, maintain the safety and cleanliness of their vehicles, and

ensure that the descriptions and availability of their vehicles on our platform are accurate and up-to-date. These practices are beyond

our direct control and the number of vehicles shared by Hosts and resulting bookings options available to Guests on our platform may decline

based on a number of factors including, among other things, public health and safety concerns, including pandemics/epidemics; economic,

social, and political factors; state laws and regulations regarding car sharing, or the absence of such laws and regulations, challenges

obtaining, insuring, financing and servicing vehicles to list on the platform, some of which may be exacerbated by infrastructure challenges

in the emerging market where we operate our business. If Hosts register and offer fewer high-quality vehicles to Guests on our platform,

our bookings and revenues may decline, and our results of operations could be materially adversely affected. Further, if Hosts with available

vehicles choose not to offer their vehicles through our platform because competitive carsharing platforms emerge that Hosts find more

attractive than our platform, Hosts may be unwilling to continue registering vehicles or making them available for bookings through the

platform. For example, Hosts may cease or reduce vehicle registrations or the periods of time they make cars available for bookings for

any number of reasons, such as competitor platforms having more Guests making bookings, risk of vehicle damage for which Hosts may not

be able to recoup damages from Zoomcar or hesitancy to install the IoT GPS-enabled tracking device we require Hosts to affix to vehicles

upon platform registration or for any other reason, we may lack sufficient supply of vehicles to attract Guests to utilize our platform.

If Hosts do not share sufficient numbers of vehicles, or if the vehicles they register to our platform are less attractive to Guests than

vehicles offered by competitors, our revenue would likely decline and our business, financial condition, and results of operations could

be materially adversely affected.

Hosts are not required to make

their vehicles available on our platform for a minimum sharing period or number of bookings and Hosts may choose not to share their vehicles

on our platform at all if we cannot generate sufficient demand for their vehicles or if bookings through our platform are not sufficiently

attractive to Hosts to retain and attract Hosts to use the platform. While we continue to invest in tools and resources to support Hosts,

the pricing features and other capabilities of our platform may not be as attractive to Hosts as those developed by our competitors, and

Hosts may not share their vehicles on our platform as a result. If Hosts perceive that listing vehicles on our platform may be insufficiently

remunerative to, for example, offset any leasing, financing, parking, registration, maintenance, and repair costs of vehicles registered

to the platform, we may lose or fail to attract Hosts and may not be able to make a sufficient number of vehicles available for use by

our Guests.

If we fail to retain existing Guests, or

attract and maintain new Guests, our business, financial condition, and results of operations may be negatively impacted.

Our business model depends

on our ability to retain and attract Guests to make bookings on our platform. There are a number of trends in and aspects of Guest preferences

which have an impact on us and the car sharing industry as a whole. These include, among others, preferences for types of vehicles, convenience

of online bookings, and monetary savings associated with car sharing and platform bookings relative to other possible transportation solutions.

Any shift in Guest preferences, which are susceptible to change, in the markets in which we operate could have a material adverse effect

on our business. For example, if the vehicles registered to our platform are not popular or of sufficient quality or are not available

at locations convenient for Guests, Guests may lose interest in utilizing our platform. Additionally, if Guests find our platform not

to be user-friendly or to lack functions that Guests expect from a carsharing or other online platform, Guests may decrease or stop using

our platform. Our competitiveness therefore depends on our ability to predict and quickly adapt to Guest trends, exploiting profitable

opportunities for platform development, innovation and upgrades without alienating our existing Guest base or focusing excessive resources

or attention on unprofitable or short-lived trends. If we are unable to respond on a timely and appropriate basis to changes in demand

or Guest preferences, our business may be adversely affected.

Additionally, if we are unable

to compete with other carsharing platforms and other mobility solutions in the markets in which we operate, our bookings will decrease,

and our financial results will be adversely affected. Guests desiring to book vehicles through our platform must pay booking fees, which

include, among other fees, “upfront booking fees,” less any applicable discounts and credits, and “value added”

or trip-protection fees payable at the time of a booking; other charges may also be incurred by Guests after a booking, such as trip cancellation

fees, gasoline fees, late fees and other charges. Many of these fees are generated through our platform functions and some of the fees

are selected by Guests from a range of options presented to them at the time of a booking. If our booking and trip-related fees are not

competitive, or our platform functionality is not appealing or outdated, or negative reviews or publications are released in connection

with our platform, Guests may stop or reduce their use of our platform, our business, results of operations, reputation, and financial

condition may be adversely affected.

If we are unable to introduce new or upgraded

platform features that Hosts or Guests recognize as valuable, we may fail to retain and attract such users to our platform and our operating

results would be adversely affected.

To continue to retain and attract

Hosts and Guests to our platform, we will need to continue to introduce new or upgraded features, functions and technologies that add

value for Hosts and Guests that differentiate us from our competitors. Developing and delivering these new or upgraded features, functions

and technologies is costly, and the success of such features, functions and technologies depends on several factors, including the timely

completion, introduction, and market acceptance of such features, functions and technologies. Moreover, any such new or upgraded features,

functions and technologies may not work as intended or may not provide intended value to Hosts and Guests. If we are unable to continue

to develop new or upgraded features, functions and technologies, or if Hosts and Guests do not perceive value in such new or upgraded

features, functions and technologies, Hosts and Guests may choose not to use our platform, which would adversely affect our operating

results.

We have made substantial investments

to develop new or upgraded features, functions and technologies, and we intend to continue investing significant resources in developing

new technologies, tools, features, services and other platform offerings. If we are unable to attract/retain and pay qualified technical

staff required to continue our platform feature development efforts, we may not realize the expected benefits of our developments.

There can be no assurance that

the new developments will exist or be sustained at the levels that we expect, or that any of these new developments will gain sufficient

traction or market acceptance to generate enough revenue to offset any new expenses or liabilities associated with these new investments.

Our development efforts with respect to new features, functions and technologies on our platform could distract management from current

operations and will divert capital and other resources from our more established functions and technologies. Even if we are successful

in developing new features, functions or technologies, or otherwise update or upgrade our platform, regulatory authorities may subject

us to new rules or restrictions in response to our innovations that could increase our expenses or prevent us from successfully commercializing

the new features, functions, technologies, updates or upgrades of our platform. If we are unable to adapt in a cost-effective and timely

manner in response to the changing market conditions or platform users’ preferences, either for technical, legal, financial or other

reasons, our business, financial condition and results of operations may be materially and adversely affected.

We require additional capital to support

current operations and will require additional capital to support the growth of our business, which may not be available on terms acceptable

to us, or at all.

To continue current operations,

we will need to raise capital imminently. Further, to continue to effectively compete thereafter, we will require additional funds to

support the growth of our business. Our operations have consumed substantial amounts of cash, and we have incurred operating losses,

since we began operating in 2013. While our cash consumption has been reduced following our business transition from short-term rental

of vehicles owned by or leased to Zoomcar to an online platform for peer-to-peer car sharing, we have consumed significant amounts of

cash in effecting such transition in terms of technology and platform innovation, and our cash consumption has varied over time.

Further, as a result

of the consummation of the Business Combination, we expect our expenses to continue to increase substantially in connection with actions

and efforts we will need to take in preparing for and operating as a public company. Moreover, we expect our expenses to increase significantly

in connection with our ongoing activities, including the continuing increase in our technological capabilities with respect to IoT, machine

learning, and artificial intelligence and particularly to the extent that we may, in the future, decide to expand our operations into

jurisdictions outside of the three countries in which we currently operate. We do not currently have sufficient cash resources to operate

our business beyond 30 days and accordingly, will need to raise capital imminently to continue our operations and to fully execute our

business plan. Additionally, circumstances could cause us to consume capital more rapidly than we currently anticipate and if our cash

resources are insufficient to satisfy our cash requirements, we may seek to issue additional equity or debt securities or obtain new

or expanded credit facilities or identify and secure additional sources of capital. Our ability to obtain external financing in the future

is subject to a variety of uncertainties, including our future financial condition, results of operations, cash flows, share price performance,

liquidity of international capital and lending markets and governmental regulations in different jurisdictions in which we currently

operate our business. In addition, incurring indebtedness would subject us to increased debt service obligations and could result in

operating and financing covenants that would restrict our operations. There can be no assurance that financing will be available in a

timely manner or in amounts or on terms acceptable to us, or at all. Any failure to raise needed funds on terms favorable to us, or at

all, will severely restrict our liquidity as well as have a material adverse effect on our business, financial condition and results

of operations. In addition, any issuance of equity or equity-linked securities could result in significant dilution to our existing shareholders.

Additionally, fundraising efforts may divert our management from its day-to-day duties and activities, which may affect our ability to

execute on our business plan. If we do not raise additional capital imminently to continue operations in the short term or otherwise

when required or in sufficient amounts and on acceptable terms, we may need to:

| ● | significantly delay, scale back or discontinue certain business