Filed Pursuant to Rule 424(b)(5)

Registration No. 333-279036

PROSPECTUS SUPPLEMENT

(To the Prospectus Dated August 7, 2024)

Up to $75,000,000

Common Stock

We

have entered into an amended and restated at-the-market sales agreement, or the Sales Agreement, with RBC Capital Markets,

LLC and BTIG, LLC, or the Sales Agents, each acting in its respective capacity as a sales agent, relating to the offer and sale of

shares of our common stock, from time to time, having an aggregate offering price of up to $75,000,000. Upon entry into the Sales Agreement,

we amended and replaced our original sales agreement, or the Original Sales Agreement, having an aggregate offering price of up to $75,000,000

we entered with BTIG, LLC on March 10, 2021, as amended on August 16, 2023.

Sales

of our common stock, if any, under this prospectus supplement will be made by any method that is deemed to be an “at the market

offering” as defined in Rule 415(a)(4) under the Securities Act of 1933, as amended, or the Securities Act. The Sales Agents are

not required to sell any specific amount of securities, but will act as our sales agent using commercially reasonable efforts consistent

with its normal trading and sales practices, on mutually agreed terms between the Sales Agents and us. There is no arrangement for funds

to be received in any escrow, trust or similar arrangement.

The

Sales Agents will be entitled to compensation at a fixed commission rate of 3.0% of the gross proceeds from the sale of our common stock

on our behalf pursuant to the Sales Agreement. In connection with the sale of the common stock on our behalf, the Sales Agents will be

deemed to be “underwriters” within the meaning of the Securities Act, and the compensation of the Sales Agents will be deemed

to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to the Sales Agents against certain

civil liabilities, including liabilities under the Securities Act or the Securities Exchange Act of 1934, as amended, or the Exchange

Act.

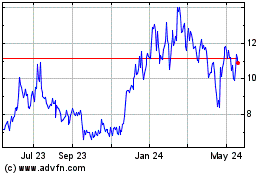

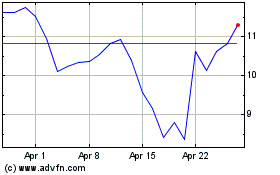

Our

common stock is currently traded on The Nasdaq Capital Market, or Nasdaq, under the symbol “INMB.” On August 8, 2024, the

last reported sales price for our common stock was $7.59 per share.

We

are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act,

and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus supplement, the accompanying

prospectus and our filings with the Securities and Exchange Commission.

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-5 of this prospectus supplement

and under similar headings in the accompanying prospectus and the other documents that are incorporated by reference herein and therein

before investing in our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is August

9, 2024.

TABLE OF CONTENTS

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying prospectus relate to the offering of our common stock. Before buying any of the common stock that we are offering,

we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with the information incorporated by

reference as described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information

by Reference” in this prospectus supplement. These documents contain important information that you should consider when making

your investment decision.

This document is in two parts.

The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to, changes and updates

information contained in the accompanying prospectus and the documents incorporated by reference herein or therein. The second part, the

accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts

of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the information

contained in any document incorporated by reference into this prospectus supplement that was filed with the Securities and Exchange Commission

(the “SEC”), before the date of this prospectus supplement, you should rely on the information in this prospectus supplement.

If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example,

a document incorporated by reference into this prospectus supplement—the statement in the document having the later date modifies

or supersedes the earlier statement.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein

or in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the

purpose of allocating risk among the parties to such agreement, and should not be deemed to be a representation, warranty or covenant

to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You should rely only on the

information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus and any free writing

prospectuses we may provide to you in connection with this offering. We have not, and the Sales Agents have not, authorized any other

person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely

on it. We are not, and the Sales Agents are not, making an offer to sell or seeking an offer to buy our common stock under this prospectus

in any jurisdiction where the offer or sale is not permitted. Persons outside the United States who come into possession of this prospectus

must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus

outside the United States. Furthermore, you should not consider this prospectus to be an offer or solicitation relating to the securities

if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.

You should not assume that the information contained in this prospectus or any free writing prospectus is accurate as of any date other

than the date on the front cover of those documents, or that the information contained in any document incorporated by reference is accurate

as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or

any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates. It

is important for you to read and consider all information contained in this prospectus supplement, the accompanying prospectus, the documents

incorporated by reference herein and therein, and any free writing prospectus prepared by or on behalf of us that we may authorize for

use in connection with this offering, in their entirety, before making an investment decision. You should also read and consider the information

in the documents to which we have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus supplement and in the accompanying prospectus.

In this prospectus supplement

and the accompanying prospectus, unless the context otherwise requires, references to “INmune Bio,” the “Company,”

“we,” “our,” or “us,” in this prospectus refer to INmune Bio Inc. and its wholly-owned subsidiaries,

unless the context suggests otherwise.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

certain information about this offering and selected information contained or incorporated by reference into this prospectus supplement

and the accompanying prospectus. This summary is not complete and does not contain all of the information that you should consider before

deciding whether to invest in our common stock. You should carefully read this entire prospectus supplement and accompanying prospectus,

including the information incorporated herein and therein, including the “Risk Factors” section beginning on page S-5 of this

prospectus supplement and the other documents incorporated by reference into this prospectus supplement, before making an investment decision.

We are a clinical-stage inflammation

and immunology company focused on developing drugs that modify the patient’s innate immune system to treat disease. We believe targeting

cells of the innate immune system that cause chronic inflammation and are involved in immune dysfunction such as cancer and neurodegenerative

diseases may make a therapeutic impact on many diseases. The Company’s drugs are in clinical trials and have not been approved by

a regulatory authority. The Company has two therapeutic platforms – a dominant-negative TNF platform (“DN-TNF”, “XPro™”,

“XPro1595™”, “INB03”, or “pegipanermin”) and a Natural Killer (“NK”, or “INKmune™”)

platform. The DN-TNF platform neutralizes soluble TNF (“sTNF”) without affecting trans-membrane TNF (“tmTNF”)

or TNF receptors. This unique biologic mechanism differentiates the DN-TNF drugs from currently approved non-selective TNF inhibitors

that inhibit both sTNF and tmTNF. Protecting the function of tmTNF and TNF receptors while neutralizing the function of sTNF is a potent

anti-inflammatory strategy that does not cause immunosuppression or demyelination which occur in the currently approved non-selective

TNF inhibitors and many other potent anti-inflammatory drugs. Currently approved non-selective TNF inhibitors treat autoimmune disease,

but are contraindicated in patients with infection, cancer and neurologic diseases because they increase the risk of infection, cancer

and demyelinating neurologic diseases; these safety problems are due to off-target effects on inhibiting tmTNF.

The NK platform targets the

dysfunctional natural killer cells in patients with cancer. NK cells are part of the normal immune response to cancer with important roles

in immunosurveillance to prevent cancer and in preventing relapse by eliminating residual disease. Residual disease is the cancer left

behind after therapy is finished. Residual disease can grow to cause relapse. The NK cells of cancer patients lose the ability to bind

and kill cancer cells. A measure of NK cell binding to cancer cells is avidity. The higher the avidity, the greater the bond between the

NK cell to cancer cell and thus the greater NK killing of cancer cells. INKmune increases NK avidity and further improves mitochondrial

function and upregulates nutrient receptors. These metabolic changes may help the INKmune™ primed NK cell to function in the hostile

tumor microenvironment and persist much longer. These mechanisms improve the ability of INKmune™ primed NK cells to overcome the

immune evasion of the patient’s cancer cells. We believe INKmune™ may be best used to eliminate residual disease after the

patient has completed other cancer therapies.

Both the DN-TNF platform and

the INKmune platform can be used to treat multiple diseases. The DN-TNF platform will be used as an immunotherapy for the treatment of

cancer (INB03) and neurodegenerative disease. INKmune™ is being developed to treat NK-resistant hematologic malignancies and solid

tumors.

We

believe our DN-TNF platform can be used as a CNS (“central nervous system”) therapy to target glial activation to prevent

progression of Alzheimer’s disease (“AD”); to target neuroinflammation in treatment resistant depression (“TRD”);

as a drug to treat many chronic inflammatory diseases; and as a cancer therapy to reduce resistance in immunotherapy. The primary focus

of the company’s development efforts for XPro™ is AD which is currently in a Phase 2 trial to determine if reduction of chronic

inflammation without immunosuppression makes a difference in cognition. The next indication to be developed with XPro™ will be TRD.

The drug is named differently for the oncology and CNS indications; INB03™ or XPro, respectively, but it is the same drug product.

This novel compound has the same mechanism of action but has novel IP protection. In each case, we believe neutralizing sTNF is a cornerstone

to the treatment of these diseases. As an immunotherapy for cancer, we are using INB03 to neutralize sTNF produced by HER2+ trastuzumab

resistant breast cancers to reverse resistance to targeted therapy. sTNF produced by the tumor causes an up-regulation of MUC4 express

causing steric hindrance of trastuzumab binding to the HER receptor on HER2+ breast cancer cells. Without binding, trastuzumab based therapies

are not effective. Neutralizing sTNF reverses MUC4 expression converting a trastuzumab resistant breast cancer cell into a trastuzumab

sensitive breast cancer cell. In a nude mouse model, INB03 may change the immunobiology of the tumor microenvironment by decreasing the

number of immunosuppressive myeloid cells, both myeloid derived suppressor cells and tumor active macrophages and phagocytic macrophages

in the TME. In the TME of immunocompetent mice, INB03 increases the number of cytotoxic lymphocytes modifies the TME by downregulating

immune exhaustion markers – PDL-1, TIGIT, LAG3, CTLA4, CD47 and SIRPꭤ. The Company has completed an open label dose escalation

trial in cancer patients with metastatic solid tumors that have failed multiple lines of therapy. The pre-clinical data in MUC4+ expressing

tumors and the clinical trial informs the design of a future Phase II trial by demonstrating that INB03 was safe and well tolerated, defined

the dose of INB03 to carry into Phase II trials, and demonstrated a pharmacodynamic endpoint. The company does not plan to commence a

Phase II trial in patients with advanced MUC4+ expressing cancer until a partner can be found or extra-mural funding is secured.

Likewise, we believe the DN-TNF

platform can be used to treat selected neurodegenerative diseases by modifying the brain microenvironment (“BME”). The Company

believes the core pathology of cognitive decline is a combination of neurodegeneration and synaptic dysfunction. Neurodegeneration is

nerve cell death that may include demyelination. Synaptic dysfunction means the connections between nerve cells stop working efficiently

and may decrease in number. The combination of neurodegeneration and synaptic dysfunction causes cognitive decline and behavioral changes

associated with Alzheimer’s disease (“AD”). XPro™ completed a Phase I trial treating patients with Alzheimer’s

disease that was partially funded by a Part-the-Clouds Award from the Alzheimer’s Association. We believe XPro targets activated

microglia and astrocytes of the brain that produce sTNF that promotes nerve cell loss, synaptic dysfunction and prevents myelin repair

- key elements in the development of dementia. In animal models, elimination of sTNF prevents nerve cell dysfunction, reverses synaptic

pruning and promotes myelin repair. The Phase I trial in patients with biomarkers of inflammation with AD has been completed. The open

label, dose escalation trial was designed to demonstrate that XPro can safely decrease neuroinflammation in patients with ADi. ADi is

the term used to delineate patients with AD with biomarkers of inflammation. The endpoints of the trial were measures of neuroinflammation

and neurodegeneration in blood and cerebral spinal fluid by measuring changes in inflammatory cytokine levels in the CNS and using MRI-DTI

to measure brain microstructural changes. XPro, at the 1mg/kg/week dose, decreased inflammatory cytokines in the CSF in the brain demonstrating

that XPro can decrease neuroinflammation in patients with AD. We also studied downstream benefits of decreasing neuroinflammation by measuring

changes in the CSF proteome and quantifying changes in novel white and gray matter MRI biomarkers. XPro significantly decreases biomarkers

of neurodegeneration as measured by changes in the CSF proteome including neurofilament light chain, phospho Tau 217 and VILIP-1;

decreases of 84%, 46% and 91% respectively after 3 months of therapy. Three months of XPro therapy improved measures of synaptic function,

as measured in the CSF proteome including a 222% increase in Contactin 2 and a 56% decrease neurogranin, changes that contribute to improved

synaptic function.

The successful completion

of the Phase I trial in AD has informed the design of a blinded randomized, placebo-controlled Phase II trial in patients with early ADi.

Early ADi includes patients with AD and MCI who have at least one biomarker of inflammation (ADi and MCI2 respectively). The early

ADi trial is a blinded randomized trial to test if treatment of early AD patients with neuroinflammation with XPro will affect cognitive

decline. The Phase II trial in early ADi has six important elements. Two hundred and one patients are being enrolled in a 2:1 ratio (XPro

vs placebo). The patients will receive 1mg/kg/week as a subcutaneous injection for six months. An enrichment strategy identical to the

successful strategy used in the Phase I trial will be used to ensure patients have neuroinflammation. Patients will need to have one or

more enrichment criteria: elevated blood level of at least one of C-reactive protein, hemoglobin A1c, erythrocyte sedimentation or at

least one allele of ApoE4. The primary endpoint will be Early/mild Alzheimer’s Cognitive Composite (“EMACC”), a validated

cognitive measure that is more sensitive than traditional endpoints used in many studies of patients with early AD. Although EMACC is

a primary endpoint, CDR-SB, a well recognized cognitive test is being used as a secondary endpoint as well. The AD program is open in

the United States, Australia, Canada, the United Kingdom, France, Germany, Spain, Czech Republic and Slovakia. Because of resource constraints,

a planned open-label extension has been stopped.

There

are at least 4 clinical milestones associated with the Phase II trial in AD. Enrollment of 201 patients in the Phase II AD trial is expected

to be complete by mid-year. Six months after the last patient is enrolled, top line cognition data with EMACC will be available. Secondary

endpoints which include CDR-SB, blood biomarker, neuroimaging and additional neuropsychiatric endpoints will be available after data-base

lock 2-3 months after top line data. Finally, several months after all the data are analyzed, the Company plans an end-of-phase II meeting

with the FDA to finalize plans for the pivotal Phase III trial. XPro for treatment of AD may be eligible for one or both accelerated approval

pathways The Company plans to apply for an accelerated pathway during 2024. The Company plans to submit of Fast Track status in 2024.

We expect to be eligible for Break Through status after completion of the Phase II trial in 2025.

Effective

therapy for TRD is a large unmet need. Twenty percent of patients with Major Depressive Disorder have TRD. Once third of TRD patients

have peripheral biomarkers to inflammation (elevated CRP). This is a large patient population. The role of TNF and anti-TNF therapeutics

was explored in a small open label clinical trial by Prof. Andrew Miller, MD of Emory University demonstrated the patients have elevated

TNF levels and treatment with infliximab treated their depression (Miller, 2011). The Company received a $2.9M USD award from the National

Institute of Mental Health (“NIMH”) to treat TRD with XPro. The blinded, randomized Phase II trial will use biomarkers of

peripheral inflammation to select patients with TRD for enrollment. Patients will be treated for 6 weeks. Primary end-points include both

clinical and neuroimaging measures. The final trial design is ongoing and discussions with the FDA are not complete. The Company expects

to receive authorization to initiate a clinical trial in TRD in the 2H24. The TRD trial is expected to start enrollment after the AD Phase

II trial finishes patient enrollment.

Our

data show that INKmune improves the ability of the patient’s own NK cells to attack their tumor. INKmune interacts with the patient’s

NK cells to convert them from inert resting NK cells into memory-like NK cells that kill the patient’s cancer cells. INKmune is

a replication incompetent proprietary cell line that is given to the patient after determining that i) the patient has adequate NK cells

in their circulation and ii) those NK cells are functional when exposed to INKmune in vitro. INKmune is designed to be given to patients

after their immune system has recovered after cytotoxic chemotherapy to target the residual disease that remains after conventional treatment.

We have in vitro data suggesting that INKmune can be used to treat numerous hematologic malignancies and solid tumors including leukemia,

multiple myeloma, lymphoma, lung, ovary, breast, renal and prostate cancer. The Company had a Phase I trial using INKmune to treat patients

with high risk MDS/AML, a form of leukemia. Two patients were treated in the Phase I trial for MDS, three patients have been treated compassionately

in AML and another MDS patient is expected to be treated shortly. During March 2024, the Company decided to terminate further enrollment

in the MDS/AML trial due to recruitment difficulties in the European trial sites. However, in the patients who were treated, INKmune therapy

was shown to be safe, and induced development of cancer killing memory-like NK cells that were found in the patient’s circulation

for up to 4 months. The Company initiated a separate Phase I/2 trial of INKmune in a metastatic castrate resistant prostate cancer in

8 trials sites across the US. The open label trial enrolled the first patient in December 2023, opened the second cohort in June and is

on track with recruitment.

The

Phase I/II trial using INKmune™ to treat patients with metastatic castrate resistant prostate cancer (mCPRC) is an open label trial.

Biomarker data from the patients will be visible as patients are treated. The Company will report data from each cohort as it becomes

available. In addition to clinical data, the Company will communicate when the Phase I portion of the trial has completed follow-up. This

is expected in September 2024. Because of the modified Bayesian design, the Company estimates the trial will be completely enrolled 1H25

with top-line data available 6 months later. Topline data are divided into immunologic and tumor response variables. The most important

immunologic response variable is related to memory like NK cell persistence. This is how long are the number of mlNK cells in patients’

blood compared to baseline. There are 3 important variables to tumor response: i) blood PSA changes; ii) change in PMSA scan and iii)

change in circulating tumor DNA (ctDNA). Ideally, the levels of all three variables decrease with treatment, but, in this patient group

with advanced disease, absence of progression will be a notable achievement. We do not expect this 6-month trial to provide survival data.

Corporate Information

Our principal executive offices

are located at 225 NE Mizner Blvd., Suite 640, Boca Raton, Florida 33432. Our telephone number is (858) 964-3720. We maintain an Internet

website at www.inmunebio.com. The information contained on, connected to or that can be accessed via our website is not part of this prospectus.

We have included our website address in this prospectus as an inactive textual reference only and not as an active hyperlink.

THE OFFERING

| Common stock offered by us |

Shares of our common stock having an aggregate offering price of up to $75,000,000. |

| |

|

| Manner of offering |

“At the market offering” that may be made from time to time to or through the Sales Agents. Please see “Plan of Distribution” on page S-8. |

| |

|

| Use of Proceeds |

We intend to use the net proceeds from this offering for general corporate purposes, including to support research and development, including clinical trials. |

| |

|

| Risk Factors |

Investing in our common stock involves significant risks. See “Risk Factors” beginning on page S-5 of this prospectus supplement and in the documents incorporated by reference herein for a discussion of factors you should consider carefully before investing in our common stock. |

| |

|

| Nasdaq Capital Market symbol |

“INMB” |

RISK FACTORS

An investment in our common

stock involves a high degree of risk. Prior to making a decision about investing in our common stock, you should carefully consider the

risk factors described below and the risk factors discussed in the sections entitled “Risk Factors” contained in our most

recent Annual Report on Form 10-K, and our other filings with the SEC and incorporated by reference in this prospectus supplement, together

with all of the other information contained in this prospectus supplement. Our business, financial condition and results of operations

could be materially and adversely affected as a result of these risks. This could cause the trading price of our common stock to decline,

resulting in a loss of all or part of your investment.

Risks Related to this Offering

We will have broad discretion in the use

of the net proceeds from this offering and, despite our efforts, we may use the net proceeds in a manner that does not increase the value

of your investment.

We currently intend to use

the net proceeds from this offering for general corporate purposes, including to support research and development, including clinical

trials. However, we have not determined the specific allocation of the net proceeds among these potential uses. Our management will have

broad discretion over the use and investment of the net proceeds from this offering, and, accordingly, investors in this offering will

need to rely upon the judgment of our management with respect to the use of proceeds, with only limited information concerning our specific

intentions. We may use the net proceeds in ways that do not improve our operating results or increase the value of your investment.

Certain shares previously sold under our Original

Sales Agreement may have been sold in violation of federal and state securities laws and may be subject to rescission rights and other

penalties, requiring us to repurchase shares sold thereunder.

In connection with our Original Sales Agreement we became aware that

our shelf registration statement on Form S-3 (file number 333-237368) (the “Registration Statement”) expired on April

2, 2023. Prior to becoming aware of the expiration, we sold an aggregate of 75,697 shares of our common stock following the expiration

of the Registration Statement and through July 17, 2023 at an average price of approximately $10.56 per share for an aggregate of approximately

$799,212 under the Registration Statement pursuant to the Original Sales Agreement (the “Sales”). Because the Registration

Statement had already expired, the Sales could be determined to be unregistered sales of securities and, in accordance with Section 5

of the Securities Act, direct purchasers in the Sales may have rescission rights pursuant to which they may be entitled to recover the

amount paid for such shares, plus statutory interest, upon returning the shares to us within one year from the transaction date. In addition,

we could be subject to enforcement actions or penalties and fines by federal and/or state regulatory authorities. We cannot predict the

likelihood of any claims or actions being brought against us or the amount of any penalties or fines in connection with the Sales.

You may experience immediate and substantial

dilution in the net tangible book value per share of the common stock you purchase in the offering. In addition, we may issue additional

equity or convertible debt securities in the future, which may result in additional dilution to you.

The offering price per share

in this offering may exceed the pro forma net tangible book value per share of our common stock outstanding as of June 30, 2024. Assuming

that we sell an aggregate of 9,816,754 shares of our common stock at a price of $7.64 per share, the last reported sale price of our common

stock on Nasdaq on August 5, 2024, for aggregate gross proceeds of approximately $75,000,000, and after deducting commissions and estimated

aggregate offering expenses payable by us, you will experience immediate dilution of $4.48 per share, representing the difference between

our pro forma as adjusted net tangible book value per share as of June 30, 2024, after giving effect to this offering and the assumed

offering price. See the section titled “Dilution” below for a more detailed illustration of the dilution you would incur if

you participate in this offering. In addition, to the extent we need to raise additional capital in the future and we issue additional

shares of common stock or securities convertible or exchangeable for our common stock, our then existing stockholders may experience dilution

and the new securities may have rights senior to those of our common stock offered in this offering.

The common stock offered hereby will be sold in “at-the-market”

offerings, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering

at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have

discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no minimum or maximum sales

price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the prices

they paid.

Sales of our common stock in this offering, or the perception

that such sales may occur, could cause the market price of our common stock to fall.

We may issue and sell shares of our common stock

for aggregate gross proceeds of up to $75,000,000 from time to time in connection with this offering. The issuance and sale from time

to time of these new shares of common stock, or our ability to issue these new shares of common stock in this offering, could have the

effect of depressing the market price of our common stock.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement,

the accompanying prospectus and the information incorporated by reference herein and therein contain or incorporate forward-looking statements

within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements reflect

management’s beliefs and assumptions. In addition, these forward-looking statements reflect management’s current views with

respect to future events or our financial performance, and involve certain known and unknown risks, uncertainties and other factors, including

those identified below, which may cause our or our industry’s actual or future results, levels of activity, performance or achievements

to differ materially from those expressed or implied by any forward-looking statements or from historical results. We intend the forward-looking

statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and

Section 21E of the Exchange Act. Forward-looking statements include information concerning our possible or assumed future results of operations

and statements preceded by, followed by, or that include the words “may,” “will,” “could,” “would,”

“should,” “believe,” “expect,” “plan,” “anticipate,” “intend,”

“estimate,” “predict,” “potential” or similar expressions.

Forward-looking statements

are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate.

Although we believe that the expectations reflected in the forward-looking statements are based upon reasonable assumptions at the time

made, we can give no assurance that the expectations will be achieved. Future events and actual results, financial and otherwise, may

differ materially from the results discussed in the forward-looking statements. Readers are cautioned not to place undue reliance on these

forward-looking statements.

The factors described under

“Risk Factors” in this prospectus supplement and in any documents incorporated by reference herein, and other factors could

cause our or our industry’s future results to differ materially from historical results or those anticipated or expressed in any

of our forward-looking statements. We operate in a continually changing business environment, and new risk factors emerge from time to

time. Other unknown or unpredictable factors also could have material adverse effects on our future results, performance or achievements.

We cannot assure you that projected results or events will be achieved or will occur.

You should read this prospectus

supplement, the accompanying prospectus and the information incorporated by reference herein and therein completely and with the understanding

that our actual future results may be materially different from what we expect. Any forward-looking statement speaks only as of the date

of this prospectus supplement. We do not assume any obligation to update any forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by law.

USE OF PROCEEDS

We may issue and sell shares

of our common stock having aggregate gross sales proceeds of up to $75,000,000 from time to time. Because there is no minimum offering

amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any,

are not determinable at this time.

We will retain broad discretion

over the use of the net proceeds from the sale of the securities offered hereby. We currently intend to use the net proceeds from this

offering for general corporate purposes, including to support research and development, including clinical trials. The precise amount

and timing of the application of such proceeds will depend upon our funding requirements and the availability and cost of other capital.

As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds that we

will have from the sale of the shares of our common stock. Pending the use of the net proceeds from this offering, if any, we may invest

the net proceeds in investment grade, short-term interest-bearing obligations, such as money-market funds, certificates of deposit, or

direct or guaranteed obligations of the United States government or hold the net proceeds as cash.

DILUTION

If you purchase shares of

our common stock in this offering, your interest will be diluted to the extent of the difference between the public offering price per

share and the net tangible book value per share of our common stock after this offering. We calculate net tangible book value per share

by dividing our net tangible assets (tangible assets less total liabilities) by the number of shares of our common stock issued and outstanding

as of June 30, 2024.

Our historical net tangible

book value at June 30, 2024 was $20,566,000 or approximately $1.04 per share of our common stock. After giving effect to the sale of our

common stock in the aggregate amount of approximately $75,000,000 in this offering, at an assumed offering price of $7.64 per share, the

last reported sale price of our common stock on Nasdaq on August 5, 2024, and after deducting estimated offering expenses and commissions

payable by us, our adjusted net tangible book value as of June 30, 2024, would have been approximately $93,251,000 or approximately $3.16

per share of our common stock. This represents an immediate increase in the net tangible book value of $2.12 per share of our common stock

to our existing stockholders and an immediate dilution in net tangible book value of approximately $4.48 per share of our common stock

to new investors. The following table illustrates per share dilution:

| Assumed public offering price per share | |

$ | 7.64 | |

| Net tangible book value per share as of June 30, 2024 | |

$ | 1.04 | |

| Increase in net tangible book value per share attributable to this offering | |

$ | 2.12 | |

| Adjusted net tangible book value per share as of June 30, 2024, after giving effect to this offering | |

$ | 3.16 | |

| Dilution per share to new investors purchasing shares in this offering | |

$ | 4.48 | |

The table above assumes for

illustrative purposes that an aggregate of 9,816,754 shares of our common stock are sold at a price of $7.64 per share, the last reported

sale price of our common stock on Nasdaq on August 5, 2024, for aggregate gross proceeds of approximately $75,000,000. The shares sold

in this offering, if any, will be sold from time to time at various prices. An increase of $2.00 per share in the price at which the shares

are sold from the assumed offering price of $7.64 per share shown in the table above, assuming all of our common stock in the aggregate

amount of $75,000,000 is sold at that price, would increase our adjusted net tangible book value per share after the offering to $3.39

per share and would increase the dilution in net tangible book value per share to new investors in this offering to $6.25 per share, after

deducting estimated offering expenses and commissions payable by us. A decrease of $2.00 per share in the price at which the shares are

sold from the assumed offering price of $7.64 per share shown in the table above, assuming all of our common stock in the aggregate amount

of $75,000,000 is sold at that price, would decrease our adjusted net tangible book value per share after the offering to $2.83 per share

and would decrease the dilution in net tangible book value per share to new investors in this offering to $2.81 per share, after deducting

estimated offering expenses and commissions payable by us. This information is supplied for illustrative purposes only.

The information above is based

on 19,706,732 shares of our common stock outstanding as of June 30, 2024, and excludes:

| ● | 6,291,807

shares of our common stock issuable upon the exercise of stock options outstanding at June 30, 2024, at a weighted average exercise price

of $8.87 per share (4,890,811 of which are exercisable at a weighted average exercise price of $8.54 per share); |

| ● | 1,602,978

shares of our common stock issuable upon the exercise of warrants outstanding at June 30, 2024, at a weighted average exercise price

of $9.71 per share; |

| |

● |

1,156,718 additional shares of our common stock available for future issuance as of June 30, 2024, under our amended and restated INmune Bio Inc. 2021 stock incentive plan; |

| |

|

|

| |

● |

75,697 shares of common stock classified as redeemable common stock a June 30, 2024; |

To the extent that outstanding

options or warrants are exercised, or we issue other shares, investors purchasing shares in this offering could experience further dilution.

In addition, to the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of

those securities could result in further dilution to our stockholders.

PLAN OF DISTRIBUTION

We have entered into the Sales

Agreement with RBC Capital Markets, LLC and BTIG, LLC under which we may issue and sell shares of our common stock having an aggregate

offering price of up to $75,000,000 from time to time through them as our Sales Agents. The sales of our common stock, if any, under this

prospectus supplement will be made at market prices by any method deemed to be an “at the market offering” as defined in Rule

415(a)(4) under the Securities Act, including sales made directly on Nasdaq, or sales made to or through a market maker other than on

an exchange.

Each time that we wish

to issue and sell shares of our common stock under the Sales Agreement, we will provide a Sales Agent with a placement notice

describing the amount of shares to be sold, the time period during which sales are requested to be made, any limitation on the

amount of shares of common stock that may be sold in any single day, any minimum price below which sales may not be made or any

minimum price requested for sales in a given time period and any other instructions relevant to such requested sales. Upon receipt

of a placement notice, the applicable Sales Agent, acting as our sales agent, will use commercially reasonable efforts, consistent

with its normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of Nasdaq, to

sell shares of our common stock under the terms and subject to the conditions of the placement notice and the Sales Agreement. We or

the applicable Sales Agent may suspend the offering of common stock pursuant to a placement notice upon notice and subject to other

conditions. The Sales Agents, in their sole discretion, may decline to accept any placement notice.

The applicable Sales

Agent will provide written confirmation to us no later than the opening of the trading day on Nasdaq following the trading day on

which shares of our common stock are sold through the applicable Sales Agent as sales agent under the Sales Agreement. Each

confirmation will include the number of shares sold on the preceding day, the net proceeds to us and the commissions payable by us

to the Sales Agents in connection with the sales.

Settlement for sales of common

stock under the Sales Agreement will occur on the first trading day following the date on which such sales are made (or on such other

date as is industry practice for regular-way trading), unless otherwise specified in the applicable placement notice, in return for payment

of the net proceeds to us. There are no arrangements to place any of the proceeds of this offering in an escrow, trust or similar account.

Sales of our common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust

Company or by such other means as we and the Sales Agents may agree upon.

We will pay the Sales Agents

commissions for its services in acting as our sales agent in the sale of our common stock pursuant to the Sales Agreement. The Sales Agents

will be entitled to compensation at a fixed commission rate of 3.0% of the gross proceeds from the sale of our common stock on our behalf

pursuant to the Sales Agreement. We also have agreed to reimburse the Sales Agents for its reasonable out-of-pocket expenses, including

the fees and disbursements of their counsel, incurred in connection with entering into the Sales Agreement, in an amount not to exceed

$20,000, plus additional amounts, not to exceed $15,000 per calendar quarter during which shares of our common stock have been sold under

the Sales Agreement.

We estimate that the total

expenses for this offering, excluding compensation payable to the Sales Agents and certain expenses reimbursable to the applicable Sales

Agents under the terms of the Sales Agreement, will be approximately $65,000. The remaining sales proceeds, after deducting any expenses

payable by us and any transaction fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the

sales, will equal our net proceeds for the sale of such common stock.

Because there are no minimum

sale requirements as a condition to this offering, the actual total public offering price, commissions and net proceeds to us, if any,

are not determinable at this time. The actual dollar amount and number of shares of common stock we sell through this prospectus supplement

will be dependent, among other things, on market conditions and our capital raising requirements.

We will report at least quarterly

the number of shares of common stock sold through the Sales Agents under the Sales Agreement, the net proceeds to us and the compensation

paid by us to the Sales Agents in connection with the sales of common stock.

In connection with the sale

of the common stock on our behalf, the Sales Agents will be deemed to be “underwriters” within the meaning of the Securities

Act, and the compensation of the Sales Agents will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification

and contribution to the Sales Agents against certain civil liabilities, including liabilities under the Securities Act or the Exchange

Act.

The Sales Agents will not

engage in any market making activities involving our common stock while the offering is ongoing under this prospectus supplement if such

activity would be prohibited under Regulation M or other anti-manipulation rules under the Securities Act. As our sales agent, the Sales

Agents will not engage in any transactions that stabilizes our common stock.

The offering pursuant to the

Sales Agreement will terminate upon the earlier of (i) the sale of all shares of common stock subject to the Sales Agreement and (ii)

termination of the Sales Agreement as permitted therein. We may terminate the Sales Agreement in our sole discretion at any time by giving

10 days’ prior notice to the Sales Agents. The Sales Agents may terminate the Sales Agreement under the circumstances specified

in the Sales Agreement and in its sole discretion at any time by giving 10 days’ prior notice to us.

The Sales Agreement has been filed as an exhibit to a current report

on Form 8-K that we filed with the SEC in connection with this offering and is incorporated into this prospectus supplement by reference.

The Sales Agents and/or their affiliates may in

the future provide, various investment banking and other financial services for us, for which services may in the future receive customary

fees.

LEGAL MATTERS

The validity of the shares

of common stock offered by this prospectus were passed upon by Sichenzia Ross Ference Carmel LLP, New York, New York. Certain matters

will be passed upon for the Sales Agents by Lowenstein Sandler LLP, New York, New York.

EXPERTS

The consolidated

financial statements of INmune Bio Inc. as of and for the years ended December 31, 2023 and 2022 appearing in INmune Bio

Inc.’s Annual Report on Form 10-K for the year ended December 31, 2023, have been audited by Marcum LLP, as set forth in its

report thereon, which includes an explanatory paragraph as to the Company’s ability to continue as a going concern, included

therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in

reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly

and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public at the SEC’s

web site at http://www.sec.gov.

We make available free of

charge on or through our Internet website www.inmunebio.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current

reports on Form 8–K, and amendments to those reports filed or furnished pursuant to Section 13(a), 14 or 15(d) of the Exchange Act

as soon as reasonably practicable after we electronically file the material with, or furnish it to, the SEC. The references to www.inmunebio.com in

this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein or therein are inactive textual

references only, and the information found on our internet website is not incorporated by reference into, and should not be considered

part of, this prospectus supplement, the accompanying base shelf prospectus or the documents incorporated by reference herein or therein.

Investors should not rely on any such information in deciding whether to invest in our common stock.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to incorporate

by reference information contained in documents we file with it, which means that we can disclose important information to you by referring

you to those documents already on file with the SEC that contain that information. The information incorporated by reference is considered

to be part of this prospectus supplement, and later information that we file with the SEC will automatically update and supersede this

information. We incorporate by reference the documents listed below and any future information filed (rather than furnished) with the

SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, between the date of this prospectus supplement and the termination of

the offering of the securities covered by this prospectus supplement, provided, however, that we are not incorporating any information

furnished under any of Item 2.02 or Item 7.01 of any Current Report on Form 8-K (and exhibits filed on such form that are related to such

items):

| ● | our

Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March

28, 2024, and as amended by Form 10-K/A on April 16, 2024; |

| ● | our Current Reports on

Form 8-K filed with the SEC on January

2, 2024, March 27, 2024, March 29, 2024, April 9, 2024, April 22, 2024, April 25, 2024, April 26, 2024, April 30, 2024,

May 13, 2024, May 16, 2024, May 23, 2024, May 30, 2024, June 13, 2024, July 1, 2024, July 5, 2024, July 19, 2024 and July 30, 2024; |

| ● | our

Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024, filed

with the SEC on May 9, 2024 and August 1, 2024, respectively; |

| ● | the

description of our common stock contained in our Registration Statement on Form 8-A filed

with the SEC on February 1, 2019 (File No. 001-38793), as amended by Exhibit 4.1 to our Annual

Report on Form 10-K filed on March 3, 2022, including any subsequent amendment or any report

filed for the purpose of updating such description; and |

| ● | all

reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date

of this prospectus and prior to the termination of this offering. |

The information about us contained in this prospectus

should be read together with the information in the documents incorporated by reference. You may request a copy of any or all of these

filings, at no cost, by writing or telephoning us at: David Moss, INmune Bio Inc., 225 NE Mizner Blvd, Suite 640, Boca Raton, Florida

33432, telephone number (858) 964-3720.

PROSPECTUS

$250,000,000

INMUNE BIO Inc.

Common Stock

Preferred Stock

Warrants

Units

We may from time to time, in one or more offerings

at prices and on terms that we will determine at the time of each offering, sell common stock, preferred stock, warrants, or a combination

of these securities, or units, up to a total offering price of $250,000,000.

This prospectus describes the general manner in

which our securities may be offered using this prospectus. Each time we offer and sell securities, we will provide you with a prospectus

supplement that will contain specific information about the terms of that offering. Any prospectus supplement may also add, update, or

change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement as

well as the documents incorporated or deemed to be incorporated by reference in this prospectus before you purchase any of the securities

offered hereby.

We are an

“emerging growth company” under applicable Securities and Exchange Commission, rules and, as such, have elected to comply

with certain reduced public company reporting requirements for this prospectus and future filings.

This prospectus may not be used to offer and sell

securities unless accompanied by a prospectus supplement.

Our common stock is currently traded on The

Nasdaq Capital Market (“Nasdaq”) under the symbol “INMB.” On July 30, 2024, the last reported sales price for

our common stock was $8.26 per share. The applicable prospectus supplement will contain information, where applicable, as to any other

listing of the securities on Nasdaq or any other securities market or exchange covered by the prospectus supplement. Prospective purchasers

of our securities are urged to obtain current information as to the market prices of our securities, where applicable.

We may offer the securities directly or through

agents or to or through underwriters or dealers. If any agents or underwriters are involved in the sale of the securities their names,

and any applicable purchase price, fee, commission or discount arrangement between or among them, will be set forth, or will be calculable

from the information set forth, in an accompanying prospectus supplement. We can sell the securities through agents, underwriters or dealers

only with delivery of a prospectus supplement describing the method and terms of the offering of such securities. See “Plan of Distribution.”

The aggregate market value of our outstanding

common stock held by non-affiliates was approximately $132.2 million which was calculated based on 19,782,429 shares of outstanding common

stock held by non-affiliates as of July 30, 2024, and a price per share of $9.86, the closing price of our common stock on July 16, 2024.

Investing in our securities involves significant

risks. We strongly recommend that you read carefully the risks we describe in this prospectus and in any accompanying prospectus supplement,

as well as the risk factors that are incorporated by reference into this prospectus from our filings made with the Securities and Exchange

Commission. See “Risk Factors” beginning on page 5 of this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

This prospectus is dated August 7, 2024

Table of Contents

You should rely only on the information contained

or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with information

different from that contained or incorporated by reference into this prospectus. If any person does provide you with information that

differs from what is contained or incorporated by reference in this prospectus, you should not rely on it. No dealer, salesperson or other

person is authorized to give any information or to represent anything not contained in this prospectus. You should assume that the information

contained in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information

contained in any document we have incorporated by reference is accurate only as of the date of the document incorporated by reference,

regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. These documents are not

an offer to sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under this shelf

registration process, we may sell any combination of the securities described in this prospectus in one of more offerings up to a total

dollar amount of proceeds of $250,000,000. This prospectus describes the general manner in which our securities may be offered by this

prospectus. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms

of that offering. The prospectus supplement may also add, update or change information contained in this prospectus or in documents incorporated

by reference in this prospectus. The prospectus supplement that contains specific information about the terms of the securities being

offered may also include a discussion of certain U.S. Federal income tax consequences and any risk factors or other special considerations

applicable to those securities. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements

made in this prospectus or in documents incorporated by reference in this prospectus, you should rely on the information in the prospectus

supplement. You should carefully read both this prospectus and any prospectus supplement together with the additional information described

under “Where You Can Find More Information” before buying any securities in this offering.

The terms “INmune Bio”, the “Company,”

“we,” “our,” or “us,” in this prospectus refer to INmune Bio Inc. and its wholly-owned subsidiaries,

unless the context suggests otherwise.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Some of the statements made under “Prospectus

Summary,” “Use of Proceeds,” and elsewhere in this prospectus, as well as the documents incorporated by reference herein,

including in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, constitute forward-looking statements within

the meaning of The Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology

such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential,” “intends,” or “continue,”

or the negative of these terms or other comparable terminology.

These forward-looking statements may include, but

are not limited to, statements related to our expected business, new product introductions, results of clinical studies, expectations

regarding regulatory clearance and the timing of FDA or non-US filings or approvals including meetings with FDA or non-U.S. regulatory

bodies, our ability to raise funds for general corporate purposes and operations, including our research activities and clinical trials,

procedures and procedure adoption, future results of operations, future financial position, our ability to generate revenues, our financing

plans and future capital requirements, anticipated costs of revenue, anticipated expenses, the effect of recent accounting pronouncements,

our anticipated cash flows, our ability to finance operations from cash flows or otherwise, and statements based on current expectations,

estimates, forecasts, and projections about the economies and markets in which we operate and intend to operate and our beliefs and assumptions

regarding these economies and markets.

Forward-looking statements are not guarantees of

future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments

made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments,

and other factors they believe to be appropriate.

Important factors that could cause actual results,

developments and business decisions to differ materially from those anticipated in these forward-looking statements include, among others,

those factors referred to in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which is incorporated by reference

herein.

These statements are only current predictions and

are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels

of activity, performance, or achievements to be materially different from those anticipated by the forward-looking statements. We discuss

many of these risks in the documents incorporated by reference herein. You should not rely upon forward-looking statements as predictions

of future events.

Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements.

Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as a result of new

information, future events or otherwise, after the date of this prospectus.

PROSPECTUS SUMMARY

This summary highlights certain information

about us and selected information contained in the prospectus. This summary is not complete and does not contain all of the information

that may be important to you. For a more complete understanding of the Company, we encourage you to read and consider the more detailed

information included or incorporated by reference in this prospectus and our most recent consolidated financial statements and related

notes.

We are a clinical-stage immunology company focused

on developing drugs that may reprogram the patient’s innate immune system to treat disease. We believe this may be done by targeting

cells of the innate immune system that cause acute and chronic inflammation and are involved in immune dysfunction associated with chronic

diseases such as cancer and neurodegenerative diseases. The Company’s drugs are in clinical trials and have not been approved by

a regulatory authority. The Company has two therapeutic platforms – a dominant-negative TNF platform (“DN-TNF”, “XPro™”,

“XPro1595™” or “pegipanermin”) and a Natural Killer (“NK”, or “INKmune™”)

platform. The DN-TNF platform neutralizes soluble TNF (“sTNF”) without affecting trans-membrane TNF (“tmTNF”)

or TNF receptors -TNFR1 and TNFR2. This unique biologic mechanism differentiates the DN-TNF drugs from currently approved non-selective

TNF inhibitors that inhibit both sTNF and tmTNF. Protecting the function of tmTNF and TNF receptors while neutralizing the function of

sTNF is a potent anti-inflammatory strategy that does not cause immunosuppression or demyelination which occur in the currently approved

non-selective TNF inhibitors. Currently approved non-selective TNF inhibitors treat autoimmune disease, but are contraindicated in patients

with infection, cancer and neurologic diseases because they increase the risk of infection, cancer and demyelinating neurologic diseases,

respectively; these safety problems are due to off-target effects on inhibiting tmTNF. The NK platform targets the dysfunctional natural

killer cells in patients with cancer. NK cells are part of the normal immunologic response to cancer with important roles in immunosurveillance

to prevent cancer and in preventing relapse by eliminating residual disease. Residual disease is the cancer left behind after therapy

is finished. Residual disease can grow to cause relapse. The mechanism by which INKmune improves the ability of the patient’s NK

cells to kill their cancer is complex. The NK cells of cancer patients lose the ability to bind and kill cancer cells. A measure of NK

cell binding to cancer cells is avidity. The higher the avidity, the greater the bond between the NK cell to cancer cell and thus the

greater NK killing of cancer cells. INKmune increases NK avidity and further improves mitochondrial function and upregulates nutrient

receptors. These metabolic changes may help the INKmune primed NK cell to function in the hostile tumor microenvironment and persist much

longer. These mechanisms improve the ability of INKmune primed NK cells to overcome the immune evasion of the patient’s cancer cells.

We believe INKmune is best used to eliminate residual disease after the patient has completed other cancer therapies. Both the DN-TNF

platform and the INKmune platform can be used to treat multiple diseases. The DN-TNF platform will be used as an immunotherapy for the

treatment of cancer and neurodegenerative disease. INKmune is being developed to treat NK sensitive hematologic malignancies and solid

tumors.

We believe our DN-TNF platform

can be used as a CNS (“central nervous system”) therapy to target glial activation to prevent progression of Alzheimer’s

disease (“AD”); to target neuroinflammation in treatment resistant depression (“TRD”); as a drug to prevent muscle

degeneration, prevent fibrosis and promote muscle regeneration in Duchene muscular dystrophy (“DMD”); and as a cancer therapy

to reduce resistance in immunotherapy. The primary focus of the company’s development efforts for XPro is AD. The next indication

to be developed with XPro will be TRD. Treatment of DMD and cancer will occur when partners for the programs are found. The drug is named

differently for the oncology and CNS indications; INB03™ or XPro, respectively, but it is the same drug product. For DMD, the company

is exploring DN-TNF compounds that is optimized for the treatment of DMD. This novel compound has the same mechanism of action but has

novel IP protection. In each case, we believe neutralizing sTNF is a cornerstone to the treatment of these diseases. As an immunotherapy

for cancer, we are using INB03 to neutralize sTNF produced by HER2+ trastuzumab resistant breast cancers to reverse resistance to targeted

therapy. sTNF produced by the tumor causes an up-regulation of MUC4 express causing steric hindrance of trastuzumab binding to the HER

receptor on HER2+ breast cancer cells. Without binding, trastuzumab based therapies are not effective. Neutralizing sTNF reverses MUC4

expression converting a trastuzumab resistant breast cancer cell into a trastuzumab sensitive breast cancer cell. In addition, INB03 may

change the immunobiology of the tumor microenvironment by decreasing the number of immunosuppressive myeloid cells, both myeloid derived

suppressor cells and tumor active macrophages, and increasing the number of cytotoxic lymphocytes and phagocytic macrophages in the TME.

The Company has completed an open label dose escalation trial in cancer patients with metastatic solid tumors that have failed multiple

lines of therapy. The pre-clinical data in MUC4+ expressing tumors and the clinical trial informs the design of a future Phase II trial

by demonstrating that INB03 was safe and well tolerated, defined the dose of INB03 to carry into Phase II trials, and demonstrated a pharmacodynamic

end-point. The company does not plan to commence a Phase II trial in patients with advanced MUC4+ expressing cancer until a partner can

be found.

Likewise, we believe the DN-TNF

platform can be used to treat selected neurodegenerative diseases by modifying the brain microenvironment (“BME”). The Company

believes the core pathology of cognitive decline is a combination of neurodegeneration and synaptic dysfunction. Neurodegeneration is

nerve cell death that may include demyelination. Synaptic dysfunction means the connections between nerve cells stop working efficiently

and may decrease in number. The combination of neurodegeneration and synaptic dysfunction causes cognitive decline and behavioral changes

associated with Alzheimer’s disease (“AD”). XPro completed a Phase I trial treating patients with Alzheimer’s

disease that was partially funded by a Part-the-Clouds Award from the Alzheimer’s Association. We believe XPro targets activated

microglia and astrocytes of the brain that produce sTNF that promotes nerve cell loss, synaptic dysfunction and prevents myelin repair

- key elements in the development of dementia. In animal models, elimination of sTNF prevents nerve cell dysfunction, reverses synaptic

pruning and promotes myelin repair. The Phase I trial in patients with biomarkers of inflammation with AD has been completed. The open

label, dose escalation trial was designed to demonstrate that XPro can safely decrease neuroinflammation in patients with ADi. ADi is

the term used to delineate patients with AD with biomarkers of inflammation. The endpoints of the trial were measures of neuroinflammation

and neurodegeneration in blood and cerebral spinal fluid by measuring changes in inflammatory cytokine levels in the CNS and using MRI-DTI

to measure brain microstructural changes. XPro, at the 1mg/kg/week dose, decreased inflammatory cytokines in the CSF in the brain demonstrating

that XPro can decrease neuroinflammation in patients with AD. We also studied downstream benefits of decreasing neuroinflammation by measuring

changes in the CSF proteome and quantifying changes in novel white matter MRI biomarkers. XPro significantly decreases biomarkers of neurodegeneration as

measured by changes in the CSF proteome including neurofilament light chain, phospho Tau 217 and VILIP-1; decreases of 84%, 46% and 91%

respectively after 3 months of therapy. Three months of XPro therapy improved measures of synaptic function, as measured in the CSF proteome

including a 222% increase in Contactin 2 and a 56% decrease neurogranin, changes that contribute to improved synaptic function.

The successful completion

of the Phase I trial in AD has informed the design of a blinded randomized, placebo-controlled Phase II trial in patients with early ADi.

Early ADi includes patients with AD and MCI who have at least one biomarker of inflammation (ADi and MCI2 respectively).

The early ADi trial is a blinded randomized trial to test if treatment of early AD patients with neuroinflammation with XPro will affect

cognitive decline. The Phase II trial in early ADi has six important elements. Two hundred and one patients are being enrolled in a 2:1

ratio (XPro vs placebo). The patients will receive 1mg/kg/week as a subcutaneous injection for six months. An enrichment strategy identical

to the successful strategy used in the Phase I trial will be used to ensure patients have neuroinflammation. Patients will need to have

one or more enrichment criteria: elevated blood level of at least one of C-reactive protein, hemoglobin A1c, erythrocyte sedimentation

and at least one allele of ApoE4. The primary end-point will be Early/mild Alzheimer’s Cognitive Composite (“EMACC”),

a validated cognitive measure that is more sensitive than traditional end-points used in many studies of patients with early AD. The AD

program is open in the United States, Australia, Canada, the United Kingdom, France, Germany, Spain, Czech Republic and Slovakia. All

patients will be offered to stay on therapy for at least 12 months in an extension trial. Clinical and biomarker data will be collected

during the extension trial.

There are at least 4 clinical

milestones associated with the Phase II trial in AD. Enrollment of 201 patients in the Phase II AD trial should be complete by mid-year.

Six months after the last patient is enrolled, top line cognition data with EMACC will be available. Secondary end-points which include

blood biomarker, neuroimaging and additional neuropsychiatric end-points will be available after data base lock 2-3 months after top line

data. Finally, several months after all the data are analyzed, the Company plans an end-of-phase II meeting with the FDA to finalize plans

for the pivotal Phase III trial. The Company plans to apply for an accelerated pathway during 2024. XPro for treatment of AD may be eligible

for one or both accelerated approval pathways. The Company plans to submit of Fast Track status in 2024. We expect to be eligible for

Break Through status after completion of the Phase II in 2025.

Effective therapy for TRD

is a large unmet need. Twenty percent of patients with a Major Depressive Disorder have TRD. Once third of TRD patients have peripheral

biomarkers to inflammation (elevated CRP). This is a large patient population. The role of TNF and anti-TNF therapeutics was explored

in a small open label clinical trial by Prof. Andrew Miller, MD of Emory University demonstrated the patients have elevated TNF levels

and treatment with infliximab treated their depression (Miller, 2011). The Company received a $2.9M USD award from the National Institute

of Mental Health (“NIMH”) to treat TRD with XPro. The blinded, randomized Phase II trial will use biomarkers of peripheral

inflammation to select patients with TRD for enrollment. Patients will be treated for 6 weeks. Primary end-points include both clinical

and neuroimaging measures. The final trial design is ongoing and discussions with the FDA are not complete. The Company received authorization

to initiate a clinical trial in AD in the US during January 2024. The TRD trial is expected to start enrollment after the AD Phase II

trial finishes patient enrollment.

We believe that INKmune improves

the ability of the patient’s own NK cells to attack their tumor. INKmune interacts with the patient’s NK cells to convert

them from inert resting NK cells into memory-like NK cells that kill the patient’s cancer cells. INKmune is a replication incompetent

proprietary cell line that is given to the patient after determining that i) the patient has adequate NK cells in their circulation and

ii) those NK cells are functional when exposed to INKmune in vitro. INKmune is designed to be given to patients after their immune system

has recovered after cytotoxic chemotherapy to target the residual disease that remains after treatment with cytotoxic therapy. We believe

INKmune can be used to treat numerous hematologic malignancies and solid tumors including leukemia, multiple myeloma, lymphoma, lung,

ovary, breast, renal and prostate cancer. The Company had a Phase I trial using INKmune to treat patients with high risk MDS/AML, a form

of leukemia. Two patients were treated in the Phase I trial for MDS, three patients have been treated compassionately in AML and another

MDS patient is expected to be treated shortly. During March 2024, the Company decided to terminate further enrollment in the MDS/AML trial.

In the patients, INKmune therapy is safe, produces memory-like NK cells that kill cancer in vitro, and promotes development of cancer

killing memory-like NK cells that can be found in the patient’s circulation of 4 months. The Company initiated a separate Phase

I/2 trial of INKmune in a metastatic castrate resistant prostate cancer. The open label trial enrolled the first patient in December 2023.

The Phase I/II trial using

INKmune to treat patients with metastatic castrate resistant prostate cancer (mCPRC) is an open label trial. Biomarker data from the patients

will be visible as patients are treated. The Company will report data from each cohort as it becomes available. In addition to clinical

data, the Company will communicate when the Phase I portion of the trial has completely enrolled. This is expected in September 2024.

Because of the modified Bayesian design, the Company estimates the trial will be completely enrolled 1H25 with top-line data available

6 months later. Topline data is divided into immunologic and tumor response variables. The most important immunologic response variable

is related to memory like NK cell persistence. This is how long are the number of mlNK cells in patients blood compared to baseline. There

are 3 important variables to tumor response: i) blood PSA changes; ii) change in PMSA scan and iii) change in circulating tumor DNA (ctDNA).