InMed Pharmaceuticals Inc. (“InMed” or the

“Company”) (Nasdaq: INM), a leader in the development,

manufacturing and commercialization of rare cannabinoids, today

announced financial results for the first quarter of fiscal year

2022 which ended September 30, 2021.

“The first quarter of fiscal 2022 saw positive momentum across

all of our programs,” says Eric A. Adams, InMed President &

CEO. “With the completion of the BayMedica Inc. (“BayMedica”)

acquisition, our integrated teams are working together to identify

rare cannabinoids in BayMedica’s pipeline for commercialization in

the consumer health and wellness industry. For the duration of

fiscal year 2022, we will be focused on growing revenues through

the launch of these selected rare cannabinoids, in addition to

expanding sales of BayMedica’s Prodiol® CBC (cannabichromene) and

progressing our existing programs.”

Business Update

BayMedicaOn October 13, 2021, InMed completed

the acquisition of BayMedica creating an industry leader in the

manufacturing and commercialization of rare cannabinoids.

Management’s immediate focus is to expedite the integration of both

companies and accelerate commercial activities including driving

wholesale B2B revenues of BayMedica’s current Prodiol® CBC product

to the consumer health and wellness sector.

Management anticipates introducing several new, rare

cannabinoids over the next few quarters with a specific focus on

high demand, attractive margin products and expects to grow

revenues considerably in the short-to-medium term.

Additionally, both InMed and BayMedica science teams will

continue to explore the therapeutic potential of BayMedica novel

cannabinoid analogs to incorporate into the Company’s

pharmaceutical drug development programs.

IntegraSyn™ The Company continues to further

optimize IntegraSyn™ as a solution for large-scale,

pharmaceutical-grade Good Manufacturing Practice (“GMP") production

of rare cannabinoids. The team is currently focused on process

optimization to prepare the manufacturing process to be GMP-ready

for pharmaceutical quality production. Next step is to advance

production to a larger batch and continue to improve upon the

previously announced industry leading yield of 5g/L.

The Company continues to believe IntegraSyn™ will be a preferred

method for pharmaceutical production and may dovetail with

BayMedica’s biosynthesis and chemical synthesis manufacturing

approaches for non-pharmaceutical applications.

INM-755 for the treatment of Epidermolysis Bullosa

(“EB”)On September 30, the Company announced it had

commenced its Phase 2 clinical trial, the 755-201-EB study, of

INM-755 (cannabinol) cream in the treatment of EB, marking the

first time cannabinol has advanced to a Phase 2 clinical trial to

be studied as a therapeutic option to treat a disease.

Additionally, InMed has submitted a request for a

pre-Investigational New Drug (“IND”) meeting with the US Food and

Drug Administration (“FDA”) to discuss potential next steps in the

INM-755 clinical program.

The 755-201-EB study is designed to enroll up to 20 patients.

InMed will evaluate the safety of INM-755 (cannabinol) cream and

its preliminary efficacy in treating symptoms and wound healing

over a 28-day treatment period. All four subtypes of inherited EB;

EB Simplex, Dystrophic EB, Junctional EB, and Kindler Syndrome are

eligible for this study.

The study is expected to take place at eleven sites across seven

countries including Austria, Germany, Greece, France, Italy, Israel

and Serbia and regulatory authority and ethics approvals are in

place in five countries. Currently, Clinical Trial Agreements are

fully executed with 5 sites and patient screening is underway at

the first site. The Company is seeking to expand the study into an

eighth country, Spain, with two more sites.

The 755-201-EB study follows two completed Phase 1 studies of

INM-755 (cannabinol) cream, including treatment on intact skin and

treatment on wounded skin, both in healthy volunteers. The Phase 1

studies provided a strong body of evidence demonstrating the

overall safety and tolerability of INM-755 cream.

INM-755 (cannabinol) cream is a topical therapy to treat EB and

potentially other dermatological diseases. Preclinical data

demonstrate that INM-755 (cannabinol) cream may help relieve

hallmark EB symptoms, such as inflammation and pain, as well

potentially restore the integrity of the skin in a subset of EB

Simplex patients.

INM-088 for the treatment of glaucoma On

August 17, 2021, InMed presented preclinical data at the H.C.

Wainwright Ophthalmology Conference demonstrating that cannabinol

(“CBN”) was effective at providing neuroprotection to the retina

ganglion cells and reducing intraocular pressure in glaucoma

models. InMed has continued to develop a larger scale drug product

manufacturing process, completed dose-ranging studies and conducted

topline clinical study design work with its clinical research

organization.

Data from preclinical studies of INM-088 show the effectiveness

of cannabinol at reducing cell death in retinal ganglion cells, an

indication of potential neuroprotection which may lead to extended

retention of vision in glaucoma and other ocular diseases.

We continue to work towards completing our preclinical studies

of our glaucoma program in preparation for human clinical trials

and estimate to file regulatory applications in the second half of

fiscal 2022 seeking to initiate human clinical testing with

INM-088.

PCT ApplicationOn November 3, 2021, InMed filed

an international patent application seeking commercial exclusivity

for the potential treatment of neurodegenerative diseases such as

Alzheimer’s Disease, Parkinson’s Disease, Huntington’s Disease and

others by demonstrating neuroprotection and enhanced neuronal

function using a rare cannabinoid.

This Patent Cooperation Treaty (“PCT”) application, entitled

“Compositions and Methods for Treating Neuronal Disorders with

Cannabinoids”, specifies a rare cannabinoid that may inhibit or

slow the progression of neurodegenerative diseases by providing

neuroprotection and promote neurite outgrowth in a population of

affected neurons.

Expanding InMed’s patent portfolio to include, in addition to

CBN, an incremental rare cannabinoid for the potential treatment of

major neurodegeneration indications demonstrates the Company’s

continued commitment to it’s pharmaceutical programs and the

potential of rare cannabinoids in treating important diseases.

InMed will be hosting analyst update teleconferences on a

semi-annual basis, with the next teleconference to be hosted for

the second quarter 2022 fiscal results. InMed also plans to host a

webinar to discuss the integration of BayMedica and outline

corporate plans for calendar year 2022.

Financing Activities and Results of Operations

(expressed in US Dollars):

On July 2, 2021, the Company closed a $12.0 million private

placement. Under the terms of the private placement, an aggregate

of 890,000 common shares and 3,146,327 pre-funded warrants, and

warrants to purchase up to an aggregate of 4,036,327 common shares,

were purchased. The warrants have an exercise price of $2.848 per

share, are exercisable immediately and have a term of five years.

After deducting the placement agent fees and estimated offering

expenses payable by the Company, the Company received net proceeds

of approximately $11.0 million.

For the three months ended September 30, 2021, the Company

recorded a net loss of $3.0 million, or $0.25 per share, compared

with a net loss of $1.6 million, or $0.31 per share, for the three

months ended September 30, 2020.

Research and development expenses were $1.5 million for the

three months ended September 30, 2021, compared with $0.9 million

for the three months ended September 30, 2020. The increase in

research and development and patents expenses was primarily due to

increased activities related to the INM-755 clinical trials.

The Company incurred general and administrative expenses of $1.4

million for the three months ended September 30, 2021, compared

with $0.6 million for the three months ended September 30, 2020.

The increase results primarily from a combination of changes

including higher insurance fees resulting from the Company’s

listing on the Nasdaq Capital Market and higher legal fees,

personnel expenses and investor relation expenses.

At September 30, 2021, the Company’s cash, cash equivalents and

short-term investments were $15.4 million, which compares to $7.4

million at June 30, 2021. The increase in cash, cash equivalents

and short-term investments during the three months to September 30,

2021, was primarily the result of the July 2, 2021 private

placement partially offset by cash outflows from operating

activities.

At September 30, 2021, the Company’s total issued and

outstanding shares were 10,327,034, or 14,137,034 including all

outstanding pre-funded warrants which are considered common share

equivalents. During the three months ending September 30, 2021,

including the pre-funded warrants, the weighted average number of

common shares was 12,047,555, which is used for the calculation of

loss per share for the interim periods.

|

Table 1: Condensed Consolidated Interim Balance Sheets

(unaudited): |

|

|

|

|

|

|

|

InMed Pharmaceuticals

Inc. |

|

|

| CONDENSED

CONSOLIDATED INTERIM BALANCE SHEETS (unaudited) |

|

|

As at September 30, 2021 and June 30, 2021 |

|

|

|

Expressed in U.S. Dollars |

|

|

|

|

September 30, |

|

June 30, |

|

|

|

2021 |

|

2021 |

|

|

|

|

|

|

ASSETS |

$ |

|

$ |

|

|

Current |

|

|

|

Cash and cash equivalents |

15,343,905 |

|

7,363,126 |

|

|

Short-term investments |

45,224 |

|

46,462 |

|

|

Accounts receivable |

14,842 |

|

11,919 |

|

|

Loan receivable |

250,000 |

|

- |

|

|

Prepaids and other assets |

322,352 |

|

956,762 |

|

|

Total current assets |

15,976,323 |

|

8,378,269 |

|

|

|

|

|

|

Non-Current |

|

|

|

Property and equipment, net |

304,934 |

|

326,595 |

|

|

Intangible assets, net |

1,037,382 |

|

1,061,697 |

|

|

Other assets |

8,625 |

|

14,655 |

|

|

Total Assets |

17,327,264 |

|

9,781,216 |

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

Current |

|

|

|

Accounts payables and accrued liabilities |

1,844,769 |

|

2,134,878 |

|

|

Current portion of lease obligations |

82,232 |

|

80,483 |

|

|

Total current liabilities |

1,927,001 |

|

2,215,361 |

|

|

|

|

|

|

Non-current |

|

|

|

Lease obligations |

178,591 |

|

189,288 |

|

|

Total Liabilities |

2,105,592 |

|

2,404,649 |

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

Common shares, no par value, unlimited authorized shares: |

|

|

|

10,327,034 (June 30, 2021 - 8,050,707) issued and

outstanding |

63,686,724 |

|

60,587,417 |

|

|

Additional paid-in capital |

29,230,464 |

|

21,513,051 |

|

|

Accumulated deficit |

(77,824,085 |

) |

(74,852,470 |

) |

|

Accumulated other comprehensive income |

128,569 |

|

128,569 |

|

|

Total Shareholders' Equity |

15,221,672 |

|

7,376,567 |

|

|

Total Liabilities and Shareholders' Equity |

17,327,264 |

|

9,781,216 |

|

| |

|

|

| |

|

|

|

|

|

Table 2: Condensed Consolidated Interim Statements of

Operations and Comprehensive Loss (unaudited): |

|

|

|

|

|

|

|

InMed Pharmaceuticals Inc. |

|

|

| CONDENSED

CONSOLIDATED INTERIM STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS (unaudited) |

| For the three months ended

September 30, 2021 and 2020 |

|

|

|

Expressed in U.S. Dollars |

|

|

| |

Three Months Ended |

| |

September 30 |

|

|

2021 |

|

2020 |

|

|

|

$ |

|

$ |

|

| Operating

Expenses |

|

|

|

Research and development and patents |

1,491,252 |

|

911,156 |

|

|

General and administrative |

1,372,867 |

|

624,788 |

|

|

Amortization and depreciation |

28,532 |

|

27,981 |

|

|

Total operating expenses |

2,892,651 |

|

1,563,925 |

|

|

|

|

|

|

Other Income (Expense) |

|

|

|

Interest income |

5,148 |

|

4,345 |

|

|

Foreign exchange loss |

(84,112 |

) |

(39,499 |

) |

|

Net loss for the period |

(2,971,615 |

) |

(1,599,079 |

) |

|

|

|

|

|

Other Comprehensive Loss |

|

|

|

Foreign currency translation gain |

- |

|

129,400 |

|

|

Total comprehensive loss for the period |

(2,971,615 |

) |

(1,469,679 |

) |

| |

|

|

|

Net loss per share for the period |

|

|

|

Basic and diluted |

(0.25 |

) |

(0.31 |

) |

|

Weighted average outstanding common shares |

|

|

|

Basic and diluted |

12,047,555 |

|

5,220,707 |

|

|

|

|

|

|

|

|

|

|

Table 3: Condensed Consolidated Interim Statements of Cash

Flows (unaudited): |

|

|

|

|

|

|

|

InMed Pharmaceuticals Inc. |

|

|

| CONDENSED

CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS (unaudited) |

| For the three months ended

September 30, 2021 and 2020 |

|

|

|

Expressed in U.S. Dollars |

|

|

|

|

2021 |

|

2020 |

|

|

|

|

|

|

Cash provided by (used in): |

$ |

|

$ |

|

|

|

|

|

|

Operating Activities |

|

|

|

Net loss for the period |

(2,971,615 |

) |

(1,599,079 |

) |

|

Items not requiring cash: |

|

|

|

Amortization and depreciation |

28,532 |

|

27,981 |

|

|

Share-based compensation |

111,142 |

|

85,407 |

|

|

Non-cash lease expense |

25,906 |

|

20,728 |

|

|

Interest income (accrued) received on short-term investments |

(23 |

) |

140 |

|

|

Unrealized foreign exchange gain |

1,262 |

|

- |

|

|

Payments on lease obligations |

(17,411 |

) |

(16,244 |

) |

|

Changes in non-cash working capital: |

|

|

|

Prepaids and other assets |

634,410 |

|

(31,681 |

) |

|

Other non-current assets |

6,030 |

|

(14,007 |

) |

|

Accounts receivable |

(2,923 |

) |

(5,554 |

) |

|

Accounts payable and accrued liabilities |

(469,227 |

) |

160,719 |

|

|

Total cash used in operating activities |

(2,653,917 |

) |

(1,371,590 |

) |

|

|

|

|

|

Investing Activities |

|

|

|

Loan receivable |

(250,000 |

) |

- |

|

|

Total cash used in investing activities |

(250,000 |

) |

- |

|

|

|

|

|

|

Financing Activities |

|

|

|

Shares issued for cash |

11,999,825 |

|

- |

|

|

Share issuance costs |

(1,115,129 |

) |

(64,648 |

) |

|

Total cash provided by (used in) financing

activities |

10,884,696 |

|

(64,648 |

) |

|

Effects of foreign exchange on cash and cash

equivalents |

- |

|

127,725 |

|

|

Increase (decrease) in cash during the period |

7,980,779 |

|

(1,308,513 |

) |

|

Cash and cash equivalents beginning of the

period |

7,363,126 |

|

5,805,809 |

|

|

Cash and cash equivalents end of the period |

15,343,905 |

|

4,497,296 |

|

|

|

|

|

|

Supplemental disclosure of non-cash financing

activities: |

|

|

|

Warrants issued to placement agent and included in |

|

|

|

share issuance costs related to July 2021 private placement |

739,920 |

|

- |

|

| |

|

|

Learn more about InMed’s Pharmaceutical Programs:

https://www.inmedpharma.com/pharmaceutical/cannabinoids-in-development/

Learn more about InMed’s Cannabinoid Manufacturing Capabilities:

https://www.inmedpharma.com/manufacturing/cannabinoid-manufacturing-capabilities/

About InMed: InMed

Pharmaceuticals is a global leader in the manufacturing and

development of rare cannabinoids. Together with our subsidiary,

BayMedica, we have unparalleled cannabinoid manufacturing

capabilities to serve a spectrum of consumer markets, including

pharmaceutical and health and wellness. We are a clinical-stage

company developing a pipeline of rare cannabinoid therapeutics and

dedicated to delivering new treatment alternatives to patients that

may benefit from cannabinoid-based pharmaceutical drugs. For more

information, visit www.inmedpharma.com.

Investor Contact: Colin ClancySenior Director,

Investor RelationsT: +1 604 416 0999E: cclancy@inmedpharma.com

Edison Group:Joe Green/Laine YonkerT:

+1.646.653.7030/+1.646.653.7035E: jgreen@edisongroup.com /

lyonker@edisongroup.com

Cautionary Note Regarding Forward-Looking

Information:

This news release contains "forward-looking

information" and "forward-looking statements" (collectively,

"forward-looking information") within the meaning of applicable

securities laws. Forward-looking statements are frequently, but not

always, identified by words such as “expects”, “anticipates”,

“believes”, “intends”, “potential”, “possible”, “would” and similar

expressions. Such statements, based as they are on current

expectations of management, inherently involve numerous risks,

uncertainties and assumptions, known and unknown, many of which are

beyond our control. Forward-looking information is based on

management's current expectations and beliefs and is subject to a

number of risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking

statements. Forward-looking information in this news release

includes statements about: identifying rare cannabinoids for

commercialization in the consumer health and wellness industry;

expanding sales of BayMedica’s products including the introduction

of new products; exploring the therapeutic potential of novel

cannabinoid analogs; preparing IntegraSyn™ to be GMP ready and as a

preferred method for pharmaceutical production of cannabinoids; the

755-201-EB study enrolling up to 20 patients to study the safety

and preliminary efficacy of INM-755 (cannabinol) cream; INM-755

(cannabinol) cream treating EB and potentially other dermatological

diseases; expanding the 755-201-EB study into Spain; the potential

of cannabinol to reduce cell death in retinal ganglion cells;

completing INM-088 preclinical studies and filing regulatory

applications in the second half of fiscal 2022; hosting future

webinars to discuss plans for 2022; being a global leader in the

manufacturing and development of rare cannabinoids; and delivering

new treatment alternatives to patients that may benefit from

cannabinoid-based pharmaceutical drugs.

With respect to the forward-looking information

contained in this news release, InMed has made numerous assumptions

regarding, among other things: the anticipated results and

potential of BayMedica’s business; continued economic and market

stability; delivering new therapeutic alternatives to patients that

may benefit from cannabinoid-based pharmaceutical drugs; advancing

IntegraSyn™ to commercial scale production; IntegraSyn™ being a

commercially viable solution for large-scale, pharmaceutical-grade

GMP production of rare cannabinoids; and developing a pipeline of

cannabinoid-based pharmaceutical drug candidates. While InMed

considers these assumptions to be reasonable, these assumptions are

inherently subject to significant business, economic, competitive,

market and social uncertainties and contingencies.

Additionally, there are known and unknown risk

factors which could cause InMed's actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking information contained herein. A complete discussion

of the risks and uncertainties facing InMed’s stand-alone business

is disclosed in InMed’s Annual Report on Form 10-K and other

filings with the Security and Exchange Commission on

www.sec.gov.

All forward-looking information herein is

qualified in its entirety by this cautionary statement, and InMed

disclaims any obligation to revise or update any such

forward-looking information or to publicly announce the result of

any revisions to any of the forward-looking information contained

herein to reflect future results, events or developments, except as

required by law.

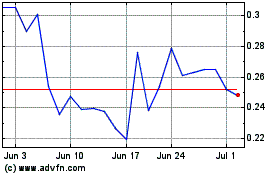

InMed Pharmaceuticals (NASDAQ:INM)

Historical Stock Chart

From Dec 2024 to Jan 2025

InMed Pharmaceuticals (NASDAQ:INM)

Historical Stock Chart

From Jan 2024 to Jan 2025