Imperial Petroleum Announces Management Estimate of Net Asset Value Per Share- $1.39

March 27 2023 - 9:20AM

Imperial Petroleum Inc. (Nasdaq: IMPP) (the “Company”), a

ship-owning company providing petroleum products, crude oil, and

drybulk seaborne transportation services, announced today that at

March 27, 2023 the Company’s management, estimates Imperial

Petroleum Inc’s Net Asset Value (“NAV”) to be $338.6 million, which

is approximately 717% above its current market capitalization. The

NAV which includes total outstanding cash of $142.2 million is

increasing daily on account of the record net cashflow contributed

by our tankers.

This translates into a NAV of $1.39 per common

share currently outstanding and $1.17 per common share on a fully

diluted basis (assuming exercise of all outstanding warrants for

cash).

NET ASSET VALUE (“NAV”)

The estimated NAV represents a snapshot in time

as of March 27, 2023, will likely change, and does not represent

the amount a stockholder would receive now or in the future for his

or her shares of the Company’s common stock. This NAV is based on

recent charter free vessel values, current debt and cash as of

March 27, 2023 which are assumptions and estimates that are

susceptible to uncertainty and subject to circumstances and market

conditions.

ABOUT IMPERIAL PETROLEUM

INC.

Imperial Petroleum Inc. is a ship-owning company

providing petroleum products, crude oil and drybulk seaborne

transportation services. The Company owns a total of twelve

vessels; five M.R. product tankers, one Aframax oil tanker, two

Suezmax tankers and four Handysize dry bulk carriers two of which

will be delivered by end of March 2023. Following these deliveries,

the Company’s fleet will have a capacity of 808,000 deadweight tons

(dwt). Imperial Petroleum Inc.’s shares of common stock and 8.75%

Series A Cumulative Redeemable Perpetual Preferred Stock are listed

on the Nasdaq Capital Market and trade under the symbols “IMPP” and

“IMPPP”, respectively.

Forward-Looking Statements

Matters discussed in this release may constitute

forward-looking statements. Forward-looking statements reflect our

current views with respect to future events and financial

performance and may include statements concerning plans,

objectives, goals, strategies, future events or performance, or

impact or duration of the COVID-19 pandemic and

underlying assumptions and other statements, which are other than

statements of historical facts. The forward-looking statements in

this release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, management’s examination of historical operating

trends, data contained in our records and other data available from

third parties. Although IMPERIAL PETROLEUM INC. believes that these

assumptions were reasonable when made, because these assumptions

are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond our control, IMPERIAL PETROLEUM INC. cannot assure you that

it will achieve or accomplish these expectations, beliefs or

projections. Important factors that, in our view, could cause

actual results to differ materially from those discussed in the

forward-looking statements include risks discussed in our filings

with the SEC and the following: the impact of

the COVID-19 pandemic and efforts throughout the world to

contain its spread, the strength of world economies and currencies,

general market conditions, including changes in charter hire rates

and vessel values, charter counterparty performance, changes in

demand that may affect attitudes of time charterers to scheduled

and unscheduled drydockings, shipyard performance, changes in

IMPERIAL PETROLEUM INC’s operating expenses, including bunker

prices, drydocking and insurance costs, ability to obtain financing

and comply with covenants in our financing arrangements, or actions

taken by regulatory authorities, potential liability from pending

or future litigation, domestic and international political

conditions, the conflict in Ukraine and related sanctions,

potential disruption of shipping routes due to accidents and

political events or acts by terrorists.

Risks and uncertainties are further described in

reports filed by IMPERIAL PETROLEUM INC. with the U.S. Securities

and Exchange Commission.

Company Contact:

Fenia Sakellaris

IMPERIAL PETROLEUM INC.

00-30-210-6250-001

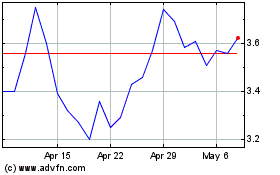

Imperial Petroleum (NASDAQ:IMPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Petroleum (NASDAQ:IMPP)

Historical Stock Chart

From Jul 2023 to Jul 2024