UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of July 2024 (Report No. 3)

Commission file number: 001-40753

ICECURE

MEDICAL Ltd.

(Translation of registrant’s name into English)

7 Ha’Eshel St., PO Box 3163

Caesarea, 3079504 Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

CONTENTS

Attached

hereto and incorporated herein is the Registrant’s Notice of Meeting, Proxy Statement and Proxy Card for the Special General Meeting

of Shareholders to be held on Wednesday, August 21, 2024 (the “Meeting”).

Only

shareholders of record who hold Ordinary Shares, no par value, of the Registrant at the close of business on Tuesday, July 23, 2024, will

be entitled to notice of and to vote at the Meeting and any postponements or adjournments thereof.

Copies of the Notice

of Special General Meeting, Proxy Statement and Proxy Card for the Meeting are furnished herewith as Exhibits 99.1, 99.2 and 99.3, respectively.

This Report of Foreign

Private Issuer on Form 6-K is incorporated by reference into the Registrant’s Registration Statements on Form F-3 (File

Nos. 333-267272 and 333-258660) and Form S-8 (File Nos. 333-270982, 333-264578 and 333-262620), filed with the Securities

and Exchange Commission, to be a part thereof from the date on which this report is submitted, to the extent not superseded by

documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

IceCure Medical Ltd. |

| |

|

|

| Date: July 16, 2024 |

By: |

/s/

Eyal Shamir |

| |

|

Name: |

Eyal Shamir |

| |

|

Title: |

Chief Executive Officer |

3

Exhibit 99.1

Dear IceCure Medical Ltd. Shareholders:

We cordially invite you to

attend the Special General Meeting of Shareholders of IceCure Medical Ltd. (the “Meeting”), to be held on Wednesday,

August 21, 2024 at 16:00 Israel time, or at any adjournment or postponement thereof, at the Company’s offices at 7 Ha’Eshel

St., Caesarea, 3079504, Israel, and by means of remote communication at the following link:

https://eu-central-1.protection.sophos.com?d=microsoft.com&u=aHR0cHM6Ly90ZWFtcy5taWNyb3NvZnQuY29tL2wvbWVldHVwLWpvaW4vMTklM2FtZWV0aW5nX1l6RmhOMkkxWVRJdFlUQmlaUzAwWlRaaExXRTFNRGd0T1RWa01XSTNOVFJoWmpRdyU0MHRocmVhZC52Mi8wP2NvbnRleHQ9JTdiJTIyVGlkJTIyJTNhJTIyNDg4N2Q4NzktOTUwZi00MjdlLWJlYzAtZDJhMTljN2M3Y2FiJTIyJTJjJTIyT2lkJTIyJTNhJTIyYTQzMTBkOGMtYjQ4Ny00YjQ1LWJlY2ItZTQ4N2VhZjA0Y2Q0JTIyJTdk&p=m&i=NjNkM2JiYjY5OTFlNjAyMDY4MTU4NzIy&t=NG93L1BTVEVxaTJodXRqSktlUy90Sm5kSGtLdmZPZ3NsNXBxUDd5WEgvTT0=&h=c20ca1b05e1f41efae47dfa1c1c4cc4b&s=AVNPUEhUT0NFTkNSWVBUSVaHTVjDFQFHfoRfhUIAIQfDOMbLd7rgyuBVOZ2qIVWVTQ

At the Meeting, shareholders

will be asked to consider and vote on the matters listed in the enclosed Notice of Special General Meeting of Shareholders. Our board

of directors recommends that you vote FOR each of the Proposals listed in the Notice.

Only shareholders of record

at the close of business on Tuesday, July 23, 2024, are entitled to be provided with notice of and to vote at the Meeting either in person

or by appointing a proxy to vote in their stead at the Meeting as detailed in the Notice.

We look forward to greeting

as many of you as can attend the Meeting.

| |

Sincerely, |

| |

|

| |

/s/ Ron Mayron |

| |

Ron Mayron |

| |

Chairman of the Board of Directors |

| |

|

| |

July 16, 2024 |

ICECURE

MEDICAL Ltd.

Notice

of SPECIAL General Meeting of shareholders

Notice is hereby given that an Special General

Meeting of Shareholders (the “Meeting”) of IceCure Medical Ltd. (the “Company”) will be held on

Wednesday, August 21, 2024 at 16:00 Israel time, or at any adjournment or postponement thereof, at the Company’s offices at 7 Ha’Eshel

St., Caesarea, 3079504, Israel, and by means of remote communication at the following link:

https://eu-central-1.protection.sophos.com?d=microsoft.com&u=aHR0cHM6Ly90ZWFtcy5taWNyb3NvZnQuY29tL2wvbWVldHVwLWpvaW4vMTklM2FtZWV0aW5nX1l6RmhOMkkxWVRJdFlUQmlaUzAwWlRaaExXRTFNRGd0T1RWa01XSTNOVFJoWmpRdyU0MHRocmVhZC52Mi8wP2NvbnRleHQ9JTdiJTIyVGlkJTIyJTNhJTIyNDg4N2Q4NzktOTUwZi00MjdlLWJlYzAtZDJhMTljN2M3Y2FiJTIyJTJjJTIyT2lkJTIyJTNhJTIyYTQzMTBkOGMtYjQ4Ny00YjQ1LWJlY2ItZTQ4N2VhZjA0Y2Q0JTIyJTdk&p=m&i=NjNkM2JiYjY5OTFlNjAyMDY4MTU4NzIy&t=NG93L1BTVEVxaTJodXRqSktlUy90Sm5kSGtLdmZPZ3NsNXBxUDd5WEgvTT0=&h=c20ca1b05e1f41efae47dfa1c1c4cc4b&s=AVNPUEhUT0NFTkNSWVBUSVaHTVjDFQFHfoRfhUIAIQfDOMbLd7rgyuBVOZ2qIVWVTQ

The following matters are on the agenda for

the Meeting:

| |

1. |

To Approve an Equity-Based Compensation Grant to Mr. Eyal Shamir, the Company’s Chief Executive Officer and Director. |

| |

2. |

To Approve an Equity-Based Compensation Grant to Mr. Ron Mayron, the Company’s Chairman of the Board of Directors. |

| |

3. |

To Approve an Equity-Based Compensation Grant to Mr. Yang Huang, a Director of the Company. |

Board Recommendation

Our board of directors (the “Board of

Directors”) unanimously recommends that you vote “FOR” each of the above proposed resolutions, which are

described in the attached proxy statement.

Shareholders of record at the close of business

on Tuesday, July 23, 2024 (the “Record Date”), are entitled to be provided with notice and to vote at the Meeting either

in person or by appointing a proxy to vote in their stead at the Meeting (as detailed below).

How You Can Vote

A form of proxy for use at the Meeting is attached

to the proxy statement and a voting instruction form, together with a return envelope, will be sent to holders of Company’s ordinary

shares, no par value (the “Ordinary Shares”). By appointing “proxies,” shareholders may vote at the Meeting

regardless of whether they attend.

Subject to applicable law and the rules of the

Nasdaq Stock Market, in the absence of instructions, the Ordinary Shares represented by properly executed and received proxies will be

voted “FOR” each of the proposed resolutions to be presented at the Meeting for which the Board of Directors recommends a

vote “FOR”.

Shareholders may revoke their proxies or voting

instruction form (as applicable) in accordance with Section 9 of the Israeli Companies Law, 5759-1999 (“Companies Law”)

regulations (proxy and positions statements).

Shareholders registered directly with the transfer

agent

If your shares are registered directly in your

name with our transfer agent, VStock Transfer, LLC, you are considered, with respect to those shares, to be the shareholder of record.

In such case, these proxy materials are being sent directly to you. As the shareholder of record, you have the right to use the proxy

card included with this Proxy Statement to grant your voting proxy directly to Ronen Tsimerman, Chief Financial Officer of the Company,

and/or Eyal Shamir, Chief Executive Officer of the Company, or to vote in person at the Meeting.

Shareholders of beneficial owner

If your shares are held through a bank, broker

or other nominee, they are considered to be held in “street name” and you are the beneficial owner with respect to those shares.

A beneficial owner as of the Record Date has the right to direct the bank, broker or nominee how to vote shares held by such beneficial

owner at the Meeting and must also provide the Company with a copy of their identity card, passport or certification of incorporation,

as the case may be. If your shares are held in “street name” as of the Record Date, these proxy materials are being forwarded

to you by your bank, broker or nominee who is considered, with respect to those shares, as the shareholder of record, together with a

voting instruction card for you to use in directing the bank, broker or nominee how to vote your shares. Because a beneficial owner is

not a shareholder of record, you may not vote those shares directly at the Meeting unless you obtain a “legal proxy” from

the bank, broker or other nominee that holds your shares directly, giving you the right to vote the shares at the Meeting. Absent specific

instructions from the beneficial owner of the shares, brokers are not allowed to exercise their voting discretion, among other things,

with respect to the election of directors or any matter that relates to executive compensation and a “broker non-vote” occurs

with respect to such uninstructed shares. Therefore, it is important for a shareholder that holds Ordinary Shares through a bank or broker

to instruct its bank or broker how to vote its shares, if the shareholder wants its shares to count for all proposals.

| |

Sincerely, |

| |

|

| |

/s/ Ron Mayron |

| |

Ron Mayron |

| |

Chairman of the Board of Directors |

| |

|

| |

July 16, 2024 |

Exhibit 99.2

ICECURE MEDICAL LTD.

CEASEREA, ISRAEL

PROXY STATEMENT

SPECIAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 21, 2024

The enclosed proxy statement

is being solicited by the board of directors (the “Board of Directors”) of IceCure Medical Ltd. (the “Company”)

for use at the Company’s special general meeting of shareholders (the “Meeting”) to be held at on Wednesday,

August 21, 2024 at 16:00 Israel time, or at any adjournment or postponement thereof, at the Company’s offices at 7 Ha’Eshel

St., Caesarea, 3079504, Israel, and by means of remote communication, at the following link:

https://eu-central-1.protection.sophos.com?d=microsoft.com&u=aHR0cHM6Ly90ZWFtcy5taWNyb3NvZnQuY29tL2wvbWVldHVwLWpvaW4vMTklM2FtZWV0aW5nX1l6RmhOMkkxWVRJdFlUQmlaUzAwWlRaaExXRTFNRGd0T1RWa01XSTNOVFJoWmpRdyU0MHRocmVhZC52Mi8wP2NvbnRleHQ9JTdiJTIyVGlkJTIyJTNhJTIyNDg4N2Q4NzktOTUwZi00MjdlLWJlYzAtZDJhMTljN2M3Y2FiJTIyJTJjJTIyT2lkJTIyJTNhJTIyYTQzMTBkOGMtYjQ4Ny00YjQ1LWJlY2ItZTQ4N2VhZjA0Y2Q0JTIyJTdk&p=m&i=NjNkM2JiYjY5OTFlNjAyMDY4MTU4NzIy&t=NG93L1BTVEVxaTJodXRqSktlUy90Sm5kSGtLdmZPZ3NsNXBxUDd5WEgvTT0=&h=c20ca1b05e1f41efae47dfa1c1c4cc4b&s=AVNPUEhUT0NFTkNSWVBUSVaHTVjDFQFHfoRfhUIAIQfDOMbLd7rgyuBVOZ2qIVWVTQ

Upon the receipt of a properly

executed proxy in the form enclosed, the persons named as proxies therein will vote the ordinary shares, no par value, of the Company

(the “Ordinary Shares”) covered thereby in accordance with the directions of the shareholders executing the proxy.

In the absence of such directions, and except as otherwise mentioned in this proxy statement, the Ordinary Shares represented thereby

will be voted in favor of each of the proposals described in this proxy statement.

Quorum and Adjournment

Two or more shareholders present,

personally or by proxy, holding not less than 25% of the Company’s Ordinary Shares, shall constitute a quorum for the Meeting. If

within half an hour of the Meeting time a quorum is not present, the Meeting shall stand adjourned until August 21, 2024, at 18:00 Israel

time. If a quorum is not present at the adjourned meeting within half an hour of this time, any number of shareholders present personally

or by proxy shall be deemed a quorum and shall be entitled to deliberate and to resolve in respect of the matters for which the Meeting

was convened. Abstentions and broker non-votes are counted as Ordinary Shares present for the purpose of determining a quorum.

Vote Required for Approval of Each of the

Proposals

Proposals No. 1 and No.

3, described hereinafter, are subject to the fulfillment of the aforementioned voting requirements and also one of the following additional

voting requirements: (i) the majority of the shares that are voted at the Meeting in favor of such proposal, excluding abstentions,

include a majority of the votes of shareholders who are not controlling shareholders and do not have a personal interest in the proposal;

or (ii) the total number of shares of the shareholders mentioned in clause (i) above that are voted against such proposal does

not exceed 2% of the total voting rights in the Company (a “Special Majority”).

For this purpose, a “Controlling

Shareholder” is defined under the Companies Law (as defined hereafter) as any shareholder that has the ability to direct the

Company’s activities (other than by means of being a director or office holder of the Company). A person is presumed to be a Controlling

Shareholder if he or she holds or controls, by himself or herself or together with others, one half or more of any one of the “means

of control” of a company. In the context of a transaction with an interested party, a shareholder who holds 25% or more of the voting

rights in a company is also presumed to be a Controlling Shareholder if no other shareholder holds more than 50% of the voting rights

in such company. “Means of Control” is defined as either: (i) the right to vote at a general meeting of a company,

or (ii) the right to appoint directors of a company or its chief executive officer.

For this purpose, “Personal

Interest” is defined under the Companies Law as: (1) a shareholder’s personal interest in the approval of an act

or a transaction of the company, including (i) the personal interest of any of his or her relatives (which includes for these purposes

foregoing shareholder’s spouse, siblings, parents, grandparents, descendants, and spouse’s descendants, siblings, and parents,

and the spouse of any of the foregoing); (ii) a personal interest of a corporation in which a shareholder or any of his or her aforementioned

relatives serve as a director or the chief executive officer, owns at least 5% of its issued share capital or its voting rights or has

the right to appoint a director or chief executive officer; or (iii) a personal interest of an individual voting via a power of attorney

given by a third party (even if the empowering shareholder has no personal interest), and the vote of an attorney-in-fact shall be

considered a personal interest vote if the empowering shareholder has a personal interest, and all with no regard as to whether the attorney-in-fact has

voting discretion or not, but (2) excludes a personal interest arising solely from the fact of holding shares in the company.

Proposal No. 2 requires the

affirmative vote of shareholders present at the Meeting, in person or by proxy, and holding Ordinary Shares representing in the aggregate

at least a majority of the votes actually cast by shareholders with respect to such proposal (a “Simple Majority”).

In accordance with the Companies

Law, and regulations promulgated thereunder, any shareholder of the Company holding at least 1% of the outstanding voting rights of the

Company for the Meeting may submit to the Company a proposed additional agenda item for the Meeting (and in case of a proposed additional

agenda item for nominating or removal of a director, at least 5% of the outstanding voting rights of the Company), to Mr. Ronen Tsimerman,

at 7 Ha’Eshel St., Caesarea, 3079504, Israel, or via e-mail: ronent@icecure-medical.com, no later than July 23, 2024.

Position Statements

Shareholders wishing to express

their position on an agenda item for this Meeting may do so by submitting a written statement in accordance with the Companies Law (a

“Position Statement”) to the Company’s offices, c/o Mr. Ronen Tsimerman, at 7 Ha’Eshel St., Caesarea, 3079504,

Israel, or via e-mail: ronent@icecure-medical.com. Any Position Statement received will be furnished to the U.S. Securities and

Exchange Commission (the “SEC”) on a Report of Foreign Private Issuer on Form 6-K and will be made available to the

public on the SEC’s website at www.sec.gov. Position Statements should be submitted to the Company no later than August 12, 2024.

A shareholder is entitled to contact the Company directly and receive the text of the proxy card and any Position Statement. The response

of the Board of Directors to the Position Statement will be submitted no later than August 16, 2024.

One shareholder or more holding

Ordinary Shares which represent 5% or more of the Company’s voting rights (49,878,397 Ordinary Shares) and whoever holds 5% (five

percent) of the Company’s voting rights without taking into consideration the shares that are held by the Company’s controlling

shareholder (24,031,790 Ordinary Shares) is entitled to examine the proxy and voting materials in the Company’s office after the

General Meeting is held.

There may be changes on the

agenda after publishing the Proxy and there may be additional Position Statements which could be published. Therefore, the most updated

agenda will be furnished to the SEC on a Report of Foreign Private Issuer on Form 6-K and will be made available to the public on the

SEC’s website at www.sec.gov.

For purposes of Proposals

No. 1 and No. 3, a shareholder must inform the Company before the vote (or if voting by proxy, indicate on the proxy card) whether such

shareholder is a controlling shareholder or has a personal interest in such proposals, and failure to do so disqualifies the shareholder

from voting on Proposals No. 1 and No. 3. If you believe that you, or a related party of yours, is a controlling shareholder or possesses

a personal interest and you wish to vote on Proposals No. 1 and/or No. 3 (as the case may be), you should indicate that you, or a related

party of yours, is a controlling shareholder or that there is a personal interest on the enclosed proxy card (if applicable) and should

therefore contact our Chief Financial Officer, Mr. Ronen Tsimerman, at 7 Ha’Eshel St., Caesarea, 3079504, Israel, or via e-mail:

ronent@icecure-medical.com, who will advise you as to how to submit your vote for such proposals. If you hold your shares in a “street

name” (i.e., shares that are held through a bank, broker or other nominee) and believe that you are a controlling shareholder or

possess a personal interest in the approval of Proposals No. 1 and No. 3, you may also contact the representative managing your account,

who could then contact our Chief Financial Officer on your behalf.

PROPOSAL 1

to approve

an equity-based compensation GRANT to Mr. Eyal Shamir, THE Company’s Chief Executive Officer and director

On June 30, 2024 and on July

2, 2024 (the “Date of Grant”), the compensation committee of the Board of Directors (the “Compensation Committee”)

and the Board of Directors, respectively, approved and recommended that the Company’s shareholders approve the grant of options

to purchase Ordinary Shares (“Options”) and Restricted Share Units (“RSUs”) to Mr. Eyal Shamir,

the Company’s Chief Executive Officer and a director, under the Company’s Amended and Restated 2024 Employee Equity Incentive Plan

(the “2024 Plan”).

The recommended grant to Mr. Shamir consists of

360,314 Options and 300,262 RSUs, (the “Grant to Mr. Shamir”). The aggregate value of the Grant to Mr. Shamir and its

terms are in accordance with the Company’s Compensation Policy (the “Compensation Policy”) and amounts to a total of

approximately $495,432.

Options terms

| - | Vesting Schedule: The Options granted to Mr. Shamir are subject to a standard vesting period

of four (4) years according to the following schedule (the “Vesting Schedule of Options”): (i) one quarter (1/4) of

the Options granted shall vest on the first anniversary commencing on the Date of Grant (the “First Installment”);

and (ii) The rest of the granted Options shall vest in 12 equal installments, at the end of each quarter, following the First Installment. |

| | | |

| - | Exercise Price: The above option grant shall be exercisable at an exercise price of $0.875 per

share. |

| | | |

| - | Acceleration Mechanism: The Vesting Schedule of Options may be accelerated upon the occurrence

of special events, as defined in the Compensation Policy and in accordance with the 2024 Plan. |

All other terms and conditions

of the Options are in accordance with the 2024 Plan.

RSUs terms

| - | Vesting Schedule: The RSUs granted to Mr. Shamir are subject to a vesting of four (4) years, which

shall be triggered upon the earlier of the following (the “Vesting Schedule of RSUs”): (1) the Company receives U.S.

Food and Drug Administration (the “FDA”) approval for its ProSense system for breast cancer treatment; or (2) raises

at least $15 million following the Date of Grant (the “Milestone Date”). Following which, the RSUs shall vest as follows:

(i) one quarter (1/4) of the Options granted shall vest on the first anniversary commencing on the Milestone Date (the “First

Installment”); and (ii) The rest of the granted Options shall vest in 12 equal installments, at the end of each quarter, following

the First Installment. |

| | | |

| - | Acceleration Mechanism: The Vesting Schedule of RSUs may be accelerated upon the occurrence of

special events, as defined in the Compensation Policy and in accordance with the 2024 Plan. |

All other terms and conditions

of the RSUs are in accordance with the 2024 Plan.

In the event of termination

of employment between the Company and Mr. Shamir, any unvested Options or RSUs at the time of such termination shall expire immediately.

The Options and RSUs are granted

in accordance with the capital gain track of Section 102 of the Israeli Income Tax Ordinance, 1961.

Together with the outstanding

Options to purchase 578,888 Ordinary Shares of the Company, granted to Mr. Shamir in aggregate in the past, subject to the approval of

shareholders to the Grant of Mr. Shamir, Mr. Shamir’s holdings will be equal to approximately 2.5% of the Company’s issued

and outstanding share capital on a fully diluted basis as of the date of this proxy statement.

In recommending the approval

of the Grant to Mr. Shamir, the Compensation Committee and the Board of Directors each have considered all relevant considerations and

discussed all matters required under the Companies Law and the regulations promulgated thereunder and also considered, including, among

other things: (i) factors enumerated in the Compensation Policy including the position, responsibilities, background and experience of

Mr. Shamir; (ii) that the Grant to Mr. Shamir is in accordance with the Compensation Policy; (iii) that the Grant to Mr. Shamir constitutes

fair and reasonable value; and (iv) Mr. Shamir’s contributions and achievements as the Company’s Chief Executive Officer,

including finalizing the ICE3 study, regulatory submission to the FDA of the ICE3 study results for breast cancer clearance and the recent

regulatory approval of the XSense system by the FDA. Additionally, Mr. Shamir has presided over the Company’s continued global growth,

as evidenced by the increased utilization of its cryoablation system, with regulatory approval and initial sales in Brazil and regulatory

clearance for IceSense3 CryoProbes, in the People’s Republic of China. Mr. Shamir has successfully overseen a strategy to raise

the awareness of the Company’s cryoablation systems, including among the leading medical societies such as the American Society

of Breast Surgeons, the Society of Interventional Radiologists and the Society of Interventional Oncologists.

The shareholders of the

Company are requested to adopt the following resolution:

“RESOLVED, to

approve the Grant to Mr. Eyal Shamir, as set forth in the Proxy Statement.”

The approval of this

proposal, as described above, requires the affirmative vote of a Special Majority.

Please note that we consider

it highly unlikely that any of our shareholders is a controlling shareholder or has a personal interest in this proposal. However, as

required under Israeli law, the enclosed form of proxy requires that you inform the company whether you are a controlling shareholder

or have a personal interest in this proposal.

The Board of Directors unanimously recommends a vote FOR on the

above proposal.

PROPOSAL 2

to approve

an equity-based compensation GRANT to Mr. RON MAYRON, THE COMPANY’S chairman OF THE BOARD OF DIRECTORS

On June 30, 2024 and on July

2, 2024, the Compensation Committee and the Board of Directors, respectively, approved and recommended that the Company’s shareholders

approve a grant of Options and RSUs to Mr. Ron Mayron, the Company’s Chairman of the Board of Directors, under the 2024 Plan.

The recommended grant to Mr.

Mayron consists of 196,364 Options and 163,636 RSUs (the “Grant to Mr. Mayron”). The aggregate value of the Grant to

Mr. Mayron and its terms are in accordance with the Company’s Compensation Policy and amounts to a total of approximately $270,000.

Options terms

| - | Vesting Schedule: The Options granted to Mr. Mayron are subject to a standard vesting period

of four (4) years according to the following schedule: (i) one quarter (1/4) of the Options granted shall vest on the first anniversary

commencing on the Date of Grant; and (ii) The rest of the granted Options shall vest in 12 equal installments, at the end of each quarter,

following the First Installment. |

| | | |

| - | Exercise Price: The above option grant shall be exercisable at an exercise price of $0.875 per

share. |

| | | |

| - | Acceleration Mechanism: The Vesting Schedule of Options may be accelerated upon the occurrence

of special events, as defined in the Compensation Policy and in accordance with the 2024 Plan. |

All other terms and conditions

of the Options are in accordance with the 2024 Plan.

RSUs terms

| - | Vesting Schedule: The RSUs granted to Mr. Mayron are subject to a vesting of four (4) years, which

shall be triggered upon the earlier of the following: (1) the Company receives FDA approval for its ProSense system for breast cancer

treatment; or (2) raises at least $15 million following the Date of Grant (the “Milestone Date”). Following which,

the RSUs shall vest as follows: (i) one quarter (1/4) of the Options granted shall vest on the first anniversary commencing on the Milestone

Date (the “First Installment”); and (ii) The rest of the granted Options shall vest in 12 equal installments, at the

end of each quarter, following the First Installment. |

| - | |

| - | Acceleration Mechanism: the Vesting Schedule of RSUs may be accelerated upon the occurrence of

special events, as defined in the Compensation Policy and in accordance with the 2024 Plan. |

All other terms and conditions

of the RSUs are in accordance with the 2024 Plan.

In the event of termination

of engagement between the Company and Mr. Mayron, any unvested Options or RSUs at the time of such termination shall expire immediately.

The Options and RSUs are granted

in accordance with the capital gain track of Section 102 of the Israeli Income Tax Ordinance, 1961.

Together with the outstanding

Options to purchase 314,591 Ordinary Shares of the Company, granted to Mr. Mayron in aggregate in the past, subject to the approval of

shareholders to the Grant of Mr. Mayron, Mr. Mayron’s holdings will be equal to approximately 1.4% of the Company’s issued

and outstanding share capital on a fully diluted basis as of the date of this proxy statement.

In recommending the approval

of the Grant to Mr. Mayron, the Compensation Committee and the Board of Directors each have considered all relevant considerations and

discussed all matters required under the Companies Law and the regulations promulgated thereunder and also considered, including among

other things: (i) the position, responsibilities, background and experience of the grantee; (ii) that the Grant to Mr. Mayron is in accordance

with the Compensation Policy; (iii) that the Grant to Mr. Mayron constitutes fair and reasonable value; and (iv) Mr. Mayron’s services

and contribution to the Company in the form of providing guidance and leadership. Mr. Mayron, as Chairman of the Board of Directors, established

the Company’s vision, and helped to develop the strategic plan that enabled the Company to achieve several key milestones over the

past year, including but not limited to the completion of the ICE3 study, regulatory submission to the FDA of the ICE3 study results for

breast cancer clearance and recent regulatory approval of the XSense system by the FDA.

The shareholders of the

Company are requested to adopt the following resolution:

“RESOLVED, to

approve the Grant to Mr. Ron Mayron, as set forth in this Proxy Statement.”

The approval of this

proposal, as described above, requires the affirmative vote of a Simple Majority.

The Board of Directors

unanimously recommends that the shareholders vote FOR the above proposal.

PROPOSAL 3

to approve

an equity-based compensation GRANT to Mr. YANG HUANG, A DIRECTOR OF THE COMPANY

Background

Mr. Yang Huang is a director

of the Company and provides services to the Company’s controlling shareholder, Epoch Partner Investments Limited.

Under the Companies Law, arrangements

concerning compensation of a Company’s controlling shareholder and his relatives, in accordance with or which exceed the terms of

the Company’s Compensation Policy, require the approval by the Compensation Committee, the Board of Directors and the Company’s

shareholders (in a Special Majority, as defined above), in that order.

Grant of Equity-Based Compensation

On June 30, 2024 and on July

2, 2024, the Date of Grant, the Compensation Committee and the Board of Directors, respectively, approved and recommended that the Company’s

shareholders approve a grant of Options and RSUs to Mr. Yang Huang, a director of the Company.

The recommended grant to Mr.

Huang consists of 76,364 Options and 63,636 RSUs to be granted to Mr. Huang (the “Grant to Mr. Huang”). The aggregate

value of the Grant to Mr. Huang and its terms are both in accordance with the Company’s Compensation Policy and amounts to a total

of approximately $105,000.

Options terms

| - | Vesting Schedule: The Options granted to Mr. Huang are subject to a standard vesting period

of four (4) years according to the following schedule: (i) one quarter (1/4) of the Options granted shall vest on the first anniversary

commencing on the Date of Grant; and (ii) the rest of the granted Options shall vest in 12 equal installments at the end of each quarter,

following the First Installment. |

| | | |

| - | Exercise Price: The above option grant shall be exercisable at an exercise price of $0.875 per

share. |

| | | |

| - | Acceleration Mechanism: The Vesting Schedule of Options may be accelerated upon the occurrence

of special events, as defined in the Compensation Policy and in accordance with the 2024 Plan. |

All other terms and conditions

of the Options are in accordance with the 2024 Plan.

RSUs terms

| - | Vesting Schedule: The RSUs granted to Mr. Huang are subject to a vesting of four (4) years, which

shall be triggered upon the earlier of the following: (1) the Company receives FDA approval for its product for breast cancer treatment;

or (2) raises at least $15 million following the Date of Grant (the “Milestone Date”). Following which, the RSUs shall

vest as follows: (i) one quarter (1/4) of the Options granted shall vest on the first anniversary commencing on the Milestone Date (the

“First Installment”); and (ii) The rest of the granted Options shall vest in 12 equal installments, at the end of each

quarter, following the First Installment. |

| | | |

| - | Acceleration Mechanism: The Vesting Schedule of RSUs may be accelerated upon the occurrence of

special events, as defined in the Compensation Policy and in accordance with the 2024 Plan. |

All other terms and conditions

of the RSUs are in accordance with the 2024 Plan.

In the event of termination

of engagement between the Company and Mr. Huang, any unvested Options or RSUs at the time of such termination shall expire immediately.

Together with the outstanding

Options to purchase 183,873 Ordinary Shares of the Company, granted to Mr. Juang in aggregate in the past, subject to the approval of

shareholders to the Grant of Mr. Huang, Mr. Huang’s holdings will be equal to approximately 0.7% of the Company’s issued and

outstanding share capital on a fully diluted basis as of the date of this proxy statement.

In recommending the approval

of the Grant of RSUs to Mr. Huang, the Compensation Committee and the Board of Directors each have considered all relevant considerations

and discussed all matters required under the Companies Law and the regulations promulgated thereunder and also considered, including among

other things: (i) that the Grant to Mr. Huang is in accordance with the Compensation Policy; (ii) that the Grant to Mr. Huang constitutes

fair and reasonable value; and (iii) Mr. Huang’s efforts and contribution to the Company’s operations in the People’s

Republic of China and regulatory achievements in the People’s Republic of China, including clearance for the IceSense3 CryoProbes.

The shareholders of the

Company are requested to adopt the following resolution:

“RESOLVED, to

approve the Grant to Mr. Huang, as set forth in this Proxy Statement.”

The approval of

this proposal, as described above, requires the affirmative vote of a Special Majority.

Please note that we consider

it highly unlikely that any of our shareholders is a controlling shareholder or has a personal interest in this proposal. However, as

required under Israeli law, the enclosed form of proxy requires that you inform the company whether you are a controlling shareholder

or have a personal interest in this proposal.

The Board of Directors

unanimously recommends that the shareholders vote FOR the above proposal.

OTHER BUSINESS

The Board of Directors is not aware of any other

matters that may be presented at the Meeting other than those described in this proxy statement. If any other matters do properly

come before the Meeting, including the authority to adjourn the Meeting, it is intended that the persons named as proxies will vote, pursuant

to their discretionary authority, according to their best judgment in the interest of the Company.

ADDITIONAL INFORMATION

The Company is subject to the informational requirements

of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), as applicable to foreign private issuers.

Accordingly, the Company files reports and other information with the SEC. All documents which the Company will file on the SEC’s

EDGAR system will be available for retrieval on the SEC’s website at http://www.sec.gov.

As a foreign private issuer, the Company is exempt

from the rules under the Exchange Act prescribing certain disclosure and procedural requirements for proxy solicitations. In addition,

the Company is not required under the Exchange Act to file periodic reports and financial statements with the SEC as frequently or as

promptly as United States companies whose securities are registered under the Exchange Act. The Notice of the Special General Meeting

of Shareholders and the proxy statement have been prepared in accordance with applicable disclosure requirements in the State of Israel.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED

IN THIS PROXY STATEMENT OR THE INFORMATION FURNISHED TO YOU IN CONNECTION WITH THIS PROXY STATEMENT WHEN VOTING ON THE MATTERS SUBMITTED

TO SHAREHOLDER APPROVAL HEREUNDER. THE COMPANY HAS NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION THAT IS DIFFERENT FROM WHAT IS

CONTAINED IN THIS DOCUMENT. THIS PROXY STATEMENT IS DATED JULY 16, 2024. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS

DOCUMENT IS ACCURATE AS OF ANY DATE OTHER THAN JULY 16, 2024, AND THE MAILING OF THIS DOCUMENT TO SHAREHOLDERS SHOULD NOT CREATE ANY IMPLICATION

TO THE CONTRARY.

Your vote is important!

Shareholders are urged to complete and return

their proxies promptly in order to, among other things, ensure action by a quorum and to avoid the expense of additional solicitation.

If the accompanying proxy is properly executed and returned in time for voting, and a choice is specified, the shares represented thereby

will be voted as indicated thereon. EXCEPT AS MENTIONED OTHERWISE IN THIS PROXY STATEMENT, IF NO SPECIFICATION IS MADE, THE PROXY WILL

BE VOTED IN FAVOR OF EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT.

Proxies and all other

applicable materials should be sent to the Company’s office at 7 Ha’Eshel St., Caesarea, 3079504, Israel.

| |

By Order of the Board of Directors |

| |

IceCure Medical Ltd. |

| |

Ron Mayron, Chairman of the Board of Directors |

Exhibit 99.3

ICECURE MEDICAL LTD.

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD

OF DIRECTORS

The undersigned hereby

appoints, Mr. Eyal Shamir, Chief Executive Officer and Mr. Ronen Tsimerman, Chief Financial Officer, as agents and proxies of the undersigned,

with full power of substitution to each of them, to represent and to vote on behalf of the undersigned all the Ordinary Shares of IceCure

Medical Ltd. (the “Company”) which the undersigned is entitled to vote at the Special General Meeting of Shareholders

(the “Meeting”) to be held on Wednesday, August 21, 2024, at 16:00 Israel time at the Company’s offices at 7

Ha’Eshel St., Caesarea, 3079504, Israel, or at any adjournments thereof, upon the following matters, which are more fully described

in the Notice of the Special General Meeting of Shareholders and proxy statement relating to the Meeting.

This proxy, when properly

executed, will be voted in the manner directed herein by the undersigned. If no direction is made with respect to any matter, this proxy

will be voted FOR such matter. Any and all proxies heretofore given by the undersigned are hereby revoked.

(Continued and to be signed on the reverse side)

ICECURE MEDICAL LTD.

SPECIAL GENERAL MEETING OF SHAREHOLDERS

Date of Meeting: August 21, 2024

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED

ENVELOPE. PLEASE

MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ☒

1. To approve an equity-based compensation grant

to Mr. Eyal Shamir, the Company’s Chief Executive Officer and Director.

| |

☐ |

FOR |

☐ |

AGAINST |

☐ |

ABSTAIN |

2. To approve an equity-based compensation grant

to Mr. Ron Mayron, the Company’s Chairman of the Board of Directors.

| |

☐ |

FOR |

☐ |

AGAINST |

☐ |

ABSTAIN |

3. To approve an equity-based compensation grant

to Mr. Yang Huang, a Director of the Company.

| |

☐ |

FOR |

☐ |

AGAINST |

☐ |

ABSTAIN |

In their discretion, the proxies are authorized

to vote upon such other matters as may properly come before the Meeting or any adjournment or postponement thereof.

PLEASE NOTE! That by signing and submitting

this proxy card, you declare that you are not a controlling shareholder of the Company (as defined in the Israeli Companies Law 5759-1999)

(the "Companies Law"), and that you have no personal interest in the approval of any of the items that are proposed for approval

at the special general meeting of shareholders, which require such declaration under the Companies Law, except as notified to the Company

to Mr. Ronen Tsimerman, via e-mail: ronent@icecure-medical.com.

Signature

Signature, if held jointly

Date

, 2024.

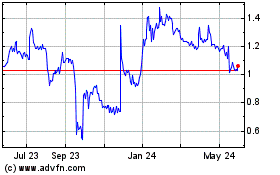

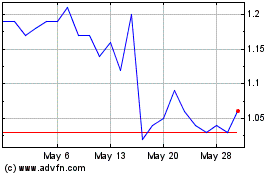

IceCure Medical (NASDAQ:ICCM)

Historical Stock Chart

From Oct 2024 to Oct 2024

IceCure Medical (NASDAQ:ICCM)

Historical Stock Chart

From Oct 2023 to Oct 2024