false000183376900018337692024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 08, 2024 |

Hyperfine, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39949 |

98-1569027 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

351 New Whitfield Street |

|

Guilford, Connecticut |

|

06437 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (866) 796-6767 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A common stock, $0.0001 par value per share |

|

HYPR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, Hyperfine, Inc. issued a press release announcing its results for the second quarter ended June 30, 2024 and providing a business update. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The press release may contain hypertext links to information on our website. The information on our website is not incorporated by reference into this Current Report on Form 8-K and does not constitute a part of this Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

HYPERFINE, INC. |

|

|

|

|

Date: |

August 8, 2024 |

By: |

/s/ Brett Hale |

|

|

|

Brett Hale

Chief Administrative Officer, Chief Financial Officer, Treasurer and Corporate Secretary |

Exhibit 99.1

Hyperfine, Inc. Reports Record Quarterly Revenue and Raises FY 2024 Revenue Guidance

─ Reports $3.6M in Q2 2024 Revenue; 50% Gross Margin

─ Raises FY 2024 Revenue Guidance to $13-16M

GUILFORD, Connecticut, August 8, 2024 (GLOBE NEWSWIRE) – Hyperfine, Inc. (Nasdaq: HYPR), the groundbreaking health technology company that has redefined brain imaging with the first FDA-cleared portable magnetic resonance (MR) brain imaging system—the Swoop® system—today announced second quarter 2024 financial results and provided a business update.

“I am proud of the Hyperfine team, achieving record revenue and delivering meaningful progress across innovation and clinical initiatives in the quarter,” said Maria Sainz, Chief Executive Officer and President of Hyperfine, Inc. “The opportunities ahead in emergency departments, clinics, and offices to support stroke and Alzheimer’s care are incredibly exciting and I believe our efforts to expand into these opportunities will position us well for significant business acceleration in 2025 and beyond.”

Second Quarter 2024 Financial Results

•Revenues for the second quarter of 2024 were a record $3.63 million, up 7.4%, compared to $3.38 million in the second quarter of 2023.

•Hyperfine, Inc. sold 13 commercial Swoop® systems in the second quarter of 2024.

•Gross margin for the second quarter of 2024 was a record $1.80 million, compared to $1.44 million in the second quarter of 2023, translating to a gross margin percentage of 49.6% compared to 42.7% in the second quarter of 2023.

•Research and development expenses for the second quarter of 2024 were $5.96 million, compared to $5.33 million in the second quarter of 2023.

•Sales, marketing, general, and administrative expenses for the second quarter of 2024 were $6.69 million, compared to $7.81 million in the second quarter of 2023.

•Net loss for the second quarter of 2024 was $10.16 million, equating to a net loss of $0.14 per share, as compared to a net loss of $10.64 million, or a net loss of $0.15 per share, for the second quarter of 2023.

Recent Achievements and Business Highlights

•FDA clearance of 9th generation AI-powered brain imaging software for enhanced speed.

•Initiated enrollment of CARE PMR (Capturing ARIA Risk Equitably with Portable MR) study assessing the clinical utility of the Swoop® System to scan Alzheimer’s patients receiving amyloid-targeting therapy to detect ARIA.

•Initial experience on the clinical utility of portable ultra-low-field MRI for Alzheimer's disease monitoring featured in two posters at the 2024 Alzheimer’s Association International Conference.

•Subset of ACTION PMR (ACuTe Ischemic strOke detectioN with Portable MR), study data published in the August 2024 issue of the Annals of Neurology.

•Appointed distributors in 12 key EU markets and India to support expansion of commercial activity to international markets.

Six Months Financial Results

•Revenues for the six months ended June 30, 2024 were $6.93 million, up 15.1%, compared to $6.02 million in the six months ended June 30, 2023.

•Gross margin for the six months ended June 30, 2024 was $3.16 million, compared to $2.60 million in the six months ended June 30, 2023, translating to a gross margin percentage of 45.6% in the six months ended June 30, 2024, compared to a gross margin percentage of 43.2% in the six months ended June 30, 2023.

•Research and development expenses for the six months ended June 30, 2024 were $11.53 million, compared to $10.79 million in the six months ended June 30, 2023.

•Sales, marketing, general, and administrative expenses for the six months ended June 30, 2024 were $13.12 million, compared to $16.53 million in the second quarter of 2023.

•Net loss for the six months ended June 30, 2024 was $20.00 million, equating to a net loss of $0.28 per share, as compared to a net loss of $22.80 million, or a net loss of $0.32 per share, for the six months ended June 30, 2023.

2024 Financial Guidance

•Management raises its revenue expectations for the full year 2024 to be $13 to $16 million from $12 to $15 million previously, reflecting year over year growth of 31% at the midpoint compared to 22% previously.

•Management continues to expect its cash burn for the full year 2024 to be approximately $40 million.

Conference Call

Hyperfine, Inc. will host a conference call at 1:30 p.m. PT/ 4:30 p.m. ET on Thursday, August 8, 2024, to discuss its second quarter 2024 financial results and provide a business update. Those interested in listening should register online by visiting https://investors.hyperfine.io/. and clicking on News & Events. Participants are encouraged to register more than 15 minutes before the start of the call. A live and archived audio webcast will be available through the Investors page of Hyperfine, Inc.’s corporate website at https://investors.hyperfine.io/.

About Hyperfine, Inc. and the Swoop® Portable MR Imaging® System

Hyperfine, Inc. (Nasdaq: HYPR) is the groundbreaking health technology company that has redefined brain imaging with the Swoop® system—the first FDA-cleared, portable, ultra-low-field, magnetic resonance brain imaging system capable of providing imaging at multiple points of care. The Swoop® system received initial U.S. Food and Drug Administration (FDA) clearance in 2020 as a portable magnetic resonance brain imaging device for producing images that display the internal structure of the head where a full diagnostic examination is not clinically practical. When interpreted by a trained physician, these images provide information that can be useful in determining a diagnosis. The Swoop® system has been approved for brain imaging in several countries, including Canada and Australia, has UKCA certification in the United Kingdom, CE certification in the European Union, and is also available in New Zealand.

The mission of Hyperfine, Inc. is to revolutionize patient care globally through transformational, accessible, clinically relevant diagnostic imaging and data solutions. Founded by Dr. Jonathan Rothberg in a technology-based incubator called 4Catalyzer, Hyperfine, Inc. scientists, engineers, and physicists developed the Swoop® system out of a passion for redefining brain imaging methodology and how clinicians can apply accessible diagnostic imaging to patient care. Traditionally, access to costly, stationary, conventional MRI technology can be inconvenient or not available when needed most. With the portable, ultra-low-field Swoop® system, Hyperfine, Inc. is redefining the neuroimaging workflow by bringing brain imaging to the patient’s bedside. For more information, visit hyperfine.io.

Hyperfine, Swoop, and Portable MR Imaging are registered trademarks of Hyperfine, Inc.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Actual results of Hyperfine, Inc. (the “Company”) may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, expectations about the Company’s financial and operating results, including, the Company’s expected revenue and cash burn for the full year 2024, the Company’s goals and commercial plans, including the Company’s international expansion plans, the Company’s stroke observational clinical study and Alzheimer’s feasibility study, the benefits of the Company’s products and services, and the Company’s future performance and its ability to implement its strategy. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside of the Company’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the success, cost and timing of the Company’s product development and commercialization activities, including the degree that the Swoop® system is accepted and used by healthcare professionals; the inability to maintain the listing of the Company’s Class A common stock on the Nasdaq Stock Market LLC; the Company’s inability to grow and manage growth profitably and retain its key employees; changes in applicable laws or regulations;

the inability of the Company to raise financing in the future; the inability of the Company to obtain and maintain regulatory clearance or approval for its products, and any related restrictions and limitations of any cleared or approved product; the inability of the Company to identify, in-license or acquire additional technology; the inability of the Company to maintain its existing or future license, manufacturing, supply and distribution agreements and to obtain adequate supply of its products; the inability of the Company to compete with other companies currently marketing or engaged in the development of products and services that the Company is currently marketing or developing; the size and growth potential of the markets for the Company’s products and services, and its ability to serve those markets, either alone or in partnership with others; the pricing of the Company’s products and services and reimbursement for medical procedures conducted using the Company’s products and services; the Company’s inability to successfully complete and generate positive data from the ACTION PMR study and the CARE PMR study; the Company’s estimates regarding expenses, revenue, capital requirements and needs for additional financing; the Company’s financial performance; and other risks and uncertainties indicated from time to time in Company’s filings with the Securities and Exchange Commission, including those under “Risk Factors” therein. The Company cautions readers that the foregoing list of factors is not exclusive and that readers should not place undue reliance upon any forward-looking statements which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

Investor Contact

Webb Campbell

Gilmartin Group LLC

webb@gilmartinir.com

HYPERFINE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

December 31,

2023 |

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

53,809 |

|

|

$ |

75,183 |

|

Restricted cash |

|

|

— |

|

|

|

621 |

|

Accounts receivable, less allowance of $308 and $321 as of June 30, 2024 and December 31, 2023, respectively |

|

|

5,368 |

|

|

|

3,189 |

|

Unbilled receivables |

|

|

2,121 |

|

|

|

942 |

|

Inventory |

|

|

7,465 |

|

|

|

6,582 |

|

Prepaid expenses and other current assets |

|

|

2,262 |

|

|

|

2,391 |

|

Total current assets |

|

|

71,025 |

|

|

|

88,908 |

|

Property and equipment, net |

|

|

3,429 |

|

|

|

2,999 |

|

Other long term assets |

|

|

2,156 |

|

|

|

2,292 |

|

Total assets |

|

$ |

76,610 |

|

|

$ |

94,199 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

Accounts payable |

|

$ |

2,238 |

|

|

$ |

1,214 |

|

Deferred grant funding |

|

|

— |

|

|

|

621 |

|

Deferred revenue |

|

|

1,425 |

|

|

|

1,453 |

|

Due to related parties |

|

|

66 |

|

|

|

61 |

|

Accrued expenses and other current liabilities |

|

|

5,056 |

|

|

|

5,419 |

|

Total current liabilities |

|

|

8,785 |

|

|

|

8,768 |

|

Long term deferred revenue |

|

|

1,064 |

|

|

|

968 |

|

Other noncurrent liabilities |

|

|

— |

|

|

|

64 |

|

Total liabilities |

|

|

9,849 |

|

|

|

9,800 |

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Class A Common stock, $.0001 par value; 600,000,000 shares authorized; 57,131,702 and 56,840,949 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively |

|

|

5 |

|

|

|

5 |

|

Class B Common stock, $.0001 par value; 27,000,000 shares authorized; 15,055,288 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively |

|

|

2 |

|

|

|

2 |

|

Additional paid-in capital |

|

|

340,480 |

|

|

|

338,114 |

|

Accumulated deficit |

|

|

(273,726 |

) |

|

|

(253,722 |

) |

Total stockholders' equity |

|

|

66,761 |

|

|

|

84,399 |

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

76,610 |

|

|

$ |

94,199 |

|

HYPERFINE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Sales |

|

|

|

|

|

|

|

|

|

|

|

|

Device |

|

$ |

2,970 |

|

|

$ |

2,810 |

|

|

$ |

5,674 |

|

|

$ |

4,942 |

|

Service |

|

|

661 |

|

|

|

571 |

|

|

|

1,252 |

|

|

|

1,074 |

|

Total sales |

|

|

3,631 |

|

|

|

3,381 |

|

|

|

6,926 |

|

|

|

6,016 |

|

Cost of sales |

|

|

|

|

|

|

|

|

|

|

|

|

Device |

|

|

1,422 |

|

|

|

1,549 |

|

|

|

2,921 |

|

|

|

2,620 |

|

Service |

|

|

406 |

|

|

|

388 |

|

|

|

848 |

|

|

|

797 |

|

Total cost of sales |

|

|

1,828 |

|

|

|

1,937 |

|

|

|

3,769 |

|

|

|

3,417 |

|

Gross margin |

|

|

1,803 |

|

|

|

1,444 |

|

|

|

3,157 |

|

|

|

2,599 |

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

5,959 |

|

|

|

5,331 |

|

|

|

11,529 |

|

|

|

10,792 |

|

General and administrative |

|

|

4,421 |

|

|

|

5,306 |

|

|

|

8,851 |

|

|

|

11,488 |

|

Sales and marketing |

|

|

2,269 |

|

|

|

2,499 |

|

|

|

4,273 |

|

|

|

5,046 |

|

Total operating expenses |

|

|

12,649 |

|

|

|

13,136 |

|

|

|

24,653 |

|

|

|

27,326 |

|

Loss from operations |

|

|

(10,846 |

) |

|

|

(11,692 |

) |

|

|

(21,496 |

) |

|

|

(24,727 |

) |

Interest income |

|

|

675 |

|

|

|

1,030 |

|

|

|

1,471 |

|

|

|

1,899 |

|

Other income, net |

|

|

15 |

|

|

|

25 |

|

|

|

21 |

|

|

|

31 |

|

Loss before provision for income taxes |

|

|

(10,156 |

) |

|

|

(10,637 |

) |

|

|

(20,004 |

) |

|

|

(22,797 |

) |

Provision for income taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss and comprehensive loss |

|

$ |

(10,156 |

) |

|

$ |

(10,637 |

) |

|

$ |

(20,004 |

) |

|

$ |

(22,797 |

) |

Net loss per common share attributable to common stockholders, basic and diluted |

|

$ |

(0.14 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.28 |

) |

|

$ |

(0.32 |

) |

Weighted-average shares used to compute net loss per share attributable to common stockholders, basic and diluted |

|

|

72,041,332 |

|

|

|

71,201,170 |

|

|

|

71,987,688 |

|

|

|

71,033,629 |

|

HYPERFINE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(20,004 |

) |

|

$ |

(22,797 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation |

|

|

516 |

|

|

|

513 |

|

Stock-based compensation expense |

|

|

2,206 |

|

|

|

2,259 |

|

Loss on disposal of property and equipment, net |

|

|

100 |

|

|

|

100 |

|

Payments received on net investment in lease |

|

|

18 |

|

|

|

4 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable, net |

|

|

(2,179 |

) |

|

|

(1,845 |

) |

Unbilled receivables |

|

|

(1,179 |

) |

|

|

(209 |

) |

Inventory |

|

|

(1,000 |

) |

|

|

(1,537 |

) |

Prepaid expenses and other current assets |

|

|

(518 |

) |

|

|

946 |

|

Due from related parties |

|

|

— |

|

|

|

48 |

|

Prepaid inventory |

|

|

693 |

|

|

|

281 |

|

Other long term assets |

|

|

46 |

|

|

|

129 |

|

Accounts payable |

|

|

867 |

|

|

|

666 |

|

Deferred grant funding |

|

|

(621 |

) |

|

|

198 |

|

Deferred revenue |

|

|

68 |

|

|

|

(134 |

) |

Due to related parties |

|

|

5 |

|

|

|

45 |

|

Accrued expenses and other current liabilities |

|

|

(912 |

) |

|

|

(1,817 |

) |

Operating lease liabilities, net |

|

|

1 |

|

|

|

— |

|

Net cash used in operating activities |

|

|

(21,893 |

) |

|

|

(23,150 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(216 |

) |

|

|

(283 |

) |

Net cash used in investing activities |

|

|

(216 |

) |

|

|

(283 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

|

114 |

|

|

|

107 |

|

Net cash provided by financing activities |

|

|

114 |

|

|

|

107 |

|

Net decrease in cash and cash equivalents and restricted cash |

|

|

(21,995 |

) |

|

|

(23,326 |

) |

Cash, cash equivalents and restricted cash, beginning of period |

|

|

75,804 |

|

|

|

118,243 |

|

Cash, cash equivalents and restricted cash, end of period |

|

|

53,809 |

|

|

|

94,917 |

|

Reconciliation of cash, cash equivalents, and restricted cash reported in the balance sheets |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

53,809 |

|

|

|

93,948 |

|

Restricted cash |

|

|

— |

|

|

|

969 |

|

Total cash, cash equivalents and restricted cash |

|

$ |

53,809 |

|

|

$ |

94,917 |

|

Supplemental disclosure of noncash information: |

|

|

|

|

|

|

Unpaid purchase of property and equipment |

|

$ |

735 |

|

|

$ |

28 |

|

v3.24.2.u1

Document And Entity Information

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity Registrant Name |

Hyperfine, Inc.

|

| Entity Central Index Key |

0001833769

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-39949

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

98-1569027

|

| Entity Address, Address Line One |

351 New Whitfield Street

|

| Entity Address, City or Town |

Guilford

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06437

|

| City Area Code |

(866)

|

| Local Phone Number |

796-6767

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

HYPR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

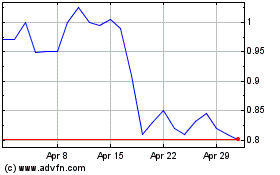

Hyperfine (NASDAQ:HYPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hyperfine (NASDAQ:HYPR)

Historical Stock Chart

From Dec 2023 to Dec 2024