Hurco Companies, Inc. (Nasdaq: HURC) today reported results for the

second fiscal quarter ended April 30, 2024. Hurco recorded a net

loss of $3,922,000, or $(0.61) per diluted share, for the second

quarter of fiscal year 2024, compared to net income of $377,000, or

$0.06 per diluted share, for the corresponding period in fiscal

year 2023. For the first six months of fiscal year 2024, Hurco

reported a net loss of $5,570,000, or $(0.86) per diluted share,

compared to net income of $1,707,000, or $0.26 per diluted share,

for the corresponding period in fiscal year 2023.

Sales and service fees for the second quarter of

fiscal year 2024 were $45,172,000, a decrease of $8,647,000, or

16%, compared to the corresponding prior year period, and included

a favorable currency impact of $59,000, or less than 1%, when

translating foreign sales to U.S. dollars for financial reporting

purposes. Sales and service fees for the first six months of fiscal

year 2024 were $90,231,000, a decrease of $18,270,000, or 17%,

compared to the corresponding prior year period, and included a

favorable currency impact of $838,000, or less than 1%, when

translating foreign sales to U.S. dollars for financial reporting

purposes.

Greg Volovic, Chief Executive Officer, stated,

“In a year of global uncertainty and broader market softening,

resulting in tighter margins and lower sales volumes, we are

focusing on adjusting our overhead and operating expenses to

minimize the impact on operating income while maintaining a strong

balance sheet. Additionally, we are optimizing inventory management

and utilizing the resulting cash flow to refine our capital

allocation strategies, enabling us to invest in new technologies,

product development, and essential capital expenditures, maximizing

cash flows without incurring significant debt. These actions will

also enable us to continue - and even expand - our investments in

research and development, product enhancements, global

distribution, and other strategic opportunities. We remain focused

on strengthening our balance sheet and ensuring our capital

allocation strategy meets both short-term and long-term business

needs, with a strong commitment to returning value to our

shareholders. We are preparing to participate in the International

Manufacturing Trade Show (IMTS) in Chicago with an expanded

presence. At IMTS, we will showcase the future of art and science

in machine and control design. Patrons will have a unique

opportunity to experience Hurco's vision of the future with a newly

styled machine tool outfitted with a novel, ergonomic,

graphics-centric, and customizable touch-screen control running our

never-before-seen revolutionary WinMax user-interface, driven by

our latest innovations in AI-powered autonomous CNC control

technologies. We will also be debuting the new Inspire+ control for

our Milltronics machines and Takumi's new advanced five-axis

product offering. ProCobots automation solutions will also be

featured on nearly all our machines, highlighting how accessible

automation is transforming machine shops worldwide. Our steadfast

investment in R&D, regardless of industry cycles, continues to

be the foundational cornerstone of our culture and a key driver of

our success."

The following table sets forth net sales and

service fees by geographic region for the second fiscal quarter and

six months ended April 30, 2024, and 2023 (dollars in

thousands):

| |

Three Months Ended |

|

Six Months Ended |

| |

April 30, |

|

April 30, |

| |

2024 |

2023 |

$ Change |

% Change |

|

2024 |

2023 |

$ Change |

% Change |

|

Americas |

$16,947 |

$18,324 |

($1,377) |

(8)% |

|

$33,597 |

$40,337 |

($6,740) |

(17)% |

| Europe |

22,720 |

29,991 |

(7,271) |

(24)% |

|

45,470 |

58,583 |

(13,113) |

(22)% |

| Asia Pacific |

5,505 |

5,504 |

1 |

0% |

|

11,164 |

9,581 |

1,583 |

17% |

| Total |

$45,172 |

$53,819 |

($8,647) |

(16)% |

|

$90,231 |

$108,501 |

($18,270) |

(17)% |

| |

Sales in the Americas for the second quarter and

first six months of fiscal year 2024 decreased by 8% and 17%,

respectively, compared to the corresponding periods in fiscal year

2023, primarily due to decreased shipments of Hurco machines. The

decrease in sales of Hurco machines was primarily attributable to

decreased shipments of VM machines, partially offset by increased

sales of higher-performing VMX and 5-axis machines.

European sales for the second quarter of fiscal

year 2024 decreased by 24%, compared to the corresponding period in

fiscal year 2023, and included a favorable currency impact of less

than 1%, when translating foreign sales to U.S. dollars for

financial reporting purposes. European sales for the first six

months of fiscal year 2024 decreased by 22%, compared to the

corresponding period in fiscal year 2023, and included a favorable

currency impact of 2%, when translating foreign sales to U.S.

dollars for financial reporting purposes. The year-over-year

decreases in European sales were primarily attributable to a

decreased volume of shipments of Hurco and Takumi machines in

Germany, the United Kingdom, and Italy, as well as decreased volume

of shipments of electro-mechanical components and accessories

manufactured by our wholly-owned subsidiary, LCM Precision

Technology S.r.l. (“LCM”), partially offset by an increased volume

of shipments of Hurco machines in France.

Asian Pacific sales for the second quarter of

fiscal year 2024 were relatively unchanged compared to the

corresponding prior year period, and included an unfavorable

currency impact of 3%, when translating foreign sales to U.S.

dollars for financial reporting purposes. Asian Pacific sales for

the first six months of fiscal year 2024 increased by 17%, compared

to the corresponding prior year period, and included an unfavorable

currency impact of 2%, when translating foreign sales to U.S.

dollars for financial reporting purposes. The year-over-year

increase in Asian Pacific sales in the six-month period was

primarily attributable to increased sales of higher-performance VMX

and 5-axis Hurco and Takumi machines in India, partially offset by

reductions in shipments of Hurco and Takumi machines in China and

Southeast Asia.

Orders for the second quarter of fiscal year

2024 were $44,192,000, a decrease of $16,031,000, or 27%, compared

to the corresponding period in fiscal year 2023, and included a

favorable currency impact of $107,000, or less than 1%, when

translating foreign orders to U.S. dollars. Orders for the first

six months of fiscal year 2024 were $94,410,000, a decrease of

$19,043,000, or 17%, compared to the corresponding period in fiscal

year 2023, and included a favorable currency impact of $893,000, or

less than 1%, when translating foreign orders to U.S. dollars.

The following table sets forth new orders booked

by geographic region for the second fiscal quarter and six months

ended April 30, 2024, and 2023 (dollars in thousands):

| |

Three Months Ended |

|

Six Months Ended |

| |

April 30, |

|

April 30, |

| |

2024 |

2023 |

$ Change |

% Change |

|

2024 |

2023 |

$ Change |

% Change |

| Americas |

$17,069 |

$22,254 |

($5,185) |

(23)% |

|

$37,865 |

$41,941 |

($4,076) |

(10)% |

| Europe |

23,873 |

32,994 |

(9,121) |

(28)% |

|

47,408 |

62,880 |

(15,472) |

(25)% |

| Asia Pacific |

3,250 |

4,975 |

(1,725) |

(35)% |

|

9,137 |

8,632 |

505 |

6% |

| Total |

$44,192 |

$60,223 |

($16,031) |

(27)% |

|

$94,410 |

$113,453 |

($19,043) |

(17)% |

| |

Orders in the Americas for the second quarter

and first six months of fiscal year 2024 decreased by 23% and 10%,

respectively, compared to the corresponding periods in fiscal year

2023. The decreases in orders for both periods were primarily due

to decreased customer demand for Hurco VM machines, partially

offset by increased orders of higher-performing VMX and 5-axis

machines.

European orders for the second quarter of fiscal

year 2024 decreased by 28%, compared to the corresponding prior

year period, and included a favorable currency impact of less than

1%, when translating foreign orders to U.S. dollars. The decrease

in orders was driven primarily by decreased customer demand for

Hurco and Takumi machines in Germany, the United Kingdom, and

Italy, as well as decreased demand for electro-mechanical

components and accessories manufactured by LCM, partially offset by

increased customer demand for Hurco machines in France. European

orders for the first six months of fiscal year 2024 decreased by

25%, compared to the corresponding prior year period, and included

a favorable currency impact of 2%, when translating foreign orders

to U.S. dollars. The year-over-year decrease was mainly due to

decreased customer demand for Hurco machines across the European

region where our customers are located and for electro-mechanical

components and accessories manufactured by LCM.

Asian Pacific orders for the second quarter of

fiscal year 2024 decreased by 35%, compared to the corresponding

prior year period, and included an unfavorable currency impact of

2%, when translating foreign orders to U.S. dollars. The decrease

in Asian Pacific orders was driven primarily by decreased customer

demand for Hurco and Takumi machines in China, India, and Southeast

Asia. Asian Pacific orders for the first six months of fiscal year

2024 increased by 6%, compared to the corresponding prior year

period, and included an unfavorable currency impact of 2%, when

translating foreign orders to U.S. dollars. The year-over-year

increase in Asian Pacific orders was driven primarily by increased

customer demand for Hurco machines in China and India, partially

offset by decreased demand for Takumi machines in China.

Gross profit for the second quarter of fiscal

year 2024 was $8,019,000, or 18% of sales, compared to $12,583,000,

or 23% of sales, for the corresponding prior year period. Gross

profit for the first six months of fiscal year 2024 was

$17,714,000, or 20% of sales, compared to $25,301,000, or 23% of

sales, for the corresponding prior year period. The year-over-year

decreases in gross profit as a percentage of sales were primarily

due to the lower volume of sales of higher-performance vertical

milling machines in the Americas and Europe. Additionally, the

second quarter of fiscal 2024 included decreases in average net

selling prices, designed for certain machines to penetrate key

markets and reduce inventories. The decreases in both sales volume

and pricing unfavorably impacted gross profit in dollars and as a

percentage of sales, reducing our leverage of fixed costs, in

comparison to the corresponding prior year periods.

Selling, general, and administrative expenses

for the second quarter of fiscal year 2024 were $11,461,000, or 25%

of sales, compared to $11,592,000, or 22% of sales, in the

corresponding fiscal year 2023 period, and included an unfavorable

currency impact of $14,000, when translating foreign expenses to

U.S. dollars for financial reporting purposes. Selling, general,

and administrative expenses for the first six months of fiscal year

2024 were $22,976,000, or 25% of sales, compared to $23,076,000, or

21% of sales, in the corresponding fiscal year 2023 period, and

included an unfavorable currency impact of $182,000, when

translating foreign expenses to U.S. dollars for financial

reporting purposes. Selling, general, and administrative expenses

as a percentage of sales increased in the second quarter and first

six months of fiscal year 2024 compared to each of the

corresponding prior year periods due to the lower volume of sales

year-over-year.

The effective tax rates for the second quarter

and first six months of fiscal year 2024 were (1)% and 9%,

respectively, compared to 44% and 35% in each of the corresponding

prior year periods. The year-over-year decreases in the effective

tax rates were primarily due to changes in geographic mix of income

and loss that includes jurisdictions with differing tax rates, a

discrete item related to stock compensation and the impact of

valuation allowances on an overall lower level of income before

taxes.

Cash and cash equivalents totaled $37,542,000 at

April 30, 2024, compared to $41,784,000 at October 31, 2023.

Working capital was $187,574,000 at April 30, 2024, compared to

$193,257,000 at October 31, 2023. The decrease in working capital

was primarily driven by decreases in accounts receivable, net and

cash and cash equivalents, partially offset by increases in

inventories, net and prepaid and other assets and decreases in

accounts payable and accrued payroll and employee benefits.

Hurco Companies, Inc. is an international,

industrial technology company that sells its three brands of

computer numeric control (“CNC”) machine tools to the worldwide

metal cutting and metal forming industry. Two of the Company’s

brands of machine tools, Hurco and Milltronics, are equipped with

interactive controls that include software that is proprietary to

each respective brand. The Company designs these controls and

develops the software. The third brand of CNC machine tools,

Takumi, is equipped with industrial controls that are produced by

third parties, which allows the customer to decide the type of

control added to the Takumi CNC machine tool. The Company also

produces high-value machine tool components and accessories and

provides automation solutions that can be integrated with any

machine tool. The end markets for the Company's products are

independent job shops, short-run manufacturing operations within

large corporations, and manufacturers with production-oriented

operations. The Company’s customers manufacture precision parts,

tools, dies, and/or molds for industries such as aerospace,

defense, medical equipment, energy, transportation, and computer

equipment. The Company is based in Indianapolis, Indiana, with

manufacturing operations in Taiwan, Italy, the U.S., and China, and

sells its products through direct and indirect sales forces

throughout the Americas, Europe, and Asia. The Company has sales,

application engineering support and service subsidiaries in China,

the Czech Republic, England, France, Germany, India, Italy, the

Netherlands, Poland, Singapore, the U.S., and Taiwan. Web Site:

www.hurco.com

Certain statements in this news release are

forward-looking statements that involve known and unknown risks,

uncertainties, and other factors that may cause our actual results,

performance, or achievements to be materially different from any

future results, performance, or achievements expressed or implied

by such forward-looking statements. These factors include, among

others, the cyclical nature of the machine tool industry; uncertain

economic conditions, which may adversely affect overall demand, in

the Americas, Europe and Asia Pacific markets; the risks of our

international operations; governmental actions, initiatives and

regulations, including import and export restrictions, duties and

tariffs and changes to tax laws; the effects of changes in currency

exchange rates; competition with larger companies that have greater

financial resources; our dependence on new product development; the

need and/or ability to protect our intellectual property assets;

the limited number of our manufacturing and supply chain sources;

increases in the prices of raw materials, especially steel and iron

products; the effect of the loss of members of senior management

and key personnel; our ability to integrate acquisitions;

acquisitions that could disrupt our operations and affect operating

results; failure to comply with data privacy and security

regulations; breaches of our network and system security measures;

possible obsolescence of our technology and the need to make

technological advances; impairment of our assets; negative or

unforeseen tax consequences; uncertainty concerning our ability to

use tax loss carryforwards; changes in the SOFR rate; the impact of

the COVID-19 pandemic and other public health epidemics and

pandemics on the global economy, our business and operations, our

employees and the business, operations and economies of our

customers and suppliers; and other risks and uncertainties

discussed more fully under the caption “Risk Factors” in our

filings with the Securities and Exchange Commission. We expressly

disclaim any obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

|

Contact: |

Sonja K. McClellandExecutive Vice President, Treasurer, & Chief

Financial Officer317-293-5309 |

| |

|

|

Hurco Companies, Inc. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(In thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

April 30, |

|

April 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

(unaudited) |

|

(unaudited) |

|

Sales and service fees |

$ |

45,172 |

|

|

$ |

53,819 |

|

|

$ |

90,231 |

|

|

$ |

108,501 |

|

|

Cost of sales and service |

|

37,153 |

|

|

|

41,236 |

|

|

|

72,517 |

|

|

|

83,200 |

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

8,019 |

|

|

|

12,583 |

|

|

|

17,714 |

|

|

|

25,301 |

|

|

Selling, general and administrative expenses |

|

11,461 |

|

|

|

11,592 |

|

|

|

22,976 |

|

|

|

23,076 |

|

|

|

|

|

|

|

|

|

|

|

Operating (loss)

income |

|

(3,442 |

) |

|

|

991 |

|

|

|

(5,262 |

) |

|

|

2,225 |

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

136 |

|

|

|

55 |

|

|

|

267 |

|

|

|

71 |

|

|

Interest income |

|

164 |

|

|

|

85 |

|

|

|

320 |

|

|

|

137 |

|

|

Investment income |

|

8 |

|

|

|

7 |

|

|

|

67 |

|

|

|

36 |

|

|

Other (expense) income, net |

|

(476 |

) |

|

|

(360 |

) |

|

|

(989 |

) |

|

|

281 |

|

|

(Loss) income before

taxes |

|

(3,882 |

) |

|

|

668 |

|

|

|

(6,131 |

) |

|

|

2,608 |

|

|

Provision (benefit) for income taxes |

|

40 |

|

|

|

291 |

|

|

|

(561 |

) |

|

|

901 |

|

|

Net (loss)

income |

$ |

(3,922 |

) |

|

$ |

377 |

|

|

$ |

(5,570 |

) |

|

$ |

1,707 |

|

|

|

|

|

|

|

|

|

|

|

(Loss) income per common share |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.61 |

) |

|

$ |

0.06 |

|

|

$ |

(0.86 |

) |

|

$ |

0.26 |

|

|

Diluted |

$ |

(0.61 |

) |

|

$ |

0.06 |

|

|

$ |

(0.86 |

) |

|

$ |

0.26 |

|

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

Basic |

|

6,518 |

|

|

|

6,486 |

|

|

|

6,500 |

|

|

|

6,536 |

|

|

Diluted |

|

6,518 |

|

|

|

6,516 |

|

|

|

6,500 |

|

|

|

6,570 |

|

|

|

|

|

|

|

|

|

|

|

Dividends per share |

$ |

0.16 |

|

|

$ |

0.16 |

|

|

$ |

0.32 |

|

|

$ |

0.31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER CONSOLIDATED FINANCIAL DATA |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

April 30, |

|

April 30, |

|

Operating Data: |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

(unaudited) |

|

(unaudited) |

|

Gross margin |

|

18 |

% |

|

|

23 |

% |

|

|

20 |

% |

|

|

23 |

% |

|

SG&A expense as a percentage of sales |

|

25 |

% |

|

|

22 |

% |

|

|

25 |

% |

|

|

21 |

% |

|

Operating (loss) income as a percentage of sales |

|

-8 |

% |

|

|

2 |

% |

|

|

-6 |

% |

|

|

2 |

% |

|

Pre-tax (loss) income as a percentage of sales |

|

-9 |

% |

|

|

1 |

% |

|

|

-7 |

% |

|

|

2 |

% |

|

Effective tax rate |

|

-1 |

% |

|

|

44 |

% |

|

|

9 |

% |

|

|

35 |

% |

|

Depreciation and amortization |

$ |

882 |

|

|

$ |

1,050 |

|

|

$ |

1,790 |

|

|

$ |

2,104 |

|

|

Capital expenditures |

$ |

479 |

|

|

$ |

807 |

|

|

$ |

1,311 |

|

|

$ |

1,406 |

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data: |

4/30/2024 |

|

10/31/2023 |

|

|

|

|

|

Working capital |

$ |

187,575 |

|

|

$ |

193,257 |

|

|

|

|

|

|

Days sales outstanding |

|

47 |

|

|

|

41 |

|

|

|

|

|

|

Inventory turns |

|

1 |

|

|

|

1.1 |

|

|

|

|

|

|

Capitalization |

|

|

|

|

|

|

|

|

Total debt |

|

-- |

|

|

|

-- |

|

|

|

|

|

|

Shareholders' equity |

|

215,577 |

|

|

|

222,231 |

|

|

|

|

|

|

Total |

$ |

215,577 |

|

|

$ |

222,231 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Hurco Companies, Inc. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands, except share and per share

data) |

|

|

|

|

|

|

|

April 30, |

|

October 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

ASSETS |

(unaudited) |

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

37,542 |

|

|

$ |

41,784 |

|

|

Accounts receivable, net |

|

27,052 |

|

|

|

39,965 |

|

|

Inventories, net |

|

163,806 |

|

|

|

157,952 |

|

|

Derivative assets |

|

365 |

|

|

|

740 |

|

|

Prepaid and other assets |

|

10,209 |

|

|

|

7,789 |

|

|

Total current assets |

|

238,974 |

|

|

|

248,230 |

|

|

Property and equipment: |

|

|

|

|

Land |

|

1,046 |

|

|

|

1,046 |

|

|

Building |

|

7,387 |

|

|

|

7,387 |

|

|

Machinery and equipment |

|

25,843 |

|

|

|

26,779 |

|

|

Leasehold improvements |

|

4,523 |

|

|

|

4,473 |

|

|

|

|

38,799 |

|

|

|

39,685 |

|

|

Less accumulated depreciation and amortization |

|

(31,453 |

) |

|

|

(30,826 |

) |

|

Total property and equipment, net |

|

7,346 |

|

|

|

8,859 |

|

|

Non-current assets: |

|

|

|

|

Software development costs, less accumulated amortization |

|

6,985 |

|

|

|

7,030 |

|

|

Intangible assets, net |

|

860 |

|

|

|

994 |

|

|

Operating lease - right of use assets, net |

|

11,490 |

|

|

|

10,971 |

|

|

Deferred income taxes |

|

4,880 |

|

|

|

4,749 |

|

|

Investments and other assets |

|

10,291 |

|

|

|

9,756 |

|

|

Total non-current assets |

|

34,506 |

|

|

|

33,500 |

|

|

Total assets |

$ |

280,826 |

|

|

$ |

290,589 |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

27,356 |

|

|

$ |

29,661 |

|

|

Customer deposits |

|

3,244 |

|

|

|

2,827 |

|

|

Derivative liabilities |

|

2,578 |

|

|

|

1,821 |

|

|

Operating lease liabilities |

|

3,658 |

|

|

|

3,712 |

|

|

Accrued payroll and employee benefits |

|

7,592 |

|

|

|

9,853 |

|

|

Accrued income taxes |

|

1,190 |

|

|

|

1,713 |

|

|

Accrued expenses |

|

4,660 |

|

|

|

4,092 |

|

|

Accrued warranty expenses |

|

1,121 |

|

|

|

1,294 |

|

|

Total current liabilities |

|

51,399 |

|

|

|

54,973 |

|

|

Non-current liabilities: |

|

|

|

|

Deferred income taxes |

|

61 |

|

|

|

83 |

|

|

Accrued tax liability |

|

698 |

|

|

|

1,293 |

|

|

Operating lease liabilities |

|

8,189 |

|

|

|

7,606 |

|

|

Deferred credits and other |

|

4,902 |

|

|

|

4,403 |

|

|

Total non-current liabilities |

|

13,850 |

|

|

|

13,385 |

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

Preferred stock: no par value per share, 1,000,000 shares

authorized; no shares issued |

|

- |

|

|

|

- |

|

|

Common stock: no par value, $.10 stated value per share, 12,500,000

shares authorized; 6,636,473 and 6,553,673 shares issued and

6,523,259 and 6,462,138 shares outstanding, as of April 30, 2024

and October 31, 2023, respectively |

|

652 |

|

|

|

646 |

|

|

Additional paid-in capital |

|

62,155 |

|

|

|

61,665 |

|

|

Retained earnings |

|

172,461 |

|

|

|

180,124 |

|

|

Accumulated other comprehensive loss |

|

(19,691 |

) |

|

|

(20,204 |

) |

|

Total shareholders' equity |

|

215,577 |

|

|

|

222,231 |

|

|

Total liabilities and shareholders' equity |

$ |

280,826 |

|

|

$ |

290,589 |

|

| |

|

|

|

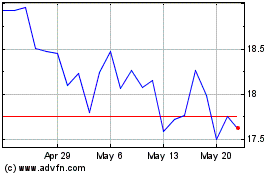

Hurco Companies (NASDAQ:HURC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Hurco Companies (NASDAQ:HURC)

Historical Stock Chart

From Jan 2024 to Jan 2025