By Asa Fitch and Ian Talley

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 6, 2018).

Dozens of major American companies are preparing to pull out of

Iran as the Trump administration closes a narrow legal window that

has allowed firms to operate there without violating U.S.

sanctions.

The companies using the exemption include big conglomerates like

Honeywell International Inc., Dover Corp. and General Electric Co.

and insurers like Chubb Ltd., many of which sought to profit from

growth in the Iranian energy industry. Some of the companies have

already booked millions of dollars in revenue from their Iranian

business, underscoring the high commercial stakes of the Trump

administration's decision to revive economy-crippling sanctions

against Iran.

In all, at least 17 U.S.-listed companies did business with Iran

using foreign subsidiaries after the Iran nuclear deal went into

effect in January 2016. Their total Iran-linked revenues since then

amounted to more than $175 million, according to an analysis of

Securities and Exchange Commission filings. Many more privately

held companies may also have done business in Iran through

subsidiaries but aren't subject to SEC disclosure rules.

Now some of those companies are hastening to shut down their

foreign subsidiaries' activity with Iran to avoid crushing U.S.

sanctions expected to begin taking effect in November.

President Donald Trump's move in May to exit from the nuclear

deal spells the end of the Obama administration's so-called General

License H, which allowed U.S. companies with foreign subsidiaries

to trade, finance, insure and invest in Iran. The exemption

afforded by the license was part of the carrot-and-stick approach

the Obama administration used to extract concessions from Iran,

using the promise of economic rejuvenation through U.S. investment,

though only indirectly through foreign subsidiaries.

Mr. Trump and his supporters saw the Iran deal as inadequate

because it failed to address Iran's military presence in the Middle

East and its development of ballistic missiles capable of reaching

U.S. allies like Israel. Like all the other sanction exemptions the

administration is revoking over the next six months, U.S. officials

say yanking License H is designed to isolate Iran politically,

financially and economically as Washington tries to pressure Tehran

into a fundamentally new military stance in the region.

"These sanctions will further cut the Iranian regime off from

abusing the global financial system," said Sigal Mandelker,

Treasury's undersecretary for terrorism and financial

intelligence.

The U.S. Treasury says U.S.-based firms operating under that

license have until Nov. 5 to wind down their operations or risk

penalties -- the same time frame for new bans against other

dealings with Iran's economy except for some specially licensed

trade in medical and food goods.

The withdrawal has drawn a fiery response from Iran, which has

vowed to quickly scale up its nuclear program if European leaders

can't work out an agreement to continue the deal without the U.S.

On Tuesday, Ali Akbar Salehi, the head of Iran's atomic agency,

said the country had constructed new infrastructure for building

advanced-enrichment centrifuges, according to the official Islamic

Republic News Agency. Centrifuge development hadn't started,

however, and the activities at a facility in the central city of

Natanz were currently within the strictures of the nuclear deal, he

said.

License H was designed to ease crippling sanctions imposed by

the Obama administration in 2012 once the nuclear deal took effect

in 2016. It gave companies a way around remaining U.S. sanctions on

Iran for terrorism, human-rights violations and its

ballistic-missile program.

Unlike several European companies such as Siemens AG, Renault

and oil giant Total, which made splashy moves into Iran, few

American firms drew attention to their Iranian dealings. But many

had big plans for a market with a population of around 80 million

people and some of the world's largest oil and gas reserves.

Now some are heading for the exit.

Illinois-based Dover, a manufacturing conglomerate, said the

revocation of License H would end its business in Iran. Dover had

been selling spare parts for pumps used in Iran's energy

infrastructure and was set to earn more than $16 million in revenue

from contracts signed there since the beginning of 2017, according

to regulatory filings.

The Wall Street Journal reported last week that GE is pulling

back from its foreign subsidiaries' work in Iran. The company had

revenue of about $24.8 million on sales of valves and spare parts

for Iran's energy industry, among other contracts, according to

regulatory filings.

"We are adapting our activities in Iran as necessary to conform

with recent changes in U.S. law," a GE spokeswoman told the Journal

last week. "GE's activities in Iran to date have been limited and

in compliance with U.S. government rules, licenses and

policies."

Honeywell has booked around $115 million of revenues from Iran

through its non-U. S. subsidiaries since the beginning of 2016,

largely in the past year, according to regulatory filings. Unless

Honeywell is able to fulfill $100 million in current contracts by

early November, it could lose future potential revenue, given that

the firm indicated in its SEC disclosures that those contracts

aren't yet completed.

U.S.-based Honeywell spokeswoman Victoria Streitfeld said the

company and its non-U. S. subsidiaries "operate within the

parameters of all applicable U.S. and international regulations and

will continue to do so."

"For those who have live contracts, they'll have to think about

how to wind them down," said Patrick Murphy, a Dubai-based lawyer

at Clyde & Co. specializing in sanctions regimes.

The License H exemption had limits and brought scrutiny on

companies using it. There were restrictions on the use of sensitive

technology with national-security implications, and the foreign

subsidiaries couldn't employ Americans.

The hoped-for benefits of the nuclear deal never fully

materialized for Iran. While the country was able to export more of

its oil, average Iranians didn't reap the rewards, as inflation and

unemployment rates remained in the double digits and remaining U.S.

sanctions deterred investment.

The end of the deal and the withdrawal of License H could cause

headaches especially for American insurers. A handful of them have

used the permission to cover whole fleets of ships, some of which

began calling at Iranian ports after the nuclear deal. Such

insurers could face penalties if they don't stop providing

protection for ships carrying oil and other cargo into Iranian

ports.

Validus Holdings, for example, said in its first-quarter report

that its non-U. S. subsidiaries provide coverage for ship cargo to

and from Iran, including crude oil and refined petroleum products.

The company declined to comment for this article, but said in its

March filing that it "intends for its non-U. S. subsidiaries to

continue to provide such coverage to the extent permitted by

applicable law."

Write to Asa Fitch at asa.fitch@wsj.com and Ian Talley at

ian.talley@wsj.com

Corrections & Amplifications GE had revenue of about $24.8

million on sales of valves and spare parts for Iran's energy

industry, among other contracts, from 2016 through the first

quarter of 2018, according to regulatory filings. An earlier

version of this article incorrectly gave the figure as $24.5

million. (June 5, 2018)

(END) Dow Jones Newswires

June 06, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

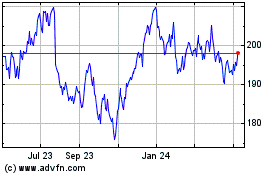

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Jul 2024 to Aug 2024

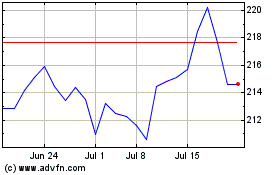

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Aug 2023 to Aug 2024