falseQ30001822492--12-28P3Yxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purehlm:Segment00018224922023-12-312024-09-2800018224922024-11-0100018224922024-09-2800018224922023-12-3000018224922024-06-302024-09-2800018224922023-07-022023-09-3000018224922023-01-012023-09-3000018224922022-12-3100018224922023-09-300001822492us-gaap:CommonStockMember2023-12-300001822492us-gaap:AdditionalPaidInCapitalMember2023-12-300001822492us-gaap:RetainedEarningsMember2023-12-300001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-300001822492us-gaap:RetainedEarningsMember2023-12-312024-03-3000018224922023-12-312024-03-300001822492us-gaap:AdditionalPaidInCapitalMember2023-12-312024-03-300001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-312024-03-300001822492us-gaap:CommonStockMember2024-03-300001822492us-gaap:AdditionalPaidInCapitalMember2024-03-300001822492us-gaap:RetainedEarningsMember2024-03-300001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3000018224922024-03-300001822492us-gaap:RetainedEarningsMember2024-03-312024-06-2900018224922024-03-312024-06-290001822492us-gaap:AdditionalPaidInCapitalMember2024-03-312024-06-290001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-312024-06-290001822492us-gaap:CommonStockMember2024-06-290001822492us-gaap:AdditionalPaidInCapitalMember2024-06-290001822492us-gaap:RetainedEarningsMember2024-06-290001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-2900018224922024-06-290001822492us-gaap:RetainedEarningsMember2024-06-302024-09-280001822492us-gaap:AdditionalPaidInCapitalMember2024-06-302024-09-280001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-302024-09-280001822492us-gaap:CommonStockMember2024-09-280001822492us-gaap:AdditionalPaidInCapitalMember2024-09-280001822492us-gaap:RetainedEarningsMember2024-09-280001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-280001822492us-gaap:CommonStockMember2022-12-310001822492us-gaap:AdditionalPaidInCapitalMember2022-12-310001822492us-gaap:RetainedEarningsMember2022-12-310001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001822492us-gaap:RetainedEarningsMember2023-01-012023-04-0100018224922023-01-012023-04-010001822492us-gaap:AdditionalPaidInCapitalMember2023-01-012023-04-010001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-04-0100018224922023-04-010001822492us-gaap:CommonStockMember2023-04-010001822492us-gaap:AdditionalPaidInCapitalMember2023-04-010001822492us-gaap:RetainedEarningsMember2023-04-010001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-010001822492us-gaap:RetainedEarningsMember2023-04-022023-07-0100018224922023-04-022023-07-010001822492us-gaap:AdditionalPaidInCapitalMember2023-04-022023-07-010001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-022023-07-0100018224922023-07-010001822492us-gaap:CommonStockMember2023-07-010001822492us-gaap:AdditionalPaidInCapitalMember2023-07-010001822492us-gaap:RetainedEarningsMember2023-07-010001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-010001822492us-gaap:RetainedEarningsMember2023-07-022023-09-300001822492us-gaap:AdditionalPaidInCapitalMember2023-07-022023-09-300001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-022023-09-300001822492us-gaap:CommonStockMember2023-09-300001822492us-gaap:AdditionalPaidInCapitalMember2023-09-300001822492us-gaap:RetainedEarningsMember2023-09-300001822492us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001822492hlm:FasteningandHardwareMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2024-06-302024-09-280001822492hlm:FasteningandHardwareMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2024-06-302024-09-280001822492hlm:FasteningandHardwareMemberhlm:CanadaSegmentMember2024-06-302024-09-280001822492hlm:FasteningandHardwareMember2024-06-302024-09-280001822492hlm:PersonalProtectionSolutionsMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2024-06-302024-09-280001822492hlm:PersonalProtectionSolutionsMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2024-06-302024-09-280001822492hlm:PersonalProtectionSolutionsMemberhlm:CanadaSegmentMember2024-06-302024-09-280001822492hlm:PersonalProtectionSolutionsMember2024-06-302024-09-280001822492hlm:KeyandKeyAccessoriesMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2024-06-302024-09-280001822492hlm:KeyandKeyAccessoriesMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2024-06-302024-09-280001822492hlm:KeyandKeyAccessoriesMemberhlm:CanadaSegmentMember2024-06-302024-09-280001822492hlm:KeyandKeyAccessoriesMember2024-06-302024-09-280001822492hlm:EngravingMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2024-06-302024-09-280001822492hlm:EngravingMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2024-06-302024-09-280001822492hlm:EngravingMemberhlm:CanadaSegmentMember2024-06-302024-09-280001822492hlm:EngravingMember2024-06-302024-09-280001822492hlm:FastenersHardwareandPersonalProtectionSegmentMember2024-06-302024-09-280001822492hlm:RoboticsAndDigitalSolutionsSegmentMember2024-06-302024-09-280001822492hlm:CanadaSegmentMember2024-06-302024-09-280001822492hlm:FasteningandHardwareMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-07-022023-09-300001822492hlm:FasteningandHardwareMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-07-022023-09-300001822492hlm:FasteningandHardwareMemberhlm:CanadaSegmentMember2023-07-022023-09-300001822492hlm:FasteningandHardwareMember2023-07-022023-09-300001822492hlm:PersonalProtectionSolutionsMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-07-022023-09-300001822492hlm:PersonalProtectionSolutionsMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-07-022023-09-300001822492hlm:PersonalProtectionSolutionsMemberhlm:CanadaSegmentMember2023-07-022023-09-300001822492hlm:PersonalProtectionSolutionsMember2023-07-022023-09-300001822492hlm:KeyandKeyAccessoriesMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-07-022023-09-300001822492hlm:KeyandKeyAccessoriesMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-07-022023-09-300001822492hlm:KeyandKeyAccessoriesMemberhlm:CanadaSegmentMember2023-07-022023-09-300001822492hlm:KeyandKeyAccessoriesMember2023-07-022023-09-300001822492hlm:EngravingMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-07-022023-09-300001822492hlm:EngravingMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-07-022023-09-300001822492hlm:EngravingMemberhlm:CanadaSegmentMember2023-07-022023-09-300001822492hlm:EngravingMember2023-07-022023-09-300001822492hlm:FastenersHardwareandPersonalProtectionSegmentMember2023-07-022023-09-300001822492hlm:RoboticsAndDigitalSolutionsSegmentMember2023-07-022023-09-300001822492hlm:CanadaSegmentMember2023-07-022023-09-300001822492hlm:FasteningandHardwareMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-12-312024-09-280001822492hlm:FasteningandHardwareMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-12-312024-09-280001822492hlm:FasteningandHardwareMemberhlm:CanadaSegmentMember2023-12-312024-09-280001822492hlm:FasteningandHardwareMember2023-12-312024-09-280001822492hlm:PersonalProtectionSolutionsMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-12-312024-09-280001822492hlm:PersonalProtectionSolutionsMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-12-312024-09-280001822492hlm:PersonalProtectionSolutionsMemberhlm:CanadaSegmentMember2023-12-312024-09-280001822492hlm:PersonalProtectionSolutionsMember2023-12-312024-09-280001822492hlm:KeyandKeyAccessoriesMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-12-312024-09-280001822492hlm:KeyandKeyAccessoriesMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-12-312024-09-280001822492hlm:KeyandKeyAccessoriesMemberhlm:CanadaSegmentMember2023-12-312024-09-280001822492hlm:KeyandKeyAccessoriesMember2023-12-312024-09-280001822492hlm:EngravingMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-12-312024-09-280001822492hlm:EngravingMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-12-312024-09-280001822492hlm:EngravingMemberhlm:CanadaSegmentMember2023-12-312024-09-280001822492hlm:EngravingMember2023-12-312024-09-280001822492hlm:FastenersHardwareandPersonalProtectionSegmentMember2023-12-312024-09-280001822492hlm:RoboticsAndDigitalSolutionsSegmentMember2023-12-312024-09-280001822492hlm:CanadaSegmentMember2023-12-312024-09-280001822492hlm:FasteningandHardwareMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-01-012023-09-300001822492hlm:FasteningandHardwareMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-01-012023-09-300001822492hlm:FasteningandHardwareMemberhlm:CanadaSegmentMember2023-01-012023-09-300001822492hlm:FasteningandHardwareMember2023-01-012023-09-300001822492hlm:PersonalProtectionSolutionsMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-01-012023-09-300001822492hlm:PersonalProtectionSolutionsMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-01-012023-09-300001822492hlm:PersonalProtectionSolutionsMemberhlm:CanadaSegmentMember2023-01-012023-09-300001822492hlm:PersonalProtectionSolutionsMember2023-01-012023-09-300001822492hlm:KeyandKeyAccessoriesMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-01-012023-09-300001822492hlm:KeyandKeyAccessoriesMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-01-012023-09-300001822492hlm:KeyandKeyAccessoriesMemberhlm:CanadaSegmentMember2023-01-012023-09-300001822492hlm:KeyandKeyAccessoriesMember2023-01-012023-09-300001822492hlm:EngravingMemberhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-01-012023-09-300001822492hlm:EngravingMemberhlm:RoboticsAndDigitalSolutionsSegmentMember2023-01-012023-09-300001822492hlm:EngravingMemberhlm:CanadaSegmentMember2023-01-012023-09-300001822492hlm:EngravingMember2023-01-012023-09-300001822492hlm:FastenersHardwareandPersonalProtectionSegmentMember2023-01-012023-09-300001822492hlm:RoboticsAndDigitalSolutionsSegmentMember2023-01-012023-09-300001822492hlm:CanadaSegmentMember2023-01-012023-09-300001822492country:UShlm:FastenersHardwareandPersonalProtectionSegmentMember2024-06-302024-09-280001822492country:UShlm:RoboticsAndDigitalSolutionsSegmentMember2024-06-302024-09-280001822492country:UShlm:CanadaSegmentMember2024-06-302024-09-280001822492country:US2024-06-302024-09-280001822492country:CAhlm:FastenersHardwareandPersonalProtectionSegmentMember2024-06-302024-09-280001822492country:CAhlm:RoboticsAndDigitalSolutionsSegmentMember2024-06-302024-09-280001822492country:CAhlm:CanadaSegmentMember2024-06-302024-09-280001822492country:CA2024-06-302024-09-280001822492hlm:OTHERDomainhlm:FastenersHardwareandPersonalProtectionSegmentMember2024-06-302024-09-280001822492hlm:OTHERDomainhlm:RoboticsAndDigitalSolutionsSegmentMember2024-06-302024-09-280001822492hlm:OTHERDomainhlm:CanadaSegmentMember2024-06-302024-09-280001822492hlm:OTHERDomain2024-06-302024-09-280001822492country:UShlm:FastenersHardwareandPersonalProtectionSegmentMember2023-07-022023-09-300001822492country:UShlm:RoboticsAndDigitalSolutionsSegmentMember2023-07-022023-09-300001822492country:UShlm:CanadaSegmentMember2023-07-022023-09-300001822492country:US2023-07-022023-09-300001822492country:CAhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-07-022023-09-300001822492country:CAhlm:RoboticsAndDigitalSolutionsSegmentMember2023-07-022023-09-300001822492country:CAhlm:CanadaSegmentMember2023-07-022023-09-300001822492country:CA2023-07-022023-09-300001822492hlm:OTHERDomainhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-07-022023-09-300001822492hlm:OTHERDomainhlm:RoboticsAndDigitalSolutionsSegmentMember2023-07-022023-09-300001822492hlm:OTHERDomainhlm:CanadaSegmentMember2023-07-022023-09-300001822492hlm:OTHERDomain2023-07-022023-09-300001822492country:UShlm:FastenersHardwareandPersonalProtectionSegmentMember2023-12-312024-09-280001822492country:UShlm:RoboticsAndDigitalSolutionsSegmentMember2023-12-312024-09-280001822492country:UShlm:CanadaSegmentMember2023-12-312024-09-280001822492country:US2023-12-312024-09-280001822492country:CAhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-12-312024-09-280001822492country:CAhlm:RoboticsAndDigitalSolutionsSegmentMember2023-12-312024-09-280001822492country:CAhlm:CanadaSegmentMember2023-12-312024-09-280001822492country:CA2023-12-312024-09-280001822492hlm:OTHERDomainhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-12-312024-09-280001822492hlm:OTHERDomainhlm:RoboticsAndDigitalSolutionsSegmentMember2023-12-312024-09-280001822492hlm:OTHERDomainhlm:CanadaSegmentMember2023-12-312024-09-280001822492hlm:OTHERDomain2023-12-312024-09-280001822492country:UShlm:FastenersHardwareandPersonalProtectionSegmentMember2023-01-012023-09-300001822492country:UShlm:RoboticsAndDigitalSolutionsSegmentMember2023-01-012023-09-300001822492country:UShlm:CanadaSegmentMember2023-01-012023-09-300001822492country:US2023-01-012023-09-300001822492country:CAhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-01-012023-09-300001822492country:CAhlm:RoboticsAndDigitalSolutionsSegmentMember2023-01-012023-09-300001822492country:CAhlm:CanadaSegmentMember2023-01-012023-09-300001822492country:CA2023-01-012023-09-300001822492hlm:OTHERDomainhlm:FastenersHardwareandPersonalProtectionSegmentMember2023-01-012023-09-300001822492hlm:OTHERDomainhlm:RoboticsAndDigitalSolutionsSegmentMember2023-01-012023-09-300001822492hlm:OTHERDomainhlm:CanadaSegmentMember2023-01-012023-09-300001822492hlm:OTHERDomain2023-01-012023-09-300001822492hlm:AjustlockMember2023-12-050001822492hlm:AjustlockMember2024-06-302024-09-280001822492hlm:KochMember2024-01-110001822492hlm:KochMemberus-gaap:CustomerRelationshipsMember2024-01-110001822492hlm:KochMemberus-gaap:TradeNamesMember2024-01-110001822492hlm:IntexMember2024-08-230001822492hlm:IntexMemberus-gaap:CustomerRelationshipsMember2024-08-230001822492hlm:IntexMemberus-gaap:TradeNamesMember2024-08-230001822492hlm:FastenersHardwareandPersonalProtectionSegmentMember2023-12-300001822492hlm:FastenersHardwareandPersonalProtectionSegmentMember2024-09-280001822492hlm:RoboticsAndDigitalSolutionsSegmentMember2023-12-300001822492hlm:RoboticsAndDigitalSolutionsSegmentMember2024-09-280001822492hlm:CanadaSegmentMember2023-12-300001822492hlm:CanadaSegmentMember2024-09-280001822492us-gaap:CustomerRelationshipsMembersrt:MinimumMember2024-09-280001822492us-gaap:CustomerRelationshipsMembersrt:MaximumMember2024-09-280001822492us-gaap:CustomerRelationshipsMember2024-09-280001822492us-gaap:CustomerRelationshipsMember2023-12-300001822492us-gaap:TrademarksMember2024-09-280001822492us-gaap:TrademarksMember2023-12-300001822492us-gaap:TrademarksMembersrt:MinimumMember2024-09-280001822492us-gaap:TrademarksMembersrt:MaximumMember2024-09-280001822492us-gaap:TrademarksMember2024-09-280001822492us-gaap:TrademarksMember2023-12-300001822492us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MinimumMember2024-09-280001822492us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MaximumMember2024-09-280001822492us-gaap:TechnologyBasedIntangibleAssetsMember2024-09-280001822492us-gaap:TechnologyBasedIntangibleAssetsMember2023-12-300001822492srt:MaximumMember2023-12-312024-09-280001822492us-gaap:InsuranceClaimsMember2024-09-280001822492hlm:GroupHealthInsuranceClaimsMember2024-09-280001822492hlm:OlliesBargainOutletSalesMember2024-06-302024-09-280001822492hlm:OlliesBargainOutletSalesMember2023-12-312024-09-280001822492hlm:OlliesBargainOutletSalesMember2023-07-022023-09-300001822492hlm:OlliesBargainOutletSalesMember2023-01-012023-09-300001822492us-gaap:RevolvingCreditFacilityMember2024-09-280001822492us-gaap:RevolvingCreditFacilityMember2023-12-300001822492hlm:SeniorTermLoanDue2028Memberus-gaap:MediumTermNotesMember2024-09-280001822492hlm:SeniorTermLoanDue2028Memberus-gaap:MediumTermNotesMember2023-12-300001822492hlm:EquityIncentivePlan2014Member2021-07-140001822492hlm:EquityIncentivePlan2014Member2024-06-302024-09-280001822492hlm:EquityIncentivePlan2014Member2023-12-312024-09-280001822492hlm:EquityIncentivePlan2014Member2023-07-022023-09-300001822492hlm:EquityIncentivePlan2014Member2023-01-012023-09-300001822492us-gaap:EmployeeStockOptionMemberhlm:EquityIncentivePlan2014Member2023-12-312024-09-280001822492us-gaap:RestrictedStockMemberhlm:EquityIncentivePlan2014Member2023-12-312024-09-280001822492hlm:EquityIncentivePlan2021Member2024-06-070001822492hlm:EquityIncentivePlan2021Member2021-07-140001822492hlm:EquityIncentivePlan2021Member2024-06-302024-09-280001822492hlm:EquityIncentivePlan2021Member2023-12-312024-09-280001822492hlm:EquityIncentivePlan2021Member2023-07-022023-09-300001822492hlm:EquityIncentivePlan2021Member2023-01-012023-09-300001822492hlm:EmployeeStockPurchasePlanMember2024-06-302024-09-280001822492hlm:EmployeeStockPurchasePlanMember2023-12-312024-09-280001822492hlm:EmployeeStockPurchasePlanMember2023-07-022023-09-300001822492hlm:EmployeeStockPurchasePlanMember2023-01-012023-09-300001822492us-gaap:StockCompensationPlanMember2024-06-302024-09-280001822492us-gaap:StockCompensationPlanMember2023-12-312024-09-280001822492us-gaap:StockCompensationPlanMember2023-07-022023-09-300001822492us-gaap:StockCompensationPlanMember2023-01-012023-09-300001822492hlm:InterestRateSwapAgreement2021Swap1Member2018-01-080001822492hlm:InterestRateSwapAgreement2021Swap2Member2018-11-080001822492hlm:InterestRateSwapAgreement2024Swap1Member2023-12-190001822492hlm:InterestRateSwapAgreement2024Swap2Member2023-12-190001822492hlm:InterestRateSwapAgreement2021Swap1Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2024-09-280001822492hlm:InterestRateSwapAgreement2021Swap1Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2023-12-300001822492hlm:InterestRateSwapAgreement2021Swap1Memberus-gaap:DesignatedAsHedgingInstrumentMemberhlm:OtherAccruedExpensesMember2024-09-280001822492hlm:InterestRateSwapAgreement2021Swap1Memberus-gaap:DesignatedAsHedgingInstrumentMemberhlm:OtherAccruedExpensesMember2023-12-300001822492hlm:InterestRateSwapAgreement2021Swap2Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2024-09-280001822492hlm:InterestRateSwapAgreement2021Swap2Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2023-12-300001822492hlm:InterestRateSwapAgreement2021Swap2Memberus-gaap:DesignatedAsHedgingInstrumentMemberhlm:OtherAccruedExpensesMember2024-09-280001822492hlm:InterestRateSwapAgreement2021Swap2Memberus-gaap:DesignatedAsHedgingInstrumentMemberhlm:OtherAccruedExpensesMember2023-12-300001822492hlm:InterestRateSwapAgreement2024Swap1Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2024-09-280001822492hlm:InterestRateSwapAgreement2024Swap1Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2023-12-300001822492hlm:InterestRateSwapAgreement2024Swap1Memberus-gaap:DesignatedAsHedgingInstrumentMemberhlm:OtherAccruedExpensesAndOtherNoncurrentLiabilitiesMember2024-09-280001822492hlm:InterestRateSwapAgreement2024Swap1Memberus-gaap:DesignatedAsHedgingInstrumentMemberhlm:OtherAccruedExpensesAndOtherNoncurrentLiabilitiesMember2023-12-300001822492hlm:InterestRateSwapAgreement2024Swap2Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2024-09-280001822492hlm:InterestRateSwapAgreement2024Swap2Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2023-12-300001822492hlm:InterestRateSwapAgreement2024Swap2Memberus-gaap:DesignatedAsHedgingInstrumentMemberhlm:OtherAccruedExpensesAndOtherNoncurrentLiabilitiesMember2024-09-280001822492hlm:InterestRateSwapAgreement2024Swap2Memberus-gaap:DesignatedAsHedgingInstrumentMemberhlm:OtherAccruedExpensesAndOtherNoncurrentLiabilitiesMember2023-12-300001822492us-gaap:DesignatedAsHedgingInstrumentMember2024-09-280001822492us-gaap:DesignatedAsHedgingInstrumentMember2023-12-300001822492us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-280001822492us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-280001822492us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-280001822492us-gaap:FairValueMeasurementsRecurringMember2024-09-280001822492us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-09-280001822492us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-09-280001822492us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-09-280001822492us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-09-280001822492us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-300001822492us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-300001822492us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-300001822492us-gaap:FairValueMeasurementsRecurringMember2023-12-300001822492us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-300001822492us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-300001822492us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-300001822492us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-300001822492hlm:ResharpMemberus-gaap:OtherCurrentLiabilitiesMember2023-12-300001822492hlm:ResharpMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-300001822492hlm:InstafobMemberus-gaap:OtherCurrentLiabilitiesMember2023-12-300001822492hlm:InstafobMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-300001822492hlm:ResharpMemberus-gaap:OtherCurrentLiabilitiesMember2023-12-312024-09-280001822492hlm:ResharpMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-312024-09-280001822492hlm:InstafobMemberus-gaap:OtherCurrentLiabilitiesMember2023-12-312024-09-280001822492hlm:InstafobMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-312024-09-280001822492hlm:ResharpMemberus-gaap:OtherCurrentLiabilitiesMember2024-09-280001822492hlm:ResharpMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-09-280001822492hlm:InstafobMemberus-gaap:OtherCurrentLiabilitiesMember2024-09-280001822492hlm:InstafobMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-09-280001822492hlm:TrueValueMember2024-06-302024-09-280001822492hlm:TrueValueMember2023-12-312024-09-280001822492hlm:TrueValueMember2024-09-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 28, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission file number 001-39609

Hillman Solutions Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 85-2096734 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 1280 Kemper Meadow Drive | | 45240 |

| Cincinnati | , | Ohio | | |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (513) 851-4900

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

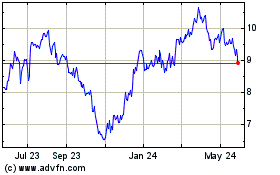

| Common Stock, par value $0.0001 per share | HLMN | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ (Do not check if a smaller reporting company) | | Smaller reporting company | | ☐ |

| Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

On November 1, 2024, 196,591,013 shares of common stock, par value $0.0001 per share, were outstanding.

| | | | | | | | |

|

| TABLE OF CONTENTS |

|

| | |

| PART I. FINANCIAL INFORMATION | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| PART II. OTHER INFORMATION | |

Item 1. | | |

Item 1A. | | |

Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| |

HILLMAN SOLUTIONS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(dollars in thousands)

| | | | | | | | | | | |

| | As of September 28, 2024 | | As of December 30, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 59,820 | | | $ | 38,553 | |

Accounts receivable, net of allowances of $10,365 ($2,770 - 2023) | 129,633 | | | 103,482 | |

| Inventories, net | 419,385 | | | 382,710 | |

| Other current assets | 15,566 | | | 23,235 | |

| Total current assets | 624,404 | | | 547,980 | |

Property and equipment, net of accumulated depreciation of $374,289 ($333,875 - 2023) | 221,769 | | | 200,553 | |

| Goodwill | 829,246 | | | 825,042 | |

Other intangibles, net of accumulated amortization of $516,026 ($470,791 - 2023) | 622,562 | | | 655,293 | |

| Operating lease right of use assets | 85,254 | | | 87,479 | |

| | | |

| Other assets | 14,332 | | | 14,754 | |

| Total assets | $ | 2,397,567 | | | $ | 2,331,101 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 165,809 | | | $ | 140,290 | |

| Current portion of debt and finance lease liabilities | 13,039 | | | 9,952 | |

| Current portion of operating lease liabilities | 16,331 | | | 14,407 | |

| Accrued expenses: | | | |

| Salaries and wages | 29,645 | | | 22,548 | |

| Pricing allowances | 6,693 | | | 8,145 | |

| Income and other taxes | 7,700 | | | 6,469 | |

| | | |

| Other accrued liabilities | 29,895 | | | 21,309 | |

| Total current liabilities | 269,112 | | | 223,120 | |

| Long-term debt | 730,666 | | | 731,708 | |

| Deferred tax liabilities | 130,403 | | | 131,552 | |

| Operating lease liabilities | 75,585 | | | 79,994 | |

| Other non-current liabilities | 10,577 | | | 10,198 | |

| Total liabilities | $ | 1,216,343 | | | $ | 1,176,572 | |

| Commitments and contingencies (Note 6) | | | |

| Stockholders' equity: | | | |

Common stock: $0.0001 par value, 500,000,000 shares authorized, 196,514,508 and 194,913,124 shares issued and outstanding in 2024 and 2023, respectfully | 20 | | | 20 | |

| Additional paid-in capital | 1,438,074 | | | 1,418,535 | |

| Accumulated deficit | (217,729) | | | (236,206) | |

| Accumulated other comprehensive loss | (39,141) | | | (27,820) | |

| Total stockholders' equity | 1,181,224 | | | 1,154,529 | |

| Total liabilities and stockholders' equity | $ | 2,397,567 | | | $ | 2,331,101 | |

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

| | | | | | | | |

1 | September 28, 2024 Form 10-Q | | |

HILLMAN SOLUTIONS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited)

(dollars in thousands, except for per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended

September 28, 2024 | | Thirteen Weeks Ended

September 30, 2023 | | Thirty-nine Weeks Ended

September 28, 2024 | | Thirty-nine Weeks Ended

September 30, 2023 |

| Net sales | $ | 393,296 | | | $ | 398,943 | | | $ | 1,123,033 | | | $ | 1,128,669 | |

| Cost of sales (exclusive of depreciation and amortization shown separately below) | 203,700 | | | 222,644 | | | 581,806 | | | 643,652 | |

| Selling, warehouse, general and administrative expenses | 130,261 | | | 113,359 | | | 369,980 | | | 335,876 | |

| Depreciation | 17,948 | | | 14,434 | | | 50,583 | | | 44,939 | |

| Amortization | 15,354 | | | 15,583 | | | 45,857 | | | 46,733 | |

| | | | | | | |

| Other (income) expense, net | (881) | | | (1,819) | | | 3 | | | 841 | |

| Income from operations | 26,914 | | | 34,742 | | | 74,804 | | | 56,628 | |

| | | | | | | |

| Interest expense, net | 15,108 | | | 16,728 | | | 44,316 | | | 52,880 | |

| | | | | | | |

| | | | | | | |

| Refinancing costs | — | | | — | | | 3,008 | | | — | |

| | | | | | | |

| Income before income taxes | 11,806 | | | 18,014 | | | 27,480 | | | 3,748 | |

| Income tax expense | 4,372 | | | 12,957 | | | 9,003 | | | 3,278 | |

| Net income | $ | 7,434 | | | $ | 5,057 | | | $ | 18,477 | | | $ | 470 | |

| | | | | | | |

| Basic income per share | $ | 0.04 | | | $ | 0.03 | | | $ | 0.09 | | | $ | 0.00 | |

| Weighted average basic shares outstanding | 196,297 | | 194,794 | | | 195,914 | | 194,662 |

| | | | | | | |

| Diluted income per share | $ | 0.04 | | | $ | 0.03 | | | $ | 0.09 | | | $ | 0.00 | |

| Weighted average diluted shares outstanding | 199,034 | | 196,575 | | | 198,370 | | 195,832 |

| | | | | | | |

| Net income from above | $ | 7,434 | | | $ | 5,057 | | | $ | 18,477 | | | $ | 470 | |

| Other comprehensive loss: | | | | | | | |

| Foreign currency translation adjustments | (14,350) | | | (2,994) | | | (18,570) | | | 1,851 | |

| Hedging activity | 7,486 | | | (4,257) | | | 7,249 | | | (10,159) | |

| Total other comprehensive loss | (6,864) | | | (7,251) | | | (11,321) | | | (8,308) | |

| Comprehensive income (loss) | $ | 570 | | | $ | (2,194) | | | $ | 7,156 | | | $ | (7,838) | |

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

| | | | | | | | |

2 | September 28, 2024 Form 10-Q | | |

HILLMAN SOLUTIONS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(dollars in thousands)

| | | | | | | | | | | |

| | Thirty-nine Weeks Ended

September 28, 2024 | | Thirty-nine Weeks Ended

September 30, 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 18,477 | | | $ | 470 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 96,440 | | | 91,672 | |

| Deferred income taxes | (1,326) | | | 1,835 | |

| Deferred financing and original issue discount amortization | 3,807 | | | 3,993 | |

| Stock-based compensation expense | 9,742 | | | 9,111 | |

| Customer bankruptcy reserve | 7,757 | | | — | |

| Loss on debt restructuring | 3,008 | | | — | |

| | | |

| Cash paid to third parties in connection with debt restructuring | (1,554) | | | — | |

| Loss on disposal of property and equipment | 56 | | | — | |

| Change in fair value of contingent consideration | 313 | | | 2,614 | |

| | | |

| Changes in operating items: | | | |

| Accounts receivable, net | (22,906) | | | (42,883) | |

| Inventories, net | (2,036) | | | 92,833 | |

| Other assets | (142) | | | (5,697) | |

| Accounts payable | 17,822 | | | 27,220 | |

| Other accrued liabilities | 10,729 | | | (9,691) | |

| | | |

| | | |

| Net cash provided by operating activities | 140,187 | | | 171,477 | |

| Cash flows from investing activities: | | | |

| Acquisition of business, net of cash received | (57,762) | | | (300) | |

| Capital expenditures | (64,196) | | | (52,145) | |

| | | |

| Other investing activities | (211) | | | (318) | |

| Net cash used for investing activities | (122,169) | | | (52,763) | |

| Cash flows from financing activities: | | | |

| Repayments of senior term loans | (4,255) | | | (86,383) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Financing fees | (33) | | | — | |

| Borrowings on revolving credit loans | 77,000 | | | 172,000 | |

| Repayments of revolving credit loans | (77,000) | | | (197,000) | |

| Principal payments under finance lease obligations | (2,698) | | | (1,687) | |

| Proceeds from exercise of stock options | 8,938 | | | 1,600 | |

| Payments of contingent consideration | (196) | | | (1,175) | |

| Other financing activities | (103) | | | 883 | |

| | | |

| Net cash provided by (used for) financing activities | 1,653 | | | (111,762) | |

| Effect of exchange rate changes on cash | 1,596 | | | 1,229 | |

| Net increase in cash and cash equivalents | 21,267 | | | 8,181 | |

| Cash and cash equivalents at beginning of period | 38,553 | | | 31,081 | |

| Cash and cash equivalents at end of period | $ | 59,820 | | | $ | 39,262 | |

| Supplemental disclosure of cash flow information: | | | |

| Interest paid | $ | 30,348 | | | $ | 43,843 | |

| Income taxes paid | 7,967 | | | 3,999 | |

| Capital expenditures in accounts payable | 2,200 | | | 1,518 | |

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

| | | | | | | | |

3 | September 28, 2024 Form 10-Q | | |

HILLMAN SOLUTIONS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (Unaudited)

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | | | | | | | | | |

| | Shares | | Amount | | | | | | Additional Paid-in-Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity |

| Thirty-nine weeks ended September 28, 2024 | | | | | | | | | | | | | | |

| Balance at December 30, 2023 | | 194,913 | | | $ | 20 | | | | | | | $ | 1,418,535 | | | $ | (236,206) | | | $ | (27,820) | | | $ | 1,154,529 | |

| Net loss | | — | | | — | | | | | | | — | | | (1,492) | | | — | | | (1,492) | |

| Stock option activity, stock awards and employee stock purchase plan | | 1,029 | | | — | | | | | | | 8,585 | | | — | | | — | | | 8,585 | |

| Hedging activity | | — | | | — | | | | | | | — | | | — | | | (1,817) | | | (1,817) | |

| Change in cumulative foreign currency translation adjustment | | — | | | — | | | | | | | — | | | — | | | 1,487 | | | 1,487 | |

| Balance at March 30, 2024 | | 195,942 | | | $ | 20 | | | | | | | $ | 1,427,120 | | | $ | (237,698) | | | $ | (28,150) | | | $ | 1,161,292 | |

| Net Income | | — | | | — | | | | | | | — | | | 12,535 | | | — | | | 12,535 | |

| Stock option activity, stock awards and employee stock purchase plan | | 214 | | | — | | | | | | | 4,742 | | | — | | | — | | | 4,742 | |

| Hedging activity | | — | | | — | | | | | | | — | | | — | | | 1,580 | | | 1,580 | |

| Change in cumulative foreign currency translation adjustment | | — | | | — | | | | | | | — | | | — | | | (5,707) | | | (5,707) | |

| Balance at June 29, 2024 | | 196,156 | | | $ | 20 | | | | | | | $ | 1,431,862 | | | $ | (225,163) | | | $ | (32,277) | | | $ | 1,174,442 | |

| Net Income | | — | | | — | | | | | | | — | | | 7,434 | | | — | | | 7,434 | |

| Stock option activity, stock awards and employee stock purchase plan | | 358 | | | — | | | | | | | 6,212 | | | — | | | — | | | 6,212 | |

| Hedging activity | | — | | | — | | | | | | | — | | | — | | | 7,486 | | | 7,486 | |

| Change in cumulative foreign currency translation adjustment | | — | | | — | | | | | | | — | | | — | | | (14,350) | | | (14,350) | |

| Balance at September 28, 2024 | | 196,514 | | | $ | 20 | | | | | | | $ | 1,438,074 | | | $ | (217,729) | | | $ | (39,141) | | | $ | 1,181,224 | |

| | | | | | | | | | | | | | | | |

| Thirty-nine weeks ended September 30, 2023 | | | | | | | | | | | | | | |

| Balance at December 31, 2022 | | 194,548 | | | $ | 20 | | | | | | | $ | 1,404,360 | | | $ | (226,617) | | | $ | (21,024) | | | $ | 1,156,739 | |

| Net loss | | — | | | — | | | | | | | — | | | (9,132) | | | — | | | (9,132) | |

| Stock option activity, stock awards and employee stock purchase plan | | — | | | — | | | | | | | 2,708 | | | — | | | — | | | 2,708 | |

| Hedging activity | | — | | | — | | | | | | | — | | | — | | | (5,142) | | | (5,142) | |

| Change in cumulative foreign currency translation adjustment | | — | | | — | | | | | | | — | | | — | | | 959 | | | 959 | |

| Balance at April 1, 2023 | | 194,548 | | | $ | 20 | | | | | | | $ | 1,407,068 | | | $ | (235,749) | | | $ | (25,207) | | | $ | 1,146,132 | |

| Net Income | | — | | | — | | | | | | | — | | | 4,545 | | | — | | | 4,545 | |

| Stock option activity, stock awards and employee stock purchase plan | | 159 | | | — | | | | | | | 4,012 | | | — | | | — | | | 4,012 | |

| Hedging activity | | — | | | — | | | | | | | — | | | — | | | (760) | | | (760) | |

| Change in cumulative foreign currency translation adjustment | | — | | | — | | | | | | | — | | | — | | | 3,886 | | | 3,886 | |

| Balance at July 1, 2023 | | 194,707 | | | $ | 20 | | | | | | | $ | 1,411,080 | | | $ | (231,204) | | | $ | (22,081) | | | $ | 1,157,815 | |

| Net Income | | — | | | — | | | | | | | — | | | 5,057 | | | — | | | 5,057 | |

| Stock option activity, stock awards and employee stock purchase plan | | 120 | | | — | | | | | | | 3,979 | | | — | | | — | | | 3,979 | |

| Hedging activity | | — | | | — | | | | | | | — | | | — | | | (4,257) | | | (4,257) | |

| Change in cumulative foreign currency translation adjustment | | — | | | — | | | | | | | — | | | — | | | (2,994) | | | (2,994) | |

| Balance at September 30, 2023 | | 194,827 | | | $ | 20 | | | | | | | $ | 1,415,059 | | | $ | (226,147) | | | $ | (29,332) | | | $ | 1,159,600 | |

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

| | | | | | | | |

4 | September 28, 2024 Form 10-Q | | |

1. BASIS OF PRESENTATION

The accompanying condensed financial statements include the consolidated accounts of Hillman Solutions Corp. and its wholly-owned subsidiaries (collectively “Hillman” or the “Company”). The accompanying unaudited financial statements include the condensed consolidated accounts of the Company for the thirteen and thirty-nine weeks ended September 28, 2024. Unless the context requires otherwise, references to "Hillman," "we," "us," "our," or "our Company" refer to Hillman Solutions Corp. and its wholly-owned subsidiaries. All significant intercompany balances and transactions have been eliminated.

The accompanying unaudited Condensed Consolidated Financial Statements present information in accordance with accounting principles generally accepted in the United States for interim financial information and the instructions to Form 10-Q and applicable rules of Regulation S-X. Accordingly, they do not include all information or footnotes required by U.S. generally accepted accounting principles for complete financial statements. Operating results for the thirteen and thirty-nine weeks ended September 28, 2024 do not necessarily indicate the results that may be expected for the full year. For further information, refer to the Consolidated Financial Statements for the year ended December 30, 2023 and notes thereto included in the Form 10-K filed on February 22, 2024 with the Securities and Exchange Commission (“SEC”).

“Hillman Solutions Corp.," "HMAN Group Holdings Inc.," and "The Hillman Companies, Inc." are holding companies with no other operations, cash flows, material assets or liabilities other than the equity interests in "The Hillman Group, Inc.,", which is the borrower under the credit facility.

Nature of Operations:

The Company is comprised of three separate operating business segments: (1) Hardware and Protective Solutions, (2) Robotics and Digital Solutions, and (3) Canada.

Hillman provides and, on a limited basis, produces products such as fasteners and related hardware items; threaded rod and metal shapes; keys, key duplication systems, and accessories; personal protective equipment such as gloves and eyewear; builder's hardware; and identification items, such as tags and letters, numbers, and signs, to retail outlets, primarily hardware stores, home improvement centers and mass merchants, pet supply stores, grocery stores, and drug stores. The Canada segment also produces fasteners, stampings, fittings, and processes threaded parts for automotive suppliers, industrial Original Equipment Manufacturers (“OEMs”), and industrial distributors.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The significant accounting policies should be read in conjunction with the significant accounting policies included in the Form 10-K filed on February 22, 2024 with the SEC.

Use of Estimates in the Preparation of Financial Statements:

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenues and expenses for the reporting periods. Actual results may differ from these estimates.

Revenue Recognition:

Revenue is recognized when control of goods or services is transferred to our customers, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services. Sales and other taxes the Company collects concurrent with revenue-producing activities are excluded from revenue.

The Company offers a variety of sales incentives to its customers primarily in the form of discounts and rebates. Discounts are recognized in the Condensed Consolidated Financial Statements at the date of the related sale. Rebates are based on the revenue to date and the contractual rebate percentage to be paid. A portion of the cost

| | | | | | | | |

5 | September 28, 2024 Form 10-Q | | |

of the rebate is allocated to each underlying sales transaction. Discounts and rebates are included in the determination of net sales.

The Company also establishes reserves for customer returns and allowances. The reserve is established based on historical rates of returns and allowances. The reserve is adjusted quarterly based on actual experience. Returns and allowances are included in the determination of net sales.

The following tables display our disaggregated revenue by product category.

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen weeks ended September 28, 2024 |

| Hardware and Protective Solutions | | Robotics and Digital Solutions | | Canada | | Total Revenue |

| Fastening and Hardware | $ | 224,850 | | | $ | — | | | $ | 33,918 | | | $ | 258,768 | |

| Personal Protective | 70,993 | | | — | | | 724 | | | 71,717 | |

| Keys and Key Accessories | — | | | 48,593 | | | 2,674 | | | 51,267 | |

| Engraving and Resharp | — | | | 11,538 | | | 6 | | | 11,544 | |

| Total Revenue | $ | 295,843 | | | $ | 60,131 | | | $ | 37,322 | | | $ | 393,296 | |

| | | | | | | |

| Thirteen weeks ended September 30, 2023 |

| Hardware and Protective Solutions | | Robotics and Digital Solutions | | Canada | | Total Revenue |

| Fastening and Hardware | $ | 228,515 | | | $ | — | | | $ | 35,497 | | | $ | 264,012 | |

| Personal Protective | 67,038 | | | — | | | 1,933 | | | 68,971 | |

| Keys and Key Accessories | — | | | 50,408 | | | 2,477 | | | 52,885 | |

| Engraving and Resharp | — | | | 13,060 | | | 15 | | | 13,075 | |

| Total Revenue | $ | 295,553 | | | $ | 63,468 | | | $ | 39,922 | | | $ | 398,943 | |

| | | | | | | |

| Thirty-nine weeks ended September 28, 2024 |

| Hardware and Protective Solutions | | Robotics and Digital Solutions | | Canada | | Total Revenue |

| Fastening and Hardware | $ | 670,369 | | | $ | — | | | $ | 106,109 | | | $ | 776,478 | |

| Personal Protective | 163,478 | | | — | | | 3,327 | | | 166,805 | |

| Keys and Key Accessories | — | | | 137,395 | | | 6,634 | | | 144,029 | |

| Engraving and Resharp | — | | | 35,691 | | | 30 | | | 35,721 | |

| Total Revenue | $ | 833,847 | | | $ | 173,086 | | | $ | 116,100 | | | $ | 1,123,033 | |

| | | | | | | |

| Thirty-nine weeks ended September 30, 2023 |

| Hardware and Protective Solutions | | Robotics and Digital Solutions | | Canada | | Total Revenue |

| Fastening and Hardware | $ | 658,629 | | | $ | — | | | $ | 111,462 | | | $ | 770,091 | |

| Personal Protective | 159,569 | | | — | | | 5,474 | | | 165,043 | |

| Keys and Key Accessories | — | | | 147,976 | | | 6,510 | | | 154,486 | |

| Engraving and Resharp | — | | | 39,014 | | | 35 | | | 39,049 | |

| Total Revenue | $ | 818,198 | | | $ | 186,990 | | | $ | 123,481 | | | $ | 1,128,669 | |

The following tables disaggregate our revenue by geographic location.

| | | | | | | | |

6 | September 28, 2024 Form 10-Q | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen weeks ended September 28, 2024 |

| Hardware and Protective Solutions | | Robotics and Digital Solutions | | Canada | | Total Revenue |

| United States | $ | 291,750 | | | $ | 60,131 | | | $ | — | | | $ | 351,881 | |

| Canada | — | | | — | | | 37,322 | | | 37,322 | |

| Mexico | 4,093 | | | — | | | — | | | 4,093 | |

| Consolidated | $ | 295,843 | | | $ | 60,131 | | | $ | 37,322 | | | $ | 393,296 | |

| | | | | | | |

| Thirteen weeks ended September 30, 2023 |

| Hardware and Protective Solutions | | Robotics and Digital Solutions | | Canada | | Total Revenue |

| United States | $ | 292,580 | | | $ | 63,468 | | | $ | — | | | $ | 356,048 | |

| Canada | — | | | — | | | 39,922 | | | 39,922 | |

| Mexico | 2,973 | | | — | | | — | | | 2,973 | |

| Consolidated | $ | 295,553 | | | $ | 63,468 | | | $ | 39,922 | | | $ | 398,943 | |

| | | | | | | |

| Thirty-nine weeks ended September 28, 2024 |

| Hardware and Protective Solutions | | Robotics and Digital Solutions | | Canada | | Total Revenue |

| United States | $ | 820,706 | | | $ | 173,086 | | | $ | — | | | $ | 993,792 | |

| Canada | — | | | — | | | 116,100 | | | 116,100 | |

| Mexico | 13,141 | | | — | | | — | | | 13,141 | |

| Consolidated | $ | 833,847 | | | $ | 173,086 | | | $ | 116,100 | | | $ | 1,123,033 | |

| | | | | | | |

| Thirty-nine weeks ended September 30, 2023 |

| Hardware and Protective Solutions | | Robotics and Digital Solutions | | Canada | | Total Revenue |

| United States | $ | 809,250 | | | $ | 186,990 | | | $ | — | | | $ | 996,240 | |

| Canada | — | | | — | | | 123,481 | | | 123,481 | |

| Mexico | 8,948 | | | — | | | — | | | 8,948 | |

| Consolidated | $ | 818,198 | | | $ | 186,990 | | | $ | 123,481 | | | $ | 1,128,669 | |

The Company's revenue by geography is allocated based on the location of its sales operations.

Hardware and Protective Solutions' revenues consist primarily of the delivery of fasteners, anchors, specialty fastening products, and personal protective equipment such as gloves and eyewear, as well as in-store merchandising services for the related product category.

Robotics and Digital Solutions revenues consist primarily of sales of keys and identification tags through self-service key duplication and engraving kiosks. It also includes our associate-assisted key duplication systems and key accessories.

Canada revenues consist primarily of the delivery to Canadian customers of fasteners and related hardware items, threaded rod, keys, key duplicating systems, accessories, personal protective equipment, and identification items as well as in-store merchandising services for the related product category.

The Company’s performance obligations under its arrangements with customers are providing products, in-store merchandising services, and access to key duplicating and engraving equipment. Generally, the price of the merchandising services and the access to the key duplicating and engraving equipment is included in the price of the related products. Control of products is transferred at the point in time when the customer accepts the goods, which occurs upon delivery of the products. Judgment is required in determining the time at which to recognize revenue for the in-store services and the access to key duplicating and engraving equipment. Revenue is recognized for in-store service and access to key duplicating and engraving equipment as the related products are delivered, which approximates a time-based recognition pattern. Therefore, the entire amount of consideration related to the sale of products, in-store merchandising services, and access to key duplicating and engraving equipment is recognized upon the delivery of the products.

| | | | | | | | |

7 | September 28, 2024 Form 10-Q | | |

The costs to obtain a contract are insignificant, and generally contract terms do not extend beyond one year. Therefore, these costs are expensed as incurred. Freight and shipping costs and the cost of our in-store merchandising services teams are recognized in selling, warehouse, general, and administrative expense when control over products is transferred to the customer.

The Company used the practical expedient regarding the existence of a significant financing component as payments are due in less than one year after delivery of the products.

3. RECENT ACCOUNTING PRONOUNCEMENTS

On November 27, 2023, the FASB ("Financial Accounting Standards Board") issued ASU ("Accounting Standards Update") 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. The amendments in this update improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. In addition, the amendments enhance interim disclosure requirements, clarify circumstances in which an entity can disclose multiple segment measures of profit or loss, provide new segment disclosure requirements for entities with a single reportable segment, and contain other disclosure requirements. The purpose of the amendments is to enable investors to better understand an entity’s overall performance and assists in assessing potential future cash flows. The amendments in this Update are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024 and should be applied retrospectively to all prior periods presented. The Company is currently evaluating the impact provided by the new standard.

On December 14, 2023, the FASB issued ASU 2023-09, Improvements to Income Tax Disclosures. The amendments in this update require that public business entities on an annual basis (1) disclose specific categories in the rate reconciliation and (2) provide additional information for reconciling items that meet a quantitative threshold. The standard requires disaggregated information about a reporting entity’s effective tax rate reconciliation as well as information on income taxes paid. The standard is intended to benefit investors by providing more detailed income tax disclosures that would be useful in making capital allocation decisions. The amendments on Income Tax Disclosures are effective for fiscal years beginning after December 15, 2024, and should be applied retrospectively to all prior periods presented. The Company is currently evaluating the impact provided by the new standard.

4. ACQUISITIONS

Ajustlock

On December 5, 2023, the Company completed its acquisition of Ajustlock, an innovative adjustable barrel bolt lock used on gates, doors or windows which self-adjusts vertically to eliminate door shift issues, for a total purchase price of $1,400, which includes a $75 hold-back payable to the seller due one year after closing. Ajustlock sells its products throughout North America and its financial results reside in the Company's Hardware and Protective Solutions reportable segment and have been determined to be immaterial for purposes of additional disclosure.

Koch Industries, Inc.

On January 11, 2024, the Company completed the acquisition of Koch Industries, Inc. ("Koch"), a premier provider and merchandiser of rope and twine, chain and wire rope, and related hardware products for a total purchase price of $23,783. In the second quarter of 2024, the Company had a final net working capital adjustment of $173, which reduced goodwill and the purchase price of the acquisition from an estimated $23,956 at closing in the first quarter of 2024 to $23,783. Koch has business operations throughout North America and its financial results will reside in the Company's Hardware and Protective Solutions reportable segment.

The following table reconciles the preliminary fair value of the acquired assets and assumed liabilities to the total purchase price of Koch.

| | | | | | | | |

8 | September 28, 2024 Form 10-Q | | |

| | | | | |

| |

| Inventory | $ | 20,194 | |

| Other current assets | 275 | |

| Property and equipment | 586 | |

| Goodwill | 3,048 | |

| Customer relationships | 4,000 | |

| Trade names | 300 | |

| |

| Total assets acquired | $ | 28,403 | |

| Less: | |

| Liabilities assumed | (4,620) | |

| Total purchase price | $ | 23,783 | |

Net sales and operating income from Koch included in the Company's Condensed Consolidated Statement of Comprehensive Income (Loss) for the thirteen and thirty-nine weeks ended September 28, 2024 were as follows:

| | | | | | | | | | | |

| Thirteen weeks ended September 28, 2024 | | Thirty-nine weeks ended September 28, 2024 |

| Net sales | $10,261 | | $31,716 |

| Operating income | 1,268 | | 3,899 |

| | | |

Pro forma financial information has not been presented for Koch as the financial results of Koch were insignificant to the financial results of the Company on a standalone basis.

Intex DIY, Inc.

On August 23, 2024, the Company completed the acquisition of Intex DIY, Inc. ("Intex"), a leading supplier of wiping cloths, consumable rags, and cleaning textiles for a total purchase price of $33,979. This acquisition expands Hillman’s offerings in the cleaning products category. Intex has business operations throughout North America and its financial results will reside in the Company's Hardware and Protective Solutions reportable segment.

The following table reconciles the preliminary fair value of the acquired assets and assumed liabilities to the total purchase price of Intex.

| | | | | |

| Accounts receivable | $ | 11,981 | |

| Inventory | 15,897 | |

| Other current assets | 26 | |

| Property and equipment | 2,846 | |

| Goodwill | 2,333 | |

| Customer relationships | 9,400 | |

| Trade names | 104 | |

| |

| Total assets acquired | $ | 42,587 | |

| Less: | |

| Liabilities assumed | (8,608) | |

| Total purchase price | $ | 33,979 | |

Net sales and operating income from Intex included in the Company's Condensed Consolidated Statement of Comprehensive Income (Loss) from the date of acquisition through September 28, 2024 were as follows:

| | | | | |

| Thirteen weeks ended September 28, 2024 |

| Net sales | $ | 6,573 | |

| Operating income | 820 | |

| | | | | | | | |

9 | September 28, 2024 Form 10-Q | | |

Pro forma financial information has not been presented for Intex as the financial results of Intex were insignificant to the financial results of the Company on a standalone basis.

5. GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill amounts by reportable segment are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Goodwill at | | Acquisitions (1) | | Dispositions | | | | Other (2) | | Goodwill at |

| December 30, 2023 | | | | September 28, 2024 |

| Hardware and Protective Solutions | $ | 575,298 | | | $ | 5,381 | | | $ | — | | | | | $ | (594) | | | $ | 580,085 | |

| Robotics and Digital Solutions | 220,936 | | | — | | | — | | | | | — | | | 220,936 | |

| Canada | 28,808 | | | — | | | — | | | | | (583) | | | 28,225 | |

| Total | $ | 825,042 | | | $ | 5,381 | | | $ | — | | | | | $ | (1,177) | | | $ | 829,246 | |

(1)The amount relates to the Koch and Intex acquisitions, see Note 4 - Acquisitions for additional information.

(2)The "Other" change to goodwill relates to adjustments resulting from fluctuations in foreign currency exchange rates for the Canada, Hardware Solutions, and Protective Solutions reporting units.

Other intangibles, net, as of September 28, 2024 and December 30, 2023 consist of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Estimated

Useful Life

(Years) | | September 28, 2024 | | December 30, 2023 |

| Customer relationships | 13 | - | 20 | | $ | 956,843 | | | $ | 944,713 | |

| Trademarks - indefinite | Indefinite | | 85,290 | | | 85,520 | |

| Trademarks - other | 2 | - | 15 | | 29,549 | | | 31,665 | |

| Technology and patents | 5 | - | 12 | | 66,906 | | | 64,186 | |

| Intangible assets, gross | | | 1,138,588 | | | 1,126,084 | |

| Less: Accumulated amortization | | | | | 516,026 | | | 470,791 | |

| Other intangibles, net | | | | | $ | 622,562 | | | $ | 655,293 | |

The amortization expense for intangible assets, including the adjustments resulting from fluctuations in foreign currency exchange rates for the thirteen and thirty-nine weeks ended September 28, 2024 was $15,354 and $45,857, respectively. Amortization expense for the thirteen and thirty-nine weeks ended September 30, 2023 was $15,583 and $46,733, respectively.

The Company tests goodwill and indefinite-lived intangible assets for impairment annually in the fourth quarter. Impairment is also tested when events or changes in circumstances indicate that the carrying values of the assets may be greater than their fair values. During the thirteen and thirty-nine weeks ended September 28, 2024 and the thirteen and thirty-nine weeks ended September 30, 2023, the Company did not identify any triggering events that would result in an impairment analysis outside of the annual assessment.

6. COMMITMENTS AND CONTINGENCIES

Insurance Coverage

The Company self-insures its general liability including product liability, automotive and workers' compensation losses up to $500 per occurrence. Catastrophic coverage has been purchased from third party insurers for occurrences up to $60,000. The two risk areas involving the most significant accounting estimates are workers' compensation and automotive liability. Actuarial valuations performed by the Company's outside risk insurance expert were used by the Company's management to form the basis for workers' compensation and automotive liability loss reserves. The actuary contemplated the Company's specific loss history, actual claims reported, and industry trends among statistical and other factors to estimate the range of reserves required. Risk insurance reserves are comprised of specific reserves for individual claims and additional amounts expected for development

| | | | | | | | |

10 | September 28, 2024 Form 10-Q | | |

of these claims, as well as for incurred but not yet reported claims. The Company believes that the liability of approximately $2,980 recorded for such risks is adequate as of September 28, 2024.

As of September 28, 2024, the Company has provided certain vendors and insurers letters of credit aggregating to $40,868 related to our product purchases and insurance coverage for product liability, workers’ compensation, and general liability.

The Company self-insures group health claims up to an annual stop loss limit of $300 per participant. Historical group insurance loss experience forms the basis for the recognition of group health insurance reserves. Provisions for losses expected under these programs are recorded based on an analysis of historical insurance claim data and certain actuarial assumptions. The Company believes that the liability of approximately $3,637 recorded for such risks is adequate as of September 28, 2024.

Import Duties

The Company imports large quantities of fastener products which are subject to customs requirements and to tariffs and quotas set by governments through mutual agreements and bilateral actions. The Company could be subject to the assessment of additional duties and interest if it or its suppliers fail to comply with customs regulations or similar laws. The U.S. Department of Commerce (the "Department”) has received requests from petitioners to conduct administrative reviews of compliance with anti-dumping duty and countervailing duty laws for certain nail products sourced from Asian countries. The Company sourced products under review from vendors in China and Taiwan during the periods selected for review. The Company accrues for the duty expense once it is determined to be probable and the amount can be reasonably estimated.

Litigation

We are involved in litigation arising in the normal course of business. In management’s opinion, any such litigation is not expected to have a material adverse effect on our consolidated financial condition, results of operations, or cash flows.

7. RELATED PARTY TRANSACTIONS

Hillman, Jefferies Financial Group Inc., certain other financial sponsors, CCMP Investors and the Oak Hill Investors entered into the Amended and Restated Registration Rights Agreement (the “A&R Registration Rights Agreement”), pursuant to which, among other things, the parties to the A&R Registration Rights Agreement agreed not to effect any sale or distribution of any equity securities of Hillman held by any of them during the lock-up period described therein and were granted certain registration rights with respect to their respective shares of Hillman common stock, in each case, on the terms and subject to the conditions therein. Richard Zannino and Joe Scharfenberger, both partners at CCMP, were members of our Board at the time Hillman entered into the A&R Registration Rights Agreement. Mr. Zannino and Mr. Scharfenberger each resigned from the Hillman Board in May 2023 following CCMP's complete exit of its investment in Hillman during the second quarter of 2023. Another director, Teresa Gendron, was the CFO of Jefferies Financial Group until March 2023.

Sales to related parties, which are included in net sales, consist of the sale of excess inventory to Ollie's Bargain Outlet Holdings, Inc. ("Ollie's"). John Swygert, President and Chief Executive Officer of Ollie's, is a member of our Board of Directors. Sales to related parties were $204 and $469 in the thirteen and thirty-nine weeks ended September 28, 2024, respectively. Sales to related parties were $519 and $1,167 in the thirteen and thirty-nine weeks ended September 30, 2023, respectively.

8. INCOME TAXES

ASC 740 requires companies to apply their estimated annual effective tax rate on a year-to-date basis in each interim period. These rates are derived, in part, from expected annual pre-tax income or loss. In the thirteen and thirty-nine weeks ended September 28, 2024, and for the thirteen and thirty-nine weeks ended September 30, 2023, the Company applied an estimated annual effective tax rate based on expected annual pre-tax income to the interim period pre-tax income to calculate the income tax expense.

For the thirteen and thirty-nine weeks ended September 28, 2024, the effective income tax rate was 37.0% and 32.8%, respectively. The Company recorded an income tax provision for the thirteen and thirty-nine weeks ended

| | | | | | | | |

11 | September 28, 2024 Form 10-Q | | |

September 28, 2024 of $4,372 and $9,003, respectively. The effective tax rate for the thirteen and thirty-nine weeks ended September 28, 2024 was the result of certain non-deductible expenses and state and foreign income taxes.

For the thirteen and thirty-nine weeks ended September 30, 2023, the effective income tax rate was 71.9% and 87.5%. The Company recorded an income tax provision for the thirteen and thirty-nine weeks ended September 30, 2023 of $12,957 and $3,278, respectively. The effective tax rate for the thirteen and thirty-nine weeks ended September 30, 2023 was the result of certain non-deductible expenses and state and foreign income taxes.

9. LONG-TERM DEBT

The following table summarizes the Company’s debt:

| | | | | | | | | | | |

| September 28, 2024 | | December 30, 2023 |

| Revolving loans | $ | — | | | $ | — | |

| Senior Term Loan, due 2028 | 747,597 | | | 751,852 | |

| Finance lease & other obligations | 10,956 | | | 9,097 | |

| 758,553 | | | 760,949 | |

| Unamortized discount on Senior Term Loan | (3,154) | | | (4,087) | |

| Current portion of long-term debt and finance leases | (13,039) | | | (9,952) | |

| Deferred financing fees | (11,694) | | | (15,202) | |

| Total long-term debt, net | $ | 730,666 | | | $ | 731,708 | |

As of September 28, 2024, the Asset-Backed Loan ("ABL") Revolver did not have an outstanding balance, and had outstanding letters of credit of $40,868. The Company has $264,819 of available borrowings under the revolving credit facility as a source of liquidity as of September 28, 2024 based on the customary ABL borrowing base and availability provisions.

Though the Company currently does not have any Canadian obligations outstanding on the ABL Revolver, the Company entered into Amendment No. 5 to the ABL Revolver on June 27, 2024 to transition its benchmark interest rate for Canadian borrowings from the Canadian Dollar Offered Rate ("CDOR") to the Term Canadian Overnight Repo Rate Average ("CORRA"). The amendment and transition was due to the discontinuation of CDOR on June 30, 2024. The foregoing descriptions of Amendment No. 5 to the ABL Revolver do not purport to be complete and is qualified in its entirety by the terms and conditions of Amendment No. 5 to the ABL Revolver and the Amended and Restated ABL Credit Agreement.

2024 Repricing

On March 26, 2024, the Company entered into a Repricing Amendment (2024 Repricing Amendment) on its existing Senior Term Loan due July 14, 2028. The 2024 Repricing Amendment (i) reduces the interest rate per annum applicable to the Term Loan outstanding from SOFR plus a margin varying from 2.50% to 2.75% plus a Credit Spread Adjustment ("CSA") varying between 0.11% to 0.43% to SOFR plus a margin varying from 2.25% to 2.50%, without the CSA and (ii) implements a 1% prepayment premium for the existing Term Loan to apply to Repricing Transactions that occur within six months after the effective date of the 2024 Repricing Amendment. In connection with the closing of the 2024 Repricing Amendment, the Company expensed $3,008 consisting of $1,554 of existing fees written off and $1,454 in new fees expensed. The Company capitalized an additional $33 primarily for the payment of upfront lender fees (original issue discount).

10. LEASES

Lessee

The Company determines if a contract is or contains a lease at inception or modification of a contract. A contract is or contains a lease if the contract conveys the right to control the use of an identified asset for a period in exchange for consideration. Control over the use of the identified asset means the lessee has both 1) the right to obtain substantially all of the economic benefits from the use of the asset and 2) the right to direct the use of the

| | | | | | | | |

12 | September 28, 2024 Form 10-Q | | |

asset. The Company leases certain distribution center locations, vehicles, forklifts, computer equipment, and its corporate headquarters with expiration dates through 2033. Certain lease arrangements include escalating rent payments and options to extend the lease term. Expected lease terms include these options to extend or terminate the lease when it is reasonably certain the Company will exercise the option. The Company's leasing arrangements do not contain material residual value guarantees, nor material restrictive covenants.

The components of operating and finance lease costs for the thirteen and thirty-nine weeks ended September 28, 2024 and thirteen and thirty-nine weeks ended September 30, 2023 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended

September 28, 2024 | | Thirteen Weeks Ended

September 30, 2023 | | Thirty-nine Weeks Ended

September 28, 2024 | | Thirty-nine Weeks Ended

September 30, 2023 |

| Operating lease costs | | $ | 5,335 | | | $ | 5,011 | | | $ | 15,778 | | | $ | 16,055 | |

| Short term lease costs | | 689 | | | 1,003 | | | 2,996 | | | 4,095 | |

| Variable lease costs | | 657 | | | 229 | | | 1,821 | | | 1,204 | |

| Finance lease costs: | | | | | | | | |

| Amortization of right of use assets | | 989 | | | 714 | | | 2,875 | | | 1,808 | |

| Interest on lease liabilities | | 142 | | | 92 | | | 405 | | | 188 | |

Rent expense is recognized on a straight-line basis over the expected lease term. Rent expense totaled $6,681 and $20,595 in the thirteen and thirty-nine weeks ended September 28, 2024 and $6,243 and $21,354 in the thirteen and thirty-nine weeks ended September 30, 2023. Rent expense includes operating lease costs as well as expenses for non-lease components such as common area maintenance, real estate taxes, real estate insurance, variable costs related to our leased vehicles, and short-term rental expenses.

The implicit rate is not determinable in most of the Company’s leases, as such management uses the Company’s incremental borrowing rate based on the information available at commencement date in determining the present value of future payments.

The weighted average remaining lease terms and discount rates for all of our operating leases were as follows as of September 28, 2024 and December 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 28, 2024 | | December 30, 2023 |

| | Operating Leases | | Finance Leases | | Operating Leases | | Finance Leases |

| Weighted average remaining lease term | | 5.63 | | 2.94 | | 6.33 | | 2.95 |

| Weighted average discount rate | | 6.74 | % | | 5.85 | % | | 7.04 | % | | 5.38 | % |

Supplemental balance sheet information related to the Company's finance leases was as follows as of September 28, 2024 and December 30, 2023:

| | | | | | | | | | | | | | |

| | September 28, 2024 | | December 30, 2023 |

| Finance lease assets, net, included in property plant and equipment | | $ | 8,980 | | | $ | 7,166 | |

| | | | |

| Current portion of long-term debt | | 3,547 | | | 2,800 | |

| Long-term debt, less current portion | | 5,727 | | | 4,512 | |

| Total principal payable on finance leases | | $ | 9,274 | | | $ | 7,312 | |

| | | | | | | | |

13 | September 28, 2024 Form 10-Q | | |

Supplemental cash flow information related to the Company's operating and finance leases was as follows for the thirty-nine weeks ended September 28, 2024 and thirty-nine weeks ended September 30, 2023:

| | | | | | | | | | | | | | |

| | Thirty-nine Weeks Ended

September 28, 2024 | | Thirty-nine Weeks Ended

September 30, 2023 |

| Cash paid for amounts included in the measurement of lease liabilities: | | | | |

| Operating cash outflow from operating leases | | $ | 15,980 | | | $ | 15,119 | |

| Operating cash outflow from finance leases | | 402 | | | 170 | |

| Financing cash outflow from finance leases | | 2,698 | | | 1,687 | |

As of September 28, 2024, our future minimum rental commitments are immaterial for lease agreements beginning after the current reporting period. Maturities of our lease liabilities for all operating and finance leases are as follows as of September 28, 2024:

| | | | | | | | | | | | | | |

| | Operating Leases | | Finance Leases |

| Less than one year | | $ | 21,818 | | | $ | 3,997 | |

| 1 to 2 years | | 21,229 | | | 3,143 | |

| 2 to 3 years | | 19,612 | | | 1,926 | |

| 3 to 4 years | | 16,988 | | | 832 | |

| 4 to 5 years | | 12,708 | | | 219 | |

| After 5 years | | 17,701 | | | 1 | |

| Total future minimum rental commitments | | 110,056 | | | 10,118 | |

| Less - amounts representing interest | | (18,140) | | | (844) | |

| Present value of lease liabilities | | $ | 91,916 | | | $ | 9,274 | |

Lessor

The Company has certain arrangements for key duplication equipment under which we are the lessor. These leases meet the criteria for operating lease classification. Lease income associated with these leases is not material.

11. EQUITY AND ACCUMULATED OTHER COMPREHENSIVE INCOME

Common Stock

Hillman Solutions Corp. has one class of common stock.

Accumulated Other Comprehensive Income (Loss)

The following is detail of the changes in the Company's accumulated other comprehensive income (loss) from December 31, 2022 to September 28, 2024, including the effect of significant reclassifications out of accumulated other comprehensive income (loss) (net of tax):

| | | | | | | | |

14 | September 28, 2024 Form 10-Q | | |

| | | | | | | | |

| | Accumulated Other Comprehensive Income (Loss) |

Balance at December 31, 2022 | | $ | (21,024) | |

| Other comprehensive income before reclassifications | | 8,812 | |

| Amounts reclassified from other comprehensive income | | (15,608) | |

Net current period other comprehensive loss (1) | | (6,796) | |

Balance at December 30, 2023 | | (27,820) | |

| Other comprehensive income before reclassifications | | (22,073) | |

| Amounts reclassified from other comprehensive income | | 10,752 | |

Net current period other comprehensive loss (2) | | (11,321) | |

Balance at September 28, 2024 | | $ | (39,141) | |

1.During the year ended December 30, 2023, the Company deferred a gain of $125, reclassified a gain of $15,608 net of tax of $3,886 into other comprehensive loss due to hedging activities. The amounts reclassified out of other comprehensive loss were recorded as interest expense. See Note 14 - Derivatives and Hedging for additional information on the interest rate swaps.

2.During the thirty-nine weeks ended September 28, 2024, the Company deferred a loss of $1,074, reclassified a loss of $10,752 net of tax of $2,429 into other comprehensive loss due to hedging activities. The amounts reclassified out of other comprehensive loss were recorded as interest expense. See Note 14 - Derivatives and Hedging for additional information on the interest rate swaps.

12. STOCK-BASED COMPENSATION

2014 Equity Incentive Plan

The 2014 Equity Incentive Plan may grant options, stock appreciation rights, restricted stock, and other stock-based awards for up to an aggregate of 14,523,510 shares of its common stock.

The 2014 Equity Incentive Plan had stock compensation expense of $337 and $1,335 recognized in the accompanying Condensed Consolidated Statements of Comprehensive Income (Loss) for the thirteen and thirty-nine weeks ended September 28, 2024, respectfully, and $876 and $3,502 for the thirteen and thirty-nine weeks ended September 30, 2023, respectfully.

Stock Options

The fair value of stock options is determined at the grant date using the Black-Scholes option pricing model. The time-based stock option awards generally vest evenly over four years from the grant date and performance-based options vest based on Company stock price hurdles.

Restricted Stock

The Company granted restricted stock at the grant date fair value of the underlying common stock securities. The restrictions lapse in one quarter increments on each of the three anniversaries of the award date, and one quarter on the completion of the relocation of the recipient to the Cincinnati area or earlier in the event of a change in control. The associated expense is recognized over the service period.

Restricted Stock Units

The Restricted Stock Units ("RSUs") granted to employees for service generally vest after three years, subject to continued employment.

Exercise of Stock Options

As of September 28, 2024, 1,216,450 outstanding options under the 2014 were exercised providing aggregate proceeds to the Company of approximately $8,938.

| | | | | | | | |

15 | September 28, 2024 Form 10-Q | | |

2021 Equity Incentive Plan