false

0001583771

0001583771

2024-12-10

2024-12-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 10, 2024

Hepion

Pharmaceuticals, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36856 |

|

46-2783806 |

| (State

or other jurisdiction |

|

(Commission |

|

IRS

Employer |

| of

incorporation or organization) |

|

File

Number) |

|

Identification

No.) |

399

Thornall Street, First Floor

Edison,

NJ 08837

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (732) 902-4000

(Former

name or former address, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered: |

| Common

Stock |

|

HEPA |

|

Nasdaq

Capital Market |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth

company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.02 Termination of Material Definitive Agreement.

As

previously disclosed on July 19, 2024, Hepion Pharmaceuticals, Inc. (the “Company”) entered into an Agreement and Plan of

Merger with Pharma Two B Ltd., a company organized under the laws of the State of Israel (“Pharma Two B”) and Pearl Merger

Sub, Inc., a Delaware corporation (“Pearl”) and an indirect wholly owned subsidiary of Pharma Two B (the “Merger Agreement”).

Pharma

Two B has informed the Company that Nasdaq will not exclude historical losses of the Company from its burn rate calculation and as a

result on December 10, 2024, the Company, Pharma Two B and Pearl entered into an agreement to terminate the Merger Agreement (the “Termination

Agreement”). Pursuant to the Termination Agreement, the Merger Agreement was terminated.

The

summary of the Termination Agreement set forth under this Item 1.02 is qualified in its entirety by reference to the complete terms and

conditions of the Termination Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein

by reference.

Item

8.01 Other Events.

On

December 11, 2024, the Company announced (i) the termination of the Merger Agreement

and (ii) that its previously announced special meeting of its

stockholders scheduled for December 12, 2024 has been cancelled and that it has withdrawn from consideration by the Company’s stockholders

the proposals set forth in the Company’s Definitive Proxy Statement on Form F-4 filed with the U.S. Securities and Exchange Commission

on November 8, 2024. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein

by reference.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

December 11, 2024

| |

HEPION

PHARMACEUTICALS, INC. |

| |

|

|

| |

By:

|

/s/

John Brancaccio |

| |

|

John

Brancaccio |

| |

|

Interim

Chief Executive Officer |

Exhibit

10.1

TERMINATION

AGREEMENT

This

TERMINATION AGREEMENT (this “Agreement”) is made as of December 10, 2024 by and between Pharma Two B Ltd. (the

“Company”), Hepion Pharmaceuticals, Inc. (“Hepion”) and Pearl Merger Sub, Inc. (“Merger

Sub”) (the Company, Hepion and Merger Sub collectively, the “Parties” and individual a “Party”).

RECITALS

Reference

is made to the Agreement and Plan of Merger by and between the Parties dated as of July 19, 2024 (the “Merger Agreement”).

Capitalized terms used herein and not otherwise defined herein shall have the meanings assigned to them in the Merger Agreement. The

Parties wish to terminate the Merger Agreement on the terms and conditions set forth herein.

NOW

THEREFORE, in consideration of the foregoing and the mutual covenants and agreements herein contained, and intending to be legally

bound hereby, the Parties hereby agree as follows:

1.

Termination of the Merger Agreement. In accordance with Section 10.01(a) of the Merger Agreement, the Parties hereby agree

to terminate the Merger Agreement in its entirety effective immediately upon the execution of this Agreement by each of the Parties,

and the Merger Agreement shall be null and void and of no further force or effect. No Party shall have any further rights or obligations

thereunder or with respect thereto, except as specifically set forth herein.

2.

Releases. Upon the termination of the Merger Agreement, each of the Parties, on its own behalf and on behalf of its principals,

affiliates, subsidiaries, directors, officers, stockholders, employees, agents, representatives, and successors and assigns of each of

them, hereby irrevocably, fully and unconditionally releases and forever discharges the other party and each of its past or present principals,

affiliates, directors, officers, stockholders, employees, agents, representatives, and successors and assigns of each of them, from and

against any and all present and future claims, counterclaims, demands, actions, suits, causes of action, damages, controversies and liabilities,

including, without limitation, any costs, expenses, bills, penalties or attorneys’ fees, whether know or unknown, contingent or

absolute, foreseen or unforeseen, and whether in law, equity or otherwise, that could have been asserted in any court or forum and relating

in any way to any conduct, occurrence, activity, expenditure, promise or negotiation arising from or relating to the Merger Agreement.

3.

Promissory Note. Notwithstanding anything contained in this Agreement, it is expressly acknowledged and agreed that that

certain Promissory Note, dated July 19, 2024, from the Company and payable to Hepion, in the original principal amount of $600,000 (the

“Promissory Note”), remains in full force and effect. Pursuant to the terms of the Promissory Note, upon execution

of this Agreement, the Promissory Note becomes immediately due and all outstanding principal and interest shall be paid from the Company

to Hepion.

4.

Representations and Warranties. Each of the Parties hereby represents and warrants to the other Parties that: (a) it has

full power and authority to enter into this Agreement and to perform its obligations hereunder in accordance with the provisions of this

Agreement, (b) this Agreement has been duly authorized, executed and delivered by such party, and (c) this Agreement constitutes a legal,

valid and binding obligation of such party, enforceable in accordance with its terms.

5.

Entire Agreement. This Agreement contains the entire understanding of the Parties with respect to the subject matter hereof

and supersede all prior agreements, understandings, discussions and representations, oral or written, with respect to such matters.

6.

Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall

be governed by and construed and enforced in accordance with the internal laws of the State of Delaware, without regard to the principles

of conflicts of law thereof.

7.

Assignment. This Agreement shall be binding upon and inure to the benefit of the Parties and their respective heirs, executors,

administrators, legal representatives, successors and permitted assigns. Except as expressly provided herein, this Agreement may not

be assigned by any Party without the prior written consent of the remaining Parties. Any assignment in violation of this paragraph will

be null and void.

8.

Execution. This Agreement may be executed in one or more counterparts, all of which when taken together shall be considered

one and the same agreement and shall become effective when counterparts have been signed by each Party and delivered to the remaining

Parties, it being understood that all Parties need not sign the same counterpart. In the event that any signature is delivered by facsimile

or e-mail transmission, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature

is executed) with the same force and effect as if such facsimile or e-mail signature page were an original thereof.

9.

Future Assurances. At the request of any Party hereto, and without further consideration, the remaining Parties hereto

will execute and deliver such other documents, forms, agreements, or instruments as may be reasonably requested for the completion of

the transactions contemplated hereby.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the Parties have executed and delivered this Agreement, or caused it to be executed and delivered by their duly authorized

officers, as of the date first above written.

| Pharma Two B Ltd. |

|

| |

|

|

| By: |

/s/

Dan Teleman |

|

| Name: |

Dan

Teleman |

|

| Title: |

Chief

Executive Officer |

|

| |

|

|

| Hepion Pharmaceuticals, Inc. |

|

| |

|

|

| By: |

/s/

John Brancaccio |

|

| Name: |

John

Brancaccio |

|

| Title: |

Executive

Chairman |

|

| |

|

|

| Pearl Merger Sub, Inc. |

|

| |

|

|

| By: |

/s/

Dan Teleman |

|

| Name: |

Dan

Teleman |

|

| Title: |

President |

|

Exhibit

99.1

Hepion

Pharmaceuticals, Inc. Announces Termination of Merger Agreement with Pharma Two B Ltd.

EDISON,

N.J., December 11, 2024 —Hepion Pharmaceuticals, Inc. (Nasdaq: HEPA) (the “Company” or “Hepion”), a clinical

stage biopharmaceutical company that had been developing a treatment for non-alcoholic steatohepatitis (“NASH”), hepatocellular

carcinoma (“HCC”), and other chronic liver diseases, today announced that it has entered into a termination agreement with

Pharma Two B Ltd. which terminates the merger agreement between the two parties that was previously entered into on July 19, 2024.

Neither

party will be required to pay the other a termination fee as a result of the mutual decision to terminate the agreement.

Hepion

also announced that its previously announced special meeting of its stockholders scheduled for December 12, 2024 has been cancelled and

that it has withdrawn from consideration by its stockholders the proposals set forth in the Company’s Definitive Proxy Statement

on Form F-4 filed with the U.S. Securities and Exchange Commission on November 8, 2024.

About

Hepion Pharmaceuticals

Hepion

is a biopharmaceutical company headquartered in Edison, New Jersey, previously focused on the development of drug therapy for treatment

of chronic liver diseases. This therapeutic approach targets fibrosis, inflammation, and shows potential for the treatment of hepatocellular

carcinoma (“HCC”) associated with non-alcoholic steatohepatitis (“NASH”), viral hepatitis, and other liver diseases.

Hepion’s cyclophilin inhibitor, rencofilstat, was being developed to offer benefits to address multiple complex pathologies related

to the progression of liver disease. In December 2023, Hepion’s board of directors approved a strategic restructuring plan to preserve

capital by reducing operating costs. Additionally, Hepion initiated a process to explore a range of strategic and financing alternatives

focused on maximizing stockholder value within the current financial environment and NASH drug development landscape. On April 19, 2024,

Hepion announced that it has begun wind-down activities in its ASCEND- NASH clinical trial which wind-down activities have since been

completed and the trial has been closed. Hepion is continuing efforts, to the extent that cash is available, to provide any value derived

from rencofilstat to its shareholders.

Forward-Looking

Statements

Certain

statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally relate to future events

or Hepion’s future financial or operating performance. When used in this press release, words such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions identify forward-looking statements. There

are a number of factors that could cause actual events to differ materially from those indicated by such forward-looking statements.

These factors include, but are not limited to, our ability to continue as a going concern; our need for additional financing; uncertainties

of patent protection and litigation; risks associated with delays, uncertainties with respect to lengthy and expensive clinical trials,

that results of earlier studies and trials may not be predictive of future trial results; uncertainties of government or third party

payer reimbursement; limited sales and marketing efforts and dependence upon third parties; and risks related to failure to obtain FDA

clearances or approvals and noncompliance with FDA regulations. Hepion Pharmaceuticals does not undertake an obligation to update or

revise any forward-looking statement. Investors should read the risk factors set forth in Hepion Pharmaceuticals’ Form 10-K for

the year ended December 31, 2023, and other periodic reports filed with the Securities and Exchange Commission.

Contact

Information

Hepion

Pharmaceuticals

info@hepionpharma.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

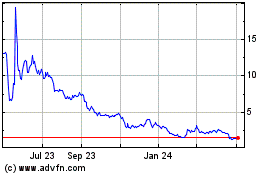

Hepion Pharmaceuticals (NASDAQ:HEPA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hepion Pharmaceuticals (NASDAQ:HEPA)

Historical Stock Chart

From Feb 2024 to Feb 2025