Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

December 02 2024 - 8:53AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Schedule

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a party other than the Registrant ☐

Check

the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☒

Definitive Additional Materials

☐

Soliciting Material under § 240.14a-12

Hepion

Pharmaceuticals, Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

☒

No fee required

☐

Fee paid previously with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11

Hepion

Pharmaceuticals Issues Letter to Shareholders Urging Support for Proposed Merger with Pharma Two B

Transaction

Creates Opportunity to Share in Potential Upside of Pharma Two B’s Late-Clinical Stage Candidate to Treat Parkinson’s Disease

Hepion’s

Board Unanimously Recommends Shareholders Approve the Merger Following Review of Strategic Alternatives – Including Challenges

of Remaining a Stand-Alone Company

EDISON,

NJ – December 2, 2024 – Hepion Pharmaceuticals, Inc. (Nasdaq: HEPA) (“Hepion” or the “Company”),

today sent an open letter to shareholders urging them to vote for Hepion’s proposed merger with Pharma Two B Ltd. (“Pharma

Two B”) at the Company’s upcoming Special Meeting of Stockholders (the “Special Meeting”) on December 12, 2024.

The

full text of the letter is below:

December

2, 2024

Dear

Shareholders of Hepion Pharmaceuticals,

We

are writing to encourage your support for Hepion’s proposed merger with Pharma Two B, which, we believe, best positions the Company’s

shareholders to maximize the value of their investment. Since the Company’s formation over a decade ago, Hepion has worked on developing

new drugs aimed at addressing critical diseases with the goal of improving the lives of a significant patient population. Regrettably,

these efforts have not yielded the desired results and, after conducting a thorough review of strategic alternatives, Hepion’s

board of directors concluded a merger with Pharma Two B is in the best interests of all shareholders. We therefore urge you to VOTE

FOR this transformational transaction.

As

outlined in Hepion’s definitive proxy statement dated November 8, 2024 (see link: Hepion Proxy Statement 2024 Special Meeting),

the continued clinical development of the Company’s drug pipeline has become increasingly challenging due to numerous risk factors-

including Hepion’s inability to continue funding such development and the investment community’s waning appetite for follow-on

financing given the deteriorating risk profile. Quite simply, the Company lacked the financial resources to advance its clinical trials

and the capital markets reflected no interest in funding further development of Hepion’s pipeline on acceptable terms.

Fortunately,

the Company’s review of strategic alternatives yielded a compelling opportunity to merge with Pharma Two B, a late-clinical stage

biotechnology company developing an innovative treatment for Parkinson’s Disease. Upon consummation of the proposed merger, Hepion’s

shareholders will be able to participate in the potential upside of Pharma Two B’s promising product candidate known as P2B001.

Furthermore,

while Pharma Two B has indicated it has no plans to advance the clinical development of Hepion’s legacy drug pipeline, Hepion remains

committed to monetizing its value for the benefit of all shareholders. Although its efforts to date have not yielded any formal indications

of interest, any such monetization could potentially provide further upside beyond Pharma Two B’s compelling prospects. Of course,

there can be no guaranty of the magnitude and timing of any potential sale, if at all.

In

the event Hepion’s proposed merger with Pharma Two B does not receive the required shareholder support, the Company faces potentially

dire consequences due to its limited financial resources. A stand-alone Hepion would be unable to fund the continued development of its

legacy drug pipeline and would likely face delisting of its common stock from Nasdaq and potential bankruptcy. Any adjournment to solicit

additional shareholder support could erode precious financial resources.

Clearly,

there is a better path forward for Hepion’s shareholders. Pharma Two B presents an opportunity to share in the potential upside

of its innovative drug candidate to treat Parkinson’s Disease. P2B001’s development is already more advanced than any candidates

in Hepion’s legacy pipeline and the post-merger company is expected to be well-funded to advance continued clinical trials with

filing of a New Drug Application with the FDA on the horizon.

We

therefore strongly urge you to VOTE FOR Hepion’s proposed merger with Pharma Two B. Please vote today to approve this important

transaction. EVERY VOTE COUNTS! No matter how many shares you may own, the outcome of the special meeting may have a material impact

on the value of your investment.

If

you have any questions regarding the Special Meeting or need assistance voting, please contact Hepion’s proxy solicitation firm

Campaign Management, LLC toll-free at 1-855-422-1042 or via email at info@campaign-mgmt.com If you have already voted for

Hepion’s proposed merger with Pharma Two B, thank you for your support. If you have previously cast your vote against the merger,

you can still change your vote at any time prior to the Special Meeting as only your latest dated vote will count.

Sincerely,

Hepion

Pharmaceuticals, Inc.

Contacts

Investors:

Michael

Fein

Campaign

Management

(212)

632-8422

michael.fein@campaign-mgmt.com

Hepion Pharmaceuticals (NASDAQ:HEPA)

Historical Stock Chart

From Jan 2025 to Feb 2025

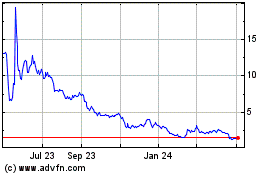

Hepion Pharmaceuticals (NASDAQ:HEPA)

Historical Stock Chart

From Feb 2024 to Feb 2025