UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 9, 2015

BioTelemetry, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

000-55039 |

|

46-2568498 |

|

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

1000 Cedar Hollow Road

Malvern, Pennsylvania |

|

19355 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (610) 729-7000

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2015, the Company announced its financial results for the third quarter ended September 30, 2015. Such information, including the Exhibit attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing. A copy of the press release is included herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number |

|

Exhibit Title |

|

99.1 |

|

Press Release by the Company, dated November 9, 2015 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CardioNet, Inc. |

|

|

|

|

|

|

|

|

|

November 9, 2015 |

By: |

/s/ Heather Getz |

|

|

|

Name: Heather Getz, CPA |

|

|

|

Title: Chief Financial Officer |

3

Exhibit Index

|

Exhibit Number |

|

Exhibit Title |

|

|

99.1 |

|

Press Release by the Company, dated November 9, 2015 |

|

4

Exhibit 99.1

FOR IMMEDIATE RELEASE

Contact: BioTelemetry, Inc.

Heather C. Getz

Investor Relations

800-908-7103

investorrelations@biotelinc.com

BioTelemetry, Inc. Reports Third Quarter 2015 Financial Results

Exceeds Company’s Adjusted EBITDA Guidance

Malvern, PA — (GLOBE NEWSWIRE) — November 9, 2015 — BioTelemetry, Inc. (NASDAQ:BEAT), the leading wireless medical technology company focused on the delivery of health information to improve quality of life and reduce cost of care, today reported results for the third quarter ended September 30, 2015.

Company Highlights

· Achieved second consecutive quarter of profitability with $2.5 million GAAP net income

· Experienced thirteenth consecutive quarter of year over year revenue growth

· Generated positive adjusted EBITDA of $8.7 million, highest since 2008

· CMS issued final 2016 physician fee schedule with an increase of 8% for Mobile Cardiac Telemetry

· Serviced over 1,000 CardioKey patients, the Company’s new low-cost, 14 day Holter

· Expecting low double-digit revenue growth and 20% adjusted EBITDA margin for 2016

President and CEO Commentary

Joseph Capper, President and Chief Executive Officer of BioTelemetry, Inc., commented: “Our third quarter results were driven by the successful execution of our corporate strategy. We delivered another quarter of strong financial performance with adjusted EBITDA of $8.7 million, beating our expectations and representing the sixth consecutive quarter of EBITDA growth. This equates to a 20% return, the highest since 2008, and is a direct result of the implementation of our growth and efficiency measures implemented throughout this year.

“Our third quarter revenue came in at $43.5 million, a slight increase over the prior year. While both Healthcare and Research revenue were higher year over year, our overall revenue growth was negatively impacted by lower product sales from our Technology division. Given the lower than expected third quarter topline growth, we are revising our full year 2015 revenue growth expectation to be in the mid-to-high single digits. However, since Technology sales generate lower margins in comparison to our Healthcare and Research businesses, we remain on track to achieve our previously issued guidance of over $32 million in adjusted EBITDA for the full year 2015, a 60% increase over the prior year.

“The Company’s outlook as we prepare to enter 2016 has never been better. We are investing in and expanding our product and service offerings, we continue to grow our Research backlog, and we exited the quarter posting some of the best patient volume trends in the history of the Company. We also just received positive news with the confirmation that the final 2016 CMS Rule includes an 8.0% increase to our mobile cardiac telemetry Medicare rate. This will have an estimated impact of approximately $5 million to both our top and bottom lines in 2016. With the improving trends in the business, coupled with the impact of the Medicare rate increase, we expect 2016 to be a record year for BioTelemetry with low double-digit revenue growth and 20% adjusted EBITDA margin.”

Third Quarter Financial Results

Revenue for the third quarter 2015 was $43.5 million compared to $43.1 million for the third quarter 2014, an increase of $0.4 million, or 0.9%. This increase was due to $1.0 million higher Healthcare revenue as a result of favorable pricing related to the timing of providing services and an improved payor mix. In addition, Research revenue increased $0.7 million due to higher study volume. These increases were partially offset by a decline of $1.3 million in Technology revenue due to lower product sales volume. For the three months ended September 30, 2015, Healthcare revenue was comprised of 43.0% Medicare and 57.0% commercial.

Gross profit for the third quarter 2015 increased to $26.3 million, or 60.6% of revenue, compared to $23.7 million, or 54.9% of revenue, in the third quarter 2014. Gross profit for the third quarter 2014 on an adjusted basis was $24.2 million, or 56.2% of revenue, excluding $0.5 million related to the integration of our 2014 acquisitions. The increase on an adjusted basis of $2.1 million was due to higher Healthcare pricing, operational efficiencies and wireless device communication savings.

On a GAAP basis, operating expenses for the third quarter 2015 were $23.3 million, compared to $23.2 million in the third quarter 2014. On an adjusted basis, operating expenses for the third quarter were $21.9 million, compared to $22.1 million for the prior year quarter. Higher general and administrative expense due to increased headcount and higher infrastructure costs along with higher bad debt expense due to timing was offset by lower sales and marketing headcount related expense and lower research and development consulting related to the development of the next generation device. These adjusted operating expenses exclude $1.4 million in the third quarter 2015 primarily related to patent litigation. Adjusted operating expenses for the third quarter 2014 exclude $1.1 million primarily related to integration activities surrounding the 2014 acquisitions, as well as legal fees from patent litigation and the Civil Investigative Demand.

On a GAAP basis, interest and other loss, net for the third quarter 2015 was $0.4 million, compared to $0.3 million in the third quarter 2014. The increase is related to additional interest expense due to the expanded debt capacity secured in December 2014.

On a GAAP basis, net income for the third quarter 2015 was $2.5 million, or $0.08 per diluted share, compared to breakeven for the third quarter 2014. Excluding expenses related to other charges, adjusted net income for the third quarter 2015 was $3.9 million, or $0.13 per diluted share. This compares to an adjusted net income of $1.6 million, or $0.06 per diluted share, for the third quarter 2014, which excludes the impact of other charges.

Liquidity

As of September 30, 2015, total cash was $15.5 million, a decrease of $4.5 million compared to December 31, 2014. The significant cash uses during the first three quarters of 2015 include the $6.4 million settlement with the Department of Justice and $10.3 million for capital expenditures, primarily medical devices. These uses were partially offset by cash generated from operations. Consolidated days sales outstanding stayed flat to December 31, 2014 at 51 days.

As of September 30, 2015, the Company had outstanding debt of $24.4 million, exclusive of debt discount. The Company also has access to a $15.0 million revolving credit facility which remains undrawn.

Conference Call

BioTelemetry, Inc. will host an earnings conference call on Monday, November 9, 2015, at 5:00 PM Eastern Time. The call will be simultaneously webcast on the investor information page of our website, www.gobio.com. The call will be archived on our website for two weeks.

About BioTelemetry

BioTelemetry, Inc., formerly known as CardioNet, Inc., is the leading wireless medical technology company focused on the delivery of health information to improve quality of life and reduce cost of care. The Company currently provides cardiac monitoring services, original equipment manufacturing with a primary focus on cardiac monitoring devices and centralized cardiac core laboratory services. More information can be found at www.gobio.com.

Cautionary Statement Regarding Forward-Looking Statements

This document includes certain forward-looking statements within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “expect,” “anticipate,” “estimate,” “intend,” “plan,” “believe,” “promises” and other words and terms of similar meaning. Such forward-looking statements are based on current expectations and involve inherent risks and uncertainties, including important factors that could delay, divert, or change any of these expectations, and could cause actual outcomes and results to differ materially from current expectations. These factors include, among other things, our ability to successfully integrate acquisitions into our business and the effect such acquisitions will have on our results of operation, effectiveness of our cost savings initiatives, relationships with our government and commercial payors, changes to insurance coverage and reimbursement levels for our products, the success of our sales and marketing initiatives, our ability to attract and retain talented executive management and sales personnel, our ability to identify acquisition candidates, acquire them on attractive terms and integrate their operations into our business, the commercialization of new products, market factors, internal research and development initiatives, partnered research and development initiatives, competitive product development, changes in governmental regulations and legislation, the continued consolidation of payors, acceptance of our new products and services, patent protection, adverse regulatory action, and litigation success. For further details and a discussion of these and other risks and uncertainties, please see our public filings with the Securities and Exchange Commission, including our latest periodic reports on Form 10-K and 10-Q. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise.

Consolidated Statements of Operations

(In Thousands, Except Per Share Amounts)

|

|

|

Three Months Ended |

|

|

|

|

(unaudited) |

|

|

|

|

September 30,

2015 |

|

September 30,

2014 |

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

43,492 |

|

$ |

43,113 |

|

|

Cost of revenues |

|

17,155 |

|

19,435 |

|

|

Gross profit |

|

26,337 |

|

23,678 |

|

|

Gross profit % |

|

60.6 |

% |

54.9 |

% |

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

General and administrative |

|

11,497 |

|

10,987 |

|

|

Sales and marketing |

|

6,632 |

|

7,299 |

|

|

Bad debt expense |

|

2,245 |

|

1,868 |

|

|

Research and development |

|

1,565 |

|

1,993 |

|

|

Other charges |

|

1,392 |

|

1,045 |

|

|

Total operating expenses |

|

23,331 |

|

23,192 |

|

|

|

|

|

|

|

|

|

Income from operations |

|

3,006 |

|

486 |

|

|

Interest and other loss, net |

|

(391 |

) |

(293 |

) |

|

|

|

|

|

|

|

|

Income before income taxes |

|

2,615 |

|

193 |

|

|

Provision for income taxes |

|

(137 |

) |

(222 |

) |

|

Net Income (loss) |

|

$ |

2,478 |

|

$ |

(29 |

) |

|

|

|

|

|

|

|

|

Net income (loss) per share (a): |

|

|

|

|

|

|

Basic |

|

$ |

0.09 |

|

$ |

(0.00 |

) |

|

Diluted |

|

$ |

0.08 |

|

$ |

(0.00 |

) |

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding (a): |

|

|

|

|

|

|

Basic |

|

27,181 |

|

26,522 |

|

|

Diluted |

|

29,311 |

|

26,522 |

|

(a) Basic net income (loss) per share is computed by dividing net income (loss) by the weighted average number of fully vested common shares outstanding during the period. Diluted net income (loss) per share is computed by giving effect to all potential dilutive common shares, including stock options, and restricted stock units (“RSUs”). If the outstanding vested options or RSUs were exercised or converted into common stock, the result would be anti-dilutive for the quarter ended September 30, 2014. Accordingly, basic and diluted net loss per share are the same for the quarter ended September 30, 2014. Please refer to the reconciliation of Non-GAAP Financial Measures for diluted share count information for the quarter ended September 30, 2014.

Consolidated Statements of Operations

(In Thousands, Except Per Share Amounts)

|

|

|

Nine Months Ended |

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

September 30,

2015 |

|

September 30,

2014 |

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

131,739 |

|

$ |

122,925 |

|

|

Cost of revenues |

|

53,446 |

|

53,990 |

|

|

Gross profit |

|

78,293 |

|

68,935 |

|

|

Gross profit % |

|

59.4 |

% |

56.1 |

% |

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

General and administrative |

|

35,100 |

|

32,898 |

|

|

Sales and marketing |

|

20,741 |

|

21,911 |

|

|

Bad debt expense |

|

6,769 |

|

6,972 |

|

|

Research and development |

|

5,161 |

|

5,740 |

|

|

Other charges |

|

4,462 |

|

5,025 |

|

|

Total operating expenses |

|

72,233 |

|

72,546 |

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

|

6,060 |

|

(3,611 |

) |

|

Interest and other loss, net |

|

(1,220 |

) |

(7,151 |

) |

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

4,840 |

|

(10,762 |

) |

|

(Provision) benefit from income taxes |

|

(260 |

) |

2,623 |

|

|

Net Income (loss) |

|

$ |

4,580 |

|

$ |

(8,139 |

) |

|

|

|

|

|

|

|

|

Net income (loss) per share (a): |

|

|

|

|

|

|

Basic |

|

$ |

0.17 |

|

$ |

(0.31 |

) |

|

Diluted |

|

$ |

0.16 |

|

$ |

(0.31 |

) |

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding (a): |

|

|

|

|

|

|

Basic |

|

27,063 |

|

26,354 |

|

|

Diluted |

|

29,019 |

|

26,354 |

|

(a) Basic net income (loss) per share is computed by dividing net income (loss) by the weighted average number of fully vested common shares outstanding during the period. Diluted net income (loss) per share is computed by giving effect to all potential dilutive common shares, including stock options, and restricted stock units (“RSUs”). If the outstanding vested options or RSUs were exercised or converted into common stock, the result would be anti-dilutive for the nine months ended September 30, 2014. Accordingly, basic and diluted net loss per share are the same for the nine months ended September 30, 2014. Please refer to the reconciliation of Non-GAAP Financial Measures for diluted share count information for the nine months ended September 30, 2014.

Summary Financial Data

(In Thousands)

|

|

|

September 30,

2015 |

|

December 31,

2014 |

|

|

|

|

(unaudited) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

15,491 |

|

$ |

20,007 |

|

|

Patient accounts receivable, net |

|

14,795 |

|

15,184 |

|

|

Other accounts receivable, net |

|

9,802 |

|

9,362 |

|

|

Days sales outstanding |

|

51 |

|

51 |

|

|

Working capital |

|

19,325 |

|

14,150 |

|

|

Total assets |

|

122,378 |

|

124,778 |

|

|

Total debt, exclusive of debt discount |

|

24,375 |

|

25,000 |

|

|

Total shareholders’ equity |

|

71,452 |

|

63,676 |

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial Measures

(In Thousands, Except Per Share Amounts)

In accordance with Regulation G of the Securities and Exchange Commission, the table set forth below reconciles certain financial measures used in this press release that were not calculated in accordance with generally accepted accounting principles, or GAAP, with the most directly comparable financial measure calculated in accordance with GAAP.

|

|

|

Three Months Ended

(unaudited) |

|

|

|

|

September 30,

2015 |

|

September 30,

2014 |

|

|

|

|

|

|

|

|

|

|

|

Income from operations — GAAP |

|

$ |

3,006 |

|

$ |

486 |

|

|

Other charges (a) |

|

1,392 |

|

1,615 |

|

|

Adjusted income from operations |

|

$ |

4,398 |

|

$ |

2,101 |

|

|

Net income (loss) — GAAP |

|

$ |

2,478 |

|

$ |

(29 |

) |

|

Other charges (a) |

|

1,392 |

|

1,615 |

|

|

Adjusted net income |

|

$ |

3,870 |

|

$ |

1,586 |

|

|

|

|

|

|

|

|

|

Net income (loss) per diluted share — GAAP |

|

$ |

0.08 |

|

$ |

(0.00 |

) |

|

Other charges per diluted share (a) |

|

0.05 |

|

0.06 |

|

|

Adjusted net income per diluted share |

|

$ |

0.13 |

|

$ |

0.06 |

|

|

Weighted average number of common shares outstanding — diluted |

|

29,311 |

|

28,191 |

|

|

|

|

Three Months Ended |

|

|

|

|

(unaudited) |

|

|

|

|

September 30,

2015 |

|

September 30,

2014 |

|

|

|

|

|

|

|

|

|

Cash provided by operating activities |

|

$ |

4,164 |

|

$ |

703 |

|

|

Capital expenditures |

|

(3,641 |

) |

(2,367 |

) |

|

Free cash flow |

|

$ |

523 |

|

$ |

(1,664 |

) |

|

|

|

Three Months Ended |

|

|

|

|

(unaudited) |

|

|

|

|

September 30,

2015 |

|

September 30,

2014 |

|

|

|

|

|

|

|

|

|

Income from operations — GAAP |

|

$ |

3,006 |

|

$ |

486 |

|

|

Other charges (a) |

|

1,392 |

|

1,615 |

|

|

Depreciation and amortization expense |

|

3,165 |

|

3,248 |

|

|

Stock compensation expense |

|

1,139 |

|

694 |

|

|

Adjusted EBITDA |

|

$ |

8,702 |

|

$ |

6,043 |

|

(a) In the third quarter 2015, the Company incurred $1.4 million of other charges primarily due to legal fees for patent litigation. In the third quarter 2014, the Company incurred $1.1 million of other charges primarily related to the integration of the Company’s 2014 acquisitions and legal fees for patent litigation and the Civil Investigative Demand. The Company also incurred $0.5 million in the third quarter 2014 for duplicative labor due to the relocation of certain business functions.

In accordance with Regulation G of the Securities and Exchange Commission, the table set forth below reconciles certain financial measures used in this press release that were not calculated in accordance with generally accepted accounting principles, or GAAP, with the most directly comparable financial measure calculated in accordance with GAAP.

|

|

|

Nine Months Ended

(unaudited) |

|

|

|

|

September 30,

2015 |

|

September 30,

2014 |

|

|

Income (loss) from operations — GAAP |

|

$ |

6,060 |

|

$ |

(3,611 |

) |

|

Other charges (a) |

|

4,462 |

|

5,915 |

|

|

Adjusted income from operations |

|

$ |

10,522 |

|

$ |

2,304 |

|

|

Net income (loss) — GAAP |

|

$ |

4,580 |

|

$ |

(8,139 |

) |

|

Other charges (b) |

|

4,462 |

|

9,445 |

|

|

Adjusted net income |

|

$ |

9,042 |

|

$ |

1,306 |

|

|

|

|

|

|

|

|

|

Net income (loss) per diluted share — GAAP |

|

$ |

0.16 |

|

$ |

(0.31 |

) |

|

Other charges per diluted share (b) |

|

0.15 |

|

0.36 |

|

|

Adjusted net income per diluted share |

|

$ |

0.31 |

|

$ |

0.05 |

|

|

Weighted average number of common shares outstanding — diluted |

|

29,019 |

|

28,205 |

|

|

|

|

Nine Months Ended |

|

|

|

|

(unaudited) |

|

|

|

|

September 30,

2015 |

|

September 30,

2014 |

|

|

|

|

|

|

|

|

|

Cash provided by operating activities |

|

$ |

7,153 |

|

$ |

4,572 |

|

|

Capital expenditures |

|

(10,310 |

) |

(9,977 |

) |

|

Free cash flow |

|

$ |

(3,157 |

) |

$ |

(5,405 |

) |

|

|

|

Nine Months Ended |

|

|

|

|

(unaudited) |

|

|

|

|

September 30,

2015 |

|

September 30,

2014 |

|

|

|

|

|

|

|

|

|

Income (loss) from operations — GAAP |

|

$ |

6,060 |

|

$ |

(3,611 |

) |

|

Other charges (a) |

|

4,462 |

|

5,915 |

|

|

Depreciation and amortization expense |

|

9,124 |

|

9,243 |

|

|

Stock compensation expense |

|

3,321 |

|

2,662 |

|

|

Adjusted EBITDA |

|

$ |

22,967 |

|

$ |

14,209 |

|

(a) In the first three quarters of 2015, the Company incurred $4.5 million of other charges primarily due to legal fees for patent litigation as well as costs related to the integration of the 2014 acquisitions. In the first three quarters of 2014, the Company incurred $5.0 million of other charges primarily due to legal fees for patent litigation and the Civil Investigative Demand, as well as acquisition and integration related charges for the 2014 acquisitions. The Company also incurred $0.9 million for duplicative labor due to the relocation of certain business functions.

(b) In addition to the $5.9 million of other charges incurred in the first three quarters of 2014, the Company recorded a non-operating charge of $6.4 million for the settlement with the Department of Justice that was finalized and paid in the first quarter 2015. This was partially offset by a $2.9 million tax benefit related to the acquisition of Mednet Healthcare Technologies, Inc. in January 2014.

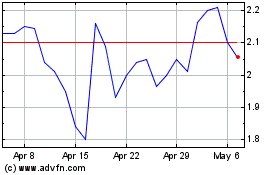

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

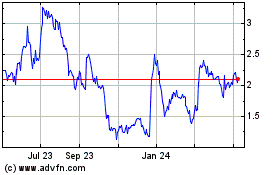

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jul 2023 to Jul 2024