CardioNet, Inc. (NASDAQ:BEAT), a leading wireless medical

technology company with a current focus on the diagnosis and

monitoring of cardiac arrhythmias, today reported results for the

third quarter ended September 30, 2010.

Third Quarter and Recent Highlights

- Received national reimbursement rate

from CMS for MCT technology

- Signed definitive merger agreement to

acquire Biotel, Inc.

- Entered into a strategic agreement with

MedApps, Inc.

- Signed 42 new payor contracts

year-to-date, covering over 6 million lives

- Monitored over 380,000 patients

nationally since inception

- 11% patient growth year-to-date through

September 30 as compared to 2009

- Granted motion to dismiss the

consolidated class action lawsuit filed in August 2009

- $43 million in cash and investments

with no outstanding debt as of September 30, 2010

- Development of our next generation

device continues with market launch expected in early 2011

President and CEO Commentary

Joseph Capper, President and Chief Executive Officer of

CardioNet, commented: “The third quarter represented another period

of transition for the Company, as we continued to realign our

infrastructure and growth strategy to reflect the current

reimbursement and macroeconomic environment. Higher co-pays and

deductibles are driving lower procedure volumes across the

healthcare industry and companies remain under pricing pressure

from payors. Despite achieving 11% patient growth year-to-date as

compared to 2009, this dynamic is impacting our volume as more

patients are forced to choose between caring for their health or

paying their bills. We believe it is important that these patients

have access to the superior diagnostic capabilities of MCOTTM and

will continue to work vigorously to increase patient access to our

service.

“Coverage for MCOTTM continues to expand with the signing of 42

payor contracts this year and the recent national price established

by The Centers for Medicaid and Medicare Services (“CMS”), further

validating the value that MCOTTM provides to the healthcare system.

We are pleased that our ongoing dialogue with CMS over the last two

years culminated in a national price, but are disappointed with the

rate of approximately $800, which we believe clearly does not

reflect the value that the service delivers. Nevertheless, we view

this as progress and we hope to continue having a productive

interaction with CMS. In spite of these advancements, we continue

to have reimbursement challenges as some large, commercial payors

carry negative coverage policies on our technology, as well as

non-contracted payors reducing their payments for our service,

which has caused a reduction in our average selling price.

“Despite these challenges, we remain excited about the

opportunities before us and have taken some aggressive steps to

improve our competitiveness. In addition to starting to reinvest in

the sales force, we recently signed two strategic agreements in

order to acquire the additional tools and expertise needed to

accelerate our growth plan. The first is a definitive merger

agreement to acquire Biotel, Inc. The acquisition is expected to

provide CardioNet with avenues of revenue diversification through

Biotel’s clinical research division and its manufacturing

operation. In connection with the merger agreement, the Companies

entered into a settlement agreement related to the outstanding

litigation which will be effective as of the close of the merger.

We are also pleased to announce that we have entered into a

strategic agreement with MedApps, Inc., a technology company that

delivers remote patient monitoring connectivity solutions in order

to track the health information of patients, including those with

chronic disease, in a timely and efficient manner. This

relationship will potentially enable CardioNet to offer additional

monitoring services. These strategic agreements, coupled with other

adjustments we are making to the business, are indicative of the

commitment we have to the rapidly evolving wireless health

industry.

“We anticipate a continued period of transition as we close out

2010 and prepare to compete in the coming year. We have created a

more cost efficient operating structure while continuing to meet

the needs of our patients. The market potential for MCOTTM remains

strong as it provides outstanding clinical value to physicians and

patients. We have $43 million in cash and investments and no debt,

putting us in a strong financial position to continue to invest

strategically, drive market penetration and diversify our

business.”

Financial Results

Revenues for the third quarter 2010 were $27.5 million, a

decrease of 17.6% compared to $33.3 million in the third quarter

2009. The decrease in revenues was driven by the impact of the 2009

Medicare rate reduction, as well as lower commercial reimbursement

rates in 2010. In addition, event patient volume was down in the

third quarter 2010 compared to the third quarter 2009. For the

three months ended September 30, 2010, payor revenue was comprised

of 36% Medicare and 64% commercial, and patient volume was

comprised of 43% Medicare and 57% commercial.

Gross profit for the third quarter 2010 decreased to $15.5

million, or 56.6% of revenues, compared to $21.5 million, or 64.5%

of revenues, in the third quarter 2009. Third quarter 2010 gross

profit margin was impacted by the 2009 Medicare and 2010 commercial

rate reductions, as well as flat MCOTTM patient volume growth.

On a GAAP basis, operating expenses for the third quarter 2010

were $23.1 million, a decrease of 15.9% compared to $27.4 million

in the third quarter 2009. Operating expenses on an adjusted basis

declined by 17.0% compared to the prior year quarter, excluding

$1.4 million in the third quarter 2010 and $1.3 million in the

third quarter 2009 related to restructuring and other nonrecurring

charges. The decrease in operating expenses was driven by the

Company’s cost reduction initiatives in response to the Medicare

rate reduction.

On a GAAP basis, net loss for the third quarter 2010 was $7.5

million, or a loss of $0.31 per diluted share, compared to net loss

of $5.4 million, or a loss of $0.23 per diluted share, for the

third quarter 2009. Excluding expenses related to restructuring and

other charges, adjusted net loss for the third quarter 2010 was

$6.1 million, or a loss of $0.25 per diluted share. This compares

to adjusted net loss of $3.9 million, or a loss of $0.16 per

diluted share, for the third quarter 2009, which excludes the

impact of restructuring and other charges.

Total cash and investments were $42.9 million as of September

30, 2010, compared with total cash and investments of $49.2 million

as of December 31, 2009, a decrease of $6.3 million. Net accounts

receivable declined $2.8 million compared to year end 2009. As a

result, the third quarter DSO declined to 118 days, a 4 day

reduction compared to year end 2009. During the third quarter,

Highmark Medicare Services (“HMS”) conducted a prepayment review of

the Company's Medicare claims. This review involved an evaluation

by HMS of whether a service was covered, and was reasonable and

necessary prior to payment. As a result of this review,

reimbursement payments to the Company were temporarily affected in

the quarter. This caused a decrease of $7 million to $9 million in

cash collections and an increase in DSO of 14 days during the third

quarter 2010, compared to trends experienced during the first half

of 2010. HMS has since completed its review and the Company expects

reimbursement for Medicare claims to resume in November 2010.

As announced, the Company recently received a national

reimbursement rate from CMS for its Medicare patients. Based on the

CMS methodology, the MCT CPT code is valued at 20.14 relative value

units. Using the CMS formula and input values currently in place,

the Company estimates the national rate to be approximately $800

which will be effective on January 1, 2011. Reimbursement from CMS

is subject to statutory and regulatory changes, rate adjustments

and other policy changes, all of which could materially impact the

reimbursement rate for MCT CPT code 93229. As such, the current

input values are set to expire in December 2010. If the United

States Congress (“Congress”) does not take action by December, the

MCT national reimbursement rate could be negatively impacted. Over

the past five years, Congress has intervened multiple times to halt

any material adjustment.

Conference Call

CardioNet, Inc. will host an earnings conference call on Monday,

November 8, 2010, at 5:00 PM Eastern Time. The call will be

simultaneously webcast on the investor information page of our

website, www.cardionet.com. The call will be archived on our

website and will also be available for two weeks via phone at

888-286-8010, access code 20335277.

About CardioNet

CardioNet is a leading provider of ambulatory, continuous,

real-time outpatient management solutions for monitoring relevant

and timely clinical information regarding an individual’s health.

CardioNet’s initial efforts are focused on the diagnosis and

monitoring of cardiac arrhythmias, or heart rhythm disorders, with

a solution that it markets as Mobile Cardiac Outpatient TelemetryTM

(MCOT™). More information can be found at

http://www.cardionet.com.

Forward-Looking Statements

This document includes certain forward-looking statements within

the meaning of the “Safe Harbor” provisions of the Private

Securities Litigation Reform Act of 1995 regarding, among other

things, our growth prospects, the prospects for our products and

our confidence in the Company’s future. These statements may be

identified by words such as “expect,” “anticipate,” “estimate,”

“intend,” “plan,” “believe,” “promises” and other words and terms

of similar meaning. Such forward-looking statements are based on

current expectations and involve inherent risks and uncertainties,

including important factors that could delay, divert, or change any

of them, and could cause actual outcomes and results to differ

materially from current expectations. These factors include, among

other things, our ability to complete the acquisition of Biotel and

integrate its operations into our business, the effect of the

acquisition on our business operations and financial results, the

effect of the implementation of CMS’ national price in 2011,

effectiveness of our efforts to address operational initiatives,

including cost savings initiatives that affect our business,

changes to insurance coverage and reimbursement levels for our

products, the success of our sales and marketing initiatives, our

ability to attract and retain talented executive management and

sales personnel, our ability to identify acquisition candidates,

acquire them on attractive terms and integrate their operations

into our business, the commercialization of new products, market

factors, internal research and development initiatives, partnered

research and development initiatives, competitive product

development, changes in governmental regulations and legislation,

the continued consolidation of payors, acceptance of our new

products and services and patent protection and litigation. For

further details and a discussion of these and other risks and

uncertainties, please see our public filings with the Securities

and Exchange Commission, including our latest periodic reports on

Form 10-K and 10-Q. We undertake no obligation to publicly

update any forward-looking statement, whether as a result of new

information, future events, or otherwise.

Three Months

Ended

Consolidated Statements of Operations (unaudited)

(In Thousands, Except Per Share Amounts) September

30, September 30, 2010 2009

Revenues $ 27,486 $ 33,340 Cost of revenues 11,938

11,829 Gross profit 15,548 21,511 Gross profit % 56.6% 64.5%

Operating expenses: General and administrative expense 8,717 9,738

Sales and marketing expense 7,305 9,562 Bad debt expense 4,934

5,642 Research and development expense 1,237 1,325 Integration,

restructuring and other charges 859 1,150 Total

operating expenses 23,052 27,417 Loss from operations

(7,504) (5,906) Interest and other income, net 34 10

Loss before income taxes (7,470) (5,896) Provision for

income taxes - 474 Net loss $ (7,470) $ (5,422)

Loss per Share:

Basic $ (0.31) $ (0.23) Diluted $ (0.31) $ (0.23) Weighted

Average Shares Outstanding: Basic 24,162 23,813 Diluted 24,162

23,813

Nine Months

Ended

Consolidated Statements of Operations (unaudited)

(In Thousands, Except Per Share Amounts) September

30, September 30, 2010 2009

Revenues $ 91,241 $ 107,324 Cost of revenues 35,522

35,661 Gross profit 55,719 71,663 Gross profit % 61.1% 66.8%

Operating expenses: General and administrative expense 26,942

29,754 Sales and marketing expense 22,178 25,548 Bad debt expense

14,058 14,086 Research and development expense 3,710 4,310

Integration, restructuring and other charges 3,932

3,109 Total operating expenses 70,820 76,807 Loss

from operations (15,101) (5,144) Interest and other

income, net 58 168 Loss before income taxes (15,043) (4,976)

Provision for income taxes - 395 Net loss $ (15,043)

$ (4,581)

Loss per Share:

Basic $ (0.63) $ (0.19) Diluted $ (0.63) $ (0.19) Weighted

Average Shares Outstanding: Basic 24,061 23,742 Diluted 24,061

23,742

Summary Financial

Data (In Thousands) September 30,

December 31, 2010 2009 (unaudited)

Cash and investments $ 42,878 $ 49,152 Accounts receivable,

net 38,066 40,885 Days sales outstanding 118 122 Working capital

70,312 75,383 Total assets 154,348 168,322 Total debt - - Total

shareholders’ equity 138,850 149,353

Three Months

Ended

September 30, September 30, 2010

2009 Cash (used in) provided by operating activities

$ (6,520) $ 2,913 Capital expenditures (946) (5,108)

Free cash flow (7,466) (2,195) Stock

compensation expense 1,192 1,668 Depreciation and amortization

expense 3,150 2,680

Nine Months

Ended

September 30, September 30, 2010

2009 Cash used in operating activities $ (3,829) $

(1,777) Capital expenditures (3,672) (16,527) Free

cash flow (7,501) (18,304) Stock compensation

expense 3,058 5,458 Depreciation and amortization expense 9,532

8,093

Reconciliation of Non-GAAP Financial

Measures(In Thousands, Except Per Share Amounts)

In accordance with Regulation G of the Securities and Exchange

Commission, the table set forth below reconciles certain financial

measures used in this press release that were not calculated in

accordance with generally accepted accounting principles, or GAAP,

with the most directly comparable financial measure calculated in

accordance with GAAP.

Three Months

Ended

(unaudited) September 30, September 30,

2010 2009 Operating loss – GAAP $ (7,504) $

(5,906) Nonrecurring charges (a) 1,357 1,290

Adjusted operating loss

$ (6,147) $ (4,616) Net loss –

GAAP $ (7,470) $ (5,422) Nonrecurring charges (net of income

taxes of $0 and ($273), respectively) (a) 1,357 1,563

Adjusted net loss $ (6,113) $

(3,859) Loss per diluted share – GAAP $ (0.31) $

(0.23) Nonrecurring charges per share (a) 0.06

0.07

Adjusted loss per diluted share $ (0.25)

$ (0.16) (a) In the third quarter of

2010, we incurred $0.8 million of severance and other exit cost

related to the restructuring of our sales and service

organizations, as well as $0.6 million of other nonrecurring

charges. In the third quarter of 2009, we incurred $0.1 million of

costs in connection with the original terminated definitive merger

agreement to acquire Biotel, Inc. and $1.2 million of integration,

restructuring and other charges.

Reconciliation of Non-GAAP Financial

Measures(In Thousands, Except Per Share Amounts)

In accordance with Regulation G of the Securities and Exchange

Commission, the table set forth below reconciles certain financial

measures used in this press release that were not calculated in

accordance with generally accepted accounting principles, or GAAP,

with the most directly comparable financial measure calculated in

accordance with GAAP.

Nine Months

Ended

(unaudited) September 30, September 30,

2010 2009 Operating loss – GAAP $ (15,101) $

(5,144) Nonrecurring charges (a) 5,504 4,478

Adjusted operating loss

$ (9,597) $ (666) Net loss –

GAAP $ (15,043) $ (4,581) Nonrecurring charges (net of

income taxes of $0 and $0, respectively) (a) 5,504

4,478

Adjusted net loss $ (9,539) $

(103)

Loss per diluted share – GAAP $ (0.63) $ (0.19) Nonrecurring

charges per share (a) 0.23 0.19

Adjusted loss per

diluted share $ (0.40) $ (0.00)

(a) In the first nine months of 2010, we incurred

$3.5 million of severance and other exit cost related to the

restructuring of our sales and service organizations and management

changes, as well as $2.0 million of other charges largely related

to our class action and Biotel law suits. In the first nine months

of 2009, we incurred $0.9 million of costs in connection with the

original terminated definitive merger agreement to acquire Biotel,

Inc., $0.5 million for special bonus paid to the then incoming CEO

and $3.1 million of integration, restructuring and other charges.

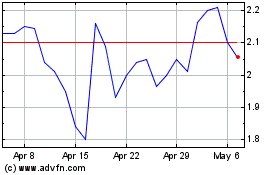

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

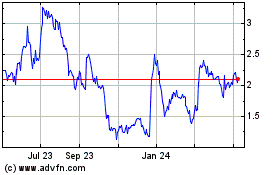

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jul 2023 to Jul 2024