CardioNet, Inc. (NASDAQ:BEAT), a leading wireless medical

technology company with an initial focus on the diagnosis and

monitoring of cardiac arrhythmias, today reported results for the

second quarter ended June 30, 2009.

Highlights and Recent Developments

- Achieved second quarter revenue of $38.3 million, an increase

of 30.4%, compared to second quarter 2008

- Experienced 59% increase in MCOTTM patient volume in the first

half of 2009 over the prior year

- Sales force currently at 141 account executives, up from 88 at

the end of 2008

- Negotiated 24 contracts in the first half of 2009, with over 5

million additional covered lives, bringing total lives covered by

MCOTTM to 196.5 million

- Enrolled physician practices increased 42% compared to first

half 2008

- MCOTTM was used in a study published in the Annals of Thoracic

Surgery which referenced long term monitoring as the standard of

care post AF ablation

- To date, 29 clinical studies or abstracts published either

demonstrating the efficacy of MCOTTM or utilizing MCOTTM technology

to support other clinical research

- Several major institutions adopted CardioNet MCOTTM, such as

the Scripps Institute and the Hospital of the University of

Pennsylvania

- MCOTTM utilization expanding to neurology and cardiac thoracic

surgery

- Enrolled approximately 950 practices in SomNet since its

introduction in June

- Achieved second quarter earnings in line with our

expectations

- Implemented cost containment measures in light of reimbursement

concerns

Chairman, President and CEO Commentary

Randy Thurman, Chairman, President and Chief Executive Officer

of CardioNet, commented: “As evidenced by the above business

highlights, CardioNet’s MCOTTM system continues to exceed the needs

of physicians and patients. We believe the overwhelming acceptance

of MCOTTM is convincing evidence of the superiority of the

technology and the revolutionary advance in monitoring and

diagnosing patients with cardiac arrhythmias. Given the recent

events with reimbursement, it is also incumbent on the emerging

wireless industry to ensure that the cost/benefit advantages are

realized by payors in the form of improved patient outcomes,

avoidance of far more costly alternatives and eliminating the

progression to more serious disease. We are confident that MCOTTM,

coupled with an acceptable outcome on reimbursement, will lead the

way in the wireless medicine industry and result in not only

superior patient outcomes but also substantial cost savings to the

healthcare system.

“During the second quarter, there was continued strong demand

for the CardioNet MCOTTM system with a 53% increase in patients

over the prior year. We believe this growth is driven by the

superior clinical results achieved with MCOTTM and the benefit that

it provides to physicians, patients and payors. To drive higher

market penetration, we have increased our sales organization to 141

account executives, including individuals focused on the hospital

and cardiothoracic surgeon markets. As our new account executives

gain experience and penetrate new geographies and market segments,

we should continue to see strong volume growth as we introduce more

physicians and patients to MCOTTM.

“In late June, we announced we were beginning to experience

somewhat lower reimbursement from commercial payors than previously

anticipated. We later announced that Highmark Medicare Services

notified us on July 10 it plans to reduce the reimbursement rate

for mobile cardiac telemetry by 33% on September 1st. We strongly

believe this rate is not supported by the facts or the accepted

methodologies for establishing reimbursement. The intrinsic value

of MCOTTM for patients, physicians and payors is overwhelming.

CardioNet is the pioneer in developing and making available this

technology for improved patient care. We accept that as the pioneer

we are breaking new ground and will need to overcome a “cost”

focused reimbursement environment and establish wireless medicine

as one of the greatest opportunities to not only improve patient

care but also avoid far more costly alternatives. We are

aggressively pursuing all potential avenues to establish

reimbursement rates at more appropriate levels than those proposed

by Highmark Medicare Services. We are working with CMS, commercial

payors and policymakers to educate them on the cost of providing

the MCOTTM service and the cost savings it generates by more

effectively detecting cardiac arrhythmias, thereby improving

patient lives and avoiding progression to far more costly medical

problems. Until we have resolution on this reimbursement issue, we

are not able to provide full year earnings guidance.

“In response to the reimbursement reductions that we are

experiencing, we are taking steps to reduce our discretionary

spending and operating costs. However, our highest priority

is to maintain the same world class service to our patients and

physician customers. We must also achieve an acceptable outcome to

the reimbursement issue in order to maintain CardioNet’s leadership

in innovation and clinical research. In addition, we have built

what we believe is the largest and most experienced sales force in

the wireless industry and are committed to giving them our full

support.”

Mr. Thurman concluded, “Wireless medicine will play an

increasingly important role in healthcare reform, particularly as

policymakers strive to improve quality and cost effectiveness while

at the same time ensuring that we protect true innovation. Wireless

medicine may be the one revolution in healthcare that drives all

three goals. We are working diligently to highlight the clinical

and economic value of MCOTTM and we believe that in the long term,

CardioNet and its shareholders will benefit from the Company’s

position as a leader in the field of wireless medicine.”

Financial Results

Revenues for the second quarter of 2009 increased to $38.3

million compared to $29.3 million in the second quarter of 2008, an

increase of $9.0 million, or 30.4%. Revenues for the six months

ended June 30, 2009 increased to $74.0 million compared to $54.8

million in the comparable period in the prior year, an increase of

$19.2 million, or 35.0%.

Gross profit increased to $26.3 million in the second quarter of

2009, or 68.7% of revenues, compared to $19.5 million in the second

quarter of 2008, or 66.5% of revenues. For the first half of 2009,

gross profit increased to $50.2 million, or 67.8% of revenues,

compared to $35.5 million, or 64.7% of revenues, in the comparable

period in the prior year.

On a GAAP basis, operating income was $2.1 million in the second

quarter of 2009 compared to $2.5 million in the second quarter of

2008. Excluding $0.4 million of expense related to the merger

agreement to acquire Biotel Inc. which has since been terminated

and a credit of $0.2 million related to an insurance claim due to

the fire, adjusted operating income increased to $2.3 million in

the second quarter of 2009, or 6.0% of revenue. This compares to

adjusted operating income of $3.1 million, or 10.7% of revenue, in

the second quarter of 2008, which excludes $0.6 million of expense

related to the integration of PDSHeart and other restructuring

efforts in the prior year period.

On a GAAP basis, operating income for the first half of the year

decreased to $0.8 million compared to $1.9 million in the

comparable period in the prior year. Excluding $3.2 million of

expense related to management restructuring, primarily severance

costs for former senior executives, and costs incurred in

connection with the merger agreement to acquire Biotel Inc. which

has since been terminated, adjusted operating income increased to

$4.0 million in the first half of 2009, or 5.3% of revenue. This

compares to adjusted operating income of $3.8 million, or 6.9% of

revenue, in the first half of 2008, which excludes $1.9 million of

integration, restructuring and other nonrecurring charges.

On a GAAP basis, net income for the second quarter of 2009 was

$1.6 million, or $0.07 per diluted share, compared to net income of

$1.6 million, or $0.07 per diluted share, for the second quarter of

2008. Net income for the second quarter of 2009 includes a

favorable impact of $0.05 per diluted share due to the expected

utilization of net operating loss carryforwards. Adjusted net

income for the second quarter of 2009 was $2.7 million, or $0.11

per diluted share, excluding the expense related to the

since-terminated merger agreement to acquire Biotel Inc. This

compares to adjusted net income of $2.0 million, or $0.08 per

diluted share, for the second quarter of 2008, which excludes the

impact of integration, restructuring and other nonrecurring

charges.

Net income for the first half of 2009 was $0.8 million, or $0.04

per diluted share, compared to net income of $1.3 million, or $0.06

per diluted share, for the first half of 2008. Net income for the

first half of 2009 includes a favorable impact of $0.06 per diluted

share due to the expected utilization of net operating loss

carryforwards. Adjusted net income for the first half of 2009 was

$3.8 million, or $0.16 per diluted share, excluding the expense

related to management restructuring, primarily severance costs for

former senior executives, and costs incurred in connection with the

since-terminated merger agreement to acquire Biotel Inc. This

compares to adjusted net income of $2.4 million, or $0.11 per

diluted share, for the first half of 2008, which excludes the

impact of integration, restructuring and other nonrecurring

charges.

Marty Galvan, CardioNet's Chief Financial Officer, commented:

“Net income on a GAAP basis in the second quarter and first half of

2009 was relatively flat compared to the previous year as we

continued to invest in the expansion of our sales and marketing

organization. These results are in-line with our expectations for

limited contribution from our newly hired account executives in the

first half of the year, with increasing productivity driving MCOTTM

volume growth in the second half of the year and beyond.”

On a GAAP basis, net income available to common shareholders,

which is derived by reducing net income by the accrued dividends

and accretion on mandatorily redeemable convertible preferred

stock, for the six month period ending June 30, 2009 was $0.8

million, or $0.04 per diluted share, compared to a net loss of $1.3

million, or a loss of $0.10 per diluted share, for the same period

last year. The mandatorily redeemable convertible preferred stock,

which was issued in part to finance the March 2007 PDSHeart

acquisition, was converted to common stock in connection with

CardioNet’s March 2008 initial public offering.

Randy Thurman concluded, “We remain confident that wireless

healthcare technologies will be one of the most dramatic,

revolutionary changes in human health for the next decade and

beyond. We believe that the cost/benefit advantages and superior

clinical outcomes of technologies such as MCOTTM will ultimately

prevail even in this cost driven reimbursement environment.”

Conference Call

CardioNet, Inc. will host an earnings conference call on

Wednesday, August 5, 2009, at 5:00 PM Eastern Time. The call will

be simultaneously webcast on the investor information page of our

website, www.cardionet.com. The call will be archived on our

website and will also be available for two weeks via phone at

888-286-8010, access code 13365384.

About CardioNet

CardioNet is the leading provider of ambulatory, continuous,

real-time outpatient management solutions for monitoring relevant

and timely clinical information regarding an individual's health.

CardioNet's initial efforts are focused on the diagnosis and

monitoring of cardiac arrhythmias, or heart rhythm disorders, with

a solution that it markets as Mobile Cardiac Outpatient TelemetryTM

(MCOT™). More information can be found at

http://www.cardionet.com.

Forward-Looking Statements

This press release includes certain forward-looking statements

within the meaning of the "Safe Harbor" provisions of the Private

Securities Litigation Reform Act of 1995 regarding, among other

things, our growth prospects, the prospects for our products and

our confidence in the Company's future. These statements may be

identified by words such as "expect," "anticipate," "estimate,"

"intend," "plan," "believe," "promises" and other words and terms

of similar meaning. Such forward-looking statements are based on

current expectations and involve inherent risks and uncertainties,

including important factors that could delay, divert, or change any

of them, and could cause actual outcomes and results to differ

materially from current expectations. These factors include, among

other things, the potential for re-evaluation from Highmark or the

CMS on reimbursement rates, the success of our sales and marketing

initiatives, our ability to attract and retain talented executive

management and sales personnel, our ability to identify acquisition

candidates, acquire them on attractive terms and integrate their

operations into our business, the commercialization of new

products, market factors, internal research and development

initiatives, partnered research and development initiatives,

competitive product development, changes in governmental

regulations and legislation, changes to reimbursement levels for

our products, the continued consolidation of payors, acceptance of

our new products and services and patent protection and litigation.

For further details and a discussion of these and other risks and

uncertainties, please see our public filings with the Securities

and Exchange Commission, including our latest periodic reports on

Form 10-K and 10-Q. We undertake no obligation to publicly update

any forward-looking statement, whether as a result of new

information, future events, or otherwise.

Three Months Ended

Consolidated Statements of Operations (unaudited)

(In Thousands, Except Per Share Amounts)

June 30,2009

June 30,2008

Revenues $ 38,264 $ 29,340 Cost of revenues 11,993

9,834 Gross profit 26,271 19,506 Gross profit

% 68.7 % 66.5 % Operating expenses: General and

administrative expense 13,919 9,770 Sales and marketing expense

8,440 5,412 Research and development expense 1,768 931 Amortization

of intangibles 215 246 Integration, restructuring and other charges

(180 ) 610 Total operating expenses 24,162

16,969 Operating income 2,109

2,537 Interest income, net 40 267 Income before

income taxes 2,149 2,804 Provision for income taxes (584 )

(1,172 ) Net income $ 1,565 $ 1,632

Earnings per Share:

Basic $ 0.07 $ 0.07 Diluted $ 0.07 $ 0.07 Weighted Average

Shares Outstanding: Basic 23,792 23,098 Diluted 23,795 24,191

Six Months Ended

Consolidated Statements of Operations (unaudited)

(In Thousands, Except Per Share Amounts)

June 30,2009

June 30,2008

Revenues $ 73,985 $ 54,803 Cost of revenues 23,831

19,353 Gross profit 50,154 35,450 Gross profit

% 67.8 % 64.7 % Operating expenses: General and

administrative expense 28,007 18,589 Sales and marketing expense

15,987 10,527 Research and development expense 2,984 2,073

Amortization of intangibles 453 492 Integration, restructuring and

other charges 1,959 1,916 Total

operating expenses 49,390 33,597 Operating income

764 1,853 Interest income, net 158 379

Income before income taxes 922 2,232 Provision for income

taxes (79 ) (940 ) Net income $ 843 $ 1,292 Dividends

on and accretion of mandatorily redeemable convertible preferred

stock - (2,597 ) Net income (loss) available

to common shareholders $ 843 $ (1,305 ) Earnings

(loss) per Share: Basic $ 0.04 $ (0.10 ) Diluted $ 0.04 $ (0.10 )

Weighted Average Shares Outstanding: Basic 23,696 13,368

Diluted 23,827 13,368

The following table presents detail of the stock based

compensation expense that is included in each functional line item

in the Condensed Statements of Operations above (000’s):

Three Months Ended

Stock based compensation expense (unaudited) (In

Thousands)

June 30,2009

June 30,2008

Stock based compensation expense included in: Cost of

revenues $ 36 $ 8 Research and development expense 25 17 General

and administrative expense 1,889 227 Sales and marketing expense

152 139 Total stock based compensation expense

$ 2,102

$ 391

Six Months Ended

Stock based compensation expense (unaudited) (In

Thousands)

June 30,2009

June 30,2008

Stock based compensation expense included in: Cost of

revenues $ 54 $ 15 Research and development expense 46 32 General

and administrative expense 3,387 466 Sales and marketing expense

275 238 Total stock based compensation expense

$ 3,762

$ 751

Summary Consolidated Balance Sheet Data

(In Thousands)

June 30,2009

December 31,2008

(unaudited) Cash and cash equivalents $ 44,566 $

58,171 Accounts receivable, net 52,930 39,431 Working capital

86,026 84,003 Total assets 171,461 165,773 Total debt 25 72 Total

shareholders’ equity 157,301 150,117 Reconciliation

of Non-GAAP Financial Measures (In Thousands, Except Per Share

Amounts) In accordance with Regulation G of the Securities

and Exchange Commission, the table set forth below reconciles

certain financial measures used in this press release that were not

calculated in accordance with generally accepted accounting

principles, or GAAP, with the most directly comparable financial

measure calculated in accordance with GAAP.

Three Months Ended

(unaudited) June 30, 2009

June 30, 2008 Operating income – GAAP $ 2,109 $ 2,537

Nonrecurring charges (a) 201 610

Adjusted operating

income

$ 2,310 $ 3,147 Net

income available to common shareholders – GAAP $ 1,565 $ 1,632

Nonrecurring charges (net of income taxes of ($955) and

$255, respectively) (a) 1,156 355

Adjusted

net income $ 2,721 $ 1,987

Expected impact of NOL

utilization

(1,337 ) -

Adjusted net income excluding NOL

utilization $ 1,384 $ 1,987

Diluted earnings available to common shareholders per basic and

diluted share – GAAP $ 0.07 $ 0.07 Nonrecurring charges per

share (a) 0.04 0.01

Adjusted earnings per

diluted share $ 0.11 $ 0.08

Expected impact of NOL

utilization

(0.05 ) -

Adjusted earnings per diluted share

excluding NOL utilization $ 0.06 $

0.08 (a) In the second quarter of 2009, we incurred

$0.4 million of costs in connection with the since-terminated

definitive merger agreement to acquire Biotel, Inc. and ($0.2)

million of integration, restructuring and other charges. In the

second quarter of 2008, we incurred $0.6 million of integration,

restructuring and other charges.

Six Months Ended

(unaudited) June 30, 2009

June 30, 2008 Operating income – GAAP $ 764 $ 1,853

Nonrecurring charges (a) 3,188 1,916

Adjusted operating

income

$ 3,952 $ 3,769

Net income (loss) available to common shareholders – GAAP $ 843 $

(1,305 )

Dividends on and accretion of

mandatorily redeemable convertible preferred stock which converted

to common stock in the first quarter of 2008

- 2,597

Net income $

843 $ 1,292 Nonrecurring charges (net

of income taxes of $273 and $807, respectively) (a) 2,915

1,109

Adjusted net income $

3,758 $ 2,401

Expected impact of NOL

utilization

(1,337 ) -

Adjusted net income excluding

NOL utilization

$ 2,421 $ 2,401

Income (loss) available to common shareholders per basic and

diluted share – GAAP $ 0.04 $ (0.10 )

Dividends on and accretion of

mandatorily redeemable convertible preferred stock which converted

to common stock in the first quarter of 2008

- 0.12

Diluted earnings per

share

$ 0.04 $ 0.02 Nonrecurring

charges per share (a) 0.12 0.09

Adjusted earnings per diluted share $ 0.16

$ 0.11

Expected impact of NOL

utilization

(0.06 ) -

Adjusted earnings per diluted

share excluding NOL utilization $ 0.10

$ 0.11 (a) In the first six months of

2009, we incurred $0.8 million of costs in connection with the

since-terminated definitive merger agreement to acquire Biotel,

Inc., $0.5 million for special bonus paid to incoming CEO and $1.9

million of integration, restructuring and other charges. In the

first six months of 2008, we incurred $1.9 million of integration,

restructuring and other charges.

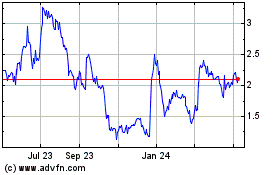

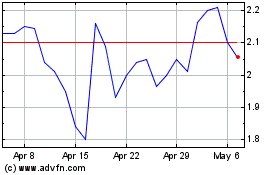

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jul 2023 to Jul 2024