Filed pursuant to Rule 424(b)(5)

Registration No. 333-258567

Prospectus Supplement

(To Prospectus dated August 6, 2021)

1,922,322 shares

CLASS A COMMON STOCK

_______________________________________________

We are offering 1,867,322 shares of Class A common stock of Hamilton Lane Incorporated. We intend to use the proceeds from our sale of shares of Class A common stock in this offering to settle, in cash, exchanges of 1,867,322 membership units in Hamilton Lane Advisors, L.L.C. (“HLA”) by certain of its members. The selling stockholder named in this prospectus supplement is offering 55,000 shares of our Class A common stock. We will not receive any proceeds from the sale of Class A common stock by the selling stockholder.

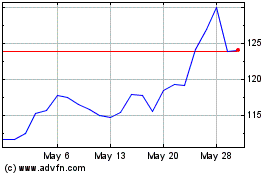

Our Class A common stock is listed on the Nasdaq Stock Market (“Nasdaq”) under the symbol “HLNE”. The last reported sale price of our Class A common stock on March 1, 2024 was $114.74 per share. We have two classes of common stock: Class A common stock and Class B common stock. Each share of Class A common stock entitles its holder to one vote on all matters presented to our stockholders. Each share of Class B common stock entitles its holder to ten votes on all matters presented to our stockholders. All of our Class B common stock is held by the Class B Holders on a one-for-one basis with the number of Class B units of HLA they own.

| | |

Investing in our Class A common stock involves a high degree of risk. See “Risk Factors” beginning on page S-8 of this prospectus supplement and page 33 of our Annual Report on Form 10-K for the fiscal year ended March 31, 2023, incorporated by reference herein. |

_______________________________________________

The underwriter has agreed to purchase the shares of Class A common stock from us and from the selling stockholder at a price equal to $108.00 per share, which will result in $201,670,776 of net proceeds to us and $5,940,000 of net proceeds to the selling stockholder, subject to the terms and conditions in the underwriting agreement among the underwriter, the selling stockholder and us.

The underwriter proposes to offer the shares of Class A common stock from time to time for sale in one or more transactions on Nasdaq, in the over-the-counter market, through negotiated transactions or otherwise, at market prices prevailing at the time of sale, at prices related to such prevailing market prices or negotiated prices, subject to its right to reject any order in whole or in part. See “Underwriting.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares of our Class A common stock to investors on or about March 7, 2024.

Prospectus Supplement dated March 4, 2024

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part is the accompanying prospectus, which describes more general information. You should read both this prospectus supplement and the accompanying prospectus, together with the additional information described under the headings “Information Incorporated by Reference” and “Where You Can Find More Information,” before you make any investment decisions regarding the Class A common stock. This prospectus supplement may add to, update or change information contained or incorporated by reference in the accompanying prospectus. If the information in this prospectus supplement is inconsistent with any information contained or incorporated by reference in the accompanying prospectus, the information in this prospectus supplement will apply and will supersede the inconsistent information contained or incorporated by reference in the accompanying prospectus.

Neither we, the selling stockholder, nor the underwriter have authorized anyone to provide any information other than that contained in this prospectus supplement, the accompanying prospectus or any free writing prospectus prepared by or on behalf of us or to which we have referred. We, the selling stockholder and the underwriter take no responsibility for, and can provide no assurance as to the reliability of, any other information that any other person may give you. We and the selling stockholder are offering to sell, and seeking offers to buy, shares of our Class A common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus supplement is accurate only as of the date of this prospectus supplement, regardless of the time of delivery of this prospectus supplement or any sale of shares of our Class A common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: we, the selling stockholder and the underwriter have not done anything that would permit this offering or possession or distribution of this prospectus supplement in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of the shares of Class A common stock and the distribution of this prospectus supplement outside the United States. See “Underwriting.”

This prospectus supplement includes or incorporates by reference certain information regarding the historical performance of our specialized funds and customized separate accounts. An investment in shares of our Class A common stock is not an investment in our specialized funds or customized separate accounts. In considering the performance information relating to our specialized funds and customized separate accounts contained herein, current and prospective Class A common stockholders should bear in mind that the performance of our specialized funds and customized separate accounts is not indicative of the possible performance of shares of our Class A common stock and is also not necessarily indicative of the future results of our specialized funds or customized separate accounts, even if fund investments were in fact liquidated on the dates indicated, and there can be no assurance that our specialized funds or customized separate accounts will continue to achieve, or that future specialized funds and customized separate accounts will achieve, comparable results.

The Company’s fiscal year ends on March 31. Unless otherwise indicated, references in this prospectus supplement and accompanying prospectus to a particular fiscal year are to the fiscal year ending March 31 of that year, e.g., references to “fiscal 2023” or our “2023 fiscal year” are to the fiscal year ended March 31, 2023.

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. In addition, our names, logos and website names and addresses are owned by us or licensed by us. We also own or have the rights to copyrights that protect the content of our solutions. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this prospectus supplement and accompanying prospectus are listed without the ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, trade names and copyrights.

This prospectus supplement and accompanying prospectus may include trademarks, service marks or trade names of other companies. Our use or display of other parties’ trademarks, service marks, trade names or products is not intended to, and does not imply a relationship with, or endorsement or sponsorship of us by, the trademark, service mark or trade name owners.

Unless otherwise indicated, information contained or incorporated by reference in this prospectus supplement concerning our industry and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources (including industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets that we believe to be reasonable. Although we believe the data from these third-party sources is reliable, we have not independently verified any third-party information. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Forward-Looking Statements” in this prospectus supplement and in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2023, filed with the Securities and Exchange Commission (the “SEC”) on May 25, 2023 (the “2023 Form 10-K”), and incorporated by reference herein. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus contain or incorporate by reference forward-looking statements, which reflect our current views with respect to, among other things, future events and financial performance, our operations, strategies and expectations. The words “will”, “expect”, “believe”, “estimate”, “continue”, “anticipate”, “intend”, “plan” and similar expressions are intended to identify these forward-looking statements. Any forward-looking statements contained or incorporated by reference in this prospectus supplement and the accompanying prospectus are based upon our historical performance and on our current plans, estimates and expectations. The inclusion of this or any forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Such forward-looking statements are subject to various risks, uncertainties and assumptions, including but not limited to global and domestic market and business conditions, our successful execution of business and growth strategies and regulatory factors relevant to our business, as well as assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include, but are not limited to, those described or incorporated by reference under “Risk Factors” in this prospectus supplement and the accompanying prospectus. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included or incorporated by reference in this prospectus supplement and the accompanying prospectus. We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information or future developments, except as otherwise required by law.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere, and/or incorporated by reference, in this prospectus supplement and the accompanying prospectus. Before making an investment decision, you should read the entire prospectus supplement and accompanying prospectus carefully, as well as the information in our 2023 Form 10-K, our subsequent Quarterly Reports on Form 10-Q and other information incorporated by reference in this prospectus supplement and accompanying prospectus.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus supplement to “we,” “us,” “our,” the “Company,” “Hamilton Lane” and similar terms refer to Hamilton Lane Incorporated and its consolidated subsidiaries. As used in this prospectus supplement, (i) the term “HLA” refers to Hamilton Lane Advisors, L.L.C. and (ii) the terms “Hamilton Lane Incorporated” and “HLI” refer solely to Hamilton Lane Incorporated, a Delaware corporation, and not to any of its subsidiaries.

We are a global private markets investment solutions provider and operate our business in a single segment. We offer a variety of investment solutions to address our clients’ needs across a range of private markets, including private equity, private credit, real estate, infrastructure, natural resources, growth equity, venture capital and impact. These solutions are constructed from a range of investment types, including primary investments in funds managed by third-party managers, direct investments alongside such funds and acquisitions of secondary stakes in such funds, with a number of our clients utilizing multiple investment types. These solutions are offered in a variety of formats covering some or all phases of private markets investment programs:

Customized Separate Accounts: We design and build customized portfolios of private markets funds and direct investments to meet our clients’ specific portfolio objectives with regard to return, risk tolerance, diversification and liquidity. We generally have discretionary investment authority over our customized separate accounts.

Specialized Funds: We organize, invest and manage specialized primary, secondary and direct investment funds. Our specialized funds invest across a variety of private markets and include equity, equity-linked and credit funds offered on standard terms as well as shorter duration, opportunistically oriented funds. We launched our first specialized fund in 1997. Since then, our product offerings have grown steadily and now include evergreen offerings that invest primarily in secondaries and direct investments in equity and credit and are available to certain high-net-worth individuals.

Advisory Services: We offer investment advisory services to assist clients in developing and implementing their private markets investment programs. Our investment advisory services include asset allocation, strategic plan creation, development of investment policies and guidelines, the screening and recommending of investments, the monitoring of and reporting on investments and investment manager review and due diligence. Our advisory clients include some of the largest and most sophisticated private markets investors in the world.

Distribution Management: We offer distribution management services to our clients through active portfolio management to enhance the realized value of publicly traded stock they receive as distributions in-kind from private equity funds.

Reporting, Monitoring, Data and Analytics: We provide our clients with comprehensive reporting and investment monitoring services, usually bundled into our broader investment solutions offerings, but also on a stand-alone, fee-for-service basis. We also provide comprehensive research and analytical services as part of our investment solutions, leveraging our large, global, proprietary and high-quality database for transparency and powerful analytics. Our data, as well as our benchmarking and forecasting models, are accessible through our proprietary technology solution, Cobalt LP, on a stand-alone, subscription basis.

Our client and investor base is broadly diversified by type, size and geography. Our client base primarily comprises institutional investors that range from those seeking to make an initial investment in alternative assets to some of the world’s largest and most sophisticated private markets investors. As we offer a highly customized, flexible service, we are equipped to provide investment services to institutional clients of all sizes and with different needs, internal resources and investment objectives. Our clients include prominent institutional investors in the United States, Canada, Europe, the Middle East, Asia, Australia and Latin America. We provide private markets solutions and services to some of the largest global pension, sovereign wealth and U.S. state pension funds. In addition, we believe we are a leading provider of private markets solutions for U.S. labor union pension plans, and we serve numerous smaller public and corporate pension plans, sovereign wealth funds, financial institutions and insurance companies, endowments and foundations, as well as family offices and high-net-worth individuals.

Organizational Structure

Hamilton Lane Incorporated was incorporated in the State of Delaware on December 31, 2007. As of March 6, 2017, following our initial public offering (“IPO”) and related transactions (the “Reorganization”), we became a publicly-traded entity and both the holding company for and sole managing member of Hamilton Lane Advisors, L.L.C. In that capacity, HLI operates and controls all of the business and affairs of HLA, and through HLA, conducts its business. As a result, HLI consolidates HLA’s financial results and reports a non-controlling interest related to the portion of HLA units not owned by HLI. The assets and liabilities of HLA represent substantially all of HLI’s consolidated assets and liabilities with the exception of cash, certain deferred tax assets and liabilities, payables to related parties pursuant to a tax receivable agreement and dividends payable. Exchanges of HLA units for HLI Class A common stock or, at our election, for cash, by our pre-IPO investors are effected pursuant to an exchange agreement entered into with HLI and HLA as part of the Reorganization. Each such exchange results in HLI owning a higher percentage of the economic interest in HLA. HLI currently holds approximately 70.1% of the economic interest in HLA. Following this offering, HLI will hold approximately 73.6% of the economic interest in HLA.

Structure Chart

Our IPO was conducted through what is commonly referred to as an “Up-C” structure, which provides our pre-IPO owners with the tax advantage of continuing to own interests in a pass-through structure and provides potential future tax benefits for both the public company and the legacy owners (through the tax receivable agreement) when they ultimately exchange their pass-through interests for shares of Class A common stock or, at our election, for cash. The below chart summarizes our organizational structure prior to this offering. See also, “Description of Common Stock” in the accompanying prospectus.

(1)The Class B Holders, who hold Class B units, and Class C Holders, who hold Class C units, are pre-IPO owners of our business who continue to hold their interests directly in HLA. Class B units and Class C units may be exchanged for shares of Class A common stock or, at our election, for cash, pursuant to and subject to the restrictions set forth in the exchange agreement.

(2)We hold all of the Class A units of HLA, representing the right to receive approximately 70% of the distributions made by HLA. We act as the sole manager of HLA and operate and control all of its business and affairs.

Corporate Information

Our principal executive offices are located at 110 Washington Street, Suite 1300, Conshohocken, PA 19428, and our phone number is (610) 934-2222. Our corporate website is www.hamiltonlane.com. Information contained on or accessible through our website is not incorporated by reference into this prospectus supplement or the accompanying prospectus and should not be considered a part of either.

| | | | | | | | |

The Offering |

| | |

Class A common stock outstanding as of March 1, 2024 | | 38,596,176 shares. |

| | |

Class A common stock offered by the selling stockholder | | 55,000 shares. |

| | |

Class A common stock offered by Hamilton Lane Incorporated | | 1,867,322 shares. |

| | |

Class A common stock outstanding immediately after this offering | | 40,463,498 shares of Class A common stock. If all Class B Holders and Class C Holders immediately after this offering elected to exchange their Class B units and Class C units for shares of our Class A common stock, 54,685,273 shares of Class A common stock would be outstanding immediately after this offering. |

| | |

Class B common stock outstanding as of March 1, 2024 | | 15,409,507 shares. |

| | |

Class B common stock outstanding immediately after this offering | | 13,664,635 shares. |

| | |

Use of proceeds | | We estimate that the net proceeds to us from this offering will be approximately $201.7 million. We intend to use the proceeds from our sale of shares of Class A common stock in this offering to settle in cash exchanges of Class B units (along with payment of the par value of a corresponding number of redeemed shares of Class B common stock) and Class C units of HLA by certain of its members. We estimate that the offering expenses will be approximately $0.4 million, which will be payable by the participating HLA members and the selling stockholder. We will not receive any proceeds from the sale of Class A common stock by the selling stockholder. See “Use of Proceeds.” |

| | |

| | | | | | | | |

Voting rights | | Each share of our Class A common stock entitles its holder to one vote on all matters to be voted on by stockholders generally.

Each share of our Class B common stock entitles its holder to ten votes until a Sunset becomes effective. After a Sunset becomes effective, each share of our Class B common stock will entitle its holder to one vote per share.

A “Sunset” is triggered by any of the following: (i) Hartley R. Rogers, Mario L. Giannini and their respective permitted transferees collectively cease to maintain direct or indirect beneficial ownership of at least 10% of the outstanding shares of Class A common stock (determined assuming all outstanding Class B units and Class C units have been exchanged for Class A common stock); (ii) Mr. Rogers, Mr. Giannini, their respective permitted transferees and employees of us and our subsidiaries cease collectively to maintain direct or indirect beneficial ownership of an aggregate of at least 25% of the aggregate voting power of our outstanding Class A common stock and Class B common stock; (iii) Mr. Rogers and Mr. Giannini both voluntarily terminate their employment and all directorships with HLA and us (other than by reason of death or, in each case as determined in good faith by our board of directors, disability, incapacity, or retirement); or (iv) the occurrence of the later of March 31, 2027 or the end of the fiscal year in which occurs the fifth anniversary of the death of the second to die of Mr. Rogers and Mr. Giannini. A Sunset triggered under clauses (i), (ii) and (iii) during the first two fiscal quarters will generally become effective at the end of that fiscal year, and a Sunset triggered under clauses (i), (ii) and (iii) during the third or fourth fiscal quarters will generally become effective at the end of the following fiscal year. A Sunset pursuant to clause (iv) will become effective on the occurrence of the latest event listed in clause (iv), unless a Sunset is also triggered under clause (i) or (ii) that would result in an earlier Sunset, in which case the earlier Sunset will result.

If Mr. Rogers or Mr. Giannini voluntarily terminates his employment and directorships as contemplated by clause (iii) after the death of the other, then the Sunset will become effective on the timing set out in clause (iii). Otherwise, a voluntary termination as to only one of them will result in a Sunset becoming effective on the timing set out in clause (iv). |

| | |

| | | | | | | | |

| | Holders of our Class A common stock and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as set forth in our certificate of incorporation or as otherwise required by applicable law. See “Description of Common Stock”. |

| | |

| | Certain Class B Holders who are significant outside investors, members of management and significant employee owners entered into a stockholders agreement pursuant to which they agreed to vote all shares of our voting stock, including their Class A common stock and Class B common stock, in the manner directed by our controlling stockholder, HLA Investments, LLC (“HLAI”), on all matters submitted to a vote of our stockholders. These Class B Holders will collectively hold 78% of the aggregate voting power of our Class A common stock and Class B common stock immediately after this offering. HLAI is thus able to exercise control over all matters requiring our stockholders’ approval, including the election of our directors and any significant corporate transactions. |

| | |

Tax Receivable Agreement | | Pursuant to a tax receivable agreement we entered into with our pre-IPO owners, as amended, we will pay 85% of the amount of tax benefits, if any, that we realize (or are deemed to realize in the case of an early termination payment by us, a change in control or a material breach by us of our obligations under the tax receivable agreement) as a result of increases in tax basis (and certain other tax benefits) resulting from purchases or exchanges of membership units of HLA. |

| | |

Controlled Company | | Following this offering, we will continue to be a “controlled company” within the meaning of the corporate governance rules of Nasdaq. |

| | |

| | | | | | | | |

Dividend policy | | On February 6, 2024, we announced a quarterly dividend of $0.445 per share of Class A common stock, including the Class A common stock being sold in this offering, to record holders at the close of business on March 15, 2024. The payment date will be April 4, 2024. The ex-dividend date will be March 14, 2024. We also declared a quarterly dividend of $0.445 in the first three quarters of fiscal 2024. In fiscal 2023, 2022 and 2021, we declared dividend amounts of $0.40, $0.35 and $0.3125 per quarter, respectively. The declaration and payment by us of any future dividends to holders of our Class A common stock is at the sole discretion of our board of directors. Our board intends to cause us to pay a cash dividend on a quarterly basis. Subject to funds being legally available, we will cause HLA to make pro rata distributions to its members, including us, in an amount at least sufficient to allow us to pay all applicable taxes, to make payments under the tax receivable agreement, and to pay our corporate and other overhead expenses. See “Dividend Policy”. |

| | |

Risk factors | | You should read “Risk Factors” beginning on page S-8 of this prospectus supplement and in Part I, Item 1A of our 2023 Form 10-K incorporated by reference herein for a discussion of risks to carefully consider before deciding to purchase or sell any shares of our Class A common stock. |

| | |

Nasdaq ticker symbol | | “HLNE” |

Unless otherwise noted, Class A common stock outstanding and other information based thereon in this prospectus supplement does not reflect any of the following:

•2,456,999 shares of Class A common stock reserved for issuance under our 2017 Equity Incentive Plan, as amended;

•863,429 shares of Class A common stock reserved for issuance under our Employee Share Purchase Plan, as amended; and

•14,221,775 shares of Class A common stock reserved as of the closing date of this offering for future issuance upon exchanges of Class B units by Class B Holders and exchanges of Class C units by Class C Holders.

RISK FACTORS

An investment in our Class A common stock involves risks. Before investing in our Class A common stock, you should carefully consider the following information about these risks and each of the risks described in the section entitled “Risk Factors” in our 2023 Form 10-K, which is incorporated by reference into this prospectus supplement, together with the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus. These risks and uncertainties are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, also may become important factors that affect us. If any of these risks materialize, our business, financial condition and results of operations could be materially adversely affected. In that case, the trading price of our Class A common stock could decline, and you may lose some or all of your investment.

Risks Related to Our Organizational Structure and This Offering

We are a “controlled company” within the meaning of the Nasdaq listing standards and, as a result, qualify for, and intend to continue to rely on, exemptions from certain corporate governance requirements. You will not have the same protections afforded to stockholders of companies that are subject to such requirements.

Holders of our Class B common stock, which is not publicly traded, control a majority of the voting power of our outstanding common stock. As a result, we qualify as a “controlled company” within the meaning of the corporate governance standards of Nasdaq. Under these rules, a listed company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance requirements, including the requirement that (i) a majority of our board of directors consist of independent directors, (ii) director nominees be selected or recommended to the board by independent directors and (iii) we have a compensation committee that is composed entirely of independent directors.

We have elected to rely on these exemptions and expect to continue to do so. As a result, we do not have a majority of independent directors, our directors are not nominated or selected by independent directors and our compensation committee does not consist entirely of independent directors. Accordingly, you will not have the same protections afforded to stockholders of companies that are subject to all of the corporate governance requirements of Nasdaq.

Our only material asset is our interest in HLA, and we are accordingly dependent upon distributions from HLA to pay dividends, taxes and other expenses.

HLI is a holding company and has no material assets other than its ownership of membership units in HLA and certain deferred tax assets. As such, HLI does not have any independent means of generating revenue. We intend to cause HLA to make pro rata distributions to its members, including us, in an amount at least sufficient to allow us to pay all applicable taxes, to make payments under the tax receivable agreement we have entered into with the direct and indirect members of HLA, and to pay our corporate and other overhead expenses. To the extent that HLI needs funds, and HLA is restricted from making such distributions under applicable laws or regulations, or is otherwise unable to provide such funds, it could materially and adversely affect our liquidity and financial condition.

The IRS might challenge the tax basis step-up we received in connection with our IPO and the related transactions and in connection with subsequent acquisitions of membership units in HLA, such as in connection with this offering.

We have used a portion of the proceeds from our IPO and from subsequent registered offerings to purchase membership units in HLA from certain of the legacy direct or indirect members of HLA, which resulted in an increase in our share of the tax basis of the assets of HLA that otherwise would not have been available. The HLA membership units held directly and indirectly by the members of HLA other than HLI, including members of our senior management team, may in the future be exchanged for shares of our Class A common stock or, at our election, for cash. We intend to use the proceeds from our sale of shares of Class A common stock in this offering to settle, in cash, exchanges of Class B units (along with payment of the par value of a corresponding number of redeemed shares of Class B common stock) and Class C units of HLA by certain of its members. These exchanges are likely to result in increases in our share of the tax basis of the assets of HLA that otherwise would not have been available. The increases in tax basis may reduce the amount of tax that we would otherwise be required to pay in the future, although it is possible that the IRS might challenge all or part of that tax basis increase, and a court might sustain such a challenge. Our ability to achieve benefits from any tax basis increase will depend upon a number of factors, as discussed below, including the timing and amount of our future income.

We are required to pay over to legacy direct or indirect members of HLA most of the tax benefits we receive from tax basis step-ups attributable to our acquisition of membership units of HLA in connection with this and prior offerings and in the future, and the amount of those payments could be substantial.

As part of our Reorganization, we entered into a tax receivable agreement for the benefit of the direct and indirect members of HLA other than us, pursuant to which we will pay them 85% of the amount of the tax savings, if any, that we realize (or, under certain circumstances, are deemed to realize) as a result of increases in tax basis (and certain other tax benefits) resulting from our acquisition of membership units or as a result of certain items of loss being specially allocated to us for tax purposes in connection with dispositions by HLA of certain investment assets. HLI will retain the benefit of the remaining 15% of these tax savings.

The term of the tax receivable agreement commenced upon the completion of our IPO and will continue until all tax benefits that are subject to the tax receivable agreement have been utilized or have expired, unless we exercise our right to terminate the tax receivable agreement (or the tax receivable agreement is terminated due to a change of control or our breach of a material obligation thereunder), in which case, we will be required to make the termination payment specified in the tax receivable agreement. In addition, payments we make under the tax receivable agreement will be increased by any interest accrued from the due date (without extensions) of the corresponding tax return.

The actual increase in tax basis, as well as the amount and timing of any payments under the tax receivable agreement, will vary depending on a number of factors, including, but not limited to, the price of our Class A common stock at the time of the purchase or exchange, the timing of any future exchanges, the extent to which exchanges are taxable, the amount and timing of our income and the tax rates then applicable. We expect that, as a result of the increases in the tax basis of the tangible and intangible assets of HLA attributable to the exchanged HLA interests, the payments that we may make to the legacy direct or indirect members of HLA could be substantial. There may be a material negative effect on our liquidity if, as described below, the payments under the tax receivable agreement exceed the actual benefits we receive in respect of the tax attributes subject to the tax receivable agreement and/or distributions to us by HLA are not sufficient to permit us to make payments under the tax receivable agreement.

In certain circumstances, payments under the tax receivable agreement may be accelerated and/or significantly exceed the actual tax benefits we realize.

The tax receivable agreement provides that if we exercise our right to early termination of the tax receivable agreement, in whole or in part, we experience a change in control, or we materially breach our obligations under the tax receivable agreement, we will be obligated to make an early termination payment to the legacy direct or indirect members of HLA equal to the net present value of all payments that would be required to be paid by us under the tax receivable agreement. The amount of such payments will be determined on the basis of certain assumptions in the tax receivable agreement, including (i) the assumption (except in the case of a partial termination) that we would have enough taxable income in the future to fully utilize the tax benefit resulting from any increased tax basis that results from an exchange and (ii) the assumption that any units (other than those held by Hamilton Lane Incorporated) outstanding on the termination date are deemed to be exchanged for shares of Class A common stock on the termination date. We have in the past exercised our right to terminate the tax receivable agreement with respect to certain individuals who had exchanged all of their HLA units and paid the related early termination payments, and we may elect to do so with respect to other individuals in the future. Any early termination payment may be made significantly in advance of the actual realization, if any, of the future tax benefits to which the termination payment relates.

Moreover, as a result of an elective early termination, a change of control or our material breach of our obligations under the tax receivable agreement, we could be required to make payments under the tax receivable agreement that exceed our actual cash savings under the tax receivable agreement. Thus, our obligations under the tax receivable agreement could have a substantial negative impact on our liquidity and could have the effect of delaying, deferring or preventing certain mergers, asset sales, or other forms of business combinations or changes of control. There can be no assurance that we will be able to finance any such early termination payment. It is also possible that the actual benefits ultimately realized by us may be significantly less than were projected in the computation of the early termination payment.

We will not be reimbursed for any payments previously made under the tax receivable agreement if the basis increases described above are successfully challenged by the IRS or another taxing authority. As a result, in certain circumstances, payments could be made under the tax receivable agreement in excess of our ultimate cash tax savings.

In certain circumstances, HLA is required to make distributions to us and the direct and indirect owners of HLA, and the distributions that HLA will be required to make may be substantial.

HLA is treated as a partnership for U.S. federal income tax purposes and, as such, is not subject to U.S. federal income tax. Instead, taxable income is allocated to members, including us. Pursuant to the limited liability company agreement of HLA, HLA makes pro rata cash distributions (“tax distributions”) to the members, including us, calculated using an assumed tax rate, to help each of the members to pay taxes on such member’s allocable share of taxable income. Under applicable tax rules, HLA is required to allocate net taxable income disproportionately to its members in certain circumstances. Because tax distributions are based on an assumed tax rate that is the highest possible rate applicable to any member, HLA is required to make tax distributions that, in the aggregate, will likely exceed the amount of taxes that HLA would have paid if it were taxed on its net income at the assumed rate. The pro rata distribution amounts will also be increased if and to the extent necessary to ensure that the amount distributed to HLI is sufficient to enable HLI to pay its actual tax liabilities and its other expenses and costs (including amounts payable under the tax receivable agreement).

Funds used by HLA to satisfy its tax distribution obligations are not available for reinvestment in our business. Moreover, the tax distributions HLA is required to make may be substantial, and may exceed

(as a percentage of HLA’s income) the overall effective tax rate applicable to a similarly situated corporate taxpayer. In addition, because these payments are calculated with reference to an assumed tax rate, and because of the disproportionate allocation of net taxable income, these payments will likely significantly exceed the actual tax liability for many of the legacy owners of HLA.

As a result of (i) potential differences in the amount of net taxable income allocable to us and to the direct and indirect owners of HLA, (ii) the lower tax rate applicable to corporations than individuals and (iii) the use of an assumed tax rate in calculating HLA’s distribution obligations, we may receive distributions significantly in excess of our tax liabilities and obligations to make payments under the tax receivable agreement. If we do not distribute such cash balances as dividends on our Class A common stock and instead, for example, hold such cash balances or lend them to HLA, the existing owners of HLA would benefit from any value attributable to such accumulated cash balances as a result of their right to acquire shares of Class A common stock or, at our election, an amount of cash equal to the fair market value thereof, in exchange for their Class B units or Class C units.

Because many members of our senior management team hold most of their economic interest in HLA through other entities, conflicts of interest may arise between them and holders of shares of our Class A common stock or us.

Because many members of our senior management team hold most of their economic interest in HLA directly through holding companies and other vehicles rather than through ownership of shares of our Class A common stock, they may have interests that do not align with, or conflict with, those of the holders of Class A common stock or with us. For example, members of our senior management team have different tax positions from Class A common stockholders and from us, which could influence their decisions regarding whether and when to dispose of assets, whether and when to incur new or refinance existing indebtedness, and whether and when we should terminate the tax receivable agreement and accelerate the obligations thereunder. In addition, the structuring of future transactions and investments may take into consideration the members’ tax considerations even where no similar benefit would accrue to us.

The disparity in the voting rights among the classes of our common stock and limited ability of the holders of our Class A common stock to influence decisions submitted to a vote of our stockholders may have an adverse effect on the price of our Class A common stock.

Holders of our Class A common stock and Class B common stock vote together as a single class on almost all matters submitted to a vote of our stockholders. Shares of our Class A common stock and Class B common stock entitle the respective holders to identical non-economic rights, except that each share of our Class A common stock entitles its holder to one vote on all matters to be voted on by stockholders generally, while each share of our Class B common stock entitles its holder to ten votes until a Sunset becomes effective. See “Description of Common Stock” in the accompanying prospectus. After a Sunset becomes effective, each share of our Class B common stock will entitle its holder to one vote. Certain of the holders of our Class B common stock who are significant outside investors, members of management and significant employee owners have agreed to vote all of their shares in accordance with the instructions of HLAI, and will therefore be able to exercise control over all matters requiring our stockholders’ approval, including the election of our directors, as well as any significant corporate transactions. The difference in voting rights could adversely affect the value of our Class A common stock to the extent that investors view, or any potential future purchaser of our Company views, the superior voting rights and implicit control of the Class B common stock to have value.

Our share price may decline due to the large number of shares eligible for future sale and for exchange.

The market price of our Class A common stock could decline as a result of sales of a large number of shares of Class A common stock in the market or the perception that such sales could occur. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate. After this offering, we will have outstanding 40,463,498 shares of Class A common stock, which includes the shares we are selling in this offering. Shares of Class A common stock that were issued in the Reorganization to the original members of HLA who became HLI stockholders are “restricted securities”, and their resale is subject to future registration or reliance on an exemption from registration. One of the HLI stockholders is acting as selling stockholder in this offering.

We have agreed with the underwriter not to dispose of or hedge any of our Class A common stock, subject to specified exceptions, during the period from the date of this prospectus supplement continuing through the date 60 days after the date of this prospectus supplement, except with the prior written consent of the underwriter listed on the cover page of this prospectus supplement. Subject to this agreement, we may issue and sell additional shares of Class A common stock in the future.

Our directors and executive officers, certain of their affiliates, and certain of our stockholders have agreed with the underwriter not to dispose of or hedge any of our common stock, subject to specified exceptions, for that same 60-day period, except with the prior written consent of the underwriter listed on the cover page of this prospectus supplement. The 14,221,775 shares of Class A common stock issuable upon exchange of the Class B units and Class C units that are expected to be held immediately after this offering by Class B Holders and Class C Holders will be eligible for resale from time to time, subject to certain exchange timing and volume and Securities Act restrictions.

We have entered into a registration rights agreement with certain Class B Holders who are significant outside investors, members of management and significant employee owners. Under that agreement, subject to certain limitations, those persons have the ability to cause us to register the resale of shares of our Class A common stock that they acquire upon exchange of their Class B units and Class C units in HLA. Registration of these shares would result in them becoming freely tradable in the open market unless restrictions apply.

We expect to continue to pay dividends to our stockholders, but our ability to do so is subject to the discretion of our board of directors and may be limited by our holding company structure and applicable provisions of Delaware and Pennsylvania law.

Since our IPO, our board of directors has declared regular quarterly dividends on our Class A common stock. Although we expect to continue to pay cash dividends to our stockholders, our board of directors may, in its discretion, increase or decrease the level of dividends or discontinue the payment of dividends entirely. In addition, as a holding company, we are dependent upon the ability of HLA to generate earnings and cash flows and distribute them to us so that we may pay our obligations and expenses (including our taxes and payments under the tax receivable agreement) and pay dividends to our stockholders. We expect to cause HLA to make distributions to its members, including us. However, the ability of HLA to make such distributions will be subject to its operating results, cash requirements and financial condition, restrictive covenants in its debt agreements and applicable Pennsylvania law (which may limit the amount of funds available for distribution to its members). Our ability to declare and pay dividends to our stockholders is likewise subject to Delaware law (which may limit the amount of funds available for dividends). If, as a consequence of these various limitations and restrictions, we are unable to generate sufficient distributions from our business, we may not be able to make, or may be required to reduce or eliminate, the payment of dividends on our Class A common stock.

Anti-takeover provisions in our charter documents and under Delaware law could make an acquisition of us more difficult, limit attempts by our stockholders to replace or remove our current management and may negatively affect the market price of our Class A common stock.

Provisions in our certificate of incorporation and bylaws may have the effect of delaying or preventing a change of control or changes in our management. Our certificate of incorporation and bylaws include provisions that:

• provide that vacancies on our board of directors may be filled only by a majority of directors then in office, even though less than a quorum;

• establish that our board of directors is divided into three classes, with each class serving three-year staggered terms;

• require that any action to be taken by our stockholders be effected at a duly called annual or special meeting and not by written consent, except that action by written consent will be allowed for as long as we are a controlled company;

• specify that special meetings of our stockholders can be called only by our board of directors or the chairman of our board of directors;

• establish an advance notice procedure for stockholder proposals to be brought before an annual meeting, including proposed nominations of persons for election to our board of directors;

• authorize our board of directors to issue, without further action by the stockholders, up to 10,000,000 shares of undesignated preferred stock; and

• reflect two classes of common stock, as discussed above.

These and other provisions may frustrate or prevent any attempts by our stockholders to replace or remove our current management by making it more difficult for stockholders to replace members of our board of directors, which is responsible for appointing the members of our management. Also, the tax receivable agreement provides that, in the event of a change of control, we will be required to make a

payment equal to the present value of estimated future payments under the tax receivable agreement, which would result in a significant payment becoming due in the event of a change of control. In addition, we are a Delaware corporation and governed by the Delaware General Corporation Law (the “DGCL”). Section 203 of the DGCL generally prohibits a Delaware corporation from engaging in any of a broad range of business combinations with any “interested” stockholder, in particular those owning 15% or more of our outstanding voting stock, for a period of three years following the date on which the stockholder became an “interested” stockholder. While we have elected in our certificate of incorporation not to be subject to Section 203 of the DGCL, our certificate of incorporation contains provisions that have the same effect as Section 203 of the DGCL, except that they provide that HLAI, its affiliates, groups that include HLAI and certain of their direct and indirect transferees will not be deemed to be “interested stockholders,” regardless of the percentage of our voting stock owned by them, and accordingly will not be subject to such restrictions.

The provision of our certificate of incorporation requiring exclusive venue in the Court of Chancery in the State of Delaware or in the federal district courts of the United States of America for certain types of lawsuits may have the effect of discouraging lawsuits against our directors and officers.

Our certificate of incorporation requires, to the fullest extent permitted by law, that (A) the Court of Chancery in the State of Delaware will be the sole and exclusive forum for (1) any derivative action or proceeding brought on our behalf, (2) any action asserting a claim of breach of a fiduciary duty owed by any of our current or former directors, officers or stockholders to us or our stockholders, (3) any action asserting a claim arising pursuant to any provision of the DGCL or our certificate of incorporation or bylaws, (4) any action to interpret, apply, enforce or determine the validity of our certificate of incorporation or bylaws or (5) any action asserting a claim governed by the internal affairs doctrine and (B) the federal district courts of the United States of America will be the sole and exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act. Although we believe this provision benefits us by making us less susceptible to forum shopping and providing increased consistency in the application of law, the provision may have the effect of discouraging lawsuits against our directors and officers.

If Hamilton Lane Incorporated were deemed an “investment company” under the Investment Company Act as a result of its ownership of HLA, applicable restrictions could make it impractical for us to continue our business as contemplated and could have a material adverse effect on our business.

An issuer will generally be deemed to be an “investment company” for purposes of the Investment Company Act if:

•it is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities; or

•absent an applicable exemption, it owns or proposes to acquire investment securities having a value exceeding 40% of the value of its total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis.

We believe that we are engaged primarily in the business of providing asset management services and not in the business of investing, reinvesting or trading in securities. We also believe that the primary source of income from our business is properly characterized as income earned in exchange for the provision of services. We hold ourselves out as an asset management firm and do not propose to engage primarily in the business of investing, reinvesting or trading in securities. Accordingly, we do not believe that either Hamilton Lane Incorporated or HLA is an “orthodox” investment company as defined in

section 3(a)(1)(A) of the Investment Company Act and described in the first bullet point above. HLA does not have significant assets other than its equity interests in certain wholly owned subsidiaries, which in turn have no significant assets other than general partner interests in the specialized funds we sponsor. These wholly owned subsidiaries are the sole general partners of the funds and are vested with all management and control over the funds. We do not believe the equity interests of HLA in its wholly owned subsidiaries or the general partner interests of these wholly owned subsidiaries in the funds are investment securities. Hamilton Lane Incorporated’s unconsolidated assets consist primarily of cash, a deferred tax asset and Class A units of HLA, which represent the managing member interest in HLA. Hamilton Lane Incorporated is the sole managing member of HLA and will hold an approximately 73.6% economic interest in HLA following this offering. As managing member, Hamilton Lane Incorporated exercises complete control over HLA. As such, we do not believe Hamilton Lane Incorporated’s managing member interest in HLA is an investment security. Therefore, we believe that less than 40% of Hamilton Lane Incorporated’s total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis comprise assets that could be considered investment securities. Accordingly, we do not believe Hamilton Lane Incorporated is an inadvertent investment company by virtue of the 40% test in section 3(a)(1)(C) of the Investment Company Act as described in the second bullet point above. In addition, we believe Hamilton Lane Incorporated is not an investment company under section 3(b)(1) of the Investment Company Act because it is primarily engaged in a non-investment company business.

The Investment Company Act and the rules thereunder contain detailed parameters for the organization and operations of investment companies. Among other things, the Investment Company Act and the rules thereunder limit or prohibit transactions with affiliates, impose limitations on the issuance of debt and equity securities, prohibit the issuance of stock options, and impose certain governance requirements. We intend to continue to conduct our operations so that Hamilton Lane Incorporated will not be deemed to be an investment company under the Investment Company Act. However, if anything were to happen that would cause Hamilton Lane Incorporated to be deemed to be an investment company under the Investment Company Act, requirements imposed by the Investment Company Act, including limitations on our capital structure, ability to transact business with affiliates (including HLA) and ability to compensate key employees, could make it impractical for us to continue our business as currently conducted, impair the agreements and arrangements between and among HLA, us or our senior management team, or any combination thereof and materially and adversely affect our business, financial condition and results of operations.

A change of control of our Company, including the occurrence of a “Sunset,” could result in an assignment of our investment advisory agreements.

Under the Investment Advisers Act, each of the investment advisory agreements for the funds and other accounts we manage must provide that it may not be assigned without the consent of the particular fund or other client. An assignment may occur under the Investment Advisers Act if, among other things, HLA undergoes a change of control. After a “Sunset” becomes effective (as described in “Prospectus Summary—the Offering—Voting Rights”), the Class B Common Stock will have one vote per share instead of ten votes per share, and the stockholders agreement will expire, meaning that the Class B Holders party thereto will no longer control the appointment of directors or be able to direct the vote on all matters that are submitted to our stockholders for a vote. These events could be deemed a change of control of HLA, and thus an assignment. If such an assignment occurs, we cannot be certain that HLA will be able to obtain the necessary consents from our funds and other clients, which could cause us to lose the management fees and performance fees we earn from such funds and other clients.

USE OF PROCEEDS

We estimate that the net proceeds to us from this offering will be approximately $201.7 million.

We intend to use the proceeds from our sale of shares of Class A common stock in this offering to settle, in cash, exchanges of Class B units (along with payment of the par value of a corresponding number of redeemed shares of Class B common stock) and Class C units of HLA by certain of its members.

We will not receive any proceeds from the sale of Class A common stock by the selling stockholder.

We estimate that the offering expenses will be approximately $0.4 million, which will be payable by the participating HLA members and the selling stockholder. For more information, see “Principal and Selling Stockholders” and “Underwriting.”

Under an exchange agreement we have entered into with the other members of HLA, those members are entitled to exchange their Class C units, and their Class B units together with an equal number of shares of Class B common stock, for shares of Class A common stock on a one-for-one basis or, at our election, for cash. The exchange agreement permits those members to exercise their exchange rights subject to certain timing and other conditions.

DIVIDEND POLICY

The table below shows the quarterly dividends declared per share of our Class A common stock during fiscal 2023 and fiscal 2024.

| | | | | | | | |

| | Dividends |

| Fiscal 2023 | | |

| First quarter | $ | 0.40 |

| Second quarter | | 0.40 |

| Third quarter | | 0.40 |

| Fourth quarter | | 0.40 |

| Fiscal 2024 | | |

| First quarter | | 0.445 |

| Second quarter | | 0.445 |

| Third quarter | | 0.445 |

| Fourth quarter | | 0.445 |

The declaration and payment by us of any future dividends to holders of our Class A common stock is at the sole discretion of our board of directors. Our board currently intends to cause us to pay a cash dividend on a quarterly basis. Subject to funds being legally available, we will cause HLA to make pro rata distributions to its members, including us, in an amount at least sufficient to allow us to pay all applicable taxes, to make payments under the tax receivable agreement, and to pay our corporate and other overhead expenses.

PRINCIPAL AND SELLING STOCKHOLDERS

The following table sets forth information regarding the beneficial ownership of our Class A common stock and Class B common stock before and after giving effect to this offering and the application of the proceeds from our issuance and sale of Class A common stock as described under “Use of Proceeds” by:

•each person known to us to beneficially own more than 5% of our Class A common stock or our Class B common stock;

•each of our directors;

•each of our named executive officers;

•all directors and current executive officers as a group; and

•the selling stockholder.

The number of shares of Class A common stock and Class B common stock outstanding and percentage of beneficial ownership before this offering set forth below is computed on the basis of 38,596,176 shares of our Class A common stock and 15,409,507 shares of our Class B common stock issued and outstanding as of March 1, 2024. Beneficial ownership information after this offering and application of the use of proceeds is presented after giving effect to the issuance of 1,867,322 shares of Class A common stock in this offering and the application of proceeds to settle, in cash, the exchange of 1,744,872 Class B units (and the payment of par value upon cancellation of a corresponding number of shares of Class B common stock) and 122,450 Class C units of HLA. This presentation also reflects that certain of our directors, officers and principal stockholders, and/or their affiliates, are expected to participate in that exchange. Under the terms of our exchange agreement, our directors, officers and members of senior management are eligible to exchange all of their Class B and Class C units.

Each Class B Holder and Class C Holder is entitled to have its Class B units or Class C units, as applicable, exchanged for Class A common stock on a one-for-one basis, or, at our option, for cash. Each Class B Holder holds one share of Class B common stock for each Class B unit it beneficially owns. As a result, the number of shares of Class B common stock listed in the table below correlates to the number of Class B units each Class B Holder beneficially owns prior to this offering. The number of shares of Class A common stock listed in the table below represents (i) shares of Class A common stock directly owned plus (ii) the number of Class C units each Class C Holder beneficially owns, and assumes no exchange of Class B units for Class A common stock. See “Description of Common Stock” in the accompanying prospectus.

Certain Class B Holders who are significant outside investors, members of management and significant employee owners entered into a stockholders agreement in connection with our IPO pursuant to which they agreed to vote all their shares of voting stock, including Class A and Class B common stock, together and in accordance with the instructions of HLAI on any matter submitted to our common stockholders for a vote. Because they are a “group” under applicable securities laws, each party to the stockholders agreement is deemed to be a beneficial owner of all securities held by all other parties to the stockholders agreement. The below table disregards shares owned by the group and lists only common stock in which the listed stockholder has a pecuniary interest. The group files reports on Schedule 13D periodically as required by law to disclose its holdings.

Unless otherwise indicated, the address for all persons listed in the table is: c/o Hamilton Lane Incorporated, 110 Washington Street, Suite 1300, Conshohocken, PA 19428.

The selling stockholder may be deemed to be an “underwriter” within the meaning of the Securities Act. Based upon the applicable facts and circumstances, including when and how its shares of Class A common stock were acquired, the selling stockholder does not believe that it should be considered an “underwriter” within the meaning of such term under the Securities Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A common stock owned before the offering | Class B common stock owned before the offering | Number of Shares of Class A common stock offered | % total voting power before the offering | % total economic interest in HLA before the offering | Class A Common stock owned after the offering | Class B Common stock owned after the offering | % total voting power after the offering | % total economic interest in HLA after the offering |

|

| Name of Beneficial Owner | Number | % | Number | | % | Number | | % | Number | | % |

Named Executive Officers and Directors: | | | | | | | | | | | | | | |

| Mario L. Giannini | 96,498 | | * | 3,312,331 | | | 21 | % | — | | 17 | % | 6 | % | 96,498 | | | * | 2,312,331 | | (1) | 17 | % | 13 | % | 4 | % |

Atul Varma(2) | 6,936 | | * | — | | | — | | — | | * | * | 6,936 | | | * | — | | | — | | * | * |

| Erik R. Hirsch | 82,771 | | * | 1,109,781 | | | 7 | % | — | | 6 | % | 2 | % | 82,771 | | | * | 1,109,781 | | (3) | 8 | % | 6 | % | 2 | % |

| Juan Delgado-Moreira | 1,280,902 | | 3 | % | — | | | — | | — | | * | 2 | % | 1,280,902 | | | 3 | % | — | | | — | | * | 2 | % |

| Lydia Gavalis | 38,369 | | * | — | | | — | | — | | * | * | 38,369 | | | * | — | | | — | | * | * |

| Hartley R. Rogers | 10,503 | | * | 7,300,667 | | | 47 | % | — | | 38 | % | 13 | % | 10,503 | | | * | 6,900,667 | | (4) | 51 | % | 39 | % | 13 | % |

| David J. Berkman | 25,000 | | * | — | | | — | | — | | * | * | 25,000 | | | * | — | | | — | | * | * |

| R. Vann Graves | 1,358 | | * | — | | | — | | — | | * | * | 1,358 | | | * | — | | | — | | * | * |

| O. Griffith Sexton | 19,598 | | * | 732,466 | | | 5 | % | — | | 4 | % | 1 | % | 19,598 | | | * | 632,466 | | (5) | 5 | % | 4 | % | 1 | % |

| Leslie F. Varon | 8,323 | | * | — | | | — | | — | | * | * | 8,323 | | | * | — | | | — | | * | * |

All current executive officers and directors as a group (12 persons)(6) | 1,895,830 | | 5 | % | 12,591,215 | | | 82 | % | — | | 66 | % | 26 | % | 1,860,830 | | | 5 | % | 11,091,215 | | | 81 | % | 63 | % | 24 | % |

| | | | | | | | | | | | | | | | |

| Other 5% Beneficial Owners: | | | | | | | | | | | | | | |

HLA Investments, LLC(7) | — | | — | | 9,328,657 | | | 61 | % | — | | 48 | % | 17 | % | — | | | — | | 8,818,657 | | | 65 | % | 50 | % | 16 | % |

HL Management Investors, LLC(8) | 679,590 | | 2 | % | 2,474,855 | | | 16 | % | — | | 13 | % | 6 | % | 557,140 | | | 1 | % | 2,339,983 | | | 17 | % | 13 | % | 5 | % |

BlackRock, Inc.(9) | 3,217,043 | | 8 | % | — | | | — | | — | | 2 | % | 6 | % | 3,217,043 | | | 8 | % | — | | | — | | 2 | % | 6 | % |

The Vanguard Group(10) | 3,395,427 | | 8 | % | — | | | — | | — | | 2 | % | 6 | % | 3,395,427 | | | 8 | % | — | | | — | | 2 | % | 6 | % |

Wasatch Advisors, Inc.(11) | 2,672,700 | | 7 | % | — | | | — | | — | | 1 | % | 5 | % | 2,672,700 | | | 7 | % | — | | | — | | 2 | % | 5 | % |

| | | | | | | | | | | | | | | | |

| Other Selling Stockholders: | | | | | | | | | | | | | | |

| Oakville Number 2 Trust | 535,015 | | 1 | % | 7 | | | — | | 55,000 | | * | 1 | % | 480,015 | | | 1 | % | 7 | | | | * | * |

* Represents beneficial ownership of less than 1%.

(1) This consists of 2,028,699 shares beneficially owned by Hamilton Lane Advisors, Inc., which is an S-corporation that is wholly owned by Mr. Giannini and 283,632 shares beneficially owned by HLAI in which Mr. Giannini has a pecuniary interest. This number does not include, and Mr. Giannini disclaims beneficial ownership of, shares owned by HLAI in which he does not have a pecuniary interest. See footnote 7.

(2) Mr. Varma resigned in fiscal 2024 and is no longer a current officer. Mr. Varma’s listed holdings are based on our corporate records as of his departure on January 31, 2024.

(3) This number includes shares beneficially owned by HL Management Investors, LLC (“HLMI”) in which Mr. Hirsch has a pecuniary interest. This number does not include, and Mr. Hirsch disclaims beneficial ownership of, shares owned by HLMI in which he does not have a pecuniary interest. See footnote 8.

(4) This number represents the shares beneficially owned by HLAI in which Mr. Rogers or a Rogers family trust has a pecuniary interest. HLAI is controlled by its managing member, which is an entity controlled by Mr. Rogers. See footnote 7.

(5) This number consists of shares beneficially owned by HLAI. Mr. Sexton is the trustee of two family trusts that have a pecuniary interest in these shares, and he has sole voting and dispositive power over these shares. This number does not include, and Mr. Sexton disclaims beneficial ownership of, shares beneficially owned by HLAI in which his affiliated trusts do not have a pecuniary interest. See footnote 7.

(6) This group does not include Mr. Varma, but does include Jeffrey Armbrister, our CFO, and Andrea Anigati Kramer, our COO.

(7) HLAI is owned by an affiliate of Mr. Rogers, family trusts of Mr. Sexton, Mr. Giannini, Oakville Number 2 Trust and other parties. Mr. Rogers controls the managing member of HLAI. Pursuant to the stockholders agreement, HLAI directs the votes of the voting group comprised of significant outside investors, members of management and significant employee owners. The voting group beneficially owns 18,023,993 shares of Class A common stock as reported in its Schedule 13D/A filed on March 24, 2023.

(8) Certain of our executive officers and other senior employees beneficially own all or a portion of their shares of our Class A common stock through HLMI.

(9) Based solely on information reported in a Schedule 13G/A filed with the SEC on January 25, 2024 by BlackRock, Inc. As reported in such filing, BlackRock, Inc. is the beneficial owner of 3,217,043 Class A shares, constituting approximately 8.3% of the Class A shares outstanding, with sole voting power with respect to 3,116,455 shares and sole dispositive power with respect to all 3,217,043 shares. Certain subsidiaries of BlackRock, Inc. beneficially own portions of the shares reported in the Schedule 13G/A, and certain of these entities have the right to receive or the power to direct the receipt of dividends from, or proceeds from the sale of, such shares. BlackRock, Inc. is located at 55 East 52nd Street, New York, NY 10055. In order to present these holdings consistently with those of management, our directors and related parties, the percentage of Class A common stock owned has been recalculated in the table above to reflect the exchange of all outstanding Class C units into Class A common stock in the denominator.

(10) Based solely on information reported in a Schedule 13G/A filed with the SEC on February 13, 2024 by The Vanguard Group. As reported in such filing, The Vanguard Group is the beneficial owner of 3,395,427 Class A shares, constituting approximately 8.8% of the Class A shares outstanding, with shared voting power with respect to 49,701 shares, sole dispositive power with respect to 3,307,412 shares and shared dispositive power with respect to 88,015 shares. Clients of The Vanguard Group, Inc., including investment companies registered under the Investment Company Act and other managed accounts, have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares reported in the Schedule 13G/A filed with the SEC. The Vanguard Group is located at 100 Vanguard Blvd., Malvern, PA 19355. In order to present these holdings consistently with those of management, our directors and related parties, the percentage of Class A common stock owned has been recalculated in the table above to reflect the exchange of all outstanding Class C units into Class A common stock in the denominator.

(11) Based solely on information reported in a Schedule 13G/A filed with the SEC on February 9, 2024 by Wasatch Advisors, Inc. As reported in such filing, Wasatch Advisors, Inc. is the beneficial owner of 2,672,700 Class A shares and has sole voting and sole dispositive power with respect to all such shares, constituting approximately 6.9% of the Class A shares outstanding. Wasatch Advisors, Inc. is located at 505 Wakara Way, Salt Lake City, UT 84108. In order to present these holdings consistently with those of management, our directors and related parties, the percentage of Class A common stock owned has been recalculated in the table above to reflect the exchange of all outstanding Class C units into Class A common stock in the denominator.

MATERIAL U.S. FEDERAL TAX CONSIDERATIONS FOR

NON-U.S. HOLDERS OF CLASS A COMMON STOCK

The following discussion is a summary of the material U.S. federal tax consequences of an investment in our Class A common stock by a Non-U.S. Holder (as defined below). This discussion does not address all aspects of U.S. federal income taxation that may be relevant to particular taxpayers in light of their special circumstances or to taxpayers subject to special tax rules (including, but not limited to, a “controlled foreign corporation,” “passive foreign investment company,” company that accumulates earnings to avoid U.S. federal income tax, tax-exempt organization, financial institution, broker or dealer in securities or former U.S. citizen or resident). Except as specifically provided herein, this discussion does not address any aspect of U.S. federal taxation other than U.S. federal income taxation or any aspect of state, local or foreign taxation. In addition, this discussion deals only with U.S. federal income tax consequences to a Non-U.S. Holder that holds our Class A common stock as a capital asset.

This summary is based on current U.S. federal income tax law, which is subject to change, possibly with retroactive effect.

A “Non-U.S. Holder” is a beneficial owner of our Class A common stock that is an individual, corporation, trust or estate that is not, for U.S. federal income tax purposes:

•an individual who is a citizen or resident of the United States;

•a corporation created or organized in or under the laws of the United States or any State thereof (including the District of Columbia);

•an estate, the income of which is subject to U.S. federal income taxation regardless of its source; or

•a trust, the administration of which is subject to the primary supervision of a court within the United States and for which one or more U.S. persons have the authority to control all substantial decisions, or that has a valid election in effect under applicable U.S. Treasury Regulations to be treated as a U.S. person.

If a partnership holds our Class A common stock, the U.S. federal income tax treatment of a partner generally will depend upon the status of the partner and the activities of the partnership. A partner of a partnership holding our Class A common stock should consult its tax advisor concerning the U.S. federal income and other tax consequences of investing in our Class A common stock.

This summary is included herein as general information only. Accordingly, each prospective purchaser of our Class A common stock is urged to consult its tax advisor with respect to U.S. federal, state, local and non-U.S. income and other tax consequences of holding and disposing of our Class A common stock.

Distributions

The distributions that we make with regard to our Class A common stock will be treated as dividends to the extent paid out of our current or accumulated earnings and profits (as determined under U.S. federal income tax principles). Dividends paid to a Non-U.S. Holder of our Class A common stock generally will be subject to withholding of U.S. federal income tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty, provided the Non-U.S. Holder furnishes a valid United States Internal Revenue Service (“IRS”) Form W-8BEN or W-8BEN-E (or other applicable documentation) certifying qualification for the lower treaty rate. If the amount of a distribution exceeds our current or accumulated earnings and profits, such excess first will be treated as a tax-free return of capital to the extent of a Non-U.S. Holder’s tax basis in its shares of our Class A common stock, and thereafter will be treated as gain from the disposition of the Non-U.S. Holder’s shares of Class A common stock. A Non-U.S. Holder that does not timely furnish the required documentation but is eligible for a reduced rate of withholding tax under an income tax treaty may obtain a refund or credit of any excess amounts withheld by filing an appropriate claim for refund with the IRS. Non-U.S. Holders should consult their tax advisors regarding their entitlement to benefits under an applicable income tax treaty and the manner of claiming the benefits of such treaty.