Form 10-Q - Quarterly report [Sections 13 or 15(d)]

August 14 2023 - 4:21PM

Edgar (US Regulatory)

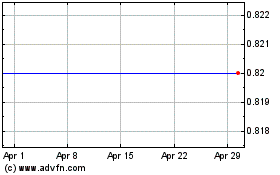

Hallmark Financial Servi... (NASDAQ:HALL)

Historical Stock Chart

From May 2024 to Jun 2024

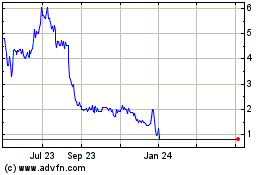

Hallmark Financial Servi... (NASDAQ:HALL)

Historical Stock Chart

From Jun 2023 to Jun 2024