- Q4 2019 net revenue of $63.7 million, at the high-end of

guidance, and pro forma EPS of $0.24, at mid-point of guidance

- Q4 2019 GAAP EPS of $0.07 as compared to GAAP EPS of $0.00 in

the same period in the prior year

- Company announces annual dividend increase of 6% from $0.36 to

$0.38 per share

- Board of Directors approves $5.0 million increase in the

Company’s share repurchase program

The Hackett Group, Inc. (NASDAQ: HCKT), a global intellectual

property-based strategic consultancy and leading enterprise

benchmarking and best practices digital transformation firm, today

announced its financial results for the fourth quarter, which ended

on December 27, 2019.

Q4 2019 net revenue (gross revenue less reimbursable expenses)

from continuing operations was $63.7 million, up 3%, as compared to

the same period in the prior year. Q4 2019 gross revenue from

continuing operations was $69.1 million, up 4%, from the same

period in the prior year.

Q4 2019 pro forma diluted earnings per share were $0.24, down 8%

when compared to $0.26 for the same period in the prior year.

Fiscal 2019 pro forma diluted earnings per share were $1.00, down

6% when compared to $1.06 for the prior year. Pro forma information

is provided to enhance the understanding of the Company's financial

performance and is reconciled to the Company's GAAP information in

the accompanying tables.

GAAP diluted earnings per share were $0.07 for the fourth

quarter of 2019, compared to earnings per share of $0.00 in the

fourth quarter of 2018. GAAP diluted earnings per share were $0.72

for fiscal year 2019 and $0.74 for fiscal year 2018. During the

fourth quarter of 2019, the Company recorded a restructuring charge

and the write-off of its investment in The Hackett Institute’s

Enterprise Analytics program, both of which negatively impacted

GAAP earnings per share by $0.12. The fourth quarter of 2018

included the impact for the discontinued operations of the Working

Capital group and the write-off of the investment for the HPE

software offering which amounted to $0.23 per share.

At the end of the fourth quarter of 2019, the Company’s cash

balances were $26.0 million. During the quarter, the Company

repurchased 145 thousand shares under its share repurchase program.

As of the end of the fourth quarter of 2019, the Company’s

remaining share repurchase program authorization was $1.7 million.

In its recent meeting, the Company’s Board of Directors approved a

$5.0 million increase in the Company’s share repurchase program and

authorized a 6% increase of its annual dividend from $0.36 to $0.38

per share, to be paid semi-annually.

“We continue to see solid U.S. performance driven by digital

transformation and implementation of cloud software initiatives

tempered by weak European results,” stated Ted A. Fernandez,

Chairman and CEO of The Hackett Group. “During the quarter we took

the necessary actions to mitigate the impact of the volatility in

Europe. More importantly, as we start the year with improving

revenue growth in the U.S. and the geopolitical headwinds impacting

Europe stabilizing, we are excited about our 2020 prospects.”

Based on the current economic outlook, the Company estimates

total net revenue for the first quarter of 2020 to be in the range

of $65.0 million and $66.5 million or gross revenue (inclusive of

reimbursable expenses) to be in the range of $70.5 million and

$72.0 million. The Company estimates pro forma diluted earnings per

share for the first quarter of 2020 to be in the range of $0.23 and

$0.25.

Other Highlights

World-Class IT Research – The Hackett Group issued world-class

IT research which found that smart automation technologies such as

robotic process automation, conversational interfaces, and

cognitive automation can enable typical IT organizations to improve

productivity by up to 23% while helping them reduce costs, improve

effectiveness, and enhance customer experience. The research also

found that smart automation serves as a valuable milestone for IT

organizations as these organizations continue their digital

transformations, enabling them to achieve staffing levels below

those seen by world-class IT organizations as they continue to

drive towards the broader benefits that come with total technology

optimization.

OneStream Platinum Partnership - The Hackett Group announced

that it has been named a Platinum level implementation partner by

OneStream Software. As a Platinum partner, OneStream recognizes The

Hackett Group’s commitment to align with OneStream’s strategic

vision and commitment to bring value to shared clients.

On Tuesday, February 18, 2020 senior management will discuss

fourth quarter results in a conference call at 5:00 P.M. ET. (800)

593-0486, [Passcode: Fourth Quarter]. For International callers,

please dial (517) 308-9371.

Please dial in at least 5-10 minutes prior to start time. If you

are unable to participate on the conference call, a rebroadcast

will be available beginning at 8:00 P.M. ET on Tuesday, February

18, 2020 and will run through 5:00 P.M. ET on Tuesday, March 3,

2020. To access the rebroadcast, please dial (800) 925-1779. For

International callers, please dial (402) 220-3079.

In addition, The Hackett Group will also be webcasting this

conference call live through the StreetEvents.com service. To

participate, simply visit http://www.thehackettgroup.com

approximately 10 minutes prior to the start of the call and click

on the conference call link provided. An online replay of the call

will be available after 8:00 P.M. ET on Tuesday, February 18, 2020

and will run through 5:00 P.M. ET on Tuesday, March 3, 2020. To

access the replay, visit www.thehackettgroup.com or

http://www.streetevents.com.

About The Hackett Group

The Hackett Group (NASDAQ: HCKT) is an intellectual

property-based strategic consultancy and leading enterprise

benchmarking and best practices digital transformation firm to

global companies, with offerings that include robotic process

automation and enterprise cloud application implementation.

Services include business transformation, enterprise analytics and

global business services. The Hackett Group also provides dedicated

expertise in business strategy, operations, finance, human capital

management, strategic sourcing, procurement and information

technology, including its award-winning Oracle and SAP

practices.

The Hackett Group has completed more than 17,850 benchmarking

studies with major corporations and government agencies, including

93% of the Dow Jones Industrials, 90% of the Fortune 100, 80% of

the DAX 30 and 57% of the FTSE 100. These studies drive Hackett’s

Digital Transformation Platform which includes the firm's

benchmarking metrics, best practices repository and best practice

configuration guides and process flows, which enable The Hackett

Group’s clients and partners to achieve world-class

performance.

More information on The Hackett Group is available at:

www.thehackettgroup.com, info@thehackettgroup.com, or by calling

(770) 225-3600.

This press release contains "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of 1995

and involve known and unknown risks, uncertainties and other

factors that may cause The Hackett Group's actual results,

performance or achievements to be materially different from the

results, performance or achievements expressed or implied by the

forward-looking statements. Factors that impact such

forward-looking statements include, among others, the ability of

our products, services, or offerings mentioned in this release to

deliver the desired effect, our ability to effectively integrate

acquisitions into our operations, our ability to retain existing

business, our ability to attract additional business, our ability

to effectively market and sell our product offerings and other

services, including those referenced above, the timing of projects

and the potential for contract cancellations by our customers,

changes in expectations regarding the business consulting and

information technology industries, our ability to attract and

retain skilled employees, possible changes in collections of

accounts receivable due to the bankruptcy or financial difficulties

of our customers, risks of competition, price and margin trends,

foreign currency fluctuations, the impact of Brexit on our

business, changes in general economic conditions and interest

rates, our ability to mitigate the impact of the recent decline in

our European operations, our ability to obtain debt financing

through additional borrowings under an amendment to our existing

credit facility as well as other risks detailed in our Company's

Annual Report on Form 10-K for the most recent fiscal year filed

with the Securities and Exchange Commission. We undertake no

obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

The Hackett Group, Inc. CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except per share data)

(unaudited)

Quarter Ended

Twelve Months Ended

December 27,

December 28,

December 27,

December 28,

2019

2018

2019

2018

Revenue: Revenue before reimbursements ("net revenue")

$

63,736

$

61,595

$

260,837

$

264,523

Reimbursements

5,370

4,940

21,635

21,364

Total revenue from continuing operations

69,106

66,535

282,472

285,887

Costs and expenses: Cost of service: Personnel costs before

reimbursable expenses

38,610

35,979

159,390

159,614

Non-cash stock compensation expense

1,056

900

3,831

3,815

Acquisition-related compensation expense (benefit)

-

14

(131)

(535)

Acquisition-related non-cash stock compensation expense

264

575

954

2,027

Reimbursable expenses

5,370

4,940

21,635

21,364

Total cost of service

45,300

42,408

185,679

186,285

Selling, general and administrative costs

14,789

14,352

58,107

58,516

Non-cash stock compensation expense

663

743

2,931

3,238

Amortization of intangible assets

247

580

1,036

2,369

Change in acquisition-related contingent consideration liability

-

(614)

(1,133)

(4,364)

Asset impairment

1,180

6,269

1,180

6,269

Restructuring costs

3,334

—

3,334

— Total selling, general, and administrative expenses

20,213

21,330

65,455

66,028

Total costs and operating expenses

65,513

63,738

251,134

252,313

Income from operations

3,593

2,797

31,338

33,574

Other expense: Interest expense

(43)

(123)

(311)

(638)

Income from continuing operations before income taxes

3,550

2,674

31,027

32,936

Income tax expense (benefit)

1,263

(41)

7,744

5,577

Income from continuing operations

2,287

2,715

23,283

27,359

Income (loss) from discontinued operations (2)

(2)

(2,851)

(6)

(3,450)

Net income (loss)

$

2,285

$

(136)

$

23,277

$

23,909

Weighted average common shares outstanding: Basic

29,837

29,517

29,805

29,379

Diluted

32,573

32,677

32,453

32,330

Basic net income per common share: Income per common share

from continuing operations

$

0.08

$

0.09

$

0.78

$

0.93

Income (loss) per common share from discontinued operations (2)

(0.00)

(0.09)

(0.00)

(0.12)

Basic net income per common share

$

0.08

$

(0.00)

$

0.78

$

0.81

Diluted net income per common share: Income per common share

from continuing operations

$

0.07

$

0.08

$

0.72

$

0.85

Income (loss) per common share from discontinued operations (2)

(0.00)

(0.08)

(0.00)

(0.11)

Diluted net income per common share

$

0.07

$

(0.00)

$

0.72

$

0.74

Pro forma data (1): Income from continuing operations

before income taxes

$

3,550

$

2,674

$

31,027

$

32,936

Non-cash stock compensation expense

1,719

1,643

6,762

7,053

Acquisition-related compensation expense (benefit) —

14

(131)

(535)

Acquisition-related non-cash stock compensation expense

264

575

954

2,027

Change in acquisition-related contingent consideration liability —

(614)

(1,133)

(4,364)

Asset impairment

1,180

6,269

1,180

6,269

Restructuring costs

3,334

—

3,334

— Acquisition-related costs — —

32

— Amortization of intangible assets

247

580

1,036

2,369

Pro forma income before income taxes

10,294

11,141

43,061

45,755

Pro forma income tax expense

2,574

2,785

10,765

11,439

Pro forma net income

$

7,721

$

8,356

$

32,296

$

34,316

Pro forma basic net income per common share

$

0.26

$

0.28

$

1.08

$

1.17

Weighted average common shares outstanding

29,837

29,517

29,805

29,379

Pro forma diluted net income per common share

$

0.24

$

0.26

$

1.00

$

1.06

Weighted average common and common equivalent shares outstanding

32,573

32,677

32,453

32,330

(1) The Company provides pro forma earnings results (which

exclude the amortization of intangible assets, stock compensation

expense, acquisition-related and other one-time expense (benefit),

and include a normalized tax rate, which is our long-term projected

cash tax rate) as a complement to results provided in accordance

with Generally Accepted Accounting Principles (GAAP). These non-

GAAP results are provided to enhance the overall users'

understanding of the Company's current financial performance and

its prospects for the future. The Company believes the non-GAAP

results provide useful information to both management and investors

by excluding certain expenses that it believes are not indicative

of its core operating results. The non-GAAP measures are included

to provide investors and management with an alternative method for

assessing operating results in a manner that is focused on the

performance of ongoing operations and to provide a more consistent

basis for comparison between quarters. Further, these non-GAAP

results are one of the primary indicators management uses for

planning and forecasting in future periods. In addition, since the

Company has historically reported non-GAAP results to the

investment community, it believes the continued inclusion of

non-GAAP results provides consistency in its financial reporting.

The presentation of this additional information should not be

considered in isolation or as a substitute for results prepared in

accordance with GAAP. (2) Discontinued operations relate to

the discontinuance of the Company's European Working Capital Group.

The Hackett Group, Inc. CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands) (unaudited)

December 27,

December 28,

2019

2018

ASSETS

Current assets: Cash and cash equivalents

$

25,954

$

13,808

Accounts receivable and contract assets, net

49,778

54,807

Prepaid expenses and other current assets

2,895

4,339

Assets related to discontinued operations (3)

-

137

Total current assets

78,627

73,091

Property and equipment, net

19,916

19,750

Other assets

2,652

3,704

Goodwill, net

84,578

84,207

Operating lease right-of-use assets

7,962

-

Total assets

$

193,735

$

180,752

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities: Accounts payable

$

8,494

$

7,429

Accrued expenses and other liabilities

32,482

34,498

Operating lease liabilities

2,707

-

Liabilities related to discontinued operations (3)

-

2,300

Total current liabilities

43,683

44,227

Long-term deferred tax liability, net

7,183

6,435

Long-term debt

-

6,500

Operating lease liabilities

5,255

-

Total liabilities

56,121

57,162

Shareholders' equity

137,614

123,590

Total liabilities and shareholders' equity

$

193,735

$

180,752

(3) The assets and liabilities related to discontinued

operations relate to the discontinuance of the Company's European

Working Capital Group.

The Hackett Group, Inc.

SUPPLEMENTAL FINANCIAL DATA (unaudited)

Quarter Ended December 27, December 28,

September 27,

2019

2018

2019

Revenue Breakdown by Group: (in thousands) S&BT (4)

$

25,875

$

24,690

$

27,435

EEA (5)

30,454

27,350

30,920

International (6)

7,407

9,555

8,400

Net revenue from continuing operations (7)

$

63,736

$

61,595

$

66,755

Revenue Concentration: (% of total revenue) Top

customer

5%

4%

6%

Top 5 customers

14%

16%

19%

Top 10 customers

22%

24%

27%

Key Metrics and Other Financial Data: Total

Company: Consultant headcount (8)

990

984

1,036

Total headcount (8)

1,209

1,226

1,271

Days sales outstanding (DSO) (8)

66

75

72

Cash provided by operating activities (in thousands)

$

15,821

$

8,056

$

8,506

Pro forma return on equity (9)

25%

30%

25%

Depreciation (in thousands)

$

887

$

609

$

884

Amortization (in thousands)

$

247

$

580

$

236

Remaining Plan authorization: Shares purchased

(in thousands)

145

15

-

Cost of shares repurchased (in thousands)

$

2,227

$

240

$ — Average price per share of shares purchased

$

15.33

$

16.01

$ — Remaining Plan authorization (in thousands)

$

1,651

$

6,934

$

3,878

Shares Purchased to Satisfy Employee Net Vesting

Obligations: Shares purchased (in thousands)

3

14

5

Cost of shares purchased (in thousands)

$

49

$

274

$

88

Average price per share of shares purchased

$

16.20

$

19.74

$

16.29

(4)

Strategy and Business Transformation Group

(S&BT) includes the results of our IP as-a-service offerings,

which includes our North America Executive Advisory Programs, our

Benchmarking Services and our Business Transformation

Practices.

(5)

ERP, EPM and Analytics Solutions (EEA)

includes the results of our North America Oracle EEA and SAP

Solutions Practices.

(6)

International Groups include the results

of our S&BT and EEA Practices, primarily in Europe.

(7)

Net revenue excludes reimbursable expenses

which are primarily travel-related expenses passed through to a

client with no associated margin.

(8)

Prior periods have been restated to

exclude the discontinuance of the Company's European Working

Capital Group.

(9)

Twelve months of pro forma net income

divided by average shareholder's equity.

(10)

Certain reclassifications have been made

to conform with current reporting requirements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200218006069/en/

Robert A. Ramirez, CFO, 305-375-8005 or

rramirez@thehackettgroup.com

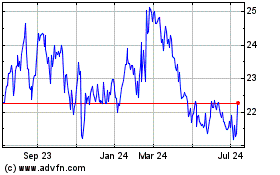

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Oct 2024 to Nov 2024

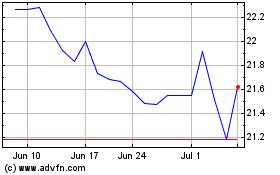

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Nov 2023 to Nov 2024