The Hackett Group, Inc. (NASDAQ:HCKT), a global strategic

advisory firm, today announced its financial results for the first

quarter, which ended April 2, 2010.

First quarter 2010 revenue was $46.7 million, an 18% increase

from the same period in 2009. Pro forma diluted earnings per share

were $0.05 for the first quarter of 2010, as compared to $0.03 for

the same period in 2009. Pro forma information is provided to

enhance the understanding of the Company’s financial performance

and is reconciled to the Company’s GAAP information in the

accompanying tables. GAAP diluted earnings per share were $0.07 for

the first quarter of 2010, as compared to $0.02 for the same period

in 2009.

“Demand for our services and accelerated client decision-making

improved noticeably during the quarter, and we expect this momentum

to continue into the second quarter,” stated Ted A. Fernandez,

Chairman & CEO of The Hackett Group, Inc. “We also experienced

favorable client reaction to our expanded service offerings

resulting from the Archstone acquisition.”

At the end of the first quarter of 2010, the Company’s cash

balances were $16.6 million. On a year to date basis as of May 11,

2010, the Company has repurchased approximately 307 thousand shares

of its common stock at $2.89, for a total cost of approximately

$0.9 million with remaining authorization of approximately $4.7

million.

Based on the current economic outlook, the Company estimates

total revenue for the second quarter of 2010 to be in the range of

$50.0 million to $52.0 million, and estimates pro forma diluted

earnings per share to be in the range of $0.06 to $0.08.

Other Highlights

Finance Book of Numbers™ Research – Hackett announced research

showing that world-class finance organizations now operate at

nearly half the annual cost of typical companies and have less than

half the staff, according to its 2010 Finance Book of Numbers,

“Outperformance: Finance’s Journey Starts Today.” Hackett found

that the efficiency gap between world-class and typical finance

organizations now translates into an annual cost savings of nearly

$140 million for a typical Global 1000 company.

Cash Culture Research – A new study from REL found that while

the global financial crisis has made cash a major priority for most

companies, many still fail to take the key steps required to build

a corporate culture that successfully focuses on cash. REL’s

research “Blueprint for a Cash Culture” describes the key steps

companies can take to build a cash culture, and how prevalent they

are in companies today. It details best practices in four key

areas: organizational alignment and collaboration; executive

leadership and sponsorship; measurement and accountability; and

incentives and compensation.

20th Annual Hackett Best Practices Conference – Hackett

announced plans to hold its 20th Annual Best Practices Conference,

“Excelling in a Volatile Recovery,” at the InterContinental Hotel

in Atlanta May 19-20. This year’s Best Practices Conference brings

together speakers from nearly a dozen of the world’s most

successful companies, including CEOs, CFOs, CIOs, and leaders in

procurement and human resources from Heidrick & Struggles,

Hewlett-Packard, McDonald’s, Merck, and Molson Coors.

At 5:00 P.M. ET on Tuesday, May 11, 2010 the senior management

of The Hackett Group, Inc. will host a conference call to discuss

first quarter earnings results for the period ending April 2,

2010.

The number for the conference call is (800) 857-9601, [Passcode:

First Quarter, Leader: Ted A. Fernandez]. For International

callers, please dial (210) 234-8000.

Please dial in at least 5-10 minutes prior to start time. If you

are unable to participate on the conference call, a rebroadcast

will be available beginning at 8:00 P.M. ET on Tuesday, May 11,

2010 and will run through 5:00 P.M. ET on Tuesday, May 25, 2010. To

access the rebroadcast, please dial (866) 431-5852. For

International callers, please dial (203) 369-0964.

In addition, The Hackett Group will also be webcasting this

conference call live through the StreetEvents.com service. To

participate, simply visit http://www.thehackettgroup.com

approximately 10 minutes prior to the start of the call and click

on the conference call link provided. An online replay of the call

will be available after 8:00 P.M. ET on Tuesday, May 11, 2010 and

will run through 5:00 P.M. ET on Tuesday, May 25, 2010. To access

the replay, visit http://www.thehackettgroup.com or

http://www.streetevents.com.

About The Hackett Group, Inc.

The Hackett Group, Inc. (NASDAQ: HCKT), a global strategic

advisory firm, is a leader in best practice advisory, benchmarking,

and transformation consulting services including strategy and

operations, working capital management, and globalization advice.

Utilizing best practices and implementation insights from more than

5,000 benchmark studies, executives use The Hackett Group's

empirically-based approach to quickly define and implement

initiatives to enable world-class performance. Through its REL

group, The Hackett Group offers working capital solutions focused

on delivering significant cash flow improvements. Through its

Archstone Consulting group, The Hackett Group offers Strategy &

Operations in the Consumer and Industrial Products, Pharmaceutical,

Manufacturing and Financial Services industry sectors. Through its

Hackett Technology Solutions group, The Hackett Group offers

business application consulting services that help maximize returns

on IT investments. The Hackett Group has worked with 2,700 major

corporations and government agencies, including 97% of the Dow

Jones Industrials, 80% of the Fortune 100, 80% of the DAX 30 and

49% of the FTSE 100.

More information on The Hackett Group is available: by phone at

(770) 225-7300; by e-mail at info@thehackettgroup.com; or on the

Web at www.thehackettgroup.com.

Book of Numbers is a trademark of The Hackett Group.

This press release contains “forward-looking statements'' within

the meaning of the Private Securities Litigation Reform Act of 1995

and involve known and unknown risks, uncertainties and other

factors that may cause The Hackett Group's actual results,

performance or achievements to be materially different from the

results, performance or achievements expressed or implied by the

forward-looking statements. Factors that impact such

forward-looking statements include, among others, the ability of

our products, services, or practices mentioned in this release to

deliver the desired effect, our ability to effectively integrate

acquisitions into our operations, our ability to retain existing

business, our ability to attract additional business, our ability

to effectively market and sell our product offerings and other

services, the timing of projects and the potential for contract

cancellations by our customers, changes in expectations regarding

the information technology industry, our ability to attract and

retain skilled employees, possible changes in collections of

accounts receivable, risks of competition, price and margin trends,

foreign currency fluctuations, changes in general economic

conditions and interest rates as well as other risks detailed in

our Company's Annual Report on Form 10-K for the most recent fiscal

year filed with the Securities and Exchange Commission. We

undertake no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

The Hackett Group, Inc. CONSOLIDATED

STATEMENTS OF OPERATIONS (in thousands, except per share

data) (unaudited) Quarter Ended April 2,

2010 April 3, 2009 Revenue: Revenue before

reimbursements $ 41,850 $ 35,990 Reimbursements 4,878 3,526

Total revenue 46,728 39,516 Costs and expenses: Cost of

service: Personnel costs before reimbursable expenses (includes

$615 and $560 of stock compensation expense in the quarters ended

April 2, 2010 and April 3, 2009, respectively) 26,749 22,274

Reimbursable expenses 4,878 3,526 Total cost of service

31,627 25,800 Selling, general and administrative costs

(includes $262 and $106 of stock compensation expense in the

quarters ended April 2, 2010 and April 3, 2009, respectively)

13,242 12,839 Total costs and operating expenses 44,869

38,639 Income from operations 1,859 877 Other income:

Non-cash acquisition earn-out shares re-measurement gain 943 -

Interest income 6 25 Income before income taxes 2,808 902

Income tax expense 110 63 Net income $ 2,698 $ 839

Basic net income per common share: Net income per common

share $ 0.07 $ 0.02 Weighted average common shares outstanding

39,636 38,443 Diluted net income per common share: Net

income per common share $ 0.07 $ 0.02 Weighted average common and

common equivalent shares outstanding 41,289 38,703 Pro forma

data (1): Income before income taxes $ 2,808 $ 902

Non-cash acquisition earn-out

shares re-measurement gain

(943 ) - Stock compensation expense 877 666 Amortization of

intangible assets 460 160 Pro forma income before income

taxes 3,202 1,728 Pro forma income tax expense 1,281 691 Pro

forma net income $ 1,921 $ 1,037 Pro forma basic net

income per common share $ 0.05 $ 0.03 Weighted average common

shares outstanding 39,636 38,443 Pro forma diluted net

income per common share $ 0.05 $ 0.03 Weighted average common and

common equivalent shares outstanding 41,289 38,703

(1) The Company provides pro forma

earnings results (which exclude the non-cash acquisition earn-out

shares re-measurement gain, amortization of intangible assets and

stock compensation expense, and include a normalized tax rate) as a

complement to results provided in accordance with Generally

Accepted Accounting Principles (GAAP). These non-GAAP results are

provided to enhance the overall users' understanding of the

Company's current financial performance and its prospects for the

future. The Company believes the non-GAAP results provide useful

information to both management and investors by excluding certain

expenses that it believes are not indicative of its core operating

results. The non-GAAP measures are included to provide investors

and management with an alternative method for assessing operating

results in a manner that is focused on the performance of ongoing

operations and to provide a more consistent basis for comparison

between quarters. Further, these non-GAAP results are one of the

primary indicators management uses for planning and forecasting in

future periods. In addition, since the Company has historically

reported non-GAAP results to the investment community, it believes

the continued inclusion of non-GAAP results provides consistency in

its financial reporting. The presentation of this additional

information should not be considered in isolation or as a

substitute for results prepared in accordance with GAAP.

The Hackett Group, Inc. CONDENSED

CONSOLIDATED BALANCE SHEETS (in thousands)

(unaudited)

April 2, 2010

January 1, 2010 ASSETS Current

assets: Cash and cash equivalents $ 15,133 $ 15,004 Accounts

receivable and unbilled revenue, net 32,253 28,653 Prepaid expenses

and other current assets 2,207 2,683 Total current assets 49,593

46,340 Restricted cash 1,475 1,475 Property and equipment,

net 7,297 7,137 Other assets 4,334 4,871 Goodwill, net 75,949

76,712 Total assets $ 138,648 $ 136,535

LIABILITIES AND

SHAREHOLDERS' EQUITY Current liabilities: Accounts payable $

6,743 $ 3,674 Accrued expenses and other liabilities 28,945 31,231

Total current liabilities 35,688 34,905 Accrued expenses and other

liabilities, non-current 2,482 3,378 Total liabilities 38,170

38,283 Shareholders' equity 100,478 98,252 Total liabilities

and shareholders' equity $ 138,648 $ 136,535

The Hackett Group, Inc. Supplemental Financial

Data (unaudited) Quarter Ended April 2,

2010 January 1, 2010 April 3, 2009 Revenue

Breakdown by Group: (in thousands) The Hackett Group (2)

(3) $ 36,582 $ 27,029 $ 27,333 Technology Solutions (4)

10,146 7,536 12,183 Total

revenue $ 46,728 $ 34,565 $ 39,516

Revenue Concentration: (% of total revenue)

Top customer 6 % 6 % 8 % Top 5 customers 21 % 23 % 21 % Top 10

customers 33 % 36 % 32 %

Key Metrics and Other

Financial Data: Total Company: Consultant

headcount (5) 601 614 532 Total headcount 771 810 723 Days sales

outstanding (DSO) 63 68 50 Cash provided by (used in) operating

activities (in thousands) $ 788 $ (3,466 ) $ (5,234 ) Depreciation

(in thousands) $ 454 $ 379 $ 536 Amortization (in thousands) $ 460

$ 555 $ 160

The Hackett Group: The Hackett Group

annualized revenue per professional (in thousands) (5) $ 369 $ 303

$ 357

Technology Solutions: Technology Solutions

consultant utilization rate 77 % 73 % 61 % Technology Solutions

gross billing rate per hour $ 107 $ 79 $ 156

Share

Repurchase Program: Shares purchased in the quarter (in

thousands) 33 1,052 1,018 Cost of shares repurchased in the quarter

(in thousands) $ 83 $ 2,926 $ 2,117 Average price per share of

shares purchased in the quarter $ 2.51 $ 2.78 $ 2.08 Remaining

authorization (in thousands) $ 5,496 $ 579 $ 4,841

(2) Comparison of a client's

demand drivers, costs and practices to a peer group in order to

empirically identify and define an organization's ability to

improve performance at a process level and to identify and compare

business practices utilized by world-class performers.

Additionally, strategic consulting support that utilizes Hackett

best practice implementation content and tools to enable clients to

accelerate transformation to world-class performance.

(3) Annual or multi-year contracts

that provide clients with on-demand access to world-class

performance metrics, best practice repository, best practice

research forums and conferences, and advice.

(4) Best Practice Implementation

of ERP Software, which is primarily Oracle and SAP, and business

performance management solutions, which is primarily EPM

Oracle.

(5) Certain items in the quarter

ended January 1, 2010 have been reclassified to conform with the

April 2, 2010 presentation.

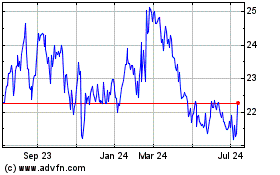

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Dec 2024 to Jan 2025

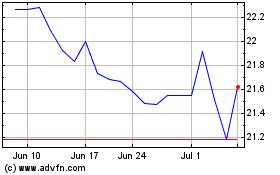

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jan 2024 to Jan 2025