Gulf Resources Provides Detailed Overview of the Economics of its Bromine Segment

November 20 2024 - 7:30AM

Gulf Resources, Inc. (Nasdaq: GURE) ("Gulf Resources", “we,” or the

"Company"), a leading manufacturer of bromine, crude salt and

specialty chemical products in China today announced the following

press release to provide investors with a detailed overview of the

key factors impacting our bromine segment, specifically focusing on

how changes in both pricing and volume have influenced performance.

Similar to oil and gold, we believe our company has a relatively

fixed amount of bromine available for extracting from our

properties. During the COVID-19 pandemic, demand for bromine,

especially for antiseptics surged. Based on numbers from

Sunsirs.com, the per tonne price of bromine increased from RMB

28,017 in Q3 2020 to RMB 49,301 in Q3 2021. Bromine prices even

peaked at RMB 69,500 in October 2021. However, over the next two

years, prices dropped to RMB 24,200 in Q3 2023 and to RMB 17,323 in

Q3 2024. Since the end of the third quarter of 2024, the price of

bromine has started to recover, standing at RMB 22,400 as of

November 17, 2024. The table below shows the price changes from

2020 to 2024.

|

Period |

Bromine Price RMB |

|

2020-Q3 |

28,017 |

|

2021-Q3 |

49,301 |

|

2022-Q3 |

51,795 |

|

2023-Q3 |

24,200 |

|

2024-Q3 |

17,323 |

|

11/17/2024 |

22,400 |

|

|

|

As the price continued to decline, management decided to limit

sales and protect our mineral assets in anticipation of a future

price rebound.

While the decline in prices impacted the profitability of our

bromine operations, the decline in production has also had an

impact. This is because factory overhead, depreciation,

amortization, and various other expenses are spread across a much

smaller number of tonnes.

As reported in our 10-Qs, in the third quarter of 2022, we sold

2,655 tonnes of bromine. In the same quarter of 2023, we sold 1,516

tonnes, and in Q3 2024, only 655.8 tonnes were sold. As a result,

our utilization rate plunged from 34% in 2022 to 19% in 2023, and

to 8% in 2024.

As shown in the numbers below, the number of tonnes sold

declined from 2,655.3 in 2022 to 655.8 in 2024, resulting in a

105.9% increase in the cost per tonne, rising from $2,773 to

$5,709. The increase in the cost per tonne was primarily due to the

need to allocate costs of the factories, such as overhead,

depreciation, amortization, and other expenses- over less than ¼

the number of tonnes. (These numbers are calculated by dividing

bromine revenues by tonnes sold.)

|

|

|

Bromine Economics Q3 |

2022-2024 |

|

|

|

|

|

Q3-Year |

Revenue |

Price |

Tonnes |

Utilization |

Cost |

Cost/Tonne |

P & L |

|

|

2022 |

19,845,773 |

7,474 |

2,655.3 |

34% |

7,362,103 |

2,772.6 |

$10,552,343 |

|

|

2023 |

4,908,152 |

3,237 |

1,516.3 |

19% |

5,995,496 |

3,954.1 |

-$2,143,203 |

|

|

2024 |

1,571,313 |

2,396 |

655.8 |

8% |

3,744,088 |

5,709.1 |

-$4,029,999 |

|

|

% change |

-92.1% |

-67.9% |

-75.3% |

-76.5% |

-49.1% |

105.9% |

|

|

|

|

|

|

|

|

|

|

|

|

Since the end of the third Quarter of 2024, the price of bromine

has increased substantially (bromine prices are sourced from

sunsirs.com).

Mr. Liu Xiaobin, the Chief Executive Officer of Gulf Resources,

stated, “As the price of bromine declined, we made a decision to

protect the long-term value of our assets by controlling our sales.

As utilization dropped sharply, our costs per tonne increased.

However, as the economy showing signs of improvement, we are now in

a position to increase our utilization. We believe this will

positively impact our future results.”

About Gulf Resources, Inc.Gulf Resources, Inc.

operates through four wholly-owned subsidiaries, Shouguang City

Haoyuan Chemical Company Limited ("SCHC"), Shouguang Yuxin Chemical

Industry Co., Limited ("SYCI"), Daying County Haoyuan Chemical

Company Limited (“DCHC”) and Shouguang Hengde Salt Industry Co.

Ltd. (“SHSI”). The Company believes that it is one of the largest

producers of bromine in China. Elemental Bromine is used to

manufacture a wide variety of compounds utilized in industry and

agriculture. Through SYCI, the Company manufactures chemical

products utilized in a variety of applications, including oil and

gas field explorations and papermaking chemical agents, and

materials for human and animal antibiotics. Through SHSI, the

Company manufactures and sells crude salt. DCHC was established to

further explore and develop natural gas and brine resources

(including bromine and crude salt) in China. For more information,

visit www.gulfresourcesinc.com.

Forward-Looking StatementsCertain statements in

this news release contain forward-looking information about Gulf

Resources and its subsidiaries business and products within the

meaning of Rule 175 under the Securities Act of 1933 and Rule 3b-6

under the Securities Exchange Act of 1934, and are subject to the

safe harbor created by those rules. The actual results may differ

materially depending on a number of risk factors including, but not

limited to, the general economic and business conditions in the

PRC, future product development and production capabilities,

shipments to end customers, market acceptance of new and existing

products, additional competition from existing and new competitors

for bromine and other oilfield and power production chemicals,

changes in technology, the ability to make future bromine asset

purchases, and various other factors beyond its control. All

forward-looking statements are expressly qualified in their

entirety by this Cautionary Statement and the risks factors

detailed in the Company's reports filed with the Securities and

Exchange Commission. Gulf Resources undertakes no duty to revise or

update any forward-looking statements to reflect events or

circumstances after the date of this release.

Contact Data

CONTACT: Gulf Resources, Inc.

Web: http://www.gulfresourcesinc.com

Director of Investor Relations

Helen Xu

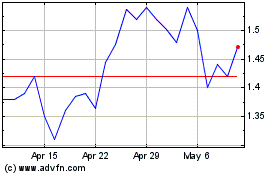

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Dec 2024 to Jan 2025

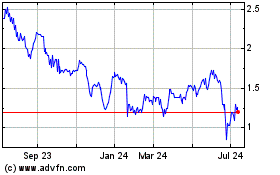

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Jan 2024 to Jan 2025