false

0000885462

0000885462

2024-11-19

2024-11-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act 1934

Date of Report (date of earliest event reported):

November 19, 2024

Gulf Resources, Inc.

(Exact name of registrant as specified in charter)

Nevada

(State or other jurisdiction of incorporation)

|

000-20936

(Commission File Number) |

13-3637458

(IRS Employer Identification No.) |

Level 11,Vegetable Building, Industrial Park

of the East City,

Shouguang City, Shandong, China 262700

(Address of principal executive offices and zip

code)

+86 (536) 567 0008

(Registrant's telephone number including area code)

(Registrant's former name or former address, if

changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0005 par value |

|

GURE |

|

NASDAQ Global Select Market |

| Item 2.02 |

Results of Operations and Financial Condition. |

On November 19, 2024, Gulf Resources, Inc. (the

“Company”) issued a press release announcing its third quarter and nine months ended September 30, 2023 unaudited financial

results. The full text of the press release is set forth in Exhibit 99.1 attached hereto.

As provided in General Instruction B.2 of SEC Form

8-K, such information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, and it shall not be deemed incorporated by

reference in any filing under the Securities Act of 1933, as amended, or under the Exchange Act, whether made before or after the date

hereof, except as expressly set forth by specific reference in such filing to this Current Report on Form 8-K.

| Item 9.01 |

Financial Statements and Exhibits. |

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| GULF RESOURCES, INC. |

|

| |

|

|

| By: |

/s/ Min Li |

|

| Name: |

Min Li |

|

| Title: |

Chief Financial Officer |

|

Dated: November 19,

2024

Gulf Resources Announces Third Quarter and Nine Months 2024 Unaudited

Financial Results

SHOUGUANG, China, Nov. 19, 2024 (GLOBE NEWSWIRE) -- Gulf Resources,

Inc. (Nasdaq: GURE) ("Gulf Resources", “we,” or the "Company"), a leading manufacturer of bromine, crude

salt and specialty chemical products in China today announced its unaudited financial results for the nine and three months ended September

30, 2024.

Three Months ended September 30, 2024:

| • |

Revenues for the third quarter were $2,242,365, a decline of 61.8% compared to the same period of 2023. |

| |

|

| • |

The net loss was $3,492,883, and the basic and diluted loss was $0.33 per share. |

| |

|

| • |

During the third quarter, bromine revenues declined by 68% to $1,571,313 and crude salt revenues declined by 26% to $654,039. |

| |

|

| • |

Bromine operation loss was $4,029,999, while crude salt operation loss was $102,657. |

| |

|

| • |

The losses from operations from our currently inactive chemical and natural gas businesses were $339,038 and $39,072, respectively. |

Nine Months ended September 30, 2024:

| • |

For the nine months, revenues were $5,932,596, a decline of 74.4% compared to the same period of 2023. |

| |

|

| • |

Losses from operations by segment were as follows: bromine - $13,475,400, crude salt - $47,725, chemicals - $993,116, and natural Gas -$140,554. |

| |

|

| • |

The net loss was $40,582,933, and basic and diluted loss was $3.78 per share. |

| |

|

| • |

We incurred a loss of $29,169,008 from the disposition of equipment and purchased $60,526,213 worth of new equipment. |

| |

|

| • |

Our cash position declined to $11,237,493 from $72,223,894 as of December 31, 2023. |

| |

|

| • |

Total assets at the end of the third quarter was $193,885,294. |

Management Commentary

We regret that the changes in auditors caused delays in filing the

2023 10-K and 2024 10-Q reports on time. We acknowledge the importance of providing investors with information needed to understand our

financial position and the decisions made by the management. Separate press releases will be issued to address several of these matters

in the near future.

Mr. Liu Xiaobin, the Chief Executive Officer of Gulf Resources, stated,

“We want investors to understand that we remain confident in China’s economic recovery, in our company’s return to profitability,

and in the decisions that we are making to act in the best interests of our shareholders.”

“Over the past year,” Mr. Liu continued, “we have

postponed the final delivery of equipment for our chemical factory, because we did not see a short-term path to profitability. We believe

some of the chemical companies in our niche in China are currently losing money. By postponing, we wanted to have the opportunity to see

which segments of the industry would recover most quickly and what new opportunities, such as those for electrical strong or flow batteries,

would emerge. When the timing is right, we will move ahead with the development of our chemical factory.”

“We also decided to hold off on additional investments in our

natural gas business,” Mr. Liu continued. “While we remain committed to this project, we are currently seeking the best strategy.”

“We also participated in a flood prevention program required

by the government,” Mr. Liu stated, “that we believe will help prevent future flood damages and allow us to drill more wells.

Additionally, we are in the process of securing additional land for salt fields and bromine wells from local groups. Based on our analysis,

we believe these fields could yield strong returns in the coming years.

“As the Chinese economy has begun to recover and bromine prices

have started to improve,” Mr. Liu concluded, “we are becoming increasingly optimistic about the opportunities for the future.”

Conference Call

Gulf Resources management will host a conference call on Wednesday,

November 20, 2024 at 08:00 AM Eastern Time to discuss its unaudited financial results of nine and three months ended September 30, 2024.

Mr. Xiaobin Liu, CEO of Gulf Resources, will be hosting the call. The

Company management team will be available for investor questions following the prepared remarks.

To participate in this live conference call, please dial Toll Free

+1 (888) 506-0062 five to ten minutes prior to the scheduled conference call time. International callers should dial +1 (973) -528-0011,

and please reference to “Gulf Resources” or Participant Access Code: 287986 while dial in.

The webcasting is also available then, just simply click on the link

below:

http://www.gulfresourcesinc.com/news-28.html

A replay of the conference call will be available two hours after the

call's completion and will expire on Wednesday, November 27, 2024. To access the replay, call +1 (877) 481-4010. International callers

should call +1 (919) 882-2331. The Replay Passcode is 51690.

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (Expressed in U.S. dollars) |

| |

| | |

| September 30,

2024

Unaudited | | |

| December 31,

2023

Audited | |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 11,237,493 | | |

$ | 72,223,894 | |

| Accounts receivable ,net | |

| 1,186,880 | | |

| 4,865,696 | |

| Inventories, net | |

| 427,839 | | |

| 577,229 | |

| Prepayments and deposits | |

| 8,311,871 | | |

| 8,395,290 | |

| Other receivable | |

| 95,245 | | |

| 7,482 | |

| Total Current Assets | |

| 21,259,328 | | |

| 86,069,591 | |

| Non-Current Assets | |

| | | |

| | |

| Property, plant and equipment, net | |

| 150,680,984 | | |

| 122,188,023 | |

| Finance lease right-of use assets | |

| 80,144 | | |

| 83,115 | |

| Operating lease right-of-use assets | |

| 6,385,605 | | |

| 6,699,784 | |

| Prepaid land leases, net of current portion | |

| 9,823,607 | | |

| 9,772,170 | |

| Deferred tax assets ,net | |

| 5,655,626 | | |

| 1,859,025 | |

| Total non-current assets | |

| 172,625,966 | | |

| 140,602,117 | |

| Total Assets | |

$ | 193,885,294 | | |

$ | 226,671,708 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 15,775,145 | | |

$ | 8,833,936 | |

| Taxes payable-current | |

| 145,642 | | |

| 475,630 | |

| Advance from customer | |

| — | | |

| 42,705 | |

| Amount due to related parties | |

| 2,598,765 | | |

| 2,586,658 | |

| Finance lease liability, current portion | |

| 201,855 | | |

| 172,625 | |

| Operating lease liabilities, current portion | |

| 498,580 | | |

| 473,653 | |

| Total Current Liabilities | |

| 19,219,987 | | |

| 12,585,207 | |

| Non-Current Liabilities | |

| | | |

| | |

| Finance lease liability, net of current portion | |

| 1,103,707 | | |

| 1,312,950 | |

| Operating lease liabilities, net of current portion | |

| 7,036,482 | | |

| 7,525,255 | |

| Total Non-Current Liabilities | |

| 8,140,189 | | |

| 8,838,205 | |

| Total Liabilities | |

$ | 27,360,176 | | |

$ | 21,423,412 | |

| | |

| | | |

| | |

| Commitment and Loss Contingencies | |

$ | — | | |

$ | — | |

| Stockholders’ Equity | |

| | | |

| | |

PREFERRED STOCK; $0.001 par value; 1,000,000 shares

authorized; none outstanding | |

$ | — | | |

$ | — | |

COMMON STOCK; $0.0005 par value; 80,000,000 shares

authorized; 11,012,754 shares issued; and 10,726,924 shares outstanding as

of September 30, 2024 and December 31, 2023, respectively | |

| 24,623 | | |

| 24,623 | |

Treasury stock; 285,830 shares as of September 30, 2024 and December 31, 2023 at

cost | |

| (1,372,673 | ) | |

| (1,372,673 | ) |

| Additional paid-in capital | |

| 101,688,262 | | |

| 101,688,262 | |

| Retained earnings unappropriated | |

| 55,711,323 | | |

| 96,294,256 | |

| Retained earnings appropriated | |

| 26,667,097 | | |

| 26,667,097 | |

| Accumulated other comprehensive loss | |

| (16,193,514 | ) | |

| (18,053,269 | ) |

| Total Stockholders’ Equity | |

| 166,525,118 | | |

| 205,248,296 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 193,885,294 | | |

$ | 226,671,708 | |

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE LOSS |

| (Expressed in U.S. dollars) |

| (UNAUDITED) |

| | |

| |

| |

| |

|

| | |

Three-Month Period Ended

September 30, | |

Nine -Month Period Ended

September 30, |

| | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| NET REVENUE | |

| | | |

| | | |

| | | |

| | |

| Net revenue | |

$ | 2,242,365 | | |

$ | 5,865,615 | | |

$ | 5,932,596 | | |

$ | 23,173,404 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING INCOME (EXPENSE) | |

| | | |

| | | |

| | | |

| | |

| Cost of net revenue | |

| (4,071,616 | ) | |

| (6,373,902 | ) | |

| (11,303,519 | ) | |

| (20,464,418 | ) |

| Sales and marketing expenses | |

| (13,484 | ) | |

| (14,428 | ) | |

| (31,608 | ) | |

| (42,850 | ) |

| Direct labor and factory overheads incurred during plant shutdown | |

| (1,736,345 | ) | |

| (1,007,689 | ) | |

| (7,185,537 | ) | |

| (4,471,954 | ) |

| General and administrative expenses | |

| (1,002,529 | ) | |

| (762,884 | ) | |

| (2,409,957 | ) | |

| (2,266,260 | ) |

| Other operating income (loss) | |

| — | | |

| — | | |

| — | | |

| 60,134 | |

| TOTAL OPERATING COSTS AND EXPENSE | |

| (6,823,974 | ) | |

| (8,158,903 | ) | |

| (20,930,621 | ) | |

| (27,185,348 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| PROFIT (LOSS) FROM OPERATIONS | |

| (4,581,609 | ) | |

| (2,293,288 | ) | |

| (14,998,025 | ) | |

| (4,011,944 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (21,191 | ) | |

| (23,791 | ) | |

| (70,835 | ) | |

| (81,322 | ) |

| Interest income | |

| 6,220 | | |

| 57,758 | | |

| 77,071 | | |

| 201,127 | |

| Other expenses (income) | |

| — | | |

| — | | |

| (29,173,011 | ) | |

| — | |

| INCOME(LOSS) BEFORE TAXES | |

| (4,596,580 | ) | |

| (2,259,321 | ) | |

| (44,164,800 | ) | |

| (3,892,139 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME TAX BENEFIT (EXPENSE) | |

| 1,103,697 | | |

| 483,524 | | |

| 3,581,867 | | |

| 876,779 | |

| NET PROFIT (LOSS) | |

$ | (3,492,883 | ) | |

$ | (1,775,797 | ) | |

$ | (40,582,933 | ) | |

$ | (3,015,360 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| COMPREHENSIVE INCOME (LOSS) | |

| | | |

| | | |

| | | |

| | |

| NET PROFIT (LOSS) | |

$ | (3,492,883 | ) | |

$ | (1,775,797 | ) | |

$ | (40,582,933 | ) | |

$ | (3,015,360 | ) |

| OTHER COMPREHENSIVE (LOSS) INCOME | |

| | | |

| | | |

| | | |

| | |

| - Foreign currency translation adjustments | |

| 3,102,876 | | |

| 2,247,978 | | |

| 1,859,755 | | |

| (7,879,513 | ) |

| TOTAL COMPREHENSIVE (LOSS) INCOME | |

$ | (390,007 | ) | |

$ | 472,181 | | |

$ | (38,723,178 | ) | |

$ | (10,894,873 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| BASIC AND DILUTED EARNINGS (LOSS) PER SHARE: | |

$ | (0.33 | ) | |

$ | (0.17 | ) | |

$ | (3.78 | ) | |

$ | (0.29 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| BASIC AND DILUTED WEIGHTED AVERAGE NUMBER OF SHARES: | |

| 10,726,924 | | |

| 10,431,924 | | |

| 10,726,924 | | |

| 10,431,924 | |

| GULF RESOURCES, INC. |

| AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Expressed in U.S. dollars) |

| (UNAUDITED) |

| | |

| |

|

| | |

Nine-Month Period Ended

September 30, |

| | |

2024 | |

2023 |

| | |

| |

|

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net income(loss) | |

$ | (40,582,933 | ) | |

$ | (3,015,360 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Amortization on capital lease | |

| 70,835 | | |

| 80,252 | |

| Depreciation and amortization | |

| 14,037,554 | | |

| 15,385,624 | |

| Unrealized translation difference | |

| — | | |

| 165,444 | |

| Deferred tax asset | |

| (3,615,091 | ) | |

| (1,002,511 | ) |

| Amortization of right-of-use asset | |

| 659,509 | | |

| — | |

| Loss on disposal of equipment | |

| 29,169,008 | | |

| — | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 3,677,653 | | |

| 3,132,796 | |

| Inventories | |

| 153,371 | | |

| 718,994 | |

| Prepayments and deposits | |

| 171,305 | | |

| (3,947,311 | ) |

| Advance from customers | |

| (42,545 | ) | |

| — | |

| Other receivables | |

| (86,423 | ) | |

| — | |

| Accounts and Other payable and accrued expenses | |

| (2,685,766 | ) | |

| (1,503,845 | ) |

| Amount due to related Parties | |

| — | | |

| — | |

| Taxes payable | |

| (330,299 | ) | |

| (229,600 | ) |

| Operating lease | |

| (889,641 | ) | |

| 85,129 | |

| Net cash (used in) provided by operating activities | |

| (293,463 | ) | |

| 9,869,612 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Purchase of property, plant and equipment | |

| (60,526,213 | ) | |

| (15,197,648 | ) |

| Net cash from investing activities | |

| (60,526,213 | ) | |

| (15,197,648 | ) |

| | |

| | | |

| | |

| CASH FLOWS USED IN FINANCING ACTIVITIES | |

| | | |

| | |

| Repayment of finance lease obligation | |

| (264,094 | ) | |

| (267,810 | ) |

| Net cash used in financing activities | |

| (264,094 | ) | |

| (267,810 | ) |

| | |

| | | |

| | |

EFFECTS OF EXCHANGE RATE CHANGES ON CASH AND CASH

EQUIVALENTS | |

| 97,369 | | |

| 1,144,609 | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | |

| (60,986,401 | ) | |

| (4,451,237 | ) |

| CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD | |

| 72,223,894 | | |

| 108,226,214 | |

| CASH AND CASH EQUIVALENTS - END OF PERIOD | |

$ | 11,237,493 | | |

$ | 103,774,977 | |

| | |

Periods Ended September 30, |

| | |

2024 | |

2023 |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | |

| | | |

| | |

| Cash paid during the nine-month period ended September 30, 2024 for: | |

| | | |

| | |

| Paid for taxes | |

$ | 1,013,382 | | |

$ | 4,930,601 | |

| Interest on finance lease obligation | |

$ | 70,835 | | |

$ | 80,252 | |

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND

FINANCING ACTIVITIES | |

| | | |

| | |

| | |

| | | |

| | |

About Gulf Resources, Inc.

Gulf Resources, Inc. operates through four wholly-owned subsidiaries, Shouguang City Haoyuan Chemical Company Limited ("SCHC"),

Shouguang Yuxin Chemical Industry Co., Limited ("SYCI"), Daying County Haoyuan Chemical Company Limited (“DCHC”)

and Shouguang Hengde Salt Industry Co. Ltd. (“SHSI”). The Company believes that it is one of the largest producers of bromine

in China. Elemental Bromine is used to manufacture a wide variety of compounds utilized in industry and agriculture. Through SYCI, the

Company manufactures chemical products utilized in a variety of applications, including oil and gas field explorations and papermaking

chemical agents, and materials for human and animal antibiotics. Through SHSI, the Company manufactures and sells crude salt. DCHC was

established to further explore and develop natural gas and brine resources (including bromine and crude salt) in China. For more information,

visit www.gulfresourcesinc.com.

Forward-Looking Statements

Certain statements in this news release contain forward-looking information about Gulf Resources and its subsidiaries business and products

within the meaning of Rule 175 under the Securities Act of 1933 and Rule 3b-6 under the Securities Exchange Act of 1934, and are subject

to the safe harbor created by those rules. The actual results may differ materially depending on a number of risk factors including, but

not limited to, the general economic and business conditions in the PRC, the risks associated with the COVID-19 pandemic outbreak, future

product development and production capabilities, shipments to end customers, market acceptance of new and existing products, additional

competition from existing and new competitors for bromine and other oilfield and power production chemicals, changes in technology, the

ability to make future bromine asset purchases, and various other factors beyond its control. All forward-looking statements are expressly

qualified in their entirety by this Cautionary Statement and the risks factors detailed in the Company's reports filed with the Securities

and Exchange Commission. Gulf Resources undertakes no duty to revise or update any forward-looking statements to reflect events or circumstances

after the date of this release.

Contact Data

CONTACT: Gulf Resources, Inc.

Web: http://www.gulfresourcesinc.com

Director of Investor Relations

Helen Xu

beishengrong@vip.163.com

v3.24.3

Cover

|

Nov. 19, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 19, 2024

|

| Entity File Number |

000-20936

|

| Entity Registrant Name |

Gulf Resources, Inc.

|

| Entity Central Index Key |

0000885462

|

| Entity Tax Identification Number |

13-3637458

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

Level 11,Vegetable Building

|

| Entity Address, Address Line Two |

Industrial Park

of the East City

|

| Entity Address, City or Town |

Shouguang City

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

262700

|

| City Area Code |

+86 (536)

|

| Local Phone Number |

567 0008

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0005 par value

|

| Trading Symbol |

GURE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

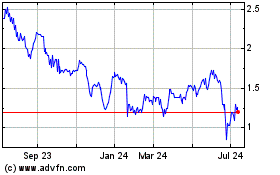

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Dec 2024 to Jan 2025

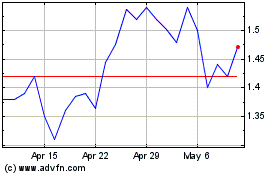

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Jan 2024 to Jan 2025